I’ll go over the top embedded finance APIs for fintech app developers in this post. Without creating infrastructure from scratch, these APIs enable developers to easily incorporate banking, payments, lending, and card issuing into apps.

- Why It Is Embedded Finance APIs for Fintech App Developers Matter

- Key Point & Best Embedded Finance APIs for Fintech App Developers

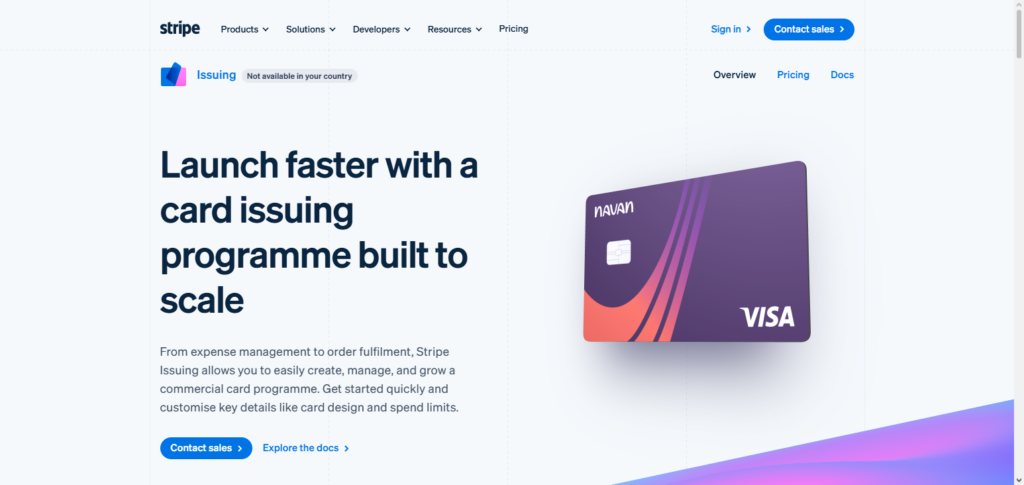

- 1. Stripe Treasury + Issuing

- Stripe, Treasury + Issuing Features, Pros & Cons

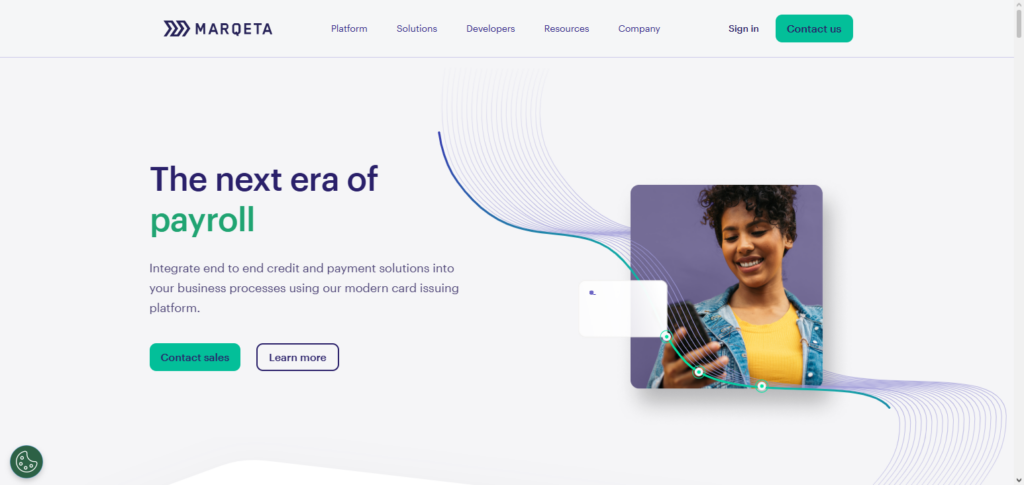

- 2. Marqeta

- Marqeta Features, Pros & Cons

- 3. Plaid

- Plaid Features, Pros & Cons

- 4. Solarisbank

- Solarisbank Features, Pros & Cons

- 5. Railsr (formerly Railsbank)

- Railsr (previously Railsbank) Features, Pros & Cons

- 6. Unit

- Unit Features, Pros & Cons

- 7. Mambu

- Mambu Features, Pros & Cons

- 8. FinBox

- FinBox Features, Pros & Cons

- 9. Rapyd

- Rapyd Features, Pros & Cons

- 10. Airwallex

- Airwallex Features, Pros & Cons

- Conclusion

- FAQ

Fintech apps may provide consumers worldwide with safe, scalable, and cutting-edge financial services by utilizing platforms such as Stripe Treasury, Marqeta, Plaid, and others.

