I’ll go over the top GoCrypto substitutes for 2025 in this post. Businesses are looking at trustworthy platforms to easily take cryptocurrencies due to the increase in cryptocurrency payments.

- What is GoCrypto Alternatives?

- Benefits Of GoCrypto Alternatives

- Key Point & Best GoCrypto Alternatives List

- 1. Crypto.com

- Crypto.com Pay – Features

- Crypto.com Pay Pros & Cons

- 2. OpenNode

- OpenNode – Features

- OpenNode Pros & Cons

- 3. Binance Pay

- Binance Pay – Features

- Binance Pay Pros & Cons

- 4. Paystand

- Paystand – Features

- Paystand Pros & Cons

- 5. Blockonomics

- Blockonomics – Features

- Blockonomics Pros & Cons

- 6. Plisio

- Plisio – Features

- Plisio Pros & Cons

- 7. AlfaCoins

- AlfaCoins – Features

- AlfaCoins Pros & Cons

- 8. BTCPay Server

- BTCPay Server – Features

- BTCPay Server Pros & Cons

- 9. BitPay

- BitPay – Features

- BitPay Pros & Cons

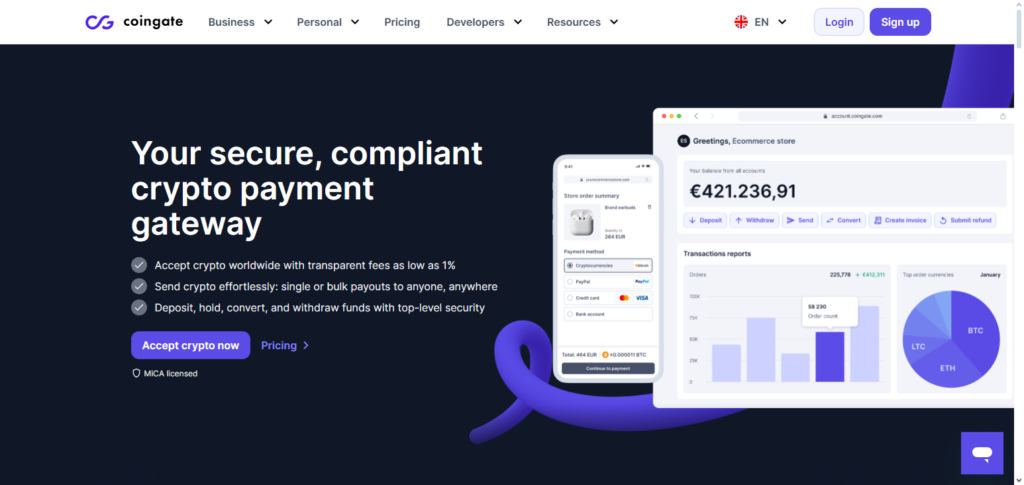

- 10. CoinGate

- CoinGate – Features

- CoinGate Pros & Cons

- How To Choose GoCrypto Alternatives

- Conclusion

- FAQ

These options offer versatile solutions for retailers seeking to increase payment methods, lower fees, and improve customer experience worldwide, ranging from secure checkout options to multi-currency support and quick transactions.

What is GoCrypto Alternatives?

Alternatives to GoCrypto are various cryptocurrency payment systems that provide comparable services to GoCrypto, enabling both individuals and companies to easily accept bitcoin payments.

Features like multi-currency compatibility, quick transaction processing, safe payment gateways, and simple interaction with online retailers or point-of-sale systems are offered by these substitutes.

Businesses can discover competitors to GoCrypto that might provide more sophisticated merchant tools, more cryptocurrency, broader regional support, or cheaper costs.

Selecting the best option guarantees seamless cryptocurrency transactions while improving client satisfaction and increasing payment choices.

Benefits Of GoCrypto Alternatives

Lower Transaction Fees – Compared to other payment gateways, some of these alternatives – at processing costs – are cheaper with every sale made by the business.

Faster payments – Compared to other banking systems, crypto-based gateways are faster, therefore, the merchants’ cash flow is improved.

More Extensive Cryptocurrency Support – There are platforms that allow a wider scope of coins and tokens enabling customers to make payments with diverse options.

Global Accessibility – Due to being crypto gateways with no borders, businesses are able to receive payment from their customers anywhere in the world without the hassle of complicated currency conversions.

