I will discuss the Best No Dealing Desk Forex Brokers . By granting direct market access, these firms eliminate intermediaries, thereby delivering quicker execution, narrower spreads, and fully transparent pricing.

- Key Point & Best No Dealing Desk Forex Brokers List

- 1.Fusion Markets

- Fusion Markets Features

- 2.Pepperstone

- Pepperstone Features

- 3.FxPro

- FxPro Features

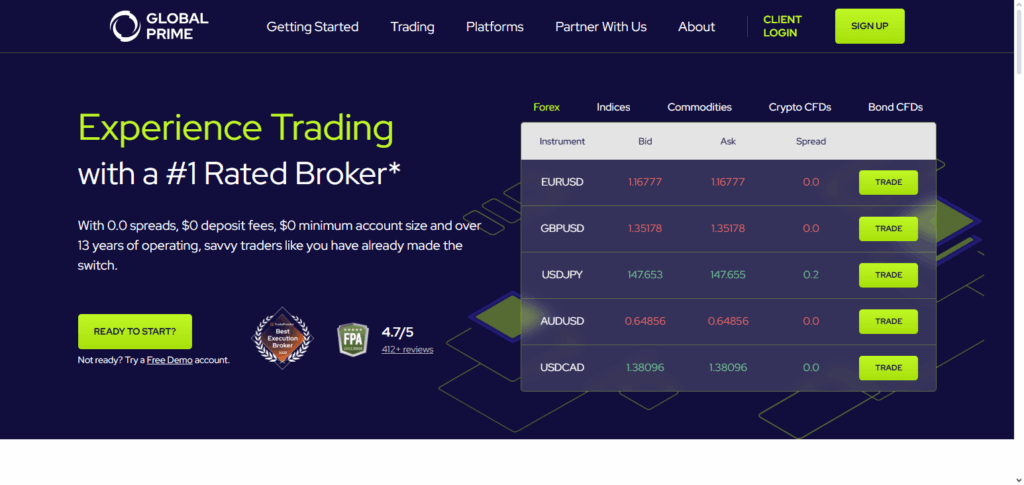

- 4.Global Prime

- Global Prime Features

- 5.IC Markets

- IC Markets Features

- 6.Vantage FX

- Vantage FX Features

- 7.FBS

- FBS Features

- 8.Eightcap

- Eightcap Features

- 9.Tickmill

- Tickmill Features

- 10.ThinkMarkets

- ThinkMarkets Features

- Conclusion

- FAQ

Such attributes appeal specifically to traders prioritising equity and operational efficiency. No dealing desk execution reduces potential conflicts of interest and operational slippage, rendering the model particularly well-suited to scalping, intraday trading, and professionally constructed Forex strategies devised for a hyper-competitive market environment.

Key Point & Best No Dealing Desk Forex Brokers List

| Broker | Key Points |

|---|---|

| Fusion Markets | Low spreads, fast execution, ASIC regulated, beginner-friendly platform |

| Pepperstone | Tight spreads, multiple platforms (MT4/MT5), strong customer support |

| FxPro | Advanced trading tools, multiple account types, FCA & CySEC regulated |

| Global Prime | ECN broker, low latency, institutional-grade liquidity, ASIC regulated |

| IC Markets | Raw spreads, fast execution, MT4/MT5/cTrader, strong liquidity |

| Vantage FX | Competitive spreads, leverage up to 500:1, MT4/MT5, ASIC & VFSC regulated |

| FBS | Micro accounts, bonuses, flexible leverage, global regulation |

| Eightcap | ECN broker, tight spreads, MT4/MT5, ASIC regulated |

| Tickmill | Low commissions, fast execution, ECN pricing, FCA & CySEC regulated |

| ThinkMarkets | Advanced tools, tight spreads, MT4/MT5, ASIC & FCA regulated |

1.Fusion Markets

Fusion Markets is widely regarded as a premier No Dealing Desk (NDD) Forex broker, distinguished by its authentic ECN model that connects traders directly to the world’s liquidity pools without intermediary interference.

Clients enjoy exceptionally tight spreads, sub-millisecond execution times, and crystal-clear price feeds, thereby removing the inherent conflicts of interest that arise with market-making practices. Regulated by ASIC, the broker demonstrates a robust framework of security and operational transparency.