Why It Is Embedded Finance APIs for Fintech App Developers Matter

Accelerated Time-to-Market: Finance APIs are embedded. Developers can quickly include banking, payments, and cards without having to build infrastructure from scratch. This means they can launch products faster.

Lower Compliance Burden: These APIs cover KYC, AML, and other compliance processes so that fintech developers can build features, rather than spend time learning and fulfilling legal process requirements.

Provides Scalable Financial Services: Cloud-based APIs allow developers to easily and efficiently scale as their user base grows, with accounts, wallets, cards, and payments.

Encourages Innovation and Customization: Embedded finance APIs offer customizable and programmable features. Apps that include spend control, lending logic, and loyalty can stand out in their market.

Improved User Experience: Now that finance is embedded in the app, users can manage money, make payments, borrow, and transact without leaving the app. This increases user engagement and retention.

Key Point & Best Embedded Finance APIs for Fintech App Developers

| Platform | Key Point |

|---|---|

| Stripe Treasury + Issuing | Enables businesses to offer banking services, issue cards, and manage money movement via Stripe’s API ecosystem. |

| Marqeta | Provides modern card issuing, payment processing, and programmable spend controls for fintechs and enterprises. |

| Plaid | Connects apps to users’ bank accounts for data access, identity verification, and payment initiation. |

| Solarisbank | German-based banking-as-a-service platform offering accounts, cards, and compliance infrastructure for fintechs. |

| Railsr (formerly Railsbank) | API-driven platform for digital banking, payments, and compliance solutions across multiple regions. |

| Unit | Offers embedded banking APIs for creating accounts, issuing cards, and managing payments in apps. |

| Mambu | Cloud banking platform for core banking operations, lending, deposits, and financial product management. |

| FinBox | Provides credit scoring, lending, and risk assessment tools for financial services and fintech apps. |

| Rapyd | Global fintech-as-a-service platform for payments, card issuing, and cross-border money movement. |

| Airwallex | Enables businesses to manage multi-currency accounts, payments, and card issuance globally. |

1. Stripe Treasury + Issuing

Without collaborating with conventional banks, Stripe Treasury + Issuing enables companies to incorporate banking functionalities straight into their apps, facilitating the creation of accounts, fund management, and card issuance.

Developers may programmatically manage compliance, automate money transfers, and regulate card usage with its powerful API. Stripe Treasury, one of the Best Embedded Finance APIs for Fintech App Developers, guarantees the smooth integration of financial services into apps while offering fraud protection and real-time reporting.

It is a popular option for fintechs looking to provide complete banking operations without creating the backend from scratch because of its scalable architecture, global reach, and dependability.

Stripe, Treasury + Issuing Features, Pros & Cons

Features

- Issuing of cards (virtual & physical) + card management

- Account management (banking)

- Movement of money / Account payouts

- APIs of reporting & balance on money, real-time

- Risk controls & compliance

Pros

- Stripe’s ecosystems deep integration

- Document support and SDK of developer’s support

- Scalable from startups to enterprise level

- Regulatory compliance facilitated by the platform

- Support of global infrastructures + uptime

Cons

- Startups face fee challenges

- Lending features are minimal

- Default markets of Stripe are the focus

- Banking functions are partner reliant

- Core banking functionality is not present

2. Marqeta

One of the most modern card issuing and payment processing platforms, Marqeta, allows enterprises and fintechs to build customizable programs around debit, credit, and prepaid cards. With products such as an open API, instant card provisioning, real-time controls on transactions, and security tokenization, Marqeta also helps apps create flexible spending, loyalty, and expense management features.

Margeta is also one of the best embedded finance APIs for fintech app developers. Its programmability, global issuing, and compliance support, make Marqeta one of the most favored card-based financial services innovators, especially among neobanks, gig economy platforms, and marketplaces.

Marqeta Features, Pros & Cons

Features

- New card issuance on API

- Real-time control & authorization programs

- Tokenization, and security

- Works debit, and credit (Pre-paid) & debit card

- Lifecycle management of cards SDKs

Pros

- Control cards programmable

- Settlement & funding options

- Spend & rewards analytics are excellent

- Advanced protection against fraud

- Seamless integration with fintech and marketplace models

Cons

- Lack of comprehensive banking or account-hosted services

- Costs may increase with sales volume

- Onboarding can be lengthy based on the region

- Developers need to build additional systems for complete platform integration

- Minimal peer-to-peer banking options

3. Plaid

Plaid allows apps to securely connect to users’ bank accounts. These services include account verification, balance checking, transaction history, and identity verification. Because of services such as ACH payment facilitation and fraud risk reduction, and the streamlining of onboarding process, fintech allows apps to effortlessly integrate with new users.

