This article will help you find instant, private, and safe platforms for seamless crypto trading by discussing the Best Sites to Swap Tokens with No KYC.

- Key Point & Best Sites to Swap Tokens with No KYC List

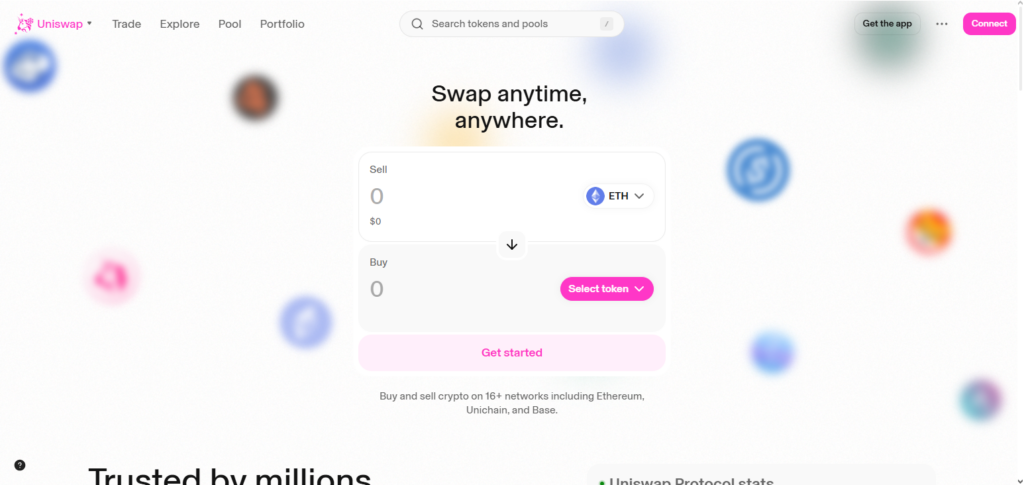

- 1. Uniswap (Ethereum)

- Pros & Cons Uniswap (Ethereum)

- Pros

- Cons

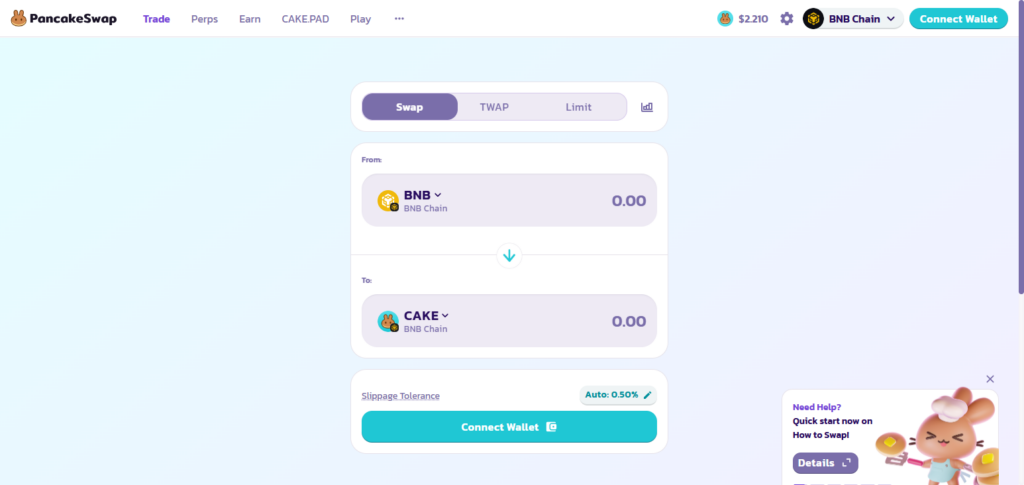

- 2. PancakeSwap (BNB Chain)

- Pros & Cons PancakeSwap (BNB Chain)

