I will discuss the Best Cross-chain Liquidity Providers, which allow smooth transfers of assets across several blockchains.

- What is Cross-chain?

- How To Choose Best Cross-chain Liquidity Providers

- Key Point & Best Cross-chain Liquidity Providers List

- 1.Symbiosis Finance

- 2.Stargate Finance

- 3.Wormhole (Portal)

- 4.Synapse Protocol

- 5.THORChain

- 6.Axelar Network

- 7.Router Protocol

- 8.LI.FI Protocol

- 9.Orbiter Finance

- 10.deBridge

- Pros & Cons Cross-chain Liquidity Providers

- Conclusion

- FAQ

These platforms facilitate multi-chain transactions, minimize slippage, and improve DeFi liquidity for users and developers. Analyzing each provider’s distinguishing characteristics, security frameworks, and overall effectiveness will guide you on the most efficient and trustworthy cross-chain options available in our ever-growing decentralized world.

What is Cross-chain?

Cross-chain allows different blockchains to interact and share assets and information. Unlike stand-alone blockchains, cross-chain solutions open silos and allow users to transfer tokens, NFTs, and data on different platforms, all without using a centralized exchange.

This improves liquidity, scale, and decentralized efficacy within the ecosystem. Applications using cross-chain platforms, like bridges and protocols, enable DeFi, gaming, and enterprise solutions to function on multiple chains, broadening the connectivity and functionality of the crypto world.

How To Choose Best Cross-chain Liquidity Providers

Here’s a straightforward guide on ‘how to select cross-chain liquidity providers in a better way‘ in easier steps.

Security & Audits: Make sure the provider underwent a rigorous audit with smart contracts and has a proven track record in maintaining security to the extent of not losing funds or being hacked.

Supported Blockchains: Look at what blockchains the provider has; the more networks supported the better.

Liquidity Depth: More liquidity results in smoother transactions with slippage being lower.

Transaction Fees: Look for more competitive fees for cross-chain swaps within providers.

Speed & Reliability: To avoid undue delays and transfers which may not go through at all, the providers should have swift transaction processing.

User Experience: Look out for simple user interfaces, organized dashboards, and wallet as well as dApp connection simplifications.

Reputation & Reviews: Determine the credibility through community reviews, active developers, and the extent of partnerships.

Decentralization Level: Greater alignment with DeFi would come from more providers which avoid the central points of control.

Key Point & Best Cross-chain Liquidity Providers List

| Cross-Chain Provider | Key Points / Features |

|---|---|

| Symbiosis Finance | Multi-chain swaps with low slippage, strong security audits, and native liquidity pools. |

| Stargate Finance | Unified liquidity across multiple chains, efficient bridging, fast settlement times. |

| Wormhole (Portal) | Decentralized bridge, supports NFTs and tokens, audited contracts for security. |

| Synapse Protocol | Interoperable swaps, low fees, supports stablecoins and native tokens across chains. |

| THORChain | Fully decentralized liquidity network, native cross-chain swaps, no wrapped tokens. |

| Axelar Network | Universal interoperability, easy dApp integration, secure messaging across chains. |

| Router Protocol | Seamless multi-chain liquidity routing, supports multiple asset types and dApps. |

| LI.FI Protocol | Aggregates bridges and DEXs, optimized routes, reduces gas costs and slippage. |

| Orbiter Finance | Lightweight bridging, low fees, focuses on token transfers across EVM chains. |

| deBridge | Cross-chain asset and data transfers, governance support, strong security focus. |

1.Symbiosis Finance

Symbiosis Finance is among the best in cross-chain liquidity provision owing to its multi-chain swapping transcendence and liquidity pools depth. The unique Symbiosis protocol permits transfers of shattered digital assets across blockchains with low slippage and low fees. The transactions are reliable and efficient.

