In this piece, I will discuss the Best Layer 2 to Layer 2 bridge solutions which facilitate the faster, cheaper, and more secure transfer of assets between different Layer 2 networks. The bridges themselves offer instant swaps, optimized fees, and security.

- Key Point & Best Layer 2 to Layer 2 bridge solutions List

- 1.Orbiter Finance

- Orbiter Finance Features

- 2.Across Protocol

- Across Protocol Features

- 3.Hop Protocol

- Hop Protocol Features

- 4.Stargate Finance

- Stargate Finance Features

- 5.Jumper Exchange

- Jumper Exchange Features

- 6.Rango Exchange

- Rango Exchange Features

- 7.Chainspot

- Chainspot Features

- 8.LI.FI Protocol

- LI.FI Protocol Features

- 9.Synapse Protocol

- Synapse Protocol Features

- 10.Celer cBridge

- Celer cBridge Features

- Conclusion

These include Orbiter Finance, Celer cBridge, and Hop Protocol, which allows the effortless transfer of tokens, moving them instantly, seamlessly, and securely across multiple blockchain ecosystems.

Key Point & Best Layer 2 to Layer 2 bridge solutions List

| Platform | Key Points / Features |

|---|---|

| Orbiter Finance | Cross-rollup and cross-chain bridge; low fees; minimal KYC; fast swaps. |

| Across Protocol | MEV-protected; secure cross-chain transfers; Ethereum L2 optimized. |

| Hop Protocol | Real-time liquidity tracking; fast L2 to L2 swaps; minimal KYC. |

| Stargate Finance | Instant cross-chain swaps; high liquidity; unified interface; minimal KYC. |

| Jumper Exchange | Aggregates multiple bridges; best rates; easy token swaps; low slippage. |

| Rango Exchange | Multi-chain bridge aggregator; supports DeFi integrations; fast swaps. |

| Chainspot | Cross-chain analytics; transaction monitoring; optimized routing. |

| LI.FI Protocol | Cross-chain aggregator; multi-chain swaps; user-friendly SDK for devs. |

| Synapse Protocol | Liquidity-focused bridge; fast settlements; supports multiple chains. |

| Celer cBridge | Layer 2 cross-chain bridge; minimal fees; high speed; secure transactions. |

1.Orbiter Finance

Orbiter Finance is among the best Layer 2 to Layer 2 bridge solutions because of its extremely low fees and ultra-fast transaction speeds. Unlike other traditional bridges, it uses direct cross-rollup swaps which avoids the use of any gateways.

Its user-intuitive interface simplifies token transfers among several Layer 2 networks, and its advanced security systems shield funds from possible exploits. Orbiter Finance is remarkably dependable and easy to use when it comes to Layer 2 to Layer 2 transfers because of the speed and cost effectiveness combined with advanced security.

Orbiter Finance Features

- Instant Transfers: Transfers of assets can be done on Layer 2 with Orbiter Finance. Users do not have to wait long because the wait times are great.

- Low Fees: Because the platform is done routing, transaction costs are kept to a minimum. This is especially great for those who make transfers frequently.

- User Friendly Interface: Even beginners can bridge assets on Layer 2 due to the intuitive user interface. The simplicity enhances effortless usage.

2.Across Protocol

Across Protocol is one of the leading top Layer 2 to Layer 2 bridging solutions with an MEV protected design. As with most of the emerging infrastructure projects MEV is a major concern within Across Protocol, guaranteeing a fair and secure transaction. Across Protocol makes sure slippage is minimized and users don’t have to worry about front-running attacks making transfers very dependable.

tween several L2 networks with low transaction fees and quick confirmation times. Across Protocol allows users to do secure, fast and dependable Layer 2 to Layer 2 transfers while achieving high security and efficiency.

Across Protocol Features

- High Security: Cross L2 transfers are secured with multi-sig and cryptographic signing making it extremely secure. This is beneficial for multi Layer 2 users.

- Optimized Liquidity: Cross chain liquidity is adequately maintained and as a result, slippage and transaction failures are minimised.

- Cross Chain Compatibility: Users can have a variety of tokens and seamlessly bridge them across different Layer 2 networks.

3.Hop Protocol

Hop Protocol stands out as a top Layer 2 to Layer 2 bridge solution, known for its real-time liquidity tracking and instantaneous token transfers between various L2 networks. Its proprietary liquidity network guarantees optimally timed transfers and minimal slippage, even when traffic is at its peak.

