The top Payget exchange substitutes that provide increased security, reduced costs, broader cryptocurrency support, and sophisticated trading tools will be covered in this post.

- What Is Payget Exchange?

- Why Choose Payget Exchange Alternatives?

- Key Point & Best Payget Exchange Alternatives List

- 1. Bybit

- Bybit Features, Pros & Cons

- 2. Gate.io

- Gate.io Features, Pros & Cons

- 3. OKX

- OKX Features, Pros & Cons

- 4. Huobi Global

- Huobi Global Features, Pros & Cons

- 5. KuCoin

- KuCoin Features, Pros & Cons

- 6. Kraken

- Kraken Features, Pros & Cons

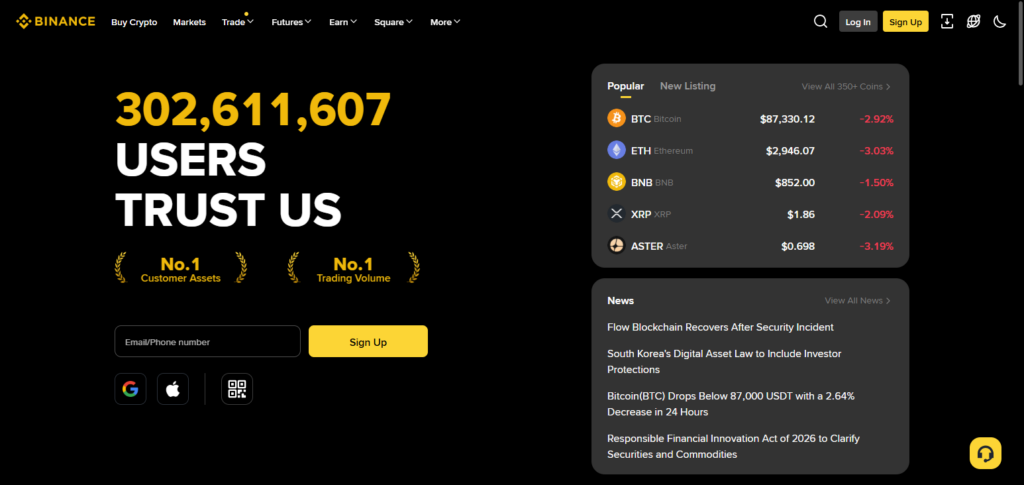

- 7. Binance

- Binance Features, Pros & Cons

- 8. Bitstamp

- Bitstamp Features, Pros & Cons

- 9. WhiteBIT

- WhiteBIT Features, Pros & Cons

- 10. MEXC Global

- MEXC Global Features, Pros & Cons

- Comparison Table: Payget vs Top Alternatives

- Conclusion

- FAQ

Compared to Payget, these platforms are perfect for users looking for dependable, regulated, and easy-to-use cryptocurrency exchanges with greater liquidity and worldwide accessibility.

What Is Payget Exchange?

Through a straightforward online interface, users of Payget Exchange, a digital cryptocurrency exchange platform, may purchase, sell, and exchange well-known cryptocurrencies.

It appeals to customers who want speedy transactions without complicated trading tools and is mainly used for crypto-to-crypto and crypto-to-fiat trades. Payget prioritizes usability over sophisticated trading capabilities and offers a number of significant digital assets.

However, Payget provides less transparency in terms of regulation, security procedures, and liquidity depth when compared to major international exchanges. Due to these restrictions, a lot of traders look into other Payget exchange options in search of greater security, broader asset support, and more affordable costs.

Why Choose Payget Exchange Alternatives?

More Security: Options use more security features including cold storage, and regular security checks.

More Regulation: The best exchanges use licensing to ensure trust, and compliance.

Less Fees: More competitive deposit and withdrawal fees save users money.

More Crypto Choices: Larger exchanges have many more options than Payget.

More Sophisticated Trading Options: Alternatives often offer futures, margins and staking which Payget does not provide.

More Fiat Choices: Alternatives often provide more options to deposit and withdraw different fiat users.

Extensive Customer Service: Customer Service being available 24/7 makes it easier to solve problems.

