What Is Compound Finance (COMP)?

Compound is a DeFi lending protocol that allows users to earn interest on their cryptocurrencies by depositing them into one of several pools supported by the platform.

When a user deposits tokens to a Compound pool, they receive cTokens in return. These cTokens represent the individual’s stake in the pool and can be used to redeem the underlying cryptocurrency initially deposited into the pool at any time. For example, by depositing ETH into a pool, you will receive cETH in return. Over time, the exchange rate of these cTokens to the underlying asset increases, which means you can redeem them for more of the underlying asset than you initially put in — this is how the interest is distributed.

On the flip side, borrowers can take a secured loan from any Compound pool by depositing collateral. The maximum loan-to-value (LTV) ratio varies based on the collateral asset, but currently ranges from 50 to 75%. The interest rate paid varies by borrowed asset and borrowers can face automatic liquidation if their collateral falls below a specific maintenance threshold.

Since the launch of the Compound mainnet in September 2018, the platform has skyrocketed in popularity, and recently passed more than $800 million in total locked value.

Compound Finance Facts

| Compound | Facts |

|---|---|

| Defi Coin Name | Compound Finance |

| Short Name | COMP |

| Platform | Decentralized Finance |

| Ethereum Contract | 0xc00e94cb662c3520282e6f5717214004a7f26888 |

| Chat Option | Click Here To Visit Compound Chat |

| CEO | Robert Leshner |

| Official Website | Click Here To Visit |

What Is Compound Finance cTokens ?

Each asset supported by the Compound Protocol is integrated through a cToken contract, which is an EIP-20 compliant representation of balances supplied to the protocol. By minting cTokens, users (1) earn interest through the cToken’s exchange rate, which increases in value relative to the underlying asset, and (2) gain the ability to use cTokens as collateral.

cTokens are the primary means of interacting with the Compound Protocol; when a user mints, redeems, borrows, repays a borrow, liquidates a borrow, or transfers cTokens, she will do so using the cToken contract.

There are currently two types of cTokens: CErc20 and CEther. Though both types expose the EIP-20 interface, CErc20 wraps an underlying ERC-20 asset, while CEther simply wraps Ether itself. As such, the core functions which involve transferring an asset into the protocol have slightly different interfaces depending on the type, each of which is shown below.

What Is Compound Finance Governance ?

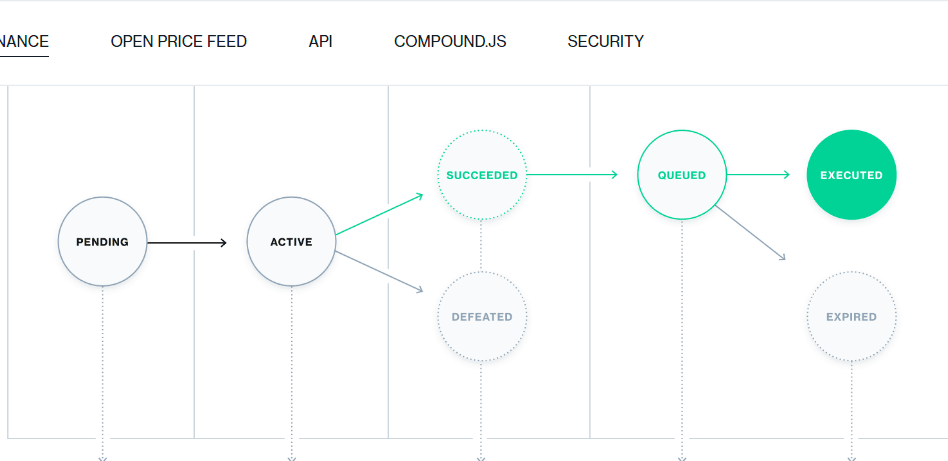

The Compound protocol is governed and upgraded by COMP token-holders, using three distinct components; the COMP token, governance module (Governor Alpha), and Timelock. Together, these contracts allow the community to propose, vote, and implement changes through the administrative functions of a cToken or the Comptroller. Proposals can include changes like adjusting an interest rate model, to adding support for a new asset.

Any address with more than 100,000 COMP delegated to it may propose governance actions, which are executable code. When a proposal is created, the community can submit their votes during a 3 day voting period. If a majority, and at least 400,000 votes are cast for the proposal, it is queued in the Timelock, and can be implemented after 2 days.

Where I Can Buy Compound Defi Coin

Compound Token Available At Several Exchange Coinbase, Binance, Poloniex . Here Are Some Exchange List From Coinmarketcap.

Where I Can Store Compound Token ?

Compound cryptocurrency can be stored in Coinbase and Web3 Metamask wallets. As it is an ERC-20 standard token, it is compatible with other wallets that use this standard, but you’d have to add it to the list of coins manually.

Compound Finance Team

Robert Leshner

CEOChartered Financial Analyst, former economist, and founder of two software startups.

Geoffrey Hayes

CTOMaintainer of Exthereum, technology founder of two startups, led Core Services at Postmates.

Torrey Atcitty

APPLICATION LEADLed mobile development at Postmates, Kahuna, and Aha Mobile.

What’s Next for Compound Labs?

Since Compound founding, Company focused exclusively on building and decentralizing the Compound protocol without regard for revenue — we don’t profit directly from the protocol at all.

Now that our core work on the protocol is done, we’re shifting our focus to developing new products and services for the crypto industry. We don’t have anything to announce quite yet, but stay tuned!

What Makes Compound Finance Unique?

According to Compound, the majority of cryptocurrencies sit idle on exchange platforms, doing nothing for their holders. Compound looks to change this with its open lending platform, which allows anybody who deposits supported Ethereum tokens to easily earn interest on their balance or take out a secured loan — all in a completely trustless way.

Compound’s community governance sets it apart from other similar protocols. Holders of the platform’s native governance token — COMP — can propose changes to the protocol, debate and vote whether to implement changes suggested by others — without any involvement from the Compound team. This can include choosing which cryptocurrencies to add support for, adjusting collateralization factors, and making changes to how COMP tokens are distributed.

These COMP tokens can be bought from third-party exchanges or can be earned by interacting with the Compound protocol, such as by depositing assets or taking out a loan.