In this article, I will cover the Best Decentralized Exchanges that provide non-custodial trading with no KYC required. These services provide full custody of assets, minimal fees, as well as on-chain transactions.

This guide is intended to provide both beginner and advanced traders with the most efficient and approachable DEXs in the expanding DeFi ecosystem.

Key Point & Best Decentralized Exchanges List

| Platform | Key Point |

|---|---|

| Hyperliquid | Decentralized perpetual futures exchange with ultra-low latency and high liquidity. |

| dYdX | Layer-2 decentralized exchange offering perpetual contracts with zero gas fees. |

| Raydium | AMM and liquidity provider built on Solana, integrated with Serum order book. |

| PancakeSwap | Leading DEX on BNB Chain offering swaps, yield farming, and lottery features. |

| SunSwap | TRON-based DEX allowing seamless TRC-20 token swaps with zero platform fees. |

| Curve Finance | Stablecoin-focused DEX optimized for low slippage and low fee trading. |

| SushiSwap | Community-driven DEX supporting multi-chain swaps and DeFi tools like Kashi. |

| 1inch | DEX aggregator that finds the best prices across multiple liquidity sources. |

| Uniswap | Pioneer Ethereum-based DEX with a permissionless AMM protocol and deep liquidity. |

| Cardano | Layer-1 blockchain platform focusing on scalability, sustainability, and peer-reviewed development. |

| Balancer V2 | Flexible AMM that enables customizable liquidity pools and dynamic asset weights. |

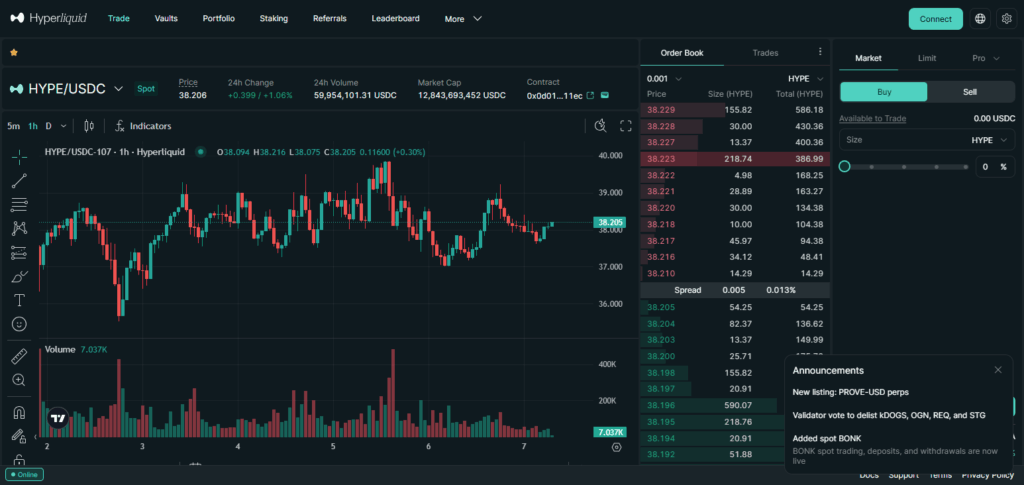

1.Hyperliquid

Hyperliquid is best known for its unparalleled speed amongst DEXs, with fully on-chain order books removing any delays seen in other DEXs. Unlike many other DEXs, Hyperliquid does not use any centralized components which allows trading to fully trustless with near-instant finality.

It strikes a balance between speed and decentralization which benefits advanced traders looking for efficiency and transparency. Hyperliquid stands out from other platforms in the growing DeFi ecosystem with its user-friendly interface, active mcommunity engagements, and self-sustaining systems.

| Attribute | Details |

|---|---|

| Exchange Name | Hyperliquid |

| Type | Decentralized Perpetual Futures Exchange |

| KYC Requirement | None (Minimal/No KYC for trading) |

| Blockchain | Custom Layer-1 (not reliant on Ethereum or Solana) |

| Key Feature | Fully on-chain order book with ultra-low latency |

| Trading Pairs | Perpetual contracts for major crypto assets |

| Fees | Low trading fees; no gas fees for trades |

| User Custody | Non-custodial (Users control their own assets) |

| Target Users | Advanced traders seeking speed, transparency, and full decentralization |

| Wallet Integration | Supports major Web3 wallets |

2.dYdX

dYdX is one of the best decentralized exchanges because it enables sophisticated perpetual trading for professionals. Its distinguishing feature is the combination of an order book and a decentralized trading interface, allowing for trading on its proprietary Layer-2 system with no gas fees.

