In this article, I will discuss the best DeFi aggregator apps. These applications enable users to manage multiple DeFi protocols on a single, all-in-one platform, enhancing asset management, optimizing trades, and tracking yields.

These tools simplify the complicated DeFi ecosystem, making it easier and more efficient for students, professionals, and seasoned DeFi investors.

Key Point & Best Decentralized Finance Aggregator Apps List

| Platform | Key Point |

|---|---|

| Zapper | Dashboard for tracking and managing DeFi assets across multiple protocols. |

| DeBank | Comprehensive DeFi portfolio tracker with analytics and lending insights. |

| 1inch | Decentralized exchange (DEX) aggregator providing best swap rates across DEXs. |

| Matcha | User-friendly DEX aggregator focused on optimized trade execution. |

| OpenOcean | Cross-chain DEX aggregator supporting multiple blockchains for swaps. |

| DefiLlama | Analytics platform offering TVL data and metrics for DeFi protocols. |

| Revert Finance | Tool for detecting and analyzing DeFi transaction failures and errors. |

| Beefy Finance | Yield optimizer that automates compound interest on DeFi yields. |

| Yearn Finance | Decentralized yield aggregator optimizing lending and farming strategies. |

| Rubic | Cross-chain DeFi aggregator offering swaps, bridging, and liquidity routing. |

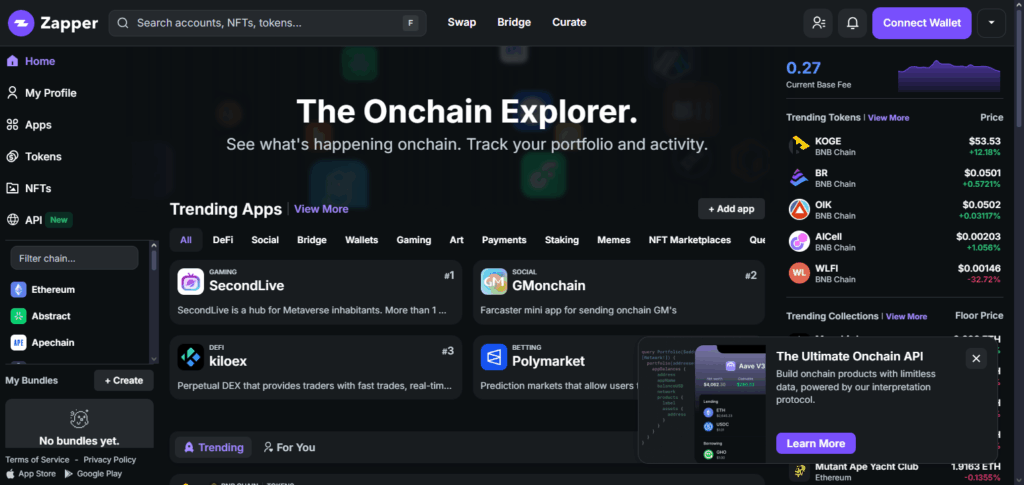

1. Zapper

Zapper is one of the best DeFi aggregator apps due to its unique, all-in-one dashboard that automates much of the effort. Unlike most platforms, Zapper consolidates multiple protocols, enabling seamless cross-chain asset management and investment tracking with minimal effort.

The interface is so intuitive that users can seamlessly navigate between real-time information and make data-informed decisions. Zapper’s approach to yield farming, liquidity provisions, and overarching portfolio management is unrivaled in DeFi’s streamlining of processes.

| Feature | Details |

|---|---|

| App Name | Zapper |

| Core Functionality | DeFi asset management and portfolio tracking |

| KYC Requirement | Minimal to none; primarily non-custodial access |

| Supported Chains | Ethereum, Polygon, Binance Smart Chain, Avalanche, and more |

| Main Use Cases | Portfolio overview, DeFi investing, yield farming, liquidity tracking |

| User Experience | Intuitive dashboard with real-time data |

| Security | Connects via wallet (MetaMask, WalletConnect), no direct custody of funds |

| Unique Selling Point | All-in-one DeFi dashboard with easy multi-protocol tracking without KYC |

