Selecting the Best Whole Life Insurance Companies is an important decision for those who seek comprehensive and lifelong protection. Many renowned firms stand out in the market due to their reliability and customer-friendly offerings. At New York Life, their financial strength, diverse policy offerings and long-standing reputation make it an excellent choice. Additionally, MassMutual stands out as another reliable option, providing policyholders with competitive dividends as well as customer care support.

- What Is Life Insurance?

- How to select the Best Whole Life Insurance Companies?

- Here Is List Of Best Whole Life Insurance Companies

- 20 Best Whole Life Insurance Companies of January 2024

- 1. Protective

- 2. Penn Mutual (Best Whole Life Insurance Companies)

- 3. Pacific Life

- 4. Symetra

- 5. Transamerica

- 6. New York Life

- 7. Amica (Top Whole Life Insurance Companies)

- 8. Lincoln Financial

- 9. MassMutual

- 10. Northwestern Mutual

- 11. State Farm (Best Whole Life Insurance Companies)

- 12. Corebridge Financial

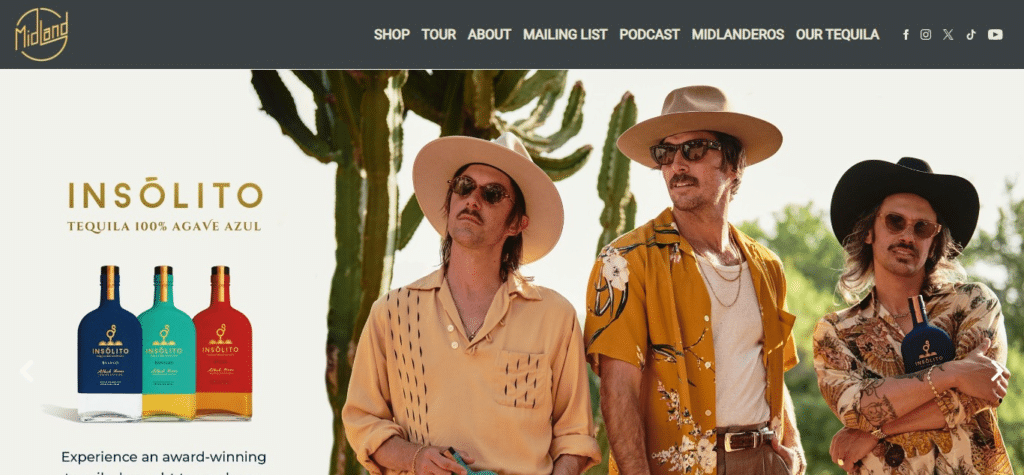

- 13. Midland

- 14. Nationwide

- 15. Guardian (Top Whole Life Insurance Companies)

- 16. AARP

- 17. Ethos Life

- 18. Ladder Life

- 19. AIG Direct

- 20. Mutual of Omaha (Best Whole Life Insurance Companies)

- How does whole life insurance work?

- Who needs whole life insurance?

- Pros and Cons Of Best Whole Life Insurance Companies

- Best Whole Life Insurance Companies Conclusion

- Best Whole Life Insurance Companies FAQ

- What is whole life insurance?

- Why choose whole life insurance?

- Which are considered the best whole life insurance companies?

- What factors should I consider when choosing a whole life insurance company?

- How do premiums work in whole life insurance?

- What is cash value in whole life insurance?

- Is whole life insurance suitable for everyone?

Northwestern Mutual is widely revered for its financial strength and adaptable policies that meet individual needs, while Guardian Life stands out with strong policyholder dividends and commitment to their policies’ holders’ best interests. These companies boast outstanding ratings in terms of financial strength, customer satisfaction and product diversity – making them prominent options for individuals seeking the security and benefits of whole life insurance.

It is crucial for individuals to compare policies, consider their needs carefully and consult with financial professionals when selecting their entire life insurer to ensure they select an organization best suited to achieving long-term financial goals.

What Is Life Insurance?

Life insurance is an investment product designed to provide beneficiaries with financial relief in the event of the policyholder’s death. Contractual life insurance involves policyholders paying regular premiums to an insurer in exchange for them promising to pay out a death benefit sum to designated beneficiaries upon the insured individual’s passing.