More Security – Due to blockchain payments being secured by cryptographic systems, the payments are lower in fraud risk.

More Options & Flexibility – There are alternatives such as open-source or non-custodial gateways which allow merchants to have full control of their funds and payment processing.

Simple Integration – Available alternatives have plugins and API’s for popular e‑commerce platforms simplifying the setup process.

Tailor-Made Elements – Depending on the platform you are using, you can have features such as instant fiat conversion, invoice systems, recurring payments, and loyalty rewards.

Key Point & Best GoCrypto Alternatives List

| Platform | Key Points |

|---|---|

| Crypto.com Pay | Easy crypto payments, multi-currency support, integrates with apps & POS. |

| OpenNode | Bitcoin-focused, Lightning Network support, fast payments, low fees. |

| Binance Pay | Supports many cryptocurrencies, no fees, global reach, integrates with Binance ecosystem. |

| Paystand | Focus on B2B payments, fiat & crypto options, recurring billing, automated invoicing. |

| Blockonomics | Bitcoin-only, non-custodial, easy WooCommerce integration, privacy-focused. |

| Plisio | Multi-crypto support, invoicing tools, quick settlements, plugin integration. |

| AlfaCoins | Wide cryptocurrency options, instant conversion to fiat, merchant-friendly. |

| BTCPay Server | Open-source, self-hosted, fully decentralized, free, highly customizable. |

| BitPay | Popular, multi-crypto support, prepaid cards, invoice management, reliable. |

| CoinGate | Supports 50+ cryptocurrencies, instant conversion, WooCommerce & Shopify integration. |

1. Crypto.com

Crypto.com Pay is a payment portal that enables users to make cryptocurrency payments to a vast array of users all over the world.

It not only simplifies payment processing, but also streamlines payments that are integrated with the wider Crypto.com Pay system, allowing merchants to elect either a crypto payment or a converted settlement in over 20 fiat currencies.

It is also easy for businesses to upload invoices and oversee payment processing, and merchants can also earn loyalty rewards in the platform’s CRO token.

Crypto.com Pay is one of the most efficient GoCrypto alternatives for e-commerce businesses as it has a large crypto market and rewards over crypto loyalty.

Crypto.com Pay – Features

| Feature | Explanation |

|---|---|

| Multi‑Crypto Support | Accepts a wide range of cryptocurrencies, letting customers pay in their preferred digital asset. |

| Fiat Settlement | Converts crypto payments into fiat automatically, reducing exposure to price volatility. |

| Merchant Dashboard | Provides tools to manage transactions, track payments, and view analytics. |

| Loyalty Rewards | Offers rewards or rebates for customers using Crypto.com ecosystem tokens. |

| Easy Checkout | Simple checkout flow with QR codes and browser‑based payment options. |

Crypto.com Pay Pros & Cons

Pros:

- A wide range of popular cryptocurrencies is available for customer selection.

- Offers seamless interactions and integrations within the Crypto.com ecosystem (wallets, app, etc.).

- Volatility risk is eliminated with the ability to settle in fiat.

- Users can gain loyalty and rewards.

- Excellent merchant analytics and dashboard.

Cons:

- Some settlements may incur fees.

- This solution is not completely decentralized — custodial model.

- Users may be required to create Crypto.com accounts in order to access full functionalities.

- Service-related geographic restrictions may be in effect.

- There is a steep learning curve for newcomers.

2. OpenNode

OpenNode is ideal for businesses that require quick and efficient bitcoin transactions, as this platform focuses on bitcoin payment processing. It is also compatible with on-chain and the Lightning Network, which helps with fast, cost-effective transactions.

OpenNode also has a number of features, which include payment buttons, hosted checkouts, and invoices as well as an API for easy adoption to websites or applications.

Merchants are also able to automatically convert BTC to local currencies, this secures without the need to worry about price volatility and eases the burden of financial record keeping.

Due to the ease of onboarding, the secure infrastructure, and the fast settlement system, OpenNode is one of the best GoCrypto competitors available to merchants that prefer Bitcoin payment acceptance along with multiple flexible mechanisms to withdraw funds.

