Best Crypto Exchanges In Hong Kong Forex brokers in Iceland play an important role in enabling the foreign exchange market for Icelandic traders and investors. Iceland, famed for its gorgeous scenery and a tiny but active financial industry, is becoming increasingly interested in forex trading. These brokers serve as go-betweens, linking Icelandic traders to the worldwide currency market. They give people and organizations access to a wide choice of currency pairs, allowing them to speculate on currency price swings.

- How To Choose Best Forex Brokers In Iceland?

- Here Is List of Best Forex Brokers In Iceland

- 20 Best Forex Brokers In Iceland

- 1.XM

- 2.AvaTrade

- 3.eToro

- 4.XTB

- 5.IG

- 6.CMC Markets

- 7.Plus500

- 8.FXTM

- 9.HFM

- 10.OctaFX

- 11.Saxo Bank

- 12.Fusion Markets

- 13.Capital.com

- 14.IC Markets

- 15.Trade Nation

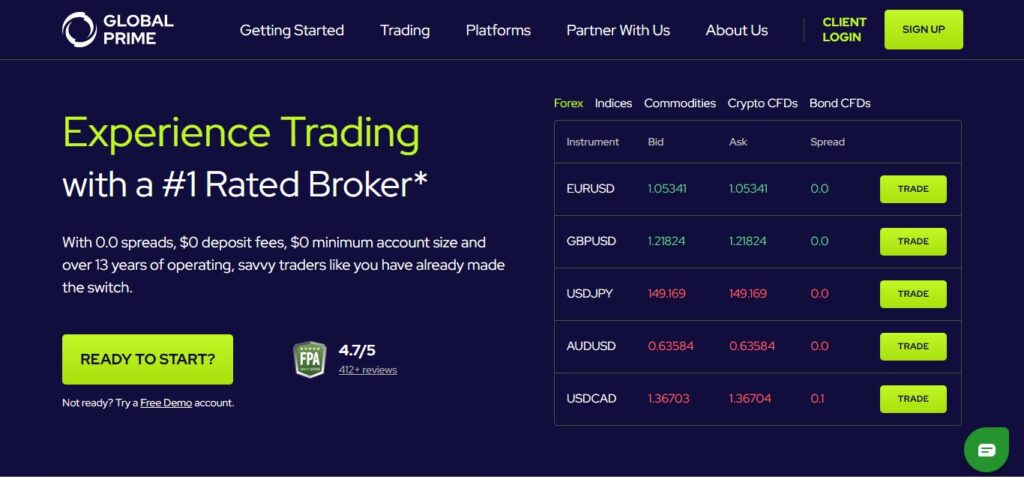

- 16.Global Prime

- 17.Tickmill

- 18.Pepperstone

- 19.FP Markets

- 20.Axi

- Conclusion Best Forex Brokers In Iceland

- FAQ Best Forex Brokers In Iceland

- What is a Forex broker, and why do need one in Iceland?

- Are Forex brokers legal in Iceland?

- Which Forex brokers are regulated in Iceland?

- What are the most popular currency pairs for trading in Iceland?

- What are the typical fees associated with Forex trading in Iceland?

- What are some recommended Forex brokers in Iceland?

Icelandic forex brokers provide a variety of trading platforms, instructional resources, and research tools to help traders make informed selections. Furthermore, they follow tight regulatory rules, protecting the safety and security of their clients’ cash while fostering openness in the trading process. As Iceland continues to embrace forex trading, these brokers provide an important link between Icelandic traders and the worldwide forex market, allowing them to participate in this dynamic and decentralized financial arena.

How To Choose Best Forex Brokers In Iceland?

Choosing the finest forex broker in Iceland, or any other country, is a critical step in ensuring your trading success. Here are some guidelines to help you choose the best Icelandic forex broker:

Compliance with regulations: Check that the broker is regulated by a credible authority. The Icelandic Financial Supervisory Authority (FME) oversees financial services, including forex brokers, in Iceland. Check to see if the broker is licensed and in accordance with Icelandic legislation.

Safety and security: Look for brokers who have solid security measures in place, including as encryption and customer funds segregation. Your funds should be kept separate from the broker’s operational finances to protect them in the event of insolvency.

Platform for trading: Examine the trading platforms available. Because of its dependability and numerous functionality, most traders use MetaTrader 4 (MT4) or MetaTrader 5 (MT5). Make sure the platform is easy to use and fits your trading style.