| Fees | No platform fees; users pay blockchain gas fees only |

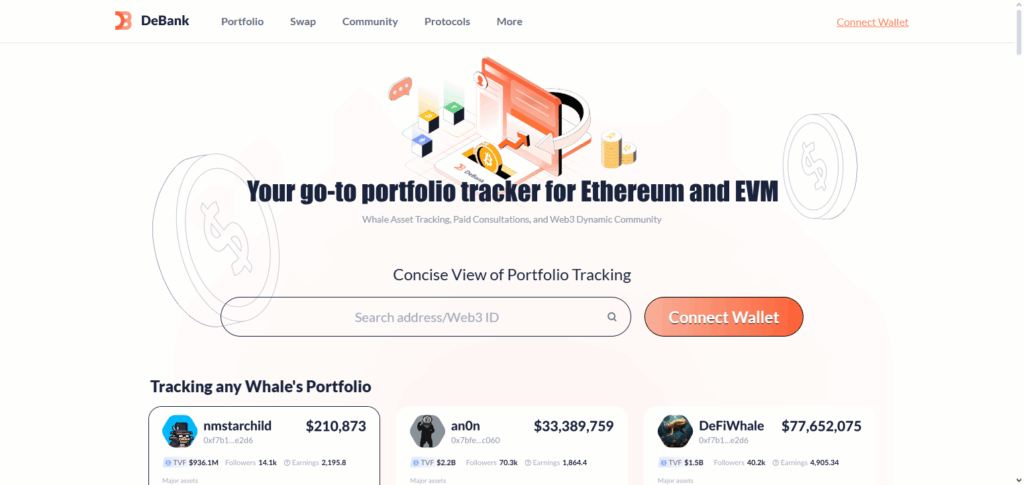

2.DeBank

DeBank is regarded as one of the best decentralized finance aggregator apps because it provides users with a comprehensive, clear picture of their activities in DeFi across multiple blockchains. It is uniquely best in merging portfolio evaluation with in-depth analytics on lending, borrowing, and yield farming.

Advanced strategy optimization, made possible by DeBank’s straightforward interface and comprehensive data, effortlessly guides users through intricate DeFi protocols that would otherwise be burdensome. Other DeFi aggregators do not offer the same depth as DeBank.

| Feature | Details |

|---|---|

| App Name | DeBank |

| Core Functionality | DeFi portfolio tracking and analytics |

| KYC Requirement | Minimal to none; wallet-based access |

| Supported Chains | Ethereum, Binance Smart Chain, Polygon, Avalanche, Fantom, and others |

| Main Use Cases | Portfolio overview, lending/borrowing insights, DeFi analytics |

| User Experience | Clear interface with detailed protocol data |

| Security | Non-custodial; connects via wallet (MetaMask, WalletConnect) |

| Unique Selling Point | Comprehensive analytics with multi-chain support without KYC |

