In This article focuses on the Best DAO Based Forex Trading Networks, presenting the best decentralized networks that provide DAO-style forex trading.

These systems allow clients to transparently, securely, and autonomously trade digital fiat currencies, synthetic forex instruments, and derivatives. Both traders and investors can now leverage these emerging platforms that herald the evolution of decentralized forex trading.

Key Points & Best Forex DAO-Based Trading Network List

| Project | Key Point |

|---|---|

| dYdX | Decentralized derivatives trading platform offering perpetual contracts. |

| Synthetix | Protocol for issuing synthetic assets backed by crypto collateral. |

| Uniswap | Leading decentralized exchange using an automated market maker (AMM). |

| Curve Finance | DEX optimized for stablecoin swaps with low slippage and fees. |

| PancakeSwap | Popular BSC-based DEX with farming and lottery features. |

| Injective Protocol | Layer-1 blockchain optimized for DeFi derivatives and order book trading. |

| Opium Protocol | Derivatives platform enabling complex financial contracts on-chain. |

| Perpetual Protocol | DEX for trading perpetual futures with up to 10x leverage. |

| Balancer | AMM allowing customizable liquidity pools with flexible token ratios. |

10 Best Forex DAO-Based Trading Network

1.dYdX

dYdX has been recognized as the best DAO-based trading platform for forex derivatives within the trading sector of decentralized finance. It provides perpetual contracts on key asset pairs using its own infrastructure and boasts low fees alongside high liquidity.

Users maintain full control of their funds while utilizing trading options such as leverage and limit orders. Community governance through the DYDX token fosters transparent and secure growth. The platform’s powerful layer-2 StarkEx scaling increases dYdX’s speed and efficiency, making it suitable for advanced forex trading.

| Feature | Description |

|---|---|

| Decentralized Derivatives | Offers perpetual contracts for major asset pairs, including synthetic forex |

| Layer-2 Scaling | Built on StarkEx for high-speed, low-cost trading |

| DAO Governance | Governed by DYDX token holders |

| Advanced Trading Tools | Supports leverage, limit orders, and real-time order books |

| Non-Custodial | Users retain full control of their assets |

2.Synthetix

Synthetix is a pioneer of DAO model trading platforms which provides on-chain access to both crypto and real-world assets, including forex. Using Synths, users can trade fiat currencies such as USD, EUR, JPY, etc., without actually owning the assets.

This provided decentralized, permissionless access to forex-like trading with high liquidity and no slippage through integrated systems like Kwenta.

Governed by SNX token holders, Synthetix is continuously evolving through community-driven proposals. Its smart contract infrastructure ensures transparency, security, and self-governance, making it a preferred platform for forex trading in the DeFi space.

| Feature | Description |

|---|---|

| Synthetic Assets (Synths) | Enables trading of synthetic fiat currencies like sUSD, sEUR, etc. |

| Decentralized Oracle Use | Uses Chainlink for accurate price feeds |

| Integrated Platforms | Supports forex trading via Kwenta and other Synthetix-based platforms |

| DAO Governance | Controlled by SNX token holders |

| Zero Slippage | Executes trades with no slippage through pooled collateral |

3.Uniswap

The largest decentralized exchange, Uniswap, has a powerful DAO-based infrastructure for forex trading with tokenized assets.

While it is not designed specifically for forex trading, its liquidity pools do allow for trading between stablecoins like USDC, DAI, and EURC, providing some synthetic forex exposure.

As an Automated Market Maker (AMM) model, it allows for 24/7 permissionless trading without the need for middlemen.

Protocol upgrades and fee changes on the ecosystem are voted on by its DAO participants using the UNI token, which secures governance power over these decisions.

