I’ll talk about the DeFi Insurance Tokens to Watch in this post, showcasing creative initiatives that safeguard digital assets in decentralized finance.

- Key Point & DeFi Insurance Tokens to Watch List

- 1.NXM – Nexus Mutual

- Pros & Cons NXM – Nexus Mutual

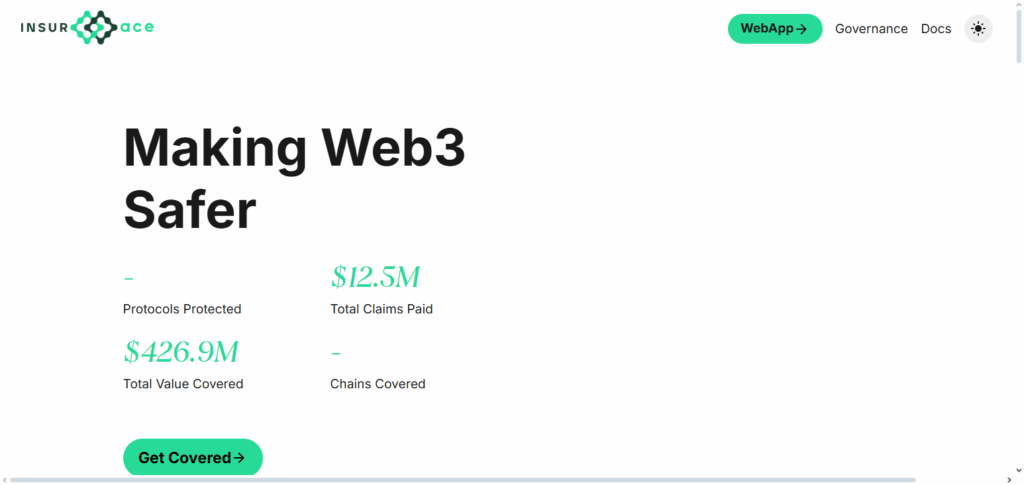

- 2.INSUR – InsurAce

- Pros & Cons INSUR – InsurAce

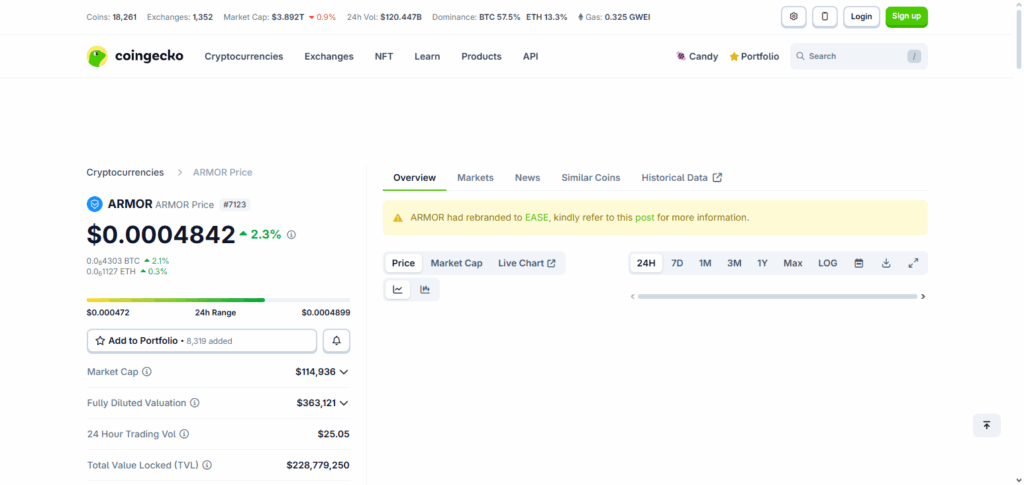

- 3.ARMOR – Armor Protocol

- Pros & Cons ARMOR – Armor Protocol

- 4.BRIGHT – Bright Union

- Pros & Cons BRIGHT – Bright Union

- 5.TIDAL – Tidal Finance

- Pros & Cons TIDAL – Tidal Finance

- 6.inSure DeFi

- Pros & Cons INSUR – InsurAce

- 7.COZY – Cozy Finance

- Pros & Cons COZY – Cozy Finance

- 8.USF – Unslashed Finance

- Pros & Cons USF – Unslashed Finance

- 9.NSURE – NSure Network

- Pros & Cons NSURE – NSure Network

- Conclusion

- FAQ

Cross-chain coverage, automatic claims, staking incentives, and adaptable protection for lending, staking, and smart contract protocols are just a few of the special characteristics that these tokens provide.

