In this article, I will cover the Best Cross-chain Aggregator For Enterprise for strategies around businesses managing assets over various blockchains.

- What is Cross-chain Aggregator?

- How To Choose Best Cross-chain Aggregator For Enterprise

- Multi-Chain Compatibility

- Transaction Efficiency

- Security and Audits

- Compliance and Regulatory Support

- Integration and Customization

- Analytics and Reporting

- Support and Maintenance

- Key Point & Best Cross-chain Aggregator For Enterprise List

- 1. Synapse Protocol

- 2. Stargate Finance

- 3. Across Protocol

- 4. Rango Exchange

- 5. LI.FI Protocol

- 6. Symbiosis Finance

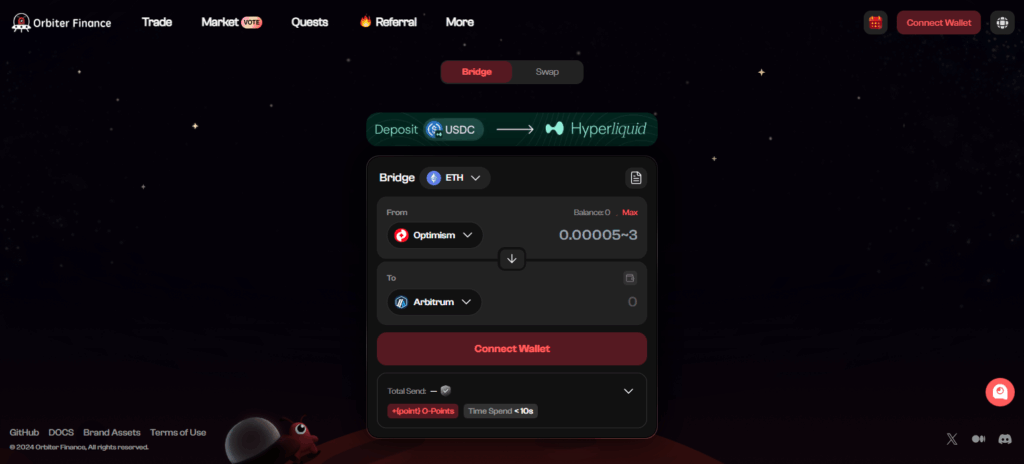

- 7. Orbiter Finance

- 8. Hop Protocol

- 9. Axelar Network

- 10. Router Protocol

- Pros & Cons

- Conclusion

- FAQ

Cross-chain aggregators facilitate transactions, optimize fees, improve security, and are vital for enterprises needing smooth multi-chain ecosystem operations.

I cover the differentiating elements of leading platforms, then pivot to what matters most when choosing the most dependable aggregator for executive-grade blockchain management.

What is Cross-chain Aggregator?

A cross-chain aggregator is one of the few Decentralized protocols or platforms that allow the easy swapping or transferring of digital assets across various blockchain networks. Users no longer have to perform each blockchain transaction with each blockchain individually.

They can perform several operations across various chains through one interface. This saves a lot of time and simplifies the transaction process.

Fee and transaction cost, speed of execution, and exchange rate are improved through the routing of transactions through optimal bridges and liquidity pools.

Cross chains aggregators fuse several ecosystems, thus bettering interoperability within the crypto space. This allows users to diversify their asset portfolios, access DeFi services, and manage several wallets, all without manual bridging or multiple wallets.

How To Choose Best Cross-chain Aggregator For Enterprise

Multi-Chain Compatibility

Confirm that the aggregator can handle multiple blockchains relevant to your business: Ethereum, Polygon, BNB Chain, Solana, and Arbitrum. This makes primal asset mobility and diversified liquidity access seamless.

Transaction Efficiency

Consider aggregators with routing algorithms that optimally lower fees, slippage, and execution times, which is vital for businesses doing a high volume of transactions.

Security and Audits

Use a potential client’s history of cross-chain aggregators to determine his and/or her business reputation. Audited smart contracts, secure bridging protocols that have field reputation and the standard encryption practices to secure cross-border business.