Unlike most DEXs which use the AMM model, dYdX caters to professional traders with provided leverage, narrows spread, and high liquidity. dYdX uniquely blends DeFi’s transparency with the execution capabilities of CEXs which is why it remains the preferred platform for traders who value control and speed.

| Attribute | Details |

|---|---|

| Exchange Name | dYdX |

| Type | Decentralized Perpetual Futures Exchange |

| KYC Requirement | None for most users (Minimal/No KYC for wallet-based access) |

| Blockchain | dYdX Chain (formerly StarkEx Layer-2 on Ethereum) |

| Key Feature | Order book trading with leverage and zero gas fees |

| Trading Pairs | Perpetual contracts on top crypto assets |

| Fees | Tiered trading fees; no gas fees |

| User Custody | Non-custodial (users retain full control of funds) |

| Target Users | Active traders needing leverage, speed, and decentralized access |

| Wallet Integration | Connects directly with Web3 wallets (e.g., MetaMask, WalletConnect) |

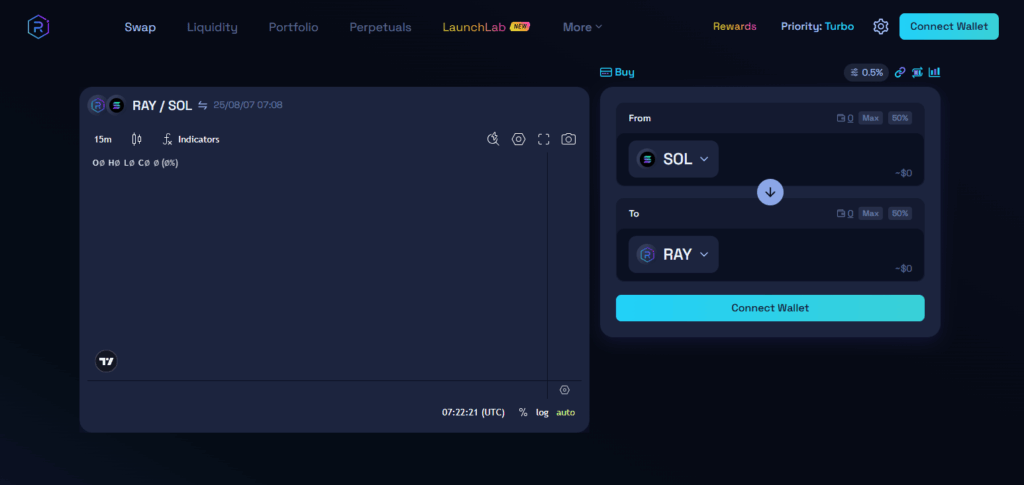

3.Raydium

Raydium is one of the best decentralized exchanges because of its unique feature of combining AMM liquidity with a central limit order book on Solana’s Serum DEX. This blended approach draws order book liquidity as well as pooled liquidity which is beneficial for Raydium users. There is better price execution and liquidity on the markets.

