In this article I will to talk about the Best Trading Journals that every trader should use to enhance their performance and monitor their progress.

- What is Trading Journals?

- How To Choose Best Trading Journals

- Key Point & Best Trading Journals List

- 1. Tradervue

- Tradervue Features

- 2. TraderSync

- TraderSync Features

- 3. Edgewonk

- Edgewonk Features

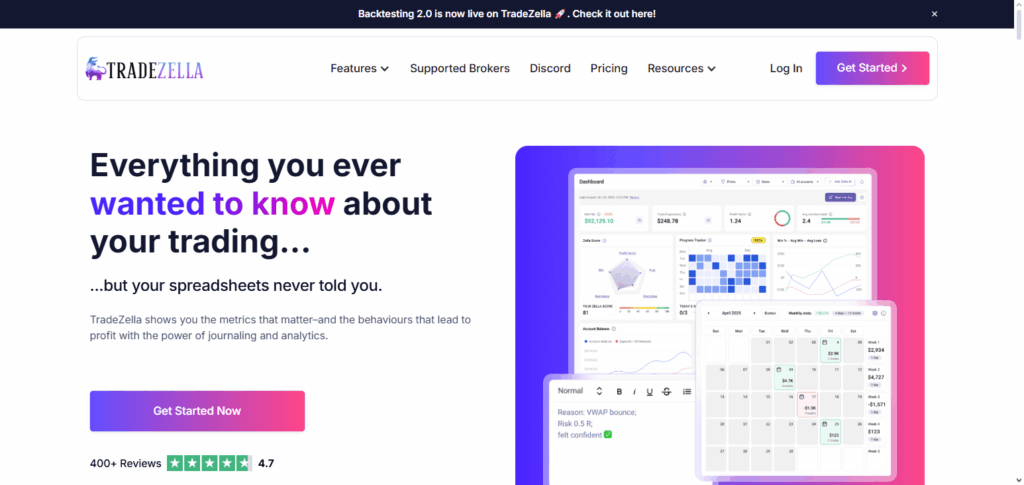

- 4. TradeZella

- TradeZella Features

- 5. Swift Journal

- Swift Journal Features

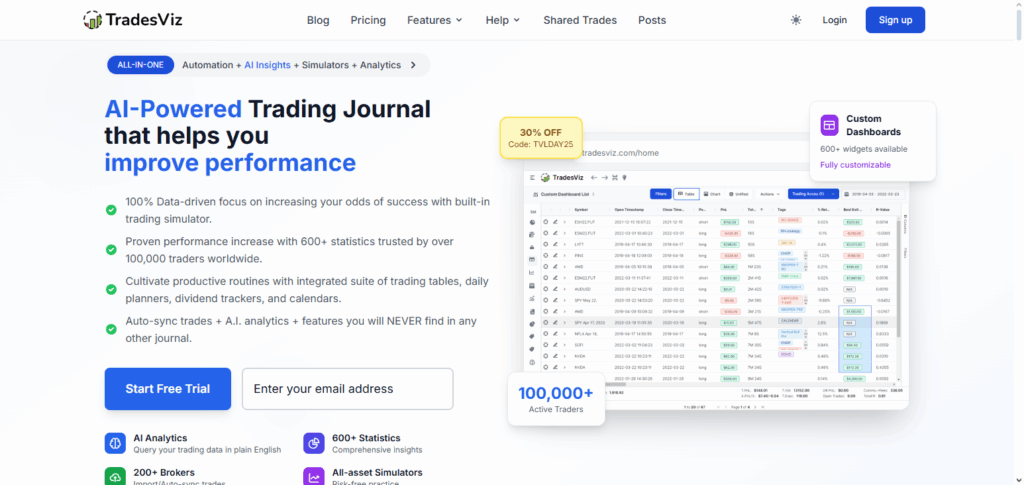

- 6. TradesViz

- TradesViz Features

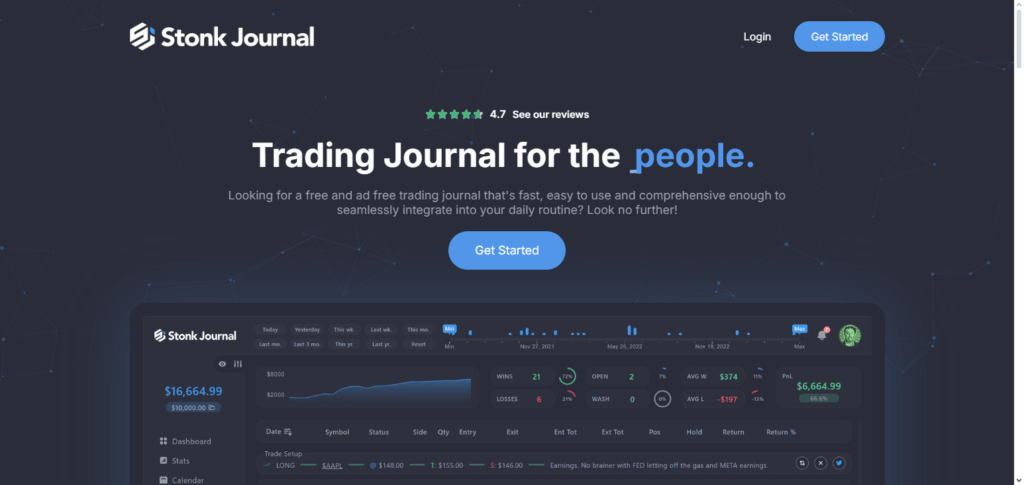

- 7. Stonk Journal

- Stonk Journal Features

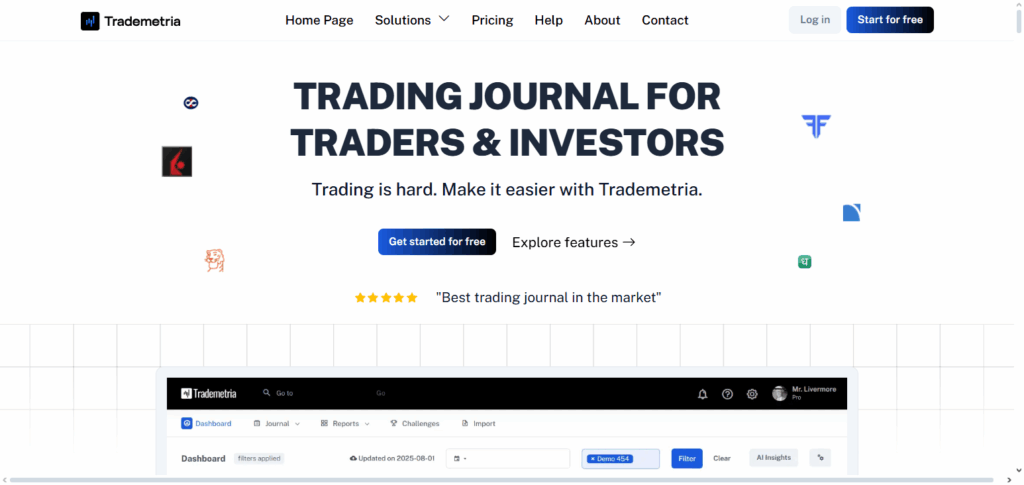

- 8. Trademetria

- Trademetria Features

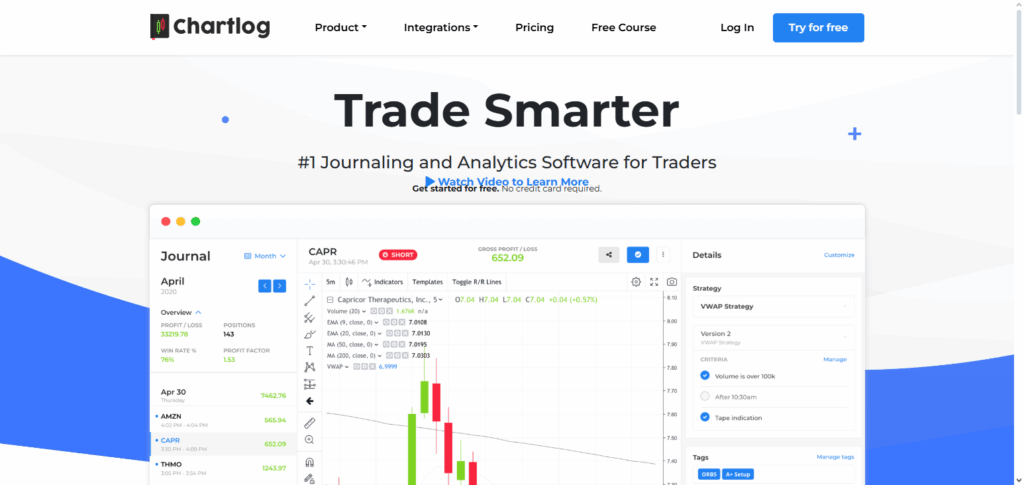

- 9. Chartlog

- Chartlog Features

- 10. Journalytix

- Journalytix Features

- Pros & Cons Best Trading Journals

- Conclusion

- FAQ

Trading journals assist in understanding the various trading strategies, their risks, and evaluating the approaches to trading and adjusting to the dominant strengths and weaknesses in the trading system.

A variety of tools from automatic trade imports to advanced analytics helps in streamlined trade logging and offers insights about the recorded trades.

What is Trading Journals?

A trading journal is a record maintained by the trader that captures details of all the trades undertaken and strategies employed along with the outcomes and the emotions felt during the trades.

It is akin to a self-analysis log that helps in recognizing the patterns in a trader’s decision making and improving it with the passage of time.

