Best Staking Coins to Buy can be an ideal strategy for crypto enthusiasts looking to earn passive income while taking part in blockchain networks. The top coins for staking include Ethereum (ETH). As it transitions towards proof-of-stake consensus mechanism with Ethereum 2.0, holders may find staking opportunities available in ETH. Cardano (ADA) stands out as a stand-out cryptocurrency, known for its secure and scalable blockchain, which enables users to stake it and receive rewards.

Polkadot (DOT), too, is becoming more widely accepted due to its interoperability features and staker incentives. Binance Coin (BNB) from the Binance Smart Chain and Solana (SOL) may also provide rewarding staking rewards to their users, although as the cryptocurrency market changes rapidly it’s essential that investors conduct thorough research before making investment decisions.

What Is Staking Coins?

Staking coins refers to actively participating in blockchain networks’ proof-of-stake (PoS) consensus mechanism by actively contributing coins for stake. Traditional proof-of-work (PoW) systems like Bitcoin require miners to compete to solve complex mathematical puzzles to validate transactions and add new blocks to the blockchain. In these systems, miners compete against one another to solve such complex equations and validate transactions and add blocks onto it.

Proof-of-stake relies on validators who pledge a certain amount of cryptocurrency as collateral in order to propose and validate new blocks. These validators are chosen according to various criteria, including how much cryptocurrency they own and are willing to “stake,” and the length of time their cryptocurrency has been held in storage. Staking participants – commonly known as stakers or validators – are incentivised to act honestly, as any malicious behavior could cause them to lose the staked coins they invested.

Staking provides an energy-efficient alternative to PoW while also giving stakers the opportunity to contribute towards maintaining and strengthening the security and functionality of blockchain networks. Staking has become an increasingly popular way for cryptocurrency holders to engage with governance of networks while making passive income through their stake in these networks.

How To Choose the Best Staking Coins to Buy

Choosing the best staking coins to buy involves careful consideration of various factors to align with your investment goals and risk tolerance. Here are some key aspects to consider when selecting staking coins:

Project Fundamentals: Investigate the project behind the staking coin. Understand its goals, use cases, and the problem it aims to solve. Assess the project’s development team, community support, and overall credibility within the cryptocurrency space.

Consensus Mechanism:

Understand the consensus mechanism used for staking. Different projects may implement proof-of-stake (PoS), delegated proof-of-stake (DPoS), or other variations. Evaluate the security and decentralization aspects of the chosen consensus mechanism.

Staking Rewards: Analyze the staking rewards offered by the coin. Consider the annual percentage yield (APY) or the potential returns on your investment. Compare the staking rewards across different projects and assess the sustainability of the reward structure.

Tokenomics: Examine the tokenomics of the staking coin, including the total supply, inflation rate, and distribution model. Evaluate how tokenomics may impact the scarcity and value of the staking coin over time.

Network Security: Assess the overall security of the network. A secure and robust blockchain is less prone to attacks and vulnerabilities. Investigate any history of security incidents or potential risks associated with the staking coin.

Community and Governance: Explore the community engagement around the project. A strong and active community can contribute to the success of the staking coin. Consider the governance model in place, allowing stakeholders to have a say in the protocol’s decision-making process.

Liquidity and Exchanges: Consider the liquidity of the staking coin. A coin with higher liquidity is generally easier to buy, sell, and trade. Check the availability of the staking coin on reputable cryptocurrency exchanges.

Regulatory Compliance: Understand the regulatory environment surrounding the staking coin. Compliance with regulations can impact the long-term viability of the project.

Technology and Development: Evaluate the technological innovation and development activity of the project. Regular updates and a roadmap for future development are positive indicators.

Risk Management: Diversify your staking portfolio to manage risk effectively. Avoid putting all your funds into a single staking coin. Stay informed about market trends, potential challenges, and changes in the cryptocurrency landscape.

By conducting thorough research and considering these factors, you can make informed decisions when choosing staking coins that align with your investment strategy and preferences. Keep in mind that the cryptocurrency market is dynamic, so staying updated on developments is crucial.