With cross-rollup processing, Hop Protocol achieves optimized security and low-cost transfers while maintaining real-time responsiveness, all due to its low-fee optimized routing and congestion-sensitive traffic management. The commendable speed, exceptional liquidity management, robust design, and user-centric approach to Layer 2 bridging assets sets Hop Protocol apart as a leading solution.

Hop Protocol Features

- Fast Settlement: Liquidity pool on L2s are used to settle transactions making them fast as they are not dependent on mainnet confirmations.

- Gas Efficiency: Operating inside Layer 2s lowers gas costs, making them more economical.

- Reliable Network Support: Works with Ethereum L2s such as Optimism, Arbitrum, and Polygon thus making interoperation have no hitches.

4.Stargate Finance

Stargate Finance is a leading Layer 2 to Layer 2 bridging solution with instant multi-chain cross swaps and deep liquidity available across many networks. Its proprietary instant liquidity pooling system enables transfers across different chains with no waiting time, no excessive slippage, and efficient asset transfer.

The platform’s simplified whole bridging interface which tackles complicated chores adds to user-friendliness. Stargate Finance is safe and quick while offering layer 2 to layer 2 token transfer with low cost and minimal fees.

Stargate Finance Features

- Unified Liquidity Pools: Combines liquidity across several chains enabling Swap rates.

- Cross-Chain Transfers: Allows effortless transfer of assets between different L2s and L1 networks.

- Transparent Fees: Offers transparency and predictability of fees for users.

5.Jumper Exchange

Jumper Exchange stands out as one of the best Layer 2 to Layer 2 bridge solutions. It combines several bridges to offer the user the best rates and the lowest possible slippage. Its one-of-a-kind proprietary algorithms guarantee that every transfer of tokens is done with optimal speed and minimal costs.

Jumper Exchange makes cross-L2 transactions effortless in the face of strong security standards by combining high liquidity with user-friendly interfaces. Prioritizing automated best-path routing and user experience is what makes Jumper Exchange one of the best-in-class solutions for Layer 2 to Layer 2 bridging of assets.

Jumper Exchange Features

- Automated Routing: Determines the optimal route for transfers between L2s for efficiency in both cost and time.

- Smart Swap Options: Allows many token types to be exchanged with optimal rates.

- Layer 2 Support: Concentrated on the bridgine of assets across highly efficient L2 networks.

6.Rango Exchange

Rango Exchange stands out with its Layer 2 to Layer 2 bridge solution which aims to combine numerous chains for rapid and effortless token transfers. Its distinctive cross-chain aggregation engine guarantees the best routes are taken to reduce both costs and transaction wait times.

With support for multiple L2 networks and partnerships with leading DeFi platforms, Rango Exchange demonstrates both effectiveness and flexibility. Users looking for dependable and easy Layer 2 to Layer 2 bridging solutions will find Rango’s emphasis on speed, low costs, and wide compatibility very appealing.

Rango Exchange Features

- Bridge Aggregation: Combines multiple bridges to identify the quickest and most economical path.

- Minimal KYC: Maintains user privacy with minimal verification requirements.

- Token Diversity: Offers many tokens for transfer on Layer 2.

7.Chainspot

Chainspot stands out as a premier Layer 2 to Layer 2 bridging solution, noted for its sophisticated cross-chain analytics and routing optimization. Transaction monitoring sets Chainspot apart from its competitors and enables its users to track transfers as they occur. This feature not only enhances transparency but also mitigates the chances of delays.

Chainspot’s infrastructure facilitates the rapid, secure, and cost-effective movement of tokens across several L2 networks. Chainspot’s powerful cross-chain analytics, efficient performance, and robust security make the bridging of Layer 2 assets not only reliable, but also quite effortless from the user’s perspective.

Chainspot Features

- Cross L2 Explorer: Allows users to monitor transactions across several L2 networks simultaneously.

- Secure Transfers: Focus on the protection of sensitive date through high-level verification methods.

- Liquidity Optimization: Actively calculates optimal pools to minimize slippage.

8.LI.FI Protocol

LI.FI Protocol sits on top of Layer 2 to Layer 2 bridge solutions because of its strong focus on developer experience and smooth cross-chain operations. With its specialized SDK, LI.FI Protocol is able to integrate with dApps, thus facilitating token swaps in a secured manner across numerous L2 chains.

