Best Credit Cards To Earn Travel Points are credit card you use might have a big impact on how much you can get back in travel rewards. A number of credit cards are particularly good at accumulating travel points because they combine attractive sign-up bonuses, competitive earning rates, and worthwhile redemption choices. One of the most well-liked features of the Chase Sapphire Preferred Card is its flexible Ultimate Rewards programme, which lets users transfer points to a number of partner hotels and airlines. Another competitor is the American Express Platinum Card, which comes with opulent benefits like premium hotel status, access to airport lounges, and sizable travel credits.

- How Can Select Best Credit Cards To Earn Travel Points?

- Here Is List of The Best Credit Cards To Earn Travel Points

- 30 Best Credit Cards To Earn Travel Points

- 1.Amex MRCC (Best Credit Cards To Earn Travel Points)

- 2.Chase Sapphire Reserve

- 3.Citi Prestige Card

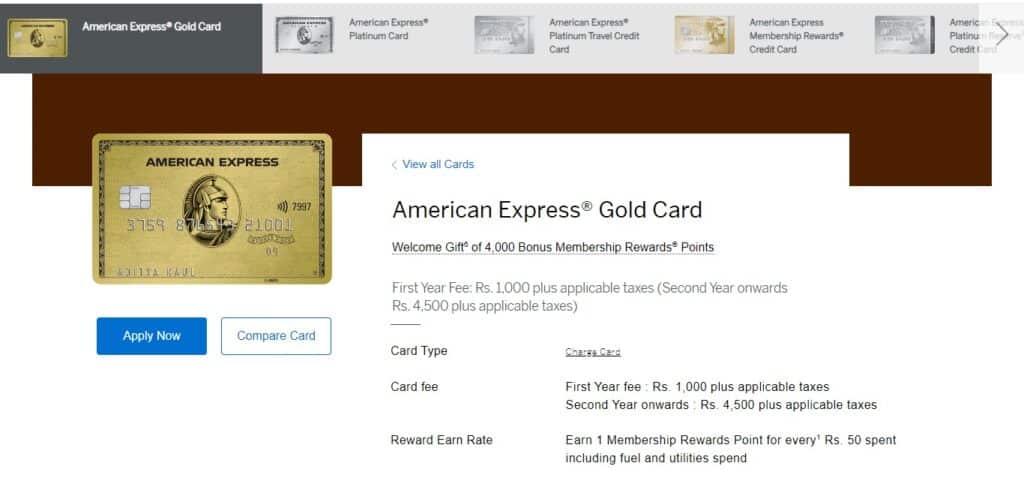

- 4.Amex Gold Charge

- 5.Yatra SBI Card (Best Credit Cards To Earn Travel Points

- 6.Axis Atlas

- 7.Credit card offer

- 8.HDFC Millennia Credit Card

- 9.SBI Air India Signature

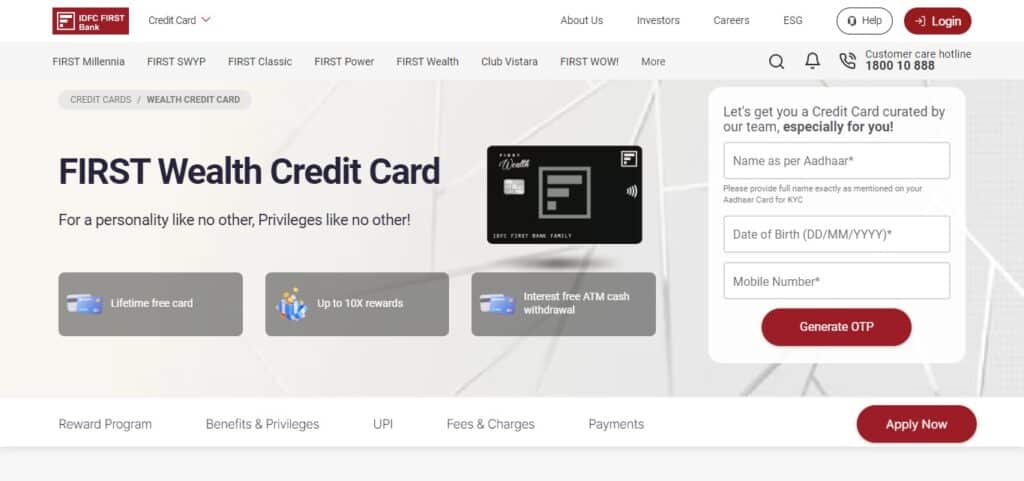

- 10.IDFC Wealth Credit Card (Best Credit Cards To Earn Travel Points

- 11.Premier® Card

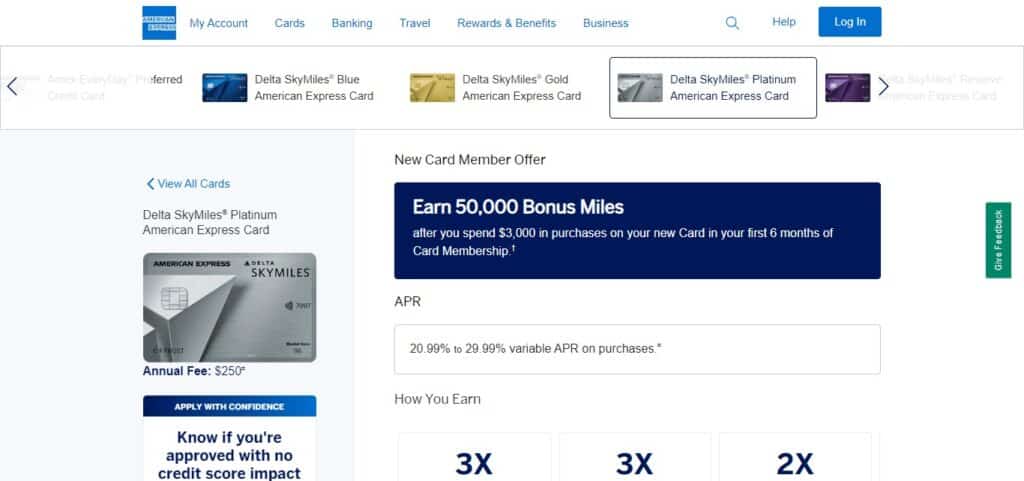

- 12.Delta SkyMiles Platinum American Express Card

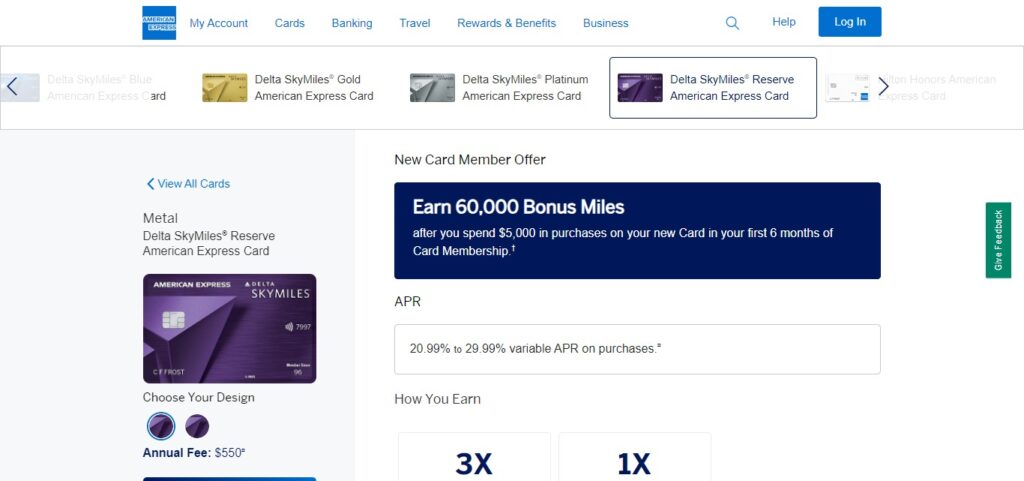

- 13.Delta SkyMiles Reserve American Express Card

- 14.Marriott Bonvoy Boundless Credit Card (Best Credit Cards To Earn Travel Points

- 15.Marriott Bonvoy Brilliant™ American Express® Card

