This article discusses the best LazerPay alternatives in Africa. Digital payments and cryptocurrency are on the rise and so are the demands for alternatives to LazerPay. Many businesses and individuals require secure and reliable payment platforms.

- What is LazerPay Alternatives?

- Factors to Consider When Choosing a LazerPay Alternative

- Payment Methods Accepted

- Costs & Fees

- User Interface and Experience

- Security and Compliance

- Customer Support

- Availability

- Deposit and Withdrawal Limits

- Key Point & Best LazerPay Alternatives in Africa List

- 1. Interswitch WebPay

- Interswitch WebPay Features , Pros & Cons

- 2. Bundle Africa Pay

- Bundle Africa Pay Features , Pros & Cons

- 3. CoinGate Africa

- CoinGate Africa Features , Pros & Cons

- 4. BitPay Africa

- BitPay Africa Features , Pros & Cons

- 5. Cryptomus Africa

- Cryptomus Africa Features , Pros & Cons

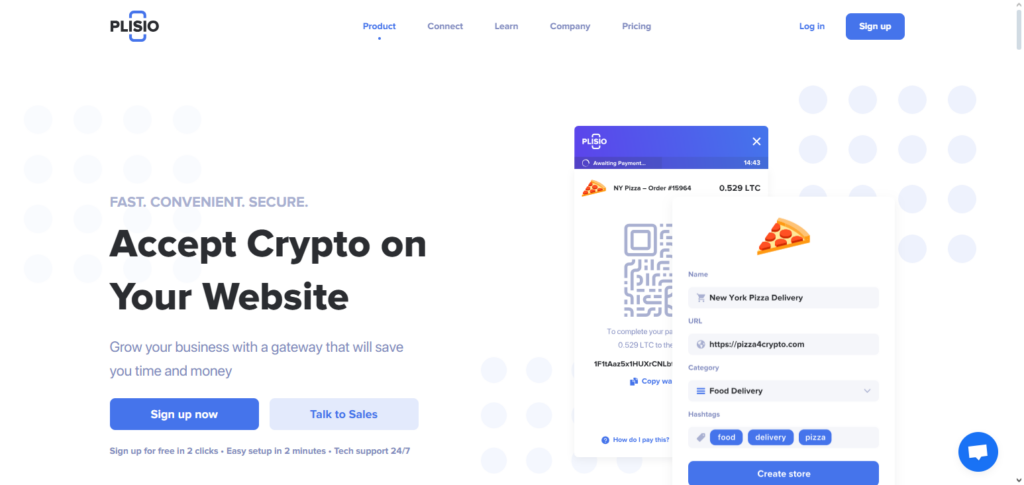

- 6. Plisio Africa

- Plisio Africa Features , Pros & Cons

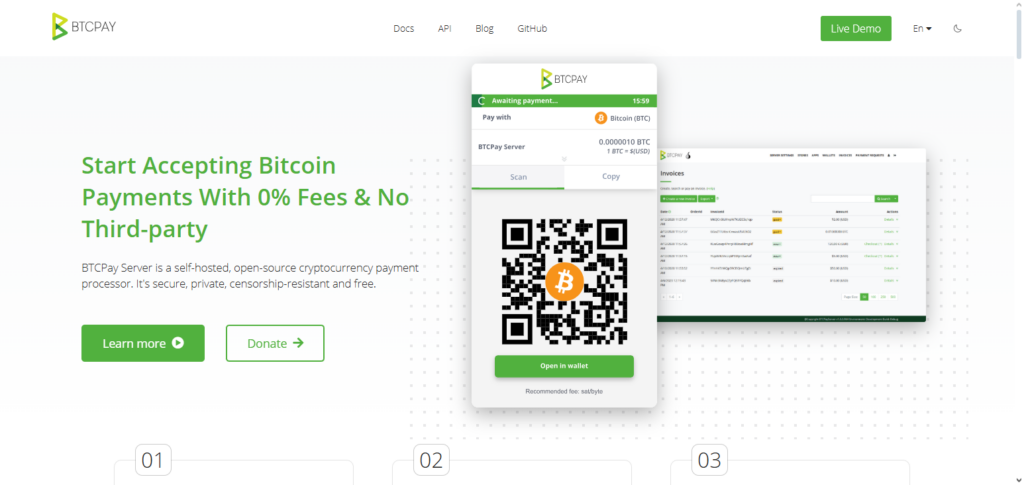

- 7. BTCPay Server (Africa)

