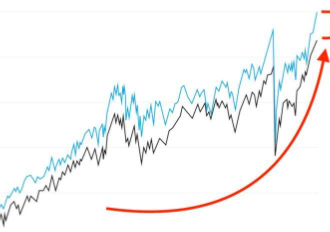

In this piece, I will share the Best European Dividend Stocks with a stable income source and potential in long-term wealth creation.

- Why It Is European Dividend-Paying Stocks Matter?

- Key Point & Best European Dividend-Paying Stocks List

- 1. Stellantis (STLA)

- Stellantis (STLA) Features

- Stellantis (STLA) Pros & Cons

- 2. Nordea Bank (NDA SE)

- Nordea Bank (NDA SE) Features

- Nordea Bank (NDA SE) Pros & Cons

- 3. Zurich Insurance Group (ZURN)

- Zurich Insurance Group (ZURN) Features

- Zurich Insurance Group (ZURN) Pros & Cons

- 4. Telekom Austria (TKA)

- Telekom Austria (TKA) Features

- Telekom Austria (TKA) Pros & Cons

- 5. Swiss Re (SREN)

- Swiss Re (SREN) Features

- Swiss Re (SREN) Pros & Cons

- 6. Holcim (HOLN)

- Holcim (HOLN) Features

- Holcim (HOLN) Pros & Cons

- 7. HEXPOL (HPOL B)

- HEXPOL (HPOL B) Features

- HEXPOL (HPOL B) Pros & Cons

- 8. freenet AG (FNTN)

- freenet AG (FNTN) Features

- freenet AG (FNTN) Pros & Cons

- 9. Evolution AB (EVO)

- Evolution AB (EVO) Features

- Evolution AB (EVO) Pros & Cons

- 10. DKSH Holding (DKSH)

- DKSH Holding (DKSH) Features

- DKSH Holding (DKSH) Pros & Cons

- Conclusion

- FAQ

European firms in the banking, insurance, telecom, cars, and construction sectors have reliable dividends, with a solid foundation.

If you are a conservative investor or are after a balanced portfolio, these stocks suit passive income generation and allow taking advantage from the stable Europe market.

Why It Is European Dividend-Paying Stocks Matter?

Steady Income Stream: Rather than only seeing the gains of these stocks when you sell them for more than you paid, dividend stocks pay out cash, which can be used, or reinvested for more gains.

Financial Stability: Consistent dividend-paying companies are generally of good dividend-paying companies are generally major players.

Lower Volatility: Dividend stocks are more stable when comparing to non-dividend stocks, which helps during times of downturn.

Attractive for Long Term Investors: Ideal for growing wealth over considerable times, dividend stocks are preferable for reinvestment plans.

Sign of Confidence: Shown by regular dividends, the confidence in future earnings by management is a show of the company’s belief in value to shareholders.

Key Point & Best European Dividend-Paying Stocks List

| Company | Key Point |

|---|---|

| Stellantis (STLA) | Global automotive manufacturer formed by FCA & PSA merger; owns brands like Jeep, Peugeot, Fiat |

| Nordea Bank (NDA SE) | Leading Nordic bank providing retail, corporate, and investment banking services |

| Zurich Insurance Group (ZURN) | Global insurance and risk management provider operating in over 210 countries |

| Telekom Austria (TKA) | Major telecom provider in Austria & Central and Eastern Europe |

| Swiss Re (SREN) | One of the world’s largest reinsurance companies offering risk solutions globally |

| Holcim (HOLN) | Global leader in cement, aggregates, and concrete for construction and infrastructure |

| HEXPOL (HPOL B) | Polymer compounding company serving automotive, industrial, and consumer sectors |

| freenet AG (FNTN) | German telecom retailer providing mobile services and digital products |

| Evolution AB (EVO) | Leading global provider of live casino and online gaming solutions |

| DKSH Holding (DKSH) | Market expansion services company focused on distribution, marketing, and logistics in Asia |

