The most effective cryptocurrency tax software is essential for demystifying the intricate realm of cryptocurrency taxes. It provides investors and cryptocurrency enthusiasts with a complete solution to track their transactions with digital assets, figure out capital gains, and make sure they are in compliance with tax laws. The seamless integration of these software programs with different cryptocurrency wallets and exchanges facilitates the importation of transaction data. Additionally, they enable users to select from a variety of tax laws and accounting techniques, which helps minimize tax obligations.

- What Is Crypto Tax Software?

- Here Is List of 20 Best Crypto Tax Software In USA

- 20 Best Crypto Tax Software In USA

- 1. CoinLedger (Best Crypto Tax Software)

- 2. ZenLedger

- 3. Koinly

- 4. TokenTax

- 5. CoinTracking (Best Crypto Tax Software)

- 6. TaxBit

- 7. Bitcoin.Tax

- 8. Coinpanda

- 9. CryptoTaxCalculator (Best Crypto Tax Software)

- 10. Accointing

- 11. Fyn

- 12. Bear.Tax

- 13.Ledgible (Best Crypto Tax Software)

- 14. BlockSentry

- 15. TurboTax

- 16. Blockpit

- 17. Cointelli (Best Crypto Tax Software)

- 18. chain.report

- 19. CryptoPrep

- 20. AEM Journaler

- How can you select Best Crypto Tax Software?

- Conclusion

- Why is crypto tax software necessary, and what does it entail?

- How can I pick the cryptocurrency tax software that best suits my needs?

- Which pricing structures are available for crypto tax software?

- Can more than one cryptocurrency and token be handled by crypto tax software?

- What data must I enter into the crypto tax software?

- How are capital gains and losses handled by cryptocurrency tax software?

- Is it possible for me to report taxes in multiple countries using crypto tax software?

- How does the crypto tax software safeguard my data, and is it secure?

Additionally, a lot of the best crypto tax software platforms have comprehensive reporting features and intuitive user interfaces that let users create accurate tax reports and lower their risk of audits. The greatest cryptocurrency tax software constantly updates its features to keep users informed and in compliance with tax authorities due to the constantly changing nature of cryptocurrency taxation.

What Is Crypto Tax Software?

For people and businesses navigating the complexities of cryptocurrency taxation, crypto tax software is a priceless tool. By streamlining the tracking and reporting of cryptocurrency transactions, this software helps users precisely calculate their tax obligations. Users can save a great deal of time and effort by having it automatically import transaction data by integrating with well-known cryptocurrency exchanges and wallets.

Additionally, crypto tax software complies with certain tax laws and supports various accounting techniques, including FIFO and LIFO, making it a flexible option for a worldwide user base.This software helps users minimize their tax liabilities in addition to making the tax filing process simpler with its intuitive interface and reporting features. Crypto tax software is a vital tool for the expanding cryptocurrency market because it regularly updates its features and guidelines to ensure users stay compliant with tax authorities as the regulatory landscape for cryptocurrencies changes.

Here Is List of 20 Best Crypto Tax Software In USA

- CoinLedger (Best Crypto Tax Software)

- ZenLedger

- Koinly

- TokenTax

- CoinTracking (Best Crypto Tax Software)

- TaxBit

- Bitcoin.Tax

- Coinpanda

- CryptoTaxCalculator (Best Crypto Tax Software)

- Accointing

- Fyn

- Bear.Tax

- Ledgible (Best Crypto Tax Software)

- BlockSentry

- TurboTax

- Blockpit

- Cointelli (Best Crypto Tax Software)

- chain.report

- CryptoPrep

- AEM Journaler

20 Best Crypto Tax Software In USA

1. CoinLedger (Best Crypto Tax Software)

The sophisticated and user-friendly cryptocurrency tax software inLedger is well-known for making the sometimes complicated world of cryptocurrency taxation simpler. This platform offers businesses and individual cryptocurrency enthusiasts an effective way to monitor and report on their transactions involving digital assets. The seamless import of transaction data is made possible by CoinLedger’s integration with a number of cryptocurrency exchanges and wallets, which helps users save important time.

Users can accurately calculate their tax liabilities thanks to the software’s support for multiple accounting methods and adaptation to various tax regulations. CoinLedger assists users in creating comprehensive tax reports and optimizing their tax obligations through its user-friendly interface and extensive reporting tools. For individuals looking for accuracy and clarity in their tax reporting, CoinLedger is a great resource in the cryptocurrency space because it updates frequently to keep users up to date with evolving tax laws and regulations.