Key Point & Best Payget Exchange Alternatives List

| Exchange | Key Points |

|---|---|

| Bybit | Strong derivatives trading, high liquidity, advanced charting tools, low trading fees, copy trading support |

| Gate.io | Wide range of altcoins, early-stage token listings, flexible trading options, staking services, strong security |

| OKX | Advanced trading tools, deep liquidity, futures & options trading, DeFi and Web3 integration, robust security |

| Huobi Global | High liquidity, global market access, diverse crypto assets, margin trading, professional trading features |

| KuCoin | Extensive altcoin support, low fees, trading bots, passive income options, beginner-friendly interface |

| Kraken | Strong regulatory compliance, institutional-grade security, fiat on-ramps, reliable customer support, low spreads |

| Binance | Largest trading volume, lowest fees, extensive coin listings, advanced trading tools, global ecosystem |

| Bitstamp | Long-standing reputation, regulatory compliance, simple interface, secure fiat-crypto trading, trusted platform |

| WhiteBIT | European-focused exchange, strong security protocols, competitive fees, user-friendly design, fiat support |

| MEXC Global | High liquidity for new tokens, zero-maker fees, futures trading, fast listings, global accessibility |

1. Bybit

Since 2018, Bybit has managed to establish itself as one of the top competitors in the futures trading sector. It has regional license(s) for preliminary sites like Dubai. It offers competitive trading fees (approx. 0.075 to 0.1% taker/maker) and gives the option to trade in multiple currencies.

With a focus on security, the exchange has developed systems with multiple layers of cold storage, insurance on funds, 2FA, etc. There is a support system with extensive help documents, which may vary in response time, live chat feature, and support in multiple languages.

Bybit Features, Pros & Cons

Features

- Spot and advanced derivatives trading

- Rapid execution and high liquidity

- Minimal costs for trading

- Smart tools and copy trading

- Supports multiple languages

Pros

- Diversified market for derivatives

- Dependable costs

- User friendly for all levels of traders

- Safe (cold wallet, 2FA)

- Supports multiple languages

Cons

- Restricted fiat services for some countries

- Complex for new users

- Asset based withdrawal costs

- Some countries have strict regulations

- Delays in KYC are common

2. Gate.io

With more than 1,400 currencies, Gate.io provides best Payget exchange alternatives, and has proven itself as one of the strongest competitors. They are registered in the Cayman islands, and hold multiple regional licenses.

They have a flat fee system, with, approximately, a 0.15% fee for every spot trade you make and average GEO trading fees. They offer support in multiple languages.

They have cold storage and 2FA security, regions stay moderately ambiguous concerning regulation, and they have risk control systems as well.Gate.io is well regarded for asset diversity, staking as well as opportunity markets, appealing to those wanting breadth.

Gate.io Features, Pros & Cons

Features

- Large variety of altcoins

- Products for earn and staking

- Spot and future options for markets

- Advanced features for trading

- Supports multiple languages

Pros

- A large selection of tokens

- Newly listed tokens can be accessed

- Available options for staking and earning

- Offers reasonable trading costs

- Supports multiple languages

Cons

- For new users, the user interface is complicated

- Responses from the support team may take time

- Regulations are not very clear

- Some coins are not liquid

- Some advanced trades come with costs

3. OKX

Established in 2017, OKX is considered one of the best Payget exchange alternatives due to its global presence and robust regulation in a number of markets (including a Dubai prep license). Pricing is decent (approximately 0.08–0.1% for spots) and is among the hundreds of coins it lists.

The exchange provides multiple languages, and DeFi/Web3 wallet integration. Security includes proof-of-reserve, insurance funds, and cold wallet storage coupled with periodic audit(s). Support is also decent with chat, tickets, and localized FAQs and is 24/7. Historically, OKX had compliance issues, but is regarded as a trustworthy spot and derivatives exchange.

OKX Features, Pros & Cons

Features

- Spot & advanced derivative.

- DeFi and Web3 wallet.

- Multiple trading interfaces.

- High liquidity

- Multi-language support

Pros

- Excellent trading resources

- Taker and maker fees are low

- DeFi ecosystem and wallet

- High liquidity

- Excellent mobile app

Cons

- For novice traders, it may be intimidating

- Some areas have legal complications

- Complex fee structures for novices

- Lag in the interface

- Varies by region

4. Huobi Global

Founded in 2013, Huobi Global is one of the older names in the industry and is among the best Payget exchange alternatives for Asian markets and beyond. It has Distributed Ledger Technology licenses in Gibraltar and Australia with region dependent varying fee(s) for competitive pricing.

Huobi has a considerable range of cryptocurrencies and offers multi-language trading. The Security measures include cold wallets, multi-signature wallet(s), and periodic internal audits. Support is chat, ticket, help centers and localizations. Its various offerings include a wide ecosystem with spot, futures, and staking products.

Huobi Global Features, Pros & Cons

Features

- Support for spot and margin markets

- Great crypto support

- Trading resources are top notch

- Earn and staking

- Multi-language support

Pros

- Industry experience

- Liquidity is high on platform

- Multiple trading alternatives

- Options for passive income

- Solid interface tools

Cons

- Global regulation is inconsistent

- Some tiers have high fees

- No complete beginner support

- Variable customer support

- Some areas have less fiat on-ramps

5. KuCoin

KuCoin has been operational since 2017 and is consistently popular, especially for altcoins and tokens, making it one of the best Payget exchange alternatives.

