For traders looking for better profit chances and flexible funding choices, I will go over the Best TradeDay Prop Firm Alternatives in this post.

- What is TradeDay Prop Firm?

- Benefits Of TradeDay Prop Firm Alternatives

- Key Point & Best TradeDay Prop Firm Alternatives List

- 1. Topstep

- Topstep Features, Pros & Cons

- 2. Apex Trader Funding

- Apex Trader Funding Features, Pros & Cons

- 3. FTMO

- FTMO Features, Pros & Cons

- 4. FundedNext

- FundedNext Features, Pros & Cons

- 5. E8 Funding

- E8 Funding Features, Pros & Cons

- 6. The5%ers

- The5%ers Features, Pros & Cons

- 7. FunderPro

- FunderPro Features, Pros & Cons

- 8. Funded Trading Plus

- Funded Trading Plus Features, Pros & Cons

- 9. LuxTrading Firm

- LuxTrading Firm Features, Pros & Cons

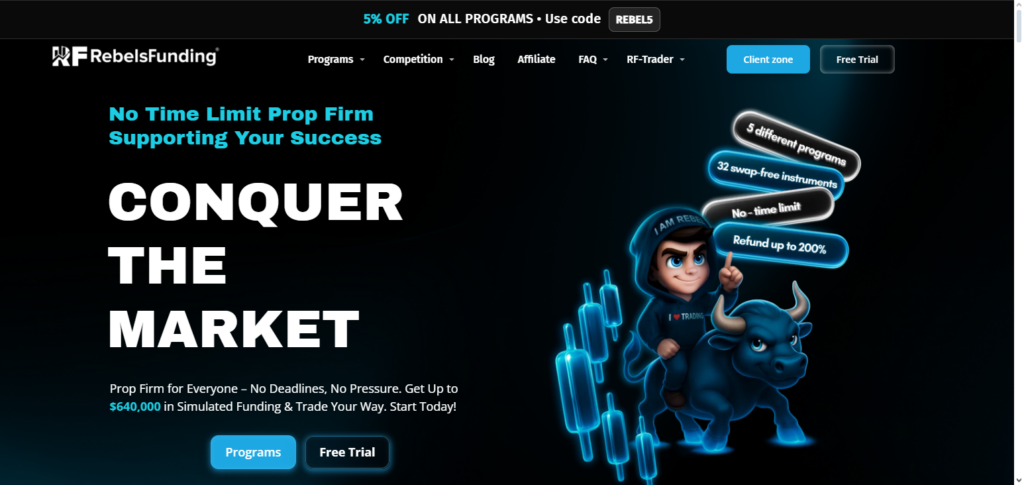

- 10. RebelsFunding

- RebelsFunding Features, Pros & Cons

- Conclusion

- FAQ

These options provide minimal fees, quick payments, scalable accounts, and clear rules for both novice and seasoned traders. To obtain the ideal funded trading solution, look into leading companies like Topstep, FTMO, Apex Trader Funding, and more.

What is TradeDay Prop Firm?

A professional trading company, TradeDay Prop Firm gives traders funded accounts so they can use the company’s capital to trade Forex, CFDs, and other financial instruments. Traders usually have to pass a test or challenge that assesses their consistency, risk management, and trading abilities.

They can retain a portion of the gains after they are funded as long as they follow the company’s trading guidelines. TradeDay Prop Firm is a well-liked solution for anyone wishing to trade with professional capital without risking their own money because it is made to assist both novice and seasoned traders by providing flexible account options, established instructions, and possibilities to scale accounts.

Benefits Of TradeDay Prop Firm Alternatives

Flexible Account Options – Most alternatives provide different types of challenges and account sizes, allowing you to choose one that fits your trading style.

Better Profit Splits – More than TradeDay, many firms offer higher profit splits, making it preferable for traders to retain more of their profits.

Lower Fees – For novice traders, it is more budget-friendly, since challenge fees and subscritpion fees tend to be lower.

Faster Payouts – Other firms, like FTMO, Topstep, and RebelsFunding, have better and faster withdrawal systems.

Scalable Accounts – Account growth is possible with these firms for successful traders, with options to scale accounts instantly or gradually.

Multiple Instruments – You have more trading options than just these, due to many firms providing trading for Forex, CFDs, crypto, futures, and commodities.

Transparent Rules – There is plenty of clear risk guidance and trading instructions so that your focus can be on trading.

Support & Education – There is a lot of trading resources that is targeted to comply with many of the rules set by the firms, which to traders, are meant to foster trading growth.