Here Is List of Best Staking Coins to Buy

- Sponge V2

- Bitcoin Minetrix

- Meme Kombat

- Wall Street Memes

- eTukTuk

- Doge Uprising

- Ethereum

- Cardano

- Solana

- Polygon

- Avalanche

- Binance Coin

- Polkadot

- Tezos

- Algorand

- Pepe

- TG Casino

- IOTA

- XRP

- Synthetix

- Chainlink

- Tether

- Mina Protocol

- Filecoin

- The Graph (GRT)

- Uniswap

- Terra LUNA Classic

- Yearn.finance (YFI)

- Starkware (STRK)

- Loopring (LRC)

30 Best Staking Coins to Buy in 2024

1. Sponge V2

$SPONGE, the well-known meme coin, has made waves in the cryptocurrency space by unveiling their eagerly anticipated V2 token via an innovative stake-to-bridge mechanism. This novel method allows current V1 holders to seamlessly transition over by staking their current holdings as part of this transitional approach.

Make this transition even more compelling with its bonus incentive structure – for every V1 token staked, participants receive an equal number of V2 tokens as a rewarding bonus – not only encouraging community engagement but also adding another layer of excitement for existing holders.

$SPONGE V2 offers investors the potential of earning an impressive 500% in Annual Percentage Yields (APYs), capitalizing on its popularity while offering them an exciting and rewarding experience. As always, investors should exercise caution and conduct in-depth research before engaging in any token swaps or staking programs.

2. Bitcoin Minetrix (Best Staking Coins to Buy)

$BTCMTX’s revolutionary stake-to-mine cryptocurrency offers users an exciting new approach to cloud mining credits through staking within its ecosystem, revolutionising how cloud mining works and providing the potential to earn credits without even mining itself! Staking $BTCMTX allows participants to unlock rewards with an impressive yield of up to 190%, making it an appealing investment option for investors seeking substantial returns. Further appealing is that participation can begin during its presale phase for only $0.0114!

$BTCMTX’s low entry point not only encourages widespread participation but also makes it a viable investment choice for crypto enthusiasts of all kinds. As the cryptocurrency market evolves, innovative projects such as $BTCMTX demonstrate how this emerging industry is capable of creating ground-breaking ideas with both utility and the potential for substantial returns. As with all investments, however, investors should conduct extensive due diligence on any crypto investments before engaging.

3. Meme Kombat

Unlock daily passive income opportunities with the latest meme cryptocurrency during its presale phase. This innovative project not only allows users to earn rewards through traditional staking but also adds a fun element by offering participants access to the Battle Arena, creating a competitive experience in investments. Users of the presale offer can take advantage of an attractive annual percentage yield (APY) of 112%, making this investment an appealing choice for those seeking consistent returns.

$MK’s native token, priced at an attractive $0.1667 during presale, provides an accessible entry point for investors from different backgrounds. As the cryptocurrency market diversifies, its amalgam of memes, staking and gamified elements add a dynamic spin that makes this project an appealing way to generate passive income streams. Potential investors should conduct thorough research before engaging in any presale or staking activities.

4. Wall Street Memes

Wall St Bulls NFT team’s viral meme coin, Wall St Bulls NFT Crypto Currency has caused quite the buzz in the crypto market by amassing $25 Million during its presale phase! Coin’s meteoric rise was further cemented with its listing on prominent exchanges like OKX and Huobi, reflecting widespread acceptance among members of the crypto community.

Beyond its viral meme status, this coin stands out by offering attractive staking rewards – drawing investors searching for both entertainment and financial incentives. Elon Musk’s tweets in support of WSM have served to increase its appeal and demonstrate its cultural relevance, underscoring how it bridges cryptocurrency with mainstream figures.

As markets continue to experience innovative projects, meme coins have gained increased interest as an innovative digital asset investment vehicle. Meme Coins have quickly captured attention as evidence that merging memes, celebrity endorsements and strong fundamentals with robust digital assets can result in successful outcomes; potential investors should do their research carefully before engaging in any meme coin investments. Ideally, potential investors should exercise due diligence prior to any investments involving meme Coins.

5. eTukTuk

BSC Proof of Stake (PoS) ecosystem aims to revolutionize transportation in developing countries by offering an astounding Annual Percentage Yield of 33,487%. This ambitious initiative offers investors not only financial incentives but also the chance to help create sustainable transportation solutions. The goal of the ecosystem is to transform traditional TukTuks by using artificial intelligence for route optimization and introducing battery-powered electric vehicles.

