About Harbor Protocol Airdrop

Harbor Protocol Airdrop is the dApp on the Comdex chain (powered by the Cosmos SDK and CosmWasm smart contracts) that enables safe listed assets to be locked in Vaults and mint $CMST. The protocol also facilitates users to earn interest by depositing $CMST in its Locker module.

Harbor Protocol is airdropping a total of 150,000,000 HARBOR to 23 various communities. Stakers and Liquidity providers of the eligible chains and pools have 84 days to claim the airdrop.

| Platform | Total Value | Max. Participants | Website |

|---|---|---|---|

| Comdex | 150,000,000 HARBOR | Unlimited | Click Here To Visit |

Step No 1

Register for the Harbor Protocol Airdrop by creating an account.

Step No 2

Verify your email & log in to your account.

Step No 3

Take part in the referral program and invite 3 friends.

Step No 4

Join Harbor Protocol Airdrop on Telegram group & Telegram channel.

Step No 5

Follow Harbor Protocol on Twitter & like/share the pinned tweet and tag 3 friends.

Step No 6

Like/follow Harbor Protocol Airdrop on Facebook & like/share the pinned post.

Step No 7

Submit your details to the Harbor Protocol Airdrop form.

What is Harbor Protocol?

A publicly governed protocol enabling the minting of $CMST by collateralising interchain assets.

- Mint – Mint Composite ($CMST), an IBC-enabled stablecoin for the multichain

- Govern – Participate in the governance of the protocol

- Earn rewards – Claim rewards for locking tokens, including rebases, fees, and external incentives

- Auctions – Participate in auctions to earn discounted collateral

Composite Money

An overcollateralised IBC enabled stable coin built for the multichain. CMST’s mechanism is designed to be the most reliable model for stablecoins, which is censorship-resistant, permissionless, and decentralized.

Composite Money – CMST

Over collateralised

Every Composite stablecoin generated is backed by excess collateral, and hence its supply is always less than the value of collateral locked in Harbor Protocol

IBC Native

From inception CMST is an IBC (Inter‐Blockchain Communication protocol) enabled stable coin

Earn Yields

Users can earn yields by locking it in Harbor protocol and on Commodo App

Decentralised

All decisions of the protocol functioning and parameter changes are voted on through governance which makes the protocol decentralized

Risk

Vault Risk

For any user on the protocol, owning a Vault is inherently risky. There are different types of risks associated with owning a Vault which are categorized as: Market Risks, System Exposure Risks, and Parameter Variability Risk.

Market Risks

Using a Vault entails minting $CMST and transferring ownership of a user’s assets to a smart-contract that can sell a user’s asset if the market falls. All $CMST producing vaults have a separate Liquidation Price, which is the price at which a user’s vault would be liquidated if the Collateralization ratio was not maintained.

Maintaining a high Collateralization Ratio is a typical strategy among users to protect themselves from Market Risks and, as a result, Liquidation.

System Exposure Risks

The following are some of the system dangers linked with the Harbor Protocol’s operation:

- Malicious hacks/attacks against the smart-contract infrastructure or Harbor protocol

- Black Swan events involving one or more collateral assets

Parameter Variability Risk

The owners of Vaults should be informed of the modifications to the Harbor protocol’s numerous parameters that regulate the system. This translates to a financial risk for the vault owner, as the parameters will change over time and will not be the same as they were when the vault was first opened. The following is a list of few key parameters that are subject to change through governance :

- Stability Fees

- Debt Ceiling

- Liquidation Penalty

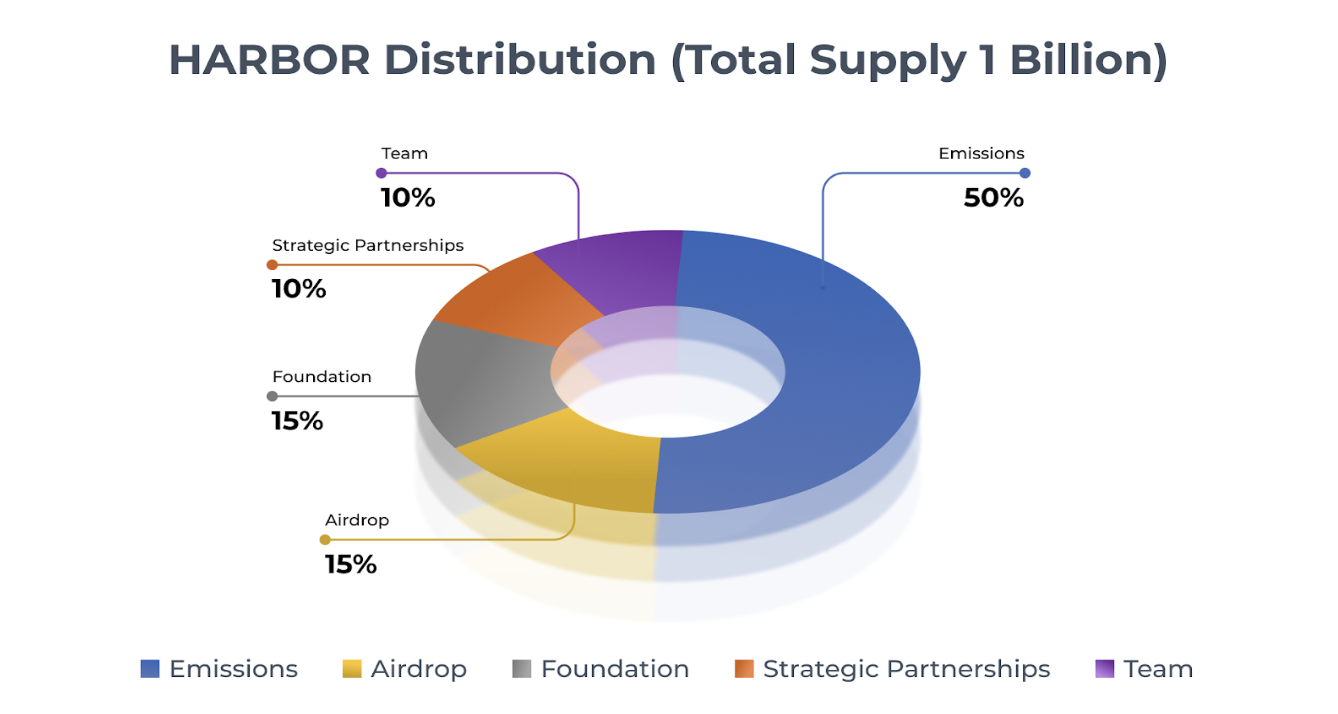

Tokenomics

HARBOR will serve as the governance token for managing policies on the protocol. HARBOR’s governance and tokenomics model adheres to the ve (3,3) model introduced by Andre Cronje. Holders of $HARBOR tokens have the option to lock their tokens for up to four months in exchange for $veHARBOR, which gives increased voting power to determine key protocol parameters like reward distributions. Harbor Protocol’s governance will become increasingly decentralized and diversified. $veHARBOR will confer voting power and serve as the governance token for managing policies on the protocol.

Token Distribution:

The supply of the HARBOR token will be 1 Billion tokens which will be distributed as follows:

- 50% Emissions will be distributed as incentives over a period of ~6 years to the community

- 15% Airdrop to various communities based on different tasks

- 15% for Foundation to be vested over 24 months linearly

- 10% for the Team to be vested over 24 months linearly with a 6-month cliff

- 10% Strategic partnerships, which include external incentivization and pool liquidity to expand adoption (community controlled)

With nearly 65% of the tokens being distributed as community incentives, $HARBOR has the most distinctive and community-focused tokenomics.