Life insurance provides loved ones with essential financial protection after the policyholder passes, shielding them from debts, mortgage payments and living expenses that might arise as a result. Life insurance can also be an integral component of estate planning, providing liquidity and security for heirs.

There are various kinds of life policies, including term life and whole life policies, with each providing unique features and benefits designed to suit the specific needs and preferences of those seeking this form of financial protection.

How to select the Best Whole Life Insurance Companies?

Selecting the ideal whole life insurance company requires careful consideration of various factors to ensure the policy fits with your individual needs and preferences. Here are key steps for making an informed choice:

Financial Stability: Evaluate the financial strength and stability of an insurance company. Ratings from independent agencies such as A.M. Best, Moody’s or Standard & Poor’s may provide valuable insight into its health.

Reputation and Customer Reviews: Conduct an in-depth investigation of a company and read customer reviews about customer service, claims processing and overall satisfaction to assess whether they offer reliable coverage. Positive comments in these areas indicate reliable insurers.

Policy Features: Gain an understanding of the features of whole life insurance policies, such as guaranteed death benefits, cash value accumulation and potential dividends. Compare policy details such as riders and options offered by various companies.

Flexibility: Selecting an insurance provider who provides customizable policies with plenty of customizability is essential, enabling you to adjust coverage, premiums or beneficiaries as your needs evolve.

Premiums and Affordability: When researching insurance premiums, keep your budget and financial goals in mind when comparing premium rates across insurers. Be wary of policies with lower upfront premiums that may have significant hikes over time.

Dividends and Participating Policies: Check to see whether any policies offered by the company participate in dividends. Some insurers allow policyholders the chance to collect dividends that could increase cash value or reduce premiums.

Customer Service: Evaluate the quality and accessibility of customer service offered by your provider. An accessible support channel that is responsive and helpful may prove instrumental during the lifecycle of your policy.

Company Longevity: Take into consideration the company’s history and longevity in the insurance industry. Long-established insurers may offer more stability and reliability.

Underwriting Process: Understand the underwriting process and any medical exams or health evaluations necessary. Different companies may have more liberal underwriting criteria.

Consult an Independent Professional: Speak to a financial advisor or insurance professional, they can provide personalized guidance tailored to your unique financial circumstances and goals.

By carefully considering these factors and comparing offerings from different whole life insurance companies, you can make an informed decision that aligns with your financial goals and provides long-term security for yourself and your loved ones.

Here Is List Of Best Whole Life Insurance Companies

- Protective

- Penn Mutual

- Pacific Life

- Symetra

- Transamerica

- New York Life

- Amica

- Lincoln Financial

- MassMutual

- Northwestern Mutual

- State Farm

- Corebridge Financial

- Midland

- Nationwide

- Guardian

- AARP

- Ethos Life

- Ladder Life

- AIG Direct

- Mutual of Omaha

20 Best Whole Life Insurance Companies of January 2024

1. Protective

Protective Life Insurance Company stands out as a premier whole life provider, with an array of comprehensive policies tailored to meet policyholders‘ diverse needs. As an industry leader in terms of financial stability and customer service excellence, Protective stands out among competitors. Policyholders of this company enjoy the flexibility to customize coverage according to their individual financial goals, making their plans fit seamlessly into life plans and strategies.

Protective’s whole life insurance policies provide long-term financial security with cash value accumulation, guaranteed death benefits and potential dividends – providing a solid basis for long-term security. Protective stands out as an outstanding provider, known for their strong financial footing and customer-first focus.

When looking for whole life coverage, individuals should carefully evaluate their own individual needs and compare policies before selecting Protective. As with any decision related to finances or insurance, individuals should make an informed choice that aligns with their overall strategy and overall needs.

2. Penn Mutual (Best Whole Life Insurance Companies)

Penn Mutual Life Insurance Company has earned an esteemed position among providers of whole life coverage, earning praise for its financial stability and customer-first approach. Penn Mutual’s history dates back to 1847 and they have consistently demonstrated their dedication to policyholders by providing reliable and flexible whole life insurance options. Lifelong coverage, guaranteed cash value accumulation, and potential dividends provide a sound basis for long-term financial planning.

Penn Mutual stands out in the highly competitive insurance market by emphasizing personalized service and flexible policy options. As policyholders seek a reliable partner to safeguard their financial futures, Penn Mutual’s excellent track record and commitment to meeting individual needs make it an attractive option for those considering whole life insurance as part of their comprehensive financial strategy. Individuals should carefully examine policy details and consult with financial professionals in order to make sure Penn Mutual fits with their goals and preferences.