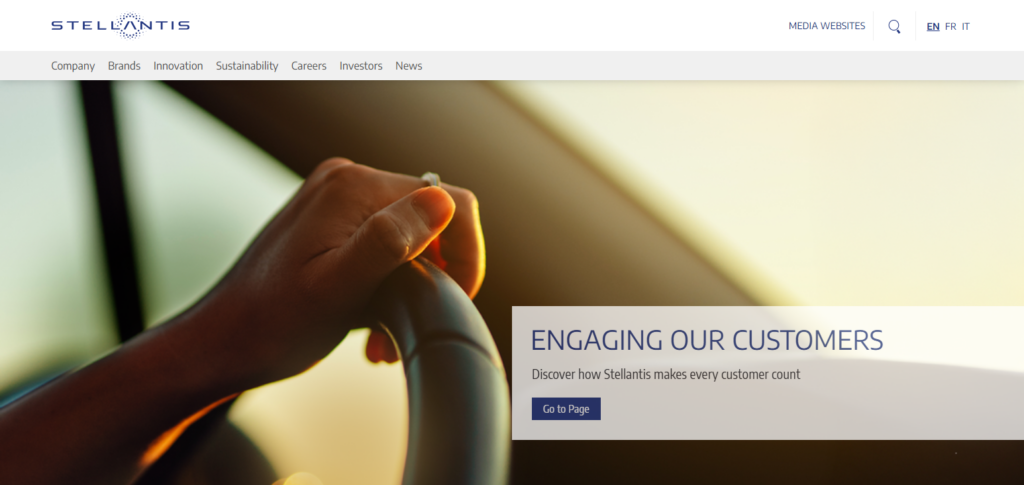

1. Stellantis (STLA)

Stellantis Inc. is one of the world’s Best European Dividend-Paying Stocks automotive manufacturers. Stellantis is a company formed from the merger of FCA and PSA in 2021.

Stellantis is one of the leading automotive manufacturers and has hosted a global presence operating in multiple regions and creating and merchandising cars, sport utility vehicles and commercial vehicles, and trades in vehicles from various famed brands like jeep, Peugeot, Fiat, and Opel since with headquarters in Netherlands, across all countries of Stellantis operates within the Netherlands.

Stellantis has a high global presence and brand diversity making dividend distributions very stable. Stellantis is also recognized as one of Europe’s dividend-paying stocks.

Stellantis (STLA) Features

Brand Exposure – Has exposure to many markets with brands like Jeep, Peugeot, and Fiat.

Flow of Cash – Cash flow keeps and supports the business and dividends.

Sustainable Mobility – Focuses on and invests in sustainable electric vehicles.

Stellantis (STLA) Pros & Cons

| Pros | Cons |

|---|---|

| 1. Global brand portfolio with diversified market exposure. | 1. Automotive industry is cyclical and sensitive to economic swings. |

| 2. Consistent dividend payouts supported by strong cash flow. | 2. High R&D and electrification costs may impact profitability. |

| 3. Growing focus on electric vehicles and sustainable mobility. | 3. Supply chain disruptions can affect production and revenue. |

| 4. Large market share in multiple regions. | 4. Regulatory changes in emission standards may increase costs. |

| 5. Innovation in technology and autonomous vehicles. | 5. Competitive automotive market can pressure margins. |

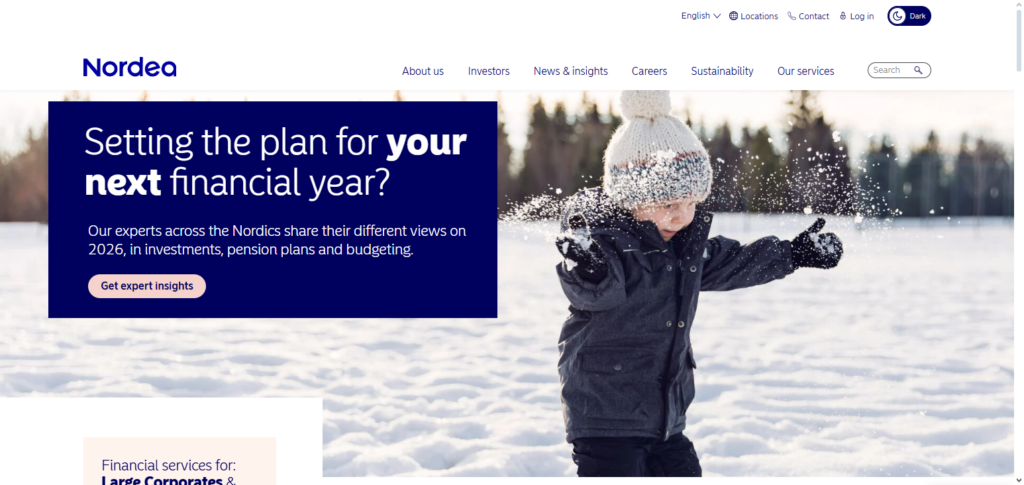

2. Nordea Bank (NDA SE)

Nordea Bank is a benchmark in the financial industry across the Northern Europe offices and is headquartered in Sweden, Stockholm Best European Dividend-Paying Stocks.