This strategy seeks to eliminate fuel costs entirely and lower overall purchase prices, making eco-friendly transportation more accessible in developing regions. By combining blockchain technology with innovative transport solutions, the BSC PoS ecosystem showcases how cryptocurrencies can help solve real-world issues while yielding economic returns and positive environmental benefits. Any parties interested in participating should conduct thorough due diligence before investing their capital in this innovative venture.

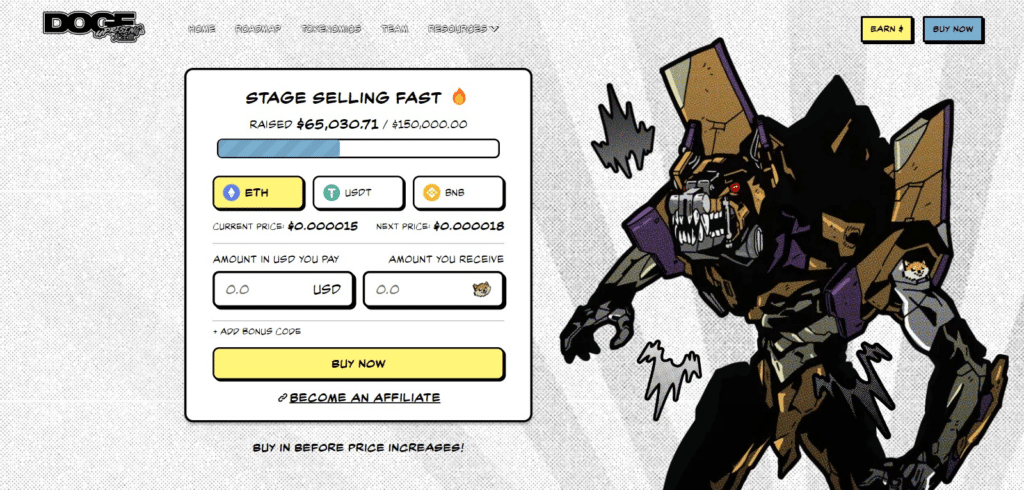

6. Doge Uprising

Inspired by Dogecoin, an ERC20 Proof of Stake (PoS) coin has recently made waves in crypto land with a unique spin: humor mixed with innovative features. Offering a 10% referral bonus, this coin encourages community engagement and growth by rewarding participants who bring others into its fold. Presale stage offers investors an impressive 100% price increase, adding excitement and anticipation. Beyond financial appeal, this coin features an intriguing narrative set in 2045:

Elon Musk pitting himself against Mark Zuckerberg as tech titans go at each other – creating excitement among potential investors! Storytelling adds an engaging experience for its community members. As the crypto space continues to change, this Doge-inspired ERC20 PoS coin aims not only to capture market interest, but also bring some fun and narrative intrigue into an otherwise serious digital asset world. Investors should approach such ventures with caution and maintain an objective view regarding both risks and rewards.

7. Ethereum (Best Staking Coins to Buy)

One of the largest and most acclaimed cryptocurrencies, Ethereum (ETH), recently made the transition from Proof-of-Work (PoW) to Proof-of-Stake (PoS). This move could make Ethereum one of the best cryptocurrency investments to stake by 2024. Through this upgrade, major network concerns such as high gas fees, scalability issues and transaction speeds will hopefully be resolved while cutting energy usage by 99.9% – something which Bitcoin cannot claim!

If you’re seeking to increase the return on your ETH holding, yield farming platforms like OKX can provide annual percentage yields over 5% for specific crypto crosses. Crypto.com also offers an impressive interest rate of 6% on ETH holdings.

With this upgrade, investors will now have access to stake Ethereum to help secure its network and earn rewards while helping protect it – with minimum staking requirements of 32 ETH per investor. Many investors consider Ethereum the premier altcoin; second only to Bitcoin with a market cap of around $148 billion and currently trading near $1,620 – significantly below its all-time high of $4,900.

8. Cardano

Cardano is a proof-of-stake blockchain platform that says its goal is to allow “changemakers, innovators and visionaries” to bring about positive global change. The open-source project also aims to “redistribute power from unaccountable structures to the margins to individuals” — helping to create a society that is more secure, transparent and fair.

Cardano was founded back in 2017, and named after the 16th century Italian polymath Gerolamo Cardano. The native ADA token takes its name from the 19th century mathematician Ada Lovelace, widely regarded as the world’s first computer programmer. The ADA token is designed to ensure that owners can participate in the operation of the network. Because of this, those who hold the cryptocurrency have the right to vote on any proposed changes to the software.