OpenNode – Features

| Feature | Explanation |

|---|---|

| Bitcoin & Lightning | Supports Bitcoin payments using both standard and Lightning Network for faster, low‑fee transactions. |

| Automated Conversion | Option to settle BTC into local currency to avoid volatility risk. |

| Invoicing Tools | Generates invoices and hosted payment pages for easy billing. |

| Developer API | API support enabling integration with custom apps and websites. |

| Security & Compliance | Strong security protocols and compliance standards for merchant protection. |

OpenNode Pros & Cons

Pros:

- There is specialized support for Bitcoin and the Lightning Network.

- Transactions are quick and inexpensive.

- Automatic conversion of Bitcoin to fiat is available.

- Easy to integrate via straightforward APIs and plugins.

- This is a solid solution for merchants who are Bitcoin-centric.

Cons:

- There is a singular focus on Bitcoin, resulting in less support for alternative coins.

- New users may be perplexed by Lightning network payments.

- This service is not ideal for merchants who require a variety of cryptocurrencies.

- Some basic technical setup is needed for the more advanced functionalities.

- Congestion on the network may result in payment delays.

3. Binance Pay

Binance Pay is the payment service that Binance offers to its users and merchants enabling them to send and receive cryptocurrency payments.

It offers its users and merchants the ability to send and receive cryptocurrency payments and enables its merchants to obtain access to over 1 million Binance users. It has the ability to facilitate payments in over 100 currencies and offers payments that are borderless and secure without the need for gas fees.

Payment and funds receipt are typically facilitated through the use of a QR code, which users can simply scan. Merchants also have the ability to integrate Binance Pay into their checkout flow.

Thus, with all the riched cryptocurrencies available and its integration into the Binance ecosystem, Binance Pay can be viewed as a GoCrypto competitor with a great potential for firms that are aiming for and advocating seamless acceptance of cryptocurrencies in payment for their products and/or services.

Binance Pay – Features

| Feature | Explanation |

|---|---|

| Wide Coin Support | Supports 100+ cryptocurrencies, giving users flexible payment options. |

| Zero Fee Payments | No fees for peer‑to‑peer crypto payments, lowering cost for merchants. |

| Global Reach | Integrated with Binance’s large user base, facilitating global transactions. |

| QR & Contactless Pay | Users can complete payments through QR scanning or contactless options. |

| Binance Integration | Works directly with Binance wallet and ecosystem features. |

Binance Pay Pros & Cons

Pros:

- Allows users to make transactions and store various currencies.

- No charge for peer-to-peer transactions.

- Expansive user base in many parts of the world.

- Payments are very easy to make.

- Payment services are smoothly connected to the entire Binance payment system.

Cons:

- New users of the Binance platform may need time to adjust.

- Not all countries allow Binance to operate.

- Limited control of your digital assets.

- Varies depending on your location.

- High demand periods may delay support responses.

4. Paystand

Paystand is a payments platform that focuses on and has been built to facilitate B2B payments in a hybrid structure of crypto and traditional payments. It is also for businesses that require the automation of invoicing, accounts receivable, and recurring billing on a seamless basis with the use of both traditional and cryptocurrency.

Compared to legacy systems, Paystand uses blockchain to improve transparency, decrease transaction costs, and improve settlement speed. APIs and integration systems interface with enterprise workflow and ERP and accounting systems.

Automation and scalable business payments help position Paystand as a GoCrypto alternative for businesses requiring advanced invoicing and payment processing solutions, as opposed to crypto checkout integrations.

Paystand – Features

| Feature | Explanation |

|---|---|

| Crypto & Fiat Payments | Accepts both traditional and cryptocurrency payments in one platform. |

| Automated Billing | Recurring invoices and automated receivables for business clients. |

| ERP Integration | Integrates with accounting and ERP systems for seamless financial workflows. |

| Blockchain Transparency | Uses blockchain to increase transaction visibility and reduce errors. |

| Enterprise‑Grade | Designed for larger businesses with complex billing needs. |

Paystand Pros & Cons

Pros:

- Allows businesses to accept both traditional and digital currencies.

- Payments can be set in advance to be automatically deducted.

- Synchronization with other systems for easier access.

- Primarily designed for larger businesses and corporations.

- Makes the payment processes on the blockchain.

Cons:

- Higher fees than traditional ways of processing payments.

- Could be easier to use if you are not a smaller retailer.

- Potentially less digital currencies available for use.

- Not the best choice for simple digital transactions.

- Not very popular to some businesses.