2. ZenLedger

ZenLedger is a top-tier cryptocurrency tax software program that provides an all-inclusive and efficient method of handling cryptocurrency taxes. ZenLedger offers an accessible platform for both individual cryptocurrency investors and businesses thanks to its simple and intuitive interface. Its smooth integration with a variety of cryptocurrency wallets and exchanges, which makes importing transaction data easier, is one of its main advantages. The software is a flexible choice for a worldwide user base because it supports multiple accounting methods, such as FIFO and LIFO, and takes into account the unique tax laws of various regions.

Users can create comprehensive tax reports using ZenLedger’s powerful reporting features, which aid in precisely calculating their tax obligations and maximizing their financial plans. ZenLedger is a trustworthy and useful tool for people navigating the complexities of cryptocurrency taxation because regular updates guarantee that users remain compliant with changing cryptocurrency tax laws.

3. Koinly

In the field of cryptocurrency tax software, Koinly is a well-known brand that provides both individuals and businesses with a reliable and easy-to-use solution. Its smooth integration with different cryptocurrency wallets and exchanges, which enables users to import transaction data with ease, is one of its best features. Koinly is a flexible option for a worldwide user base because it supports various accounting methods and takes into consideration local tax laws.

Users can easily generate comprehensive tax reports, ensuring accurate calculations and assisting in the optimization of their tax liabilities, thanks to the system’s user-friendly interface and robust reporting tools. Koinly is a dependable and essential tool for individuals looking to manage the complexity of cryptocurrency taxation while remaining compliant with the most recent tax laws due to the platform’s frequent updates and dedication to staying current with the constantly shifting cryptocurrency tax landscape.

4. TokenTax

A well-known cryptocurrency tax software, TokenTax has a reputation for making the complex world of cryptocurrency taxation easier to understand. Its robust features and user-friendly interface make it an ideal solution for both businesses and individual investors. Its seamless integration with multiple cryptocurrency wallets and exchanges, which makes transaction data importation easier, is one of its main advantages. Because it supports various accounting systems and complies with particular tax laws, TokenTax is appropriate for users globally.

Users can easily generate accurate tax reports with its effective reporting tools, which help with the accurate calculation of tax liabilities and the optimization of their financial strategies. With frequent updates, TokenTax stays up to date with the constantly changing tax laws pertaining to cryptocurrencies, making it a reliable and important tool for individuals trying to understand the intricacies of crypto taxation and make sure they are in compliance with the most recent tax laws.

5. CoinTracking (Best Crypto Tax Software)

A well-liked cryptocurrency tax program called oinTracking offers a thorough approach to monitoring and controlling transactions involving digital assets. With its user-friendly platform that demystifies the frequently complicated world of cryptocurrency taxation, it’s a useful tool for both individual and corporate cryptocurrency investors. One of CoinTracking’s unique features is its integration capabilities, which let users import data from a variety of cryptocurrency wallets and exchanges with ease.

The program is appropriate for users worldwide because it supports a range of accounting techniques and takes particular tax laws into account. CoinTracking helps users generate detailed tax reports, ensures accurate calculations, and helps optimize their tax liabilities with its user-friendly interface and robust reporting features… It gives users the assurance that they can effectively and in compliance with the most recent regulations navigate the complexities of cryptocurrency taxation. It’s a dependable solution for remaining compliant with the constantly evolving laws governing cryptocurrency taxes.

6. TaxBit

One of the top platforms for cryptocurrency tax software, TaxBit provides an easy-to-use, all-inclusive solution for handling tax obligations linked to cryptocurrencies. For both businesses and individual investors, TaxBit makes the complicated world of cryptocurrency taxation easier to understand. Transaction data can be imported with ease thanks to the software’s seamless integration with a variety of cryptocurrency wallets and exchanges.

It offers a flexible tool to a worldwide user base by supporting various accounting techniques and taking into consideration local tax laws.TaxBit’s user-friendly interface and robust reporting features enable users to create comprehensive tax reports, guaranteeing accurate tax liability calculations and supporting the optimization of their financial strategies. TaxBit is a dependable and helpful tool for individuals navigating the complexities of crypto taxation while staying up to date with the most recent tax regulations because it regularly updates its users to keep them informed and compliant with the ever-evolving laws governing cryptocurrencies.

