The Best Forex Brokers with Custom Risk Settings, which let traders reduce losses, manage exposure, and optimize tactics, will be covered in this article.

- Why Use Forex Brokers with Custom Risk Settings

- Benefits of Forex Brokers with Custom Risk Settings

- Key Point & Best Forex Brokers with Custom Risk Settings List

- 1. AvaTrade

- AvaTrade – Features

- Pros & Cons AvaTrade

- 2. FXCM

- FXCM – Features

- Pros & Cons FXCM

- 3. Tickmill

- Tickmill – Features

- Pros & Cons Tickmill

- 4. Pepperstone

- Pepperstone – Features

- Pros & Cons Pepperstone

- 5. OANDA

- Oanda – Features

- Pros & Cons OANDA

- 6. Exness

- Exness – Features

- Pros & Cons Exness

- 7. eToro

- eToro – Features

- Pros & Cons eToro

- 8. XM

- XM – Features

- Pros & Cons XM

- 9. XTB

- XTB – Features

- Pros & Cons XTB

- 10. RoboForex

- RoboForex – Features

- Pros & Cons RoboForex

- Conclusion

- FAQ

These brokers offer sophisticated risk management instruments, such as negative balance protection, stop-loss, take-profit, and adjustable leverage. These brokers assist in customizing trading risk to meet your specific demands, regardless of your level of experience.

Why Use Forex Brokers with Custom Risk Settings

Manage Your Risk: With customizable risk settings, you can handle potential risks on trades, and losses can be managed with varying degrees of leverage, and stop-loss and take-profit settings.

Keep Your Money Safe: With features like negative balance protection, a trader can never have a balance that goes below zero, and you ensures that you don’t lose more than what you have in your Forex account.

Diverse Trading Methods: With risk management tools being adjustable, you trade how you like, and effectively apply your scalping, swing, and long-term trading methods.

Less Stress: With risk management tools being adjustable, you trade how you like, and effectively apply your scalping, swing, and long-term trading methods.

Efficient Gain/Loss Balance: Traders can optimize profits. Overall trading performance is improved by having more control on losses.

Benefits of Forex Brokers with Custom Risk Settings

Increased Risk Management: Investors are able to stop-loss, take-profit, and adjust leverage controls to fit their risks.

Account Safety: Negative balance protection ensures that you will not lose more than the sum of your account balance.

Flexible Trading Techniques: Different strategies such as scalping, day trading, or long-term investing with customized risk parameters are supported.

Emotional trading: Having risk parameters or limits can help mitigate the tendency for traders to act on emotion and assist them to remain more strategic and disciplined.

Possibly Profitable: Traders can get the most profit and the least amount of risk and loss by managing their exposure.

Key Point & Best Forex Brokers with Custom Risk Settings List

| Broker | Key Points / Features |

|---|---|

| AvaTrade | Regulated globally, wide range of instruments, user-friendly platforms, strong risk management tools, competitive spreads. |

| FXCM | Advanced trading platforms, educational resources, reliable execution, robust risk control, multi-asset trading. |

| Tickmill | Low spreads, fast execution, multiple account types, strong customer support, MT4/MT5 availability. |

| Pepperstone | ECN pricing, low latency execution, multiple trading platforms, tight spreads, excellent support. |

| OANDA | Strong regulatory oversight, flexible lot sizes, advanced charting, low fees, comprehensive research tools. |

| Exness | Flexible leverage, competitive spreads, fast withdrawals, strong platform stability, multi-account options. |

| eToro | Social and copy trading, beginner-friendly, regulated globally, multiple assets, intuitive platform. |

| XM | Wide account options, low minimum deposit, educational resources, tight spreads, MT4/MT5 supported. |

| XTB | Proprietary platform xStation, fast execution, strong research, low fees, multi-asset trading. |

| RoboForex | High leverage options, multiple account types, diverse assets, MT4/MT5/ cTrader, low spreads. |