The team behind the layered blockchain say that there have already been some compelling use cases for its technology, which aims to allow decentralized apps and smart contracts to be developed with modularity.

9. Solana

Solana is a highly functional open source project that banks on blockchain technology’s permissionless nature to provide decentralized finance (DeFi) solutions. While the idea and initial work on the project began in 2017, Solana was officially launched in March 2020 by the Solana Foundation with headquarters in Geneva, Switzerland.

The Solana protocol is designed to facilitate decentralized app (DApp) creation. It aims to improve scalability by introducing a proof-of-history (PoH) consensus combined with the underlying proof-of-stake (PoS) consensus of the blockchain.

Because of the innovative hybrid consensus model, Solana enjoys interest from small-time traders and institutional traders alike. A significant focus for the Solana Foundation is to make decentralized finance accessible on a larger scale.

10. Polygon

Polygon (previously Matic Network) is the first well-structured, easy-to-use platform for Ethereum scaling and infrastructure development. Its core component is Polygon SDK, a modular, flexible framework that supports building multiple types of applications.

Using Polygon, one can create optimistic rollup chains, ZK rollup chains, stand alone chains or any other kind of infra required by the developer. Polygon effectively transforms Ethereum into a full-fledged multi-chain system (aka Internet of Blockchains). This multi-chain system is akin to other ones such as Polkadot, Cosmos, Avalanche etc. with the advantages of Ethereum’s security, vibrant ecosystem and openness.

The $MATIC token will continue to exist and will play an increasingly important role, securing the system and enabling governance. Polygon (formerly Matic Network) is a Layer 2 scaling solution backed by Binance and Coinbase. The project seeks to stimulate mass adoption of cryptocurrencies by resolving the problems of scalability on many blockchains.

Polygon combines the Plasma Framework and the proof-of-stake blockchain architecture. The Plasma framework used by Polygon as proposed by the co-founder of Ethereum, Vitalik Buterin, allows for the easy execution of scalable and autonomous smart contracts.

11. Avalanche (Best Staking Coins to Buy)

Avalanche is a layer one blockchain that functions as a platform for decentralized applications and custom blockchain networks. It is one of Ethereum’s rivals, aiming to unseat Ethereum as the most popular blockchain for smart contracts. It aims to do so by having a higher transaction output of up to 6,500 transactions per second while not compromising scalability.

This is made possible by Avalanche’s unique architecture. The Avalanche network consists of three individual blockchains: the X-Chain, C-Chain and P-Chain. Each chain has a distinct purpose, which is radically different from the approach Bitcoin and Ethereum use, namely having all nodes validate all transactions. Avalanche blockchains even use different consensus mechanisms based on their use cases.

After its mainnet launch in 2020, Avalanche has worked on developing its own ecosystem of DApps and DeFi. Different Ethereum-based projects such as SushiSwap and TrueUSD have integrated with Avalanche. Furthermore, the platform is constantly working on improving interoperability between its own ecosystem and Ethereum, like through the development of bridges.

12. Binance Coin

Binance Coin (BNB) serves as the cornerstone of the BNB Chain ecosystem and is widely recognized as an iconic utility token globally. Beyond being traded on an exchange, BNB’s versatility extends into multiple applications and use cases within its ecosystem, making it one of the world’s most widely adopted utility tokens that empower users to engage in various transactions within its ecosystem – making it essential for those navigating it successfully.

Furthermore, BNB’s wide adoption and diverse functionality contributes to its lasting popularity among cryptocurrency enthusiasts – those curious enough can learn more by clicking here or reaching out directly.

13. Polkadot

Polkadot is an open-source sharded multichain protocol that connects and secures a network of specialized blockchains, facilitating cross-chain transfer of any data or asset types, not just tokens, thereby allowing blockchains to be interoperable with each other. Polkadot was designed to provide a foundation for a decentralized internet of blockchains, also known as Web3.

Polkadot is known as a layer-0 metaprotocol because it underlies and describes a format for a network of layer 1 blockchains known as parachains (parallel chains). As a metaprotocol, Polkadot is also capable of autonomously and forklessly updating its own codebase via on-chain governance according to the will of its token holder community.