By being aware of these tokens, users and investors can protect their DeFi investments and look for expansion prospects in the quickly changing ecosystem.

Key Point & DeFi Insurance Tokens to Watch List

| Token | Key Points |

|---|---|

| NXM | Smart contract insurance, mutual model, staking rewards |

| INSUR | Multi-chain coverage, low premiums, diversified risk pools |

| ARMOR | Gasless coverage, pay-as-you-go, smart contract focus |

| BRIGHT | Cross-chain insurance, minimal KYC, bridge protection |

| TIDAL | DeFi lending/borrowing insurance, liquidity-backed coverage |

| inSure DeFi | because it provides automated, decentralized coverage |

| COZY | Flexible coverage, yield on premiums, lending & staking protection |

| USF | Multi-chain, DAO-governed, parametric smart contract insurance |

| NSURE | Cross-chain coverage, modular risk pools, low-cost protection |

1.NXM – Nexus Mutual

NXM—Nexus Mutual—represents a distinctive proposition within decentralized finance (DeFi) insurance, grounded in a member-controlled mutual model that enables policyholders to assume risk and exercise voting rights in equal measure.

In contrast to conventional insurance frameworks, the NXM protocol invites participants to stake platform tokens as a means of underwriting smart contract coverage, thereby generating yield commensurate with the risk assumption.

The protocol’s emphasis on on-chain governance and its bespoke staking architecture confer a significant degree of transparency and adaptivity. By marrying collective risk-sharing with economic incentives and shared governance, NXM warrants close observation as a leading indicator of the broader evolution within the DeFi insurance market.

Pros & Cons NXM – Nexus Mutual

Pros:

- Governed by peers: Claims evaluation and policy structuring occur through a decentralized mutual model.

- Broad risk applicability: Covers direct losses arising from smart contracts that fail.

- Established credibility: The project has built a solid track record within DeFi since 2017.

Cons:

- Liquidity constraints: Executing large trades in NXM can cause significant slippage.

- Steep learning curve: The interface still challenges users who are not technically proficient.

- Network fees burden: Deployment and settlement occur on the Ethereum mainnet, incurring persistently high transaction costs.

2.INSUR – InsurAce

INSUR—InsurAce has emerged as a DeFi insurance token of considerable merit, delivering broad, cross-chain protection for numerous protocols while maintaining low premiums and rigorous risk controls.

The protocol mitigates exposure by spreading risk across an array of DeFi and CeFi platforms, thus shielding policyholders from systemic shocks.

Automated claims processing, a cornerstone of operational reliability, guarantees prompt settlement, while scalable architecture accommodates ecosystem growth. The combination of multi-chain interoperability, competitive pricing, and structural innovation distinguishes INSUR as a leading instrument within the DeFi insurance sector.

Pros & Cons INSUR – InsurAce

Pros:

- Cross-chain provisioning: Validates and covers assets across Ethereum, Binance Smart Chain, and other Layer 1 and Layer 2 networks.

- Attractive pricing: Premium volumes are consistently lower relative to industry averages.

- Tailored coverage: Users can purchase protection for individual or aggregated protocols in a single policy.

Cons:

- Limited market penetration: Brand recognition does not match the longer-standing Nexus Mutual.

- Audit dependency: Benefit payouts require confirmation from trusted third-party audit firms.

- Semi-centralized governance: Certain major protocol upgrades are subject to centralized developer votes.

3.ARMOR – Armor Protocol

ARMOR – The Armor Protocol represents a noteworthy advancement in DeFi insurance by offering a gasless, pay-as-you-go coverage structure. This model simplifies and democratizes access to protective instruments for DeFi participants.

By abolishing pre-paid premium barriers, ARMOR enables users to insure digital holdings solely as circumstances demand, thus enhancing capital efficiency.

The protocol prioritizes smart contract safeguarding and boasts effortless interoperability with a diverse array of DeFi applications, guaranteeing effective risk mitigation. By furnishing actionable, context-sensitive insurance activated at the moment of need, ARMOR differentiates itself as the pre-eminent candidate within the sector for trustworthy, scalable coverage.

Pros & Cons ARMOR – Armor Protocol

Pros:

- Dynamic pricing model: Customers incur costs only during active coverage windows.

- Seamless DeFi orchestration: Instant integrations with lending, borrowing, and liquidity protocols.

- User custodial freedom: Funds are not transferred to insurance underwriters; the user retains private-key control.

Cons:

- Capped aggregate limits: Policies address medium-sized protocols and fail to accommodate multi-million-dollar positions.