Nordea Bank is an all-service financial institution, and offers their customers the following, retail, corporate, and investment banking, with ancillary services like loans and deposits, asset management, and insurance.

Because of a strong emphasis in sector digitalization, Nordea Bank invests in and improves the technological services that modernize banking.

Nordea Bank maintains a strong capital position, and consistently dividend to their stockholders. Because of their strong position in the industry and the stable environment of the Northern Europe offices, Nordea Bank becomes a valuable option for dividend investors.

Nordea Bank (NDA SE) Features

Strong Presence – Has a strong influence in the Nordic countries of Sweden, Finland, Denmark, and Norway.

Strong Payout – Has a strong balance sheet and issues reliable dividends.

Financing – Specialized in digital and sustainable banking.

Nordea Bank (NDA SE) Pros & Cons

| Pros | Cons |

|---|---|

| 1. Strong presence in stable Nordic markets. | 1. Sensitive to interest rate fluctuations affecting margins. |

| 2. Consistent dividend yield backed by solid balance sheet. | 2. Regulatory compliance costs can be high. |

| 3. Diversified banking services: retail, corporate, private. | 3. Exposure to credit risk from loans and corporate clients. |

| 4. Digital transformation and fintech adoption. | 4. Intense competition in banking sector. |

| 5. Sustainable finance initiatives improving ESG profile. | 5. Economic downturns may impact profitability. |

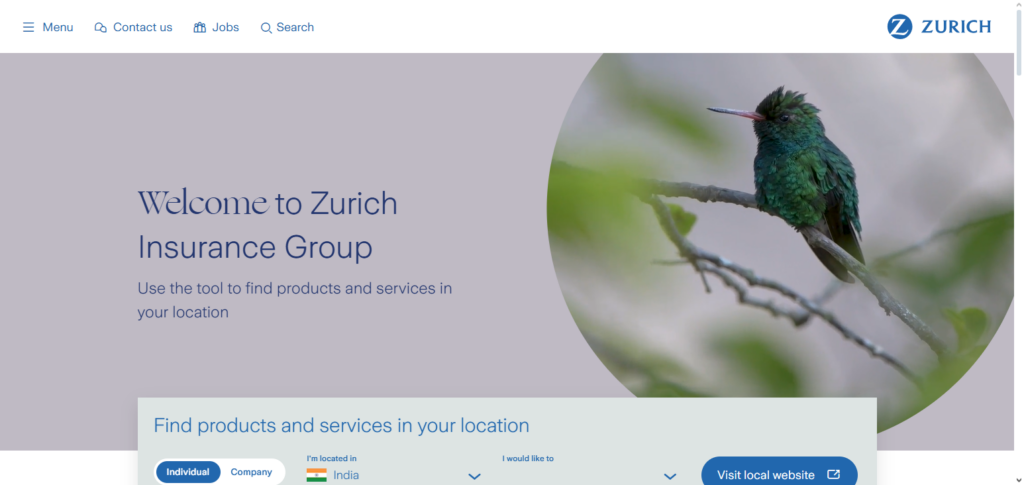

3. Zurich Insurance Group (ZURN)

Zurich Insurance Group operates out of Switzerland and is among the Best European Dividend-Paying Stocks in the insurance and risk management industries. Zurich offers life, property, and casualty, general insurance as well as risk management to individuals, companies, and establishments in over 210 countries.

Zurich has a reputation for excellent financial health and responsible underwriting as well as a diversified business strategy. Investors who focus on dividends appreciate the company’s consistent dividend payouts which are a direct result of the company’s stability and steady profitabilty.

The company has a global market presence and focuses on long-term growth. Zurich is among the top dividend paying insurance companies within the European region. Zurich Insurance Group has a solid financial reputation, stable and consistent dividends, and global market presence within the insurance industry.