| Fees | No platform fees; only blockchain transaction fees apply |

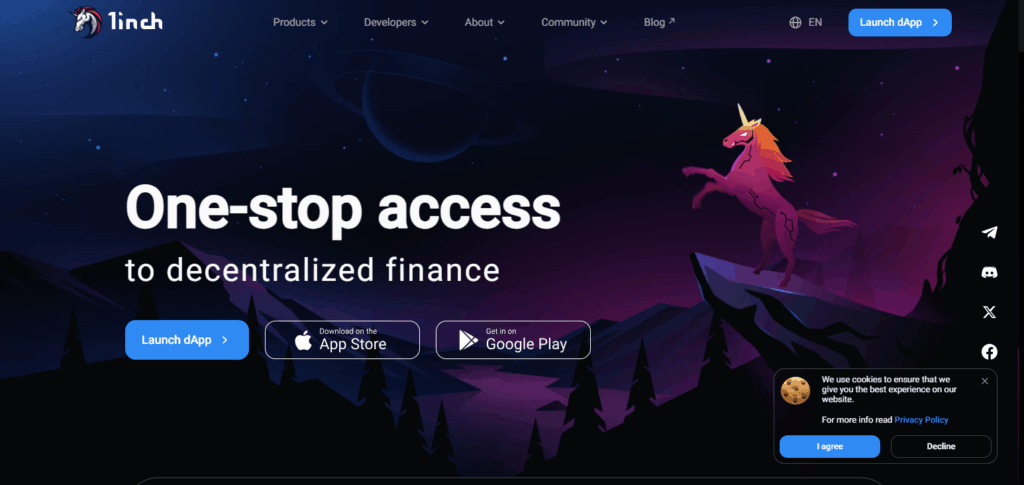

3.1inch

1inch is one of the best decentralized finance aggregator apps because it leverages all the decentralized exchanges and can find the best trading route for users to take. It’s an algorithm that both minimizes slippage and optimizes prices, which enables users to take advantage of the best rates for swaps.

Moreover, 1inch adds even more value for casual and advanced traders with limit orders and gas fee optimization. Its advanced routing capabilities make 1inch an unparalleled leader in DeFi.

| Feature | Details |

|---|---|

| App Name | 1inch |

| Core Functionality | Decentralized exchange (DEX) aggregator |

| KYC Requirement | Minimal to none; wallet-based access |

| Supported Chains | Ethereum, Binance Smart Chain, Polygon, Avalanche, Optimism, Arbitrum, and more |

| Main Use Cases | Token swaps with optimized routing and low slippage |

| User Experience | Simple interface with advanced trade options |

| Security | Non-custodial; connects via wallets like MetaMask, WalletConnect |

| Unique Selling Point | Smart order routing splitting trades across multiple DEXs for best price |

| Fees | No platform fees; users pay blockchain gas fees and DEX fees |

4. Matcha

Matcha is regarded as one of the best decentralized finance aggregator applications owing to its clean, easy-to-use interface, robust trade optimization, and enhanced algorithms. In addition to its intuitive interface, what makes Matcha stand out is its prioritization of ease of use for all users, despite lacking advanced features.

It augments liquidity from numerous DEXs to offer the best rates and guarantees fast, smooth transactions. For new users, easy onboarding combined with a transparent fee structure makes navigating DeFi effortless. This is part of the reason why Matcha is ranked so high—it delivers efficiency and convenience in decentralized swaps.

| Feature | Details |

|---|---|

| App Name | Matcha |

| Core Functionality | Decentralized exchange (DEX) aggregator |

| KYC Requirement | Minimal to none; wallet-based access |

| Supported Chains | Ethereum, Polygon, Binance Smart Chain, Avalanche, Arbitrum, Optimism |

| Main Use Cases | Token swaps with best price execution |

| User Experience | Clean, user-friendly interface |

| Security | Non-custodial; connects via wallets like MetaMask, WalletConnect |

| Unique Selling Point | Simple interface combined with powerful price optimization |

| Fees | No platform fees; users pay gas fees and DEX fees |

5.OpenOcean

OpenOcean stands out as one of the top decentralized finance aggregator apps because of its distinct cross-chain functionality. OpenOcean stands out because it offers cross-chain liquidity aggregation, facilitating swaps of various tokens and ecosystems. Users receive enhanced value and flexibility because of the broader matrix of liquidity that can be tapped into.

OpenOcean’s approach to bridging and swapping is one of the most flexible and effective in the DeFi aggregator environment. That is why it is one of the first on the market and stands out with its strong multi-chain integration.

| Feature | Details |

|---|---|

| App Name | OpenOcean |

| Core Functionality | Cross-chain decentralized exchange (DEX) aggregator |

| KYC Requirement | Minimal to none; wallet-based access |

| Supported Chains | Ethereum, Binance Smart Chain, Polygon, Avalanche, Solana, Tron, Fantom, and others |

| Main Use Cases | Cross-chain token swaps and liquidity aggregation |

| User Experience | Integrated swapping and bridging in one platform |

| Security | Non-custodial; connects via wallets like MetaMask, WalletConnect |

| Unique Selling Point | Seamless cross-chain swaps with broad blockchain support |