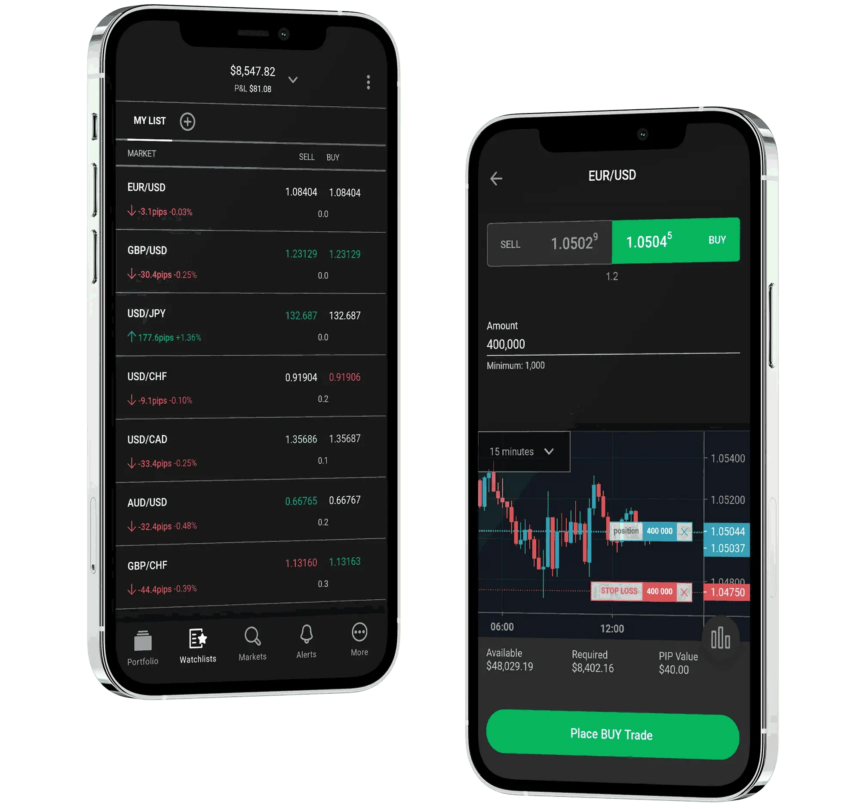

1. AvaTrade

AvaTrade was established in 2006 and has become a global Best Forex Brokers with Custom Risk Settings & CFD broker with a reputation for technological and educational reliability. He has a regulation in various jurisdictions such as the Central Bank of Ireland, ASIC and Australia, FSCA and South Africa, BVI FSC and others, which means the clients have an extensive oversight and protection.

Different types of accounts have different spreads and fees, with some accounts allowing low or commission-free trading with overnight financing fees on some of the CFDs. AvaTrade is compatible with MetaTrader 4/5, the proprietary AvaTradeGO app, and with customizable stop-loss measures and negative balance protection, which makes him an attractive option for users who want a tailored trading and a diversified market.

AvaTrade – Features

Regulation: Multiple licenses across the globe including South Africa, Japan, Ireland, and Australia, all of which provide a strong layer of protection for clients.

Platforms: AvaTrade supports MT4, MT5, and AvaTradeGO, accommodating both novice and experienced traders.

Risk Tools: Customizable risk management tools such as stop loss, take profit, trailing stop, and guaranteed stop.

Market Access: Forex, CFDs, options, and crypto providing diverse financial instruments for risk diversification.

Fees & Spreads: Spreads are low and the commission is at an optimal level supporting risk managed trading.

Pros & Cons AvaTrade

Pros:

- Multiple Jurisdictions Approved – This means traders can consider it safe and reputable.

- Variety of Trading Platforms – Traders can choose between MT4, MT5, and AvaTradeGO.

- Educational Materials – This broker provides its clients with step-by-step guides, training sessions, and other educational materials.

- Variety of Assets – AvaTrade provides access to the following assets: Forex, CFDs, cryptocurrencies, commodities, and indexes.

- Short-Term Trading Is Supported – Customers can engage in short-term trading due to the presence of tight spreads.

Cons:

- Research Tools Are Scarce – Charting and analysis tools are limited.

- U.S Clients Cannot Be Assumed – AvaTrade has limited jurisdiction.

- Fees – If an account is inactive, then it is subject to fees.

- Help – Client help can be sluggish sometimes.

- Account Types – Advanced traders cannot choose between account types.

2. FXCM

Forex Capital Markets or FXCM started its operation in 1999 and has been providing services as a retail Best Forex Brokers with Custom Risk Settings for many years. He is currently under regulation from the FCA in the UK as well as other countries for restructuring under Jefferies Financial Group.

Spreads are considered competitive, however, Variable fees may also apply depending on the market and the account. Users of the broker have the ability to use proprietary solutions, as well as the Trading Station and MetaTrader and benefit from guaranteed stop losses, trailing stops, and position sizing.

In addition to Forex tools that allow for precision control while managing risk associated with major and minor currency pairs, the analytics and regulation of FXCM also offers its users a high level of trust and control.