- Pros

- Cons

- 3. 1inch

- Pros & Cons 1inch

- Pros

- Cons

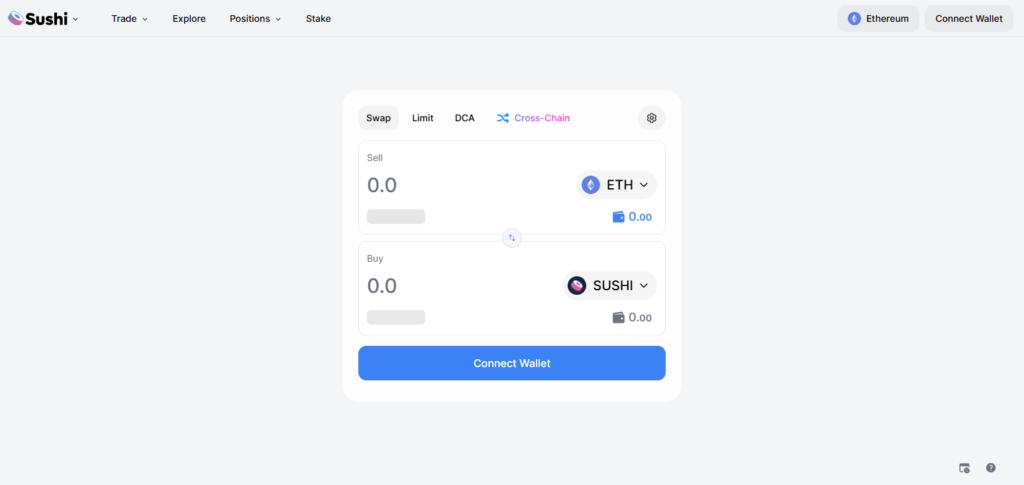

- 4. SushiSwap

- Pros & Cons SushiSwap

- Pros

- Cons

- 5. Curve Finance

- Pros & Cons Curve Finance

- Pros

- Cons

- 6. Balancer

- Pros & Cons Balancer

- Pros

- Cons

- 7. Raydium (Solana)

- Pros & Cons Raydium (Solana)

- Pros

- Cons

- 8. dYdX (non‑custodial)

- Pros & Cons dYdX (non-custodial)

- Pros

- Cons

- 9. OpenOcean

- Pros & Cons OpenOcean

- Pros

- Cons

- 10. QuickSwap (Polygon)

- Pros & Cons QuickSwap (Polygon)

- Pros

- Cons

- Conclusion

- FAQ

No-KYC exchanges can allow you to swap tokens directly from your wallet without undergoing the hassle of verification, providing all users with privacy, convenience, and unrestricted access from all layers of the blockchain.

Key Point & Best Sites to Swap Tokens with No KYC List

| Platform | Key Points |

|---|---|

| Uniswap | Leading DEX on Ethereum; AMM-based; high liquidity; supports ERC-20 tokens. |

| PancakeSwap | Popular on BSC; low fees; token swaps, yield farming, lottery features. |

| 1inch | DEX aggregator; finds best prices across multiple DEXs; reduces slippage. |

| SushiSwap | AMM-based; supports staking, lending, yield farming; cross-chain expansion. |

| Curve Finance | Optimized for stablecoin swaps; low slippage; high capital efficiency. |

| Balancer | AMM with flexible pool weights; multi-token pools; liquidity provider incentives. |

| Raydium | AMM + order book; fast and low-cost transactions; integrated with Serum. |

| dYdX | Non-custodial trading; margin and perpetual contracts; low gas fees on L2. |

| OpenOcean | DEX aggregator; cross-chain swaps; optimizes trade routes and fees. |

| QuickSwap | AMM on Polygon; fast, low-fee swaps; liquidity mining and staking options. |

1. Uniswap (Ethereum)

Unswap is an Automated market maker which is used to directly swap tokens from their wallets and is therefore trustless and transparent which is beneficial to the users especially new users.

It is one of the most used and listed as one of the Best Sites to Swap Tokens with No KYC. Its users can use wallets and benefit without any of the downsides that come with centralization.

