What Is Crypto-Bot?

Discover the mission and vision of CRYPTO BOT: One of Europe’s largest automated bots to buy and sell cryptocurrencies on globally established exchanges. CRYPTO BOT makes automatic trading in a wide range of digital currencies via various exchanges available to everyone by offering transparent rates and an easy to use and set up platform. Clear and well-arranged for both the novice and experienced traders.

They bridge the gap between the traditional and the groundbreaking. With the ease of use of the platform, the low rates and the security protocols, we offer our users the best of all worlds and contribute to the emergence of the digital economy, spread over multiple exchanges.

Crypto-Bot Review Key Points

| Key | Points |

|---|---|

| Bot Name | Crypto-Bot |

| Starting Price | 7.99 Euro |

| Free Trial | Yes Available |

| Device Supported | Mobile , Desktop |

| Cloud Based | Yes |

| Customer Support | Email, User Guide Document, & Contact Form Support |

| Payment Options | Crypto |

| Affiliate Program | Available |

| Official Website | https://crypto-bot.eu/en |

What is Price Of Crypto-Bot?

Crypto-Bot is a trading bot which is available for purchase. Prices vary depending on the version of Crypto-Bot purchased and the exchange it is being used on, but typically range from 7.99 EURo to 99.99 Euro Month.

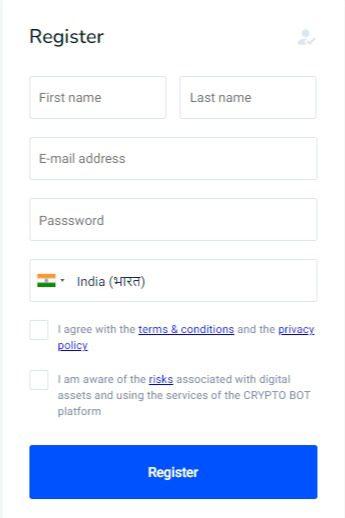

How To Open A Crypto-Bot Account

Opening a crypto-bot account typically involves the following steps:

- Choose a crypto-bot platform: There are several crypto-bot platforms available, and you need to choose one that suits your trading needs. Some popular options include 3Commas, HaasOnline, and Cryptohopper.

- Create an account: Once you have chosen a platform, visit their website and click on the “Sign up” or “Create account” button. You will need to provide some basic information such as your name, email address, and password. Some platforms may also require you to verify your identity by providing government-issued identification.

- Fund your account: After creating your account, you will need to fund it with cryptocurrency or fiat currency. Most platforms accept popular cryptocurrencies such as Bitcoin, Ethereum, and Litecoin. You can also use your credit/debit card or bank transfer to deposit fiat currency.

- Connect your exchange: Once your account is funded, you need to connect it to a crypto exchange where the bot will execute trades on your behalf. Most platforms support popular exchanges like Binance, Coinbase, and Kraken. You will need to provide API keys to connect the two accounts.

- Set up your trading strategy: After connecting your accounts, you need to set up your trading strategy. You can choose from a variety of pre-built strategies or create your own. Some popular strategies include trend-following, mean-reversion, and arbitrage.

- Start the bot: Once you have set up your trading strategy, you can start the bot and let it execute trades on your behalf. It’s important to monitor the bot’s performance regularly and make adjustments to your strategy as needed.

Overall, opening a crypto-bot account is a straightforward process that requires some basic information and a few simple steps. Just make sure to choose a reliable platform and carefully consider your trading strategy before starting the bot.

How To Use Crypto-Bot Trading Bot?

Using a crypto-bot trading bot typically involves the following steps:

- Choose a trading strategy: Before you start using a crypto-bot trading bot, you need to choose a trading strategy. There are many different strategies to choose from, including trend-following, mean-reversion, and arbitrage. Some bots come with pre-built strategies, while others allow you to create your own.

- Set up your bot: Once you have chosen your trading strategy, you need to set up your bot. This involves configuring your bot’s settings, such as your preferred trading pair, order type, and risk management settings. You may also need to connect your bot to your preferred crypto exchange.

- Test your bot: Before you start using your bot with real money, it’s a good idea to test it out with a demo account. This will allow you to see how your bot performs under different market conditions without risking any real money.

- Monitor your bot: Even after you have started using your bot with real money, it’s important to monitor its performance regularly. This will help you identify any issues or opportunities for optimization.

