The Best In-House Trading Platforms Replacing MetaTrader will be covered in this post, along with how prop firms are shifting to more contemporary, bespoke systems.

- Key Point & Best In-House Trading Platforms Replacing MetaTrader

- 1. TradingView

- TradingView Features

- TradingView Advantages & Disadvantages

- 2. NinjaTrader

- NinjaTrader Features

- NinjaTrader Advantages & Disadvantages

- 3. TradeStation

- TradeStation Features

- TradeStation Advantages & Disadvantages

- 4. Tradelocker

- TradeLocker Features

- TradeLocker Advantages & Disadvantages

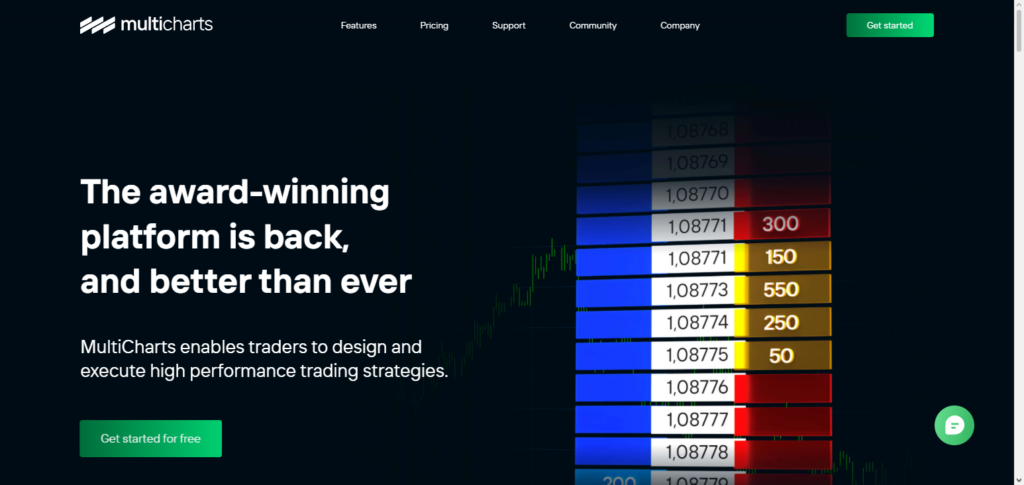

- 5. MultiCharts

- MultiCharts Features

- MultiCharts Advantages & Disadvantages

- 6. Sierra Chart

- Sierra Chart Features

- Sierra Chart Advantages & Disadvantages

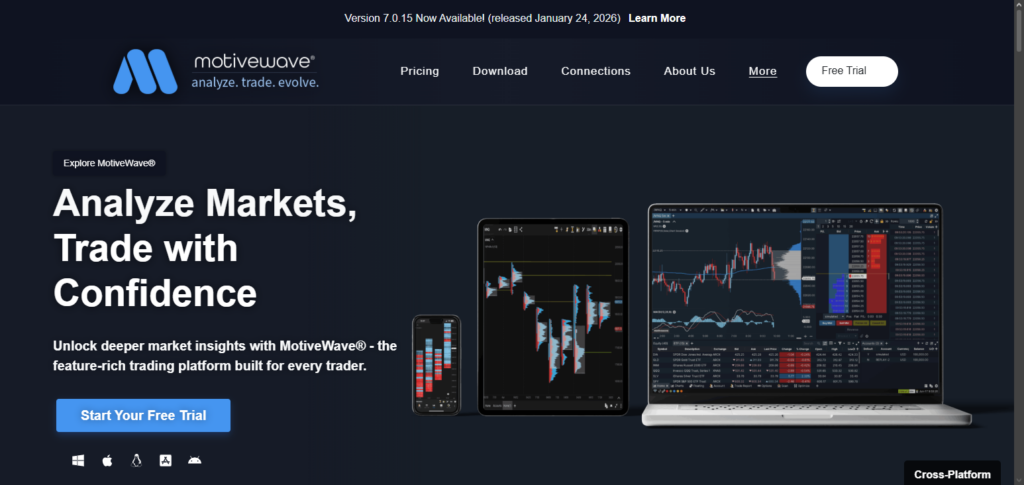

- 7. MotiveWave

- MotiveWave Features

- MotiveWave Advantages & Disadvantages

- 8. VertexFX

- VertexFX Features

- VertexFX Advantages & Disadvantages

- 9. ProRealTime

- ProRealTime Features

- ProRealTime Advantages & Disadvantages

- 10. Bookmap

- Bookmap Features

- Bookmap Advantages & Disadvantages

- Conclusion

- FAQ

Faster execution, sophisticated risk management, real-time analytics, and adaptable interfaces are all provided by these platforms.