In today’s market concentrated and efficient liquidity is necessary and with the option of V3 users can placed limit orders and use advanced tools to manage their portfolios. It is also secured by the huge liquidity of Ethereum.

Pros & Cons Uniswap (Ethereum)

Pros

- Thousands of ERC-20 tokens with great liquidity.

- Solid security backed through the Ethreum Network.

- No KYC at all, decentralized trading.

Cons

- Gas fees are high if the network is congested.

- Assets are limited to Ethereum unless bridged.

- For low-liquidity pools, price impacts can be significant.

2. PancakeSwap (BNB Chain)

PancakeSwap is the top DEX on the BNB Chain. It is a low-cost and quick-defi service. PancakeSwap is one of the Best Sites to Swap Tokens with No KYC offers users the ability to quickly exchange BEP-20 tokens with zero identification verifications.

PancakeSwap provides yield farming, staking, lotteries, and token swaps, among other things. It is one of the versatile defi platforms.

It offers AMM pools and major tokens. The interface is intuitive and user-friendly. PancakeSwap is at the top of its for its connections with BNB Chain. It is growing its network to offer more opportunities to customers in defi.

Pros & Cons PancakeSwap (BNB Chain)

Pros

- On the BNB Chain, transaction fees are extremely low.

- There are many features: swapping, farming, staking, etc.

- Quick transactions with no KYC.

Cons

- Less secure than DEXs based on Ethereum.

- Greater risk of low-quality tokens.

- Dependent on the BNB Chain’s ecosystem.

3. 1inch

1inch is a top decentralized exchange aggregator 1inch is the top DEX aggregator, offering traders the best swap rates by scanning other DEXs. 1inch is one of the Best Sites to Swap Tokens with No KYC.

There is no account opening and token swaps do not require identification verifications. 1inch provides the best marketplace and efficient low-cost trades. 1inch receives the highest value for the lowest cost.

Other features include optimized route finding, slippage reduction, and efficient price trades. Users benefit from limit orders, liquidity rewards, and cost-effective transactions.

Pros & Cons 1inch

Pros

- For the best price, it aggregates multiple DEXs.

- Uses an optimized route at lower slippage.

- Multiple blockchains are supported with no KYC.

Cons

- Depending on the network, gas fees may also be high.

- Beginners may find it complex.

- The underlying DEXs’ liquidity can affect pricing.

4. SushiSwap

SushiSwap offers cross-platform decentralization on SushiSwap with access to Ethereum, Polygon, Arbitrum, and BNB Chain. SushiSwap performs many functions, such as investing and borrowing, yield farming, and participating in launchpads.

Because of their easy, no KYC ID swaps, they are in the Best Sites to Swap Tokens with No KYC category. Their access to multiple AMM pools allows them to compete with the best of them in market resources, and seasonal expansions provide them with more of the market.

SushiSwap, with their $SUSHI governance provided with AMM liquidity, allows more participation in the community and encourages more usage of the platform with their dashboard and resources.

Pros & Cons SushiSwap

Pros

- Crosses multiple chains; Ethereum, BNB Chain, and Polygon.

- Provides numerous services including swaps, staking, lending, and farming.

- Is fully decentralized and does not require KYC.

Cons

- In terms of liquidity, they are not as dominant as Uniswap.

- Reputation has taken a hit due to some leadership controversies in the past.

- Some liquidity pools have a greater risk of impermanent loss.