- 16.Hilton Honors American Express Aspire Card

- 17.United Explorer Card

- 18.Southwest Rapid Rewards® Premier Credit Card

- 19.Platinum Card® from American Express (Best Credit Cards To Earn Travel Points

- 20.Gold Delta SkyMiles® Credit Card from American Express

- 21.Barclaycard Arrival Plus World Elite Mastercard

- 22.World of Hyatt Credit Card (Best Credit Cards To Earn Travel Points

- 23.IHG® Rewards Club Premier Credit Card

- 24.Alaska Airlines Visa Signature® Credit Card

- 25.Bank of America® Premium Rewards® Credit Card (Best Credit Cards To Earn Travel Points

- 26.Wells Fargo Propel American Express® Card

- 27.Discover it® Miles

- 28.JetBlue Plus Card (Best Credit Cards To Earn Travel Points

- 29.Avianca Vuela Visa® Card

- 30.British Airways Visa Signature® Card (Best Credit Cards To Earn Travel Points

- Key Selection Best Credit Cards To Earn Travel Points

- Pros And Cons Best Credit Cards To Earn Travel Points

- Conclusion Best Credit Cards To Earn Travel Points

- FAQ Best Credit Cards To Earn Travel Points

The Capital One Venture Rewards Credit Card is also praised for its ease of use, offering clear rewards and simple redemption processes for travel-related costs. Co-branded credit cards, such as the Marriott Bonvoy Boundless Credit Card or the Delta SkyMiles Platinum American Express Card, might offer specialised perks to individuals who are committed to certain airline or hotel chain. The ideal credit card for accruing points ultimately comes down to personal spending patterns, preferred modes of transportation, and required redemption flexibility.

