In this piece, I will analyze the Best Gold ETFs to Invest on, including the top options that offer safe, inexpensive, and flexible exposure to gold.

- What is Gold ETFs?

- How To Choose Best Gold ETFs to Invest

- Key Point & Best Gold ETFs to Invest List

- 1. iShares Gold Trust Micro ETF (IAUM)

- iShares Gold Trust Micro ETF (IAUM) Features

- 2. SPDR Gold Shares (GLD)

- SPDR Gold Shares (GLD) Features

- 3. SPDR Gold MiniShares Trust (GLDM)

- SPDR Gold MiniShares Trust (GLDM) Features

- 4. GraniteShares Gold Trust (BAR)

- GraniteShares Gold Trust (BAR) Features

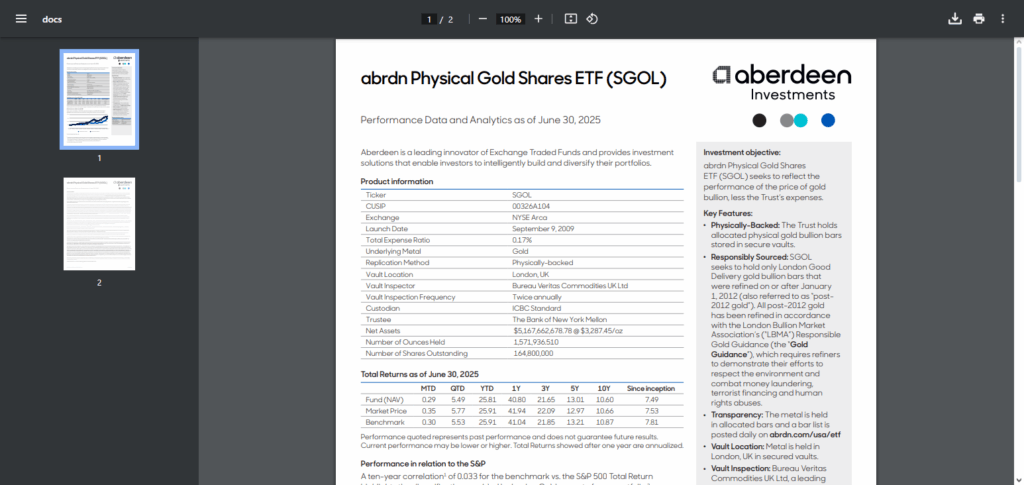

- 5. abrdn Physical Gold Shares ETF (SGOL)

- abrdn Physical Gold Shares ETF (SGOL) Features

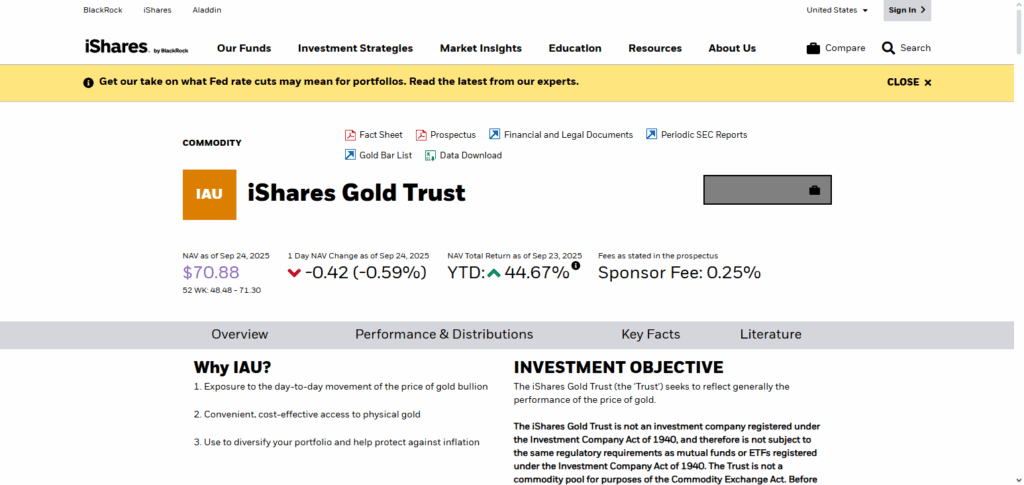

- 6. iShares Gold Trust (IAU)