3. Pacific Life

Pacific Life stands out as one of the premier providers of whole life insurance, recognized for their financial strength, longevity in the industry and commitment to customer satisfaction. Established in 1868, they have provided reliable coverage with comprehensive protection at competitive rates for policyholders over time. Whole life policies from this provider offer guaranteed death benefits, cash value accumulation and dividend potential – providing a solid basis for long-term financial planning.

Pacific Life prides itself on offering policyholders an open and straightforward experience when it comes to understanding their coverage and potential benefits. Pacific Life stands out as an attractive choice for individuals searching for long-term financial protection through whole life insurance, due to its focus on flexibility, customizability and reasonable premiums. As with any financial decision, it is vital that individuals carefully assess their needs, compare policies carefully and consult professionals so that Pacific Life meets with their overall goals and financial plans.

4. Symetra

Symetra Life Insurance Company has built up an excellent reputation as a provider of whole life policies designed to meet policyholders’ diverse needs. Symetra has earned its place as a trusted name in the insurance industry through a dedication to both financial stability and customer satisfaction. Whole life policies from this company provide guaranteed death benefits, cash value accumulation and potential dividends, providing long-term financial security.

Symetra provides flexible policy options that enable individuals to tailor coverage according to their own circumstances and financial goals. Policyholders seeking life insurance protection can rely on Symetra’s commitment to stability and customer service when searching for their life insurance provider of choice. Individuals looking at whole life policies as part of their financial planning strategy should carefully compare features and benefits offered by Symetra policies so as to make sure it matches up with their specific objectives.

5. Transamerica

Transamerica is widely acknowledged as one of the premier providers of whole life insurance policies, offering comprehensive protection and financial security to policyholders since 1904. Transamerica has built up an impeccable reputation within the insurance industry since 1904; they remain one of the industry leaders today.

Whole life policies offered by this company provide guaranteed death benefits, cash value accumulation, and potential dividends – providing a solid platform for long-term financial planning. Transamerica has long been recognized for their dedication to innovation and customer satisfaction, providing flexible policy options tailored to meet the varying needs of individuals.

Transparency and affordability make Whole Life Insurance an appealing choice for anyone seeking long-term protection and investment opportunities through whole life coverage. Transamerica stands out as an attractive option when individuals consider life insurance policies; their strong track record and customer-first philosophy makes them a top choice to include in a holistic financial strategy. Consultation with financial professionals can help individuals assess whether this provider aligns with their specific goals and preferences.

6. New York Life

New York Life Insurance Company stands out as a premier whole life insurer, boasting unparalleled financial strength, longevity and dedication to customer satisfaction. Since 1845, New York Life has provided its customers with reliable and comprehensive coverage. Whole life policies from this provider offer guaranteed death benefits, cash value accumulation and potential dividends for long-term financial security.

New York Life stands out in the insurance marketplace due to its wide array of policy offerings and ability to tailor them specifically to each policyholder’s individual needs. Furthermore, its dedication to financial education and personalized service sets it apart. As individuals search for a trustworthy partner to meet their life insurance needs,

New York Life offers an attractive choice. Prospective policyholders should carefully examine policy details, compare features, and seek professional advice when making their selection; New York Life may well match up perfectly with their objectives and preferences.

7. Amica (Top Whole Life Insurance Companies)

Although Amica is widely acknowledged for their expertise in property and casualty insurance, they may not be seen as an authoritative provider of whole life policies. Amica Mutual Insurance Company provides policies tailored to the unique needs of their policyholders in areas like auto, home and life insurance. Amica’s approach to whole life insurance emphasizes flexibility, enabling individuals to personalize coverage to their financial goals and circumstances.

Amica may not be as widely recognized in the whole life insurance market, but their excellent customer service and commitment to policyholder satisfaction make them worthy contenders for consideration when seeking comprehensive protection. As with any decision about insurance policies or services, individuals should carefully compare offerings and consult financial professionals when selecting an insurer like Amica that aligns with their specific preferences and financial strategy.