Zurich Insurance Group (ZURN) Features

Global Reach – Provides life, property, and casualty insurance to customers all over the world.

Strong Financials – Their strong financial situation allows them to consistently keep dividend payouts.

Unique Insurance – Has top tier underwriting with advanced insurance.

Zurich Insurance Group (ZURN) Pros & Cons

| Pros | Cons |

|---|---|

| 1. Global operations diversify risk across regions. | 1. Vulnerable to catastrophic events and claims volatility. |

| 2. Consistent dividend history. | 2. Regulatory and compliance requirements are stringent. |

| 3. Expertise in risk management and underwriting. | 3. Investment market fluctuations can affect profits. |

| 4. Innovative insurance products including climate risk solutions. | 4. Competition in global insurance markets. |

| 5. Strong brand reputation and financial stability. | 5. Long claims settlement cycles may affect cash flow. |

4. Telekom Austria (TKA)

Austria Telekom holds the position as the most dominant telecommunication enterprise in Best European Dividend-Paying Stocks. Their services include wireless and broadband and information communication services. Their services and products include cloud computing as well as high speed and digital television.

With a network covering many areas of Central and Eastern Europe, they service many millions of customers. Telekom continues to report net income and continues to invest in modernizing the network for 5G.

This stable cash flow position enables consistent regular net income distributions on a quarterly basis to the net income freedom shareholders for the firm. The firm is an industry leader in the telecommunications market for Europe, making the firm an ideal candidate for net income production in telecom sector as Telekom Austria shows firm dominance in the subscriber base.

Telekom Austria (TKA) Features

Mobile Networks – Operates some of the largest broadband and mobile networks in the country.

Predictable Revenue – They can always be relied on to deliver consistent and predictable revenue.

Digital – They put money into solutions like enterprise, IPTV, and data.

Telekom Austria (TKA) Pros & Cons

| Pros | Cons |

|---|---|

| 1. Established telecom infrastructure in Austria and Central Europe. | 1. Regulatory pressures in telecom can limit pricing flexibility. |

| 2. Stable dividend payouts supported by recurring revenue. | 2. Intense competition from other telecom providers. |

| 3. Expansion in digital services like IPTV and enterprise solutions. | 3. High capital expenditure for network upgrades. |

| 4. Strong market position in Austria. | 4. Slower growth in mature telecom markets. |

| 5. Recurring income from mobile and broadband subscriptions. | 5. Risk of technological disruption with new communication tech. |

5. Swiss Re (SREN)

Swiss Re provides property and casualty insurance Best European Dividend-Paying Stocks. Their services also include reinsurance for life as well as health insurance and they are one of the largest provided of reinsurance in the world as well as the largest in Europe.

Swiss Re has strong risk management systems, along with a firm basis of contrained capital to form a stable and reliable candidate for consistent quarterly net income dividends for their shareholders.

The firm has an esperanto base which positions the firm well to present a firm base for net income in the insurance sector and is one of the leading candidates for production of net income in Europe.

Swiss Re (SREN) Features

Global Reinsurers. Reinsurers, including Swiss Re, offer multiple lines including property and casualty, in addition to life reinsurance.

Dividends. Swiss Re has provided dividends consistently.

Innovation and Risk Solution. Emerging risks, climate, and catastrophes are their focus areas.

Swiss Re (SREN) Pros & Cons

| Pros | Cons |

|---|---|

| 1. Global reinsurance market leader. | 1. Exposure to large catastrophic events. |

| 2. Reliable dividend history. | 2. Sensitivity to interest rate and market fluctuations. |

| 3. Expertise in risk management and analytics. | 3. Regulatory compliance requirements are complex. |

| 4. Innovative products for emerging risks and climate. | 4. Competitive reinsurance market. |

| 5. Diversified global operations. | 5. Complexity of business model may challenge new investors. |

6. Holcim (HOLN)

Headquartered in Switzerland, Holcim is a global leader in construction materials such as cement, aggregates, concrete, and other infrastructure construction solutions Best European Dividend-Paying Stocks.

The company has operations in Europe, North America, South America, Asia, and Africa, providing geographic diversification. Holcim is dedicated to sustainable construction and efficient growth, and as a result, the company is focused on decreasing its emissions while growing. Income investors appreciate Holcim’s stable revenue and profitability.