FXCM – Features

Regulation: FCA, ASIC, and other bodies provide the regulation and the clients’ safety as well as the transparency of the trading.

Platforms: Station and MT4 are compatible with advanced charting, testing of the strategies, and the management of the risk.

Risk Tools: Tools for risk management such as stop-loss, the guarantee variety, alerts on the margin, and the sizing of the positions.

Execution: The firm is able to provide the service of trade execution.

Fees & Spreads: The clients are able to trade and the prices are the same.

Pros & Cons FXCM

Pros:

- U.S. Regulation – FXCM is regulated by the FCA.

- Multiple Platforms – Clients can choose between Trading Station, MT4, and NinjaTrader.

- Pricing – Clients receive competitive pricing with no other fees.

- Educational Material – FXCM offers its customers access to webinars, educational guides, and other types of materials.

- Flexible Leverage Options – Different jurisdiction leads to different leverage.

Cons:

- A Slightly Smaller Selection of Cryptocurrencies. – More concentrated on Forex and CFDs.

- Higher Minimum Deposit on Some Account Types. – May hinder new traders.

- Slippage. – Can occur during times of high volatility.

- No US Clients. – US residents can not trade here.

- Few Bonuses and Promotions. – Not as generous as rival brokers.

3. Tickmill

Tickmill is one of the most prominent online Forex & CFD Brokers since its establishment in 2014 Best Forex Brokers with Custom Risk Settings. It is regulated by most of the leading authorities: FCA (UK), CySEC (EU), FSCA (South Africa), and FSA in Seychelles. As a result, the company has very strong regulation.

Tickmill has negative spread (Raw spreads from 0.0 pips with a small commission), and trading costs are quite low since deposit and withdrawal are free.

Tickmill is compatible with MT4, MT5 and its own Tickmill Trader platform, which has great risk management and control settings including negative balance protection, customizable stop-loss and take-profit levels, as well as leverages (region dependent). Thus, Tickmill is the best choice for traders who are looking for exposure and risk control focused on on granular levels.

Tickmill – Features

Regulation: Tickmill is regulated by FCA, CySEC, and FSCA which means there is plenty of regulatory oversight.

Platforms: Tickmill supports MT4 and MT5 and offers trading risk management add-ons that integrate with the trading platforms.

Risk Tools: Tickmill offers the risk management tools of negative balance protection, stop-loss, take-profit, and trailing stops.

Execution: Tickmill offers an execution model with low latency ECN pricing which is the best for scalping and fast strategies.

Fees and Spreads: Tickmill offers low spreads that begin at 0.0 pips on Raw accounts and has low commissions.

Pros & Cons Tickmill

Pros:

- Low Spread and Commission. – Perfect for scalping and high frequency.

- Quick Execution Speeds. – Pioneers ECN trading with little to no slippage.

- Global Regulation. – Regulated by FCA, CySEC, and FSCA for peace of mind.

- Some Educational Tools. – Webinars, videos, and trading guides.

- Demo Accounts. – Great for practice trading.

Cons:

- Limited Offering of Cryptocurrencies. – Focusses primarily on Forex and CFDs.

- No US or Canadian Clients. – Some countries can’t use this service.

- Basic Research Tools. – Limited market analysis.

- No Custom Platform. – Only use MT4/MT5.

- Limited Types of Accounts.- Standard, Pro, and VIP.

4. Pepperstone

Founded in 2010, Pepperstone is a global Best Forex Brokers with Custom Risk Settings that is regulated by FCA (UK), ASIC (Australia) and other authorities. Pepperstone is known for its Razor ECN accounts that have tight spreads and competitive pricing.

Pepperstone also allows MT4 and MT5 along with cTrader and TradingView integration. On ECN accounts, there are low commissions and variable spreads, while on standard accounts, there are low commissions.

Traders have access to advanced risk management tools to help them, such as stop losses, margin alerts, and customizable leverage. Deep liquidity and fast execution support Pepperstone’s possible use by scalpers and algorithmic traders, as they value quick execution and are highly focused on risk management.

Pepperstone – Features

Regulation: Pepperstone is regulated by FCA, ASIC, and CySEC which offers client protection.

Platforms: Pepperstone offers MT4, MT5, cTrader, and TradingView which all offer professional tools for risk management.

Risk Tools: Pepperstone offers stop-loss, take-profit, trailing stops, margin alerts, and negative balance protection which gives flexible control of risk.

Execution: Pepperstone offers fast execution on their ECN with deep liquidity that minimizes the risk of slippage.