- Limited user adoption: The smaller pool results in reduced liquidity and community support.

- Smart contract exposure: Inherent protocol bugs may jeopardize entire coverage.

4.BRIGHT – Bright Union

BRIGHT – Bright Union serves as a noteworthy DeFi insurance token owing to its focus on cross-chain protection, delivering coverage specifically for bridging protocols and multi-chain DeFi services while imposing only minimal KYC limitations.

The protocol’s primary advantage resides in mitigating the accelerating hazards intrinsic to cross-chain transfers, a threat vector that remains under-addressed in the decentralized finance landscape.

Through its synthesis of extensive protocol protection, streamlined accessibility, and intuitive user interfaces, Bright Union presents a forward-looking framework that responds contemporaneously to the evolving DeFi risk spectrum. These characteristics render the token attractive to investors for whom the convergence of security and operational simplicity is paramount.

Pros & Cons BRIGHT – Bright Union

Pros:

- Cross-chain integration: Delivers coverage across multiple blockchain architectures.

- Automated execution: Rules embedded in smart contracts expedite claims adjudication.

- Expanding collaborative network: New strategic alliances enhance its DeFi presence.

Cons:

- Nascent operation: Historical claims data remains insufficient for exhaustive reliability assessment.

- BRIGHT token exposure: Value-sensitive coverage can diminish through market-driven price swings.

- Restricted visibility: Community size is presently smaller when benchmarked against leading rivals.

5.TIDAL – Tidal Finance

TIDAL – Tidal Finance functions as a targeted insurance token in DeFi, concentrating on safeguarding on-chain lending and borrowing operations.

The protocol is engineered to deliver liquidity-backed coverage, which promises timely and credible settlement in the event of protocol failure. Tidal achieves a distinctive edge by merging protocol-specific risk evaluations with dynamically governed insurance pools, thereby enabling participants to hedge capital with a high degree of precision.

By zeroing in on lending and borrowing—the most commercially active horizontal in the DeFi landscape—TIDAL stands as a narrowed but resilient hedge, thus appealing to users who prefer purpose-built, transparent risk transfer mechanics in a rapidly evolving financial ecosystem.

Pros & Cons TIDAL – Tidal Finance

Pros:

- Targeted protection: Core mandate is DeFi megasizes and professional counter-parties.

- Embedded retrocession pools: Secondary liquidity absorbs tail-event intensity.

- Sophisticated underwriting tools: In-browser models telescope risk and warranty choices.

Cons:

- Elevated premiums: Institutional penetration carries baseline cost which may price out smaller wallets.

- Cascading architecture: Retail transparency is diluted by derivative and retro-transparency nodes.

- Segmented tract size: Minimal cooperative coverage for marginal DeFi balance sheets.

6.inSure DeFi

inSure DeFi positions itself as a noteworthy decentralized finance (DeFi) insurance token by delivering automated, permissionless coverage specifically for smart contracts and DeFi protocols. Its operational transparency is matched by streamlined claims processing that occurs largely on-chain.

The project’s core advantage rests on algorithmic risk evaluation, enabling individualized safeguards with minimal human oversight; this architecture enhances both processing speed and reliability whilst controlling operational risk.

By targeting advanced, technology-first insurance methodologies that nestle naturally into the DeFi landscape, inSure DeFi equips stakeholders with the tools to secure and manage digital asset exposures, thereby furnishing investors with a forward-looking, resilient risk-mitigation vehicle within the rapidly evolving DeFi arena.

Pros & Cons INSUR – InsurAce

Pros:

- Multi-chain support: Provides coverage across Ethereum, BSC, Polygon, and additional chains.

- Cost-effective premiums: Attractive pricing for both small and large-scale users in the DeFi space.

- Tailored policies: Delivers both single-asset and diversified portfolio coverage products.

Cons:

- Limited brand visibility: Still less prominent in the market than Nexus Mutual.

- Audit-dependent protection: Security guarantees frequently hinge on external smart contract audits.

- Partial centralization: Certain governance and operational processes retain a degree of centralized control.

7.COZY – Cozy Finance

COZY – Cozy Finance introduces a decentralized finance (DeFi) insurance token of interest, characterized by yield-generating coverage specifically designed for lending and staking protocols. Its architecture enables participants to direct premiums into productive pools that accrue yield, thereby transforming an ordinarily non-productive outlay into a compounding cash flow stream without relinquishing underlying asset exposure.

The Core proposition rests upon a modular, opt-in insurance overlay that integrates frictionlessly into existing DeFi ecosystems, thereby compressing the latency and cognitive costs of traditional risk management to negligible levels.