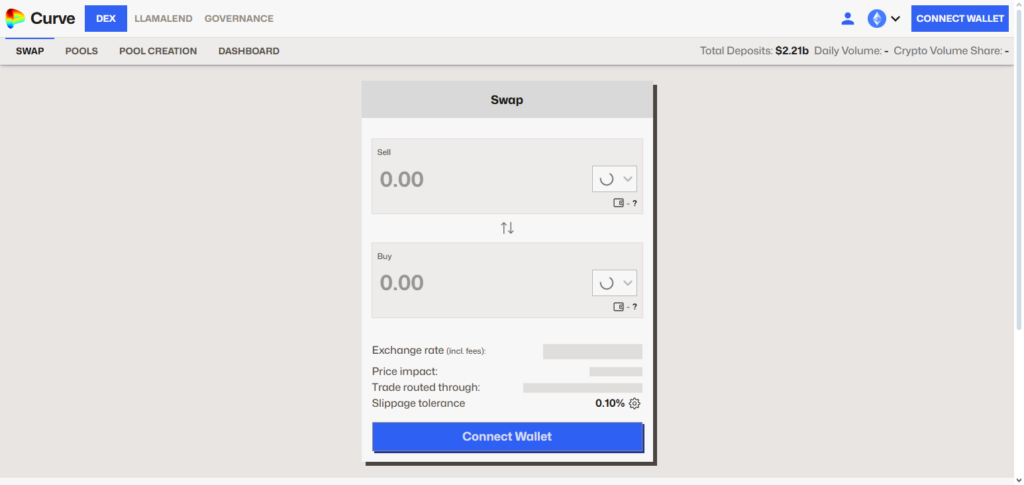

5. Curve Finance

Curve Finance offers the lowest slippage swaps, which is why it’s popular with quick frequent retraiders for stablecoins and their wrapped assets. It’s AMM is setup optimally for stable peg pools such as in USDC, USDT, and DAI in which pools are highly incentivized.

Curve has also found recent notoriety in the Best Sites to Swap Tokens with No KYC for it’s low fee, and fast zero knowledge swaps. Curve also offers enhanced liquidity pools through their Curve boosted systems and Curve gauge systems. Their recent focus on highly reliable systems for stable assets has provided them as a must have for stability in DeFi.

Pros & Cons Curve Finance

Pros

- Offers the best platform to swap stablecoins with little to no slippage.

- Offers low cost and high liquidity for stablecoin swaps.

- Fully on chain and does not require KYC.

Cons

- Mostly limited to stablecoins and other pegged currencies.

- Can be difficult to navigate for entry level users.

- Requires some knowledge to fully utilize the advanced features.

6. Balancer

Dissimilar to the primitive 50/50 pools, Balancer is an upgraded AMM that allows the creation of customizable pools balancing at flexible ratios. Users are able to create as well as configure multi-token pools, profiting off the income generated by the trades that pool receives.

Balancer is among the Best Sites to Swap Tokens with No KYC as it allows anonymous trading of tokens on several assets on Ethereum.

The smart pool model of Balancer automatic portfolio rebalancing which is a plus for the traders as well as liquidity givers. With the partnership of Balancer DAO, Balancer is able to provide yield-optimized vaults. Balancer’s innovations in the field are helping out a lot of DeFi users.

Pros & Cons Balancer

Pros

- Offers customizable and innovative multi-token liquidity pools.

- Provides users with automatic portfolio rebalancing done through AMM.

- Is fully decentralized and does not require KYC.

Cons

- Compared to other simple DEXs, the interface is more complicated.

- Less liquidity in comparison to market-leading platforms.

- Participating in experimental pools comes with a higher risk.