Fees and Spreads: Pepperstone offers low spreads and clear commissions.

Pros & Cons Pepperstone

Pros:

- Fast Execution and Low Latency. – Great for scalping and automated trading.

- Multiple Platforms Available – Supports MT4, MT5, and cTrader.

- Top Tier Regulation – Reliable due to ASIC, FCA, DFSA regulation.

- Competitive Spread – Particularly on the EUR/USD.

- Amazingly Responsive Customer Service – 24/5 and in multiple languages.

Cons:

- Few Available Cryptos – Mainly focused on Forex & CFDs.

- No Clients From The US – Trading limitations.

- Withdrawal Fees Apply in Some Instances – Fees on some methods.

- Restrictions on Account Base Currency – Not all currencies offered.

- Education Is Lacking – Not as much as with other brokers.

5. OANDA

OANDA started operating in 1996, and as a linear broker, it is well regarded for its pricing and quality of data services Best Forex Brokers with Custom Risk Settings. It operates in a variety of jurisdictions, such as the US (CFTC/NFA), the UK (FCA), Canada (IIROC), Japan (FSA), and Australia (ASIC), making them one of the more highly regulated brokers.

There is no set minimum deposit in most regions for the brokers’ variable spreads, with overnight positions incurring a holding fee. The brokers’ risk management tools distributed across the fxTrade and MetaTrader services are flexible and include transparent stop losses and customizable alerts, and back testing aids.

Oanda – Features

Regulation: They are regulated by the FCA, CFTC/NFA, ASIC, and other regulators, which provides safe trading.

Platforms: They offer a proprietary platform which is the fxTrade platform, and MT4, which have complete risk management functionalities.

Risk Management: They offer stop loss, take profit, and alerts as well as negative balance protection.

Execution: They provide reliable execution with adequate requotes and consistent pricing.5. Fees & Spread: Accessible trading with a competitive cost structure with no minimum deposit.

Pros & Cons OANDA

Pros:

- Excellent Track Record – Reputable broker dating back to 1996.

- Choice of Account Types – Micro and standard accounts.

- Cutting Edge Platforms – MT4 and the proprietary fxTrade platform.

- Worldwide Regulation – FCA, ASIC, IIROC, etc.

- Quality Research & Market Analysis – Calendar, news, and market commentary.

Cons:

- Wider Spread – Spreads comparatively higher than ECN brokers.

- Sparse Cryptocurrency Availability – CFDs are very limited.

- No Fixed Leverage in Certain Regions – Regulatory limitations.

- Few Promotions Available – Bonuses are uncommon.

- Execution Slows During Market Volatility – An issue for some fast traders.

6. Exness

Exness is a global broker, known to customers as being very flexible and requiring extremely low deposits Best Forex Brokers with Custom Risk Settings. They started operating in 2008, and are regulated in several places, such as the FSA (Seychelles), the FCA (UK), and the FSA (South Africa).

Exness offers zero or low commission trading with fast execution and variable spreads via the Exness Terminal and MetaTrader 4/5. They are recognized for offering customizable risk tools, including high leverage (depending on the region).

Because Exness allows traders to personalize parameters to their risk appetite, they can modify loss/take profit settings, adjustable levels of leverage, and margin. Due to its deep liquidity, variable pricing, and high volume, it can be utilized by active traders.

Exness – Features

Regulation: Strong oversight with FCA, CySEC, FSCA, and FSA.

Platforms: Risk management and automation with stable environments of MT4 and MT5.

Risk Tools: Flexible risk management with adjustable leverage, stop-loss, take-profit, trailing stops, and margin alerts.

Execution: Less market exposure with fast and stable execution.

Fees & Spread: Low commission and very low spread for cost-efficient trading.

Pros & Cons Exness

Pros:

- Leverage – At 1:2000, the offered leverage on some accounts is the highest I’ve ever seen.

- Spreads – The low and even negative spreads seem perfect for the scalpers.

- Withrawals – I’ve enjoyed instant and same day withdrawal processing.

- Account Variety – Exness offers 4 account types: Standard, Pro, Zero, and ECN.

- Licenses – The company is licensed in the FCA, CySEC, and FSCA.

Cons:

- Education – There are no resources for beginners, im hoping this will change.

- No Platforms – Exness does not provide their services on their own platform, only MT4 and MT5.

- Instruments – There is not a very big selection of instruments. Mostly only Forex and CFDs.

- Support – I’ve had to wait to chat with support.

- Geo Restriction – Exness is not available for US traders.