Pairs of currencies: Check if the broker provides a diverse variety of currency pairs, including the ones you intend to trade. This variety may increase trading opportunities.

Trading Fees: To determine total trading expenses, compare spreads (the difference between the bid and ask price), charges, and overnight financing rates (swap rates). Lowering your costs can boost your profitability.

Leverage: Use leverage with caution. According to ESMA regulations, the maximum leverage for retail traders in Iceland is normally limited at 1:20. Ascertain that the broker sticks to these limitations and offers appropriate leverage alternatives.

Customer Service: Contact the broker’s customer service with any queries or concerns. Support that is responsive and helpful is vital, especially during volatile markets.

Withdrawals and deposits: Examine the broker’s deposit and withdrawal options. Check if they provide convenient and secure solutions for your requirements.

Educational Materials: Look for brokers who offer instructional tools including webinars, tutorials, and market analyses. These materials can assist you in improving your trading abilities.

Feedback and Reputation: Read evaluations from other traders to learn about the broker’s reputation. To acquire a balanced perspective, look for both positive and negative responses.

Types of Accounts: Choose a broker who provides account kinds that are appropriate for your trading experience and funds. Some brokers cater to novice traders, while others cater to more experienced traders.

Speed and dependability of execution: For day traders and scalpers, a broker with fast and reliable order execution can be critical.

Here Is List of Best Forex Brokers In Iceland

- XM

- AvaTrade

- eToro

- XTB

- IG

- CMC Markets

- plus500

- FXTM

- HFM

- OctaFX

- Saxo Bank

- Fusion Markets

- Capital.com

- IC Markets

- Trade Nation

- Global Prime

- Tickmill

- Pepperstone

- FP Markets

- Axi

20 Best Forex Brokers In Iceland

1.XM

The XM Group is regulated by ASIC in Australia (Trading Point of Financial Instruments Pty Limited), CySEC in Cyprus (Trading Point of Financial Instruments Ltd), the FSC in Belize (XM Global Limited), and the DFSA (Trading Point MENA Limited).

Size is irrelevant. Regardless of net capital value, account type, or investment size, the client comes first at XM. All of our clients receive the same high-quality services, execution, and support. These are the values that XM was founded on, and they will not alter.

2.AvaTrade

AvaTrade Is a Forerunner in Online Trading Since 2006 With 9 regulations across 6 continents, we are one of the most secure brokers in the industry. We provide a diverse range of assets, leading platforms, and favorable trading terms.

AvaTrade is dedicated to empowering people to invest and trade with confidence in an innovative and dependable environment, backed up by best-in-class personal service and unwavering honesty.

3.eToro

eToro is a trading and investing platform that allows you to expand your knowledge and fortune as a member of a global community. Everyone wants their money to work harder. Some of us are new to this, while others are more seasoned, but we all wish we could perform better.

eToro was formed in 2007 with the idea of creating a world in which anybody could trade and invest in a simple and transparent manner. We believe that shared information has tremendous power. As a result, we’ve established an investment community centered on social collaboration and investor education. platform is intended to give you the tools you need to expand your knowledge and riches.

4.XTB

They are one of the world’s major stock exchange-listed FX and CFD brokers, giving retail traders quick access to hundreds of global marketplaces. With nearly 20 years of expertise, XTB is one of the world’s largest stock exchange-listed FX & CFD brokers.

They have offices in more than 13 countries, including the United Kingdom, Poland, Germany, France, and Chile. XTB aspires to give our clients with the finest trading experience possible, and our basic principles are closely connected with that objective.

5.IG

You’ve arrived to the correct location. Using CFDs, we enable thousands of traders to capitalize on opportunities in indices, currency, stocks, and other markets. More traders place their trust in us than anywhere else, making us the world’s leading CFD provider1.

In addition to placing a priority on the security of client money, IG International is licensed by the Bermuda Monetary Authority to conduct investment and digital asset transactions. We want our customers to stick with us. As a result, we’ve structured our company around being on your side and wanting you to trade profitably.

6.CMC Markets

They strive to maintain tight spreads regardless of market volatility, while also providing competitive and dependable pricing. They provide competitive spreads across the board, starting as 0.5 pips on EUR/USD.

1 point on important indexes including the UK 100, and 0.2 points on Gold. Our currency margin rates begin at 3.3%, indices and commodities at 5%, and shares and treasuries at 20%.