7. Bitcoin.Tax

The frequently complicated world of cryptocurrency taxation is made simpler by the dependable and user-friendly crypto tax software known as Bitcoin.Tax. It provides an easy-to-use platform for managing transactions involving digital assets, making it a useful tool for businesses and individual cryptocurrency investors alike. The program promises easy integration with multiple cryptocurrency wallets and exchanges, which simplifies the process of importing transaction data. Bitcoin.Tax ensures its relevance for users worldwide by accommodating various accounting methods and taking particular tax regulations into consideration.

Its robust reporting features and user-friendly interface enable users to generate accurate tax reports, thereby optimizing financial strategies and facilitating precise calculations of tax liabilities. Bitcoin.Tax is a reliable and essential tool for individuals attempting to manage cryptocurrency taxation while adhering to the most recent tax laws because it is updated on a regular basis to stay current with the constantly changing cryptocurrency tax landscape.

8. Coinpanda

One well-known cryptocurrency tax software program that excels at streamlining the intricate world of cryptocurrency taxation is Coinpanda. This platform simplifies the tracking and reporting of transactions involving digital assets and provides a user-friendly experience for both businesses and individual cryptocurrency investors. Its smooth integration with a variety of cryptocurrency wallets and exchanges, which makes the import of transaction data simple, is one of its best features. Coinpanda is a flexible option for users worldwide because it supports a range of accounting techniques and takes into consideration unique tax laws from various locations.

Users can create thorough tax reports with ease thanks to the system’s user-friendly interface and robust reporting tools, which guarantee accurate tax liability calculations and aid in the optimization of financial strategies. Through frequent updates, Coinpanda stays current with the ever-changing tax laws pertaining to cryptocurrencies, making it a dependable and indispensable tool for individuals attempting to navigate the complexities of crypto taxation while adhering to the most recent tax laws.

9. CryptoTaxCalculator (Best Crypto Tax Software)

One notable piece of crypto tax software that aims to streamline the complex world of cryptocurrency taxation is called CryptoTaxCalculator. This platform, which offers a user-friendly interface and robust features for managing and reporting transactions involving digital assets, caters to both individual and corporate cryptocurrency investors. One of CryptoTaxCalculator’s best features is how easily it integrates with a wide range of cryptocurrency wallets and exchanges, making data import simple. Users worldwide can choose from a variety of accounting methods supported by the software, which also takes into account regionally specific tax regulations.

Users can create accurate tax reports with ease thanks to the system’s user-friendly interface and extensive reporting features, which make it easier to calculate tax liabilities and help them optimize their financial plans. CryptoTaxCalculator is a dependable and indispensable tool for managing the complexities of cryptocurrency taxation because it is updated frequently to stay current with the constantly changing cryptocurrency tax landscape and guarantee that users comply with all applicable laws.

10. Accointing

Accointing is a reputable crypto tax software platform that simplifies the intricate world of cryptocurrency taxation. It provides a user-friendly solution for individual crypto investors and businesses, streamlining the tracking and reporting of digital asset transactions. What sets Accointing apart is its seamless integration with various cryptocurrency exchanges and wallets, making it a breeze to import transaction data. The software supports different accounting methods and takes into account specific tax regulations, catering to users around the world.

Accointing’s user-friendly interface and extensive reporting capabilities enable users to create thorough tax reports, guaranteeing precise tax liability calculations and supporting the enhancement of their financial strategies. Accointing is a dependable and indispensable tool for individuals navigating the complexities of crypto taxation while remaining compliant with the most recent tax regulations because it receives regular updates that keep it up to date with the laws governing cryptocurrencies.

11. Fyn

Fyn is a rising star in the cryptocurrency tax software market, providing an all-inclusive and intuitive way to handle your tax obligations. Fyn makes it easier for businesses and individual investors alike to navigate the complicated world of cryptocurrency taxation. Its smooth integration with different cryptocurrency wallets and exchanges, which makes importing transaction data simple, is one of its primary features.

Fyn is a flexible tool for a global user base that supports various accounting methods and takes into consideration local tax laws. Fyn’s user-friendly interface and robust reporting features enable users to produce accurate tax reports, precisely calculate their tax liabilities, and optimize their financial strategies. Fyn is a reliable and indispensable tool for individuals navigating the complexities of cryptocurrency taxation while remaining compliant with the most recent tax regulations because it is updated on a regular basis to stay up to date with the constantly changing cryptocurrency tax landscape.