It fosters the learning process. Reviewing a trading journal helps the trader to come to the right conclusions and formulate more effective trading strategies. It also helps in effective risk management, discipline, and stride limb control.

It does not matter whether it is used in the stock, forex, or crypto or any other market, it is equally beneficial for a founding trader as well as a seasoned trader. It enhances consistency along with fostering long term success.

How To Choose Best Trading Journals

Here are the key points to consider while selecting the best trading journal:

User-Friendly – A journal sould be simple enough so that recording trades can be done quickly and easily.

Customizable – It should allow tracking of as many as possible strategical elements including the entry and exit points, risk, the type of trade, and even the market conditions.

Integration – It should perform well across different devices and platforms for easy capturing and saving of journal entries.

Privacy and Protection – For the users that store their journal entries on the cloud, it should keep the sensitive trading data protected.

Analysis Features – A journal should be able to highlight and identify mistakes while capturing diagrams, graphs, and key charts to clarify the performance.

Collaboration and Active Support – Several journals are enhanced to offer trading works, comprehensive platforms, and also big supportive communities.

Key Point & Best Trading Journals List

| Trading Journal | Key Points |

|---|---|

| Tradervue | Cloud-based, detailed trade analysis, supports multiple asset classes. |

| TraderSync | Real-time trade import, performance metrics, risk analysis tools. |