With optimized routing, low-cost transactions, and swift confirmation times, LI.FI Protocol delivers exemplary user experience. Its strong developer and user focus, coupled with consistent performance, gives LI.FI Protocol a competitive edge as a Layer 2 to Layer 2 bridge.

LI.FI Protocol Features

- Bridge Aggregation: Uses different bridge providers to serve users with optimal routes.

- Smart Routing: Selects the most efficient routes with minimal cost across multiple L2s.

- Wide Compatibility: Supports numerous Layer 2 networks and tokens with seamless integration.

9.Synapse Protocol

Synapse Protocol stands out as the premier Layer 2 to Layer 2 Bridge solution, distinguished by its architecture that prioritizes liquidity. Synapse provides seamless and rapid token transfers. Its diverse system of liquidity pools mitigates slippage and delays in transactions, even during congestion in the network.

Synapse Protocol is also robust and affordable as it caters to several L2 networks and possesses low fees. Users looking for fast, secure, and dependable liquidity seamlessly use Synapse Protocol for Layer 2 to Layer 2 bridging and translates to profound user trust.

Synapse Protocol Features

- Focus Multi-Chain: Bridges L1 and L2 networks with low cost.

- Instant Transactions: Uses liquidity pools for quick cross L2 transfers.

- Secure Infrastructure: Uses advanced and well audited smart contracts.

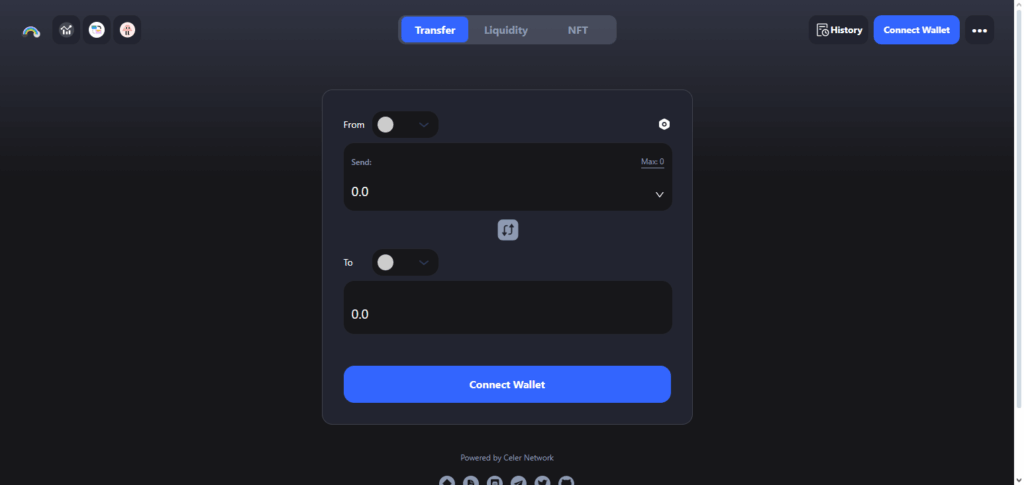

10.Celer cBridge

Celer cBridge remains unrivaled as a main Layer 2 to Layer 2 bridging solution because of the significantly lower fees and faster transactions. Its distinctive multi-chain structure allows direct cross L2 transfers which alleviate wait times and streamline operations.

cBridge utilizes Celer’s secure liquidity network which grants cBridge the capability to provide trustable and token transfers across Layer 2 networks. Its main focus of cBridge is speed and cost simply bolsters the claim that the service can be used without concern for inefficiency or reliability.

Celer cBridge Features

- High Throughput: Offers transfers across numerous Layer 2 regions at speed.

- Cost Effective: Gas and transaction fees are low.

- Cross Layer Support: Interoperates with supported chains from Ethereum L2s.

Conclusion

To summarize, the leading Layer 2 to Layer 2 bridging solutions—Orbiter Finance, Across Protocol, Hop Protocol, Stargate Finance, Jumper Exchange, Rango Exchange, Chainspot, LI.FI Protocol, Synapse Protocol, and Celer cBridge—enable users to transfer tokens swiftly and economically across several L2 networks in a single transaction with no loss in trust.

Every platform has distinct features, for example optimized routing, real-time liquidity tracking, and MEV protection, with some being more integration-friendly for developers. Together, they grant users outstanding bridging solutions for the shifting Layer 2 landscape and focus on customization and MEV protection.