Located in Seychelles, KuCoin has low fees (~0.1%) and supports various languages. It has legal and compliance issues in the U.S., but has cold storage, PoR transparency, and 2FA. Customer support has a live chat, ticketing system, and a large help site.

There are a lot of advanced trading tools for KuCoin and an active community. There are also a lot of options for new and experienced traders.

KuCoin Features, Pros & Cons

Features

- Variety of listed tokens

- Complex trading features

- KuCoin Earn and trading bots

- Community initiatives

- Support in multiple languages

Pros

- Great for low cap and new coins

- Fees are low

- Trading bots for automation

- Earn passive income

- Global presence

Cons

- Major markets have no full regulation

- Response time is highly variable

- Overwhelming at first

- On-ramp services are limited

- User protection is their security

6. Kraken

Kraken has been around since 2011 and is owned by Payward, Inc. In the U.S. and E.U., it has the highest regulatory compliance. It is also consistently rated one of the best Payget exchange alternatives for security in the industry.

It has a wide selection of services, supports a large number of cryptocurrencies, and has transparent fees (~0.16% on the spot market). There are no trading restrictions in Europe and there is also strong security with a large amount of cold storage and audits done regularly. Support is also responsive and available 24/7.

Kraken Features, Pros & Cons

Features

- Regulatory oversight

- Security

- Fiat support

- Futures and spot trading

- Various language support

Pros

- Transparency and security are top-notch

- Generally regulated

- Long-term investment friendly

- Easy to understand fee structure

- Support for fiat currencies is decent

Cons

- Limited trading features compared to most competitors

- Some users find the UI lacks modernity

- Compared to services with no fee charges, the cost is a little high

- Many users face delays in getting verified

- Compared to exchanges that center around a large number of altcoins, listings are much smaller

7. Binance

Binance is the largest exchange with over 1,000 cryptocurrencies and is consistently listed as one of the best Payget exchange alternatives. Founded in 2017, it has about the same amount of fees as the competitors with ~0.1%. They also have a large selection of currencies. They also have a multilingual, fully localized platform that supports multiple currencies.

Some of Binance’s features include SAFU Fund, cold storage, and audits for their security, while for their support, there are faqs, community support, and real-time chat. Their ecosystem is large and covers all bases including spot, p2p, earn, and future products.

Binance Features, Pros & Cons

Features

- Most extensive crypto marketplace

- Large liquidity

- Margin spot, futures, etc.

- Reduced fees with BNB

- Support in multiple languages

Pros

- Most extensive asset availability

- Most competitive pricing in most service segments

- Comprehensive range of supplementary services & products

- Comprehensive security features

- Ample liquidity

Cons

- Marketing limitations in flowing jurisdictions

- UI is unstructured for non-technical users

- Overly burdensome KYC requirements

- Support is notoriously slow

- The pricing structure is unorganized and confusing

8. Bitstamp

Established in 2011, Bitstamp is widely recognized as one of the most reliable and oldest exchanges and is often mentioned as one of the best alternatives to Payget for exchanging crypto for fiat. With firm compliance to European regulations and based in Luxembourg, Bitstamp’s fees are clear and balanced.

With strong EU compliance, Bitstamp specializes in the major crypto currencies, and is available in multiple languages for ease of use.

Security includes cold storage, layered authentication, and licensed (regulated) activities. Customers can reach support through email, and phone, and extensive help guides. For many, their commitment for years and covering regulations is a comfort.

Bitstamp Features, Pros & Cons

Features

- Most experienced and respectable exchange.

- Focus on fiat to crypto trading.

- Strong regulation.

- Multi language options

- Understanding of the fee structure

Pros

- Terror of reputation

- transparency

- Dekstop bank transfers are not a problem

- All the paperwork is done

- Everything is on the level

Cons

- Choose from a small number of tokens

- Not so many tools to trade

- Fees start to kick in when a trader is not active

- Limited staking and earning opportunities

- Not for traders who want to trade on margin

9. WhiteBIT

WhiteBIT, which began operating in 2018, is one of the best Payget Exchange alternatives for users from Europe, as it places a major focus on European compliance and fiat currency support.

With an emphasis on the major and growing cryptocurrencies, multiple languages, and adjustable User interfaces, competitors including Bitstamp come in at a lower level.

With cold storage, 2FA, and encryption, the security is top level, and support is provided through multilingual help centers, ticketing systems, and educational resources.It is also mapping out basic trading tools, in addition to having a clear fee structure, making it a good fit for beginner traders and advanced traders alike.