| Edgewonk | Advanced analytics, customizable dashboards, psychological tracking. |

| TradeZella | Focus on algorithmic and discretionary traders, automatic trade logging. |

| Swift Journal | Simple interface, easy logging, performance summaries, beginner-friendly. |

| TradesViz | Automated trade import, visual analytics, strategy performance tracking. |

| Stonk Journal | Stock-focused, easy tracking, customizable reports, cloud-based. |

| Trademetria | Multi-broker support, portfolio tracking, detailed statistics. |

| Chartlog | Visual trade review, strategy evaluation, chart annotations. |

| Journalytix | AI-driven insights, performance tracking, detailed trade metrics. |

1. Tradervue

Founded in 2013, Tradervue has the best trading journal integrated with analytics for hyperactive traders, but is still the most competitive in the market with its emphasis on user experience.

Its biggest strength is the automated trade imports feature, which works with over 80 brokers (like Interactive Brokers and TradeStation). Its advanced analytics feature (exit analyses, liquidity reports, and performance tracking), which is performance driven, works alongside the user interface to aid traders in predetermining and optimizing their trading strategies.

Tradervue’s pricing plans consists of a complimentary plan with easily accessible and limited features, Silver at $ 29.95 a month, and Gold at $49.95 a month, with both approbated for a 7-day trial.

Tradervue Features

- Detailed tracking of trades – Logs symbols, strategies, and notes as well as trades.

- Performance metrics – Provides rich analytical graphs and parameters to evaluate trading over a period.