12. Bear.Tax

A notable cryptocurrency tax software program that does a great job of streamlining the intricate world of cryptocurrency taxation is Bear.Tax. It offers a user-friendly platform for tracking and reporting transactions involving digital assets, catering to both businesses and individual cryptocurrency investors. Its smooth integration with different cryptocurrency wallets and exchanges, which makes it simple to import transaction data, is one of its best features. Bear.Tax is a flexible tool that is available to users worldwide.

It supports various accounting methods and considers specific tax regulations.Users can create thorough tax reports with ease thanks to the system’s user-friendly interface and powerful reporting tools, which make it easier to calculate accurate tax liabilities and help users optimize their financial plans. Bear.Tax is a dependable and essential tool for individuals navigating the complexities of cryptocurrency taxation while staying compliant with the most recent tax regulations because it is updated on a regular basis to stay up to date with the laws governing cryptocurrency.

13.Ledgible (Best Crypto Tax Software)

Ledgible is a well-known cryptocurrency tax software program that makes cryptocurrency taxation less complicated. It provides an all-inclusive platform with easy-to-use tools for tracking and reporting transactions involving digital assets for both businesses and individual cryptocurrency investors. One notable feature of Ledgible is its easy-to-use integration with a wide range of cryptocurrency wallets and exchanges, which makes importing transaction data a breeze. With support for multiple accounting systems and consideration for regionally-specific tax laws, the software serves a global user base.

Ledgible’s user-friendly interface and extensive reporting functionalities enable users to produce precise tax reports, guaranteeing accurate assessments of tax obligations and supporting the enhancement of their financial tactics. Ledgible is a dependable and essential tool for individuals navigating the complexities of crypto taxation while remaining compliant with the most recent tax regulations because it receives regular updates that keep it in line with the constantly changing laws governing cryptocurrencies.

14. BlockSentry

The goal of the new cryptocurrency tax software platform BlockSentry is to make cryptocurrency taxation less complicated. It offers a user-friendly solution with effective tools for tracking and reporting transactions involving digital assets for both businesses and individual cryptocurrency investors. Its ability to integrate with different cryptocurrency wallets and exchanges, which makes it easy to import transaction data, is one of its standout features. BlockSentry caters to users worldwide by supporting various accounting methods and taking particular tax regulations into consideration.

BlockSentry helps users create accurate tax reports, enabling accurate calculations of tax liabilities and supporting the optimization of financial strategies with its user-friendly interface and powerful reporting capabilities. BlockSentry is a promising solution for individuals navigating the complexities of crypto taxation while remaining compliant with the most recent tax regulations because it is a dynamic player in the crypto tax software market and is dedicated to staying updated with the constantly changing cryptocurrency tax laws.

15. TurboTax

Although TurboTax is a well-known tax preparation program and can be used for a variety of tax scenarios, including those listed in the criteria, it should be made clear that TurboTax is not a crypto tax program. It does not, therefore, naturally address cryptocurrency taxation. This page contains information only about TurboTax’s services for filing regular tax returns; it does not cover transactions involving cryptocurrencies. TurboTax Free Edition is a handy choice for people with straightforward tax returns, but for more thorough handling of cryptocurrency taxes, it’s frequently advised to use specialized software designed for handling cryptocurrency taxes.

This software can import and analyze cryptocurrency transactions from multiple exchanges, apply various accounting techniques, and guarantee compliance with tax laws pertaining to cryptocurrencies.Accurate reporting of cryptocurrency activities, including intricate elements like capital gains and losses that are frequently connected to cryptocurrencies, is made easier for investors by this specialized software.

