What Is Compound.finance

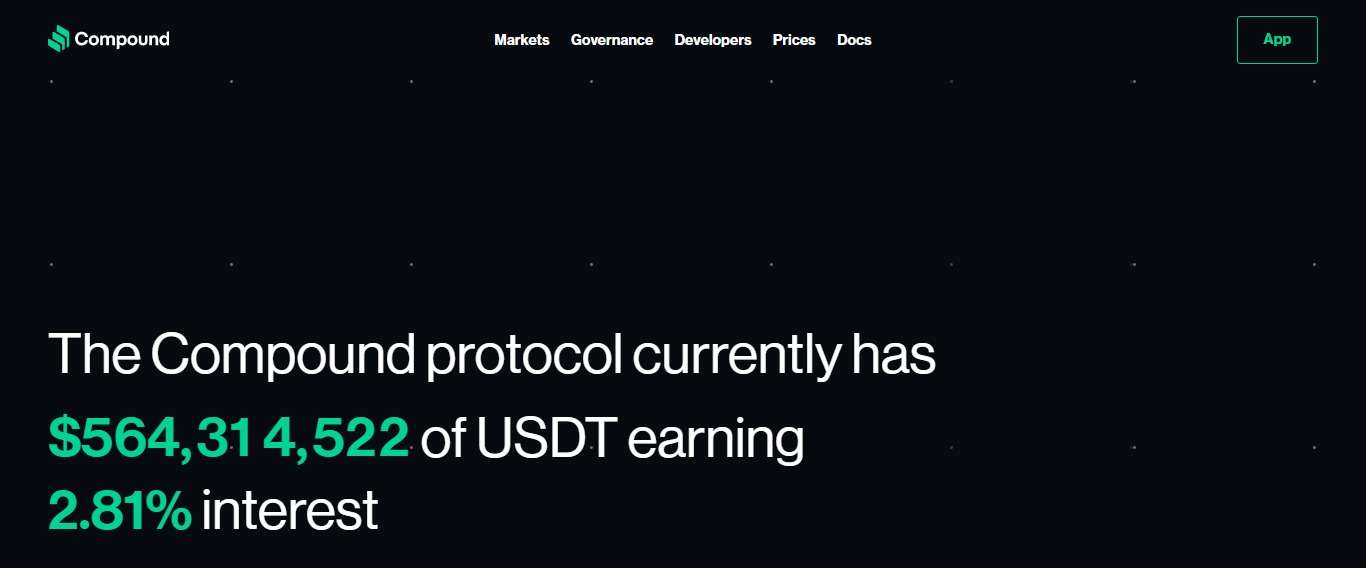

Compound.finance is a DeFi lending protocol that allows users to earn interest on their cryptocurrencies by depositing them into one of several pools supported by the platform. When a user deposits tokens to a Compound pool, they receive cTokens in return. These cTokens represent the individual’s stake in the pool and can be used to redeem the underlying cryptocurrency initially deposited into the pool at any time.

- What Is Compound.finance

- Important Points Table Of Compound.finance

- How to Buy the Compound.finance (COMP) Coin & Trade On Exchange?

- Protocol Math

- cToken and Underlying Decimals

- What Makes Compound Unique?

- Legacy financial System

- Compound Distribution

- What is COMP, and why is it being distributed?

- How does the distribution work?

- How Is the Compound Network Secured?

- Where Can You Buy Compound (COMP)?

For example, by depositing ETH into a pool, you will receive cETH in return. Over time, the exchange rate of these cTokens to the underlying asset increases, which means you can redeem them for more of the underlying asset than you initially put in — this is how the interest is distributed.

Compound.finance the flip side, borrowers can take a secured loan from any Compound pool by depositing collateral. The maximum loan-to-value (LTV) ratio varies based on the collateral asset, but currently ranges from 50 to 75%. The interest rate paid varies by borrowed asset and borrowers can face automatic liquidation if their collateral falls below a specific maintenance threshold.