- iShares Gold Trust (IAU) Features

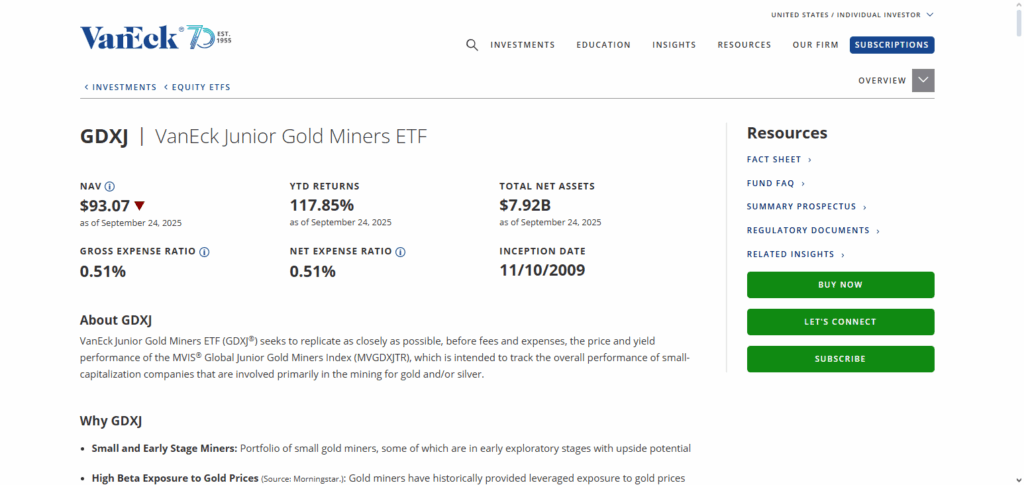

- 7. VanEck Junior Gold Miners ETF (GDXJ)

- VanEck Junior Gold Miners ETF (GDXJ) Features

- 8. WisdomTree Physical Gold (PHAU)

- WisdomTree Physical Gold (PHAU) Features

- Pros & Cons Gold ETFs to Invest

- Conclusion

- FAQ

These ETFs offer something for everyone, be it a beginner or an seasoned investor. From bullion that is backed by physical gold to mining funds that focus on growth, these ETFs will help diversify your portfolio and protect your wealth, all while profiting from gold’s long-term stability.

What is Gold ETFs?

Gold ETFs (Exchange-Traded Funds) as investment vehicles which enable purchase and investment in gold without the need for owning the metal. The investment vehicles are gold bullion and gold mining stocks. Gold ETFs are traded like normal stocks on the stock market.

Buying gold ETFs helps in easily investing in gold without burdensome costs, and easily liquidating it. Gold ETFs help in splitting investment portfolios, shielding investors from inflation, and reducing extreme market risks.

Gold ETFs are inexpensive which makes them easily accessible for small and big individual investors. Gold ETFs help gold owners in gaining the convenience from traditional brokerage for easier buying and selling.

How To Choose Best Gold ETFs to Invest

Type of Gold Exposure: Backed Physically ETFs with direct gold ownership and Gold mining ETFs with indirect ownership via mining companies.

Expense Ratio: Management fees should be as low as possible as high expenses reduce returns.

Liquidity: Choose ETFs with high trading volume to ease the buying and selling without impacting price.

Tracking Accuracy and Other Metrics: Minimize tracking errors by making sure the ETF closely follows gold prices.

Fund Size and Reputation: investor trust and the stability of funds like GLD or IAU.

Investment Goals: wealth preservation and growth potential.

Accessibility: ETFs like IAUM and GLDM for those wishing to invest in smaller amounts.

Storage and Backing: ETF holds physical gold placed in highly secure vaults (location and allocation secure are important for safety).