Compliance and Regulatory Support

Aggregators that KYC/AML check and have regulatory check-listing software are more favorable for business transactions at any scale.

Integration and Customization

Business API/SDK cross-chain aggregators need to feature customizable blocks to their code for reverse engineering to suit their goals.

Analytics and Reporting

Corresponding with every other report aggregation tools, transactional analytics, raw data reporting, and performance trackers help an enterprise make calculated business moves.

Support and Maintenance

Check that the provider guarantees responsive customer care and routine servicing and updates so the aggregator remains secure and aligned with advancing blockchain architectures.

Key Point & Best Cross-chain Aggregator For Enterprise List

| Protocol / Aggregator | Key Points |

|---|---|

| Synapse Protocol | Supports multi-chain swaps, fast bridging, high liquidity, low slippage. |

| Stargate Finance | Native asset bridges, unified liquidity pools, efficient cross-chain transfers. |

| Across Protocol | Optimized for low fees, secure token bridging, instant settlement. |

| Rango Exchange | Aggregates multiple bridges, user-friendly interface, multi-chain DEX support. |

| LI.FI Protocol | Integrates various bridges and DEXs, provides smart routing, cross-chain swaps. |

| Symbiosis Finance | Multi-chain liquidity routing, AMM integration, secure asset transfers. |

| Orbiter Finance | Lightweight cross-chain transfers, low gas fees, fast execution. |

| Hop Protocol | Layer 2 bridging, scalable liquidity, fast token transfers across L2 networks. |

| Axelar Network | Universal interoperability, secure decentralized messaging, multi-chain support. |

| Router Protocol | Cross-chain asset transfers, aggregated liquidity, optimized routing for enterprises. |

1. Synapse Protocol

Synapse Protocol is highly regarded as one of the best cross-chain aggregators for enterprises because of its unrivaled integration of multi-chain liquidity and optimized bridging.

Unlike its competitors, Synapse Protocol is built on speed, security, and scalability, allowing enterprises to move assets across chains with minimal latency and low fees.

Its sophisticated routing algorithm selects the fastest routes for transactions and minimizes slippage and operational costs.

Its smart contracts and regular audits ensure unmatched security. Synapse Protocol is built to support numerous chains with customizable cross-chain integrations, making it exceptionally versatile for businesses.

| Feature | Details |

|---|---|

| Platform Name | Synapse Protocol |

| Type | Cross-chain Aggregator |

| Enterprise Focus | Yes – optimized for high-volume, multi-chain operations |

| KYC Requirement | Minimal – suitable for enterprises seeking low-friction onboarding |

| Supported Blockchains | Ethereum, BNB Chain, Polygon, Arbitrum, Avalanche, Fantom, and more |

| Transaction Speed | High – optimized routing for fast execution |

| Fees | Competitive – optimized via smart routing and liquidity aggregation |

| Security | Audited smart contracts, robust bridge protocols |

| Integration | APIs/SDKs for seamless enterprise system integration |

| Unique Point | Combines multi-chain liquidity with enterprise-grade security and minimal KYC |

2. Stargate Finance

Stargate Finance is one of the best cross-chain aggregators on the market because of its innovative approach to bridging liquidity and assets.

Its liquidity-agnostic unified pool, which is a one-of-a-kind offering in the industry, allows businesses to remotely access assets and pay lower fees on multiple blockchains. Its rapid transfers are made possible with Stargate’s protocol, which focuses on reliability and speed during high-volume transfers.

Addiitonally, its enterprise-level architecture allows simple, smooth access to multiple blockchains without complex additional systems. Stargate connects cross-chain systems with the best possible innovation, security, and performance.

| Feature | Details |

|---|---|

| Platform Name | Stargate Finance |

| Type | Cross-chain Aggregator |

| Enterprise Focus | Yes – designed for scalable, high-volume enterprise operations |

| KYC Requirement | Minimal – low-friction onboarding suitable for enterprises |

| Supported Blockchains | Ethereum, BNB Chain, Avalanche, Polygon, Arbitrum, Fantom, and more |

| Transaction Speed | High – fast asset transfers across chains |

| Fees | Optimized – native asset bridging reduces costs |

| Security | Audited smart contracts, secure native bridges |

| Integration | API support for seamless enterprise integration |

| Unique Point | Native asset bridging with unified liquidity pools for efficient enterprise cross-chain transfers |