- Make adjustments: Based on your bot’s performance, you may need to make adjustments to your trading strategy or bot settings. This could involve changing your risk management settings, tweaking your trading parameters, or switching to a different trading strategy altogether.

- Stay informed: Finally, it’s important to stay informed about the latest developments in the cryptocurrency market. This will help you make informed decisions about when to use your bot and when to stay on the sidelines.

Overall, using a crypto-bot trading bot can be a powerful tool for automating your trading strategy and taking advantage of market opportunities. However, it’s important to carefully consider your strategy and monitor your bot’s performance to ensure that you achieve the best possible results.

Is Crypto-Bot safe?

Crypto-Bot is safe to use and does not contain malicious software. It is designed with safety in mind and has a number of safeguards built in to protect users and their funds. That said, it is still important to exercise caution when trading with any automated bot or system.

Crypto-Bot Pro Or Cons

| PRO | CONS |

|---|---|

| This can save you time and effort and allow you to take advantage of market opportunities 24/7. | Using a crypto-bot requires some technical knowledge, such as understanding API keys and trading strategies. This can be a barrier to entry for some traders. |

| Bots can execute trades faster than humans, which can be an advantage in fast-moving markets. | Crypto-bots can have bugs and errors that can lead to unexpected losses. It’s important to test your bot thoroughly and monitor its performance regularly. |

| This can help you optimize your strategy and identify potential issues before you start trading with real money. | Even the most advanced crypto-bots can’t predict sudden changes in the market, such as regulatory changes or unforeseen events. |

| Bots don’t have emotions like fear or greed, which can lead to more disciplined and consistent trading. | It’s easy to become over-reliant on your crypto-bot and neglect other important aspects of trading, such as market research and risk management. |

Features Of Crypto-Bot

Automated trading

The primary feature of a crypto-bot is the ability to automate your trading strategy. You can set up your bot to execute trades based on specific parameters, such as price movements, technical indicators, and market conditions.

Backtesting

Many crypto-bots allow you to backtest your trading strategy using historical data. This can help you optimize your strategy and identify potential issues before you start trading with real money.

Multiple exchanges

Most crypto-bots support multiple cryptocurrency exchanges, allowing you to trade on different platforms from a single account.

Trading indicators

Crypto-bots often come with a wide range of trading indicators, such as moving averages, RSI, and MACD. These indicators can help you identify potential trading opportunities and make informed trading decisions.

Risk management

Many crypto-bots come with built-in risk management tools, such as stop-loss orders and trailing stop orders. These tools can help you minimize your losses and protect your capital.

Notifications

Crypto-bots may send notifications to your email or mobile device when certain trading conditions are met, such as when a trade is executed or when a certain price level is reached.

Customization

Many crypto-bots allow you to customize your trading strategy and bot settings to fit your specific trading style and risk tolerance.

The Best Crypto-Bot Alternatives

- TradingView: TradingView is a popular charting and analysis platform that allows you to create and test trading strategies using a wide range of technical indicators. While it doesn’t offer automated trading, it can be used in combination with other trading platforms to execute trades.

- 3Commas: 3Commas is a cloud-based trading platform that offers automated trading bots for cryptocurrencies. It supports multiple exchanges and offers a wide range of trading indicators and risk management tools.

- HaasOnline: HaasOnline is a popular automated trading platform that offers advanced features such as backtesting, strategy optimization, and custom scripting. It supports multiple exchanges and offers a wide range of trading indicators and risk management tools.

- Zenbot: Zenbot is an open-source trading bot that can be customized and modified to fit your specific trading needs. It supports multiple exchanges and offers a wide range of trading indicators.

Crypto-Bot FAQ

What is a crypto-bot?

A crypto-bot is an automated trading program that executes trades on your behalf based on specific rules and parameters.

How does a crypto-bot work?

A crypto-bot uses algorithms to analyze market data and execute trades based on pre-defined rules and parameters set by the user.

Do I need to have programming skills to use a crypto-bot?

No, you don’t need to have programming skills to use a crypto-bot. Many platforms offer user-friendly interfaces that allow you to set up and customize your bot without any coding knowledge.

Can I make money with a crypto-bot?

Yes, it’s possible to make money with a crypto-bot if you have a well-designed trading strategy and properly manage your risk. However, it’s important to remember that trading always involves risk, and there are no guarantees of profits.