I will discuss the Best DeFi Aggregators with Insurance Integration , emphasizing systems that offer decentralized finance investment opportunities together with integrated risk mitigation.

These aggregators provide protection against smart contract malfunctions, hacks, and protocol weaknesses while enabling users to manage assets, monitor yields, and access numerous protocols. They provide a safer and more effective approach to take part in DeFi by including insurance.

Key Point & Best DeFi Aggregators with Insurance Integration List

| Platform | Key Points |

|---|---|

| Zapper | Aggregates DeFi assets, dashboards for yield farming, integrates insurance tracking. |

| DeBank | Portfolio tracker, DeFi aggregator, supports cross-chain analytics. |

| DefiLlama | Tracks TVL across protocols, analytics for DeFi strategies, insurance coverage insights. |

| Bright Union | DeFi insurance aggregator, covers multiple protocols, minimizes KYC. |

| Tidal Finance | NFT and DeFi insurance, cross-chain coverage, low KYC requirements. |

| InsurAce | Insurance for DeFi projects, staking benefits, multi-chain support. |

| Sherlock Protocol | Smart contract auditing insurance, DeFi protocol protection, risk analysis. |

| Unslashed Finance | Comprehensive DeFi insurance, supports multiple protocols, on-chain claims. |

1.Zapper

Zapper distinguishes itself as a premier DeFi aggregator by embedding insurance functionality directly within its user experience. Investors can consolidate portfolio oversight and risk management within a single terminal: a unified dashboard that reconciles live balance and performance across supported chains with real-time visualization of insurance coverage.

Intuitive navigation facilitates common yield-optimizing operations—farm management, staking, and liquidity provisioning—allowing both novice and seasoned participants to execute complex multi-chain strategies without steep acclimatization. By isolating insured capital and transparent risk metrics, Zapper empowers users to pre-emptively calibrate exposure to smart-contract failures and custodial third-party vulnerabilities.

| Feature | Details |

|---|---|

| Platform Name | Zapper |

| Purpose | DeFi aggregator with insurance tracking |

| Insurance Integration | Tracks coverage for smart contract risks and protocol vulnerabilities |

| KYC Requirement | Minimal – allows basic access without full identity verification |

| Supported Chains | Ethereum, Polygon, Binance Smart Chain, Avalanche, and others |

| Key Functionality | Portfolio tracking, yield farming management, liquidity monitoring |

| Unique Point | Combines cross-chain DeFi aggregation with real-time insurance visibility |

2.DeBank

DeBank has established itself as a foremost decentralized finance (DeFi) aggregator, distinguished by its seamless integration of insurance metrics within the platform. By furnishing users with an extensive overview of their entire digital asset portfolio, DeBank enables continuous monitoring of positions arising from lending, borrowing, and yield farming activities distributed across diverse blockchain networks.

A unique feature of the interface is the display of insurance coverage status alongside asset balances, thereby permitting informed scrutiny of protection layers prior to transacting with any underlying protocol. This synthesis of real-time portfolio management and insurance transparency equips users—regardless of expertise level—to adopt a forward-looking stance on risk and leverages cross-chain analytical tools to validate the robustness of their DeFi engagements.

| Feature | Details |

|---|---|

| Platform Name | DeBank |

| Purpose | DeFi aggregator with insurance tracking |

| Insurance Integration | Provides visibility of insurance coverage for DeFi investments |

| KYC Requirement | Minimal – basic access without full identity verification |

| Supported Chains | Ethereum, Polygon, Binance Smart Chain, Avalanche, and other major chains |

| Key Functionality | Portfolio tracking, lending/borrowing overview, cross-chain analytics |

| Unique Point | Combines real-time DeFi asset management with insurance insights for risk-aware investing |