- BTCPay Server (Africa) Features , Pros & Cons

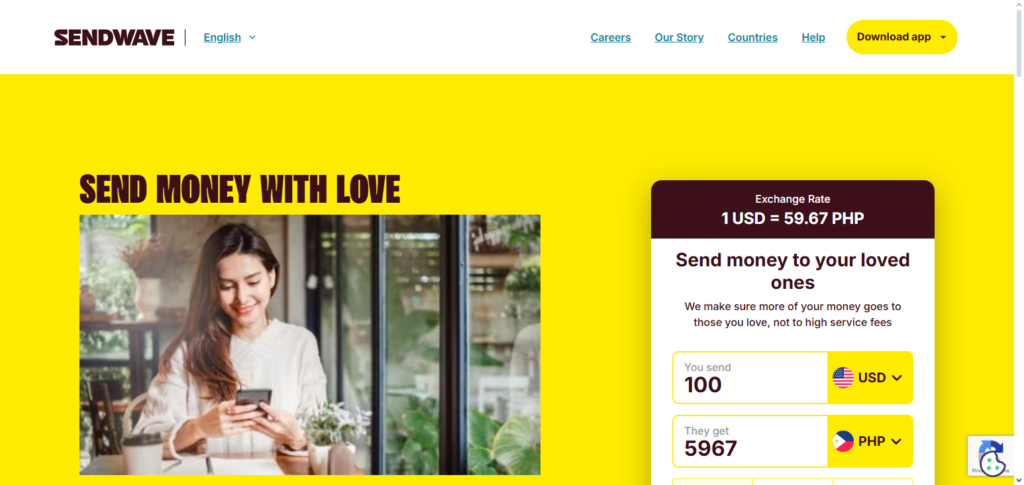

- 8. Sendwave Africa

- Sendwave Africa Features , Pros & Cons

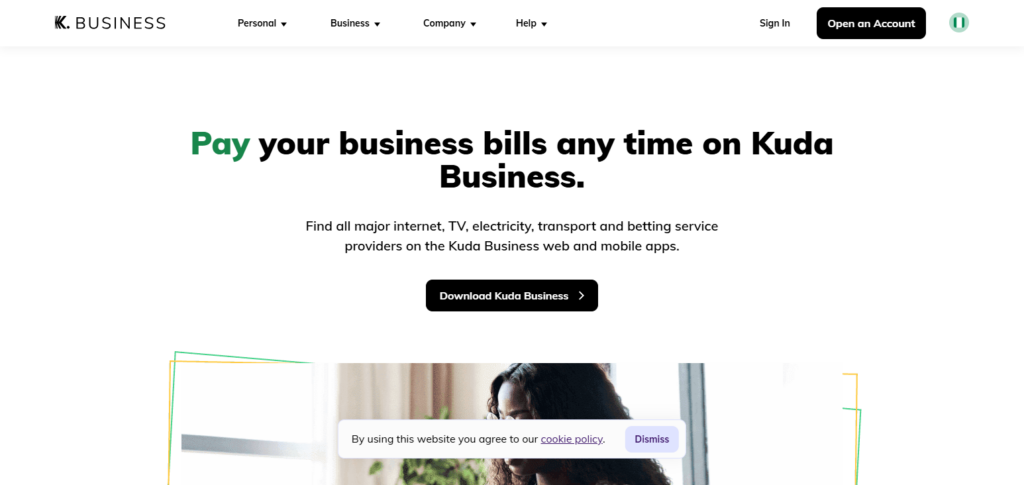

- 9. Kuda Business Pay

- Kuda Business Pay Features , Pros & Cons

- 10. Eversend

- Eversend Features , Pros & Cons

- How To Choose LazerPay Alternatives in Africa

- Check Supported Payment Methods

- Compare Fees & Charges

- Evaluate Security & Compliance

- Consider Regional Availability

- Assess User Experience

- Look at Customer Support Quality

- Comparison Table

- Conclusion

- FAQ

These alternatives provide low fee integration for mobile money, crypto wallets, and facilitate easy cross-border transactions so users can manage payments in Africa.

What is LazerPay Alternatives?