Businesses may take complete control over trading operations, give traders access to professional-grade tools, and guarantee scalable, safe, and technologically advanced trading environments by replacing MetaTrader.

Key Point & Best In-House Trading Platforms Replacing MetaTrader

| Platform | Key Point |

|---|---|

| TradingView | Cloud-based charting with real-time data, custom Pine Script indicators, and seamless broker integration, enabling firms to offer branded, web-accessible trading terminals. |

| NinjaTrader | Advanced futures-focused platform providing low-latency execution, automated strategy development, and deep order flow tools for professional prop firm environments. |

| TradeStation | Institutional-grade analytics with EasyLanguage automation, direct market access, and robust backtesting for building firm-controlled proprietary trading systems. |

| TradeLocker | Lightweight, web-native trading interface designed for prop firms, featuring real-time risk controls, fast execution, and customizable dashboards for trader monitoring. |

| MultiCharts | High-performance multi-broker platform supporting advanced algorithmic trading, portfolio backtesting, and real-time strategy deployment across asset classes. |

| Sierra Chart | Ultra-low-latency charting and order routing platform with professional-grade futures tools and direct exchange connectivity for precise trade execution. |

| MotiveWave | Advanced technical analysis suite offering Elliott Wave, Gann, and harmonic tools, ideal for firms emphasizing deep market structure and strategy visualization. |

| VertexFX | White-label trading platform enabling full broker and prop firm customization, including risk management modules, CRM integration, and multi-asset support. |

| ProRealTime | Web-based and desktop platform delivering automated trading, server-side strategies, and institutional-grade charting with integrated brokerage connectivity. |

| Bookmap | Order book visualization platform providing real-time liquidity heatmaps and depth-of-market analytics for firms focused on HFT, scalping, and order flow trading. |

1. TradingView

For prop businesses looking for adaptable, branded trading platforms, TradingView has developed into a potent, web-first solution. It provides social trading capabilities, real-time market data, sophisticated charting, and the ability to create custom indicators using Pine Script.

Businesses Using the Best Internal Trading Platforms TradingView’s cloud-based access will take the place of MetaTrader value, enabling traders to connect in from any device without installing any software.

Direct order execution is made possible by its broker and exchange connections, while risk management systems and performance tracking dashboards are supported by API connectivity.

The platform is perfect for businesses that value accessibility, transparency, and a contemporary user experience because of its scalability, user-friendly interface, and international community.

TradingView Features

- Real-time access to global markets and cloud-based charting

- Pine Script for customizable indicators and strategies

- Web and mobile trading and integrations with brokers and exchanges

- Social trading and ideas community

- Dashboards and performance tracking via APIs

TradingView Advantages & Disadvantages

| Advantages | Disadvantages |

|---|---|

| Cloud-based access from any device without installation | Limited native broker integrations for full order routing |

| Powerful charting with thousands of indicators | Advanced automation requires external APIs |

| Social trading and idea-sharing community | Real-time data can require paid subscriptions |

| Easy custom scripting with Pine Script | Less suited for ultra-low-latency HFT |

| Clean, intuitive user interface | Limited server-side risk management tools |

2. NinjaTrader

NinjaTrader is the most recognized prop firm for futures and derivatives trading, making it the most reliable for performance-driven prop firms. It has advanced charting, automation of strategy development, and market analysis tools order flow and volume profile.

Firms moving toward Best In-House Trading Platforms Replacing MetaTrader rely on NinjaTrader’s low latency and direct market access for institutional trading environments. It has powerful custom risk controls, analytics, and trader performance metrics.

With backtesting, sufficient simulation modes, and a strong API, prop firms are able to tightly control their operations while providing NinjaTrader with the sophisticated tools required by their traders.