The platform also supports a large number of tokens and emphasizes security with its audited smart contracts. Symbiosis Finance brings swift execution and decentralized liquidity with a simplified interface to the users and developers of DeFi enabling seamless interaction over multiple networks. It remains a cross-chain liquidity provider of choice for many.

| Feature | Details |

|---|---|

| Platform Name | Symbiosis Finance |

| Type | Cross-chain liquidity provider |

| KYC Requirement | Minimal / Optional for basic swaps |

| Supported Blockchains | Ethereum, Binance Smart Chain, Polygon, Avalanche, Fantom, others |

| Liquidity Pools | Deep multi-chain liquidity for low slippage |

| Transaction Fees | Low fees optimized per network |

| Security | Audited smart contracts, decentralized protocols |

| Key Use Case | Multi-chain swaps, DeFi integrations, token transfers |

| Speed & Reliability | Fast settlements with real-time routing |

| Unique Advantage | Efficient, low-cost cross-chain swaps without requiring full KYC |

2.Stargate Finance

Stargate Finance is regarded as one of the best for cross-chain liquidity provision thanks to its liquidity protocol which facilitates seamless cross-chain transfers of assets. Its standout feature is real-time settlement with low slippage which enables users to efficiently bridge tokens without any behov of wrapped assets.

Stargate combines deep liquidity pools with a secure and audited infrastructure for reliable transaction assurance. Midstream, the focus is on speed, transparency and seamless exchange which empowers users and participants of DeFi fros cross-chain fund movement and transaction. For this reason, Stargate Finance is a leading solution for cross-chain liquidity management.

| Feature | Details |

|---|---|

| Platform Name | Stargate Finance |

| Type | Cross-chain liquidity provider |

| KYC Requirement | Minimal / Optional for basic swaps |

| Supported Blockchains | Ethereum, Binance Smart Chain, Avalanche, Polygon, Fantom, Optimism |

| Liquidity Pools | Unified multi-chain liquidity for low slippage |

| Transaction Fees | Low fees, optimized per network |

| Security | Audited smart contracts, secure bridging protocol |

| Key Use Case | Seamless cross-chain token transfers, DeFi integrations |

| Speed & Reliability | Real-time settlements, high transaction efficiency |

| Unique Advantage | Efficient bridging with unified liquidity across multiple chains |

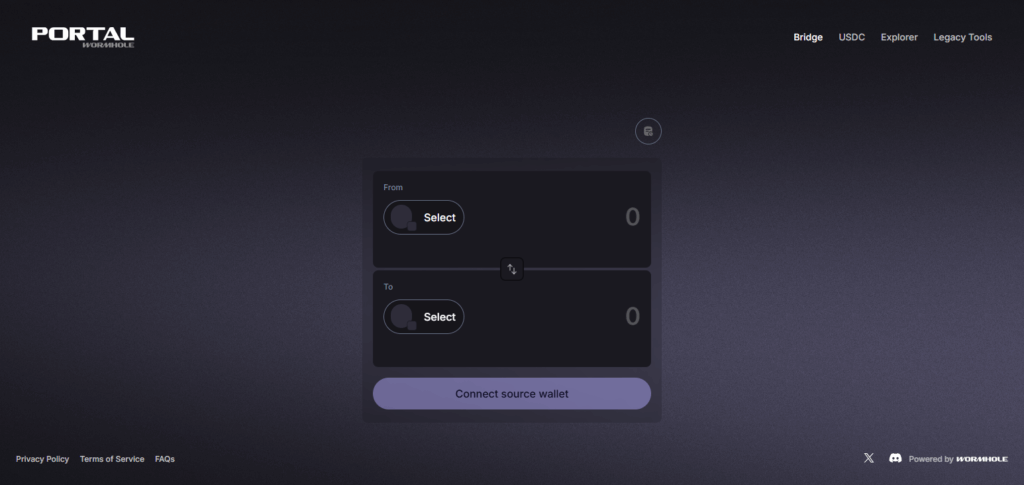

3.Wormhole (Portal)

Wormhole (Portal) provides cross-chain liquidity on a decentralised basis through the seamless bridging of various blockchain networks. The company’s uniqueness comes from the ability to decrease risk while improving efficiency through trustless transfers without the necessity of a centralized processor.