7.Plus500

Plus500 is a multinational multi-asset fintech company that operates trading platforms based on proprietary technologies. Plus500 provides a variety of trading products to customers, including Contracts for Difference (“CFDs”) and Share dealing, as well as futures trading in the United States through Plus500US. Plus500 has a premium listing on the London Stock Exchange’s Main Market (symbol: PLUS) and is a component of the FTSE 250 index.

Plus500CY Ltd provides the Plus500 trading platform. As a result, the financial instruments described or offered on this website are issued and sold by Plus500CY Ltd. Plus500CY Ltd is a Cyprus-based firm with headquarters in Limassol. The Cyprus Securities and Exchange Commission (CySEC) has authorized and regulated the company under license no.

8.FXTM

Forex (commonly known as FX) is the global marketplace for buying and selling foreign currencies. This market is worth more than $6 trillion each day, with central and private banks, hedge funds, dealers, and tourists operating.

Throughout the world 24 hours a day, 5.5 days a week, exchanging money at various prices. Currency prices change every second, providing investors with an infinite number of trade chances. And investors attempt to profit by properly anticipating the price changes of several pairs.

9.HFM

HFM is a multi-award winning forex and commodities broker that offers trading services and facilities to retail and institutional clients. HFM has positioned itself as the forex broker of choice for traders globally by delivering the best possible trading conditions to its clients and enabling both scalpers and traders utilizing expert advisers unlimited access to its liquidity.

HFM provides a variety of account types, trading software, and tools to help individuals and institutions trade Forex and derivatives online. All Retail, Affiliate, and White Label clients have access to varied spreads and liquidity via cutting-edge automated trading platforms.

10.OctaFX

Overall, OctaFX is a reliable and worthwhile broker, with a trust score of 90 out of 100. OctaFX’s trading fees are highly competitive, and its low spreads round out its services. CySEC regulates and authorizes the domain octafx.eu.

11.Saxo Bank

The largest online trading platform connecting investors and traders to global financial markets is provided by Saxo. Clients get secure access to over 71,000 financial instruments as a fully regulated and licensed independent supplier. At Saxo, believe that investing sparks a new sense of wonder for the world around you.

You will interact with new companies, towns, and possibly even countries after discovering an innate urge within to actively learn, investigate, and ask questions. This may be described as a hunger for new knowledge and abilities. Curiosity is what we call it. Ultimately, everything we do as a firm is geared around getting curious individuals invested in the world by providing more options for our clients to make more money.

12.Fusion Markets

Fusion Markets was created by Australian FX industry professionals. With over 50 years of combined experience,objective is to build a broker who follows a few fundamental principles Reduce dramatically the cost of trading forex, CFDs, and other financial products.

Friendly assistance for all levels of experience. Utilize cutting-edge technology to assist in providing a flawless trading experience.

13.Capital.com

For decades, financial services have been run by and for the wealthy. Capital.com’s founders intended to change that. goal was to upend traditional finance in order to make trading more accessible. They set out to provide people with access to the financial markets. From this basic notion arose a revolution a revolution driven by ordinary people.

Who took control and changed their lives, their financial futures, and, most significantly, the destiny of the globe. When retail investors began rallying behind Tesla to help build one of the world’s most valuable companies, they were investing in more than simply a growth stock with groundbreaking technology; they were investing in the promise of a better, more sustainable future.

14.IC Markets

IC Markets Global is a well-known Forex CFD provider, providing trading solutions for both active day traders and scalpers, as well as traders new to the forex market. IC Markets Global provides cutting-edge trading platforms, low latency connectivity, and exceptional liquidity to its clients.

IC Markets Global is changing the face of online forex trading. Traders now have access to pricing that was previously exclusively available to investment banks and high-net-worth individuals. executive team has extensive experience in the Asian, European, and North American Forex, CFD, and equity markets. This experience has allowed us to select the best technology solutions and handpick some of the best pricing providers in the market.

15.Trade Nation

Trade Nation was founded in 2014. We’ve grown from a team of 10 devoted employees to over 120 now, thanks to our award-winning reputation for our market-leading low-cost trading service. We’ve grown from two tiny offices in London and Sydney to a global firm with teams in the United Kingdom, Australia, South Africa, the Seychelles, Malaysia, and The Bahamas.

Executive team has over 200 years of industry expertise! So we know what we’re doing. Our number one objective, in particular, is to protect our customers’ money. Trade Nation will never combine its own funds with those of its clients.

16.Global Prime

Global Prime was created in 2010 to primarily address a growing institutional appetite for MT4 Forex trading at the time. They opened doors to retail clients in 2011 and have never looked back.