How Can Select Best Credit Cards To Earn Travel Points?

Taking into account a number of aspects that correspond with your trip objectives, spending patterns, and preferences is necessary when choosing the best credit card to accrue travel points. This guide will assist you in selecting the appropriate card:

Investigate and Compare: Begin by learning about several travel rewards credit cards. Examine the characteristics, advantages, and costs of each. Seek for credit cards with enticing introductory offers, competitive earnings rates on transactions, and adaptable redemption schedules.

Sign-Up Bonuses: A lot of travel rewards credit cards include sizeable welcome bonuses. Think about the bonus points’ worth, the amount of money needed to obtain them, and if you can comfortably fulfil the criteria in the allotted time.

Earning Percentages: Analyse the points that can be earned on regular purchases. Certain credit cards provide more points in particular categories, such as dining, travel, or groceries. To get the most points possible, use a credit card that corresponds with your usual spending habits.

Options for Redemption: Verify the range and flexibility of available redemption alternatives. Transferring points to airline and hotel partners is a common feature of the finest travel cards, giving you more value and flexibility when it comes to redeeming your rewards. Consider how simple it is to exchange points for lodging, airfare, and other travel-related costs.

Foreign Transaction Charges: To avoid paying extra money, use a card that has no foreign transaction fees if you intend to use it abroad.

Benefits of Travel: Certain cards come with travel-related benefits including elite status with specific airlines or hotel chains, concierge services, access to airport lounges, and travel insurance. Consider these extra benefits and whether they suit your travel needs.

Here Is List of The Best Credit Cards To Earn Travel Points

- Amex MRCC

- Chase Sapphire Reserve

- Citi Prestige Card

- Amex Gold Charge

- Yatra SBI Card

- Axis Atlas

- Credit card offer

- HDFC Millennia Credit Card

- SBI Air India Signature

- IDFC Wealth Credit Card

- Citi Premier® Card

- Delta SkyMiles Platinum American Express Card

- Delta SkyMiles Reserve American Express Card

- Marriott Bonvoy Boundless Credit Card

- Marriott Bonvoy Brilliant™ American Express® Card

- Hilton Honors American Express Aspire Card

- United Explorer Card

- Southwest Rapid Rewards® Premier Credit Card

- The Platinum Card® from American Express

- Gold Delta SkyMiles® Credit Card from American Express

- Barclaycard Arrival Plus World Elite Mastercard

- World of Hyatt Credit Card

- IHG® Rewards Club Premier Credit Card

- Alaska Airlines Visa Signature® Credit Card

- Bank of America® Premium Rewards® Credit Card

- Wells Fargo Propel American Express® Card

- Discover it® Miles

- JetBlue Plus Card

- Avianca Vuela Visa® Card

- British Airways Visa Signature® Card

30 Best Credit Cards To Earn Travel Points

1.Amex MRCC (Best Credit Cards To Earn Travel Points)

Among the greatest credit cards for accruing travel points is the American Express Membership Rewards Credit Card (MRCC). Cardholders can quickly accrue Membership Rewards points through a comprehensive rewards programme, which can then be redeemed for a range of travel-related costs. The card is a good option for people who eat out or travel regularly because it offers expedited point earning on categories including eating, travel, and some internet activities. Furthermore, the MRCC frequently offers alluring welcome bonuses that significantly increase your point balance right away.

The card’s attractiveness is increased by the versatility of redemption choices, which include transfers to other airline and hotel partners. Access to premium travel features like travel insurance and airport lounge access makes the Amex MRCC a one-stop shop for anybody looking to maximise travel points and take advantage of extra lifestyle perks.

2.Chase Sapphire Reserve

Considered by many to be among the best credit cards for accruing travel miles and taking advantage of opulent travel perks is the Chase Sapphire Reserve. This card offers an amazing rewards programme that lets customers accrue points faster on eating and travel expenses. Since the welcome bonus is frequently big, cardholders have a significant advantage when it comes to accruing points. The flexibility of redemption that the Chase Sapphire Reserve offers is what makes it stand out. Points may be transferred at a good rate to a number of hotel and airline loyalty programmes.

To further improve the travel experience, the card also offers a $300 yearly travel credit, free access to airport lounges, and reimbursement for TSA PreCheck or Global Entry fees. For those looking for a top-tier credit card to improve their travel rewards game, the Chase Sapphire Reserve is an alluring option with its premium features, substantial rewards, and stylish metal appearance.

3.Citi Prestige Card

With a competitive rewards programme, premium bonuses, and a number of other features, the Citi Prestige Card is one of the best credit cards for accumulating travel miles. Focusing on expenses related to travel allows cardholders to quickly collect points—particularly in areas like meals and airfare. A compelling welcome bonus is frequently offered by Citi Prestige Cards, which significantly increases the starting point balance. The distinctive benefits of this card are what make it stand out, such as the free fourth night at any hotel when four or more nights are booked in advance. For frequent travellers, this may add up to big savings.