Raydium is a DEX, and as such it is greatly aided by the high-speed, low-cost transaction environment presented by Solana, which favors active traders. As with other DeFi services on Solana, Raydium is able to provide decentralized services such as trading and yield farming maintaining speed and scalability on a decentralized network.

| Attribute | Details |

|---|---|

| Exchange Name | Raydium |

| Type | Decentralized Exchange & AMM |

| KYC Requirement | None (Minimal/No KYC for all users) |

| Blockchain | Solana |

| Key Feature | Integrates AMM liquidity with Serum’s central limit order book |

| Trading Pairs | SPL tokens and Solana-based assets |

| Fees | Low transaction fees due to Solana’s high efficiency |

| User Custody | Non-custodial (users trade directly from their wallet) |

| Target Users | DeFi users seeking fast, low-cost trades and liquidity provision |

| Wallet Integration | Supports Solana wallets (e.g., Phantom, Solflare) |

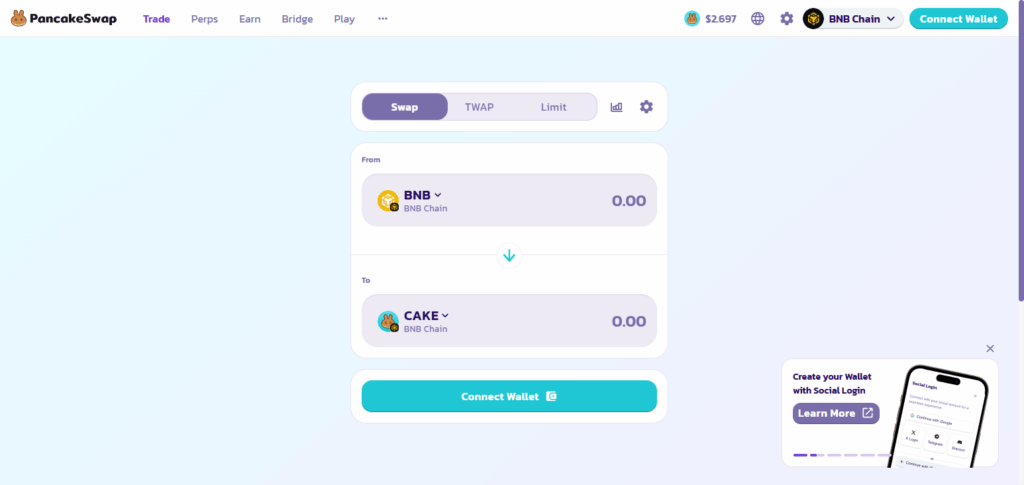

4.PancakeSwap

PancakeSwap is ranked among the top decentralized exchanges owing to its simple interface on the BNB Chain, paired with extremely low fees and high-speed transactions. Its standout feature is the integration of gamified DeFi elements, including lotteries, NFT collectibles, and prediction markets, which make trading more engaging.

Unlike most DEXs, PancakeSwap offers a blend of yield farming, token swapping, and staking within a user-friendly and enjoyable framework. It is this blend of utility and entertainment that has fostered a dedicated community and continuous growth of the platform.

| Attribute | Details |

|---|---|

| Exchange Name | PancakeSwap |

| Type | Decentralized Exchange & AMM |

| KYC Requirement | None (Minimal/No KYC for all users) |

| Blockchain | BNB Chain (formerly Binance Smart Chain) |

| Key Feature | Fast, low-cost token swaps with yield farming and gamified DeFi features |

| Trading Pairs | BEP-20 tokens |

| Fees | ~0.25% per trade |

| User Custody | Non-custodial (users control their assets via connected wallets) |

| Target Users | General DeFi users seeking efficiency, farming rewards, and low fees |

| Wallet Integration | Supports wallets like MetaMask, Trust Wallet, and WalletConnect |