Key Point & Best Gold ETFs to Invest List

| ETF/Trust | Key Points |

|---|---|

| iShares Gold Trust Micro ETF (IAUM) | Micro version of IAU, low-cost exposure to physical gold, ideal for small investors, tracks gold price closely. |

| SPDR Gold Shares (GLD) | Largest gold ETF, highly liquid, physically backed by gold bullion, widely used by institutional and retail investors. |

| SPDR Gold MiniShares Trust (GLDM) | Lower-cost, smaller-share alternative to GLD, physically backed, suitable for cost-conscious investors. |

| GraniteShares Gold Trust (BAR) | Low-expense ratio, physically backed by gold, competitive alternative to GLD and IAU. |

| abrdn Physical Gold Shares ETF (SGOL) | Gold stored in Switzerland, low expense ratio, transparent holdings, tracks physical gold. |

| iShares Gold Trust (IAU) | Popular gold ETF, low expense ratio, physically backed, tracks gold price accurately. |

| VanEck Junior Gold Miners ETF (GDXJ) | Exposure to small and mid-cap gold mining companies, higher volatility, indirect gold exposure via equities. |

| WisdomTree Physical Gold (PHAU) | Physically backed by gold in London vaults, low tracking error, European-focused ETF with cost efficiency. |

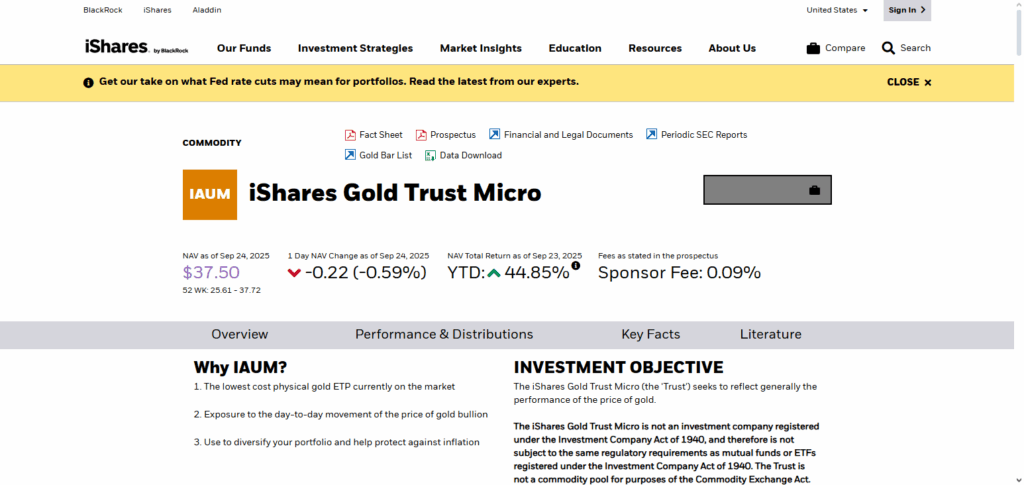

1. iShares Gold Trust Micro ETF (IAUM)

The iShares Gold Trust Micro ETF (IAUM) is one of the best gold ETFs that you can access with affordability and accuracy in gold price tracking.

IAUM is different from other gold ETFs in that it can be purchased in micro-shares, meaning that investors can have access to physical gold with no large financial commitments. This is perfect for novice investors and small-scale investors.

Each share is represented by gold because it is physically backed, and it has one of the lowest expense ratios of any ETF.

This is a strong liquidity and hold transparency which means IAUM is a great and flexible selection for investors looking for long-term wealth preservation and diversification of their portfolio.

iShares Gold Trust Micro ETF (IAUM) Features

- Micro Share Structure: Gives smaller-scale capital investors access to the commodity gold.

- Physically Backed: Share represents allocated gold guaranteeing real gold exposure.

- Low Expense Ratio: Portfolio investors looking for diversification over a long period will appreciate its value.