Key Point & Best TradeDay Prop Firm Alternatives List

| Prop Firm | Key Points / Features |

|---|---|

| Topstep | Focuses on futures trading, offers a structured evaluation program, weekly payouts, and risk management rules. |

| Apex Trader Funding | Offers Forex & CFDs funding, fast account approvals, flexible evaluation, and high profit split options. |

| FTMO | Well-known for Forex & CFD funding, reliable profit splits up to 90%, free demo trial, fast withdrawals. |

| FundedNext | Simple evaluation, low fees, multiple account options, daily risk monitoring, and competitive profit split. |

| E8 Funding | Focus on Forex and crypto, flexible challenge plans, fast payouts, and personal account support. |

| The5%ers | Long-term funding model, instant scaling opportunities, low-risk approach, funding for Forex traders. |

| FunderPro | Offers Forex & CFD funding, free challenge accounts, straightforward rules, and quick withdrawals. |

| Funded Trading Plus | Provides multiple funding levels, low challenge fees, scalable accounts, and consistent payout schedule. |

| LuxTrading Firm | Offers Forex & commodities funding, flexible evaluation, profit split up to 80%, and instant support. |

| RebelsFunding | Fast account funding, low challenge fees, multiple account options, and transparent rules for traders. |

1. Topstep

Topstep is known as one of the leading prop firms in the industry for trading futures and is focused on helping traders enact consistent positive trading. Initially, traders start out with a practice account and must adhere to specific risk management and evaluation criteria to qualify for account funding.

After getting funded, traders can look forward to weekly payouts and have more clear and structured guidelines to help with account growth. Because of the evaluation structure, Topstep is great for traders looking to be more disciplined. From the Best TradeDay Prop Firm Alternatives, Topstep is the best regarding futures, firm trading, and risk management.

Topstep Features, Pros & Cons

Features

- Futures focused firm.

- Clear milestones within evaluative structure.

- Funded traders receive weekly payouts.

- Advanced risk management guidelines.

- Trading dashboard provides analytics and reporting tools.

Pros

- Easy to understand and follow rules.

- Globally trusted company.

- Offers education and resources.

- Payouts are dependable and consistent.

- Good customer support.

Cons

- No trading outside of futures.

- Evaluative structure may be challenging for novices.

- There are monthly subscription costs.

- No trading of crypto or Forex.

- Steep risk management guidelines can diminish trading options.

2. Apex Trader Funding

Apex Trader Funding provides flexible evaluation accounts with quick approvals for funding solutions on Forex and CFDs. Traders can choose different challenge types and account sizes to match their strategies.

Apex guarantees high profit splits and scalable growth potential, which is beneficial for both new and seasoned traders. As one of the Best TradeDay Prop Firm Alternatives,

Apex Trader Funding is recognized for having great onboarding speed, flexible requirements, and great support, which gives traders assurance in their funded accounts. They are low-cost, with challenges that are easy to complete, putting them ahead of many competitors in the prop trading field.

Apex Trader Funding Features, Pros & Cons

Features

- Provides funding for Forex and CFD.

- Rapid account approval.

- Traders can choose from various account sizes.

- Evaluation options that cater to traders.

- Funded accounts can receive high profit splits.

Pros

- Streamlined onboarding.

- Accounts that can be customized.

- Good for beginners.

- Accounts that allow for upward scaling.

- Good profit potential.

Cons

- Still growing compared to the bigger global prop firms.

- Brand is not as well known.

- Minimum amount of educational tools and resources.

- Additional fees for evaluative challenges.

- Depending on which account you have, payout schedules may vary.

3. FTMO

FTMO is among the biggest and most reputable prop trading firms internationally. It offers Forex and CFDs funding after the trader goes through an evaluation, which includes a challenge and a verification stage.

Funded traders can receive profit share of up to 90% and obtain withdrawals that are quick and consistent. FTMO has free demo accounts, offers trading reports, and analyzes traders to help them enhance their trading skills.

FTMO is viewed as very professional among the Best TradeDay Prop Firm Alternatives due to the global presence and the clear-cut structure of their evaluations. They are most suited to traders looking for a long-term prop trading firm partnership due to their fair profit share and clear guidelines.

FTMO Features, Pros & Cons

Features:

- CFDs and Forex funding programs.

- Two-phase evaluation consisting of Challenge and Verification.

- Up to 90% profit split.

- Practice demo account is free.

- Withdrawals are processed quickly and efficiently.

Pros:

- Earned a reputation of trust and recognition worldwide.

- Profit splits may be higher.

- Risk management and rule structure is transparent.

- Ample support and resources for traders.

- Evaluation is well structured.

Cons:

- For novices, the evaluation process may be challenging.

- More expensive than alternatives for the challenge.

- Account sizes at the start may be limited.

- Trading in crypto is not offered.

- Risk management rules can be limiting in terms of creativity.

4. FundedNext

Among the Best TradeDay Prop Firm Alternatives, FundedNext is well-known for having a very simple and straightforward evaluation cycle. This includes low fees and several accounts that can be scaled for Forex, crypto, and CFDs traders. With daily risk management, FundedNext’s traders are able to make challenges and get funding.