| Fees | No platform fees; users pay blockchain gas and bridge fees |

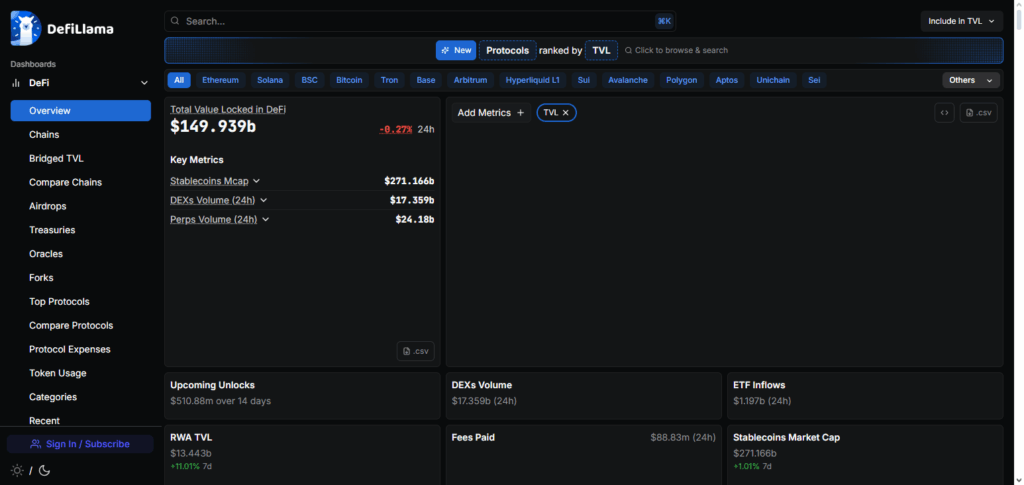

6.DefiLlama

DefiLlama stands out as one of the best apps for aggregating services in the field of decentralized finance, primarily because of its emphasis on thorough and transparent DeFi analytics. One of its distinct advantages is the continuous provision of the total value locked (TVL) metric across multiple chains and projects, all for free.

DefiLlama’s commitment to community and open-source development guarantees trustworthiness and accuracy as users track the evolution of DeFi, and crucially, helps users make better decisions, which cements its reputation in the decentralized finance space.

| Feature | Details |

|---|---|

| App Name | DefiLlama |

| Core Functionality | DeFi analytics and total value locked (TVL) tracking |

| KYC Requirement | None; fully open and transparent data platform |

| Supported Chains | Ethereum, Binance Smart Chain, Polygon, Avalanche, Solana, Fantom, and many others |

| Main Use Cases | Tracking DeFi protocol TVL, analytics, and market trends |

| User Experience | Simple, data-focused interface |

| Security | No funds held; purely informational |

| Unique Selling Point | Transparent, unbiased, community-driven DeFi data without KYC |

| Fees | Free to use |

7. Revert Finance

Revert Finance is noted as a leading decentralized finance (DeFi) aggregator app for its niche in diagnosing and analyzing failed DeFi transactions. Its ability to identify the precise causes of a reversion—slippage, gas problems, or contract flaws—works to the user’s advantage.

Such deep diagnostic insight enables a trader or a developer to troubleshoot and refine their undertakings, thereby saving them from expensive blunders. Such an emphasis on failure analysis gives Revert Finance a design function for advanced DeFi interactions, which helps bridge a significant logic gap.

| Feature | Details |

|---|---|

| App Name | Revert Finance |

| Core Functionality | Analyzes and explains failed DeFi transactions |

| KYC Requirement | None; wallet-based, no personal info required |

| Supported Chains | Ethereum and compatible EVM blockchains |

| Main Use Cases | Diagnosing transaction failures to save time and costs |

| User Experience | Clear, detailed error reports for smart contract interactions |

| Security | Non-custodial; no fund handling |

| Unique Selling Point | In-depth failure analysis helps users optimize transactions |

| Fees | Free to use |

8. Beefy Finance

Beefy Finance stands out as a top-rated app in decentralized finance for having automated yield optimization across multiple blockchains. Fee-by-fee, it allows users to earn returns and automatically compound interests from different liquidity pools, yielding effortless returns—collection and farming strategies.