Wormhole provides speed and security through audited smart contracts and a wide array of supported tokens on cross-chain transactions. It connects various ecosystems for effortless asset movement which makes Wormhole an ideal solution for DeFi application and multi-chain interoperability. It simplifies transactions for developers and users, helping them through seamless asset movement.

| Feature | Details |

|---|---|

| Platform Name | Wormhole (Portal) |

| Type | Cross-chain liquidity provider |

| KYC Requirement | Minimal / Optional for basic transfers |

| Supported Blockchains | Ethereum, Solana, Binance Smart Chain, Avalanche, Terra, Polygon |

| Liquidity Pools | Decentralized liquidity across multiple chains |

| Transaction Fees | Low fees, varies by network |

| Security | Audited smart contracts, trustless bridging |

| Key Use Case | Token and NFT transfers across multiple blockchains |

| Speed & Reliability | Fast and secure cross-chain settlements |

| Unique Advantage | Enables trustless, decentralized transfers of tokens and NFTs across chains |

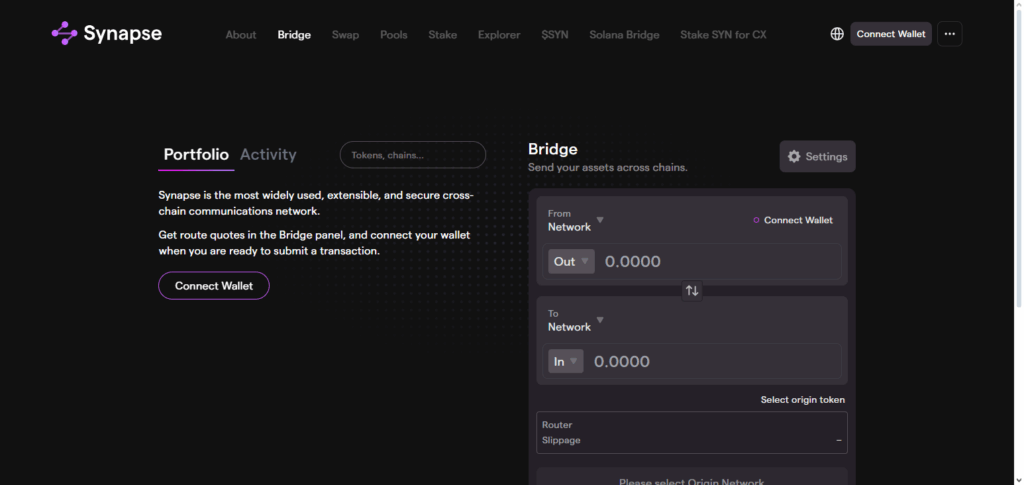

4.Synapse Protocol

Synapse Protocol is well-know In cross-chain liquidity provision because It provides fast and cheap multi-chain blockchain transfers with an unmatched level of interoperability. With minimal slippage and delay on transactions, Its tailored dual support for stablecoins and native tokens is the reason why Synapse stands out.

It combines protected, approved smart contracts and a simplistic dashboard to level the multi-chain swaps for the developers and users. The Synapse Protocols’ fast, efficient and dependable ethos optimizes the interactions the users have with the decentralized finance world. Its commitment to user satisfaction along with the blockchain slippage makes them one of the most trusted cross-chain liquidity providers.

| Feature | Details |

|---|---|

| Platform Name | Synapse Protocol |

| Type | Cross-chain liquidity provider |

| KYC Requirement | Minimal / Optional for basic swaps |

| Supported Blockchains | Ethereum, Binance Smart Chain, Polygon, Avalanche, Fantom, Optimism |

| Liquidity Pools | Optimized multi-chain liquidity for low slippage |

| Transaction Fees | Low fees, network-dependent |

| Security | Audited smart contracts, secure bridging |

| Key Use Case | Multi-chain token swaps and DeFi integrations |

| Speed & Reliability | Fast settlements with reliable routing |

| Unique Advantage | Supports both stablecoins and native tokens with optimized cross-chain routing |

5.THORChain

THORChain takes center stage among providers of cross-chain liquidity and is known for its almost completely decentralized method for swapping assets on different blockchains. Its key strength is complete decentralization with true native cross-chain swaps not involving wrapped tokens, thereby minimizing counterparty risk.

THORChain uses liquidity pools and its own secure and auditable protocols to provide fast and cost-effective transactions. Its transparent, trustless, and easily executed cross-chain integration allows users to transfer assets across different blockchains seamlessly. THORChain’s multi-chain DeFi solution is unrivaled.

| Feature | Details |

|---|---|

| Platform Name | THORChain |

| Type | Cross-chain liquidity provider |

| KYC Requirement | Minimal / Optional for basic swaps |

| Supported Blockchains | Bitcoin, Ethereum, Binance Smart Chain, Litecoin, Cosmos, Avalanche |

| Liquidity Pools | Deep native liquidity for direct cross-chain swaps |

| Transaction Fees | Low fees, network-dependent |

| Security | Audited smart contracts, decentralized and trustless swaps |

| Key Use Case | Native token swaps across multiple blockchains |

| Speed & Reliability | Fast, trustless settlements |

| Unique Advantage | Enables true decentralized cross-chain swaps without wrapped tokens |

6.Axelar Network

Axelar Network is one of the best providers of cross-chain liquidity because of its capability to facilitate interoperability across multiple chains. Axelar stands out due to its easy dApp integration which allows developers to cross-chain and message assets without a complicated configuration. Axelar is also security-focused and protocol-audited.