Digital payment systems and fintech solutions that provide comparable services to LazerPay, allowing customers to transfer, receive, and manage money online—often with additional cryptocurrency support—are known as LazerPay alternatives.

These options are intended for African companies and individuals who require quick, safe, and practical cross-border payment methods. They usually offer advantages like simple access through mobile apps or web platforms, cheap transaction fees, support for multiple currencies, and connection with mobile wallets.

By selecting a LazerPay substitute, consumers can investigate more affordable prices, increased security, broader geographic coverage, or specialized services catered to certain financial requirements for businesses or individuals.

Factors to Consider When Choosing a LazerPay Alternative

Payment Methods Accepted

- Determine whether the service allows transfers or payments through bank accounts. Also, check whether the service includes payments mobile phone, debit or credit cards, and digital currencies.

- This allows to suit the needs of both personal and business transactions.

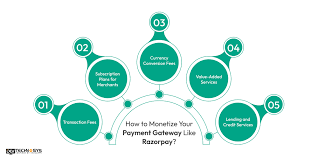

Costs & Fees

- Examine the different charges for transferring, converting, and withdrawing currency.

- Lower costs are best for saving more money and for cost efficiency.

User Interface and Experience

- Determine whether the service has user-friendly mobile applications and websites.

- This helps to create lesser errors and faster transactions.

Security and Compliance

- Make sure the service is licensed and uses secure encryption for transactions.

- This protects against fraud and cyber crime.

Customer Support

- They must be able to respond quickly through chat, email, or phone.

- This quickens the solution of issues presented, especially during transactions of high urgency.

Availability

- Make sure the service runs in your country and uses your local currency.

- This is important for easy payments.

Deposit and Withdrawal Limits

- Think about the daily, monthly, or transaction specific limits.

- This is to improve the user experience.

Key Point & Best LazerPay Alternatives in Africa List

| Platform | Key Features |

|---|---|

| Interswitch WebPay | Online payments, card processing, e-commerce integration |

| Bundle Africa Pay | Crypto wallet, payments, peer-to-peer transfers |

| CoinGate Africa | Crypto payments, invoicing, merchant tools |

| BitPay Africa | Bitcoin & crypto payments, invoicing, prepaid cards |

| Cryptomus Africa | Crypto payment gateway, multi-currency support |

| Plisio Africa | Crypto payment processing, invoicing |

| BTCPay Server (Africa) | Open-source crypto payment processor |

| Sendwave Africa | International remittances, mobile money transfers |

| Kuda Business Pay | Business payments, mobile banking, invoicing |

| Eversend | Multi-currency wallet, cross-border payments, crypto |

1. Interswitch WebPay

Interswitch WebPay is a secured website to do business payments. One of LazerPay Alternatives in Africa, you make payments with your card, mobile wallet, or do online banking. WebPay is one of the most secured competitors, and also the most reliable.

They are able to process transactions without complications. They integrate with most online businesses so ecommerce WebPay is great to use.

Most users look to the WebPay alternative Africa in this Widget to be able to process crypto payments. WebPay, and most of the other competitors in Africa, is constrained in this area.

Interswitch WebPay Features , Pros & Cons

Features:

- Processing of cards and payment online

- Merchant and e-commerce

- Support for mobile money in some countries

Pros:

- They are very reputable and secure in a lot of Africa

- Integration with e-commerce is easy

- They are efficient when it comes to processing payments

Cons:

- They have very little support for cryptocurrency as a whole

- They mainly focus on the older payment methods

- Service will most likely not be available for every country in Africa

2. Bundle Africa Pay

With services in both cryptocurrency and fiat Bundle Africa Pay is one of the Best LazerPay Alternative in Africa and an easy to use option. Users can buy, keep, and sell multiple cryptocurrencies, and each have their transactions facilitated from a single mobile application.

It includes peer-to-peer payments and low-fee transactions, allowing for every day use. The interface is very simple, allowing for beginners to navigate the complex crypto world. However, compared to other payment gateways, it has limited merchant integrations, allowing it to serve people, and small businesses, better than large businesses.,

Bundle Africa Pay Features , Pros & Cons

Features:

- Cryptocurrency wallet for multiple assets.

- Transfers and payment capabilities.

- Mobile application interface.

Pros:

- Crypto is inexpensive and easy to access.

- Beginners easily use the mobile interface.

- Payments between users can be made instantaneously.

