This article will cover the highest interest rate saving accounts avaiable in europe and help you determine which accounts will keep your funds secure, while also increasing your earning potential.

- Key Factors to Consider When Choosing a High-Interest Account

- Interest Rate

- Deposit Protection

- Liquidity and Access

- Fees and Minimum Balance Requirements

- Platform Reputation and Security

- User Experience & Mobile App Features

- Currency & Regional Availability

- Growth Potential & Risk

- Key Point & Best Savings Accounts in Europe with High Interest

- Bondora Go & Grow – Pros & Cons

- Trading 212 Cash Account – Pros & Cons

- Mintos Cash Account – Pros & Cons

- Trade Republic Cash Account – Pros & Cons

- N26 Standard Savings – Pros & Cons

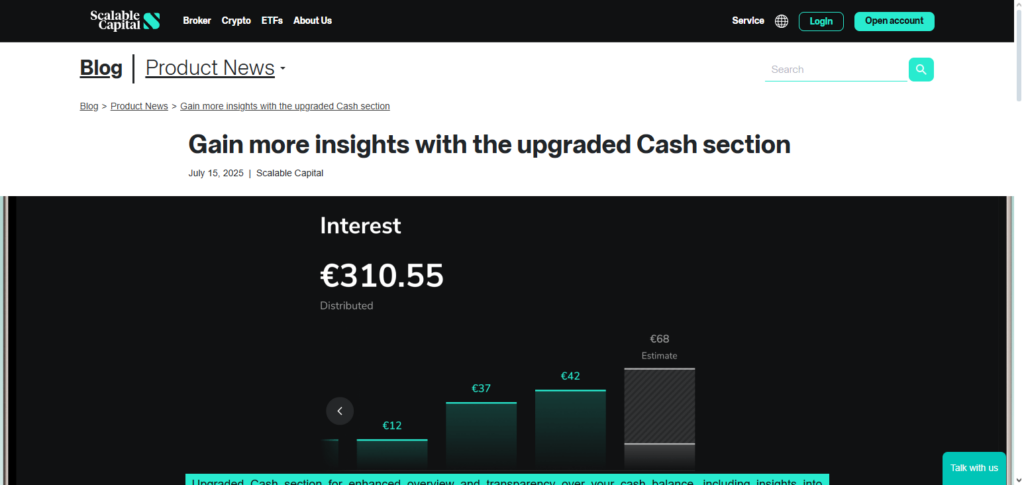

- Scalable Capital Cash Account – Pros & Cons

- Lightyear Cash Account – Pros & Cons

- Revolut Savings Vaults – Pros & Cons

- Bunq Easy Savings – Pros & Cons

- Monese Savings Pots – Pros & Cons

- Risks and Limitations

- Market or Investment Risk

- Interest Rate Fluctuations

- Limited Deposit Protection

- Withdrawal Restrictions

- Fees and Charges

- Platform or Regulatory Risk

- Inflation Risk

- Complex Terms and Conditions

- Conclusion

- FAQ

Digital banks such as N26 and Revolut along with investment platforms like Bondora Go & Grow offer eu accounts with fin tech features and instant access to funds, all while providing a high yield.

Key Factors to Consider When Choosing a High-Interest Account

Interest Rate

- If you want to get the most on your high yield savings account, you should get interest rates that are constantly higher than what a normal bank savings rate would be.

- You should also see if the interest that is being offered is fixed, or if it has the possibility to be changed, and see what the rates for compounding interest would be.

Deposit Protection

- In the event that you lose the money that you deposited, you should make sure that you will be able to get it back. There are some banks in Europe that will refund up to €100,000 for the money that you deposited.

- There are some bank accounts that are linked to Investments, such as Bondora Go and Grow, that may not fall in this protection category.

Liquidity and Access

- If you need to get your money out, check to see what their process is for withdrawing it without having to pay a fee.

- Some accounts that are considered to be high yield investment accounts may take a while or have some rules when it comes to accessing your money.