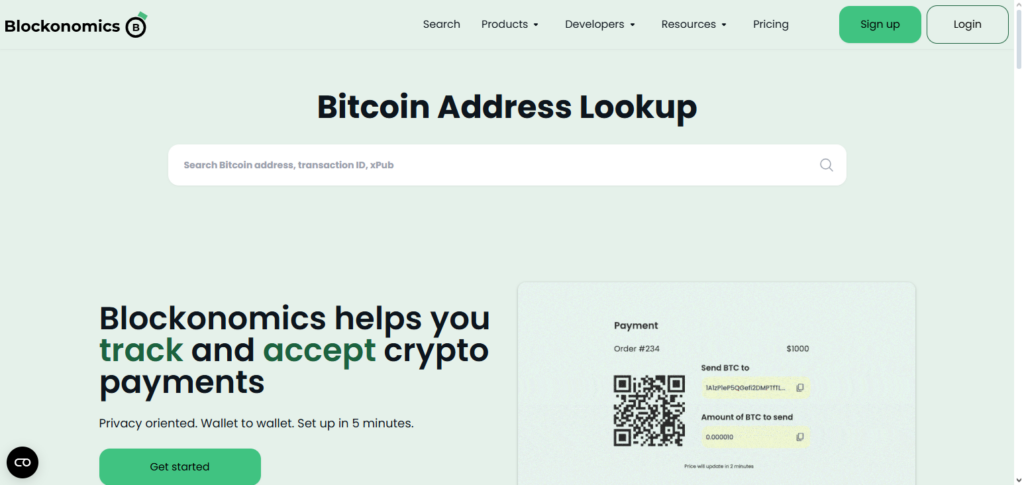

5. Blockonomics

Blockonomics is a decentralized, non-custodial crypto payments gateway that enables merchants to receive payments with no third-party custodial dependencies. It is compatible with Bitcoin and a few other coins, and it is mployable with e-commerce systems using plugins or APIs.

Blockonomics is privacy-oriented and frictionless onboarding due to KYC-free processes. Since payments go directly to merchant wallets, funds remain completely in their control.

These characteristics, combined with a straightforward setup, make it well suited for freelancers, small shops, and privacy-oriented sellers. This is what makes Blockonomics a GoCrypto alternative for direct, wallet payments.

Blockonomics – Features

| Feature | Explanation |

|---|---|

| Non‑Custodial | Payments go directly to the merchant’s wallet; no custodial risk. |

| Simple Setup | Easy integration with e‑commerce platforms via plugins or APIs. |

| Bitcoin Focus | Primarily supports Bitcoin payments with clear address generation. |

| Privacy‑Friendly | Minimal KYC requirements, enhancing user privacy. |

| Wallet Control | Merchants retain full control of private keys and funds. |

Blockonomics Pros & Cons

Pros:

- Store and protect your digital money without a third party.

- Very easy to use with many popular services.

- Limited shifts in currency transactions.

- No charge to manage your bank account.

Cons:

- Supporting only Bitcoin or a few other coins.

- No built-in conversion to fiat.

- Lacks advanced features in invoicing.

- Might not be a good fit for bigger businesses that need assistance.

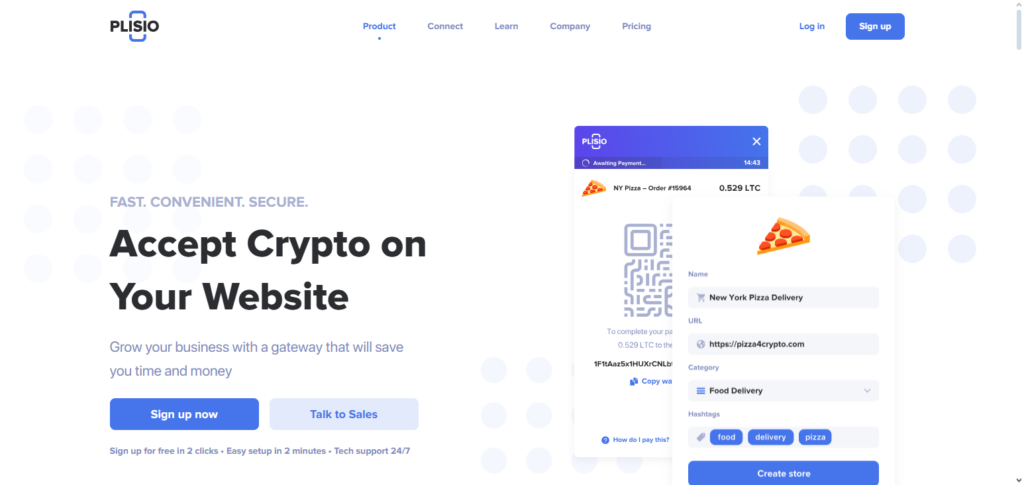

6. Plisio

Plisio is a straightforward, easy to use cryptocurrency payment gateway that supports a range of digital currencies and offers merchants functional tools to facilitate payment collection.