Cons:

- There are not many merchants to partner with.

- Focus is primarily on West Africa.

- Advanced features can only be used after the account is verified.

3. CoinGate Africa

CoinGate Africa is a flexible crypto payment platform with payments and transactions in multiple cryptocurrencies, with payments being worldwide, and is a powerful platform for businesses and individuals alike.

It is a Best LazerPay Alternative in Africa with services such as crypto invoicing, payment integrations, cash registers, and more. Users targeting payments in crypto flexibility as it supported Bitcoin, Ethereum, and a large variety of altcoins.

This platform is great for businesses that have customers with crypto. However, due to the wide variety of tools and settings that the platform has, it is complex for beginners. It is a good choice as a pure payments provider for crypto.

CoinGate Africa Features , Pros & Cons

Features:

- Accepts different cryptocurrencies.

- There are tools for merchants to create invoices and use a point of sale.

- Payment buttons are available for websites.

Pros:

- There is widespread support for different cryptocurrencies.

- Offers flexibility in terms of business transactions.

- Offers strong features for payment processing.

Cons:

- The user interface is not as friendly for beginners.

- There is limited support for African fiat.

- Support may be slower in Africa

4. BitPay Africa

Bitpay Africa is the most experienced crypto payment processor in Africa, and so, makes another Best LazerPay Alternative. The company lets businesses accept bitcoin along with other major cryptocurrencies, and get prepaid cards, invoices, and locally settled payments.

The company’s security and global reach makes it reliable for many merchants, and individuals seeking safe crypto payments. The platform is ideal for more cross-border and larger payments.

As such, it has become best suited for international clientele. On the other hand, more expensive small transactions occur and it may take crypto beginners some time to get used to it and understand all of the features. Because of this, it’s most professional crypto payment processor in Africa.

BitPay Africa Features , Pros & Cons

Features

- Enables payments in Bitcoin and other cryptocurrencies

- Offers prepaid cards and invoice payments

- Provides tools for online merchants

Pros

- Excellent security and acceptance worldwide

- Comprehensive crypto payment processing

- Offers multi-coin support

Cons

- Fees for small amounts tend to be unreasonably high

- Some options might be overwhelming for novices

- Limited support for local African currencies

5. Cryptomus Africa

Cryptomus Africa is a crypto payment gateway and wallet service that provides users a seamless interface to handle different cryptocurrencies. It is the Best LazerPay Alternative in Africa, and enables quick transaction processing, multi-currency wallet management, and efficient payment services for individuals and businesses, corporate and private.

Cryptomus is one of the few providers that thoroughly attempt to facilitate the crypto experience of users, which include merchant service integratoin for users, and crypto payments for businesses. The app is a bit slower, and fewer coins are available, and the service is still being adapted to local merchants. Overall, it is a good option for users.

Cryptomus Africa Features , Pros & Cons

Features

- Offers a multi-crypto wallet and payment gateway

- Prioritizes speedy and safe transactions

- Offers support for merchant integrations

Pros

- Accommodates a great number of different cryptocurrencies

- Allows for speedy transactions across the network

- Considerable versatility for customers and businesses

Cons

- Some features in the mobile app and tablet app are lacking

- Merchant integration in Africa is still developing

- Primary market is non-cryptocurrency users

6. Plisio Africa

Plisio Africa is a payment processing platform that specializes in crypto payments, making it easier for users, both individuals, and businesses, to receive their payments in a variety of cryptocurrencies.

What Plisio Africa is lauded for is being the best LazerPay Alternative in Africa for having systems for invoicing, payment buttons, and integration of these payment systems directly into e-commerce sites.

The platform is designed for people in small to mid-sized businesses and goes best with clients in the crypto industry.

The primary downside to this platform is that the number of clients in this industry is on the small side, especially in several parts of Africa. Overall, the service Plisio offers is a good and uncomplicated crypto payment processing system, and the clients in Africa offer a good market opportunity for this platform.

Plisio Africa Features , Pros & Cons

Features

- Processes payments in cryptocurrencies

- Offers merchants invoicing features

- Applies to multiple cryptocurrencies

Pros

- Offers easy integration in e-commerce

- Provides support for a variety of cryptocurrencies

- Simple to use for merchants

Cons

- Limited growth in African countries

- Poor customer support options

- More focus on crypto payments, less on traditional fiat

7. BTCPay Server (Africa)

The BTCPay Server is completely Self-hosted and open-source so it is a completely Decentralized best LazerPay Alternative in Africa.