For individuals who appreciate ease and luxury in their travels, the card also provides lounge access, airline credits, and travel and purchase safeguards, boosting the overall value. For those looking for a high-end credit card to boost their travel points, the Citi Prestige Card is a great option because of its all-inclusive travel advantages and alluring rewards.

4.Amex Gold Charge

If you want to get the most travel points possible with a variety of lifestyle perks, the American Express Gold Charge Card is a great option. This card, which focuses on dining and grocery spending, is a great choice for foodies and frequent supermarket shoppers because it delivers expedited Membership Rewards points. Frequently, the card comes with a substantial introductory bonus that gives users a head start on point accumulation.

The flexibility of the Amex Gold Charge Card’s point redemption is what sets it apart; cardholders can use their points to book stays at different hotels and airlines or apply them as statement credits for qualified travel costs. The card also improves the whole travel experience with features like travel insurance, eating credits, and access to airport lounges. The Amex Gold Charge Card is among the greatest credit cards for accumulating travel points with a hint of luxury because of its generous travel benefits and strong rewards in everyday purchasing categories.

5.Yatra SBI Card (Best Credit Cards To Earn Travel Points

If you’re looking for a credit card designed with travellers in mind, the Yatra SBI Card is a great option. This credit card, which is partnered with Yatra.com, a well-known online travel agency, provides enticing advantages for people who travel regularly. In order to accelerate the accrual of travel points, cardholders can earn accelerated reward points on a variety of travel-related costs, such as hotels, flights, and more. The card frequently comes with alluring welcome bonuses that give the points balance a quick boost.

Additionally, consumers may use their points to book reservations and receive discounts on Yatra.com, which enhances the usefulness and convenience of their travel experience. When it comes to credit cards that are most suited for everyday use as well as fulfilling travel, the Yatra SBI Card stands out due to its travel-focused design and exclusive offers and discounts.

6.Axis Atlas

The top-tier Axis Bank Vistara Credit Card, sometimes referred to as the Axis Atlas Card, is intended primarily for travellers and comes with a number of features that improve the journey experience in general. Through their frequent travel and purchases, cardholders may quickly accrue Club Vistara Points with this co-branded credit card in collaboration with Vistara Airlines. The card frequently comes with alluring welcome bonuses that give the points balance a quick boost. For frequent travellers, the Axis Atlas Card is a great option because it offers free access to domestic lounges, priority check-in, and other benefits.

Furthermore, cardholders can use their accrued points to book flights, get upgrades, and do much more with their travels, making them far more worthwhile. The Axis Atlas Card is among the greatest credit cards for accruing travel points because of its emphasis on travel benefits and incentives. It provides frequent travellers with a smooth combination of luxury and usefulness.

7.Credit card offer

When it comes to credit card offers, few can match the allure of those tailored for earning travel points, and among them stands out a select few as the best in the category. These cards, often with lucrative welcome bonuses, present an opportunity for cardholders to swiftly accumulate points through everyday spending and specific travel-related categories. The allure of accelerated rewards on dining, flights, and hotels makes these cards particularly attractive to frequent travelers. The flexibility in redeeming points, often including transfers to various airline and hotel loyalty programs, adds to their appeal.

Premium travel credit cards typically offer a host of additional benefits such as airport lounge access, travel insurance, and statement credits for travel-related expenses. Whether it’s the sleek metal design of a premium card or the exclusive perks accompanying it, credit card offers for earning travel points provide a gateway to a world of enhanced travel experiences, making them a sought-after choice for savvy consumers looking to turn their regular expenses into exciting travel opportunities.

8.HDFC Millennia Credit Card

When it comes to credit cards that combine regular spending with generous travel benefits, the HDFC Millennia Credit Card is a great choice. This card, which offers expedited rewards on areas like dining, entertainment, and shopping, is specifically tailored to meet the needs of millennials. As such, it’s a great option for people who lead busy lives. In addition to receiving extra perks like savings on meals and gas costs, cardholders can earn cashback on a number of websites.

Additionally, the HDFC Millennia Credit Card offers the option to convert accrued reward points into airline miles or travel vouchers, giving users a practical way to transform everyday expenses into thrilling travel opportunities. The HDFC Millennia Credit Card stands out as one of the best credit cards for accruing travel points because of its emphasis on both lifestyle and travel advantages. This makes it appealing to people who want to strike a balance between their daily expenses and the possibility of fulfilling trip experiences.

9.SBI Air India Signature

For seasoned travellers and regular flyers who want to maximise their travel points and take advantage of special incentives, the SBI Air India Signature Credit Card is an excellent option. This credit card, which is co-branded with Air India, has an attractive rewards programme that enables users to accrue a substantial amount of Air India Flying Returns points for both regular travel and airline purchases. Users can start earning miles right away with the card’s generous welcome bonus, which is commonly included. In addition to its extensive rewards programme, the SBI Air India Signature Credit Card offers a number of travel benefits that improve the whole travel experience, including as priority check-in, free access to airport lounges, and extra luggage allowance.

