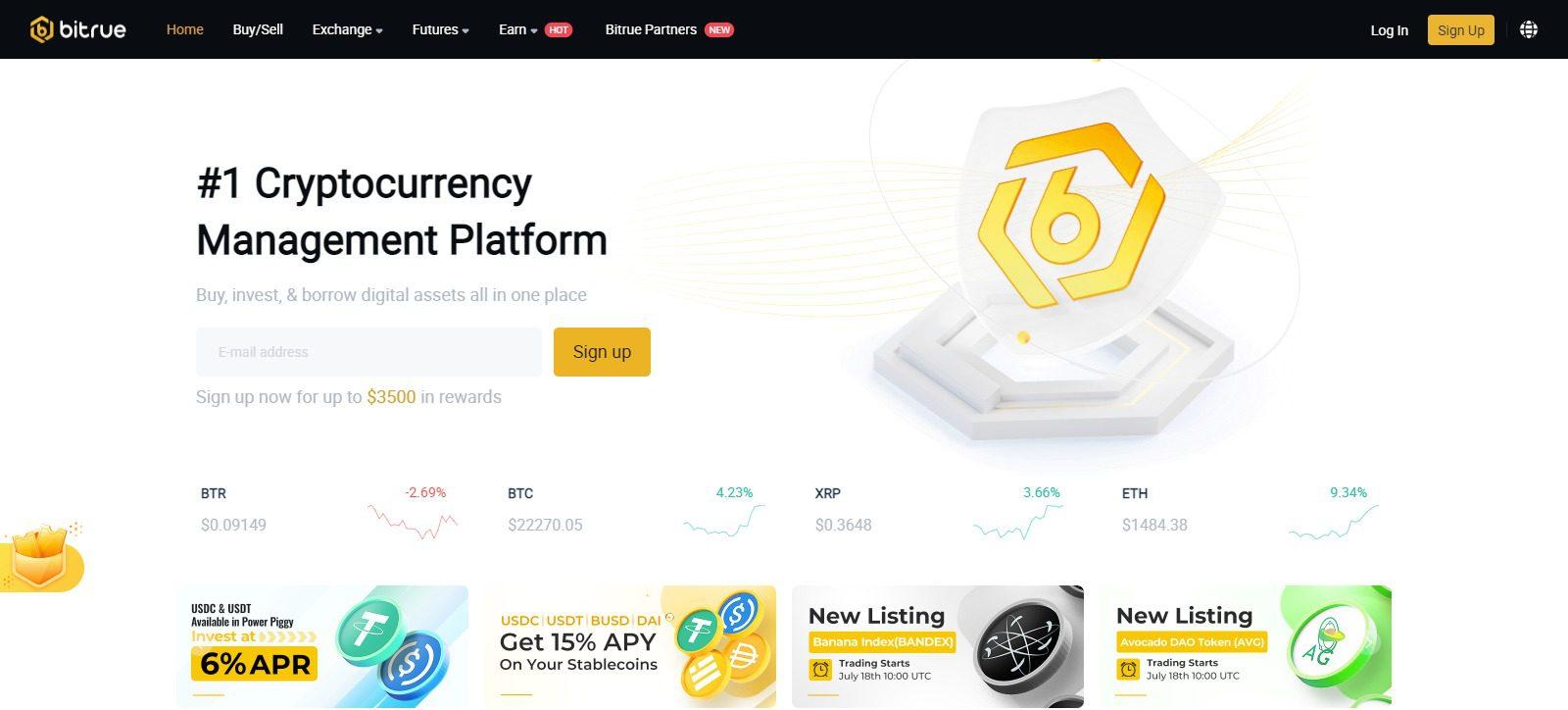

What Is Bitrue (BTR)?

Bitrue was established by a group of blockchain enthusiasts with a goal of providing complete financial services for the currencies of the future. They are dedicated to providing safe, convenient, and diversified services to meet all crypto needs, including trading, investing, purchasing, staking, borrowing, and more.

Contents

Important Points Table Of BTR

| Basic | Points |

|---|---|

| Coin Name | Bitrue |

| Short Name |