5.SunSwap

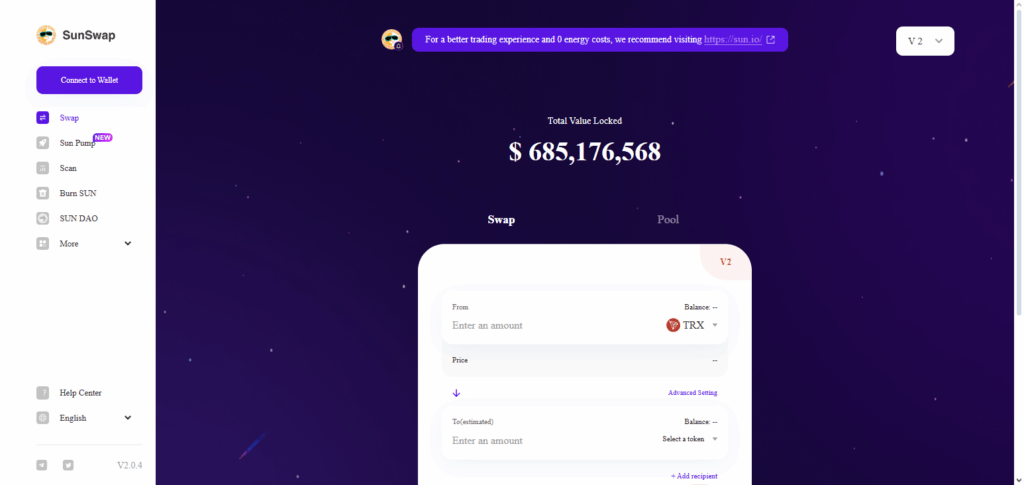

As one of the top decentralized exchanges, SunSwap offers exclusive token swaps within the TRON ecosystem. Its main unique advantage is zero platform fees on TRC-20 token exchanges, making it highly cost-effective for users.

SunSwap is built on top of TRON’s blockchain, which provides high-speed confirmation within the ecosystem, ensuring fast confirmation and minimal gas costs. Its focus on TRON assets improves performance and simplicity, providing users with a DeFi experience that is effortless and sophisticated while requiring minimal effort.

| Attribute | Details |

|---|---|

| Exchange Name | SunSwap |

| Type | Decentralized Exchange & AMM |

| KYC Requirement | None (Minimal/No KYC for all users) |

| Blockchain | TRON Network |

| Key Feature | Zero platform fees for TRC-20 token swaps |

| Trading Pairs | TRC-20 tokens |

| Fees | Network gas fees only (very low on TRON) |

| User Custody | Fully non-custodial (users keep control of funds) |

| Target Users | TRON users seeking cheap, fast, and easy token swaps |

| Wallet Integration | Supports TRON wallets (e.g., TronLink, TokenPocket) |

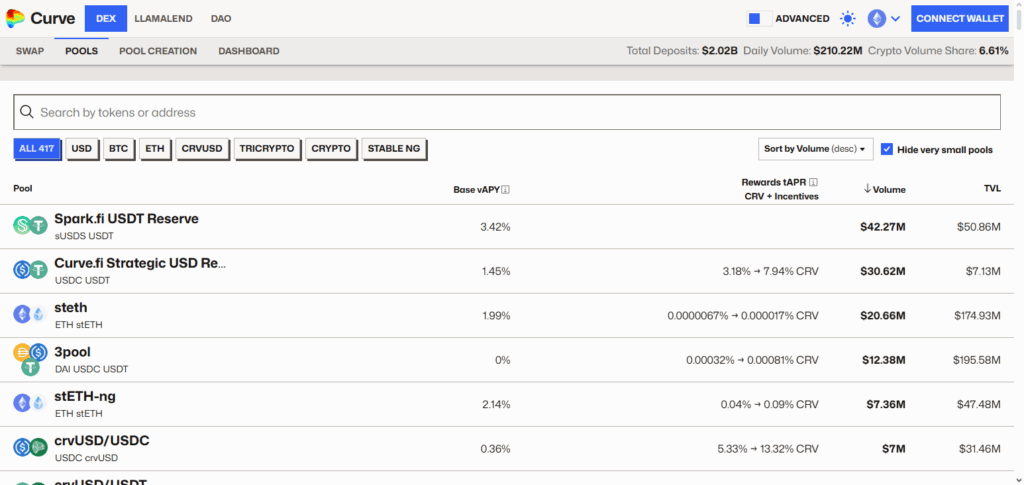

6.Curve Finance

Curve Finance stands out as one of the top decentralized exchanges because of its niche in stablecoin and wrapped asset trading with low slippage and low fees. Unlike traditional AMMs, Curve uses a unique algorithm tailored for low slippage swaps between stable assets, providing efficiency unmatched by traditional AMMs.