No matter the amount of payment processors, users will always have full control over their funds and the trade will always become cheaper and more private for anyone involved. In this platform, users can trade crypto as well as a variety of other currencies and also trade a variety of invoicing services and other customizable features for merchants.

The main downside, especially for people with no technical background, is that this system is designed to be complex with people having to learn a lot to use it. All in all, this platform offers users complete autonomy over their payment system and is a great choice for the people of Africa.

BTCPay Server (Africa) Features , Pros & Cons

Features

- Open-source, self-hosted crypto payment processor

- Full control over assets

- Directly distributed with no intermediary cut.

Pros:

- Unrestricted Freedom for All.

- No expenses unless you fully host it yourself.

- Compatible with Bitcoin and various altcoins.

Cons:

- Technical expertise necessary for initial configuration.

- Tough to handle during upkeep.

- Not very easy to use for initators.

8. Sendwave Africa

One of the more convenient options for international money transfer services, Sendwave Africa is ideal for smaller companies and personal remittances.

While Sendwave Africa was recognized as a LazerPay alternative in Africa, its services are especially catered towards mobile money and banking within various African nations. Most of the time, Sendwave service transfers are continuous.

The platform, however, does lose some value as a remittance platform for customers who do not value the use of services involving the transfer of digital assets as Sendwave Africa does not offer cryptocurrencies. Sendwave is often one of the most used platforms for fast transfer services.

Sendwave Africa Features , Pros & Cons

Features:

- Prompt sending of international money.

- Transfer to mobile wallets or banks.

- Affordable cross-border transaction fees.

Pros:

- Transfers are speedy and hassle free.

- Low cost solution for sending money.

- Interface designed for seamless use.

Cons:

- Not possible to make payments using crypto.

- Not all business features are included.

- There are fewer countries where the service is offered.

9. Kuda Business Pay

Zero-fee transfers, simplified controls for managing business accounts, and convenient platform design aimed for business customers also makes Kuda Business Pay one more of the mobile banking platforms.

Kuda Business Pay is recognized as one of the most convenient mobile banking platforms for business payments, invoicing, and payroll management solutions. Kuda Business Pay is LazerPay Alternative in Africa and offers locally supported currency transfers, which is a platform aimed at African business owners and Small and Medium Enterprises (SMEs).

Due to Kuda’s emphasis on business banking and transactions in fiat, the lack of relevant servicing for the platform’s use in crypto targets business banks. Nevertheless, spending for business purposes has become a more reliable service in Africa as a result of the platform’s low transaction fees and its low overall expenses.

Kuda Business Pay Features , Pros & Cons

Features:

- Business mobile banking.

- Management of invoices and payroll.

- Transactions in native currencies.

Pros:

- Transfers cost nothing.

- Business dashboard is simple to navigate.

- Even small endeavors are well catered for.

Cons:

- Very few features concerning crypto.

- Only available in Nigeria for the most part.

- Fewer options for receiving payments from foreign countries.

10. Eversend

Eversend is a cross-border payment and currency exchange platform with a multi-currency digital wallet. Eversend was recently awarded Best LazerPay Alternative. Users may also do cryptocurrencies at low fees, and have many wallet and wallet trading currencies.

Users can pay bills, make cross-border transfers, and trade crypto in the app. Eversend is user-friendly and caters to individuals and small businesses.

Accessibility varies by country, and some advanced features may require a whitelisted account. Overall, Eversend is a very convenient and flexible payment option for users in Africa.

Eversend Features , Pros & Cons

Features:

- Wallet for various currencies.

- Payments to cross-border and domestic bills.

- Crypto currency trading and sending.

Pros:

- Supports many currencies + monopoly money.

- Fees are not pocket breaking.

- Good for the common person + new business.

Cons:

- No access in some countries.

- To access features you need to be verified and even then it may be basic.

- Might not be suited for heavy duty enterprise use.

How To Choose LazerPay Alternatives in Africa

Check Supported Payment Methods

- Confirm that the platform has the payment methods you require, like bank transfers, mobile money, cards, and crypto.

- It provides versatility for both payment and receival.