As a Holcim’s European dividend-paying stock, investors receive steady income, construction sector exposure, and potential long-term growth, making Holcim ideal for conservative and value investors.

Holcim (HOLN) Features

Global Producer. Produces and sells ready mix concrete, cement, and aggregates.

Sustainable Development. Developed low-carbon construction and eco-friendly solutions.

Consistency of Dividends. Consistent dividends owing to strong infrastructure demand.

Holcim (HOLN) Pros & Cons

| Pros | Cons |

|---|---|

| 1. Global presence in building materials and infrastructure. | 1. Cyclical demand linked to construction markets. |

| 2. Focus on sustainable and eco-friendly solutions. | 2. Commodity price volatility can affect costs. |

| 3. Stable dividend payments. | 3. High capital expenditure for production and logistics. |

| 4. Strong operational efficiency and supply chain. | 4. Environmental regulations increase compliance costs. |

| 5. Exposure to growing infrastructure demand globally. | 5. Competition from regional building material producers. |

7. HEXPOL (HPOL B)

Headquartered in Sweden, HEXPOL is a global polymer compounding company in the automotive, industrial, and consumer Best European Dividend-Paying Stocks. HEXPOL manufactures automotive parts, industrial equipment, and consumer products.

HEXPOL sustains its competitive advantage through their focus on innovation, R&D, and environmental sustainably. The company is able to make consistent dividend payments due to revenue growth and profitability.

HEXPOL is an attractive European dividend-paying stock in the materials and industrial sector due to its steady revenue and niche polymer compounding. HEXPOL enhances long-term value for shareholders through their commitment to quality and environmental sustainably.

HEXPOL (HPOL B) Features

Automobile, Healthcare, and Healthcare. Produces polymer and rubber for the industrial, automotive, and healthcare industry.

Reliability of Dividends. Their dividends are stable as their performance is reliable.

Research and Development. Especially in sustainable materials and polymers.

HEXPOL (HPOL B) Pros & Cons

| Pros | Cons |

|---|---|

| 1. Leading polymer and rubber manufacturer. | 1. Cyclical demand in industrial and automotive sectors. |

| 2. Consistent dividend payments. | 2. Raw material price fluctuations affect margins. |

| 3. Strong R&D and innovation in specialty materials. | 3. Dependence on automotive and industrial clients. |

| 4. Global customer base across multiple sectors. | 4. Environmental compliance costs can be high. |

| 5. Sustainable and innovative materials focus. | 5. Currency fluctuations can affect international revenue. |

8. freenet AG (FNTN)

Freenet AG is one of Germany’s telecom and digital services leaders Best European Dividend-Paying Stocks.

Offering consumers and businesses cellular phone contracts, internet connectivity, and IT products, freenet AG has a strong retail and online distribution presence throughout Germany. As stable and profitable businesses normally do, freenet AG pays dividends regularly, ensuring a steady income stream for investors.

freenet AG is a dividend payer, and as such, it offers investors positive cash flow along with necessary diversification into the telecom sector. Furthermore, the dividends and capital growth freenet AG pays are as a result of positive growth Germany’s digital services and technology.

freenet AG (FNTN) Features

Telecommunications. Spanning broadband, mobile, and digital content in Germany.

Recurrence of Revenue. Revenue from subscriptions and contracts is stabilized.

Dividends. Consistent cash flow allows for stable dividends.

freenet AG (FNTN) Pros & Cons

| Pros | Cons |

|---|---|

| 1. Strong presence in German telecom market. | 1. Highly competitive telecom environment. |

| 2. Stable dividends supported by recurring revenue streams. | 2. Regulatory restrictions on telecom services. |

| 3. Growth in digital services and bundled offerings. | 3. Slower growth in mature domestic market. |

| 4. Reliable customer base with subscription models. | 4. Technological advancements require continuous investment. |

| 5. Predictable cash flow for operations. | 5. Pressure on margins from price competition. |

9. Evolution AB (EVO)

Evolution is a world-wide leader of online gaming and real-time, live-action gaming in the sector Best European Dividend-Paying Stocks. Based in Sweden, Evolution produces streaming real-time casino games that provide gaming experiences to a worldwide audience.

Evolution’s positive and growing market share results from the diversification of products within the company. Strong financial performance and high profitability allow Evolution AB to offer dividends, and to Evolution AB shareholders/dividend investors, Evolution AB is a positive investment in the online gaming sector.