It has multicurrency wallets, low-cost transactions, customizable invoices, and broad plugin support for e‑commerce portals, including OpenCart and WooCommerce. Global merchants using Plisio can configure their payment options and display their prices in various fiat currencies without major technical effort.

Plisio integrates effortlessly, and merchants can accept flexibly offered payments. For merchants seeking ease, multi‑coin support, and merchant‑focused functionality, Plisio is a Beneficial GoCrypto Alternative.

Plisio – Features

| Feature | Explanation |

|---|---|

| Multi‑Currency | Supports many popular cryptocurrencies for payment acceptance. |

| Invoicing | Create custom invoices with crypto payment options. |

| Plugin Support | Works with major e‑commerce platforms via plugins and modules. |

| Flexible Settlement | Options to settle in crypto or convert to fiat. |

| Dashboard Management | Intuitive dashboard to track orders and payouts. |

Plisio Pros & Cons

Pros:

- Supports the many most widely used cryptocurrencies

- Various invoicing and checkout solutions

- Integrations with popular e-commerce systems

- Reasonable prices and optional fiat currencies settlement

- Useful dashboard for tracking payments

Cons:

- Less popular in comparison to industry giants

- Response time for support tickets may be longer than with enterprise solutions

- Fees may be charged for the conversion of fiat currencies

- Technical skills may be necessary for more elaborate customizations

- Some cryptocurrencies do not have a lot of liquidity

7. AlfaCoins

AlfaCoins AlfaCoins works as a crypto payment processor to let business owners accept a plethora of cryptocurrencies such as Bitcoin, Ethereum, and XRP. It offers seamless integration with buttons, APIs, and website plugins, and it even generates invoices with fixed rates to help with pricing transparency.

Businesses can automatically convert their crypto transactions to fiat, which is a feature that helps to mitigate volatility and allows for revenue to be easier to manage.

This is particularly useful since competitors’ cryptocurrencies feature a broader range, but AlfaCoins is a useful GoCrypto alternative particularly for participants looking to simplify crypto acceptance to a straightforward system with added, optional fiat conversion.

AlfaCoins – Features

| Feature | Explanation |

|---|---|

| Multi‑Coin Checkout | Accepts several cryptocurrencies for customer payments. |

| Automatic Fiat Conversion | Converts crypto received into fiat to minimize volatility. |

| API & Plugins | Provides integration tools for websites and online stores. |

| Clear Rates | Fixed exchange rates at checkout for transparent pricing. |

| Merchant Tools | Dashboard with reporting and transaction history. |

AlfaCoins Pros & Cons

Pros:

- Has a decent number of cryptocurrencies

- Automatic conversion to fiat currency stabilizes pricing

- Easy integration with simple documentation and APIs

- Clear rates for currency exchange are shown during checkout

- Merchant dashboard for tracking activity

Cons:

- Supports fewer coins than Binance Pay or CoinGate

- Limited number of advanced features for merchants

- Less popular ecosystem and smaller number of users

- Plan of custodial model means less control of funds

- Developers have a very limited amount of documentation

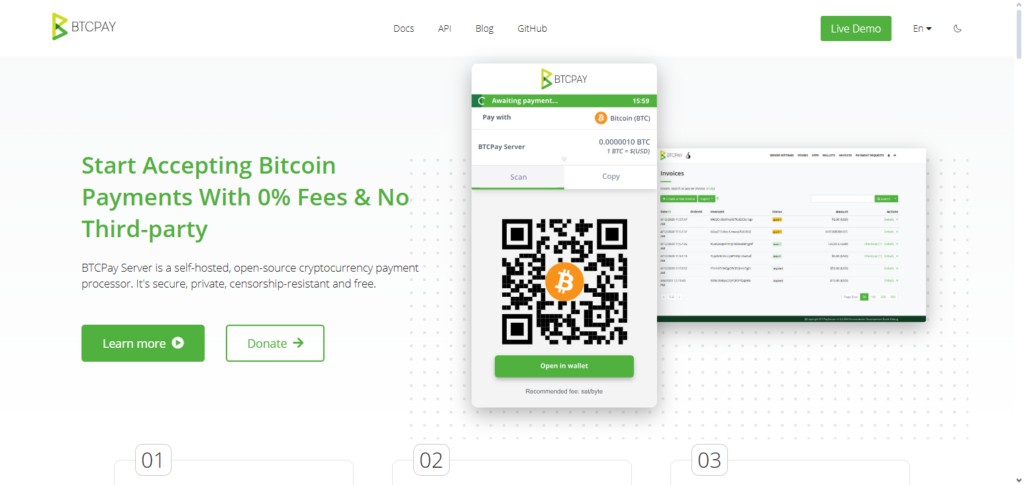

8. BTCPay Server

BTCPay Server allows business participants to accept Bitcoin and other assets while relinquishing full infrastructure and fund control to a self-hosted, open-source, crypto-payment processor alternative.

With no platform fees and completely decentralized, merchants are also able to manage their own server instance that interfaces directly to e-commerce. BTCPay offers invoice generation, point-of-sale, and Lightning payments.

Developers and businesses interested in transparency and security without third-party custody are drawn to its open-source model. Organizations that seek low-cost and hands-on options, BTCPay Server is one of the top-tier GoCrypto alternatives.

BTCPay Server – Features

| Feature | Explanation |

|---|---|

| Open Source | Free, community‑driven, fully open‑source payment processor. |

| Self‑Hosted | Merchants run their own server, retaining full control of funds and infrastructure. |

| Bitcoin & Lightning | Supports Bitcoin payments and Lightning Network transactions. |

| No Fees | No platform fees; only network transaction fees apply. |

| Custom Integrations | Highly customizable with developer tools and API access. |

BTCPay Server Pros & Cons

Pros:

- Completely no charge and is open source

- Self-hosted, which means complete control over funds

- Accepts both Bitcoin and Lightning payments

- Highly customizable with good privacy.

Cons:

- A technical setup is required (server, hosting).

- Does not have built-in fiat conversion.

- Less user-friendly if non-technical merchants are concerned.

- There is no official centralized support team.

- Bad choice if you are looking for simple, turnkey solutions.

9. BitPay

BitPay is among the pioneer and most reputed crypto payment processors in the industry. Merchants have the facilities to manage payments of Bitcoin, Ethereum, and several stable assets, including the previously mentioned crypto.

They are also equipped with the invoicing, hosted checkout, point-of-sale systems, and e-commerce integrations. Additional features include settlement of funds in fiat or crypto and other financial services such as prepaid debit cards.

Due to its respectable history and impressive regulatory record, it is of great reputation among large and regulated companies. Thanks to its extensive history, reputation, and dependability, BitPay is one of the top-tier merchants GoCrypto alternatives.

BitPay – Features

| Feature | Explanation |

|---|---|

| Multi‑Asset Support | Accepts major cryptocurrencies including BTC, ETH, stablecoins, and more. |

| Fiat Settlement | Converts received crypto into local fiat for merchant payouts. |

| Hosted Checkout | Provides a user‑friendly hosted payment page for checkout. |

| POS & Invoicing | Includes point‑of‑sale tools and invoice generation. |

| Prepaid Card | Optional crypto‑backed card for spending received crypto. |

BitPay Pros & Cons

Pros:

- Long-establishment, reputable gateways.

- A lot of major cryptocurrencies, stablecoins supported.

- Auto-converts crypto to fiat.

- Covers invoicing, POS, and hosted checkout.

- Fund spending is available with optional prepaid cards.

Cons:

- Settlement fees are higher.

- Limited control of private keys (custodial model).

- Some features are locked behind higher business tiers.

- Some business verification is required.

- Not a good choice for self-hosted or privacy-only setups.

10. CoinGate

CoinGate is an all-in-one crypto payment processor that enables organizations to accept numerous virtual currencies and offers the flexibility to settle in crypto or fiat.