Additionally, cardholders can choose to use their accrued miles to pay for airfare, hotel stays, and other travel-related costs, which significantly enhances the value of their trips. For individuals who frequently fly with Air India, the SBI Air India Signature Credit Card stands out as one of the best credit cards for collecting travel miles because of its emphasis on airline-specific benefits and rewarding points structure.

10.IDFC Wealth Credit Card (Best Credit Cards To Earn Travel Points

For those looking for a credit card that combines travel rewards, financial management, and luxury, the IDFC financial Credit Card is a great option. This credit card is designed for high-net-worth customers and is a premium offering from IDFC First Bank. It offers a number of advantages. Cardholders who want both luxury and functionality might choose this card because it offers accelerated reward points on a variety of spending categories, such as travel, eating, and lifestyle. Attractive welcome bonuses are a common feature of the IDFC Wealth Credit Card, providing an initial boost to the points balance.

In addition, the card offers special access to concierge services, airport lounges, and other high-end benefits that improve the whole travel experience. The IDFC Wealth Credit Card, which caters to people who value sophistication and smooth travel experiences, stands out as one of the best credit cards for accruing travel points because of its emphasis on wealth management and travel rewards.

11.Premier® Card

Among the best credit cards for people looking to maximise travel points and take advantage of premium travel advantages is the Premier® Card. This credit card, which is frequently provided by reputable financial institutions, has a strong rewards programme that lets users accrue points more quickly, particularly on travel-related costs like lodging, meals, and airfare. Typically, the Premier® Card comes with an alluring welcome bonus that gives cardholders a significant early advantage in accruing points. This card stands out for its flexible point redemption options, which frequently let users transfer points to different hotel and airline loyalty programmes or use them as statement credits for travel-related costs.

To further improve the whole travel experience, these elite cards frequently include special travel benefits like access to airport lounges, travel insurance, and concierge services. For those looking for a premium credit card that will allow them to maximise their travel points and treat themselves to luxurious travel experiences, the Premier® Card is a great option because of its extensive travel rewards and premium features.

12.Delta SkyMiles Platinum American Express Card

Among the greatest credit cards for frequent travellers hoping to earn substantial travel rewards is the Delta SkyMiles Platinum American Express Card, particularly for those using Delta Air Lines. With the help of this co-branded credit card’s extensive rewards programme, users can accrue SkyMiles for regular expenditures made on Delta products as well as other expenses. The card frequently comes with a tempting welcome bonus that gives the points balance a quick boost. The specific Delta-related benefits offered by this card, such as priority boarding, free checked baggage, and discounted Delta Sky Club entry, are what really appeal to me.

Travel insurance is another perk for cardholders, guaranteeing a safe and worry-free trip. Within the vast Delta network, the Delta SkyMiles Platinum American Express Card allows for flexible point redemption for flights, upgrades, and other travel-related costs. This credit card is a great option for frequent Delta flyers who want to improve their travel points and overall experience because of its extensive rewards programme and airline-specific benefits.

13.Delta SkyMiles Reserve American Express Card

The Delta SkyMiles Reserve American Express Card stands out as a premier choice for travelers seeking top-notch benefits and premium rewards within the Delta Air Lines network. This co-branded credit card offers an exceptional rewards program, allowing cardholders to earn SkyMiles at an accelerated rate on Delta purchases and other eligible spending categories. The card often features a substantial welcome bonus, providing a robust start to accumulating travel points. What distinguishes this card is its exclusive Delta-related perks, including complimentary Delta Sky Club access, priority boarding, and a companion certificate, allowing a travel companion to join on a Delta flight annually.

Additionally, cardholders enjoy benefits like free checked bags and priority security screening. The Delta SkyMiles Reserve American Express Card provides a pathway to elite status within the Delta SkyMiles program, unlocking even more privileges for frequent flyers. With its comprehensive travel rewards, premium benefits, and exclusive Delta perks, this credit card is an excellent choice for those who prioritize luxury and convenience when earning travel points within the Delta Air Lines ecosystem.

14.Marriott Bonvoy Boundless Credit Card (Best Credit Cards To Earn Travel Points

Travellers who wish to earn important travel points inside the Marriott Bonvoy reward programme should consider the Marriott Bonvoy Boundless Credit Card. This co-branded credit card, which is frequently provided by top banks, offers a strong rewards programme that lets users accrue points for regular purchases as well as stays at Marriott hotels. The card usually comes with a sizable welcome bonus that adds a significant amount to the starting point balance. The Marriott Bonvoy Boundless Credit Card is unique in that it offers cardholders flexible redemption options for their points, including hotel stays, room upgrades, and even transferability to different airline partners.