Fees and Minimum Balance Requirements

- Be on the lookout for monthly account fees every month, fees to maintain the account, or rules that they require you to follow in order to be able to get the interest rate that they used in the advertisement.

- Some bank accounts will require you to have a minimum amount of money in there if you want to earn interest on your high yield savings account.

Platform Reputation and Security

- When it comes to banking, you will want to choose a regulated bank or a legal Fintech platform that is going to keep your information and money safe.

- You will want to read the reviews and check to see if there are any regulations in place for keeping your money safe to make sure you are not getting scammed.

User Experience & Mobile App Features

- It gives users the ability to monitor and manage deposits and withdrawals with ease.

- Allowing users to set goals for savings, enabling automated rounding for transactions, or offering vault options are also great features to have.

Currency & Regional Availability

- Check to make sure the account offers the currency you want and it’s also accessible within your region.

- For users with international accounts, some multi-currency accounts offer more features and benefits.

Growth Potential & Risk

- For accounts with investment options, it’s wise to take into account the overall historical performance and risk level, how it’s diversified, as well as the expected returns.

- Look for a balance that meets your goals with a high interest, and level of risk that’s more acceptable.

Key Point & Best Savings Accounts in Europe with High Interest

| Platform | Key Points |

|---|---|

| Bondora Go & Grow | P2P-based savings product offering automated investing with daily liquidity, fixed target returns, no lock-in period, and simple app-based access for passive income seekers. |

| Trading 212 Cash Account | Commission-free cash account that pays interest on uninvested balances, offers daily interest accrual, high liquidity, strong app interface, and protection under investor compensation schemes. |

| Mintos Cash Account | Low-risk cash management option providing competitive interest through diversified lending exposure, instant deposits/withdrawals, automated allocation, and regulated platform security. |

| Trade Republic Cash Account | High-interest cash account with ECB-linked rates, full liquidity, German banking regulation, deposit protection up to €100,000, and seamless integration with investing features. |

| N26 Standard Savings | Digital bank savings option with easy transfers, instant access to funds, no minimum balance, strong mobile banking experience, and EU deposit guarantee protection. |

| Scalable Capital Cash Account | Cash account offering competitive interest rates, automatic interest payouts, high liquidity, German deposit protection, and smooth connection with investment portfolios. |

| Lightyear Cash Account | Multi-currency cash account providing competitive interest, instant access, transparent fees, modern app interface, and ideal for international investors. |

| Revolut Savings Vaults | Flexible savings vaults with daily interest calculation, customizable goals, instant withdrawals, strong app automation, and multi-currency support. |

| Bunq Easy Savings | Eco-friendly savings account with competitive interest, instant access, no withdrawal penalties, EU deposit protection, and sustainability-focused banking features. |

| Monese Savings Pots | Simple savings pots allowing users to separate funds, automate deposits, earn interest, and manage money easily through a mobile-first banking app. |

1. Bondora Go & Grow

Bondora Go & Grow is an online savings-style investment product from Europe that distributes its clients’ money into a varied assortment of consumer loan fractions, which generates an annual return of as high as 6 % that is compounded daily and virtually liquidated in real time.

Unlike bank savings accounts, this product does not have a deposit guarantee scheme and is an investment product, which makes it riskier.

However, the product’s automated diversification and the company’s historical success as an investment firm makes it attractive for clients who are looking to invest for the higher-yield savings accounts.

Bondora Go & Grow Features

High Return Potential: It is one of the most high-bearing savings account in Europe. Go & Grow accounts get a return of around 6 percent historically earned by investing in a diversified portfollio of consumer loans.

Anytime Liquidity*: Withdrawing money is allowed at almost any time.

Fully Automated: Investing gets simplified for beginners where they don’t have to make any active decisions.

No Minimum Balance Required: New high interest savings account holders can start with very little money.

