In this article, I will discuss the Guide to Bridging Solana with Other Networks, more particularly how users can transfer tokens across blockchains safely and efficiently.

- What is a Blockchain Bridge?

- Guide to Bridging Solana with Other Networks steps by steps

- Example: Transferring Solana Coins to Ethereum

- Step 1. Select a Good Bridge

- Step 2. Connect a Wallet

- Step 3. Pick Source and Target Networks

- Step 4. Select Token and Amount

- Step 5. Make Finalizing Payment of Transaction and Other Costs

- Step 6. Wait Transaction Completion

- Step 7. Getting your Funds

- Why Bridge Solana with Other Networks?

- Fees and Transaction Times

- Security and Safety Tips

- Common Mistakes to Avoid

- Future of Solana Bridges

- Conclusion

- FAQ

You will understand the stepwise procedure, the fees involved and the security involved, and some suggestions to mitigate mistakes. This guide simplifies cross-chain transactions, regardless of whether the user is new to crypto, or has experience with crypto.

What is a Blockchain Bridge?

A blockchain bridge is designed to link independent blockchain networks for the seamless movement of assets, tokens or data across them. It “translates” different protocols enabling users to shift tokens across blockchains without them having to be sold or swapped.

Bridges are crucial for enhancing liquidity, expanding the usability of digital assets, and developing a more unified crypto ecosystem.

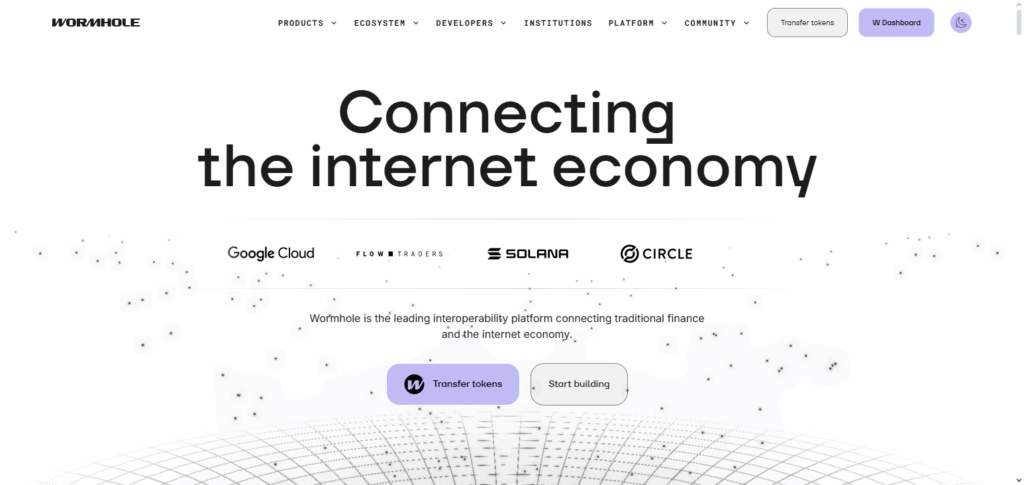

Wormhole and Allbridge, which facilitate Solana and other networks, are popular examples. Users, however, for their own protection, need to be vigilant regarding the possible risks including the exposure to smart contract weaknesses when employing bridges.

Guide to Bridging Solana with Other Networks steps by steps

Example: Transferring Solana Coins to Ethereum

Step 1. Select a Good Bridge

First review a bridge like Wormhole that specializes in Solana to Ethereum transfers.

Step 2. Connect a Wallet

Pick a Solana-held wallet like Phantom or Sollet and bridge it to the platform.

Step 3. Pick Source and Target Networks

Pick Solana as the step-out zone and Ethereum as the step-in zone.

Step 4. Select Token and Amount

Specify the token (SOL, or a Solana-based USDC) and the value to move.

Step 5. Make Finalizing Payment of Transaction and Other Costs

Confirm the transaction details (network and bridge fees) and authorize the wallet deduction to finalize the transaction.

Step 6. Wait Transaction Completion

The bridge will finalize in a couple of Ethereum minutes. Once the transaction is verified the tokens will show up in the Ethereum wallet.

Step 7. Getting your Funds

Gather the transaction hash and check wallet balance to confirm successful*

Why Bridge Solana with Other Networks?

Access to More Liquidity: Additional Solana token markets and Liquidity pools are unlocked when other blockchains are incorporated with Solana.