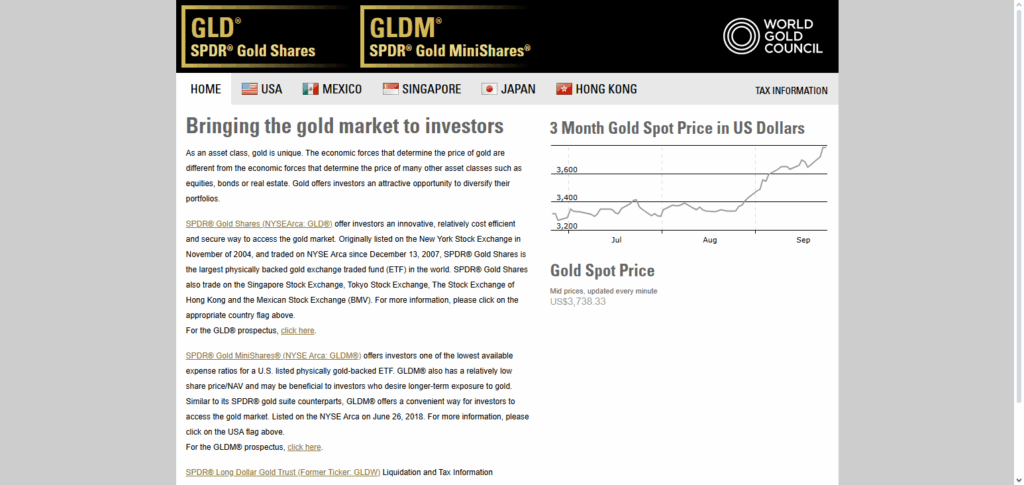

2. SPDR Gold Shares (GLD)

The SPDR Gold Shares (GLD) is very well known for being one of the best gold-related ETFs due to the sheer size, liquidity, and reliability of the fund. GLD holds the record for being the largest gold ETF in the world, and offers investors direct exposure to physical gold.

This makes it extremely easy for investors to diversify their portfolios, and to manage potential downturns in the market. The high volume of trades on GLD makes it easy for investors to enter and exit the fund easily.

The ETF is gold backed, and is backed by allocated gold bullion which is stored in secure vaults. This along with the impressive track record of GLD, along with the transparent holdings, and the level of confidence investors have in GLD makes it an ETF of choice for institutional investors and retail sellers.

SPDR Gold Shares (GLD) Features

- Largest Gold ETF: It has high market acceptance and liquidity.

- Physical Gold Backing: Gain exposure with gold bullion kept in a secure and prosperous location.

- Reliable Tracking: It maintains substantial correlations with the gold price for confident investments.

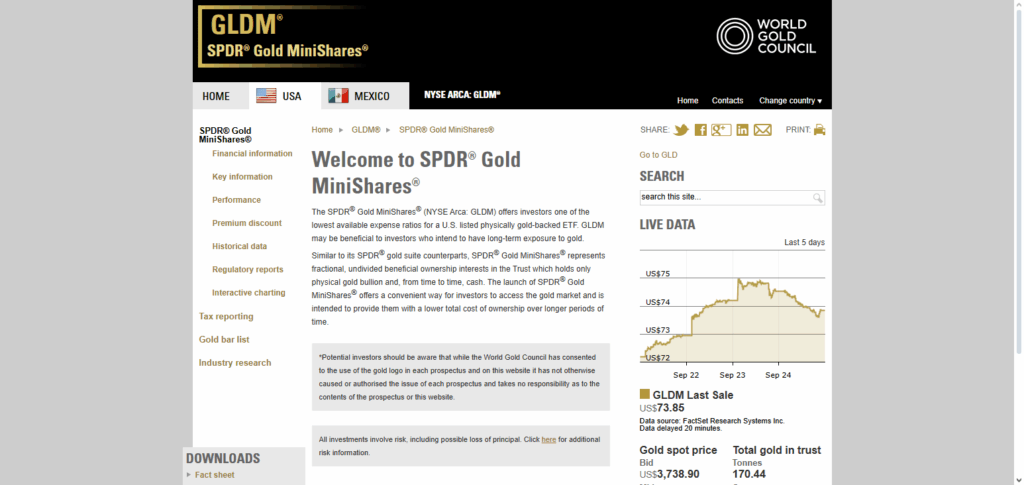

3. SPDR Gold MiniShares Trust (GLDM)

The SPDR Gold MiniShares Trust may be the gold ETF that is best suited for investment because of its lowest costs, easiest access, and operational effectiveness of all the glod ETFs in the market.

GTXM GLDM is a gold ETF which is relatively cheap and its reduced share price makes it possible for gold investments without large capital outlays as compared to the other gold ETFs.

GLDM is perfect for first-time or economical investors. GLDM has shares that are physiacally backed offering low expense ratios which reflect operational effectiveness. Its solid liquidity, coupled with transparent deal execution, makes GLDM a flexible, reliable, and inexpensive option. It is perfect for diversifying wealth and investment with gold.

SPDR Gold MiniShares Trust (GLDM) Features

- Affordable Entry: Friendly price makes it attractive to investors with limited capital.

- Physically Backed: Provides a more direct relationship to gold price movements.

- Low Costs: Has a competitive expense ratio suitable for long term investments.

