I’ll talk about the Best Forex Brokers with Segregated Tier-1 Banking in this post, emphasizing brokers who protect customer money in prestigious banks.

- What Are Segregated Tier-1 Banking Accounts?

- How to Choose the Right Broker with Segregated Tier-1 Banking

- Key Point & Best Forex Brokers with Segregated Tier-1 Banking List

- 1. Admiral Markets

- Admiral Markets Features, Pros & Cons

- 2. eToro

- eToro Features, Pros & Cons

- 3. XM

- XM Features, Pros & Cons

- 4. XTB

- XTB Features, Pros & Cons

- 5. RoboForex

- RoboForex Features, Pros & Cons

- 6. ThinkMarkets

- ThinkMarkets Features, Pros & Cons

- 7. Pepperstone

- Pepperstone Features, Pros & Cons

- 8. IC Markets

- IC Markets Features, Pros & Cons

- 9. Swissquote

- Swissquote Features, Pros & Cons

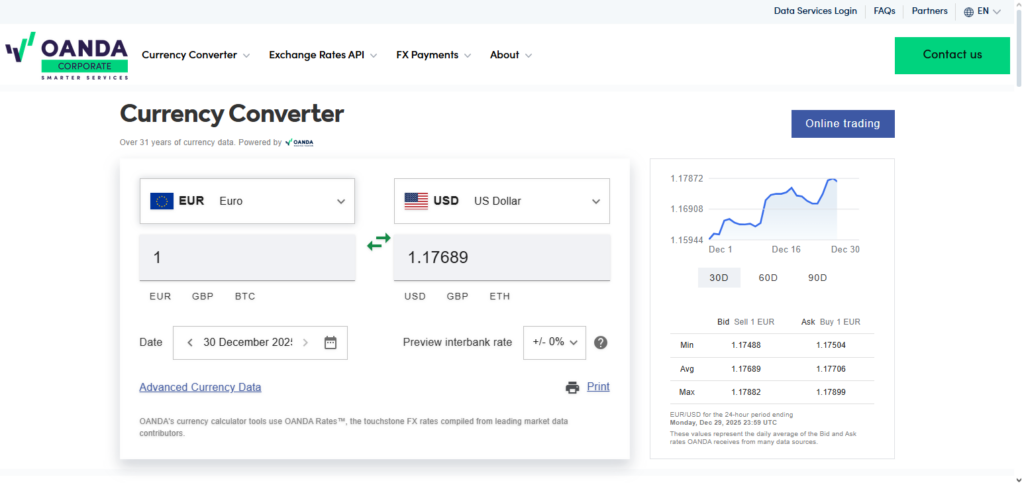

- 10. OANDA

- OANDA Features, Pros & Cons

- Benefits of Forex Brokers with Segregated Tier-1 Banking

- Conclusion

- FAQ

- What are segregated Tier-1 bank accounts in forex trading?

- Why are segregated Tier-1 banking accounts important for forex traders?

- Which brokers are considered the best with segregated Tier-1 banking?

- Are funds in segregated accounts insured?

- Can beginners benefit from brokers with segregated Tier-1 banking?

Segregated accounts guarantee safety and transparency by shielding traders’ deposits from broker insolvency.

In order to assist traders in selecting a secure and competent trading environment, we will investigate top brokers that provide dependable trading platforms, competitive spreads, and strong regulatory monitoring.

What Are Segregated Tier-1 Banking Accounts?

In top-tier, extremely secure institutions, segregated Tier-1 banking accounts are specialty accounts where forex brokers keep their clients’ money apart from their own operating funds. This guarantees the protection of traders’ money even in the event that the broker experiences financial difficulties or becomes insolvent.

An additional degree of security is provided by Tier-1 banks, which are regarded as the most stable and financially sound organizations. Because client funds cannot be utilized for the broker’s business expenditures, these accounts offer transparency. Selecting brokers with segregated Tier-1 accounts offers traders lower risk, safer trading, and assurance that their investments are completely secure.