Expanded Token Utility: Assets of Solana such as staking, lending, and trading can be exercised on alternative networks like Ethereum or BSC.

Lower Fees and Faster Transactions: When bridging assets, strategically Solana’s low fees can be added to more expensive, slower networks.

Cross-Chain DeFi Opportunities: Enable the use of other blockchains to access a range of decentralized finance protocols.

Portfolio Diversification: Use and hold assets on multiple chains.

Support for Interoperable DApps: Solana’s usability increases with the use of bridges as DApps can interact with other ecosystems.

Fees and Transaction Times

Bridge Fees: Most bridges charge a service fee for transactions being processed for the transaction service, usually a certain percentage of the transferred value.

Gas Fees: Users also pay gas fees on the source and destination networks in addition to the bridge fee. Solana network fees are quite low compared to fees on other networks like Ethereum and gas fees in general.

Transaction Speed: Users are able to send and receive Solana transactions in a matter of seconds while bridging to other, slower networks such as Ethereum can take a couple of minutes, and in some cases longer.

Adjustable Factors: Certain Fees and transaction speed can be changes with optimised network congestion, token type used, and bridge platform.

Cost Minimization: Slow network periods are the time for bridging. Check service fee amounts, and token compatibility to make sure there are no transaction failures.

Security and Safety Tips

Use Official Bridges Only: To avoid scams, always use verified and trustworthy bridges like Wormhole, Allbridge, or others.

Double-Check URL: Ensure you are on the correct and official site before connecting your wallet, as phishing websites can resemble bridges.

Check for Token Compatibility: Only bridge the listed supported tokens to avoid losing your funds.

Secure Your Wallet: Store your funds in a hardware wallet or a secure wallet app and enable 2FA if it is available.

Confirm Payment Details et Me: Check the amount, destination address, and the network before payment confirmation.

Stay Updated: Official accounts should be followed for announcements and updates, including maintenance and known vulnerabilities.

Common Mistakes to Avoid

Using Unfrequently Crossed Bridges: Avoid crossing to unknown or questionable bridges, lest you get scammed or lose your money.

Transferring Unsupported Tokens: Ensure that the token you are transferring is acceptable from the current network to the destination network.

Ignoring Status Confirmation: Not checking the status of your transaction can erase any possibility of recovering your funds.

Not Examining the Deltas: Not knowing the delta of the bridge and the delta of the network can cause you to under or over pay the bridge.

Omitting Wallet Protection: Wallets that have no protection or have their private keys exposed are susceptible to theft.

Ignoring the Rush in the Network: If you do not choose the correct time to transfer, the funds will take a long time to reach the other end, or completely fail.

Future of Solana Bridges

The future of Solana bridges will depend largely on interoperability and infrastructure because of its current institutional use. Reduced intermediary trust and increased security through the use of cryptographic trust-minimized bridges, instead of centralized validation, is one evolution of the Solana ecosystem.

Projects such as those on 1inch are leading the way in the development of cross-chain decentralized swaps between Solana and major EVMs. This eliminates the use of which bridges are used as monolithic intermediaries in trustless, MEV blocked cross-chain swap relay transactions.

In addition, due to partnerships like those with the Solana Foundation and R3 which enables clients like Bank of America and HSBC to quickly settle and administrative costs on tokenized asset transactions on Solana, integrated use shows how much traditional financial systems depend on Solana integration.

As Solana matures alongside the traditional financial ecosystem, Solana’s bridges will likely adapt to the developing ecosystem of decentralized finance and cross-chain applications with added usability and integration.

Conclusion

To sum up, connecting Solana to other networks brings many new possibilities to crypto users, like accessing greater liquidity and engaging in cross-chain DeFi, as well as diversifying assets across different blockchains.

By taking the proper measures—using a reliable bridging service, ensuring token compatibility, and maintaining optimal security—users can move assets across compatible networks at minimal costs and delays with safety as a priority.

The evolution of Solana’s bridges is expected to increase their efficiency, security, and ease of use. This will be crucial to the future of interlinked blockchain ecosystems.

FAQ

Can I bridge any token from Solana?

No, only tokens supported by both the source and destination networks can be bridged. Always check token compatibility before initiating a transfer.

How long does a bridging transaction take?

Solana transactions are usually confirmed within seconds, but bridging to slower networks like Ethereum may take several minutes depending on network congestion.

What fees are involved in bridging Solana?

Users typically pay bridge fees plus network/gas fees on both the source and destination chains. Solana’s fees are generally lower than most networks.