The trading interface is designed with user-friendliness, accommodating both novice and veteran traders. By adhering strictly to a genuine NDD architecture, Fusion Markets delivers an environment characterized by fairness, efficiency, and competitive cost structures for Forex transactions.

Fusion Markets Features

- Low Spreads & Maximum Transparency: Access to the market with ultra-narrow spreads and no hidden markup, since all trading occurs outside a dealing desk.

- Rapid Trade Execution: Orders processed in milliseconds to reduce latency, minimizing slippage and benefiting strategies reliant on speed.

- Choice of Platforms: MetaTrader 4 and 5 available, each equipped with third-party add-ons that facilitate deep, automated analysis.

2.Pepperstone

Pepperstone distinguishes itself as a leading No Dealing Desk (NDD) Forex broker through its genuine ECN pricing and direct market access, guaranteeing that order execution occurs without broker mediation.

The result is exceptionally tight spreads, minimal execution latency, and aggregation of liquidity from numerous venues, which together foster an environment of transparency and operational efficiency. The firm operates under the supervision of premier regulatory bodies, namely ASIC and FCA, thereby aligning investor protection with operational integrity.

Further, the broker provides access to robust trading infrastructures—including MetaTrader 4, MetaTrader 5, and cTrader—positioning itself as an optimal choice for both institutional market participants and retail investors who prioritize unbiased, conflict-free Forex execution.

Pepperstone Features

- Pure ECN/STP Route: Orders routed to tier-one banks and non-bank liquidity, guaranteeing order execution without re-quotes and no dealer bias.

- Competitive Pricing & Commissions: Aggressive spreads paired with volume-based, low-per-trade commissions, making it cost-effective for frequent trading.

- Globally Integrated Service: Around-the-clock support in multiple languages, complemented by regional offices that foster client confidence and continuity.

3.FxPro

FxPro earns recognition as a leading No Dealing Desk (NDD) forex broker principally on the strength of its genuine direct market access and authentic ECN execution model that guarantees client transactions are processed without broker interposition.

The broker’s sophisticated trading architecture delivers near-instantaneous order fill, exceptionally narrow spreads, and considerable depth of liquidity aggregated from numerous sources. Oversight by preeminent regulatory bodies, including the UK’s FCA and Cyprus’ CySEC, underscores the firm’s commitment to transparency and operational integrity.

Targeting both seasoned and novice market participants, FxPro provides a curated suite of platforms—MetaTrader 4, MetaTrader 5, and cTrader—enabling seamless, conflict-free foreign exchange trading.

FxPro Features

- Diverse Account Solutions: STP accounts with transparent commission structures where order routing is entirely processed through automated networks.

- Institutional Tier Platforms: Access to MetaTrader 4, MetaTrader 5, and cTrader, all enhanced with sophisticated risk and trade management functionalities.

- Comprehensive Regulatory Oversight: Authorization from a consortium of reputable financial authorities, guaranteeing operational integrity and client asset protection.

4.Global Prime

Global Prime stands as a leading contender among No Dealing Desk (NDD) Forex brokers due to its implementation of genuine ECN execution, enabling clients to interact directly with institutional liquidity pools, free from intermediary influence.

The firm delivers exceedingly low spreads, negligible slippage, and order fills measured in milliseconds, thereby establishing a robust and efficient trading framework. Regulation by the Australian Securities and Investments Commission (ASIC) reinforces the dual pillars of security and transparency, while a suite of advanced analytical tools and full compatibility with MT4 and MT5 platforms sharpens execution precision.

The broker’s unwavering adherence to a strictly NDD model positions it as the preferred counterpart for institutional and professional traders who demand a trading arena characterized by fairness, total transparency, and cost efficiency in foreign exchange transactions.

Global Prime Features

- Tier-1 Institutional Liquidity: Direct connections to leading global liquidity providers yield the most accurate and transparent market prices, crucial for high-precision strategies.

- No Requotes: Every trade is fulfilled at the requested price; true ECN execution ensures optimal market access without dealer manipulation.

- Low Latency Servers: Infrastructure is engineered for constant, minimal delay, guaranteeing rapid and dependable order filling.