Furthermore, Evolution AB is an attractive investment as a growing company that can provide investors with both dividends and capital appreciation.

Evolution AB (EVO) Features

Leader in Live Casino. Their market for live casino and gaming is unmatched.

Cash Flow. Their dividends are supported by their high cash flow.

Global and Innovative. New gaming business solutions for unexplored regions.

Evolution AB (EVO) Pros & Cons

| Pros | Cons |

|---|---|

| 1. Market leader in live casino and online gaming. | 1. Regulatory dependence across different jurisdictions. |

| 2. High-margin business model supporting dividends. | 2. Competitive online gaming market. |

| 3. Strong cash flow and revenue growth. | 3. Currency exposure from international operations. |

| 4. Innovation in interactive gaming solutions. | 4. Risk of market saturation in certain regions. |

| 5. Expanding into new global markets. | 5. Limited diversification outside gaming sector. |

10. DKSH Holding (DKSH)

Also being one of the oldest companies in the field of market development services, DKSH started in Switzerland and is now focused on Asia Best European Dividend-Paying Stocks. Their distribution, marketing, and logistics services tailored for each customer facilitate growth of companies in Asia.

DKSH operates in the markets of healthcare, consumer goods, and technology and supplies to performance materials, which sufficiently diversifies their portfolio. DKSH possesses a number of services, knowledge, and reliable relations of partners, and that’s why the Revenue generation is high.

Cash flow operations ensure consistent payments of dividends. DKSH as a dividend stock provides unique coverage to the rising markets in Asia. This makes DKSH a valuable stock in a Dividend Portfolio, especially in Europe.

DKSH Holding (DKSH) Features

Market Expansion Services – Assists clients in the procurement, merchandising, and distribution across Asia.

Dividend Reliability – Reliable and consistent payments to investors of the company.

Diversified Business Model – Participates in the various sectors of the economy like healthcare, consumer products, and active materials with well-organized logistics.

DKSH Holding (DKSH) Pros & Cons

| Pros | Cons |

|---|---|

| 1. Leading market expansion services provider in Asia. | 1. Exposure to Asian economic cycles. |

| 2. Consistent dividend payouts. | 2. Currency fluctuations affect international earnings. |

| 3. Diversified services in healthcare, consumer goods, and materials. | 3. Competition from other distribution and logistics firms. |

| 4. Efficient supply chain and logistics solutions. | 4. Dependence on partner companies for revenue. |

| 5. Strong presence in fast-growing Asian markets. | 5. Slower growth in mature markets limits upside. |

Conclusion

To sum up, purchasing dividend-yielding shares in based European businesses means a steady inflow of income and means taking part in the growth of large stable businesses in various industries.

Stellantis, Nordea Bank, Zurich Insurance Group, and Holcim are dividend-yielding, stable, and have solid businesses with good dividends and dividends are optioned and are in with the strong basis and operations in various countries.

Evolution AB and HEXPOL atract long-term investors by growth. Having the right selection of sectors, to name a few: automotive, banking, insurance, telecom, materials, and technology, provides investors in the European market with a steady stream income and a diverse portfolio.

FAQ

What are dividend-paying stocks?

Dividend-paying stocks are shares of companies that distribute a portion of their profits to shareholders, typically on a quarterly or annual basis. These stocks provide a steady income stream in addition to potential capital appreciation.

Why invest in European dividend-paying stocks?

European dividend stocks offer stable income, exposure to well-established companies, and diversification across various industries such as banking, insurance, telecom, and automotive. They are often favored by long-term, income-focused investors.

Which sectors in Europe are known for strong dividends?

Key sectors include banking and financial services (Nordea Bank), insurance (Zurich Insurance Group, Swiss Re), telecommunications (Telekom Austria, freenet AG), automotive (Stellantis), construction and materials (Holcim, HEXPOL), and technology/gaming (Evolution AB).

Are European dividend stocks safe investments?

While dividend stocks generally offer stability, risks exist due to economic cycles, sector performance, and company-specific factors. Companies with consistent profitability, strong cash flow, and a history of regular dividends are considered safer.

How can I start investing in these stocks?

Investors can purchase shares through a brokerage account, either directly or via dividend-focused ETFs that track European dividend-paying companies. It’s important to research each stock’s dividend history, payout ratio, and financial health before investing.