In addition to a rapidly growing international network, Plaid’s extensive U.S. banking partnerships provide developers with a banking-related fintech solution. It offers real-time financial data to users, which is why most personal finance apps, lending services, and investment management firms use it.

Plaid Features, Pros & Cons

Features

- Access to bank accounts

- APIs for transactions and balances

- ID verification

- Support for authentication and payment initiation

- Supports multiple banks

Pros

- Very large banking system coverage

- Rapid syncing of data

- Eases KYC / risk management processes

- Excellent SDKs and documentation

- Reliable reputation within the fintech space

Cons

- Quality of bank access connectivity can be an issue

- Very expensive at larger scales

- Mainly acts as a data level, not a complete banking backend

- Limited options for payment orchestration

- Support in certain areas is underdeveloped

4. Solarisbank

Solarisbank is an example of a Banking-as-a-Service (BaaS) provider. Solarisbank offers accounts, card issuance, and other compliance-related services to fintechs. In addition to regulatory-banked services, embedded finance apps have access to payment, lending, and identity solutions through the integration of Solarisbank APIs.

From a compliance perspective, embedded finance apps have access to payment, lending, and identity solutions through the integration of Solarisbank APIs. Fintechs building neobanks, lending platforms, or digital wallets to focus on the user experience, not on complex banking systems or backend solutions, and rely on the rapid deployment of new products.

Solarisbank Features, Pros & Cons

Features

- Banking as a Service platform

- Digital accounts and IBANs

- KYC and compliance tools

- Issuing and processing of cards

- Modules for lending and credit

Pros

- Complete regulatory coverage of bank licensing

- Comprehensive coverage in Europe

- Robust, modular APIs

- Built-in compliance and reporting features

- Excellent for complete digital banking solutions

Cons

- Takes time to integrate

- Has EU region focus

- Compared to plug-and-play, takes longer to go to market

- May need more advanced technical skills

- Not as ideal for basic payments

5. Railsr (formerly Railsbank)

Railsr (formerly Railsbank) is a global banking and compliance platform that provides APIs for payments, digital banking, and managing financial accounts. In addition, it provides card issuance, virtual IBANs, and cross-border payments.

Best Embedded Finance APIs for Fintech App Developers, Railsr enables developers of Fintech apps to incorporate banking features without the necessity of creating fundamental banking systems.

With a modular API design and worldwide connectivity, developers can use Railsr for apps requiring multi-currency capabilities and diverse compliance regulation. Many market-wallets and neobanks that want to worldwide financial services while preserving product and experience customization.

Railsr (previously Railsbank) Features, Pros & Cons

Features

- Financial services products API

- Bank accounts & card issuance

- Wallets & virtual IBANs

- Payments (cross-border)

- KYC and compliance

Pros

- Platform has global flexibility

- Financial modular building blocks

- Perfect for marketplaces & fintech

- Supports multiple currencies

- Included strong compliance engine

Cons

- Features are region-specific

- Complexity implies learning curve

- For some apps, simplicity is preferred

- Pricing is not transparent

- Needs strong technical resources

6. Unit

Fintech companies may offer accounts, payments, lending, and card issuance right within their apps thanks to Unit’s embedded banking APIs. Its platform makes fund management, KYC verification, and compliance easier.

The most adaptable of the Best Embedded Finance APIs for Fintech App Developers, Unit supports a wide range of financial products, including digital wallets, credit lines, and savings accounts.

Unit’s capacity to shorten time-to-market while offering a safe, completely compliant banking backend is advantageous to startups and scale-ups. Fintechs creating embedded finance solutions with an emphasis on user experience and operational efficiency frequently use it because of its developer-friendly documentation and modular services.

Unit Features, Pros & Cons

Features

- Banking APIs embedded

- Wallets & deposit accounts

- APIs for credit & lending

- Card issuance

- Reporting and compliance tools

Pros

- Fintech companies can onboard quickly

- Excellent embedded finance design

- Documentation & support are good

- Overhead is reduced due to built-in compliance

- Rapid prototyping is possible

Cons

- Not all companies are as global as competitors

- Some APIs are basic to start

- For payments, partner integrations may be needed

- Less complex analytics

- Not always the cheapest

7. Mambu

Mambu provides the tools fintechs and other financial institutions need to start, operate, and scale digital banking and lending products via a cloud-native core banking platform. Mambu covers deposit accounts, loans, and orchestration of financial products.

Mambu provides banking features to embedded finance app developers while giving app owners control over the product logic and customer experience.

Heavily operational costs are decreased with Mambu’s SaaS model, and the platform is fast to deploy and highly scalable. Mambu’s ecosystem is best suited for fintechs, neobanks, and credit providers who want to improve banking systems, and fully automate financial service to customers without the restraints of a legacy system.