In the Marriott Bonvoy programme, cardholders also automatically earn Silver Elite status, which entitles them to extra benefits including priority late checkout and bonus points for stays. For those looking for a credit card that offers a plethora of lodging options and improves their travel point accumulation, the Marriott Bonvoy Boundless Credit Card is a great option thanks to its extensive travel rewards, exclusive Marriott benefits, and the wide range of Marriott hotels it operates worldwide.

15.Marriott Bonvoy Brilliant™ American Express® Card

For tourists wishing to enhance their hotel stays and accrue worthwhile travel points, the Marriott Bonvoy BrilliantTM American Express® Card is a standout credit card. This credit card, co-branded with Marriott Bonvoy, comes with an alluring rewards programme that lets users accrue points on a variety of regular purchases in addition to Marriott stays. The card typically comes with a sizable welcome bonus that greatly increases the starting point balance. This card stands out because to its wealth of premium features, which include free Gold Elite status, an annual free night reward, and an annual statement credit for Marriott Bonvoy properties.

In addition, cardholders get access to lounges, priority check-in, and free Wi-Fi in their rooms, among many other travel benefits. For individuals looking for a credit card that combines extensive travel rewards with exclusive hotel privileges, the Marriott Bonvoy BrilliantTM American Express® Card is a great option because it offers a smooth route to opulent travel experiences across the Marriott portfolio.

16.Hilton Honors American Express Aspire Card

One of the best options for travellers looking for strong rewards and premium perks inside the Hilton Honours loyalty programme is the Hilton Honours American Express Aspire Card. With the help of this co-branded credit card’s attractive rewards programme, users can accrue Hilton Honours points for stays at Hilton hotels as well as for a number of other qualified purchases. The card frequently comes with an alluring welcome bonus that gives you a significant advantage when it comes to point accumulation. The Hilton Honours American Express Aspire Card is unique due to its abundance of upscale features, which include a significant annual resort credit, free Diamond status, and an annual weekend stay incentive.

In addition, cardholders receive automatic Hilton Honours elite status and priority PassTM Select membership, which gives access to airport lounges across the globe. The card is a great option for people looking for a credit card that combines extensive travel rewards with special hotel amenities for an improved travel lifestyle because it provides a smooth route to opulent hotel experiences within the Hilton network.

17.United Explorer Card

For those who travel frequently and want to get the most out of their benefits inside the United Airlines network, the United Explorer Card is a great option. Frequently offered by large financial institutions, this co-branded credit card provides an attractive rewards programme that lets users accrue miles for ordinary expenses as well as purchases made on United. A generous welcome bonus is often included with the card, giving you a strong start when it comes to earning travel miles. The exclusive benefits offered by United, such as priority boarding, free checked baggage, and two United Club passes per year, set the United Explorer Card apart.

In addition, cardholders receive extra travel benefits and protections that improve traveller satisfaction overall. Within the vast United Airlines network, the card offers flexibility when it comes to using miles for flights, upgrades, and other travel-related costs. The United Explorer Card is a great option for credit card users looking to maximise their travel points and gain access to extra benefits inside the United Airlines network, thanks to its extensive travel rewards, premium benefits, and unique United perks.

18.Southwest Rapid Rewards® Premier Credit Card

If you want to earn important travel points, especially inside the South-west Airlines loyalty programme, the South-west Rapid Rewards® Premier Credit Card is a great option. Often offered by large financial institutions, this co-branded credit card offers an exciting rewards programme designed just for fans of South-west Airlines. In addition to earning points for regular spending, cardholders gain Rapid Rewards points on purchases made with South-west Airlines. The card sometimes comes with an alluring introductory bonus to help launch the accumulation of points.

The South-west Companion Pass, which enables a specified companion to travel for free (excluding taxes and fees) when the cardholder purchases or redeems points for a ticket, is one of the card’s exclusive benefits that makes the South-west Rapid Rewards® Premier Credit Card especially alluring. This card is a great option for anyone looking to maximise their travel points within the South-west Airlines network while taking advantage of special features that improve the overall travel experience, such as priority boarding and anniversary points.

19.Platinum Card® from American Express (Best Credit Cards To Earn Travel Points

The American Express Platinum Card® is the ultimate option for discriminating travellers looking for unmatched luxury and generous travel benefits. Known for its elite standing, this credit card boasts an extensive rewards programme that lets users accrue Membership Rewards points for a variety of purchases, with a focus on travel-related costs. The Platinum Card frequently comes with a sizable welcome bonus that significantly increases the starting point balance. This card stands out for its extensive list of travel benefits, which includes elite status with multiple hotel chains, access to airport lounges worldwide, and statement credits for travel-related costs.

In addition, cardholders receive discounts on exclusive events, travel insurance, and concierge services. American Express’s Platinum Card® is a representation of luxury travel, providing a smooth fusion of first-rate rewards and upscale perks. It is the perfect option for individuals who appreciate refinement and unmatched travel experiences.