5.IC Markets

IC Markets has earned a prominent reputation as a leading No Dealing Desk (NDD) Forex broker, distinguished by a wholly transparent ECN architecture that routes orders directly to a global pool of liquidity providers, thereby eliminating any broker intermediation.

Traders enjoy access to raw spreads that are among the narrowest in the market, coupled with near-instantaneous order execution and substantial order book depth, thereby limiting slippage and maximizing trade precision.

Oversight by both ASIC and CySEC provides a solid framework of regulatory assurance and transparent operating practices. Compatibility with MT4, MT5, and cTrader, along with a network optimized for high-speed trade execution, positions IC Markets as the preferred choice for institutional and algorithmic participants in search of unconflicted execution and reliable stability.

IC Markets Features

- Genuine ECN Access: An agency-model broker, operating without a dealing desk and delivering spreads that start at 0.0 pips.

- Speed-Oriented Execution: Servers, co-located with liquidity providers, are engineered for rapid execution of algorithm-driven strategies.

- Comprehensive Asset Coverage: Currency pairs, global equity indices, physical and synthetic commodities, and digital currencies are available on MT4, MT5, and cTrader.

6.Vantage FX

Vantage FX distinguishes itself among No Dealing Desk (NDD) Forex brokers through the provision of genuine ECN execution, enabling traders to connect seamlessly to worldwide liquidity pools with no intermediary or discretionary latency.

Ultra-tight spreads, near-instantaneous order fulfillment, and insignificant slippage aggregate to a transparent, cost-efficient FX execution framework. Oversight by the Australian Securities and Investments Commission (ASIC) and the Vanuatu Financial Services Commission (VFSC) further fortifies the firm’s fiduciary integrity and operational robustness.

By offering both MetaTrader 4 and MetaTrader 5, Vantage FX accommodates a spectrum of trader sophistication, rendering the broker a clear preference for anyone pursuing Forex execution that is both fair and demonstrably cost-transparent.

Vantage FX Features

- Hybrid Account Architecture: Traders can select STP or ECN environments with raw spreads and transparent spreads pulled directly from liquidity.

- Execution Precision: Proprietary technologies reduce lag and slippage to levels suitable for institutional trading.

- Internationally Supervised: Operations are licensed and supervised across multiple jurisdictions, providing the highest levels of client fund insulation.

7.FBS

FBS has established itself as a premier no Dealing Desk (NDD) Forex broker by virtue of its direct market access coupled with authentic ECN execution, facilitating trade processing free from intermediary influence.

The firm delivers consistently tight spreads, low-latency order execution, and linkage to a diverse pool of liquidity sources, thereby furnishing market participants with a transparent and efficient trading framework.

Subject to global oversight and featuring a spectrum of account configurations, FBS serves novice and seasoned practitioners alike. The broker’s unwavering adherence to a genuine NDD architecture positions it as a venue for equitable, dependable, and conflict-free foreign exchange activity.

FBS Features

- No Intermediary Execution: All client orders are routed straight to liquidity providers via STP, creating transparent pricing and minimizing spread widening.

- User-Centric Incentives: A wide range of loyalty promotions and trading bonuses are available to amplify trading equity for both entry-level and active traders.

- Cross-Platform Accessibility: Traders can manage positions on MT4, MT5, or custom mobile solutions, ensuring constant market access.

8.Eightcap

Eightcap ranks among the premier No Dealing Desk (NDD) Forex brokers, delivering genuine ECN execution that links market participants straight to worldwide liquidity pools with no intermediary actions. The firm’s razor-thin spreads, instantaneous order fulfilment, and substantial market coverage establish a clear, unwalled arena for currency trading.

Oversight by ASIC confirms the firm’s adherence to stringent combined financial and operational standards, while support for both the widely adopted MetaTrader 4 and the advanced MetaTrader 5 platforms caters to traders across the proficiency spectrum. Earning its reputation from a commitment to unbiased operations, consistently low transaction costs, minimal slippage, and, critically, the absence of a trading desk, Eightcap presents an optimal choice for market participants demanding a polished, conflict-free, high-velocity execution in Forex.