Curve directs liquidity toward stable pairs, ensuring reliability amid market volatility. The protocol also encourages long-term governance participation through the veCRV governance system, which aligns community and platform interests, cementing its status as a foundational DeFi protocol.

| Attribute | Details |

|---|---|

| Exchange Name | Curve Finance |

| Type | Decentralized Exchange & AMM |

| KYC Requirement | None (Minimal/No KYC for all users) |

| Blockchain | Ethereum and multiple Layer-2/sidechains (e.g., Arbitrum, Optimism, Polygon) |

| Key Feature | Optimized for low-slippage stablecoin and wrapped asset swaps |

| Trading Pairs | Primarily stablecoins and pegged assets |

| Fees | Very low trading fees (~0.04%) |

| User Custody | Non-custodial (users maintain full wallet control) |

| Target Users | Stablecoin traders and liquidity providers seeking efficient trading |

| Wallet Integration | Supports major Ethereum wallets (e.g., MetaMask, WalletConnect) |

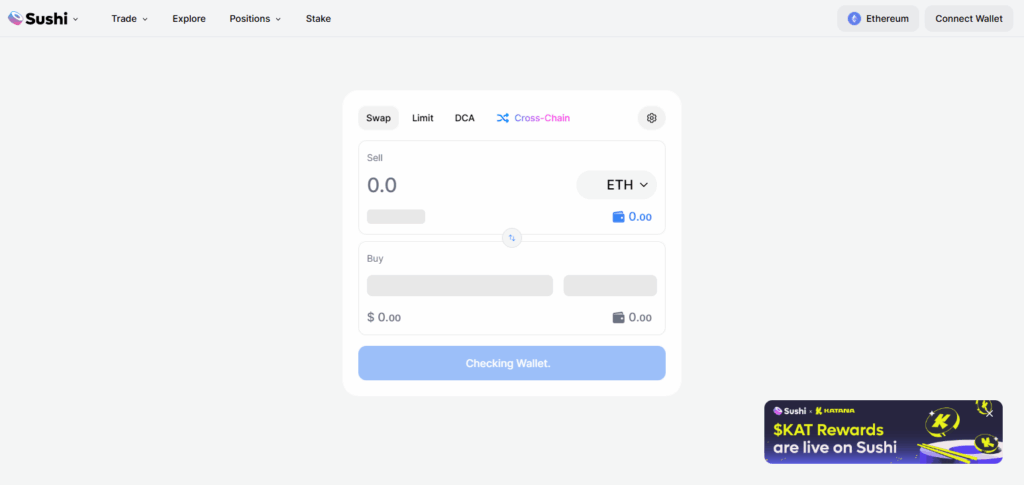

7.SushiSwap

SushiSwap is one of the best decentralized exchanges due to its presence in multiple chains and the community-driven innovations it adopts. It’s novel for offering more than just token swaps, expanding the offering to BentoBox and Kashi for lending, margin trading, and even more complex strategy vaults—all within one platform.

Unlike most DEXs, SushiSwap focuses on offering full-stack DeFi services, is open-source, and remains governed by its users. This system-wide approach provides users with advanced financial capabilities and transforms SushiSwap from a simple DEX into a decentralized finance hub.

| Attribute | Details |

|---|---|

| Exchange Name | SushiSwap |

| Type | Decentralized Exchange & AMM |

| KYC Requirement | None (Minimal/No KYC for all users) |

| Blockchain | Multi-chain (Ethereum, Arbitrum, Polygon, BNB Chain, Avalanche, more) |

| Key Feature | Full DeFi suite including swaps, lending, margin trading, and yield farming |

| Trading Pairs | Wide range of tokens across multiple chains |

| Fees | ~0.3% per swap (0.25% to LPs, 0.05% to protocol) |

| User Custody | Fully non-custodial (user retains wallet control) |

| Target Users | DeFi users seeking broad features and multi-chain access |

| Wallet Integration | Compatible with major Web3 wallets (MetaMask, WalletConnect, etc.) |