How to Choose the Right Broker with Segregated Tier-1 Banking

Check Out Regulatory Compliance – To have the appropriate sense of guarantee, the brokers should be licensed by the authorities with a top tier, such as the FCA, ASIC, CySEC, or FINMA.

Verify Segregation of Funds – Adequate protection of all of the deposits can be certified provided client funds are maintained in segregated accounts that are with Tier-1 banks.

Evaluate Trading Platforms – Evaluate the trading platforms provided to see if you like any of the more popular options, i.e. MT4, MT5, cTrader, or any proprietary ones.

Compare Spreads and Fees – Make sure that trading costs, commissions, and spreads are at a satisfactory level in order to have reasonable trading costs.

Evaluate Customer Support – Make sure you choose brokers that have good support and offer training materials for new users and advanced users.

Key Point & Best Forex Brokers with Segregated Tier-1 Banking List

| Broker | Key Point / Feature |

|---|---|

| Admiral Markets | Offers segregated Tier-1 banking accounts with strong regulatory oversight. |

| eToro | Social trading platform with client funds held in segregated Tier-1 banks. |

| XM | Provides segregated accounts, negative balance protection, and low spreads. |

| XTB | Tier-1 bank segregation ensures secure client funds with transparent policies. |

| RoboForex | Segregated accounts and strong risk management tools for traders. |

| ThinkMarkets | Offers segregated Tier-1 banking with robust trading platforms and analytics. |

| Pepperstone | Client funds protected in segregated accounts with top-tier banking partners. |

| IC Markets | Segregated Tier-1 banking ensures safety and fast execution for high-volume traders. |

| Swissquote | Swiss-regulated broker with Tier-1 bank segregation and strong financial stability. |

| OANDA | Transparent pricing and segregated accounts with Tier-1 banking protection. |

1. Admiral Markets

Admiral Markets is considered as one of the best forex brokers with segregated Tier-1 banking, which means that client funds are kept in separate bank accounts that are with top-tier banks.

This means that traders are protected in the event that something happens to the financial situation of the broker. Admiral Markets is regulated by the FCA and ASIC, which are both reputable.

Besides the safety of client funds, Admiral Markets offers the traders the ability to trade with low spreads, offers many different account types, and offers the ability to trade through the platforms MetaTrader 4 and 5, which are advanced platforms.

This makes Admiral Markets one of the best brokers for both beginner and professional traders who are looking for a safe and transparent broker to trade forex with.

Admiral Markets Features, Pros & Cons

Features

- Tier-1 banking with segregated accounts for fund safety

- FCA & ASIC regulation

- MT4 & MT5 available

- Account options include Standard, Zero, and Invest

- Leverage and spread offerings are competitive

Pros

- Safety of high funds

- Variety of tradable instruments

- Professional charting

- Low spreads for high volume traders

- Good reputation worldwide

Cons

- Less options for cryptocurrencies

- Some trainings are behind a registration wall

- Account fees for inactivity

- Some locations have poor support

- More experienced traders are preferred

2. eToro

eToro is one of the best forex brokers with segregated Tier-1 banking. eToro protects client funds in segregated accounts with top-tier banks in which the funds the broker holds will not be used for operational purposes, which in turn protects the funds that the clients are trading with.

eToro is regulated in many countries, and one of the things eToro is famous for is their social trading. This means that a client can copy the trades of one of the top traders on the platform. The platform is beginner friendly and offers many different assets, which makes it a good trading platform for both advanced and beginner traders.

eToro Features, Pros & Cons

Features

- Tier-1 banking with segregated accounts

- Social and copy trading are available

- Multiple assets are available including forex, stocks, and crypto

- FCA, CySEC, and ASIC regulation

- Simple user interface

Pros

- Great for inexperienced traders

- Trading ecosystem with social features

- Funds are secure in segregated accounts

- Zero-commission trading on stocks

- There is an application available for trading on mobile

Cons

- The spread for forex is wide

- Trading features that are for advanced traders are absent

- There are fees for withdrawals

- MT4 and MT5 use is limited

- In many locations, services are limited

3. XM

XM is praised as one of the best forex brokers with segregated Tier-1 banking, which means customer deposits are handled by top-tier banks. Negative balance protection means traders can’t lose more than what is in their accounts.