WhiteBIT Features, Pros & Cons

Features

- Focus on european traders

- Trading fees are modest

- Spot and margin trading

- Very intuitive design

- Direct transfers available

Pros

- Understanding of european regulations

- Modest trading fees

- High usability of the platform

- Direct transfers available

- High level of security

Cons

- Limited number of coins when compared on a global scale

- Low liquidity in the market

- Support can be lacking

- Advanced trading options are not available

- Low activity trading is not recommended

10. MEXC Global

Founded in 2018, and based in Seychelles, with several regional registrations, MEXC Global is a best Payget exchange alternative, especially for token explorers and traders looking for low fees.

MEXC Global is also one of the best low-cost exchanges for cryptocurrencies. Operating in multiple languages, MEXC offers futures, spot, and staking products, as well as cold storage and 2FA security. However, regulatory status varies by country.

MEXC provides user support and documents that focus on trading and onboarding. With more than 1000 cryptocurrencies to trade, MEXC Global is an attractive offering in the market.

MEXC Global Features, Pros & Cons

Features

- Freshly added tokens

- Low trading fees

- Availability of spot and futures trading

- Several languages for the user interface

- Large community

Pros

- First to trade on tokens that are not yet in the market

- Trading fees are low

- Futures trading is available

- Several trading pairs with good liquidity

- mobile application is good

Cons

- Little to no presence in the regulatory world

- Support is not uniform in quality

- Simple UI is not so simple to new users

- Limited options for fiat purchases

- Not the highest level of security, but it is acceptable

Comparison Table: Payget vs Top Alternatives

| Platform | Founded | Regulation/Compliance | Fees | Supported Cryptos | Security | Customer Support |

|---|---|---|---|---|---|---|

| Bybit | 2018 | Licensed in select regions | Low trading & derivatives fees | Hundreds of cryptos | Strong security controls | 24/7 live chat + help center |

| Gate.io | 2013 | Registered in global jurisdictions | Moderate fees | Very large range of altcoins | Cold storage + 2FA | Ticket + FAQ support |

| OKX | 2017 | Regional compliance in multiple areas | Competitive fees | Wide selection | Multi-layer security | 24/7 support |

| Huobi Global | 2013 | Multiple regional registrations | Tier-based fees | Extensive crypto list | Cold storage & authentication | Chat + ticket support |

| KuCoin | 2017 | Registered in Seychelles | Low fees | Very large token support | Multi-factor security | Live chat + documentation |

| Kraken | 2011 | Strong regulation in US/EU markets | Moderate fees | Large crypto range | Institutional-grade security | 24/7 support |

| Binance | 2017 | Multiple global licenses | Very low fees | Thousands of assets | Strong security protocols | Live + comprehensive support |

| Bitstamp | 2011 | EU regulated | Simple fee structure | Major cryptos | High compliance & security | Email + phone support |

| WhiteBIT | 2018 | European-focused compliance | Competitive fees | Mid-range list | Standard security features | Ticket + help center |

| MEXC Global | 2018 | Regional registrations | Low trading fees | Large crypto list | Standard security setup | Live + docs |

Conclusion

Your trading objectives, security requirements, and local accessibility all play a role in selecting the best Payget exchange options. While Bybit, OKX, and MEXC Global attract active traders with low fees and cutting-edge tools, Binance, Kraken, and Bitstamp stand out for their robust regulation and trustworthiness.

While WhiteBIT offers a strong European-focused choice, Gate.io and KuCoin offer broad altcoin support, making them perfect for diversification.

All things considered, these top Payget exchange substitutes offer more liquidity, more extensive cryptocurrency support, improved security features, and attentive customer service, making them dependable options for both novice and experienced cryptocurrency traders.

FAQ

What are the best alternatives to Payget exchange?

Top alternatives include Binance, Bybit, OKX, Huobi Global, KuCoin, Kraken, Gate.io, Bitstamp, WhiteBIT, and MEXC Global, offering improved liquidity, diverse crypto support, and strong security.

Which exchange has the lowest trading fees?

Binance, MEXC Global, and OKX are known for some of the lowest fees in the industry, often lower than Payget’s fee structure.

Are these exchanges safe and regulated?

Many, like Kraken, Bitstamp, and Binance, operate under strict regulatory frameworks in multiple regions and use industry-standard security measures like cold storage and 2FA.

Can I trade a wide range of cryptocurrencies on these platforms?

Yes. Exchanges like Gate.io, KuCoin, and MEXC Global support thousands of tokens, offering broader options than many smaller exchanges.

Do they support fiat deposits and withdrawals?

Platforms like Binance, Kraken, and Bitstamp offer fiat on-ramps. Availability depends on local regulations and supported currencies.