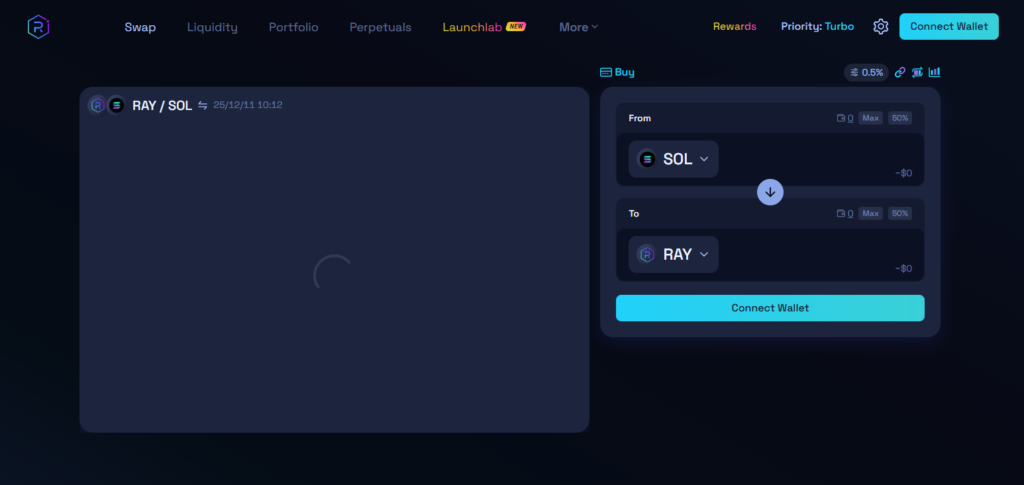

7. Raydium (Solana)

Raydium operates as a Solana based DEX with instant token swaps. It is on of the DEX with the lowest transaction fees. Raydium combines AMM liquidity pools with the the order pool of Serum, resulting in efficient trades with minimal liquidity.

Raydium is also among the Best Sites to Swap Tokens with No KYC because it also allows remote token trading.

It offers a variety of services like yield farming, staking, IDO participation and a launchpad for new tokens. With Solana’s increased transaction speed, Raydium is an aquatic ecosystem providing trading and liquidity for users. The customer base continues to grow thus providing more liquidity to the pool.

Pros & Cons Raydium (Solana)

Pros

- Offers some of the cheapest and rapid transactions due to being on the Solana blockchain.

- Has a unique hybrid AMM and order-book system through Serum.

- Does not require KYC for swapping tokens.

Cons

- Has been prone to reliability issues due to Solana outages.

- Can only be used on Solana ecosystem tokens.

- The richness of liquidity differs among pools of liquidity.

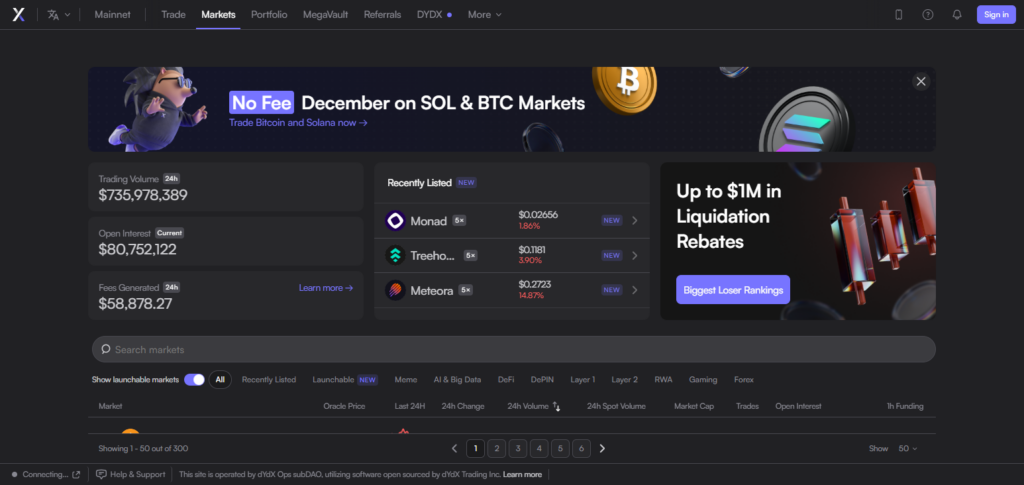

8. dYdX (non‑custodial)

dYdX is one of the few dExs (dedicated exchanges) dYdX is non-custodial and is dedicated to offering and learning up-to-date interactive trading experiences and feature sets (including leverage trading functions, and offering contracts with expiration dates, aka futures, and margined accounts to allow for highly active trading).

dYdX has branched out to doing their own dedicated chain for high throughput, high speed. It is top tier. dYdX has the most access to trading, the lowest fees, and the ability to trade with liquid assets at a moment’s notice.