NinjaTrader Features

- Low-latency and direct market access for futures trading

- Tools for order flow, market depth, and volume profiling

- Automation of strategies via NinjaScript and C#

- Trade simulation and backtesting environments

- API integrations and add-ons for third-party vendors

NinjaTrader Advantages & Disadvantages

| Advantages | Disadvantages |

|---|---|

| Low-latency execution for futures and derivatives | Primarily focused on futures markets |

| Advanced order flow and depth-of-market tools | Steeper learning curve for beginners |

| Strong automation using C# and NinjaScript | Windows-only desktop platform |

| Robust backtesting and simulation environment | Some advanced features require paid license |

| Large ecosystem of third-party add-ons | Setup and customization can be complex |

3. TradeStation

TradeStation customizes automation in analytics for usage in systematic and quantitative trading. With the company’s proprietary scripting language, EasyLanguage, firms and traders can create, test, and automate strategies.

As TradeStation was recognized among the Best In-House Trading Platforms Replacing MetaTrader, it includes features such as direct market access, rapid execution, and performance reports.

The company also provides a multi-asset portfolio backtesting engine for firms to analyze risk and trader consistency. Firms can fully monitor and control trading dashboards through proprietary compliance tools, risk management systems, and cloud-connected APIs.

TradeStation Features

- Automation with EasyLanguage and analytics of institutional quality

- Access to markets for equities, options, and futures, and crypto

- Backtesting at advanced levels, and for whole portfolios

- Dashboards and analytics for real-time trading and performance

- APIs for account management, risk, and compliance

TradeStation Advantages & Disadvantages

| Advantages | Disadvantages |

|---|---|

| Institutional-grade analytics and automation | Platform complexity for new traders |

| EasyLanguage scripting for custom strategies | Monthly fees for advanced data packages |

| Direct market access across multiple assets | Limited white-label customization options |

| Powerful backtesting and portfolio tools | Heavier system requirements |

| Strong API and reporting features | Slower for ultra-high-frequency strategies |

4. Tradelocker

Since TradeLocker is a web-based trading platform, it is one of the quickest within the prop firm ecosystem. With adjustable settings for a fully branded platform, TradeLocker also provides customizable dashboards for account performance in real-time.

For firms seeking Best In-House Trading Platforms Replacing MetaTrader, TradeLocker provides drawdown risk, position limits, and analytics for performance.

Its design provides trader accessibility within any browser and device, and the integrated backend APIs with the CRM, payout, and trader evaluation modules are systems of seamless operation. For funded trader programs, the combination of speed and flexibility with operational transparency is an attractive offering from TradeLocker.

TradeLocker Features

- Lightweight web-based interface designed for prop trading firms

- Real-time risk management and drawdown controls

- White-labeling and customizable dashboards

- Infrastructure in the cloud for quick order execution

- Integration with trader evaluation, payout, and CRM systems

TradeLocker Advantages & Disadvantages

| Advantages | Disadvantages |

|---|---|

| Web-based and lightweight for fast onboarding | Smaller indicator and tool ecosystem |

| Built-in risk management for prop firms | Limited advanced algorithmic trading |

| Custom branding and white-label support | Fewer broker integrations than legacy platforms |

| Easy CRM and payout system integration | Less suitable for professional quants |

| Fast cloud-based execution | Feature set still evolving |

5. MultiCharts

MultiCharts boasts extreme versatility for in-depth strategy creation, as well as automating at the portfolio level. Since it works with many brokers and data feeds, it allows companies to consolidate their trading operations for different asset classes.

In the Best In-House Trading Platforms Replacing MetaTrader, MultiCharts has several advantages like the best real-time strategy implementation, backtesting, and the broadest range of compatibility with EasyLanguage.

Companies are able to construct sophisticated algorithmic systems and stress-test them with historical data to keep track of live performance with integrated dashboards.

Its highly developed support of APIs makes it possible to integrate it with internal risk management software, trade compliance, and replication systems, allowing it to meet the needs of professional proprietary trading companies that practice scalable, systematic trading.

MultiCharts Features

- Support for trading across multiple brokers and assets.

- Deployment of automated strategies & algorithmic trading.

- Real-time and historical back-testing engine.

- EasyLanguage for the portability of strategies.

- Integration of API with risk and compliance systems of the firm.