8. Lincoln Financial

Lincoln Financial Group is widely recognized as a top provider of whole life insurance policies, offering comprehensive policies designed to meet policyholders’ diverse needs. Lincoln Financial has built its name over time as an industry leader and reliable player since 1905. Whole life policies from this provider offer guaranteed death benefits, cash value accumulation and potential dividends – providing a solid platform for long-term financial planning. Lincoln Financial has long been recognized for their financial strength, innovation and customer-centric focus.

Their policies offer flexible coverage options that enable individuals to tailor coverage according to their own individual circumstances and financial goals. Lincoln Financial offers reliable life insurance policies at an attractive price, making them an attractive option when searching for the right life insurer to partner with. Prospective policyholders should carefully compare policy features, read policy details and consult financial professionals in order to ensure Lincoln Financial meets their personal objectives and preferences.

9. MassMutual

MassMutual Life Insurance Company stands out as an exceptional provider of whole life coverage, known for its financial strength, customer-first approach, and longstanding legacy. MassMutual was established in 1851, providing reliable and comprehensive coverage to its policyholders ever since. Whole life policies from this company provide guaranteed death benefits, cash value accumulation and potential dividends – offering long-term financial security.

MassMutual stands out as an industry leader thanks to its competitive dividends and customizable policy options, enabling individuals to tailor their protection precisely according to their unique requirements. MassMutual stands out as an industry leader when it comes to policyholder satisfaction and financial strength, making them a reliable option for anyone searching for long-term protection and investment opportunities offered by whole life insurance policies.

When making life insurance choices, individuals should carefully evaluate all policies offered by MassMutual before consulting financial professionals to make sure their choices align with individual financial goals and preferences.

10. Northwestern Mutual

Northwestern Mutual stands out as a premier provider of whole life insurance, known for its financial strength, custom policies, and dedication to policyholder satisfaction. Northwestern Mutual, with roots dating back to 1857, has built up a sterling reputation within the insurance industry since then.

Whole life policies from this company offer guaranteed death benefits, cash value accumulation, and potential dividends to provide long-term financial security planning. Northwestern Mutual’s policies are known for being flexible, enabling individuals to customize coverage according to their specific circumstances and financial goals.

Financial education, personalized service, and consistently high ratings of financial stability make the company an attractive option for those seeking comprehensive coverage and long-term security.

Individuals considering whole life insurance as part of their financial strategy should carefully research Northwestern Mutual’s policies, compare features, and consult with financial professionals in order to make sure it aligns with their specific objectives and preferences.

11. State Farm (Best Whole Life Insurance Companies)

State Farm is widely renowned and trusted as a provider of whole life insurance, known for their wide network of agents, financial stability and commitment to exceptional customer service. State Farm is an established insurance provider, dating back to 1922. Today, they offer a broad array of products including whole life coverage. Whole life policies from this company offer policyholders guaranteed death benefits, cash value accumulation and dividend potential – providing a secure foundation for long-term financial planning.

State Farm is well known for their personalized approach, competitive premiums, and selection of policies tailored specifically to individual needs. State Farm stands out in the insurance industry as an outstanding option for individuals searching for reliable and comprehensive whole life coverage. When making this important financial decision, taking careful note of policy details and consulting with State Farm agents is paramount to making sure their coverage aligns with individual financial goals and preferences.

12. Corebridge Financial

Corebridge Financial (formerly AIG Life & Retirement) stands firm on their promise: to empower individuals in pursuing their future goals with our range of retirement solutions and insurance products. Corebridge Financial specializes in comprehensive financial planning to assist people in safeguarding their futures.

Their wide array of offerings includes retirement solutions and insurance products tailored specifically for individuals based on their unique requirements. By employing a proactive and strategic approach, Corebridge Financial helps their clients navigate through the complexities of retirement planning with confidence, providing them with all of the tools needed for an assured and fulfilling retirement future.

13. Midland

Hailing from Dripping Springs, TX lead vocalist Mark Wystrach fronts Midland’s rich sound that is rounded out with lead guitarist/ vocalist Jess Carson and bass player/ vocalist Cameron Duddy. Rooted in tradition in both sound and style, the trio initially garnered attention playing clubs in the region.

Their critically-acclaimed sophomore album LET IT ROLL (Big Machine Records) earned the No. 1 position on Billboard’s Top Country Album Sales chart upon release,receiving praise from outlets such as Rolling Stone, Variety, NPR and Entertainment Weekly among others.