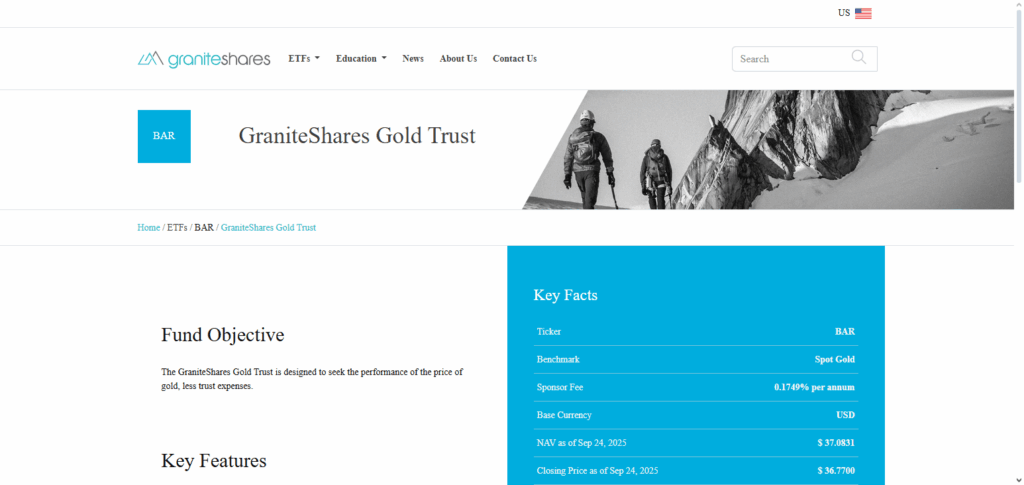

4. GraniteShares Gold Trust (BAR)

The GraniteShares Gold Trust (BAR) is one of the best gold ETFs to invest in one of the best gold ETFs to invest in because of its extremely low expense ratio and its transparent and physically backed structure.

Each share is tethered to gold bullion, thus providing investors with secure and precise exposure to the gold price BAR is transparent and most efficient way to invest in gold in the market,

BAR is extremely cost efficient compared to the other market and large ETFs It is extremely liquid with economic and transparent reporting of performance BAR is extremely favorable due to its low cost and reliable price performance.

GraniteShares Gold Trust (BAR) Features

- Very Low Expense Ratio: One of the lowest in the market for a gold backed ETF.

- Allocated Gold Backing: The shares are secured with gold held physically in the investors’ name.

- Transparent Holdings: The company’s clear records enhances investor’s trust.

5. abrdn Physical Gold Shares ETF (SGOL)

The abrdn Physical Gold Shares ETF (SGOL), like the other SGOL gold ETFs, is ranked among the best gold ETFs to Invest in because the gold is held in Switzerland and gives users physical gold, luxury and extra security.

Each share is backed by gold which is allocated to secure vaults in Switzerland, which means direct investment exposure and guaranteed gold price investment. SGOL’s low expense is the last thing in a range of first-class services it offers investors, alongside the company’s strict focus on high-quality gold storage and vaults.

SGOL is ranked among the best gold ETFs to Invest in because of the unmatched liquidity and the fool-proof tracking of the gold. SGOL is a gold ETF offering its users a gold investment opportunity surpassing all gold ETF investment opportunities in value and efficiency.

abrdn Physical Gold Shares ETF (SGOL) Features

- Swiss Vault Storage: Provides an extra layer of safety as gold is kept in secure facilities in Switzerland.

- Physically Backed: Each share carries corresponding allocated gold bullion.

- Cost-Efficient: Low expense ratio adds value to the investment for the long run.

6. iShares Gold Trust (IAU)

The iShares Gold Trust (IAU) is reputed for its ease of investing in gold due to its gold ETFs’ cost effective structure and gold bullion friendly exposure. Investors can easily invest in the gold market with relative ease since every share is allocated gold bullion.

IAU is reputable for having one of the lowest expense ratios on the market which makes it affordable for any size investors all the while offering optimal liquidity for hassle-free trade.

IAU is beneficial for investors still as its expense to tracking IAU designate can give investors high reliability and confidence. Investors who want cost efficient and hassle-free gold options will still choose IAU as it is a gold legal tender in any situation.

iShares Gold Trust (IAU) Features

- Low-Cost Gold Exposure: Very low pricing provides gold exposure at the bottom of the market.