- Community & Sharing – The public can view journals, while the owner can keep some to themselves.

2. TraderSync

Founded in 2015, TraderSync started off as a sophisticated journal for traders and has grown to become a premier journal because of its deep analytics integration.

The aspect that sets it apart from others in the market is the AI-Driven Performance Assistant, which determines and assists in the pattern recognition and mistake rectification trades for traders by providing unique, value-adding insights from comprehensive trade data.

TraderSync enables easy trade imports from 700+ supported brokers, including the most popular ones, such as RObinhood, Webull, and Interactive Brokers. The pricing plans start from Pro at $29.95/month or $237.12/year, Premium at $49.95/month or $521.40/year, and Elite at $79.95/month or $834.60/year, each providing traders with more sophisticated features at each tier.

TraderSync Features

- Brokerage connections – Enables traders to connect with brokers and upload trades to the program.

- Detailed analytics – Provides risk/reward metrics as well as win ratios and expectation.

- Strategy tagging – Allows traders to delineate trades across strategy, symbol, or market.

3. Edgewonk

Founded in 2015, Edgewonk is a reputable trading journal focused towards trader performance with analytics and customization towards user needs.

Continent with Forex, stocks, and crypto alongside futures and options, Edgewonk also integrates with most platforms and brokers. Charged at 169 dollars per year, Edgewonk includes automated trade imports, performance analytics, and unlimited journals.

Edgewonk provides diep tools such as psychological tracking, trading checklists, and smart tagging to streamline a trader’s workflow, and optimize strategies and performance by aiding in trend and mistake recognition.

Edgewonk Features

- Flexible Journals – Assigns a journal to a specific market or trading style.

- Emotional training – Records trading psychology and emotions to bolster trading decisions.

- Circadian analytics – Unique metrics like streaks, performance curves, and position size are offered.

4. TradeZella

TradeZella is a new trading journal and analytics platform intended to assist traders improve their performances based on insights and journal entries. It was created by Usman Ashraf, a trader, and entrepreneur. TradeZella has automated trade logging, advanced analytics, and backtesting tools. All of which are features of TradeZella. Its most notable feature is the trade replay.

It offers users the ability to replay and analyze their trades. For pricing, the Basic Plan begins at $29/a month, and $49/a month on the Pro Plan. Discounts are available with an annual subscription.

TradeZella Features

- Privacy-centered minimum KYC – Ensures quick registration with less than KYC Type 1.

- Effortless record keeping – Collects trades effortlessly from numerous exchanges, especially cryptocurrency.

- Deep analytics – Generates complete Profit & Loss and performance metrics of strategies.

5. Swift Journal

The Swift Journal is the first of its kind trading journal designed for forex traders which also enables them to work on MetaTrader 4 and 5.

It has an automated trade copier which allows for the easy replication of trades on different accounts and also has more than 950 broker integrations. The journal can be bought for Basic ($49/month), Pro ($99/month) and Elite ($129/month) Plans all of which have discounts on an annual chargeable subscription. Also read reviews on Swift Journal on .

The Swift Journal is a excellent forex trading journal for broker traders desiring automated performance tracking and streamlined account handling.

Swift Journal Features

- Easy User Interface: Fast entry of trade data for novices as well as experienced traders.

- Tag & Filter Trades: Trade categorized by asset, strategy, or time frame.

- Performance Reports: Summarizes trades and offers insights for improvement.

6. TradesViz

Established in 2019, TradesViz as a trading journal offers greatness in flexibility and feature richness. If you are a trader who specializes in stocks, options, futures, forex and even crypto, TradesViz has built a seamless and impressive journal which enables you to import, analyze and work with the data as you please.

A key feature of TradesViz is the multi-symbol trading simulator which enables you to practice trade in a forex-like mock environment. Starting with the Basic plan which is free of charge, and the Pro plan priced at 19.99 USD or 14.99 USD if billed annually, TradesViz is affordable as the pricing release is aimed at traders of all levels.

Pro plan subscribers will enjoy a 7-day free trial and every user has access to a 30% discount from the code use TVLDAY25 in the period of August 29th to September 10th, 2025. Especially with the advanced features and the detailed analysis tools, TradesViz offers traders flexible pricing and the perfect journal to improve on.