Bondora Go & Grow – Pros & Cons

| Pros | Cons |

|---|---|

| High potential returns (higher than traditional bank savings). | Not protected by European deposit guarantee schemes. |

| Daily liquidity — withdraw anytime without penalty. | Returns are variable and not guaranteed. |

| Simple automated investing, ideal for beginners. | Being investment‑linked, there is market risk. |

| No minimum balance required to start. | Interest rates may fluctuate based on performance. |

2. Trading 212 Cash Account

Clients of the trading platform can earn interest with the Cash Account under Trading 212 and get interest for their uninvested cash holdings.

They advertise they offer a competitive interest rate that is higher than the interest rate offered by most euro savings accounts. They also post interest earned on a daily basis.

Created for both investors and savers in Europe, this account enables you to earn interest and maintain easy access, letting you keep your money liquid while also earning a yield.

While it does not give traditional bank deposit protection, it is a safe bet because of the strong regulatory framework and millions of accounts worldwide. This account also earns a high interest on cash, which allows it to rank as one of the best high-interest cash accounts in Europe.

Trading 212 Cash Account Features

Interest on Idle Cash. With positive growth via interest, even when it is not used to invest in stocks or in ETFs, money can grow uninvested in the account. This is a huge benefit with cash in the account, uninvested.

Daily Interest Credit. Interest benefits with savings are enhanced because it is calculated on a daily basis and credited consistently.

Commission-Free Platform. Without any fees on the cash, you receive these cash benefits. This makes it a good platform economically.

Strong Regulatory Framework: The additional robust European regulations governing the operations of the platform ensure additional peace of mind for the users of the platform.

Trading 212 Cash Account – Pros & Cons

| Pros | Cons |

|---|---|

| Earn interest on uninvested cash balances. | Not a traditional bank — may lack full deposit protection. |

| Daily interest calculation boosts returns. | Interest rate can change with market conditions. |

| No commission on holding cash. | Not designed primarily as a savings account. |

| Easy access to funds via app. | May lack features dedicated to goal‑based saving. |

3. Mintos Cash Account

Mintos Smart Cash feature enables users in Europe to earn interest on their idle cash at highly competitive rates of about 2% p.a., while enjoying full flexibility and same-day withdrawals.

Rather than a traditional savings account, your cash is invested in a very highly rated money market fund, which gives you a strong balance between liquidity and returns, only at a lower volatility.

With this, you have a reserve savings option to give you a little better yield than your ordinary bank accounts, which makes it a pretty strong choice. This is especially true for savers because it is within a regulated investment marketplace with reputable risk transparency.

Mintos Cash Account Features

Smart Cash Feature: The Cash Account earns interest, allocated into a pooled account that is diversified in a money market-like investment. This results in a higher interest rate than what is ‘where the cash sits out.

Instant Access: There is great flexibility, with instant withdrawals to cash on hand that is waiting to be used, day to day.

Diversification Benefits: The capital is allocated to many loan originators in the market, resulting in lesser concentration risk on any single loan.

Flexible Deposits: The cash account allows for constant cash contributions, making it a great option for ongoing savings to increase steadily.

Mintos Cash Account – Pros & Cons

| Pros | Cons |

|---|---|

| Smart Cash diversifies exposure for better yields. | Not protected by deposit guarantee schemes. |

| Instant or near‑instant withdrawals. | Potential risk if loan originators default. |

| Good alternative to traditional savings accounts. | Returns subject to economic or platform performance. |

| Flexible deposits anytime. | Interest may be lower compared to riskier investment products. |

4. Trade Republic Cash Account

Trade Republic cash account is a German-regulated option that allows users to keep their funds at any time and still earn interest on the uninvested balances.

This account offers both safety and potential return, especially with interest rates often at 2 % p.a. and the German Deposit Guarantee Scheme offering protection. N26 is known for solid mobile savings and safe deposit accounts.

Interest is calculated daily and paid out once a month. Sure, you have safety and interest perhaps even more than inflation, but availability is a big factor. This account is often referred to as high interest savings accounts in europe for lack of a more hostile marketing.

Trade Republic Cash Account Features

Competitive Interest Rates: Your cash that is not invested earns a high level of interest, and is available at your convenience.