MultiCharts Advantages & Disadvantages

| Advantages | Disadvantages |

|---|---|

| Advanced algorithmic and portfolio trading | Interface less modern than cloud platforms |

| EasyLanguage compatibility | Requires desktop installation |

| Powerful backtesting engine | Licensing costs can be high |

| Multi-broker and data feed support | Setup can be technical for beginners |

| API integration for firm systems | Limited built-in social trading features |

6. Sierra Chart

Sierra Chart is renowned for its rich futures market capabilities and ultra-low latency performance. For accurate execution, it provides direct exchange access, sophisticated order routing, and professional-grade charting.

Businesses Using the Best Internal Trading Platforms Changing the value of MetaTrader Sierra Chart’s automated trading methods, personalized indicators, and fine-grained control over data feeds. Complex risk management criteria, depth-of-market analysis, and real-time performance tracking are all supported by its highly configurable environment.

The platform offers prop businesses a dependable infrastructure for challenging trading situations because of its speed and stability, which make it perfect for high-frequency, scalping, and order-flow-based trading tactics.

Sierra Chart Features

- Routing orders and ultra-low-latency data.

- Tools for order flow and futures of professional grade.

- Automated trading systems and indicators that are customizable.

- For exact execution, direct exchange connectivity.

- Price analytics and advanced depth of the market and market profile.

Sierra Chart Advantages & Disadvantages

| Advantages | Disadvantages |

|---|---|

| Ultra-low-latency and high-performance | Steep learning curve |

| Direct exchange connectivity | Dated user interface |

| Professional-grade order flow tools | Limited broker compatibility |

| Highly customizable and stable | Requires technical configuration |

| Excellent for scalping and HFT | Minimal built-in automation wizards |

7. MotiveWave

MotiveWave is a cutting-edge analytical platform focused on advanced trading tools market players need for in-depth analysis. Available features include Elliott Wave analysis, Gann analysis, Fibonacci studies, and various harmonic pattern recognition tools.

MotiveWave is on our list of Best In-House Trading Platforms Replacing MetaTrader since, along with MetaTrader, allows firms to incorporate advanced features for visualization and strategy formulation for technical traders.

With multi-broker access to trading futures, equities, and forex, MotiveWave provides internal analytics and risk systems for firms via API tools. Custom workspaces, automation of strategies, and a comprehensive breakdown of firm-trader analytics allows firms to customize and utilize MotiveWave to monitor trader activity and automate tools to adhere to firm risk policies.

MotiveWave Features

- Tools for analysis of Elliott Wave, Gann, and harmonic patterns.

- Connectivity for trading multiple brokers and multiple assets.

- Features of backtesting and development of automated strategies.

- Unique technical libraries and customizable study workspaces.

- Integrations for reporting and analytics of performance.

MotiveWave Advantages & Disadvantages

| Advantages | Disadvantages |

|---|---|

| Advanced Elliott Wave and Gann tools | Heavy on system resources |

| Strong technical analysis suite | Smaller user community |

| Multi-broker and multi-asset support | Less focus on HFT performance |

| Automated strategy and backtesting tools | Higher licensing cost |

| Customizable workspaces | Complex for casual traders |

8. VertexFX

VertexFX designed a fully customizable white-label trading platform for brokers and prop firms focused on having complete control of their trading environment. With support for multi-assets, integrated CRM, and advanced risk management modules, VertexFX streamlines firms aiming for Best In-House Trading Platforms Replacing MetaTrader by offering plenty of options in branding their interfaces, custom trading rules, and automation of compliance processes.

VertexFX provides backend tools for real-time trader monitoring, behavior, exposure, and payout forecasting. With analytics, performance dashboards, and payment systems integrated via API, VertexFX provides a comprehensive and flexible environment for firms seeking to develop a proprietary, scalable trading system.

VertexFX Features

- A trading platform for firms that is customizable and fully white label.

- Integrated risk management modules for multi-asset trading.

- Systems for trader management and built-in CRM.

- Tools for exposure control and real-time monitoring.

- API for compliance, analytics, and payment platforms.

VertexFX Advantages & Disadvantages

| Advantages | Disadvantages |

|---|---|

| Full white-label customization | Requires technical deployment |

| Built-in CRM and risk management | Higher setup and maintenance cost |

| Multi-asset trading support | Smaller global user base |

| Real-time trader monitoring tools | Limited third-party plugins |

| API integration for payments and analytics | Not trader-focused out of the box |

9. ProRealTime

ProRealTime has two trading platforms, web-based and desktop, that come with automated trading and charting at an institutional level. It features server-side automated trade processing, which minimizes reliance on local computing power and hardware.