It provides tools for single and bulk payouts, secure management of deposits, and simple integration via APIs and plugins for e-commerce platforms. CoinGate is MiCA-licensed in the EU, which provides certain regulatory compliance and assurance for merchants.

It supports global remittances and has responsive settlement features, making it easier for businesses of all sizes to accept crypto. For merchants who need flexible, secure, and compliant payment processing, CoinGate is an excellent alternative to GoCrypto.

CoinGate – Features

| Feature | Explanation |

|---|---|

| Wide Coin List | Supports a large variety of cryptocurrencies for payment. |

| Flexible Payout | Merchants choose to settle in crypto or convert to fiat. |

| E‑Commerce Plugins | Easy integration with platforms like WooCommerce, Shopify, and more. |

| Compliance | Meets regulatory standards in supported regions for secure operations. |

| Payout Automation | Bulk payout capabilities and scheduled settlements. |

CoinGate Pros & Cons

Pros:

- Supports a large number of cryptocurrencies.

- Provides flexible payout options (crypto or fiat).

- Integrations available for major ecommerce platforms.

- Complies with regulations in supported regions.

- Available are bulk payouts and automation.

Cons:

- Fees apply for fiat conversion.

- Lower Lightning support compared to OpenNode or BTCPay.

- There is a lack of support for free accounts.

- Some features are designed for medium or large merchants.

- Due to regulatory restrictions, some features may not work in some locations.

How To Choose GoCrypto Alternatives

Cryptocurrency Support – Verify the cryptocurrencies and tokens that are supported. Some merchants may have a preference for Bitcoin only, and some may need multiple cryptocurrencies supported to reach a wider customer base.

Fees – Review the processing fees for crypto and fiat. When it comes to high-volume transactions, the fees can have a significant effect on the profit margin.

Payout Methods – Find out if the platform offers automatic conversion and if the payout will be in fiat or crypto is a useful feature for eliminating volatility risk and accounting simplification.

Integration – Determine platforms that can easily integrate with your website, e-commerce, or POS system. Faster implementation is possible by selecting platforms that have APIs, plugins, or hosted checkout.

Privacy & Security – To what extent are the platforms custodial or non-custodial? Relinquishing control to custodial services means that they will manage the security; alternatively, you can manage it with open-source or self-hosted solutions.

Worldwide Availability – If you have a global customer base, confirm that the platform offers international transactions as well as support for a variety of fiat currencies.

Support – Automated and prompt support is vital for smooth operations and quickly resolving payment challenges.

Conclusion

In conclusion, a number of trustworthy substitutes for GoCrypto have emerged as a result of the rising demand for bitcoin payments, each with special capabilities to meet various business requirements.

While OpenNode and BTCPay Server offer quick, safe transactions to Bitcoin-focused merchants, platforms like Crypto.com Pay and Binance Pay offer broad multi-crypto support and worldwide reach.

While BitPay, CoinGate, and Blockonomics offer reliable, scalable solutions for both small and large businesses, Paystand, Plisio, and AlfaCoins offer versatile invoicing and settlement options.

In the quickly changing cryptocurrency landscape, selecting the best GoCrypto substitute guarantees smooth payments, reduced costs, and increased customer happiness.

FAQ

What are GoCrypto alternatives?

GoCrypto alternatives are other cryptocurrency payment gateways that let merchants accept digital assets from customers. These platforms often offer different features, supported coins, fees, and integrations, helping businesses choose the best fit for their needs.

Why would someone choose an alternative to GoCrypto?

Merchants may look for lower fees, broader coin support, faster settlement speeds, better integrations (e.g., Shopify, WooCommerce), or self‑custody options. Some alternatives also offer advanced invoicing, recurring billing, and global reach.

Are these alternatives secure?

Yes. Most reputable crypto payment gateways use encryption, blockchain validation, and secure APIs. Open‑source platforms like BTCPay Server further enhance security by letting businesses self‑host and control funds.

Can all these alternatives convert crypto to fiat?

Many do. Platforms like Crypto.com Pay, BitPay, CoinGate, and AlfaCoins offer automatic conversion to local currencies, helping businesses avoid volatility and simplify accounting.

Which alternative is best for small online stores?

For small e‑commerce sites, user‑friendly options like CoinGate, Plisio, or BitPay are often ideal due to simple setup and plugin support. Blockonomics is great for direct wallet payments with minimal setup.