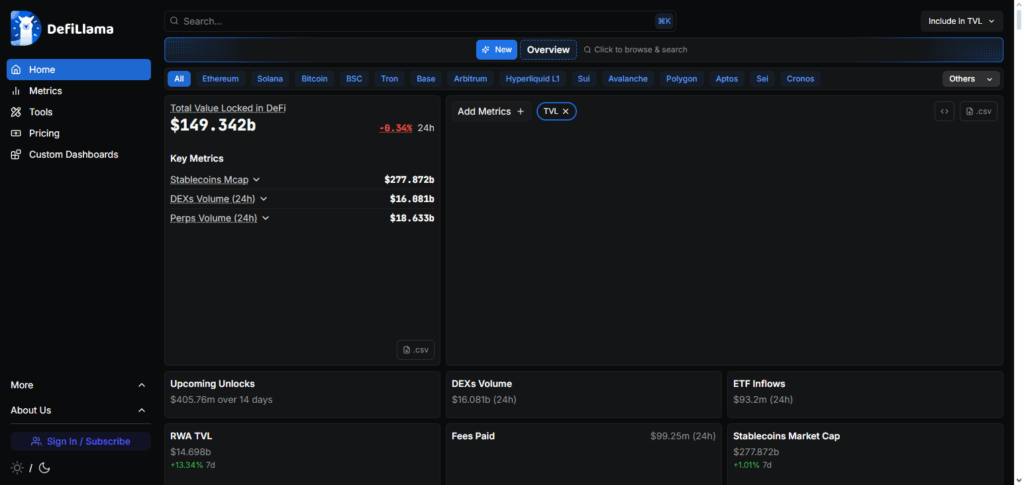

3.DefiLlama

DefiLlama is recognized as a premier DeFi aggregator that seamlessly incorporates insurance data, presenting a dual view of opportunity and protective coverage across a broad array of protocols. The platform excels in delivering total value locked (TVL) figures while concurrently layering insurance metrics, thus enabling users to contextualize growth in tandem with risk exposure.

Comprehensive cross-chain analysis, paired with targeted exposure of protocols that include insurance, equips stakeholders with actionable intelligence needed for prudent capital allocation. This synthesis of openness, rigorous analytical depth, and explicit risk signaling positions DefiLlama as a leading resource for informed DeFi engagement.

| Feature | Details |

|---|---|

| Platform Name | DefiLlama |

| Purpose | DeFi aggregator with insurance tracking |

| Insurance Integration | Highlights protocols with insurance coverage, tracks risk exposure |

| KYC Requirement | Minimal – users can access analytics without full identity verification |

| Supported Chains | Ethereum, Binance Smart Chain, Polygon, Avalanche, Solana, and others |

| Key Functionality | TVL tracking, cross-chain analytics, risk and insurance visibility |

| Unique Point | Combines detailed DeFi analytics with insurance insights, enabling informed and secure investment decisions |

4.Bright Union

Bright Union ranks among the foremost decentralized finance aggregation platforms integrating insurance, owing to its singular emphasis on harmonizing yield-generation strategies with custodial risk mitigation. Its comparative advantage resides in the simultaneous aggregation of leading DeFi yield sources and the provision of embedded coverage, thereby attenuating the exposure to vulnerabilities intrinsic to smart contract architecture.

Within a unified interface, end-users can explore a curated spectrum of yield-enhancing protocols while the latent insecurity of contract failure is actively hedged. By situating risk management on a par with return optimization, the platform affirms to participants that capital can be effectively deployed while remaining insulated from catalogued structural and operational dangers.

| Feature | Details |

|---|---|

| Platform Name | Bright Union |

| Purpose | DeFi aggregator with built-in insurance coverage |

| Insurance Integration | Provides automatic insurance protection for DeFi investments |

| KYC Requirement | Minimal – allows users to access services with limited verification |

| Supported Chains | Ethereum, Polygon, Binance Smart Chain, Avalanche |

| Key Functionality | Aggregates DeFi protocols, monitors yields, integrates insurance |

| Unique Point | Combines multi-protocol aggregation with native insurance to reduce risk exposure |

5.Tidal Finance

Tidal Finance merits recognition among the leading decentralized finance aggregators integrating insurance services by seamlessly merging high-yield strategies with bespoke coverage through NFTs and protocol-level insurance.

The interface facilitates the optimisation of yield across multiple blockchains while concurrently surfacing investment tiers safeguarded by insurance. In doing so, it reduces exposure to potential adversities arising from smart contract vulnerabilities.

By embedding insurance assessment into the core portfolio workflow, the platform affords users dynamic insight into the magnitude and structure of their protection. Coupled with rigorous diversification, this architecture positions Tidal Finance as a sound vehicle for participants whose objectives encompass durable return preservation alongside measured capital appreciation within the DeFi ecosystem.

| Feature | Details |

|---|---|

| Platform Name | Tidal Finance |

| Purpose | DeFi aggregator with insurance coverage for NFTs and DeFi protocols |

| Insurance Integration | Offers protection against smart contract failures and protocol risks |

| KYC Requirement | Minimal – basic verification for access |

| Supported Chains | Ethereum, Polygon, Binance Smart Chain, Avalanche |

| Key Functionality | Cross-chain investment management, NFT and DeFi insurance, portfolio tracking |

| Unique Point | Integrates real-time insurance insights for both DeFi and NFT assets, reducing investment risk |

6.InsurAce

InsurAce is distinguished as a leading decentralized finance (DeFi) aggregator with built-in insurance by virtue of its rigorous commitment to providing wide-ranging multi-chain insurance protection. Unlike conventional aggregators that track DeFi positions in isolation, InsurAce anticipively shields users from smart contract vulnerabilities, sovereign or third-party exploits, and liquidity squeezes.