Flexible leverage, tight spreads, and several account types tailored to different trading strategies are offered by XM. They are regulated by the FCA, CySEC, and ASIC which provides transparency and assurance. With MT4, MT5, and exceptional customer service, XM provides traders with safety and a comfortable trading environment.

XM Features, Pros & Cons

Features:

- Banking that is Segregated for Tier-1

- Control by FCA, CySEC, ASIC

- Use of MT4 and MT5 platforms

- Negative balance protection

- Having different account types and low spreads

Pros:

- Fund protection

- Having good trading conditions

- Straightforward platforms

- Educational material is available

- Micro accounts are accepted

Cons:

- Small selection of products outside of forex

- Slippage can happen in fast moving markets

- Limited features for automated trading

- Support can be unresponsive

- No in house platform

4. XTB

XTB is one of the best forex brokers with segregated Tier-1 banking, which means clients’ funds are kept in separate accounts with top-tier banks. With regulatory coverage by FCA, KNF, and CySEC clients are ensured protective measures will be in place.

For all levels of traders, XTB features competitive spreads, innovative trading tools, and a custom developed trading platform, xStation. Clients can peace of mind to know that XTB’s segregated banking system means traders’ funds will be secure and unavailable for company use. Overall, XTB provides excellent trading tools and financial safety.

XTB Features, Pros & Cons

Features:

- Segregated accounts with Tier-1 banks

- xStation 5 and MT4 platforms

- FCA and KNF regulation

- Tight spread on forex pairs

- Extensive market research and educational materials

Pros:

- Funds are well protected

- Great trading platforms

- Good research

- Fast execution

- Easy to use for beginners

Cons:

- Cryptocurrencies are few

- There are less account types

- Spreads are higher on exotic pairs

- not many promos of bonuses available

- There is no cTrader platform

5. RoboForex

RoboForex is one of the best forex brokers with segregated Tier-1 banking, which protects the funds of all its clients by keeping accounts with trustworthy banks. This means that in the event that the broker goes bankrupt, the traders’ deposits are safe.

There are different account types including ECN and Pro-Cent accounts, which are suitable for all traders from beginners to professionals. Multiple trading platforms are also offered including MT4, MT5, and cTrader with varying spreads and levels of leverage. RoboForex is one of the brokers traders that is top to safety, fund security, and more advanced trading options.

RoboForex Features, Pros & Cons

Features:

- Segregated accounts

- ECN and Pro-Cent account types

- cTrader, MT4, and MT5 available

- IFSC regulation

- leverage of 1:2000

Pros:

- Many account types

- High leverage

- Good variety of trading platforms

- Good global presence

- Bonuses are available

Cons:

- IFSC less strict than ASIC/FCA

- Spreads may widen during volatility

- Limited tools for research

- High leverage is riskier

- Customer support has occasional delays

6. ThinkMarkets

ThinkMarkets is one of the best forex brokers with segregated Tier-1 banking as the sole focus of the broker is to keep the client funds secured by storing the deposits in top-tier, segregated bank accounts. Think or Spread and prices are tightly controlled with advanced trading platforms and analytic tools for all types of traders.

FCA and ASIC regulate these brokers, which adds to the transparency and reliability of the brokers. Users of the system are protected from neg balances and the design of the systems is to keep it simple. These features combine to give a professional touch to the system. Users who are highly concerned about the safety of their funds and trading solutions rate these brokers as the best in the forex industry.