Deposit Protection: Your money is safeguarded as such is a German bank and protected for €100,000 under the deposit guarantee scheme.

Integrated with Investing: Savings options and investment account options are available in the single app, simplifying your finances.

No Hidden Fees: There is a clear fee policy. There are no excessive fees for account maintenance for basic cash balances.

Trade Republic Cash Account – Pros & Cons

| Pros | Cons |

|---|---|

| Competitive interest on unused cash. | Interest depends on ECB/base rate conditions. |

| Full deposit protection up to €100,000 (German bank). | Usually no additional savings tools like goals or vaults. |

| Easy integration with trading/investment. | Best interest may require specific terms or conditions. |

| No maintenance fees for cash balance. | Not available outside supported countries. |

5. N26 Standard Savings

N26 allows its clients to utilize one of their premiums and instantly transfer funds to a savings account with interest. Interest rates depend on the user’s Membership Tier, but for premiums like Metal or Visa, it’s possible to get preferential rates on a savings account while still maintaining access.

N26 allows you to open a German account and as such, your funds will be protected to the limit of €100,000 in the German Deposit Guarantee Scheme. This makes N26 as one of the best offers on the market if you are looking for simple and flexible savings account with decent interest secured with high safety.

N26 Standard Savings Features

Easy Access Savings: Savings and checking accounts are kept separate, but you can transfer them instantly, providing balances to be kept flexible.

Tiered Interest: Some plans offered by N26 have higher interest depending on account tier, plans can be Premium, or Metal for example.**

Full Deposit Guarantee: Deposits in euro-regulated based banks are insured up to 100,000 euros.

Simple Mobile Experience: To effectively and easily supervise and enhance savings, a clear app is used.

N26 Standard Savings – Pros & Cons

| Pros | Cons |

|---|---|

| Easy, instant access to funds. | Interest rates can vary and may be modest. |

| Strong deposit protection (EU bank scheme). | Higher earned interest may require premium plans. |

| Simple, intuitive mobile UI. | May not be available in all European countries. |

| Flexible transfers between accounts. | No advanced savings tools (e.g., goals) on base plan. |

6. Scalable Capital Cash Account

Scalable offers a unique savings instrument for the Eurozone. You can earn interest on your non-invested funds. It comes with an investable cash account and a seamless integration to the digital investment ecosystem.

Starting Tiers display interest at a competitive 2% p.a. on cash holdings, although interest rates are dependent on subscription tiers and their respective plans. There is flexibility to access and withdraw cash at any point.

User experience is prioritized in the app and it integrates the ability to withdraw cash on a card and invest, placing it top on the list of convenience. Flexible access to funds and a smooth experience while integrating savings and investments makes it one of the highest interest savings accounts in Europe.

Scalable Capital Cash Account Features

Competitive Interest: The potential to earn cash balance interest is a great return option for those who want savings liquidity.

Integrated Investment Ecosystem: For effortless wealth management, it integrates with Scalable investment solutions.

Deposit Protection: Under German deposit protection, these funds are safe up to 100,000 euros.

Easy Setup: Start earning interest and saving quickly digitally through seamless onboarding.

Scalable Capital Cash Account – Pros & Cons

| Pros | Cons |

|---|---|

| Competitive interest on cash. | Interest may depend on subscription tier. |

| Covered by German deposit protection. | Interest yields could be lower than riskier investment options. |

| Seamless investing + savings ecosystem. | Might require additional steps to optimize returns. |

| Easy digital onboarding. | Not widely known outside investment community. |

7. Lightyear Cash Account

Lightyear is a cash accounts service that allows you to earn interest on uninvested funds. Users can hold multiple currencies uninvested at the same time and have the ability to access their funds at any time.

According to the user, ‘it distills aspirations of a modern investment experience without the hassle of paperwork and the complications that often come with a banking service. It’s a digital bank where investing and savings come along together, undoubtedly a great experience it gives.

The rates that they offer are higher than most, earning empty bank accounts a positive yield in the digital age’.