7. eToro

eToro was established in 2007 and offers traditional Forex & CFD trading, in addition to social/copy trading Best Forex Brokers with Custom Risk Settings. For relevant services, they are regulated by the FCA (UK), CySEC (EU), ASIC (Australia), and FinCEN (US).

Fees are present, including spread fees with no commission for stock trading, and overnight, conversion, and other fees. Risk control is complemented via the proprietary platform including adjustable stop loss/take profit, and other tools to enhance diversified portfolio structures.

Among the traders, the social trading platform allows them to view risk-managed portfolios and follow the traders. This feature is especially attractive for novice traders, and is useful for people who are engaged in the community for tailoring the risk.

eToro – Features

Regulation: Secure trading with FCA, CySEC, ASIC, and FinCEN.

Platforms: Unique eToro platform with social and copy trading.

Risk Tools: Portfolio diversification, stop-loss, take-profit, and trailing stops.

Execution: Transparent spread, reliable execution, and copy trading risk management.

Fees & Spread: Commission-free trading on stocks with CFDs carrying a small commission.

Pros & Cons eToro

Pros:

- Copy Trading – eToro has useful social trading features, including CopyTrader and CopyPortfolios, for beginner traders who want to passively follow the strategies of experienced traders.

- Instruments – eToro offers a wide selection of assets across categories, including Forex, stocks, ETFs, and even cryptocurrencies.

- Global Licenses – eToro is regulated by FCA, CySEC, and ASIC.

- User Friendly – eToro is one of the easiest to navigate platforms.

- No Commission – Long term investors don’t have to worry about paying commissions on stocks.

Cons:

- Spreads – Compared to ECN brokers, eToro does have higher spreads on Forex trading.

- Tools – There is very little in the way of charting tools to help with advanced technical analysis.

- Withdrawal – eToro does charge a fee on withdrawal.

- Fee – If a user is inactive for 12 months, eToro charges an inactivity fee.

- No MT4/MT5 – eToro is not compatible with MT4 and MT5. They only use their own proprietary platform.

8. XM

XM is among the multi-regulated brokers operating since 2009 with an active license in CySEC (EU), ASIC (Australia), DFSA (Dubai), and FSC (Belize) Best Forex Brokers with Custom Risk Settings.

XM offers competitive spreads. Clients can choose commission-free accounts or tiered pricing with Zero accounts, starting with low minimum deposits (as low as $5). XM offers the MetaTrader 4/5 platforms, with customizable features such as negative balance protection, adjustable stop loss levels, and various order types.

XM offers educational material and 24/5 support in several languages, which is valuable for traders who want to fine-tune their risk management and trading discipline.

XM – Features

Regulation: Regulated trading with licenses from CySEC, ASIC, DFSA, and FSC.

Platforms: Risk management with multi-device access on MT4 and MT5.

Risk Tools: Stop-loss, take-profit, and trailing stops with negative balance protection.

Execution: Stable and quick execution with reduced market risk.

Fees & Spreads: No commission and tight spread standard accounts for risk-adjusted trading profitability.

Pros & Cons XM

Pros:

- Beginners can Start for $5 – Low minimum deposit.

- Variety of Trading Options – Trade Forex, indices, CFDs, and more.

- Regulatory Compliance – ASIC, CySEC, and IFSC regulation.

- Free Educational Resources – Attend free webinars, and view videos.

- Variety of Accounts – Micro Accounts, XM Zero, and Standard Accounts.

Cons:

- Small Number of Cryptocurrencies – CFDs on cryptos is limited.

- Micro Accounts Have Spread Costs – Highest with EUR/USD.

- Limited Platform Options – MT4 and MT5 are the only options.

- Withdrawals Slower than Average – Waiting 1–2 days is common.

- Few Incentives Offered – Only occasional bonuses are found.

9. XTB

XTB was established in 2002 and is among the largest publicly listed Best Forex Brokers with Custom Risk Settings firms regulated by the KNF (Poland), FCA (UK), and CySEC (Cyprus). XTB is active in most asset classes including forex, and other CFDs (indices, commodities).

XTB offers its clients low spreads and zero deposit/withdrawal fees in certain countries. Advanced risk management features such as stop loss, trailing stop, risk calculator, and alerts are available on XTB’s xStation and MetaTrader platforms.

This helps traders manage their exposure. XTB offers good educational materials and market analysis for clients who wish to operate in a more professional environment, with clear risk management controls.

XTB – Features

Regulation: Regulation by KNF, FCA, and CySEC ensures a safe trading environment.