The artefact of this fusion – a dynamic policy that simultaneously mitigates downside risk, offers liquid exposure to interest-earning activities, and retains the friction of premium outlay – positions COZY as a standout conduit within the emergent field of on-chain insurance.

Pros & Cons COZY – Cozy Finance

Pros:

- Self-executing coverage: Smart contracts autonomously trigger settlement without intermediaries.

- Optimized transaction fees: Layer-2 integration minimizes excessive gas expense.

- User-centric design: Step-by-step pathways cater to non-technical participants.

Cons:

- Narrow risk selection: Scope of insured activities smaller than in older platforms.

- Limited track record: Fewer historical events prevent broad reliability assessments.

- Reliance on oracle pricing: Claim validations may halt if external valuation feeds fail.

8.USF – Unslashed Finance

USF – Unslashed Finance presents itself as a noteworthy DeFi insurance utility token, distinguished by a framework that delivers multi-chain, DAO-governed insurance alongside configurable parametric payouts.

This arrangement guarantees rapid, on-chain verification of claims, granting immediate, auditable protection to both smart contracts and major stablecoin pairs. The principle differentiator lies in marrying decentralized governance with dynamically adjustable insurance cover, enabling users to defend assets seamlessly across a spectrum of DeFi protocols.

The project centres on automation, on-chain transparency, and extensive compatibility, thereby positioning itself as a forward-looking insurance solution. Investors and users alike may regard USF as a pivotal instrument for obtaining dependable, boundlessly scalable protection within the continuously advancing DeFi landscape.

Pros & Cons USF – Unslashed Finance

Pros:

- Multi-chain risk transfer: Coverage extends seamlessly across major Layer-1 and Layer-2 environments.

- Pooling efficiency: Dynamic algorithms maximize capital utilization without excessive liquidity buffers.

- Democratic protocol governance: Policyholders propose and ratify key risk parameters.

Cons:

- Moderate marketplace presence: Reduced scale pressures effective liquidity and diversification.

- Mathematical risk model opacity: Decomposing tri-variate stress scenarios may challenge non-expert users.

- Limited empirical claims record: In-depth reliability benchmarking requires multi-period data.

9.NSURE – NSure Network

NSURE – NSure Network merits attention as a DeFi insurance token due to its provision of cross-chain coverage via modular risk pools, which permits users to tailor protection based on individually defined parameters.

The outstanding feature is its synthesis of low-cost, elastic insurance with decentralized governance, empowering the community to supervise and allocate risk with precision.

Concentrating on accessibility and bespoke coverage for nascent DeFi protocols, NSure Network delivers a pragmatic, novel remedy, positioning the token as a distinctive choice for participants in search of secure, adaptable, and prescient insurance solutions within the decentralized finance ecosystem.

Pros & Cons NSURE – NSure Network

Pros:

- Decentralized mutual model: Policyholders share and finance losses without central administrators.

- Attractive pricing design: No-intermediary structure yield lower effective annual premiums.

- Token-linked governance: Proposals and referendum on parameters reside with staker majority.

Cons:

- Nascent growth stage: Large, distributed claims testing remains hypothetical.

- Fewer ecosystem integrations: Limited strategic alliances restrain cross-protocol synergy.

- Intrinsic token risk: NSURE protocol native price may alter effective coverage and pricing on settlement date.

Conclusion

To summarize, DeFi insurance tokens are swiftly transforming the decentralized finance environment by delivering inventive, community-oriented, and automated means of safeguarding digital holdings.

Domains such as NXM, INSUR, ARMOR, BRIGHT, TIDAL, RISK, COZY, USF, NSURE, and inSure DeFi each illustrate distinct methodologies—spanning cross-chain protection, parametric settlement, and adaptable, yield-bearing coverage.

With the ongoing expansion of DeFi, these instruments are establishing fundamental security and dependability, rendering them substantive initiatives for continued scrutiny by both capital allocators and users intent on engaging with enhanced safety in decentralized ecosystems.

FAQ

What are DeFi insurance tokens?

DeFi insurance tokens represent decentralized protocols that provide coverage for smart contracts, lending, staking, and cross-chain risks, allowing users to protect their digital assets.

Why should I watch these tokens?

These tokens offer innovative risk management, decentralized governance, automated claims, and unique coverage solutions, making them key players in the growing DeFi ecosystem.

Are these tokens profitable to hold?

Beyond potential price appreciation, some tokens offer staking rewards, yield on premiums, or participation in governance, adding extra utility.