About Ellipsis

Ellipsis (EPS) is a cryptocurrency and operates on the Binance Smart Chain platform. Ellipsis has a current supply of 424,619,762.819565 with 301,458,080.93219817 in circulation. The last known price of Ellipsis is 1.08990539 USD and is up 25.78 over the last 24 hours. It is currently trading on 17 active market(s) with $391,720,209.30 traded over the last 24 hours.

Ellipsis Defi Coin Finance officially launched on March 2021 as an authorized fork of Curve Finance. The Ellipsis team will receive support from the Curve Finance team and will commit to Curve Finance core values: a trustless and decentralized architecture, zero deposit or withdrawal fees, no lock ups on liquidity and extremely efficient stable coin exchanges.

Ellipsis Defi Facts

| Lightning Network | Facts |

|---|---|

| Defi Coin Name | Ellipsis |

| Short Name | EPS |

| Explore | Click Here To View Explore |

| Source | Click Here To View Source |

| Chat Option | Click Here To Visit Chat |

| Document | Click Here To View Document |

| Official Website | Click Here To View Website |

Flexible Price

The live Ellipsis price today is $1.10 USD with a 24-hour trading volume of $395,614,241 USD. They update the EPS to USD price in real-time. Ellipsis is up 28.89% in the last 24 hours. The current CoinMarketCap ranking is #241, with a live market cap of $331,831,039 USD. It has a circulating supply of 301,458,081 EPS coins and a max. supply of 1,000,000,000 EPS coins.

The EPS Token

Ellipsis (EPS) is the native token on the platform and provides value for liquidity providers and token holders.

Utility

Stake EPS to earn fees from Ellipsis Protocol.

Is EPS a governance token?

No. EPS is not a governance token, as there is no EPS governance.

Token Supply & Emission

The EPS token supply is one billion (1,000,000,000) tokens to be emitted over five years.

Token Distribution

- 55% Liquidity provider rewards: Continuously minted over five years with a progressively decreasing rate.

- 25% veCRV airdrop: Distributed weekly based on a veCRV snapshot.

- 20% team / development fund: Vested for one year with a continuous release.

Reward Pool and Staking Pool

Liquidity providers receive EPS rewards that vest for 3 months. Rewards can be claimed before the end of the vesting period but are subject to a 50% early exit penalty.

EPS from the early exit penalty is distributed to the locked staking pool. The most loyal EPS holders will stand to gain the maximum benefit upon conclusion of the 3 month vesting period.

The staking pool receives trading fees as well as the EPS penalty revenue from people who Exit the reward pool early (before the end of the 3 month vesting). The staking pool has no mandatory lock-up.

Liquidity Provider Rewards

80% of the rewards are distributed evenly between liquidity providers of the stablecoin pools while 20% are distributed to EPS/BNB liquidity providers.

Rewards for stablecoin pools are distributed based on the overall TVL of the stablecoin pools, therefore the APYs of these pools are identical.

The liquidity provider rewards will be as follows:

30% of EPS supply as rewards within year one as follows:

5% — month 1

4% — month 2

3% — month 3

18% — rest of year 1 (2% a month)

EpsStaker

EpsStaker allows users to stake EPS in order to receive a portion of the trade fees generated by the Ellipsis platform. It is loosely based on the Synthetix staking rewards contract.

Querying Pool Info

The address of the token staked within this contract (EPS).

An array of addresses for reward tokens distributed by the contract. All stakers receive each reward token porportionally to the amount of EPS they have deposited. The exception to this rule is the token at index zero (EPS) which is only distributed based on locked balances.

The period of time, given in seconds, over which a reward token is released after it is added to the contract. Reward tokens are streamed out linearly to stakers; for example if 100 tokens were added and with a reward duration of 10 days, 10 tokens would be rewarded to stakers each day.

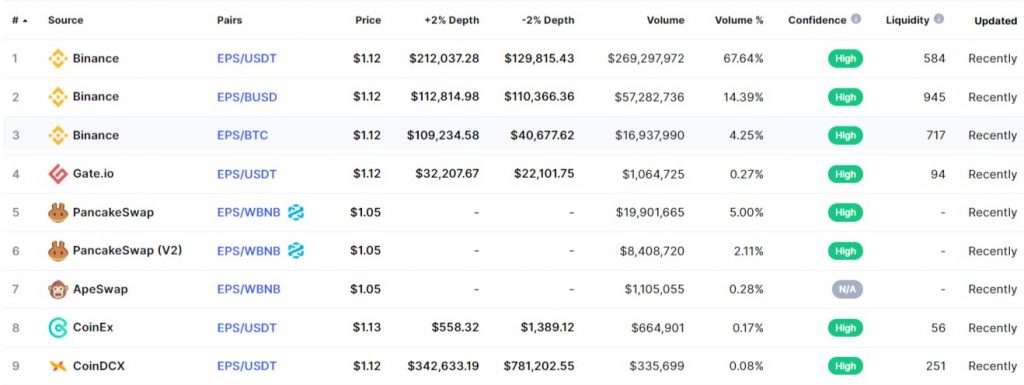

Where Can Buy