It supports a diverse array of tokens and networks. Axelar’s service elasticity lowers the multi-chain interaction barriers by offering fast and reliable transfers. This makes Axelar Network the perfect provider of tethered DeFi cross-chain liquidity and multi-chain interaction for users who want a fast, trustless, and scalable solution.

| Feature | Details |

|---|---|

| Platform Name | Axelar Network |

| Type | Cross-chain liquidity provider |

| KYC Requirement | Minimal / Optional for basic transfers |

| Supported Blockchains | Ethereum, Binance Smart Chain, Polygon, Avalanche, Cosmos, Solana |

| Liquidity Pools | Aggregated multi-chain liquidity |

| Transaction Fees | Low fees, optimized per network |

| Security | Audited protocols, secure and trustless bridging |

| Key Use Case | Seamless asset transfers and messaging between dApps across chains |

| Speed & Reliability | Fast, reliable cross-chain settlements |

| Unique Advantage | Universal interoperability with easy dApp integration across chains |

7.Router Protocol

Router Protocol provides incredible cross-chain liquidity due to its constant optimal asset and liquidity routing from chain to chain. The uniqueness of their invention comes from the complicated task of determining the optimal routing and minimizing slippage and fees, throughout the plurality of available blockchain networks.

Router Protocol is versatile and user-friendly, supporting all major tokens and providing seamless integration with most dApps. The combination of fast and secure routing with top-tier cross-chain security provides decentralized finance users with the ability to transfer their assets with unmatched reliability. Hence, with excellent liquidity, Router Protocol is a premier solution for cross-chain liquidity.

| Feature | Details |

|---|---|

| Platform Name | Router Protocol |

| Type | Cross-chain liquidity provider |

| KYC Requirement | Minimal / Optional for basic swaps |

| Supported Blockchains | Ethereum, Binance Smart Chain, Polygon, Avalanche, Fantom, Solana |

| Liquidity Pools | Multi-chain liquidity with optimized routing |

| Transaction Fees | Low fees, minimized via efficient routing |

| Security | Audited smart contracts, secure bridging |

| Key Use Case | Multi-chain token swaps and liquidity routing |

| Speed & Reliability | Fast transactions with optimized cross-chain paths |

| Unique Advantage | Intelligent routing ensures lowest slippage and efficient multi-chain transfers |

8.LI.FI Protocol

LI.FI Protocol is at the forefront of cross-chain liquidity provisioning due to the ability to consolidate numerous bridges and DEXes to provide users with the most efficient routes to transfer assets. It is uniquely positioned to enhance transactions in real-time while minimizing gas fees and slippage.

Due to the multi-chain approach, multi-chain interactions with LI.FI remain simple and cheaper, as it facilitates support for a multitude of tokens across multiple blockchains. The combination of route optimization and programmable reliability along with easy integration makes LI.FI Protocol one of the best options for cross-chain liquidity.

| Feature | Details |

|---|---|

| Platform Name | LI.FI Protocol |

| Type | Cross-chain liquidity provider |

| KYC Requirement | Minimal / Optional for basic swaps |

| Supported Blockchains | Ethereum, Binance Smart Chain, Polygon, Avalanche, Fantom, Solana |

| Liquidity Pools | Aggregates multiple bridges and DEXs for optimized liquidity |

| Transaction Fees | Low fees, route-optimized to reduce gas and slippage |

| Security | Audited smart contracts, secure cross-chain execution |

| Key Use Case | Efficient multi-chain token swaps and bridging |

| Speed & Reliability | Fast, reliable transfers with optimized routing |

| Unique Advantage | Aggregates multiple bridges and DEXs to find the most efficient transfer routes |

9.Orbiter Finance

Orbiter Finance is one of the top providers of cross-chain liquidity and specializes in lightweight bridging services across the EVM-compatible blockchains. Its singular advantage is barely any transfer fee and instant accessibility of many tokens for both large and small-scale transactions.