Mambu Features, Pros & Cons

Features

- Core banking engine in the cloud

- Builder for lending products

- Support for deposit & savings accounts

- Architecture that’s API-first

- Tools for orchestration of workflow

Pros

- Excellent for lending & banking

- Enormous product complexity flexibility

- Accommodates large financial ecosystems

- Operational tools are good

- Cloud SaaS lessens infrastructure burden

Cons

- More build work is needed initially

- By itself, no payments processing

- No direct APIs to issue cards

- Full stack might need partners

- Apps that are small require more work

8. FinBox

FinBox is a fintech company in India and other developing markets that provides credit scoring, lending, and risk assessment APIs to businesses. Customers build apps that assess user creditworthiness using alternative data.

FinBox is one of the best embedded finance APIs for fintech app developers. It allows easy lending and credit decision capabilities to be integrated into apps. Its solutions enable digital onboarding and automated risk to be managed with instant approvals, simplifying operational processes.

With lending platforms, neobanks, and digital marketplaces, FinBox is aimed at offering instant credit with a decreased risk of default. The embedded finance apps benefit from their focus on compliance, analytics, and data-driven lending.

FinBox Features, Pros & Cons

Features

- APIs for risk and credit scoring

- Evaluation of alternative data

- Toolkit for loan origination

- Checking for fraud & compliance

- Financial profiling of customers

Pros

- Deciding credit is their strong suit

- Assists in lowering the risk of defaults

- Does well in developing countries

- Rapid workflows for decisioning

- Lending apps integrate easily

Cons

- Banking stack is not complete

- Payment capabilities are limited

- Focus is mainly on India / EM

- Not ideal for issuing cards

- Varying data sources regionally

9. Rapyd

Rapyd is an example of a global provider of fintech-as-a-service. This company offers APIs for global payments, card issuance, and international money transfers. They support a variety of payment methods and currencies, including wallets, bank transfers, and credit and debit cards.

They provide payment solutions for all legal jurisdictions, including the United States, the European Union, and other global regions. They are one of the best Embedded Finance APIs for Fintech App Developers.

They make it easy for app developers to add financial services to the app without obtaining international banking licenses. Rapyd is the go-to payment solutions provider for both large and small e-commerce businesses and international B2B service companies.

Rapyd Features, Pros & Cons

Features

- Payment acceptance globally

- Wallets for multiple currencies

- Solutions for card issuing

- Foreign Exchange Conversions

- Application Programming Interface (APIs)

Pros

- Effective support for multi-country business operations

- Numerous payment options

- Strong for marketplaces & platforms

- Integrated wallets & pay-in/out functionality

- Satisfactory tools for developers

Cons

- Varying support for different pricing models

- Needs regulatory compliance setup

- Additional partners for some capabilities

- Inconsistent quality of documentation

- Self-adjusting risk management controls

10. Airwallex

For companies of all sizes, Airwallex offers multi-currency accounts, card issuance, and cross-border payments. Developers may handle foreign transactions, FX conversions, and virtual or actual cards via its APIs. Fintech app developers can use Airwallex’s best embedded finance APIs to streamline international payments, enhance liquidity management, and provide multi-currency wallets.

Global financial alliances, competitive foreign exchange rates, and smooth integration are its main advantages. By integrating foreign financial capabilities into apps without having to deal with numerous banking partners, startups and expanding fintechs use Airwallex to streamline operations and provide end users with seamless, reasonably priced cross-border financial services.

Airwallex Features, Pros & Cons

Features

- Accounts with multiple currencies

- Foreign exchange and global payments

- Card issuance and management

- Treasury API (Application Programming Interface)

- Reporting and reconciliation

Pros

- Outstanding global foreign exchange and payments

- Strong treasury management features

- Excellent for international business operations

- Integrated reconciliation components

- Friendly for software developers

Cons

- Not the most economical options for every payment route

- KYC (Know Your Customer) documentation is necessary

- Less emphasis on pure lending

- Varying capabilities of the Application Programming Interface by region

- Not a fully functional core banking system

Conclusion

For fintech app developers who want to provide smooth banking, payments, and lending experiences without creating infrastructure from scratch, selecting the appropriate embedded finance API is essential.

While Marqeta is a leader in programmable card solutions, platforms like Stripe Treasury + Issuing and Unit are excellent at managing accounts and issuing cards. Solarisbank or Railsr offer fully compliant banking-as-a-service solutions, while Plaid offers dependable financial data connectivity.

Mambu and FinBox enable core banking and credit decision-making, while Rapyd and Airwallex streamline cross-border payments for global reach. Fintech developers may guarantee regulatory compliance, expedite time-to-market, and provide their users with creative, scalable financial experiences by utilizing these APIs.