Polkadot provides a foundation to support a decentralized web, controlled by its users, and to simplify the creation of new applications, institutions and services.

The Polkadot protocol can connect public and private chains, permissionless networks, oracles and future technologies, allowing these independent blockchains to trustlessly share information and transactions through the Polkadot Relay Chain (explained further down). Polkadot’s native DOT token serves three clear purposes: staking for operations and security, facilitating network governance, and bonding tokens to connect parachains .

14. Tezos

Tezos is a blockchain network that’s based on smart contracts, in a way that’s not too dissimilar to Ethereum. However, there’s a big difference: Tezos aims to offer infrastructure that is more advanced — meaning it can evolve and improve over time without there ever being a danger of a hard fork. This is something that both Bitcoin and Ethereum have suffered since they were created. People who hold XTZ can vote on proposals for protocol upgrades that have been put forward by Tezos developers.

This open-source platform bills itself as “secure, upgradable and built to last” — and says its smart contract language provides the accuracy that is required for high-value use cases. According to Tezos, its approach means that it is futureproof and will “remain state-of-the-art long into the future,” meaning it can embrace developments in blockchain technology. The technology underpinning Tezos was first proposed in a white paper that was released in September 2014. After a series of delays, the Tezos mainnet launched four years later.

15. Algorand

Algorand is a self-sustaining, decentralized, blockchain-based network that supports a wide range of applications. These systems are secure, scalable and efficient, all critical properties for effective applications in the real world. Algorand will support computations that require reliable performance guarantees to create new forms of trust.

The Algorand mainnet became live in June 2019, and was able to handle almost 1 million transactions per day as of December 2020. Algorand transaction metrics can be viewed here. Algorand initial coin offering (ICO) was held in June 2019, with the Algorand price of $2.4 per token.

16. Pepe (Top Staking Coins to Buy)

PEPE is a deflationary memecoin launched on Ethereum. The cryptocurrency was created as a tribute to the Pepe the Frog internet meme, created by Matt Furie, which gained popularity in the early 2000s.

The project aims to capitalize on the popularity of meme coins, like Shiba Inu and Dogecoin, and strives to establish itself as one of the top meme-based cryptocurrencies. PEPE appeals to the cryptocurrency community by instituting a no-tax policy and being up-front about its lack of utility, keeping things pure and simple as a memecoin.

The PEPE roadmap features three phases, where phase one includes listing on CoinMarketCap, and getting $PEPE trending on Twitter, while phase two includes listing on centralized exchanges (CEXs) and phase three includes “tier 1” exchange listings and what the team terms a “meme takeover.”

17. TG Casino

TG.Casino, a dynamic player in the online gaming industry, has made a significant impact since its inception in September 2023, quickly becoming a go-to destination for casino enthusiasts. The platform stands out for its seamless integration of advanced technology and user-friendly interface, catering to both seasoned gamblers and newcomers alike.

The TG.Casino project launched on 21st September with a presale goal of $5m which was reached in mid December 2023. The casino launched on 28th September 2023 just 7 days later and has constantly evolved and improved ever since. This is fully licensed and is backed by seasoned casino operators, with full support of a very experienced web3 team who are based worldwide.

18. IOTA

IOTA is a distributed ledger technology (DLT) that features unique architecture and an open-source product suite for individuals, businesses, and institutions to use in Web3. It is built on a directed acyclic graph (DAG) called the Tangle, which can be pictured as a multi-dimensional blockchain. It enables the exchange of data and value on a decentralized platform through direct and secure transfers, executed on and immutably recorded on the network.

Together with its staging network Shimmer, IOTA aims to offer solutions to establish a secure and permissionless infrastructure that can drive the economy of the future. It enables the development of decentralized applications through automated trust in the form of Ethereum-compatible smart contracts, an advanced consensus algorithm, and thoughtfully balanced incentives.

IOTA delivers tools for creating and managing custom Layer 2 (EVM) chains, deploying smart contracts, minting native tokens and NFTs with distinctive features, and introducing digital identities to users.

19. XRP

Launched in 2021, the XRP Ledger (XRPL) is an open-source, permissionless and decentralized technology. Benefits of the XRP Ledger include its low-cost ($0.0002 to transact), speed (settling transactions in 3-5 seconds), scalability (1,500 transactions per second) and inherently green attributes (carbon-neutral and energy-efficient).