Wystrach, Carson and Duddy all played an integral role in writing the 14-track album with Shane McAnally and Josh Osborne as a follow-up to the critically acclaimed, GOLD-certified debut album, ON THE ROCKS (Big Machine Records). Launching in 2017 with rave reviews, ON THE ROCKS was declared “the year’s best Country album” by Washington Post.

Their 2x Platinum-certified chart-topping debut “Drinkin’ Problem,” which offers an intentional nod to Country music reminiscent of the 1970s and 80s, earned the band their first GRAMMY® Awards nominations for Best Country Song and Best Country Duo/Group Performance.

14. Nationwide

Nationwide stands out as a premier provider of whole life insurance, distinguished by its financial strength, wide array of insurance products, and dedication to customer satisfaction. Nationwide Insurance has built an outstanding track record since 1926 and earned itself a trusted and reliable status among policyholders and customers alike.

Whole life policies from this provider offer guaranteed death benefits, cash value accumulation and potential dividends to provide a secure foundation for long-term financial planning.

Nationwide Insurance has long been recognized for its personalized service, competitive premiums, and variety of policy options that meet individual needs. As an established and reputable provider of life insurance policies, Nationwide makes an ideal choice for those seeking comprehensive and long-term protection.

Individuals interested in whole life coverage should carefully examine its policy details, compare features against each other, and consult with agents of this insurer in order to ensure alignment between them and their own specific financial goals and preferences.

15. Guardian (Top Whole Life Insurance Companies)

Guardian Life Insurance Company is widely considered to be one of the premier providers of whole life insurance policies, earning an enviable reputation for their financial strength, customer-first approach, and commitment to policyholder satisfaction. Guardian Insurance Company was established in 1860, and since that time has demonstrated their longstanding dedication to providing comprehensive and dependable coverage.

Whole life policies offered by this company provide guaranteed death benefits, cash value accumulation and potential dividends; providing long-term financial security. Guardian stands out for its competitive dividends, flexible policy customization options and personalized care services that meet individual needs.

Thanks to its commitment to transparency and its proven track record, Guardian stands as an outstanding option for anyone searching for stability and benefits from whole life insurance policies. Individuals looking into whole life insurance as part of their financial strategy should review Guardian policies carefully, compare features, and consult with financial professionals in order to ensure alignment with their own individual objectives and preferences.

16. AARP

AARP and New York Life Insurance Company work in cooperation to offer whole life policies tailored specifically to the needs of its members, who tend to be aged 50 years or over. This partnership unites AARP with New York Life to form an unrivalled combination of trustworthiness and financial expertise.

AARP whole life policies offer lifetime coverage with guaranteed death benefits and cash value accumulation – no medical exam necessary! These policies are tailored to provide financial security and peace of mind to older individuals and their families, taking into account all their specific considerations.

AARP and New York Life have long been recognized as two leaders in the insurance industry, making their collaboration an excellent option for individuals over 50 who require whole life coverage tailored to meet their specific financial goals and preferences. Individuals considering purchasing whole life coverage through AARP should carefully read policy details, compare features and consult with insurer before making their final decision.

17. Ethos Life

Ethos Life Insurance has earned widespread respect as an award-winning provider of whole life insurance policies, known for their innovative and customer-friendly approach to the industry. Ethos Insurance began operations in 2016 with an aim of using technology to streamline and simplify the application process for individuals seeking comprehensive coverage. Whole life policies from this company provide policyholders with guaranteed death benefits, cash value accumulation and dividend potential, providing a secure foundation for long-term financial planning.

Ethos Insurance emphasizes simplicity, transparency and affordability when developing their policies – making them an appealing option for those who prioritize an easy and straightforward insurance experience. Ethos Life stands out in the market by using technology to enhance customer experiences, providing individuals with whole life insurance an appealing alternative. Prospective policyholders should carefully research Ethos’ policies, compare features, and speak with representatives at Ethos to make sure that it aligns with their individual financial goals and preferences.

18. Ladder Life

Ladder Life Insurance stands out in the insurance market by taking an innovative and modern approach to whole life coverage. Ladder Life Insurance Company was launched in 2017 with an aim of making life insurance simpler by providing flexible policies tailored to individual policyholders’ individual needs. Leveraging technology, applications and underwriting processes are made more efficient so as to make accessing coverage both accessible and convenient for users. Ladder’s whole life insurance policies offer guaranteed death benefits, cash value accumulation and potential dividends that provide long-term financial security.