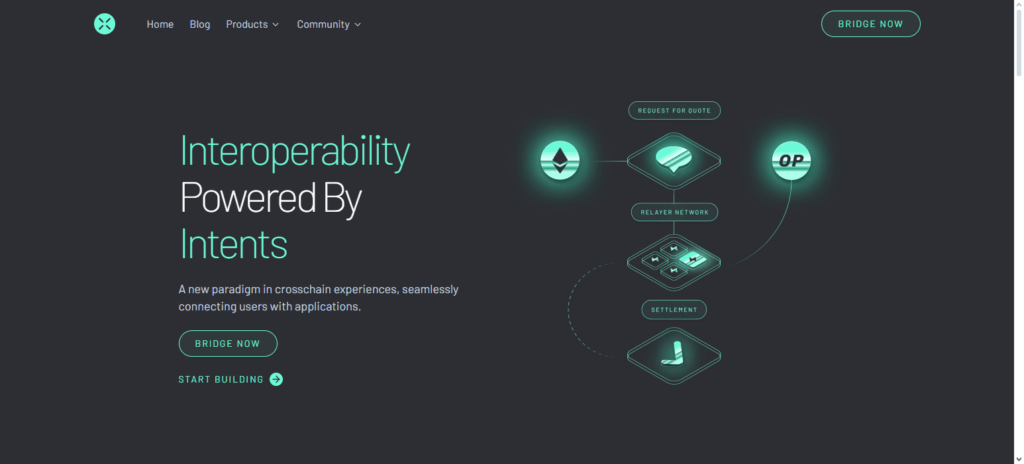

3. Across Protocol

Across Protocol is one of the finest cross-chain aggregators for enterprises because of its focus on secure, instant, and low-cost token transfers on multiple blockchains. The design employs specialized bridging mechanisms to bring latency and transaction costs to the bare minimum, making it suitable for enterprises with large-scale asset movements.

Across Protocol with its advanced bridging technologies also ensures robust security with audited smart contracts to protect enterprise assets.

The intuitive design and advanced bridging technologies make it easy for enterprises to add cross-chain operations to existing workflows. Across Protocol works efficiently on multiple chains giving reliable speed, low latency, and strong security, making it ideal for enterprise management.

| Feature | Details |

|---|---|

| Platform Name | Across Protocol |

| Type | Cross-chain Aggregator |

| Enterprise Focus | Yes – optimized for secure, high-volume enterprise transactions |

| KYC Requirement | Minimal – streamlined onboarding for enterprises |

| Supported Blockchains | Ethereum, Polygon, Arbitrum, Optimism, and other major chains |

| Transaction Speed | Fast – optimized bridging with minimal latency |

| Fees | Low – efficient routing reduces costs for enterprise transfers |

| Security | Audited smart contracts, secure bridge protocols |

| Integration | API and SDK support for enterprise system integration |

| Unique Point | Optimized for low-fee, instant cross-chain transfers while maintaining enterprise security standards |

4. Rango Exchange

Rango Exchange has become a flagship enterprise cross-chain aggregator for its specialized technology that combines multiple bridges and decentralized exchanges into a single interface.

This single interface framework allows enterprises to achieve maximum liquidity and execution across many blockchains without the hassles of multiple, blockchain interfaces. Rango Exchange seeks to maximize efficiency and agility by automatically routing transactions through the fastest and cheapest channels, thus saving time and lowering costs.