The XRP Ledger also features the first decentralized exchange (DEX) and custom tokenization capabilities built into the protocol. Since 2012, the XRP Ledger has been operating reliably, having closed 70 million ledgers.

20. Synthetix

Synthetix is creating a decentralized liquidity provisioning protocol that any protocol can tap into for various uses. With deep liquidity and minimal fees, Synthetix serves as the backend for many exciting Optimism and Ethereum protocols. Synthetix ecosystem includes many user-facing protocols such as Kwenta (Spot and Futures), Lyra (Options), Polynomial (Automated Options), and 1inch & Curve (Atomic Swaps), that leverage Synthetix liquidity for their respective services.

Synthetix was founded on both Optimism and Ethereum mainnet to enable its operations. Synthetix Network is secured with collateral comprised of SNX, ETH and LUSD to facilitate the issuance of synthetic assets (Synths). Synths track and offer returns on an underlying asset without necessitating direct ownership.

Synthetix offers pooled collateral as a basis for creating on-chain composable financial instruments backed by liquidity from Synthetix. Perps V2, designed to enable low-fee futures trading using off-chain oracles, and Synthetix V3 are two promising upcoming releases from SNX that stand out. Perps should allow low-cost futures trading using oracles while Synthetix hopes to rebuild itself into a fully permissionless derivatives protocol – both can be learned more about on their blog or joining the SNX Discord server.

21. Chainlink (Best Staking Coins to Buy)

Founded in 2017, Chainlink is a blockchain abstraction layer that enables universally connected smart contracts. Through a decentralized oracle network, Chainlink allows blockchains to securely interact with external data feeds, events and payment methods, providing the critical off-chain information needed by complex smart contracts to become the dominant form of digital agreement.

The Chainlink Network is driven by a large open-source community of data providers, node operators, smart contract developers, researchers, security auditors and more. The company focuses on ensuring that decentralized participation is guaranteed for all node operators and users looking to contribute to the network.

22. Tether

Launched in 2014, Tether is a blockchain-enabled platform designed to facilitate the use of fiat currencies in a digital manner. Tether works to disrupt the conventional financial system via a more modern approach to money.

Tether has made headway by giving customers the ability to transact with traditional currencies across the blockchain, without the inherent volatility and complexity typically associated with a digital currency.

As the first blockchain-enabled platform to facilitate the digital use of traditional currencies (a familiar, stable accounting unit), Tether has democratised cross-border transactions across the blockchain.

23. Mina Protocol

Mina Protocol is a minimal “succinct blockchain” built to curtail computational requirements in order to run DApps more efficiently. Mina has been described as the world’s lightest blockchain since its size is designed to remain constant despite growth in usage.

Furthermore, it remains balanced in terms of security and decentralization. The project was rebranded from Coda Protocol to Mina in October 2020. The Mina network has a size of only 22 KB, which is miniscule when compared to Bitcoin’s 300 GB blockchain.

Mina is working on achieving an efficient distributed payment system that enables users to natively verify the platform right from the genesis block. Its technical whitepaper calls this a “succinct blockchain.”

The protocol uses Zero-Knowledge Succinct Non-Interactive Arguments of Knowledge (zk-SNARKs), a cryptographic proof that enables someone to authenticate information without revealing said information.

However, enabling a user to trace the platform back to its genesis block can be impractical in a large network. As such, Mina incrementally computes SNARKS that concentrate only on the last few blocks — meaning that end-users check that zk-SNARK-compressed proof, instead of a block’s entire transaction history.

24. Filecoin

Filecoin is a decentralized storage system that aims to “store humanity’s most important information.” The project raised $205 million in an initial coin offering (ICO) in 2017, and initially planned a launch date for mid-2019. However, the launch date for the Filecoin mainnet was pushed back until block 148,888, which is expected in mid-October 2020.

The project was first described back in 2014 as an incentive layer for the Interplanetary File System (IPFS), a peer-to-peer storage network where users pay for data storage and distribution services in $FIL. Filecoin is open protocol and backed by a blockchain that records commitments made by the network’s participants, with transactions made using FIL, the blockchain’s native currency. The blockchain is based on both proof-of-replication and proof-of-spacetime.

Filecoin is open-source and decentralized, which means that all governance is in the hands of the community. On the Filecoin platform, developers have the opportunity to create cloud file storage services like Dropbox or iCloud. Anyone can join Filecoin and start storing their data or earn money by providing space for someone else’s funds. The creators of Filecoin opted for their blockchain technology to run the network and their token with their own consensus.