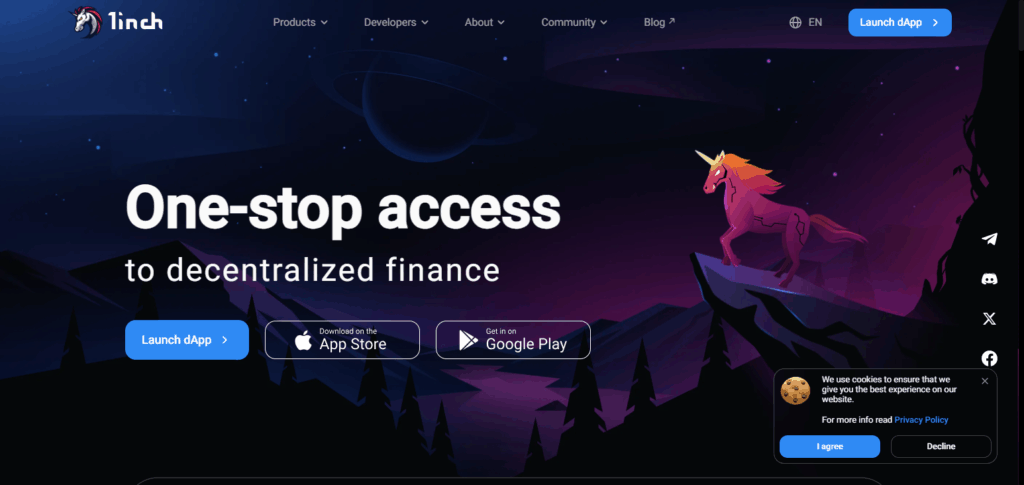

8.1inch

1inch is recognized as one of the top decentralized exchanges because it serves as a powerful aggregator that efficiently routes trades across numerous DEXs to obtain the most favorable prices.

It Pathfinder algorithm is singular in that one of the orders is an ecosystem unto itself. It uses all of the DeFi space in an interconnected serial manner. The algorithm on the whole does the most effective method of algorithimic actions of every user. The proprietary algorithm outlines a space of computation in advance.

| Attribute | Details |

|---|---|

| Exchange Name | 1inch |

| Type | Decentralized Exchange Aggregator |

| KYC Requirement | None (Minimal/No KYC for standard use) |

| Blockchain | Multi-chain (Ethereum, BNB Chain, Arbitrum, Polygon, Avalanche, more) |

| Key Feature | Pathfinder algorithm finds best prices across multiple DEXs |

| Trading Pairs | All tokens available on connected DEXs |

| Fees | No aggregator fee; trading fees depend on underlying DEX |

| User Custody | Non-custodial (trades executed from user’s wallet) |

| Target Users | Traders seeking optimal rates and low slippage |

| Wallet Integration | Supports MetaMask, WalletConnect, Coinbase Wallet, and others |

9.Uniswap

Uniswap is known as one of the first decentralized exchanges to implement the automated market marker (AMM) model and thus removing the need for order books for on-chain trading. Its major strength is the permissionless token listing feature, which allows anyone to create liquidity pools within moments.

This feature promotes quick innovation and wide availability of new tokens. Uniswap has deep liquidity, a strong community governance through the UNI tokens, and a clean interface, which makes it the go to place for a decentralized and trustless asset exchange on Ethereum. Uniswap has set the standard for automated, decentralized trading.

| Attribute | Details |

|---|---|

| Exchange Name | Uniswap |

| Type | Decentralized Exchange & AMM |

| KYC Requirement | None (Minimal/No KYC for protocol use via Web3 wallets) |

| Blockchain | Ethereum mainnet and supported Layer-2s (Arbitrum, Optimism, Base, etc.) |

| Key Feature | Pioneered AMM model with permissionless token listings |

| Trading Pairs | Wide variety of ERC-20 tokens and L2 assets |

| Fees | Varies by pool (typically 0.05%, 0.3%, or 1%) |

| User Custody | Fully non-custodial (users trade from their wallets) |

| Target Users | General DeFi users seeking reliable swaps and liquidity |

| Wallet Integration | Supports MetaMask, WalletConnect, Coinbase Wallet, and others |