Platforms: xStation 5 and MT4 offer trading tools for risk analytics and tracking.

Risk Tools: Tools include stop-loss, take-profit, trailing stops, risk calculators, and margin alerts.

Execution: Fast execution and effective liquidity reduces exposure.

Fees & Spreads: Narrow spreads and low commission accounts ensures efficient trading.

Pros & Cons XTB

Pros:

- Globally Regulated – CySEC, KNF, FCA.

- Excellent Proprietary Platform – Sophisticated XStation has analysis and charting.

- Variety of Offerings – Buy cryptos, commodities, forex, and more.

- Guides & Webinars Offered – Learn with videos & live analysis.

- Lower Fees on Standard Accounts – Better spreads are available.

Cons:

- Two Account Types – Only Pro and Standard are available.

- No MT5 – Only XStation for Pro users.

- No ECN Broker Spreads Here – This is important for scalpers.

- Limited Cryptos – Only a small number of coins are offered.

- Limited by Geography – Some countries are excluded.

10. RoboForex

RoboForex has been active since 2009 and is primarily regulated by the IFSC of Belize. Belize is a member of the Financial Commission which offers a compensation fund for added protection to clients Best Forex Brokers with Custom Risk Settings.

RoboForex connects with numerous consoles like MetaTrader 4/5, R Trader, WebTrader, and mobile apps, apart from providing 12,000+ instruments. Spreads and account commissions differ, and entry barriers go as low as 10 dollars, as they try to keep competition cost effective.

Some risk management measures are negative balance protection, leverage customization, and choice to adjust order types. RoboForex is a good choice for those traders who want to switch up risk management across a large number of other markets.

RoboForex – Features

Regulation: Regulated by IFSC (Belize) and is a member of the Financial Commission compensation fund.

Platforms: Trading flexibility across MT4, MT5, cTrader, R Trader, and mobile apps.

Risk Tools: Protections against negative balances, adjustable leverage, stop-loss, take-profit, and trailing stop.

Execution: Fast execution and slippage are minimal with ECN-style accounts.

Fees & Spreads: Low commission and spread increases trading efficiency with controlled risk.

Pros & Cons RoboForex

Pros:

- Different Types of Accounts – Pro, ECN, Prime, and Cent accounts.

- Multiple Platforms – MT4, MT5, cTrader, and in-house platforms.

- High Leverage – 1:2000 or even greater depending on the regulatory zone.

- Multiple Instruments Offered – Forex, commodities, indices, and even cryptocurrencies.

- Promotional Offers – Nice welcome proposition for new clients.

Cons:

- Weak License in the Jurisdiction – Compared to other brokers, the risk is greater.

- Variable Account Spreads – Depending on the account, this may vary.

- Support – Slow response time is apparent.

- Research is Limited – A piece of research is available but not advanced market studies.

- Blocked Countries – Limited geographical reach.

Conclusion

For traders who desire exact control over their trades, capital protection, and strategy optimization, selecting the best Forex broker with customized risk settings is crucial.

Strong regulation, competitive fees, cutting-edge platforms, and adaptable risk management tools like adjustable leverage, customized stop-loss, and negative balance protection are all provided by brokers like AvaTrade, FXCM, Tickmill, Pepperstone, OANDA, Exness, eToro, XM, XTB, and RoboForex.

You may comfortably manage exposure while having access to dependable execution, a variety of instruments, and support by choosing a broker that fits your trading style and risk tolerance. This will make your Forex trading safer and more efficient.

FAQ

What does “custom risk settings” mean in Forex trading?

Custom risk settings refer to tools and features that let traders control exposure — such as adjustable leverage, customizable stop‑loss and take‑profit orders, trailing stops, and risk calculators. These help manage potential loss and align trades with personal risk tolerance.

Why are custom risk settings important?

They allow traders to protect capital, limit downsides, and implement precise strategies. Without them, you may face larger losses during volatility or be unable to adapt to changing market conditions.

Which brokers offer the best risk management tools?

Brokers like AvaTrade, FXCM, Tickmill, Pepperstone, OANDA, Exness, eToro, XM, XTB, and RoboForex offer robust risk tools — including adjustable stops, negative balance protection, and flexible leverage.

Are these brokers regulated?

Yes — most are regulated by recognized authorities (e.g., FCA, ASIC, CySEC). Regulation ensures client fund safety and transparent operations.

Do custom risk settings increase trading costs?

Not usually. Most brokers provide risk tools at no extra charge. Costs typically come from spreads, commissions, or overnight fees — not the risk settings themselves.