ThinkMarkets Features, Pros & Cons

Features:

- Segregated Tier-1 accounts

- Regulated by FCA & ASIC

- MT4, MT5, ThinkTrader

- Fast execution & tight spreads

- Negative balance protection

Pros:

- Excellent safety for funds

- Reliable platforms

- Good risk management features

- Good execution speeds

- Covers multiple asset classes

Cons:

- Education is lacking

- Global presence is limited

- Opening an account may take time

- Limited crypto offerings

- Some instruments have fees

7. Pepperstone

Pepperstone can be described as one of the top forex brokers with Tier-1 banking and funds safety as they keep client money in segregated accounts with top-tier banks. Their fund segregation protects the client money from being misused by the company.

They are regulated by the FCA, ASIC, and DFSA in order to provide the clients with the enforcement of strict financial guidelines. The broker has low spread, fast order execution, and offers trading on multiple platforms such as MT4, MT5, and cTrader. With the combination of safety of funds and high quality trading tools, they are highly rated by traders for their forex and CFD trading.

Pepperstone Features, Pros & Cons

Features:

- Segregated Tier-1 banking

- Regulation by FCA & ASIC

- cTrader, MT4, & MT5

- Fast execution & low spreads

- VPS available for traders

Pros:

- High level of fund security

- Algorithm and scalping trading preffered

- cTrader, MT4, & MT5

- Customer service is excellent

- Competitive spreads

Cons:

- Limited trading instruments

- No proprietary trading instruments

- Some inactivity fees apply

- Fewer account types offered

- Bonuses are limited

8. IC Markets

IC Markets has earned a top-tier banking and fund safety for which he can be classified as one of the best forex brokers with segregated Tier-1 banking. For which he offers fund safety at IC Markets with top-tier bank account segregation.

The traders funds are therefore safe against the broker’s bankruptcy. IC Markets has got his clients with the regulation from ASIC, CySEC, and SCB, with which he guarantees them low levels of compliance and a high level of transparency.

With a low level of spread, a level of fluidity, and a high level of cTrader, he has become one of the IC Markets offers the safety of the funds along with the conditions of the trade. They provide the traders with a safe environment in which they can trade without any fear. The customer is Active and he is the high-volume trader.

IC Markets Features, Pros & Cons

Features:

- Tier-1 banking segregation

- ASIC and CySEC regulation

- MT4, MT5, and cTrader Platforms

- Tight ECN Spreads

- VPS and Algorithmic Trading Support

Pros:

- Significant Liquidity and Miniscule Spread

- Quick Execution

- High-Frequency Trading is Supported

- Numerous Trading Platforms

- Exceptional for Professional Traders

Cons:

- Resources for Training are Scarce

- No Standalone Platform

- Customer Support Feedback is Inconsistent

- Withdrawal Fees are Applicable

- Potentially Dangerous High Leverage

9. Swissquote

Swissquote is one of the top forex brokers involving segregated Tier-1 banking, since client funds are stored in Swiss banking institutions. This model protects investors from agents going bust. Keeping the clients’ interest in mind, Swissquote is regulated by FINMA, which entails strict observation and following the laws of Switzerland.

The forex, CFDs and crypto broker has varying account options, complicated spread arrangements, as well as multiple platforms. Due to Swissquote’s reliability and transparency, they have many clients willing to trust them with their funds and use their services for professional trading. It is one of the top brokers for forex services.

Swissquote Features, Pros & Cons

Features:

- Swiss Bank Account with Segregated Accounts

- Regulated by FINMA

- MT4 with Advanced Trader

- Spreads Affordable and Risks are Low

- Large Product Offering: Forex, CFDs and Crypto

Pros:

- Impeccable Security and Transparency

- Regulation from Switzerland is Strong

- Varied Account Offerings

- Sophisticated Trading Features

- Support from Customer Service is Steady

Cons:

- Spread is More than ECN Brokers

- Deficient Promotions and Bonuses

- Steep Learning Curve on Proprietary Platform

- Account Activity Fees

- High-Frequency Trading is not Optimal

10. OANDA

OANDA is one of the top forex brokers with segregated Tier-1 banking, meaning client money is kept in bank accounts with top tier consolidated banks.