20.Gold Delta SkyMiles® Credit Card from American Express

For frequent travellers looking to maximise their benefits within the Delta Air Lines network, American Express’s Gold Delta SkyMiles® Credit Card is an excellent option. It offers a strong rewards programme as a co-branded credit card, enabling users to accrue SkyMiles for purchases made on Delta and other qualified transactions. Usually, the card comes with a tempting welcome bonus that gives the points accumulation a big first boost. The Gold Delta SkyMiles® Credit Card stands out due to its unique Delta-related perks, which include discounted in-flight shopping, priority boarding, and a free checked bag on Delta flights.

To improve their overall travel experience, cardholders can also get purchase protection and travel insurance. The card is a great option for those looking for a credit card that combines comprehensive travel rewards with special benefits designed for fans of Delta Air Lines because it allows SkyMiles to be redeemed for flights, upgrades, and other travel-related expenses within the vast Delta network.

21.Barclaycard Arrival Plus World Elite Mastercard

For those looking for flexible travel rewards and an easy redemption process, the Barclaycard Arrival Plus World Elite Mastercard is a great option. With the substantial rewards programme offered by this travel credit card, users can accrue miles for each purchase, regardless of category. Usually, the card comes with a tempting welcome bonus that gives the miles balance a quick boost. The Barclaycard Arrival Plus stands out for how easy it is to use miles for travel expenses. Cardholders can easily redeem miles for a statement credit that can be used to approved travel purchases.

The card is appropriate for overseas travellers because it also provides benefits like no foreign transaction fees. For individuals who like ease and flexibility in accumulating and using travel points, the Barclaycard Arrival Plus World Elite Mastercard is a great option due to its emphasis on flexible travel rewards and easy-to-use redemption choices.

22.World of Hyatt Credit Card (Best Credit Cards To Earn Travel Points

Among the Hyatt credit cards, the World of Hyatt Credit Card is a great option for frequent travellers who value staying in upscale hotels. It is a co-branded credit card with an extensive rewards programme designed with Hyatt fans in mind. In addition to earning points on Hyatt hotel stays, dining, and other qualifying purchases, cardholders frequently receive an alluring welcome bonus that significantly increases the value of their point balance. This credit card stands out for its unique benefits inside the World of Hyatt programme, which include extra elite night credits, an annual free night prise, and automatic Discoverist membership.

Additionally, cardholders receive free nights at certain Hyatt hotels and resorts, significantly enhancing the value of their travel experiences. For those looking for a credit card that meets their needs for upscale lodging and extraordinary travel experiences, the World of Hyatt Credit Card is a great option because of its extensive rewards, unique Hyatt benefits, and point redemption system that allows for opulent stays.

23.IHG® Rewards Club Premier Credit Card

When it comes to travel, the InterContinental Hotels Group (IHG) Premier Credit Card is a great option for making the most of your benefits. With the rich rewards programme of this co-branded credit card, users may accrue IHG Rewards Club points for meals, hotel stays, and other qualifying purchases. Usually, the card comes with an alluring welcome bonus that gives you a significant advantage when it comes to point accumulation. This credit card is unique because of its many special IHG-related benefits, such as an annual free night award, automatic Platinum Elite status, and a fourth reward night free on consecutive stays.

In addition, cardholders receive global entry or TSA precheck fee credit, as well as purchase and travel protection. For those looking for a credit card that combines extensive travel rewards with exclusive hotel privileges, the IHG® Rewards Club Premier Credit Card is a great option because it offers a smooth route to upgraded hotel experiences across the IHG network.

24.Alaska Airlines Visa Signature® Credit Card

The Alaska Airlines Visa Signature® Credit Card is a standout choice for travelers who frequent Alaska Airlines and desire a credit card that offers valuable rewards and exclusive benefits. This co-branded credit card allows cardholders to earn Alaska Mileage Plan miles on eligible purchases, with a particular emphasis on Alaska Airlines transactions. The card often features an attractive welcome bonus, providing a substantial boost to the initial miles balance.

What makes this credit card compelling is its exclusive Alaska Airlines perks, including an annual Companion Fare™ that allows a companion to travel with you for a discounted fare. Cardholders also enjoy benefits like free checked bags and Alaska’s Famous Companion Fare™ every year, which further adds value to their travel experiences. With its focus on Alaska Airlines rewards and tailored benefits, the Alaska Airlines Visa Signature® Credit Card is an excellent choice for those seeking a credit card that aligns with their travel preferences and provides exclusive perks within the Alaska Airlines ecosystem.

25.Bank of America® Premium Rewards® Credit Card (Best Credit Cards To Earn Travel Points

The Bank of America® Premium Rewards® Credit Card is a particularly adaptable and satisfying option for people who want to accumulate travel points and take advantage of various travel-related perks. With the help of this credit card’s attractive rewards programme, users may accrue points for all transactions, plus extra points for eating and travel. The card typically comes with a sizable welcome bonus that greatly increases the starting point balance. The flexibility with which points can be redeemed for gift cards, cash back, or travel is what sets the Bank of America® Premium Rewards® Credit Card apart and gives cardholders the choice to select their favourite redemption option.