Compare Fees & Charges

- When reviewing fees, consider transaction fees, currency conversion fees, fees for withdrawals, and any other potential hidden fees.

- If you are going to be conducting business regularly, lower fees will be beneficial to you and will greatly reduce your overall costs.

Evaluate Security & Compliance

- Choose platforms that have regulatory supervision, strong encryption, and compliance with security standards.

- This guarantees the safety of your money and the risk of fraud is reduced.

Consider Regional Availability

- Ensure that the service is operational in your country and that it caters for your local currency.

- There are some platforms that have less availability in certain regions in Africa.

Assess User Experience

- Services that have user friendly mobile apps and dashboards simplify and accelerate the process of making transfers.

- Enhanced User Experience will lead to fewer mistakes and will increase overall productivity.

Look at Customer Support Quality

- Select other options that have great customer service with quick response times through live chat, and emails or logging a call.

- When you have an issue to solve and you need help to troubleshoot, quick response support is essential.

Comparison Table

| Platform | Key Features | Crypto Support | Fees | Regional Availability |

|---|---|---|---|---|

| Interswitch WebPay | Online payments, e-commerce integration, card & mobile payments | ❌ Limited | Low-medium | Widely in Africa (Nigeria & selected countries) |

| Bundle Africa Pay | Crypto wallet, peer-to-peer payments, mobile app | ✅ Yes | Low | Pan-Africa, mainly West Africa |

| CoinGate Africa | Crypto payments, invoicing, merchant tools | ✅ Yes | Medium | Selected African countries & global |

| BitPay Africa | Bitcoin & crypto payments, prepaid cards, invoicing | ✅ Yes | Medium-high | Selected African countries & global |

| Cryptomus Africa | Multi-crypto wallet, payment gateway | ✅ Yes | Low-medium | Growing adoption in Africa |

| Plisio Africa | Crypto payment processing, invoicing, merchant integration | ✅ Yes | Low | Limited Africa coverage |

| BTCPay Server (Africa) | Open-source crypto payment processor, decentralized | ✅ Yes | Free (self-hosted) | Global (requires self-setup) |

| Sendwave Africa | International remittances, mobile money transfers | ❌ No | Low | Pan-Africa & global remittances |

| Kuda Business Pay | Business payments, invoicing, payroll, mobile banking | ❌ Limited | Low | Mainly Nigeria & expanding |

| Eversend | Multi-currency wallet, cross-border payments, crypto exchange | ✅ Yes | Low | Pan-Africa, selected countries |

Conclusion

For companies and people looking for quick, safe, and affordable transactions in Africa, selecting the appropriate payment platform is crucial.

The top LazerPay substitutes in Africa, such as Interswitch WebPay, Bundle Africa Pay, CoinGate Africa, BitPay Africa, Cryptomus Africa, Plisio Africa, BTCPay Server, Sendwave Africa, Kuda Business Pay, and Eversend, offer a variety of features, from complete cryptocurrency support to conventional bank and mobile payments.

Every platform has its own advantages, such as affordable costs, strong security, crypto integration, or intuitive user interfaces. You can choose the best option to simplify payments and effectively expand your business by assessing your requirements, transaction volume, and local support.

FAQ

What are LazerPay alternatives?

LazerPay alternatives are fintech platforms and payment services that offer similar features to LazerPay, such as online payments, money transfers, mobile money integration, and sometimes cryptocurrency support. These alternatives help users and businesses in Africa transact securely and efficiently across borders.

Do these alternatives support cryptocurrency?

Yes, many LazerPay alternatives like Bundle Africa Pay, CoinGate Africa, BitPay Africa, Cryptomus Africa, Plisio Africa, BTCPay Server, and Eversend offer cryptocurrency support, allowing users to send, receive, and accept digital assets. Others focus more on fiat payments and remittances.

Which platform is best for remittances in Africa?

Sendwave Africa and Eversend are popular choices for remittances due to their low fees, fast transfers, and support for mobile money and bank payouts in multiple African countries.

Are these alternatives secure?

Most reputable alternatives prioritize security, using encryption, compliance standards, and anti-fraud systems. Always check if the platform is regulated and offers strong account protection before transacting.

Can small businesses use these platforms?

Yes, many platforms such as Interswitch WebPay, Kuda Business Pay, and crypto payment options like CoinGate and BitPay provide tools for merchants to accept payments, create invoices, and manage transactions.