It also has the most access to trading without the KYC, identity and verification, barrier being a deterrent. dYdX has a trading core self-custodial trading marketplace, and is one of the few self-custodial to trade, perhaps the only, with a centralized speed. dYdX also has the trading speed and access, with non-kyc, that is comparable to a centralized.

Pros & Cons dYdX (non-custodial)

Pros

- Advanced trading functionality such as leverage and perpetuals.

- Non-custodial, and no KYC is needed.

- Matching of orders at high speed via the order-book.

Cons

- Usefulness as a platform diminishes for simple, spot token swaps.

- Beginners can find perpetual trading to be risky.

- Where you are may restrict your access.

9. OpenOcean

OpenOcean is a cross chain DEX aggregator and is able to pull trading pairs from various blockchains — Ethereum, BNB Chain, Polygon, Solana, Optimism — and determines the best routing for each traded pair to minimize slippage, gas fees, and better swap prices.

OpenOcean is one of the Best Sites to Swap Tokens with No KYC, as users can trade and interact with a multitude of networks while enjoying the benefits of privacy.

OpenOcean is a hybrid aggregator as it incorporates some centralized exchanges and provides limit orders on spot trading, but is best for priced orders across a chain due to its simple user interface and wider multiple chain support.—

Pros & Cons OpenOcean

Pros

- Aggregator across chains for decentralized exchanges, aiming to find the best prices.

- Compatible with various networks such as Ethereum, BNB Chain, Polygon, Solana, among others.

- KYC is not needed for swapping.

Cons

- Underlying DEX liquidity is a constraint.

- Additional steps may be required for bridge swaps.

- New users may find the interface to be disorienting.

10. QuickSwap (Polygon)

Quickswap is one of the best DEXs (Decentralized Exchanges) on Polygon. Transactions on QuickSwap happen with little gas fees and it only takes a few seconds.

Built on the AMM (Automated Market Maker) liquidity is provided on a number of assets on Polygon. We consider it one of the Best Sites to Swap Tokens with No KYC as QuickSwap does not require identification to trade.

In addition to trading and yielding farming, users can stake their assets and participate in liquidity pairs with the growing number of DEXs. The scalability offered by Polygon makes QuickSwap a DEX of choice for fast and inexpensive trades on the Polygon network.

Pros & Cons QuickSwap (Polygon)

Pros

- Extremely low fees, and very fast swap times.

- Wide variety of tokens available that use the Polygon infrastructure.

- No KYC is required, and the interface is user-friendly.

Cons

- Market depth is less than that of DEXs built on Ethereum.

- Without bridging, only Polygon assets are accessible.

- If not vigilant, be aware of the risks of scam tokens.

Conclusion

No-KYC site allow users to instantly, privately, and securely trade crypto assets without the need for lengthy identity verifications. Uniswap, PancakeSwap, 1inch, Curve, SushiSwap, QuickSwap, and other similar platforms Positioning themselves as trustless platforms, customers remain in control of their own wallets and funds.

In their own unique way, these decentralized exchanges are among the quickest, most accessible, and easiest to use available to users around the world. There are several features to consider, such as advanced liquidity, multi-chain access, and low fees. No-KYC DEXs provide the unparalleled versatility and transparency required in today’s decentralized world.

FAQ

What are the Best Sites to Swap Tokens with No KYC?

The best no-KYC token swap platforms include Uniswap, PancakeSwap, 1inch, SushiSwap, Curve Finance, Balancer, Raydium, dYdX, OpenOcean, and QuickSwap. These decentralized exchanges allow users to trade instantly without identity checks.

Are no-KYC crypto swap platforms safe to use?

Yes, most no-KYC platforms are decentralized exchanges (DEXs) where users control their own wallets. Safety depends on using reputable platforms, verifying smart contracts, and keeping wallets secure.

Why do DEXs not require KYC?

DEXs are built on blockchain smart contracts and enable wallet-based interactions. Since funds never leave the user’s control, they don’t operate like centralized exchanges and therefore do not require identity verification.