25. The Graph (GRT) (Top Staking Coins to Buy)

The Graph is an indexing protocol for querying data for networks like Ethereum and IPFS, powering many applications in both DeFi and the broader Web3 ecosystem. Anyone can build and publish open APIs, called subgraphs, that applications can query using GraphQL to retrieve blockchain data. There is a hosted service in production that makes it easy for developers to get started building on The Graph and the decentralized network will be launching later this year. The Graph currently supports indexing data from Ethereum, IPFS and POA, with more networks coming soon.

The Graph has a global community, including over 200 Indexer Nodes in the testnet and more than 2,000 Curators in the Curator Program as of October 2020. To fund network development, The Graph raised funds from community members, strategic VCs and influential individuals in the blockchain community including Coinbase Ventures, DCG, Framework, ParaFi Capital, CoinFund, DTC, Multicoin, Reciprocal Ventures, SPC, Tally Capital and others. The Graph Foundation also successfully completed a public GRT Sale with participation from 99 countries (not including the U.S.). To date as of November 2020, The Graph has raised ~$25M.

26. Uniswap

Uniswap is a popular decentralized trading protocol, known for its role in facilitating automated trading of decentralized finance (DeFi) tokens.

An example of an automated market maker (AMM), Uniswap launched in November 2018, but has gained considerable popularity this year thanks to the DeFi phenomenon and associated surge in token trading.

Uniswap aims to keep token trading automated and completely open to anyone who holds tokens, while improving the efficiency of trading versus that on traditional exchanges. Uniswap creates more efficiency by solving liquidity issues with automated solutions, avoiding the problems which plagued the first decentralized exchanges.

In September 2020, Uniswap went a step further by creating and awarding its own governance token, UNI, to past users of the protocol. This added both profitability potential and the ability for users to shape its future — an attractive aspect of decentralized entities.

27. Terra LUNA Classic

Terra is a blockchain protocol that uses fiat-pegged stablecoins to power price-stable global payments systems. According to its white paper, Terra combines the price stability and wide adoption of fiat currencies with the censorship-resistance of Bitcoin (BTC) and offers fast and affordable settlements.

Development on Terra began in January 2018, and its mainnet officially launched in April 2019. As of September 2021, it offers stablecoins pegged to the U.S. dollar, South Korean won, Mongolian tugrik and the International Monetary Fund’s Special Drawing Rights basket of currencies — and it intends to roll out additional options.

On May 28, 2022, the genesis block of the new chain was launched to conduct future transactions under the name Terra (LUNA), and the original Terra Chain was rebranded as Terra Classic. The original native token — LUNA has also been renamed as LUNA Classic (LUNC). Moreover, all network stablecoins (UST, KRT, EUT) have been renamed to Terra Classic stablecoins (USTC, KRTC, EUTC). There will be no Terra stablecoins on the new chain.

28. Yearn.finance (YFI)

Yearn.finance is an aggregator service for decentralized finance (DeFi) investors, using automation to allow them to maximize profits from yield farming.

Its goal is to simplify the ever-expanding DeFi space for investors who are not technically minded or who wish to interact in a less committal manner than serious traders.

Launched in February 2020, the service, formerly known as iEarn, has seen huge growth in recent months as new products debuted and developers released in-house token YFI.

29. Starkware (STRK)

StarkWare stands at the forefront of innovation in the blockchain industry, specializing in the development of STARK-based solutions. With a clear focus on enhancing the security, trustlessness, and scalability of blockchain applications, StarkWare’s products represent a significant stride towards overcoming some of the inherent challenges faced by the industry. The utilization of STARK (Scalable Transparent Arguments of Knowledge) technology, known for its cryptographic prowess, enables StarkWare to provide blockchain solutions that are not only secure but also capable of achieving impressive levels of scalability.

By leveraging this technology, StarkWare contributes to the creation of a robust and decentralized blockchain ecosystem, offering businesses and developers the tools they need to build and deploy applications with increased efficiency and confidence. In essence, StarkWare plays a pivotal role in shaping the future of blockchain technology by pioneering solutions that align with the industry’s evolving demands for security, trust, and scalability.