Moreover, Beefy enhances user experience with its intuitive graphical interface while securing smart contracts, ensuring minimal gas fees, and maximizing asset growth. These features, as well as automation and multi-chain support, yield effortless DeFi yield farming, further solidifying Beefy Finance’s stellar reputation.

| Feature | Details |

|---|---|

| App Name | Beefy Finance |

| Core Functionality | Automated yield optimizer for DeFi farming |

| KYC Requirement | None; connects via wallets, no personal info needed |

| Supported Chains | Ethereum, Binance Smart Chain, Polygon, Avalanche, Fantom, and others |

| Main Use Cases | Auto-compounding yields in liquidity pools and farms |

| User Experience | Easy-to-use interface with secure smart contracts |

| Security | Non-custodial; users retain control of funds |

| Unique Selling Point | Automated compounding across multiple blockchains |

| Fees | No platform fees; users pay standard blockchain gas fees |

9. Yearn Finance

Yearn Finance is best known as one of the top decentralized finance aggregator apps, owing to its innovative automated yield farming strategy. Its vault system automates the allocation of capital to various protocols, maximizing yield while minimizing gas and risk costs.

Yearn optimizes community-governed investment strategies that cater to users seeking passive income, making Yearn a simplifier in the DeFi space. The combination of automation and community collaboration, and the flexibility in responding to changes, makes Yearn Finance exceptional in the automated yield aggregation field.

| Feature | Details |

|---|---|

| App Name | Yearn Finance |

| Core Functionality | Automated yield aggregator and vault management |

| KYC Requirement | None; wallet-based access, no personal data required |

| Supported Chains | Primarily Ethereum |

| Main Use Cases | Automated yield optimization and passive income generation |

| User Experience | User-friendly vaults with community-driven strategies |

| Security | Non-custodial; audited smart contracts |

| Unique Selling Point | Intelligent vault strategies that optimize yield and reduce fees |

| Fees | Performance fees on yields; blockchain gas fees apply |

10. Rubic

Rubic is remarkable among decentralized finance aggregators because of its one-stop platform for cross-chain swaps and bridges. The multi-chain bridge and asset swapping features work in concert for the user’s convenience, enabling the effortless transfer of assets across blockchains.

The comprehensive method facilitates the consolidation of various interactions in DeFi, reducing the number and cost of transactions. Rubic stands out among the many decentralized finance aggregators due to its strong commitment to user ease, multifunctionality, and emphasis on interoperability.

| Feature | Details |

|---|---|

| App Name | Rubic |

| Core Functionality | Cross-chain DeFi aggregator with swapping and bridging |

| KYC Requirement | None; wallet-based access only |

| Supported Chains | Ethereum, Binance Smart Chain, Polygon, Avalanche, Fantom, Solana, and more |

| Main Use Cases | Cross-chain token swaps and asset bridging |

| User Experience | Simple interface combining swaps and bridges |

| Security | Non-custodial; funds remain in user wallets |

| Unique Selling Point | Integrated cross-chain swapping and bridging in one platform |

| Fees | No platform fees; users pay blockchain gas and bridge fees |

Conclusion

Ultimately, the leading decentralized finance aggregator applications combine creativity, ease of use, and the integration of multiple protocols to streamline complex DeFi processes. These platforms enable users to manage and interact within the decentralized world of finance—effectively and safely —through trade optimization, portfolio monitoring, yield automation, or cross-chain swaps.

They enhance users’ confidence in participation through intelligent routing, advanced analytics, automation, cross-platform interoperability, and other unique automation functionalities. These differences provide decisive advantages to users seeking effortless and comprehensive decentralized finance solutions.

FAQ

What is a decentralized finance aggregator app?

A decentralized finance (DeFi) aggregator app combines multiple DeFi protocols and platforms into a single interface, allowing users to manage assets, trade tokens, track portfolios, or optimize yields more efficiently.

Why should I use a DeFi aggregator app?

Using an aggregator saves time and effort by providing the best prices, simplifying complex DeFi tasks, and offering insights across various protocols without switching between multiple platforms.

Are DeFi aggregator apps safe to use?

Most reputable DeFi aggregators use audited smart contracts and do not hold users’ funds directly, but always exercise caution, double-check contract addresses, and use trusted apps to minimize risks.