With high liquidity, low slippage, and wide asset coverage, the platform stands out as a versatile gateway to decentralized forex trading and synthetic asset exchanges.

| Feature | Description |

|---|---|

| AMM Model | Enables permissionless token swaps using liquidity pools |

| Stablecoin Forex Pairs | Supports trading between stablecoins like USDC, DAI, EURC |

| DAO Governance | UNI token holders control protocol decisions |

| Deep Liquidity | Large volumes available for seamless forex-style swaps |

| No Order Book | Trades are routed automatically via liquidity pool ratios |

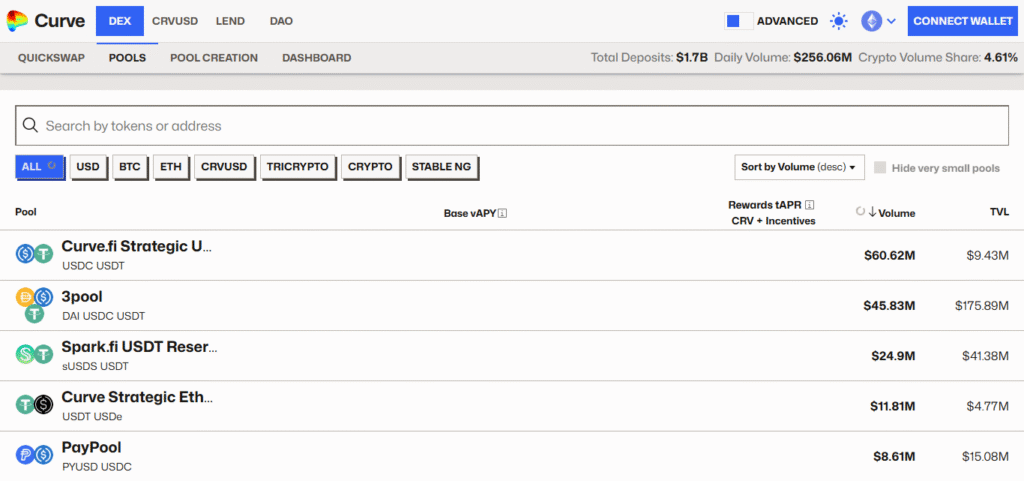

4.Curve Finance

Curve Finance stands out as a DAO-based trading platform specifically designed for stablecoin and synthetic forex trading. It’s unique automated market maker (AMM) is tailored for swaps between stable assets, minimizing slippage during forex-style trading.

These trades involve tokenized fiat currencies such as EURC, USDC, and sEUR. The protocol’s governance DAO is managed by CRV token holders, who make decisions regarding the allocation of gauge weights, rewards, and upgrades to the protocol.

Curve’s agile liquidity pools provide low-cost and unencumbered trading of forex-like assets while its integrations with other protocols such as Synthetix augment exposure to forex markets and deepen liquidity.

| Feature | Description |

|---|---|

| Stablecoin Optimized AMM | Specializes in low-slippage swaps between stablecoins and tokenized fiat currencies |

| Deep Liquidity Pools | High-volume pools for efficient forex-style trading |

| DAO Governance | Managed by CRV token holders through Curve DAO |

| Low Fees | Extremely low transaction costs |

| Synthetix Integration | Enables access to synthetic forex assets |

5.PancakeSwap

PancakeSwap It is the foremost trading platform based on DAO on Binance Smart Chain which provides synthetic asset trading and stablecoin trading at low slippage and costs.

With the AMM model, the users can seamlessly trade between tokenized fiat currencies like USDT, BUSD, and TUSD with minimal slippage.

The DAOs governing it through CAKE token holders manages farming rewards, liquidity incentives, and upgradeable protocols. Easily accessible yield farming and an interface make it easier for users to trade synthetic forex tokens.

Furthermore, enhanced support for synthetic forex tokens makes forex-style trading convenient and approachable in the DeFi ecosystem.

| Feature | Description |

|---|---|

| BSC-Based AMM | Fast and cost-efficient trading on Binance Smart Chain |

| Stablecoin Pairs | Supports BUSD, USDT, TUSD, ideal for forex-style trading |

| DAO Governance | Controlled by CAKE holders |

| Yield Farming | Incentivizes liquidity provision with high APYs |

| User-Friendly Interface | Accessible to retail traders and DeFi beginners |

6.Injective Protocol

Injective is the first-ever DAO governed blockchain created for decentralized derivatives and Forex-style trading with high performance. As a fully decentralized order book system, it allows for sophisticated trading strategies such as limit orders, leverage trading, and eliminates gas fees.

Users can trade on markets that resemble forex trading using stablecoins and synthetic assets with high liquidity and order execution speed. The protocol is governed by holders of the INJ token, fueling community sponsored development and creation of marketplaces.