Seamless routing, integration, and balance security from audited smart contracts make Rango Exchange integration easy for most systems. Enterprises can depend on Rango Exchange Cross-chain Operations for seamless interoperability, reduced deployment complexity, and efficient scalable routing.

| Feature | Details |

|---|---|

| Platform Name | Rango Exchange |

| Type | Cross-chain Aggregator |

| Enterprise Focus | Yes – designed for seamless multi-chain operations and high-volume transactions |

| KYC Requirement | Minimal – low-friction onboarding suitable for enterprise use |

| Supported Blockchains | Ethereum, BNB Chain, Polygon, Avalanche, Fantom, Arbitrum, and more |

| Transaction Speed | High – automatic routing through fastest liquidity paths |

| Fees | Optimized – aggregated liquidity ensures low-cost transfers |

| Security | Audited smart contracts, secure bridge integration |

| Integration | API support for easy enterprise system integration |

| Unique Point | Aggregates multiple bridges and DEXs to provide enterprises with maximum liquidity and optimal routing |

5. LI.FI Protocol

LI.FI Protocol differentiates itself from other cross-chain aggregators tailored for businesses by the capacity to converge numerous bridges and DEXs into a single routing strategy.

This permits businesses to perform cross-chain transactions at the lowest possible cost with the lowest possible delay. Its intelligent routing mechanism instantly chooses the best cross-chain routing for any number of transactions to save time and money for the enterprise.

Security and trustworthiness are equally critical: enterprise assets are protected by thoroughly audited smart contracts.

Enterprises can perform cross-chain operations with ease due to the flexible P2P integration and operations on the cross-chain. This simplifies the cross-chain operations for businesses with an increased elastic demand on cross-chain blockchain operations.

| Feature | Details |

|---|---|

| Platform Name | LI.FI Protocol |

| Type | Cross-chain Aggregator |

| Enterprise Focus | Yes – designed for scalable, multi-chain enterprise operations |

| KYC Requirement | Minimal – low-friction onboarding for businesses |

| Supported Blockchains | Ethereum, Polygon, BNB Chain, Avalanche, Fantom, Arbitrum, Optimism, and more |

| Transaction Speed | High – intelligent routing optimizes execution time |

| Fees | Low – optimized via smart routing across multiple bridges and DEXs |

| Security | Audited smart contracts, robust bridging protocols |

| Integration | API and SDK support for seamless enterprise integration |

| Unique Point | Integrates multiple bridges and DEXs into a single routing system for efficient enterprise cross-chain transfers |

6. Symbiosis Finance

Symbiosis Finance is one of the best cross-chain aggregators because it adds liquidity multi-chain routing with AMM cross-chain liquidity obstructions, allowing smooth, efficient, and economic movement of assets between any two blockchains.

Its advanced architecture ensures that the transactions are done via the most optimal routes, generating the lowest possible fees and slippage, which is essential for volume-sensitive enterprises.

The security and reliability relies on smart contracts along with robust bridging protocols which protects the institutional assets under advanced theft systems.

Self-service integration tools with multi-chain architecture enables Symbiosis Finance for business to perform complex, symbiotically intertwined, cross-chain business transactions with optimal operational speed, security, and global scale.

| Feature | Details |

|---|---|

| Platform Name | Symbiosis Finance |

| Type | Cross-chain Aggregator |

| Enterprise Focus | Yes – optimized for high-volume, multi-chain enterprise operations |

| KYC Requirement | Minimal – streamlined onboarding suitable for enterprises |

| Supported Blockchains | Ethereum, Polygon, BNB Chain, Avalanche, Fantom, Arbitrum, and more |

| Transaction Speed | High – advanced routing reduces latency |

| Fees | Competitive – optimized via multi-chain liquidity and AMM integration |

| Security | Audited smart contracts, secure bridging protocols |

| Integration | API and SDK support for enterprise system integration |

| Unique Point | Combines multi-chain liquidity routing with AMM integration for efficient enterprise transfers |

7. Orbiter Finance

Orbiter Finance is perceived as one of the best cross-chain aggregators in the market today owing to its unique lightweight and high-speed bridging functionality which allows for asset transfers across multiple blockchains in record time and at a very low cost.

It is architecture is uniquely designed to minimize gas fees and latency which is a must for businesses that are involved in high volume and or frequency transactions.

Reliability and security are also major focal points as Orbiter Finance has robust mechanisms to protect enterprise assets with smart contracts that are thoroughly audited.