10.Cardano

Cardano is widely regarded as one of the best decentralized ecosystems because of its well-researched development process and the concentration on peer-reviewed and secure blockchain structural design. Its distinct advantage is to utilize a layered design where the settlement and computation are separated, which improves the system’s scalability and flexibility.

Unlike most of the other platforms, Cardano employs the Ouroboros proof-of-stake protocol which is energy efficient and secure. Cardano’s scientific approach helps to support long-term sustainability, and this makes Cardano a robust decentralized exchange enabling precision smart contracts and dependable DeFi dealings in the world.

| Attribute | Details |

|---|---|

| Platform Name | Cardano |

| Type | Layer-1 Blockchain Platform |

| KYC Requirement | None at the protocol level (Minimal/No KYC for most Cardano-based DEXs) |

| Key Feature | Peer-reviewed, scalable, and energy-efficient blockchain with native tokens |

| Supported DEXs | Minswap, SundaeSwap, WingRiders, VyFinance |

| Fees | Low transaction fees (typically < $0.50 per swap) |

| User Custody | Fully non-custodial through Cardano wallets |

| Target Users | Users seeking reliable, research-driven DeFi infrastructure |

| Wallet Integration | Compatible with Nami, Eternl, Lace, Flint, and other Cardano wallets |

11.Balancer V2

Among the top decentralized exchanges, Balancer V2 is known for its highly customizable liquidity pools which go beyond the 50/50 tokens model. The most distinguishing feature is the splitting of AMM logic from asset management, enabling external protocols to govern pools for maximized yields.

This structure not only improves capital efficiency but also lowers expenses on gas fees. With Balancer V2, capital and gas expenses empower users and developers with the flexible tools needed to build advanced DeFi strategies and makes the platform achieving and flexible for decentralized trading.

| Attribute | Details |

|---|---|

| Exchange Name | Balancer V2 |

| Type | Decentralized Exchange & Automated Market Maker (AMM) |

| KYC Requirement | None (Minimal/No KYC for all users) |

| Blockchain | Ethereum and supported Layer-2s (Arbitrum, Polygon, Optimism, etc.) |

| Key Feature | Customizable liquidity pools with dynamic token weights and smart vaults |

| Trading Pairs | Wide range of ERC-20 tokens |

| Fees | Set by pool creators; typically low and configurable |

| User Custody | Fully non-custodial (trades and liquidity from user wallets) |

| Target Users | Advanced DeFi users and liquidity providers seeking capital efficiency |

| Wallet Integration | Supports major Ethereum wallets (MetaMask, WalletConnect, etc.) |

Conclusion

To wrap things up, the leading decentralized exchanges, including Uniswap, dYdX, Hyperliquid, PancakeSwap, Raydium, SunSwap, Curve Finance, SushiSwap, 1inch, Balancer V2 and the and the Cardano powered DEXs are the best for a reason. They provide innovative trading algorithms, low scalability costs, community governance, customizable liquidity models and many more. They collectively redefine the entire trading and exchange process of digital assets. They provide a global reach, empower individuals with control over their finances and enable partial control over finances while protecting privacy, enabling these exchanges to transform the current financial paradigm.

FAQ

What is a decentralized exchange (DEX)?

A DEX is a blockchain-based platform that allows users to trade cryptocurrencies directly from their wallets without relying on centralized intermediaries.

Why choose a DEX over a centralized exchange?

DEXs offer greater privacy, user control, lower risk of hacks, and censorship resistance, as users retain full ownership of their funds.

Are decentralized exchanges safe?

Yes, DEXs are generally safe if used properly. However, risks like smart contract bugs, rug pulls, and phishing still exist. Always use reputable platforms.