Also, profitable split arrangements can be made. FundedNext is particularly recognized for its flexible policies and quick setup, as well as its clear rules when it comes trading. With the emphasis on the growth of traders, FundedNext is a great substitute to the older firms, allowing traders to concentrate on their operational performance even as administrative burdens are minimal.

FundedNext Features, Pros & Cons

Features:

- Forex, CFDs, and crypto are all supported.

- Different account types are available with varying levels of funding.

- Challenges are offered at a low fee.

- Daily monitoring and tracking of risk is available.

- Accounts that are scalable to more accounts are available for traders who demonstrate success.

Pros:

- Ideal for beginners.

- Rules are flexible and easy to understand.

- Account approvals are done quickly.

- Challenges are offered for low costs.

- Guidelines are clear and transparent.

Cons:

- Firm is relatively new, and smaller.

- Global recognition is lower.

- The number of educational materials is fewer.

- Community support is limited.

- Payout schedules are subject to change.

5. E8 Funding

Even though E8 Funding specializes in providing funds to Forex and crypto traders, they also offer diverse challenge options and risk management. E8 Funding allows traders to have evaluation accounts that best fit their trading preferences and offers direct payout solutions once traders are funded.

Thus, traders favor E8 Funding because they focus on personal support and account approvals. E8 Funding is one of the top-rated alternatives to Trade Day, because E8 Funding provides flexible terms, fast withdrawals, and transparent policies. Also, E8 Funding is among the top-rated alternatives to Trade Day offers support in obtaining funded accounts that is free of complicated evaluation qualifications.

E8 Funding Features, Pros & Cons

Features:

- Supports crypto and Forex trading.

- Evaluation plans are flexible to accommodate all types of traders.

- Fast account approval.

- Individualized support for traders.

- Rapid payment system.

Pros:

- Rapid onboarding.

- More flexible evaluation criteria.

- Higher quality support for traders.

- Multiple trading instrument access.

- Minimalistic support for beginners.

Cons:

- Smaller firm, limited presence worldwide.

- Less sophisticated trading tools.

- Smaller community of traders.

- Less available educational resources.

- Payout requirements vary.

6. The5%ers

The5%ers is different than other prop firms as it focuses on sustainable funding for Forex traders that use lower risk strategies. Traders are able to grow their accounts through the firm’s scaling opportunities and are able to get access to higher funding amounts.

The firm puts an emphasis on sustainable and consistent profitability and risk management. Among the Best TradeDay Prop Firm Alternatives, The5%ers is known for their low risk, reasonable account scaling and funding for professional traders as it shifts the model away from aggressive challenge-based funding, and instead focuses on stability and structure.

The5%ers Features, Pros & Cons

Features:

- Funding model based on the long-term.

- Immediate scaling for consistent traders.

- Emphasis on low-risk strategies.

- Accounts are Forex focused.

- Growth plans focused on funded traders.

Pros:

- Promotion of sustainable growth.

- Options for scalable accounts.

- Safe trading environment.

- Reliable model of funding.

- Catering to the needs of professional traders.

Cons:

- Mostly focused on Forex.

- Absence of futures trading.

- Scaling is based on consistent profits.

- Longer challenges than those of other firms.

- Limited options for beginners.

7. FunderPro

FunderPro provides flexible funding possibilities and free challenge accounts for Forex and CFD traders. With trader funding, there are rapid withdrawals and profit splits. The platform emphasizes trader support and processes clear risk management.

FunderPro proves to be one of the Best TradeDay Prop Firm Alternatives because of their streamlined registration and evaluation systems. They are consistently low-cost and have rapid payment, while providing easily accessible funding for traders. They are a great option for those looking to have the fewest barriers to entry and still having professional-level prop firm perks.

FunderPro Features, Pros & Cons

Features:

- Funding for Forex and CFDs available.

- Challenges with no upfront costs available.

- Rapid account approval.

- Rules are straightforward and transparent.

- Quickly processed withdrawals for funded accounts.

Pros:

- The platform is friendly to beginners.

- Evaluation is straightforward and transparent.

- Funding is accessible quickly.

- Challenges are offered at lower prices.

- Accounts with scaling are available.

Cons:

- Smaller companies compared to global leaders.

- Fewer available trading instruments.

- Lack of global recognition.

- Scarce resources for education.

- Limited tools for advanced trading.

8. Funded Trading Plus

Multiple funding tiers and account sizes are offered at Funded Trading Plus for Forex and CFD traders. At low prices, traders can take part in evaluation challenges for payouts that are received consistently after funding. The firm manages risk, while allowing flexible trading.

As a part of the Best TradeDay Prop Firm Alternatives, Funded Trading Plus proves popular for its low challenge fees, scalable account options, and profit-sharing frequency. They have a clear focus on supporting trader growth and evaluation transparency, making them a more appealing option for those who liked complexity eliminated and funded possibilities.