Eightcap Features

- Transparent ECN Model: Every order is sent directly to market without dealer interference, and pricing is sourced from multiple liquidity sources.

- Economical Pricing for Active Clients: Spreads are ultra-tight, and commission charges on volume remain competitive for high-frequency traders.

- Dual-Regulatory Oversight: The broker is licensed by both the Australian Securities and Investments Commission and the Vanuatu Financial Services Commission, ensuring a secure trading environment.

9.Tickmill

Tickmill has established itself as a premier No Dealing Desk (NDD) Forex broker by leveraging a genuine ECN model that provides traders unmediated access to worldwide liquidity, thereby eliminating any broker intervention.

The firm delivers exceptionally tight spreads, rapid order processing, and the lowest levels of slippage, all of which contribute to a transparent and efficient trading ecosystem. Under the supervision of the FCA and CySEC, Tickmill furnishes a comprehensive framework of oversight and capital protection.

The platform supports the widely adopted MetaTrader 4 alongside a suite of advanced analytical and execution tools, catering to both novice and expert market participants. This combination of stringent regulation, unparalleled execution conditions, and a conflict-free pricing model positions Tickmill as an optimal venue for cost-sensitive and ethically-minded Forex trading.

Tickmill Features

- True Electronic Communication Network Execution: Executes trades without internalization by a dealing desk, providing access to raw spreads commencing at zero pips, an advantageous feature for scalpers and participants in high-frequency trading.

- Accelerated Order Processing: Proprietary technologies minimize slippage and reinforce the reliability of trade executions, thereby safeguarding the accuracy of client intended transactions.

- Diverse Platform Selection: Compatible with MetaTrader 4, MetaTrader 5, and an array of specialized professional trading applications, facilitating user preference and portfolio-specific optimization.

10.ThinkMarkets

ThinkMarkets positions itself as a preeminent No Dealing Desk (NDD) Forex broker, furnishing clients with authentic ECN execution that facilitates direct access to worldwide liquidity while circumventing broker interference.

By delivering ultra-narrow spreads, sub-second order execution, and nominal slippage, the firm cultivates a trading milieu distinguished by transparency and operational efficiency. Supervised by premier regulators, including the FCA and ASIC, ThinkMarkets promises a high degree of security and operational dependability.

Its platform suite embraces MT4, MT5, and a proprietary solution, serving both novice and institutional traders and thereby establishing itself as the preferred venue for Forex transactions defined by fairness, absence of conflict, and low implicit costs.

ThinkMarkets Features

- Dealing-Desk-Free Accounts: Guarantees execution via an STP and ECN model, ensuring transparent and conflict-free pricing for end-users.

- Narrow Spreads and Economical Commissions: Delivers a low-cost trading ecosystem across both Forex and Contracts for Difference, enhancing net profitability for margin traders.

- Sophisticated Technological Framework: Features the ThinkTrader platform, which integrates comprehensive risk management utilities alongside fully programmable automated trading.

Conclusion

In summary, the leading No Dealing Desk (NDD) Forex brokers—Fusion Markets, Pepperstone, FxPro, Global Prime, IC Markets, Vantage FX, FBS, Eightcap, Tickmill, and ThinkMarkets—present a seamless, transparent, and efficient environment for currency traders.

Their provision of genuine ECN execution, coupled with direct routing to global liquidity sources, ultra-tight spreads, and negligible slippage, effectively removes conflicts of interest while guaranteeing equitable order handling.

Fully authorised by the world’s foremost regulatory bodies, these firms amalgamate robust fund protection with cutting-edge trading platforms, catering equally to novice traders and experienced professionals who prioritise consistent, transparent, and cost-effective Forex execution.

FAQ

What is a No Dealing Desk (NDD) broker?

A No Dealing Desk broker provides direct market access without intermediaries, meaning trades are executed straight with liquidity providers, reducing conflicts of interest and ensuring fair pricing.

What are the benefits of using NDD brokers?

They offer faster execution, tighter spreads, minimal slippage, and transparency, making them ideal for scalping, day trading, and high-frequency trading.

Are all NDD brokers regulated?

Most top NDD brokers are regulated by authorities like ASIC, FCA, or CySEC, but it’s important to verify each broker’s license for fund safety.