TradesViz Features

- Visual Analytics: Employs charts, graphs, and heat maps to visually analyze and evaluate trades.

- Broker Integration: Imports trades automatically from many supported brokers.

- Strategy Evaluation: Allow traders to analyze and improve on strategies based on previous trades.

7. Stonk Journal

Stonk Journal was founded in 2021 and has since then been a no cost and no ad trading journal that helps traders to simplify their journal process. It has a unique “entry of a trade” feature that helps users keep track and log their trades in a very efficient and fast manner.

It has other supporting features such as visual charts with entries and exits, customized preferences aiding in faster data entry, and trade actionable stats. Stonk journal free of charge supports a multitude of traders with varying needs as it includes stocks, options, forex, and futures and crypto trading.

The Stonk Journal platform has no hidden fees, data monetization or additional costs, welcoming traders that wish to improve their trading techniques without paying.

Stonk Journal Features

- Equity Focused: Provides equities trading analysis exclusively.

- Trade Tagging: Provides easier monitoring of categorized trades.

- Portfolio Metrics: Monitors portfolio net profits, success rate, and overall portfolio growth.

8. Trademetria

Founded in 2016, Trademetria has its focus on bringing detailed analytics support to traders and integrating it into a useful trading journal that improves trader performance.

The platform’s most useful trait is its AI assistant feature which offers traders actionable insights from their journal entries and aids in their journaling process to help them find consistent patterns and improvement opportunities.

The platform is versatile in its abilities, covering many forms of trading like stocks, options, futures, forex, and even cryptocurrency. The pricing options consist of a Free plan with very basic tools, a Basic plan priced at $29.95 monthly, and a Pro plan priced at $39.95 monthly with the option of engaging annual plans for a discount.

Trademetria Features

- Multi-Asset Support: Capable of trading stocks, options, futures, and crypto.

- Performance Analysis: Assess trades for risk, profit factors, and overall analysis, providing valuable insights.

- Cloud Based: Trade data is secured online and can be accessed from any device.

9. Chartlog

Chartlog was founded in 2019 by traders Adrian Campos and Igor Milivojevic. It’s a top-tier trading journal meant for active traders that want to make monitoring their performance as easy as possible.

The most amazing thing is that real-time trade imports can be integrated with major brokers such as Interactive Brokers, TradeStation, and Webull, and other brokers. The platform features robust TradeView charting that empowers traders to visualize their entries and exits. Lite Plan is $14.99/month and comes with a 7-day free trial.

Chartlog Features

- Charts: Allows trade journaling with charts for snapshots of charts for improved context.

- Trade Annotations: Chart notes with specific associated details.

- Performance Metrics: Assess win-loss vs. strategy metrics, and overall performance trends.

10. Journalytix

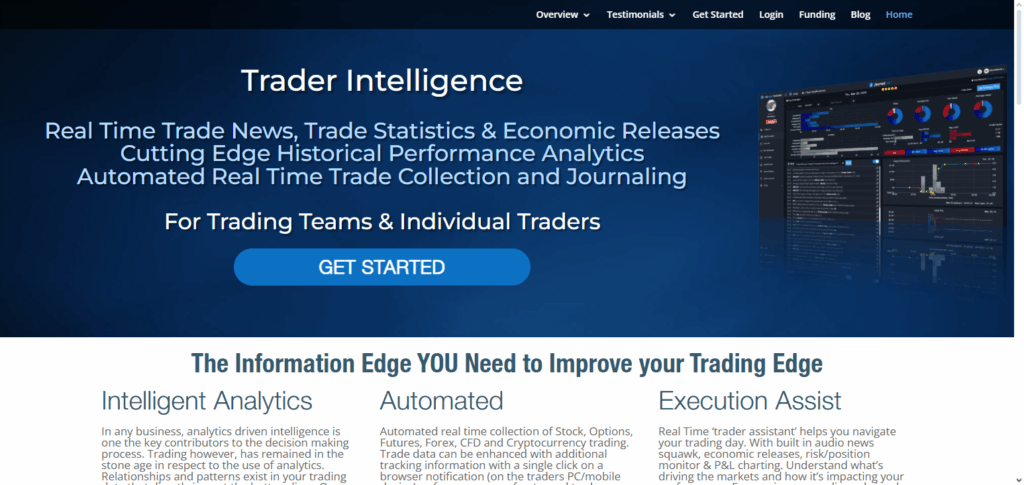

Journalytix is a high-level, proprietary trading journal designed for individual traders and proprietary trading firms. Created by the Jigsaw Trading team, the product comes with a full compliment of proprietary features designed to maximize one’s trading performance.