The broker also eliminates negative balance, meaning traders can only lose what they have in their accounts. OANDA is regulated by the FCA, CFTC, ASIC, and IIROC which speaks for their commitment towards safety and regulation.

The broker has complicated spread arrangements, and a couple of custom trading solutions in addition to the MT4. OANDA’s clients’ funds, professional services, and transparency are what make them a trusted broker to use for forex trading.

OANDA Features, Pros & Cons

Features:

- Tier-1 Banking Accounts With Segregation

- Regulated by FCA, CFTC, IIROC, and ASIC

- MT4 and the fxTrade Proprietary Platform

- Competitive Spreads with Negative Balance Protection

- High Variety of Instruments to Trade

Pros:

- Strong Security of Funds

- Fees and Pricing are Transparent

- Plenty of Regulations

- Dependable platforms.

- Good for novices & experts.

Cons:

- Less leverage than some other brokers

- No crypto CFDs on certain accounts

- Fewer bonuses

- For seasoned traders, the platform can feel basic.

- Less diverse accounts than some rivals

Benefits of Forex Brokers with Segregated Tier-1 Banking

Increased Fund Safety – Client funds are kept separately in Tier 1 banks, so funds are not at risk of being lost in the case of broker bankruptcy or internal fraud.

Compliance with Regulations – Brokers are compliant with strict financial regulations when they keep client funds in Tier 1 segregated accounts.

Trust and Transparency – Traders are able to track their money whenever it’s not in the broker’s working capital.

Traders Relax – Without the risk of losing money, traders can concentrate on strategy instead of fund protection.

Better Trading Conditions – Tier 1 segregated bank brokers tend to work with advanced trading system, better spreads, and faster order routing.

Conclusion

In conclusion, traders who value the security and transparency of their money must select the top forex brokers with segregated Tier-1 banking. In addition to offering segregated accounts, brokers such as Admiral Markets, eToro, XM, XTB, RoboForex, ThinkMarkets, Pepperstone, IC Markets, Swissquote, and OANDA also offer strong regulatory oversight, competitive trading conditions, and cutting-edge platforms.

Traders can enjoy dependable execution and expert trading tools while safeguarding their deposits against future broker insolvency by choosing brokers with Tier-1 bank segregation. Making fund security a top priority guarantees comfort and a solid basis for profitable trading.

FAQ

What are segregated Tier-1 bank accounts in forex trading?

Segregated Tier-1 bank accounts are dedicated accounts where brokers keep client funds separate from company funds in top-rated, highly secure banks. This ensures traders’ money is protected even if the broker faces financial issues, offering maximum safety and transparency.

Why are segregated Tier-1 banking accounts important for forex traders?

These accounts safeguard client funds from misuse and broker insolvency. Traders can trade with confidence knowing their deposits are stored securely in top-tier banks, making them a key factor in choosing reliable forex brokers.

Which brokers are considered the best with segregated Tier-1 banking?

Some of the best forex brokers with segregated Tier-1 banking include Admiral Markets, eToro, XM, XTB, RoboForex, ThinkMarkets, Pepperstone, IC Markets, Swissquote, and OANDA. These brokers combine fund safety with competitive trading conditions.

Are funds in segregated accounts insured?

While segregated accounts protect your funds from broker insolvency, insurance coverage depends on the broker and its regulatory framework. Many Tier-1 segregated brokers also offer additional compensation schemes under regulatory protection.

Can beginners benefit from brokers with segregated Tier-1 banking?

Yes, beginners benefit greatly because their deposits are secure, reducing financial risk while they learn trading. Combined with user-friendly platforms and educational resources, these brokers provide a safe environment for all trading levels.