Ladder stands out among competitors as being both transparent and affordable, making them a top pick among digital-first insurance options for individuals seeking whole life protection. As individuals explore whole life coverage options through Ladder, it is important that they carefully consider its policies, features and consultation with Ladder so as to meet individual financial goals and preferences.

19. AIG Direct

AIG Direct, part of American International Group, is widely recognized for providing whole life insurance policies that offer both comprehensive coverage and financial security to policyholders. AIG Direct provides individuals looking for straightforward life insurance solutions an accessible experience. Whole life policies from this company provide policyholders with guaranteed death benefits, cash value accumulation and possible dividends to establish long-term financial planning security.

AIG Direct stands out as a user-friendly whole life insurer with its straightforward application process and competitive premiums, along with their emphasis on transparency and customer satisfaction. AIG Direct makes an attractive option for individuals seeking reliable whole life coverage – those considering AIG Direct should carefully examine policy details, compare features, and consult the company directly in order to ensure it aligns with their financial goals and preferences.

20. Mutual of Omaha (Best Whole Life Insurance Companies)

Mutual of Omaha stands out as a reliable and longstanding provider of whole life insurance, recognized for their dedication to financial stability and customer service. Established since 1909, they have built up an excellent reputation within the insurance industry. Whole life policies from this company offer their policyholders guaranteed death benefits, cash value accumulation and dividend opportunities – providing a firm foundation for long-term financial security.

Mutual of Omaha is widely known for providing personalized service at highly competitive premiums with policy options tailored to suit the unique needs of each customer. Mutual of Omaha stands out as an appealing choice for individuals searching for comprehensive and long-term coverage, thanks to its commitment to transparency and reliability. Before purchasing whole life insurance from Mutual of Omaha, individuals should carefully examine policy details, compare features, and consult the company in order to ensure that it fits with their financial goals and preferences.

How does whole life insurance work?

Whole life insurance is a type of permanent life insurance that provides coverage for the entire lifetime of the insured, as long as premiums are paid. It operates by combining a death benefit with a cash value component. The policyholder pays regular premiums, a portion of which goes towards the death benefit – the amount paid to beneficiaries upon the insured’s death.

Another portion of the premium goes into the policy’s cash value, a tax-advantaged savings or investment account. This cash value accumulates over time and can be accessed by the policyholder through withdrawals or loans during their lifetime. The death benefit is typically paid out tax-free to beneficiaries, providing financial protection.

Whole life insurance offers stability with fixed premiums and a guaranteed death benefit, making it a long-term financial planning tool. The cash value component allows for potential growth and can be utilized for various financial needs, such as supplementing retirement income or covering unexpected expenses.

Who needs whole life insurance?

The suitability of whole life insurance varies based on individual financial goals, circumstances, and preferences. Here are some situations where individuals might consider whole life insurance:

Permanent Coverage Needs: Whole life insurance is suitable for those who have a lifelong need for coverage, such as providing financial support for dependents, paying estate taxes, or leaving a legacy.

Estate Planning: Individuals with substantial assets may use whole life insurance as a tool for estate planning, helping to cover potential estate taxes and ensuring the smooth transfer of assets to heirs.

Wealth Transfer: Whole life insurance can be utilized to transfer wealth to the next generation. The death benefit is typically paid out tax-free to beneficiaries, providing a financial legacy.

Supplemental Retirement Income: The cash value component in whole life insurance policies can be accessed during the policyholder’s lifetime. Some individuals use this cash value as a supplement to their retirement income.

Business Owners: Business owners may use whole life insurance to fund buy-sell agreements, provide key person insurance, or assist with business succession planning.

Risk Aversion: Individuals who prefer financial products with fixed premiums and guarantees may find whole life insurance appealing. The policy provides a predictable death benefit and cash value growth.

Long-Term Savings: The cash value accumulation in whole life insurance can serve as a forced savings mechanism. Policyholders can access this cash value for various purposes, such as a down payment on a home or funding education.

Those Able to Afford Premiums: Whole life insurance premiums are generally higher than those for term life insurance. Individuals considering whole life insurance should ensure they can comfortably afford the ongoing premium payments.