Its standout functionality resides in the contextual embedding of insurance options directly into the DeFi investment process, thereby enabling users to protect collateral and yield in a single workflow. The synthesis of rigorous protection with operational fluidity renders InsurAce a preferred platform for price-sensitive and risk-mitigating DeFi participants.

| Feature | Details |

|---|---|

| Platform Name | InsurAce |

| Purpose | DeFi aggregator with multi-chain insurance coverage |

| Insurance Integration | Provides protection against smart contract failures, hacks, and protocol risks |

| KYC Requirement | Minimal – basic access without full identity verification |

| Supported Chains | Ethereum, Binance Smart Chain, Polygon, Avalanche, Solana |

| Key Functionality | Multi-protocol DeFi insurance, staking benefits, risk management |

| Unique Point | Combines comprehensive insurance coverage with DeFi asset tracking, ensuring secure investments |

7.Sherlock Protocol

Sherlock Protocol distinguishes itself as a premier decentralized finance (DeFi) aggregator by embedding insurance integration into its core architecture. Unlike standard aggregators that prioritize yield optimization alone, Sherlock centers on mitigating smart-contract-related risk, thereby aligning security with performance.

Users can seamlessly allocate capital across a curated spectrum of yield protocols, with every staked asset and liquidity position automatically covered by on-chain insurance against exploit and bug-related losses.

This layered custodial approach obviates additional sign-up or premium-laden artefacts, eliminating friction and cognitive load. By operationalizing continuous risk assessment and autonomous insurance provisioning, Sherlock democratizes advanced security practices and empowers investors with a unified, efficient, and vigilant DeFi operational environment.

| Feature | Details |

|---|---|

| Platform Name | Sherlock Protocol |

| Purpose | DeFi aggregator with smart contract insurance |

| Insurance Integration | Provides coverage for smart contract vulnerabilities and hacks |

| KYC Requirement | Minimal – basic access without full identity verification |

| Supported Chains | Ethereum, Polygon, Binance Smart Chain, Avalanche |

| Key Functionality | Smart contract risk assessment, automated insurance, cross-protocol monitoring |

| Unique Point | Focuses on protecting staked and liquidity assets with automated insurance, ensuring safer DeFi participation |

8.Unslashed Finance

Unslashed Finance ranks prominently among the leading decentralized finance aggregators featuring integrated insurance, owing to its capability of consolidating multi-protocol investment oversight with extensive risk-transfer solutions.

The service’s principal distinction is its delivery of instantaneous and continuously updated coverage for holdings dispersed across disparate DeFi ecosystems, thereby shielding stakeholders against the failures of smart contracts, unauthorized breaches, and correlated vulnerabilities.

By embedding the insurance dimension directly into the user’s portfolio dashboard, the platform empowers investors to observe returns in real-time while maintaining a parallel and guaranteed level of capital safety. The amalgamation of crystal-clear analytics, cross-chain asset aggregation, and anticipatory risk mitigation renders Unslashed Finance the platform of choice for participants prioritizing security within decentralized environments.

| Feature | Details |

|---|---|

| Platform Name | Unslashed Finance |

| Purpose | DeFi aggregator with integrated insurance coverage |

| Insurance Integration | Real-time protection against smart contract failures, hacks, and protocol risks |

| KYC Requirement | Minimal – basic access without full identity verification |

| Supported Chains | Ethereum, Binance Smart Chain, Polygon, Avalanche |

| Key Functionality | Multi-protocol DeFi insurance, portfolio tracking, risk management |

| Unique Point | Combines cross-chain aggregation with proactive insurance, enabling secure and efficient DeFi investing |

Conclusion

In summary, the leading DeFi aggregators with embedded insurance solutions forge an optimal equilibrium of yield maximization and risk curtailment.

Services such as Zapper, DeBank, DefiLlama, Bright Union, Tidal Finance, InsurAce, Sherlock Protocol, and Unslashed Finance furnish users with frictionless portfolio oversight and, at the same time, encompass rigorous insurance safeguards.

Their distinguishing attributes—spanning cross-chain performance dashboards to automated smart contract safeguarding—empower users to survey DeFi landscapes with verifiable assurance. By merging upward growth trajectories with anticipatory protection, these aggregators establish the benchmark for sound and effective engagement in decentralized finance.

FAQ

What are DeFi aggregators with insurance integration?

They are platforms that combine DeFi investment management, such as yield farming or staking, with insurance coverage to protect users from smart contract failures, hacks, or protocol vulnerabilities.

Why should I use a DeFi aggregator with insurance?

It allows you to maximize returns across multiple protocols while minimizing risk, offering a safer way to participate in DeFi.

Which are the top DeFi aggregators with insurance integration?

Leading platforms include Zapper, DeBank, DefiLlama, Bright Union, Tidal Finance, InsurAce, Sherlock Protocol, and Unslashed Finance.