One of the Best In-House Trading Platforms Replacing MetaTrader, ProRealTime includes direct brokerage access, a vast array of technical indicators, and an advanced user-friendly interface for backtesting.

Through the integrated dashboards, firms can deploy automated systems, track performance, and apply risk management. Customization, reliability, and cloud-based trading experience infrastructure make it geared towards prop firms for discretionary and algorithmic proprietary trading models.

ProRealTime Features

- Execution of strategies and automated trading on the server-side.

- Top-tier technical indicators and charting.

- Support for desktop and the web with cloud-based access.

- Tools for optimization and back testing of advanced features.

- Integrations of direct market data and brokerage.

ProRealTime Advantages & Disadvantages

| Advantages | Disadvantages |

|---|---|

| Server-side automated trading | Limited broker availability in some regions |

| Web and desktop access | Paid subscriptions for advanced features |

| Strong backtesting and charting tools | Fewer white-label options |

| Institutional-grade reliability | Automation language learning curve |

| Cloud-based performance | Less suited for ultra-low-latency HFT |

10. Bookmap

Bookmap is a leading platform for order flow and market depth analysis, mainly for institutions and professionals. To aid traders in making accurate entry and exit decisions, it offers information and real-time liquidity heatmaps for all order book levels (level 2) and volume-at-price clusters.

As part of Best In-House Trading Platforms Replacing MetaTrader, leading firms who offer proprietary trading and high-frequency (HFT) and scalping book strategy via the cloud, integrate advanced analytics and book depth.

Bookmap also offers extensive coverage of integrated trading services. Without a trading platform, firms have proprietary trading systems and Bookmap analytics. It also provides greater oversight on the execution of strategies to traders.

Bookmap Features

- Visualization of the order book and real-time heatmap of liquidity.

- Market depth and volume cluster analysis

- Connectivity with principal exchanges and trading systems

- Analytics for high-frequency trading and scalping

- Data export and API for tracking firm performance

Bookmap Advantages & Disadvantages

| Advantages | Disadvantages |

|---|---|

| Unique liquidity heatmap visualization | Not a full standalone trading platform |

| Excellent for order flow analysis | Requires integration with another platform |

| Real-time depth-of-market insights | Steep learning curve |

| Popular among professional scalpers | High cost for full feature access |

| Supports major exchanges and brokers | Limited automation capabilities |

Conclusion

A larger change in the way prop businesses handle risk, performance, and trader experience is reflected in the move toward Best In-House Trading Platforms Replacing MetaTrader.

Faster execution, more in-depth analytics, adaptable interfaces, and smooth interaction with internal payout, monitoring, and compliance systems are all features of modern platforms. Adopting cloud-based access, sophisticated automation, and real-time data visualization gives businesses more operational control while providing traders with tools fit for a professional.

In addition to increasing transparency and scalability, this evolution puts prop businesses in a position to quickly adjust to changes in regulations, new asset classes, and the increasing need for high-performance, technologically advanced trading platforms.

FAQ

Why are prop firms moving away from MetaTrader?

Firms seek greater control over risk rules, execution quality, and data ownership. In-house platforms offer custom drawdown logic, real-time monitoring, API integration, and branded trader dashboards that MetaTrader cannot natively support at scale.

Are in-house platforms faster than MetaTrader?

Many use direct exchange or broker APIs, cloud servers, and low-latency infrastructure. This can reduce execution delays, improve order routing, and support high-frequency or scalping strategies more effectively than retail-focused platforms.

What features matter most for prop firms?

Key features include automated risk management, real-time performance analytics, API connectivity, multi-asset support, cloud access, compliance reporting, and customizable trading rules tailored to funded account programs.

Can traders still use custom indicators and bots?

Yes. Platforms like TradingView, NinjaTrader, and MultiCharts support scripting, automation, and API-based bots, allowing traders to build, test, and deploy strategies within firm-controlled environments.

How do in-house platforms improve risk management?

They enable server-side enforcement of drawdowns, position limits, time-based rules, and exposure caps. This ensures traders cannot bypass firm policies through local terminal modifications.