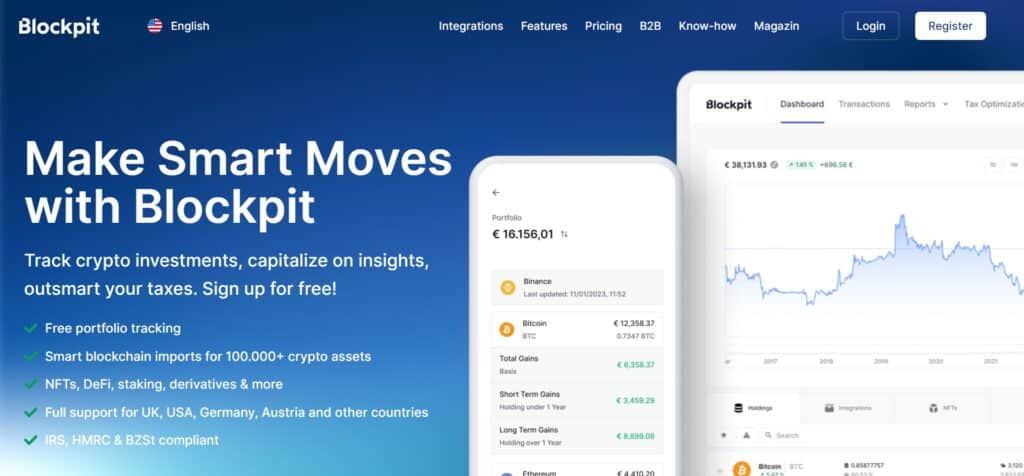

16. Blockpit

Blockpit is a reliable software solution for cryptocurrency taxes that aims to streamline the intricate realm of cryptocurrency taxation. It offers a user-friendly platform for tracking and reporting transactions involving digital assets, catering to both individual investors and businesses. Its smooth integration with multiple cryptocurrency wallets and exchanges, which makes transaction data importation simple, is one of its primary features. Blockpit is adaptable for users worldwide, supporting a range of accounting techniques and accounting for regionally specific tax laws.

Blockpit’s user-friendly interface and extensive reporting capabilities enable users to create accurate tax reports, which facilitates the precise computation of tax liabilities and the optimization of financial strategies. Blockpit is a dependable and priceless tool for individuals managing the complexities of crypto taxation while remaining up to date with the most recent tax regulations because regular updates guarantee that it stays compliant with the constantly changing laws governing cryptocurrencies.

17. Cointelli (Best Crypto Tax Software)

A comprehensive and user-friendly solution for handling cryptocurrency tax obligations is offered by the crypto tax software Cointelli. It provides a streamlined method for monitoring and reporting transactions involving digital assets, meeting the needs of both businesses and individual cryptocurrency investors. Its smooth integration with numerous cryptocurrency wallets and exchanges, which facilitates the import of transaction data, is one of its main advantages. With support for multiple accounting systems and consideration for regional tax laws, Cointelli offers a flexible solution to a worldwide user base.

Cointelli helps users generate accurate tax reports, makes it easier to calculate tax liabilities precisely, and optimizes their financial strategies with its user-friendly interface and robust reporting features. Frequent updates ensure that Cointelli stays up to date with the constantly changing tax laws pertaining to cryptocurrencies, making it a reliable and helpful tool for anyone attempting to navigate the intricacies of crypto taxation while adhering to the most recent tax laws.

18. chain.report

The rights mentioned suggest that Chain.report is a crypto tax program that prioritizes user data privacy and protection. Under the General Data Protection Regulation (GDPR), users have a number of rights. These rights include the ability to access information about their personal data that the company has stored, the right to have incorrect personal data corrected, the right to request that their data be deleted, and the right to restrict data processing under specific circumstances.

In addition, if they have a contract with the company or have given their consent to data processing, users have the right to request data portability and object to the processing of their data. In addition, users’ consent is respected by the company, and they can withdraw it at any time from further data processing. Sustaining confidence and adhering to data protection laws requires a strong commitment to user rights and data privacy.

19. CryptoPrep

The goal of the cryptocurrency tax software ChainCryptoPrepreport is to streamline the frequently difficult and time-consuming process of cryptocurrency tax compliance. Tax reporting can be a difficult undertaking for a lot of cryptocurrency enthusiasts, particularly when there are a lot of transactions involved. The needs of cryptocurrency users who participate in different facets of the ecosystem, such as centralized and decentralized finance (CeFi and DeFi), are addressed by this software.It recognizes the difficulties encountered by yield farmers, lenders, borrowers, liquidity providers, and more.

Traditional tax preparers might not fully comprehend the nuances of these transactions, but the developers of ChainCryptoPrepreport do. They want to free up users to concentrate on what they do best, which is trade and invest in the cryptocurrency market, by taking care of the tedious task of tax reporting. This method guarantees that users stay in compliance with tax laws while engaging in the cryptocurrency market, saving them time and giving them peace of mind.