Enterprises are also able to easily adopt Orbiter Finance as its simplistic integration to the already existing enterprise system allows for optimized routing. Ultimately, the combination of speed, low cost, and security makes Orbiter Finance one of the most trusted cross-chain solutions for enterprise operational use.

| Feature | Details |

|---|---|

| Platform Name | Orbiter Finance |

| Type | Cross-chain Aggregator |

| Enterprise Focus | Yes – optimized for fast, high-volume enterprise transactions |

| KYC Requirement | Minimal – low-friction onboarding suitable for enterprises |

| Supported Blockchains | Ethereum, Polygon, BNB Chain, Arbitrum, Optimism, Avalanche, and more |

| Transaction Speed | High – lightweight bridging ensures fast execution |

| Fees | Low – optimized routing and minimal gas usage |

| Security | Audited smart contracts, secure bridging protocols |

| Integration | API support for seamless enterprise system integration |

| Unique Point | Lightweight, fast, and cost-efficient cross-chain transfers for enterprises |

8. Hop Protocol

Hop Protocol has quickly become the go-to cross-chain aggregator for enterprises because of its focus on Layer 2 scalability and rapid token transfers.

Hop Protocol minimizes congestion and expensive gas fees on Layer 2 and Ethereum and minimizes congestion and expensive gas fees.

Its carefully constructed advanced liquidity pools and meticulously crafted optimized routing guarantee the execution of a transaction with the least amount of slippage possible. Hop Protocol has also integrated audited smart contracts and robust security policies to protect the assets of any enterprise customer.

Its straightforward and versatile protocol, with rapid adaptivity, enables seamless integration with multi-chain workflows, ensuring enterprises cross-chain operations are speedy, cost-effective, and reliable at scale.

| Feature | Details |

|---|---|

| Platform Name | Hop Protocol |

| Type | Cross-chain Aggregator |

| Enterprise Focus | Yes – optimized for Layer 2 scaling and high-volume enterprise transfers |

| KYC Requirement | Minimal – streamlined onboarding for businesses |

| Supported Blockchains | Ethereum, Polygon, Arbitrum, Optimism, and other major Layer 2 networks |

| Transaction Speed | Very High – optimized for fast Layer 2 transfers |

| Fees | Low – reduces gas costs with Layer 2 bridging |

| Security | Audited smart contracts, secure bridging protocols |

| Integration | API and SDK support for enterprise system integration |

| Unique Point | Focused on Layer 2 scalability and fast cross-chain transfers for enterprise efficiency |

9. Axelar Network

Axelar Network has established itself as a top-rated cross-chain aggregator for enterprises on account of its interoperability and secure decentralized messaging infrastructure.

In difference to traditional aggregators, Axelar allows enterprises to tether any blockchain, enabling assets and data to traverse networks without any barriers.

Its protocol guarantees security, reliability, and scalability, with smart contracts and cryptographic guarantees tethering enterprise transactions.

Moreover, Axelar facilitates loose coupling to enterprise architectures, streamlining cross-chain workflows without compromising on performance.

Narrowing it down, Axelar Network stands out for its cross-multi-chain support, as well as its security and simplified interoperability, allowing enterprises to carry out cross-chain operations with increased speed and confidence.

| Feature | Details |

|---|---|

| Platform Name | Axelar Network |

| Type | Cross-chain Aggregator |

| Enterprise Focus | Yes – optimized for secure, multi-chain enterprise operations |

| KYC Requirement | Minimal – low-friction onboarding suitable for enterprises |

| Supported Blockchains | Ethereum, Polygon, BNB Chain, Avalanche, Solana, Fantom, Arbitrum, and more |

| Transaction Speed | High – fast, reliable cross-chain transfers |

| Fees | Optimized – efficient routing across multiple chains |

| Security | Audited smart contracts, decentralized messaging, robust bridge protocols |

| Integration | API and SDK support for seamless enterprise integration |

| Unique Point | Universal interoperability with secure decentralized messaging for enterprise-grade cross-chain operations |

10. Router Protocol

Router Protocol is reputed to be the ideal cross-chain aggregator for enterprises as it focuses on liquidity aggregation on multiple chains and optimizing the cross-chain routing of transactions.