The platform features automatic trade logging in real-time for stocks, trades in earlier markets, options, future, forex, CFD, and crypto trading. The real-time trader assistant is one of the important components of the platform.

It integrates audio news squawk, real-time alerts of economic releases, risk monitoring, and P&L charting, ensuring traders have up-to-the-minute information to help them monitor and control their trades. Journalytix also offers users hands-free voice trading or journaling and trade note-taking via speech-to-text.

Users also have multiple options in terms of payment plans. The Journalytix subscription is 47amonthor47amonthor399 annually while proprietary trading teams and firms can submit their desired price for the custom enterprise solution. This blend automation, real-time metrics, and friendly features makes Journalytix a clear candidate for Journalytix.

Journalytix Features

- All-In-One Trading Dashboard: Allows Trade Journaling along with Analysis and Trade Reconstructions.

- Customizable Reports: Users can design custom reports for different strategies, markets, and brokers.

- Risk & Strategy Insights: Provides assessments on risk, position size, and successful trades.

Pros & Cons Best Trading Journals

Pros

- Expanded Strategy Formulation: The more detailed the journal entries are, the more patterns the trader can break down pertaining to the trades and refine strategies Optimum performance.

- Emotional Discipline Improvement: Journals over time help to track people in trades and how emotions help/ hurt them to help them become more disciplined.

- Risk Management Improvement: Proper journal entries and consistent reviews can help traders to recognize the implementation of the changes of managing money through the rules if they defend and can.

- Progress Tracking and Learning: There are many entries in progress that are visible and easier to track and show the progress and imrove upon.

Cons

- Entry of Data: The amount of changes for entering data can seem endless and can be changed for many, although it can be easy to make mistakes such as typos.

- Structural Dedication: There is a lack of structure in a journal and if it is trying to be formed, the journals as a whole, become more paralyzed in the analysis.

- Needs Concentration: For some traders, the exercise can become more complicated an added stress, but overall it is better to maintain a clear mindset.

- Distortion of Facts: The data does become biased, but to a certain degree every journal will will some if not most data. For every journal, it’s best to come to the conclusions most people will come to without having to rely on the conclusions made.

Conclusion

To summarize, effective trade journals are an important aspect for every trader who seeks to enhance their execution, discipline, and craft new strategies.

All TraderSync, Tradervue, Edgewonk, TradesViz, and Journalytix have their own individual advantages such as AI trade analysis, analytical automation, broker connections, and individualized performance analytics enabling ease for new or advanced traders.

Consistent logging, assiduous contemplation on each trade, and risk mitigation craft an environment conducive for traders to increase earnings and sustain them in volatile markets.

FAQ

Why should I use a trading journal?

Using a trading journal enhances discipline, improves risk management, and allows for continuous learning by analyzing past trades and tracking emotional and financial outcomes.

Which trading journals are considered the best?

Top trading journals include TraderSync, Tradervue, Edgewonk, TradesViz, Journalytix, Swift Journal, Stonk Journal, TradeZella, Trademetria, and Chartlog. Each offers unique features like AI analytics, real-time logging, or voice-activated entries.

Are trading journals expensive?

Pricing varies: some journals like Stonk Journal offer free plans, while others like TraderSync or Journalytix have monthly plans ranging from $29 to $79 or annual subscriptions for savings.

Can I use a trading journal for all asset types?

Most top trading journals support stocks, options, futures, forex, CFDs, and cryptocurrencies, making them versatile for multi-asset trading.

Do trading journals integrate with brokers?

Yes, many journals like Tradervue, TraderSync, and Chartlog integrate with brokers such as Interactive Brokers, Webull, Robinhood, and TradeStation for seamless trade imports.