In just 12 years, we’ve expanded to serve thousands of clients worldwide and become the industry’s top-rated broker*. objective is to continue democratizing access to global financial markets. As a result, try to provide a wide selection of products with extremely low trading expenses and no minimum account size.

17.Tickmill

Tickmill is a trading name of Tickmill Ltd, a subsidiary of the Tickmill Group and a member of the Seychelles Financial Services Authority (FSA). Tickmill has established itself as a trusted market leader and innovator thanks to a track record of good financial results and sustained growth.

Team members have trading experience that dates back to the 1980s and have successfully traded on all major financial markets from Asia to North America.Our objective is to serve retail and institutional clients all over the world with an amazing trading environment that allows them to fulfill their full potential.

18.Pepperstone

We understand what it’s like to trade at Pepperstone. We’re here to provide you with everything you need to take on the global markets with confidence, with the scale of a global fintech and the agility of a start-up. Pepperstone was started in 2010 in Melbourne, Australia by a group of seasoned traders who were united in their desire to better the world of online trading.

They set out to deliver superior technology, low-cost spreads, and a genuine commitment to helping traders throughout the world master the trade after being frustrated by delayed executions, costly prices, and inadequate customer service.

19.FP Markets

FP Markets is a global Financial Technology services Foreign Exchange (Forex) and Contracts for Differences (CFD) broker that has been established and regulated since 2005. We take pleasure in providing an amazing trading experience and have been named the #1 Value Global Forex Broker* on numerous occasions.

Forex traders understand the significance of trading with a regulated universal broker in the Forex market because it entails FP Markets adhering to some of the most stringent international regulations imposed by the Australian Securities and Investment Commission (ASIC), the Cyprus Securities and Exchange Commission (CySEC), and the European Securities and Markets Authority (ESMA).

20.Axi

We grew from a two-person startup in 2007 to an industry-leading online trading enterprise trusted by 60,000+ consumers. We understand what you want because we are merchants ourselves.

Whether you’re a novice or a seasoned trader, we provide you with narrow spreads, lightning-fast execution, cutting-edge tools, and award-winning customer service. We are also licensed and regulated, with consumers in over 100 countries.

Conclusion Best Forex Brokers In Iceland

In Conclusion, when looking for the finest Forex brokers in Iceland, numerous important elements must be considered. To begin, regulatory compliance should be prioritized, and brokers operating in Iceland should follow the tight criteria established by the Icelandic Financial Supervisory Authority (FME).

Traders should also seek for brokers who provide reasonable spreads, a diverse variety of currency pairs, and strong trading interfaces with advanced analytical tools. Customer service and dependability are also essential, as the Forex market operates 24 hours a day, 7 days a week, and assistance may be required at any moment.

Finally, it is critical to evaluate the broker’s reputation, customer ratings, and industry track record. While the possibilities for Forex trading in Iceland may be limited due to the country’s small market, a comprehensive examination of these variables can assist traders in selecting the ideal broker that matches their trading objectives and preferences.

FAQ Best Forex Brokers In Iceland

What is a Forex broker, and why do need one in Iceland?

A Forex broker is a financial intermediary who facilitates currency trading in the foreign exchange market for individuals and corporations. To gain access to the global currency markets and engage in currency trading, you must first choose a Forex broker in Iceland.

Are Forex brokers legal in Iceland?

Yes, Forex brokers are legally permitted in Iceland. To ensure your safety and compliance with local laws, use a broker authorized by the Icelandic Financial Supervisory Authority (FME).

Which Forex brokers are regulated in Iceland?

The Icelandic Financial Supervisory Authority (FME) regulates some Forex brokers. For a list of regulated brokers, consult the FME or the broker’s website.

What are the most popular currency pairs for trading in Iceland?

Popular currency pairs for trading in Iceland include EUR/USD, GBP/USD, USD/JPY, and EUR/GBP. However, based on your strategy and tastes, you can trade a wide selection of currency pairs.

What are the typical fees associated with Forex trading in Iceland?

Spreads (the difference between the buy and sell prices), commissions (on specific accounts), and overnight financing charges (swap rates) are all examples of forex trading fees in Iceland. Make sure you understand your broker’s charge structure.

What are some recommended Forex brokers in Iceland?

Forex brokers that have formerly catered to Icelandic traders include XM, FXTM, and IG. When selecting a broker, however, always undertake thorough research and evaluate your unique trading demands.