Injective is a top tier network for programmable and Forex trading as its fully customized Cosmos based layer 1 has unmatched speed and scaling for institutions.

| Feature | Description |

|---|---|

| Fully Decentralized Order Book | Supports advanced forex-style trading with order book depth and speed |

| Cosmos-Based Layer-1 | Offers scalability and zero gas fees |

| DAO Governance | INJ token holders decide on upgrades and market creation |

| Forex Markets Support | Allows custom synthetic fiat and forex-like derivatives |

| Institutional-Grade Tools | Advanced features like limit orders, leverage, and risk controls |

7.Opium Protocol

The Opium Protocol is a Defi derivatives trading platform that inherently has the capability to create sophisticated financial instruments like forex products. As a DAO, it allows users to create, issue, and trade custom contracts attached to fiat currencies, interest rates, and synthetic forex indices.

Opium is built on Ethereum and combines transparency, automation, and proactive risk management on smart contracts. OPIUM token holders partake in governance, defining exogenous parameters and protocol upgrades.

Because Opium is easier to use in complex finance maneuvers, it is regarded as the most powerful decentralized programmable forex trading platform.

| Feature | Description |

|---|---|

| Custom Derivatives | Users can create and trade complex forex-related financial contracts |

| Ethereum-Based | Leverages Ethereum’s security and composability |

| DAO Governance | Managed by OPIUM token holders |

| On-Chain Risk Management | Built-in tools for assessing and limiting financial exposure |

| Synthetic Forex Exposure | Supports products tied to fiat currencies and forex indexes |

8.Perpetual Protocol

Perpetual Protocol is one of the best in the DAO-based trading network space. It offers decentralized perpetual futures, including synthetic forex pairs. It is built on Optimism and Arbitrum enabling low latency, high efficiency trading of up to 10x leverage.

Trading of assets such as EUR/USD or other stablecoin pairs can be done without any intermediaries thus Users keeping full custody of funds. Its virtual AMM (vAMM) model guarantees sufficient liquidity and pricing.

The PERP token holders govern the DAO which takes decisions for upgrades, incentives and, risk parameters. Perpetual Protocol stands out among all others for DeFi regarding forex-style trading for its features and focus on decentralization.

| Feature | Description |

|---|---|

| Perpetual Futures | Supports leveraged trading of synthetic forex pairs |

| Layer-2 Support | Operates on Optimism and Arbitrum for low fees and speed |

| vAMM Model | Virtual AMM ensures consistent pricing and liquidity |

| DAO Governance | PERP holders vote on upgrades and economic policies |

| Leverage Trading | Offers up to 10x leverage for supported markets |

9.Balancer

Balancer offers users a more sophisticated approach to managing funds compared to standard AMMs. It allows multiple assets to be held within a single pool with different weights and serves as a trading platform with customizable liquidity pools for smooth currency-like exchanges.

This feature serves as an advantage for using stablecoin owing to it making it easier to form synthetic forex markets. It is possible to access trades with minimal slippage, and liquidity providers collect fees based on the pool’s assets.

The treasury, liquidity mining, protocol upgrades, and DeFi governance are all conducted by BAL token holders under DAO supervision. Incorporating everything enables composable design, which makes it easier to code swap frameworks, boosting Bolancer’s strength in automated and decentralized forex trading.

| Feature | Description |

|---|---|

| Customizable Liquidity Pools | Allows multi-token pools with variable weightings—ideal for forex baskets |

| DAO Governance | Managed by BAL token holders through the Balancer DAO |

| Stablecoin Pooling | Supports tokenized fiat trading through DAI, USDC, EURC, etc. |

| Low Slippage Trades | Smart routing for optimized, low-cost forex-style swaps |

| Integrations | Can be combined with Synthetix and Curve for synthetic forex exposure |

Conclusion

In conclusion, the most efficient Forex DAO-based trading networks incorporate decentralization, synthetic asset exposure, and sophisticated trading functionalities. dYdX, Synthetix, and Injective Protocol are frontrunners in the field of derivatives, governance, and scalability.

Synthetix, as well as the other mentioned protocols, allow users to trade seamlessly through AMMs or order books, providing them with permissionless trading that adheres to the standards of forex trading with unprecedented opportunities to engage with international currency markets in the DeFi environment.