- Physically Backed: Provides direct gold exposure and settles in gold.

- High Liquidity: In the golden custody of the dwarf, the Gold of the little dwarf, custody.

7. VanEck Junior Gold Miners ETF (GDXJ)

The VanEck Junior Gold Miners ETF (GDXJ) is widely regarded as one of the finest gold ETFs to consider for investors looking for growth in the gold industry.

Unlike other gold ETFs, GDXJ concentrates on small to mid-cap gold mining companies, which have the possibility of greater returns as these miners ramp up production and uncover new deposits.

It is more volatile, but it does provide indirect leverage to gold price appreciation and upside in the equity markets. Plus, the portfolio of junior miners is sufficiently diversified to eliminate most company-specific risks.

Their excellent liquidity solves any trading ease problems. GDXJ is perfect for investors bullish on gold as it goes beyond capitalizing on bullion.

VanEck Junior Gold Miners ETF (GDXJ) Features

- Growth Potential: Targets emerging small and mid-cap gold mining firms.

- Indirect Gold Exposure: Equities of mining companies with the gold market.

- Diversification: Spreading investments across mining companies to lower risks.

8. WisdomTree Physical Gold (PHAU)

Physical gold PHAU, one of Europe’s best gold-backed ETFs, is highly praised for its efficient PHAU gold ETF management, secure PHAU London gold vaults, transparent gold ownership representation, gold bullion, and customer gold bullion ownership.

It efficiently tracks its gold holdings with low error and expenses, providing long-term gold investment accessibility. PHAU is one of the best gold ETFs to invest due to the shifting market coordination, strict liquidity regulations, and powerful PHAU gold funds Europe supervision.

PHAU for gold investors is highly secure PHAU gold funds, precise PHAU gold London vaults for ownership representation, with outstanding PHAU fund management yielding results.

WisdomTree Physical Gold (PHAU) Features

- European Focus: Gold in custody at a vault in London under superior supervision.

- Efficient Ownership: Allocated gold for ownership and ease.

- Physically Backed: Very low tracking ratio makes gold tracking performance more productive.

Pros & Cons Gold ETFs to Invest

Pros

- Easily Accessible Gold: Exposure to gold is available without buying and storing gold bullion.

- Liquidity: Flexibility is achieved buying and selling ETFs on exchanges like stocks.

- Cost Expenses: Expense ratios of gold ETFs are much lower than owning physical gold or investing in gold funds.

- Market Volatility: Combating inflation and market volatility is achieved through diversification.

- Transparency: Regular disclosure of holdings and net asset values is a standard procedure.

- Micro or Mini ETFs: With gold ETFs a fraction of the investment can be made.

Cons

- No Direct Ownership: Ownership of gold is indirect, except when the ETF is physically backed.

- Volatility: The set market price is subject to change, like any other traded commodity.

- Expense Ratio: Overall yield is reduced over time, albeit modestly, through management fees.

- Limited Growth: Growth on gold mining stocks is not experienced, unlike ETFs pure in gold.

- ETF Pricing: The price of the ETF may not the same as the price of the gold.

Conclusion

To sum up, Gold ETFs strategically work to simplify cost-effective and safe gold investing and are thus very useful for diversification and wealth preservation.

IAUM, GLD, GLDM, BAR, SGOL, IAU, GDXJ, and PHAU offer various products for different users—micro shares at a bargain, physical gold, or equities of gold mining companies for the growth oriented.

With its liquidity, transparency, ease of trading, and ETF structure, it allows direct or indirect access to gold investments, making them very reliable and flexible. It is a very supportive gold exposure to gold, ideal for the novice or seasoned investor wanting strong and stable growth.

FAQ

Which are the top gold ETFs to invest in?

Some of the best options include IAUM, GLD, GLDM, BAR, SGOL, IAU, GDXJ, and PHAU, each offering unique features such as low costs, micro shares, or mining exposure.

Are gold ETFs safe investments?

Yes, physically backed ETFs are generally safe, as they hold real gold in secure vaults. Mining ETFs carry additional market risk due to stock volatility.

What are the advantages of investing in gold ETFs?

They offer liquidity, diversification, low costs, transparency, and a simple way to hedge against inflation or economic uncertainty.