Lightyear Cash Account Features

Multi-Currency Support: People who frequently travel or are expatriated find it useful to hold and earn interest in different currencies.

Competitive Yield: The potential interest earned is usually consistent with savings accounts.

Instant Access: Fast fund withdraws are available with instant access.

Modern App Interface: Managing and campaigning cash is smooth with a modern mobile interface.

Lightyear Cash Account – Pros & Cons

| Pros | Cons |

|---|---|

| Multi‑currency interest options. | May not offer highest interest vs riskier accounts. |

| Instant access and low fees. | Not always protected under traditional deposit guarantee schemes. |

| Modern intuitive interface. | Interest rates vary by currency and market conditions. |

| Good for international users. | Product terms may change with platform strategy. |

8. Revolut Savings Vaults

Funds are held by a trustee and are then placed in interest accruing accounts. Savings Vaults allows you to earn interest by placing money into our partner bank’s interest-bearing accounts, which you can access through the app at any time and manage.

You may receive competitive interest rates (often changing and dependent on the plan) with the chosen bank and the terms that you select. Your deposits would potentially also be protected by the local deposit guarantee schemes up to relevant ceilings.

With no minimums and flexible withdrawals, these vaults are ideal for savers who want to be offered a mobile high-interest option that is coupled with the digital ease of use and the security of a traditional deposit.

Revolut Savings Vaults Features

Flexible Savings Vaults: Achieve multiple separate goals by earning interest all vaults with deposit flexibility.

Partner Bank Deposits: Funds are secured with interest earned by partner banks.

No Minimum: Start saving even if you only have a penny to spare & still incur no penalties.

Automated Features: Use round-ups and automated transfers to grow your savings without manual effort.

Revolut Savings Vaults – Pros & Cons

| Pros | Cons |

|---|---|

| Flexible savings “vaults” for multiple goals. | Interest depends on partner banks and schemes. |

| No minimum balance to earn interest. | Not all vaults may offer high interest. |

| Automatic features (round‑ups, repeat savings). | Deposit protection depends on partner bank rules. |

| Easy mobile access & tracking. | Not ideal for large long‑term savings. |

9. Bunq Easy Savings

bunq Easy Savings accounts assist users from Europe in increasing their savings with interest and in being able to manage their funds in different pots.

Yields are typically a bit higher than other banks (around 2.01 % p.a.) and interest would be paid out more frequently (often weekly) and is also compounded. Savings would grow quicker over time.

Bunq also gives the digital banking experience with extra automatic features that will encourage you to save, like rounding up purchases. Easy Savings is one of the top choices for those in need of high yield, flexible savings solutions as the funds are also deposit protected in the Netherlands.

Bunq Easy Savings Features

High Interest: Interest critters provided are years ahead of others in the market making the savings grow.

Weekly Interest Payout: Interest paying out weekly makes the savings grow even faster.

Eco Friendly Approach: Sustainability in finace is the new wave and Bunq is making this a priority .

Full Deposit Protection: Deposit in Dutch banks are insured up to €100,000.

Bunq Easy Savings – Pros & Cons

| Pros | Cons |

|---|---|

| Above‑average interest rates vs traditional banks. | Available only where Bunq operates. |

| Weekly interest payments accelerate growth. | May require premium plan for best rates. |

| Strong EU deposit protection. | Smaller feature set than full investment platforms. |

| Easy goal‑based saving options. | Interest can fluctuate with market rate changes. |

10. Monese Savings Pots

Monese Savings Pots allow users to reserve a portion of their balance from their everyday spending account to earn interest on.

Apart from fintech alternatives with greater interest rates, these funds present a user-friendly method to foster savings over time, with the ability to deposit and withdraw at one’s discretion.

Monese savings functionality is suited to occasiopnal savers aiming to achieve a specific savings target and prefer uncomplicated mobile-saving tools that provide a means to earn an interest on savings.

Monese Savings Pots Features

Simple Savings Pots: Split your money into pots so you can keep your core accounts untouched.