Since the launch of the Compound mainnet in September 2018, the platform has skyrocketed in popularity, and recently passed more than $800 million in total locked value.

Important Points Table Of Compound.finance

| Basic | Points |

|---|---|

| Coin Name | Compound.finance |

| Short Name | COMP |

| Total Supply | 10,000,000 |

| Explorer | Click Here To View |

| Source | Click Here To View |

| Website | Click Here To Visit |

How to Buy the Compound.finance (COMP) Coin & Trade On Exchange?

Protocol Math

The Compound protocol contracts use a system of exponential math, Exponential.sol, in order to represent fractional quantities with sufficient precision. Most numbers are represented as a mantissa, an unsigned integer scaled by 1 * 10 ^ 18, in order to perform basic math at a high level of precision.

cToken and Underlying Decimals

Prices and exchange rates are scaled by the decimals unique to each asset; cTokens are ERC-20 tokens with 8 decimals, while their underlying tokens vary, and have a public member named decimals.

What Makes Compound Unique?

According to Compound, the bulk of cryptocurrencies take a seat down idle on trade platforms, doing not anything for his or her holders. Compound seems to extrade this with its open lending platform, which lets in everybody who deposits supported Ethereum tokens to without problems earn hobby on their stability or take out a secured loan — all in a totally trustless way.

Compound’s network governance units it other than different comparable protocols. Holders of the platform’s local governance token — COMP — can endorse modifications to the protocol, debate and vote whether or not to put into effect modifications recommended through others — with none involvement from the Compound team. This can encompass selecting which cryptocurrencies to feature assist for, adjusting collateralization factors, and making modifications to how COMP tokens are distributed.

These COMP tokens may be offered from third-birthday birthday celebration exchanges or may be earned through interacting with the Compound protocol, along with through depositing belongings or taking away a loan.

Legacy financial System

The legacy financial system is slow, inefficient, and constrained by intermediaries. We’re on a mission to change that. Compound Labs is an open-source software development company building tools, products, and services for the decentralized finance (DeFi) ecosystem.

Compound Distribution

Compound (COMP) is an ERC-20 asset that empowers community governance of the Compound protocol; COMP token-holders and their delegates debate, propose, and vote on all changes to the protocol.

By placing COMP directly into the hands of users and applications, an increasingly large ecosystem will be able to upgrade the protocol, and will be incentivized to collectively steward the protocol into the future with good governance.

What is COMP, and why is it being distributed?

Compound (COMP) is an ERC-20 asset that empowers community governance of the Compound protocol; COMP token-holders and their delegates debate, propose, and vote on all changes to the protocol.

By placing COMP directly into the hands of users and applications, an increasingly large ecosystem will be able to upgrade the protocol, and will be incentivized to collectively steward the protocol into the future with good governance.

How does the distribution work?

Each day, approximately 2,312 COMP will be distributed to users of the protocol; the distribution is allocated to each market (ETH, USDC, DAI…), and is set through the governance process by COMP token-holders. Within each market, half of the distribution is earned by suppliers, and the other half by borrowers.

How Is the Compound Network Secured?

Everything on Compound is handled automatically by smart contracts, which act to mint cTokens after Ethereum and ERC20 assets are deposited, and allow Compound users to redeem their stake using their cTokens.

The protocol enforces a collateralization factor for all assets supported by the platform, ensuring each pool is overcollateralized at all times. If the collateral falls below the minimum maintenance level, it will be sold to liquidators at a 5% discount, paying down some of the loan and returning the remainder to an acceptable collateralization factor.

This arrangement helps to ensure borrowers maintain their collateral levels, provides a safety net for lenders, and creates an earning opportunity for liquidators.

Where Can You Buy Compound (COMP)?

COMP is currently available to trade on hundreds of cryptocurrency exchange platforms, including Coinbase Pro, Binance and Huobi Global. It can be traded against most other popular cryptocurrencies, as well as a range of fiat currencies, including the U.S. dollar (USD), Indian rupee (INR) and Australian dollar (AUD).