30. Loopring (LRC) (Best Staking Coins to Buy)

LRC is the Ethereum-based cryptocurrency token of Loopring, an open protocol designed for the building of decentralized crypto exchanges.

In 2020, the average daily trading volume of the entire cryptocurrency market fluctuated in the approximate range of $50-$200 million. Most of that trading is conducted on centralized cryptocurrency exchanges — online platforms operated by private companies that store users’ funds and facilitate the matching of buy and sell orders.

Such platforms have a number of downsides common to all of them, so a new type of exchange — decentralized— has emerged to try to alleviate these disadvantages. However, fully decentralized exchanges are not without their own flaws.

Loopring’s purported goal is to combine centralized order matching with decentralized on-blockchain order settlement into a hybridized product that will take the best aspects of both centralized and decentralized exchanges.

LRC tokens became available to the public during an initial coin offering (ICO) in August 2017, while the Loopring protocol was first deployed on Ethereum mainnet in December 2019.

What to look for in Best Staking Coins to Buy?

Goals and Use Cases: Understand the project’s objectives and the real-world problems it aims to solve.

Development Team: Assess the credibility and expertise of the development team behind the project.

Community Support: Evaluate the size and engagement of the project’s community, as community support often correlates with project success.

Type of Consensus: Determine the consensus mechanism employed by the project (e.g., PoS, DPoS, LPoS) and its implications for security and decentralization.

APY (Annual Percentage Yield): Analyze the staking rewards offered and compare the APY across different projects.

Reward Structure: Evaluate the sustainability and structure of the staking rewards, considering factors such as inflation rates and potential changes over time.

Total Supply: Examine the total supply of the staking coin and how it may impact scarcity and value.

Distribution Model: Understand how the staking coin is distributed, including any vesting periods for early contributors.

Security Features: Assess the overall security features of the blockchain, including any notable security incidents in its history.

Decentralization: Consider the degree of decentralization achieved by the project’s consensus mechanism.

Governance Model: Understand the governance model in place, allowing stakeholders to participate in decision-making processes.

Community Engagement: Evaluate the level of community engagement, as an active community can contribute to the project’s success.

Best Staking Coins to Buy Conclusion

Conclusion When choosing the appropriate staking coins to purchase, an all-encompassing approach must be taken. It must take into account various considerations to suit individual investment goals and risk preferences. Conducting in-depth research of project fundamentals – development team, use cases and community support – is essential to making informed decisions about any staking coin project.

Understanding its consensus mechanism, staking rewards and tokenomics provides insight into its returns potential as well as sustainability. Assessing network security, community engagement and governance models also plays a role in the viability of an investment. Liquidity, regulatory compliance, technological innovation and diversifying portfolio strategies all play a part in selecting suitable staking coins.

Staying abreast of market trends, risk assessments and developing investment strategies is essential as cryptocurrency landscape continues to change; keeping informed and reviewing your staking portfolio regularly will enable you to make sound investment decisions within this volatile world of blockchain staking.

Best Staking Coins to Buy FAQ

What are staking coins, and how does staking work?

Staking coins involve participating in the proof-of-stake (PoS) consensus mechanism, where users lock up a certain amount of cryptocurrency as collateral to propose and validate new blocks on a blockchain. Stakers are rewarded with additional cryptocurrency for their participation.

How do I choose the best staking coins to buy?

Consider project fundamentals, such as goals and community support, the consensus mechanism used, staking rewards, tokenomics, network security, community engagement, and governance models. Also, evaluate liquidity, regulatory compliance, technological innovation, and diversify your staking portfolio for risk management.

What factors should I consider in assessing staking rewards?

Look at the annual percentage yield (APY), potential returns on investment, and the sustainability of the reward structure. Compare staking rewards across different projects and assess how they align with your investment goals.

Are there risks associated with staking coins?

Yes, there are risks. Market volatility, regulatory changes, project vulnerabilities, and potential security issues can impact staking investments. Diversification and staying informed about market trends and project developments can help manage risks.

How does the regulatory environment affect staking coins?

Regulatory compliance is essential. Understanding the legal framework surrounding staking coins in different jurisdictions can impact their long-term viability. Stay informed about regulatory developments and choose projects that comply with local laws.

Is community engagement important when choosing staking coins?

Yes, a strong and active community can contribute to a project’s success. Community support often reflects the level of trust and credibility in a staking coin. Engage with the community, forums, and social media channels to gather insights.