It’s important to note that while whole life insurance offers unique benefits, it may not be necessary or suitable for everyone. Factors such as budget, financial goals, and risk tolerance should be carefully considered, and consulting with a financial advisor can help individuals make informed decisions based on their specific circumstances.

Pros and Cons Of Best Whole Life Insurance Companies

Pros:

Lifetime Coverage: Whole life insurance provides coverage for the entire lifetime of the insured, offering peace of mind and financial protection for loved ones.

Guaranteed Death Benefit: The death benefit is guaranteed and is generally tax-free to beneficiaries, providing a financial safety net.

Cash Value Accumulation: Whole life policies build cash value over time, which policyholders can access through withdrawals or loans for various financial needs.

Stable Premiums: Premiums for whole life insurance are typically fixed and remain constant throughout the life of the policy, providing predictability for budgeting.

Dividends: Some whole life policies, particularly participating ones, may pay dividends to policyholders, which can be used to enhance the cash value or reduce premiums.

Estate Planning: Whole life insurance can be a valuable tool for estate planning, helping cover potential estate taxes and ensuring the smooth transfer of assets.

Potential for Dividends: Some policyholders may receive dividends if the insurance company performs well, providing an additional source of income.

Cons:

Higher Premiums: Whole life insurance generally has higher premiums compared to term life insurance, which can be a disadvantage for those on a tight budget.

Complexity: The cash value component and various features of whole life policies can make them more complex compared to simpler insurance products.

Limited Investment Growth: The cash value growth in whole life insurance is often conservative compared to other investment options, limiting potential returns.

Opportunity Cost: The premiums paid for whole life insurance could potentially achieve higher returns in other investment vehicles.

Limited Flexibility: Whole life policies may have limited flexibility compared to other types of insurance, making it challenging to adjust coverage based on changing needs.

Not Suitable for Short-Term Needs: Whole life insurance is designed for long-term needs, and surrendering the policy in the early years may result in financial losses.

Best Whole Life Insurance Companies Conclusion

In conclusion, choosing the best whole life insurance company involves a thoughtful evaluation of various factors tailored to individual financial goals and preferences. Reputable companies such as New York Life, MassMutual, Northwestern Mutual, and Guardian have distinguished themselves in the market by offering comprehensive coverage, financial stability, and customer-centric policies.

These companies provide guaranteed death benefits, cash value accumulation, and potential dividends, serving as a secure foundation for long-term financial planning. Prospective policyholders should consider factors such as financial strength, policy features, flexibility, and customer service when making their decision.

It is crucial to carefully review policy details, compare offerings, and, when needed, seek guidance from financial professionals to ensure alignment with specific objectives. Ultimately, the best whole life insurance company is one that caters to individual needs, providing enduring financial security for policyholders and their loved ones.

Best Whole Life Insurance Companies FAQ

What is whole life insurance?

Whole life insurance is a type of permanent life insurance that provides coverage for the entire lifetime of the insured. It combines a death benefit with a cash value component and offers features such as guaranteed death benefits and potential dividends.

Why choose whole life insurance?

Whole life insurance is chosen for its lifelong coverage, stable premiums, guaranteed death benefits, and the ability to accumulate cash value over time. It’s suitable for those with long-term financial goals and estate planning needs.

Which are considered the best whole life insurance companies?

Reputable whole life insurance providers include New York Life, MassMutual, Northwestern Mutual, Guardian, and others. These companies are known for their financial stability, customer satisfaction, and comprehensive policy offerings.

What factors should I consider when choosing a whole life insurance company?

Key factors to consider include the company’s financial strength, policy features, flexibility, customer service, and overall reputation. It’s essential to align these factors with your specific financial goals and preferences.

How do premiums work in whole life insurance?

Premiums for whole life insurance are typically fixed and remain constant throughout the life of the policy. They are higher than term life insurance premiums but provide stability for budgeting purposes.

What is cash value in whole life insurance?

Cash value is a savings or investment component within a whole life insurance policy. It accumulates over time and can be accessed by the policyholder through withdrawals or loans for various financial needs.

Is whole life insurance suitable for everyone?

Whole life insurance may not be necessary or suitable for everyone. It is best for those with long-term coverage needs, estate planning goals, and the ability to commit to higher premiums.