For ease of access and security, it offers audited smart contracts wit its simple interface. Speed and operational cost have been the keystones of reliable multi-chain connectivity. Thus, Orbiter Finance has emerged as the most distinctive solution in cross-chain liquidity. It offers unmatched support for users and developers in the DeFi ecosystem.

| Feature | Details |

|---|---|

| Platform Name | Orbiter Finance |

| Type | Cross-chain liquidity provider |

| KYC Requirement | Minimal / Optional for basic transfers |

| Supported Blockchains | Ethereum, Binance Smart Chain, Polygon, Avalanche, Fantom |

| Liquidity Pools | Lightweight multi-chain liquidity with low slippage |

| Transaction Fees | Very low fees, optimized for EVM-compatible chains |

| Security | Audited smart contracts, secure bridging |

| Key Use Case | Fast and low-cost token transfers across EVM chains |

| Speed & Reliability | High-speed settlements with consistent reliability |

| Unique Advantage | Lightweight and low-cost bridging focused on EVM-compatible networks |

10.deBridge

DeBridge is a leading cross-chain liquidity provider known for secure and versatile asset and data transfers across blockchains. Their cross-chain liquidity governance support allows multiple token swaps and decentralized governance.

With a reduced risk, audited smart contracts, and decisive security protocols, deBridge assures safe transactions. Automated systems navigate their rich cross-chain deFi applications, coupled with a wide network span. Increasing cross-chain interaction, deBridge reinforces user and developer confidence, furthering its position as a leading provider for cross-chain liquidity.

| Feature | Details |

|---|---|

| Platform Name | deBridge |

| Type | Cross-chain liquidity provider |

| KYC Requirement | Minimal / Optional for basic transfers |

| Supported Blockchains | Ethereum, Binance Smart Chain, Polygon, Avalanche, Solana, Fantom |

| Liquidity Pools | Cross-chain liquidity with governance-enabled support |

| Transaction Fees | Low fees, network-dependent |

| Security | Audited smart contracts, secure and trustless bridging |

| Key Use Case | Token and data transfers across multiple chains |

| Speed & Reliability | Fast and reliable settlements |

| Unique Advantage | Combines cross-chain asset transfers with governance and robust interoperability |

Pros & Cons Cross-chain Liquidity Providers

Pros:

Interoperability – Facilitates cross-chain transfer of assets.

Increased Liquidity – Assures liquidity consolidation across the ecosystem, resulting sparse slippage.

Decentralization – Eliminates the need for a central authority and operates in a trustless environment.

Efficiency – Provides swift services in comparison to centralized exchanges for cross-chain mergers.

DeFi Integration – Support cross-chain decentralized apps, thereby improving multi-chain DeFi services.

Cons:

Security Risks – Subject to smart contract vulnerabilities, bridge hacks, and lazy security.

Complexity – Cross-chain users tend to struggle with the different mechanics involved.

Fees – High transaction and negligent gas costs are unavoidable in some networks.

Network Dependency – Block speed and congestion is the main factor for performance.

Limited Asset Support – The periphery of available tokens and NFTs support is limited on different chains.

Conclusion

To sum up, the top cross-chain liquidity providers are crucial to the development of the DeFi and blockchain ecosystem by allowing smooth, safe, and effective movement of assets across several networks. THORChain, Wormhole, Synapse Protocol, and Symbiosis Finance are prominent for the original methods, be it native swaps, optimized routing, or decentralized bridging.

These providers combine deep liquidity, fast execution, solid security, and multi-chain interoperability which enable users and developers to operate confidently in the decentralized environment. For this reason, cross-chain solutions are necessary for blockchain finance in the future.

FAQ

Why are cross-chain liquidity providers important?

They increase interoperability, enhance liquidity, reduce slippage, and allow DeFi applications to operate across multiple blockchains efficiently.

Which are the top cross-chain liquidity providers?

Popular options include THORChain, Wormhole, Synapse Protocol, Symbiosis Finance, Axelar Network, Router Protocol, LI.FI Protocol, Orbiter Finance, Stargate Finance, and deBridge.

How do fees work in cross-chain liquidity providers?

Fees vary depending on the provider, network congestion, and token type. Some providers optimize routes to reduce gas costs and slippage.