Its smart system ensures that the enterprise transfers that it handles in aggregate or on behalf of enterprises are done in the most efficient manner possible in terms of costs and time. Router Protocol places a premium value on transparency and security, and protects enterprise value through smart contracts and decentralized validation.

Its support for multiple blockchains and the ability to be integrated seamlessly into enterprise systems enables frictionless cross-chain operations. Businesses can now manage and execute multi-chain workflows seamlessly and cost-efficiently due to Router Protocol’s perfect balance of scale, reliability, and value.

| Feature | Details |

|---|---|

| Platform Name | Router Protocol |

| Type | Cross-chain Aggregator |

| Enterprise Focus | Yes – optimized for scalable, high-volume enterprise transfers |

| KYC Requirement | Minimal – streamlined onboarding suitable for enterprises |

| Supported Blockchains | Ethereum, Polygon, BNB Chain, Avalanche, Fantom, Arbitrum, Optimism, and more |

| Transaction Speed | High – optimized routing ensures fast execution |

| Fees | Low – efficient liquidity aggregation reduces costs |

| Security | Audited smart contracts, secure bridge protocols |

| Integration | API and SDK support for seamless enterprise system integration |

| Unique Point | Aggregates liquidity across multiple chains and provides optimal routing for enterprise-level cross-chain operations |

Pros & Cons

| Pros | Cons |

|---|---|

| Seamless Multi-Chain Access: Allows enterprises to operate across multiple blockchains from a single platform. | Complexity: Some aggregators require technical expertise for integration and maintenance. |

| Optimized Transaction Costs: Intelligent routing minimizes fees and reduces slippage. | Dependency on Bridges: Reliance on third-party bridges may introduce additional risk. |

| High Speed & Scalability: Supports large-volume transfers with minimal latency. | Security Risks: Smart contract vulnerabilities or bridge exploits can affect assets if not audited. |

| Enterprise Integration: Can integrate with existing systems for workflow automation. | Regulatory Uncertainty: Cross-chain operations may face evolving compliance requirements. |

| Enhanced Analytics & Reporting: Provides detailed insights for transaction monitoring and decision-making. | Liquidity Limitations: Some chains may have limited liquidity, affecting swap efficiency. |

| Improved Reliability & Security: Audited contracts and secure bridging protocols protect enterprise assets. | Cost of Advanced Features: Customization and premium features may increase operational expenses. |

Conclusion

In closing, selecting the right cross-chain aggregator is critical for any business looking for seamless, secure, and economical multi-chain functionality.

The most popular cross-chain aggregators, such as Synapse Protocol, Stargate Finance, Across Protocol, Rango Exchange, LI.FI, Symbiosis Finance, Orbiter Finance, Hop Protocol, Axelar Network, and Router Protocol have their pros in routing optimizing, security, fee pricing, and scaling capacity.

Businesses can simplify the transfer and cross-chain workflow of their assets while broadening the liquidity accessible to them by using these cross-chain aggregators. In the end, the business goals of exercising undiluted operational ease, and cross-chain network complexity dominion is highly achievable through the strategically sound choice of an aggregator.

FAQ

Why do enterprises need cross-chain aggregators?

Enterprises require cross-chain aggregators to access liquidity across multiple blockchains, reduce transaction costs, minimize slippage, and streamline multi-chain operations without managing separate bridges or wallets.

What features make a cross-chain aggregator ideal for enterprise use?

Key features include multi-chain compatibility, optimized routing, low fees, high-speed execution, robust security, compliance support, analytics, and easy integration with existing systems.

Which are the best cross-chain aggregators for enterprises?

Top options include Synapse Protocol, Stargate Finance, Across Protocol, Rango Exchange, LI.FI Protocol, Symbiosis Finance, Orbiter Finance, Hop Protocol, Axelar Network, and Router Protocol, each offering unique advantages in liquidity, security, and scalability.