Flexible Withdrawals: Once you move funds to a pot, you can always draw from your spending pot whenever you’d like.

Mobile First Interface: Manage all your savings and budgets through the app.

Goal Based Saving: Save with a vision using the designated pots (ex. Travel, emergency, etc).

Monese Savings Pots – Pros & Cons

| Pros | Cons |

|---|---|

| Simple and intuitive savings pots. | Interest rates typically lower than specialized high‑yield products. |

| Supports easy mobile savings and withdrawals. | Limited advanced savings features. |

| Flexible transfers between pots and accounts. | Not the best option for long‑term high interest. |

| Good for organizational budgeting. | May not be available in all regions. |

Risks and Limitations

Market or Investment Risk

- Accounts that are different such as Bondora Go & Grow and Mintos are correlated with investment value fluctuations.

- There are unguaranteed returns and when the market takes a downturn, the returns could be less than the market as the returns may be lower than the stated market value.

Interest Rate Fluctuations

- Accounts that offer a variable interest rate are subject to a batch of rate cuts if the central banks decide to decrease interest rates.

- There are instances when the higher interest rate that gets advertised gets applicable for a short promotional period.

Limited Deposit Protection

- There are Investment accounts that do not provide the government deposit assurance schemes.

- In the European Union, the protection of a standard savings account in a bank covers a maximum of €100,000 for each individual.

Withdrawal Restrictions

- There is a number of high yield accounts that limit the number of withdrawals as well as delay the withdrawals.

- There are accounts that are fixed for a term that investment withdrawals result in a penalty for early withdrawals.

Fees and Charges

- In some rare instances, a negative return may result such as maintenance subscriptions or inactivity fees.

- There are some fintech platforms that have a lower interest rate unless a certain balance is kept.

Platform or Regulatory Risk

- In most instances, there is a lack of regulatory oversight in Fintech or non-bank platforms.

- There is a juxtaposition that access to funds can be impacted by platform failures and insolvency.

Inflation Risk

- Also, even those savings accounts with the highest interests may not be sufficient to counter inflation, leading to a decrease in the overall purchasing power.

Complex Terms and Conditions

- On some accounts, the methods of calculating interest are overly complex, and some added restrictions may be detrimental to the returns of the account.

Conclusion

Your financial objectives, risk tolerance, and liquidity requirements will determine which high-interest savings accounts in Europe are best for you. For depositors who are concerned about their safety, traditional digital banks like Trade Republic, N26, Scalable Capital, Bunq, and Revolut are perfect since they provide solid deposit security together with competitive interest rates.

For individuals who are prepared to take on some risk, platforms like Bondora Go & Grow, Mintos, Trading 212, and Lightyear offer greater earning possibilities through investment-based cash solutions. In general, flexible, high-interest savings solutions that combine superior rates, ease of access, and contemporary digital convenience are now available in Europe’s fintech scene.

FAQ

What qualifies as a high‑interest savings account in Europe?

A high‑interest savings account offers interest rates above the average of traditional banks (often above the ECB’s base rate), letting your savings grow faster. These can be digital bank accounts, fintech cash accounts, or investment‑linked products that provide higher yields while ensuring liquidity and safety.

Are high‑interest savings accounts safe?

Many are safe if provided by licensed banks covered by the European Deposit Guarantee Scheme (protects up to €100,000 per person per bank). Investment‑linked cash solutions like Bondora or Mintos carry more risk since they are not protected by deposit guarantees.

Can I withdraw my money anytime?

Most high‑interest savings accounts in Europe offer instant access without penalties. However, some investment‑oriented products may have slight delays for liquidity or settlement times if funds are invested in loan pools or markets.

Do these accounts charge fees?

Digital savings and cash accounts typically have no monthly maintenance fees, but some fintech platforms may charge subscription fees or have conditions for earning the advertised interest. Always check the fee schedule before opening.

How is interest paid and calculated?

Interest is usually calculated daily and credited monthly or annually. Some accounts offer compound interest that helps your savings grow faster over time. Always check whether interest is simple or compounded.