Funded Trading Plus Features, Pros & Cons

Features:

- Various funding levels available for traders.

- Accounts that scale as growth increases.

- Low fees for challenges.

- Consistent breakdowns of payouts.

- Transparent rules for risk management.

Pros:

- Challenges that are budget friendly.

- Funding that scales as performance does.

- Adaptive rules regarding trading.

- Evaluation processes that are straightforward.

- Perfect for traders who are consistent.

Cons:

- Lack of experience and recognition globally.

- Firm size is small and limited offerings of trading instruments.

- Little support from the community.

- Limited choice of platforms.

9. LuxTrading Firm

LuxTrading Firm offers various evaluation plans, profit sharing of up to 80%, and specializes in funding commodities and Forex. Quick account approvals, clear regulations, and immediate assistance are all advantageous to traders. With a focus on risk control and scalability, the company serves both novice and expert traders.

LuxTrading Firm is regarded as one of the Best TradeDay Prop Firm Alternatives because of its easily available funding packages and attentive customer service. It is a great option for traders looking for growth with dependable funding alternatives because of its combination of flexible trading conditions, reasonable fees, and transparent evaluation procedures.

LuxTrading Firm Features, Pros & Cons

Features:

- Trading accounts for Forex and commodities.

- Several evaluation plans to choose from.

- Profit splits of up to 80%.

- Accounts are approved quickly.

- Customer support is available.

Pros:

- Evaluation and rules that are flexible.

- Quick onboarding for accounts.

- Accounts that grow and are competitive for profit splits.

- Platforms that are friendly to beginners.

Cons:

- Fewer instruments to choose from.

- Global recognition is limited, and they are a smaller company.

- Scarce resources for education.

- Evaluation process can be difficult for some traders.

- Limited demonstrations available.

10. RebelsFunding

RebelsFunding provides traders with minimal challenge fees, a variety of account options, and quick account financing. To be eligible for funded accounts with competitive profit splits, traders can take part in evaluation programs.

The company places a strong emphasis on quick withdrawals, transparent trade regulations, and openness. RebelsFunding is regarded as one of the Best TradeDay Prop Firm Alternatives because of its ease of use, adaptability, and encouraging atmosphere.

It is a good option for traders who want to swiftly obtain funding while keeping their full attention on trading performance and account growth because of its effective onboarding and dependable payout system.

RebelsFunding Features, Pros & Cons

Features:

- Quick funding for accounts.

- Low fees for challenges.

- Different account options.

- Rules are set in stone and easy to understand.

- Payment is done in a timely manner.

Pros:

- Seamless and easy to understand onboarding.

- Reasonably priced challenge fees.

- Different account sizes to select from.

- Payment is reliable and done quickly.

- Rules are easy to understand and flexible.

Cons:

- Not in the top category yet and newer to the industry.

- Limited options to trade.

- Not enough advanced tools

- Community support is relatively small.

- Not a lot of people are familiar with them.

Conclusion

In conclusion, traders searching for TradeDay substitutes have a plethora of great choices that each suit various trading objectives and approaches. While Apex Trader Funding and FundedNext offer flexible accounts and quick approvals, companies like Topstep and FTMO offer systematic evaluation and dependable payouts.

While sites like FunderPro and RebelsFunding emphasize ease of use and speedy funding, The5%ers prioritize long-term growth. These prop firms guarantee that traders may concentrate on performance rather than administrative obstacles by offering scalable accounts, competitive profit splits, and clear regulations.

Your trading strategy, risk tolerance, and funding preferences will determine which option is best for you, but all of these choices offer reliable, expert routes to becoming a funded trader.

FAQ

What are the best alternatives to TradeDay Prop Firm?

The best alternatives include Topstep, Apex Trader Funding, FTMO, FundedNext, E8 Funding, The5%ers, FunderPro, Funded Trading Plus, LuxTrading Firm, and RebelsFunding. Each offers unique funding models and benefits suited for different trading styles.

How do prop firm alternatives compare on profit splits?

Profit splits vary: FTMO and LuxTrading Firm offer up to 90% and 80% respectively, while others like Apex Trader Funding and FundedNext also provide competitive rates depending on plan and performance.

Do these alternatives have evaluation challenges?

Yes. Most prop firms require you to pass a challenge or evaluation phase that tests your trading skills and risk management before granting a funded account.

Which alternative is best for beginners?

Firms like Apex Trader Funding, FundedNext, and FunderPro are beginner‑friendly due to flexible rules, low fees, and easier evaluation paths compared to more rigid programs.

Are payouts fast with these firms?

Yes. Top alternatives like FTMO, Topstep, and RebelsFunding are known for fast, reliable payouts, typically weekly or monthly based on firm policies.