20. AEM Journaler

The goal of the progressive cryptocurrency tax software AEM Journaler is to completely transform how people and companies manage their bitcoin transactions. Promoting efficiency, safety, and openness in cryptocurrency transactions is their main objective. By redefining the field of crypto accounting and bringing it into line with the rapidly developing blockchain technology, AEM hopes to make a significant and long-lasting global impact.

Their dedication to change and adapt is in line with the cryptocurrency market’s dynamic nature. AEM Journaler is committed to transforming the way the world interacts with digital assets, making it more secure and accessible for all parties involved. They do this by gradually establishing a future in which cryptocurrencies become the new norm.

How can you select Best Crypto Tax Software?

Integration with Exchanges and Wallets: To make the process of importing your transaction data easier, look for software that easily integrates with a variety of cryptocurrency exchanges and wallets.

Supported Features: Verify that the program offers the features you need. This covers various accounting techniques (FIFO, LIFO, specific identification), local tax laws, and any particular cryptocurrency-related activities you partake in, like yield farming or staking.

User-Friendly Interface: Select software that makes it simple for you to enter and examine your data by having an intuitive and user-friendly interface. The software ought to make it simple to produce precise tax reports.

Accuracy and Compliance: Make sure the software complies with the most recent cryptocurrency tax regulations and is accurate. It ought to assist you in precisely estimating capital gains, losses, and any applicable tax obligations.

Security: To safeguard your private keys and sensitive financial information, make sure the software places a high priority on security. Keep an eye out for features like two-factor authentication and encryption.

Customer service: Excellent customer service is very important. Select software that offers helpful support teams who can help you with any queries or problems that might come up during the tax reporting procedure.

User Testimonials: Go through user reviews and testimonials to learn about other users’ experiences with the program. This may reveal details about its dependability and performance.

Cost: Take into account the software’s price as well as any related charges. Make sure the pricing plans you are considering fit both your needs and your budget by comparing them.

Updates and Maintenance: In order to keep up with the ever-changing regulations surrounding cryptocurrencies and tax laws, the software should be updated on a regular basis.

Trial Period: A lot of companies that provide crypto tax software provide a demo or trial period. Use this to determine whether the program is a good fit for your needs before committing.

Conclusion

To sum up, choosing the best cryptocurrency tax software is crucial for everyone interested in the cryptocurrency space. It’s critical to have a dependable and effective tool to manage and report your cryptocurrency transactions as the regulatory landscape for digital assets changes over time. In order to choose the best software for your needs, it is essential to consider factors like cost, frequent updates, ease of use, accuracy, security, compliance, customer support, and integration with exchanges and wallets.

It’s also critical to take into account the complexities of your cryptocurrency activities, your local tax laws, and your unique financial situation.By carefully weighing these factors, you can select crypto tax software that will simplify the frequently complex world of cryptocurrency taxation and expedite the tax reporting process while also guaranteeing that you stay in compliance with current tax laws.

Why is crypto tax software necessary, and what does it entail?

Users can compute and report their cryptocurrency transactions for tax purposes with the use of crypto tax software. It’s necessary to make sure tax laws are followed and to calculate your precise tax liability for cryptocurrency-related activities.

How can I pick the cryptocurrency tax software that best suits my needs?

Take into account elements like cost, customer support, frequent updates, accuracy, security, user-friendliness, compliance, and exchange integration. Make a decision based on your unique financial circumstances and tax obligations.

Which pricing structures are available for crypto tax software?

Different pricing structures are available, such as free versions, one-time purchases, subscription-based models, and tiers of plans according to how complex your cryptocurrency activity is.

Can more than one cryptocurrency and token be handled by crypto tax software?

Numerous cryptocurrencies and tokens are supported by the majority of crypto tax software. Verify whether the program works with the particular assets you have.

What data must I enter into the crypto tax software?

Usually, transaction information must be entered, such as dates, sums, buy/sell prices, and any applicable fees. Wallets and exchanges can automatically import this data using certain software.

How are capital gains and losses handled by cryptocurrency tax software?

The program computes capital gains and losses based on your transaction data, accounting for each cryptocurrency’s cost basis and holding duration.

Is it possible for me to report taxes in multiple countries using crypto tax software?

International users are catered for in a lot of crypto tax software solutions. Ensure that the software takes into account the tax laws unique to your nation or area.

How does the crypto tax software safeguard my data, and is it secure?

Security is given top priority in reputable crypto tax software, which includes features like encryption and two-factor authentication. Make sure the software you select has robust security features.