To further improve the travel experience, the card offers beneficial travel advantages like an annual travel credit, access to airport lounges, and travel insurance. This credit card is a good alternative for individuals looking for a flexible and lucrative way to make the most of their travel points because of its extensive rewards programme and travel benefits.

26.Wells Fargo Propel American Express® Card

If you’re looking for a credit card that can combine regular spending with valuable travel points, the Wells Fargo Propel American Express® Card is a great option. With the help of this credit card’s comprehensive rewards programme, users may accrue points for a variety of transactions, including meals, vacation, and other well-liked categories. The card frequently comes with an alluring welcome bonus that significantly increases the amount of points that users can accrue. The Wells Fargo Propel Card is unique in that it offers cardholders several alternatives for redeeming their points, such as cash back or travel.

For people who enjoy travelling abroad, this card is especially appealing because it has no annual charge and no foreign transaction taxes. In addition, the Wells Fargo Propel American Express® Card offers beneficial travel benefits like travel insurance and protection for your telephone. This is a great credit card for anyone looking for a flexible way to earn and use travel points because of its flexible redemption options, extensive rewards structure, and travel-friendly features.

27.Discover it® Miles

If you want a simple and lucrative way to accrue travel points, the Discover it® Miles credit card is a great option. With every dollar spent on all purchases, cardholders may accrue an infinite amount of 1.5 miles through this card’s straightforward rewards programme. The Discover Match® programme, which doubles the benefits earned by matching all miles at the conclusion of the first year, is the card’s distinctive feature. Those who want to maximise their travel benefits without paying extra are drawn to the Discover it® Miles card because it doesn’t have an annual fee.

The card additionally offers a convenient and adaptable redemption method by granting freedom in the use of miles for travel-related costs, such as lodging, airfare, and vehicle rentals. For those looking for an easy and lucrative credit card for their travel spending, the Discover it® Miles credit card stands out due to its user-friendly rewards system and the possibility of doubled miles in the first year.

28.JetBlue Plus Card (Best Credit Cards To Earn Travel Points

When it comes to earning important travel points within the JetBlue Airways ecosystem, the JetBlue Plus Card is a standout option. With the help of this co-branded credit card’s extensive rewards programme, users can accrue TrueBlue points for both regular spending categories and JetBlue purchases. The card frequently comes with a compelling welcome bonus that significantly increases the starting point balance. The JetBlue Plus Card stands out because to its specific airline-related privileges, such as the chance to achieve Mosaic elite status and gain access to priority boarding, free first and second checked bags, and accelerated security checks.

Additionally, cardholders receive a hefty anniversary bonus that awards extra points annually. With its extensive rewards programme, special JetBlue benefits, and opportunity for elite status, the JetBlue Plus Card is a great option for anyone looking for a credit card that complements their love of JetBlue travel and provides useful benefits for a smooth and fulfilling trip.

29.Avianca Vuela Visa® Card

A great option for anyone looking for a credit card that offers substantial benefits through the Avianca LifeMiles programme is the Avianca Vuela Visa® Card. With the help of this co-branded credit card’s attractive rewards programme, users may accrue LifeMiles for both regular spending and purchases made on Avianca Airlines. The card frequently comes with an alluring welcome bonus that gives you a big advantage when it comes to accruing travel miles. The versatility of the Avianca Vuela Visa® Card in redeeming LifeMiles for flights, hotel stays, and other travel-related costs across the vast Avianca network and its Star Alliance partners is what sets it apart.

In addition, cardholders receive special benefits such a discount on award ticket redemptions and the opportunity to share LifeMiles with friends and family. The Avianca Vuela Visa® Card is a great option for people looking for a credit card that suits their preference for Avianca travel and offers useful incentives for a smooth and fulfilling travel experience because of its extensive rewards programme and special Avianca privileges.

30.British Airways Visa Signature® Card (Best Credit Cards To Earn Travel Points

For those who would like to have a credit card that supports both British Airways and the larger oneworld alliance, the British Airways Visa Signature® Card is a great option. With a focus on British Airways purchases, this co-branded credit card offers an attractive rewards programme that lets users earn Avios, the airline’s loyalty currency, on eligible expenditure. The card usually comes with a sizable welcome bonus that adds a substantial amount to the initial Avios balance. Unique benefits like the Travel Together Ticket, which lets a companion fly on a reward flight with the cardholder after paying taxes and fees, are what make the British Airways Visa Signature® Card stand out.

In addition, cardholders receive discounts on in-flight purchases and priority boarding, among other travel-related benefits. The British Airways Visa Signature® Card is a great option for anyone looking for a credit card that improves their travel experience with British Airways and provides valuable benefits for a smooth and fulfilling trip because of its extensive rewards structure and exclusive British Airways benefits.

Key Selection Best Credit Cards To Earn Travel Points

Sapphire Preferred® Card from Chase: provides a hefty welcome boost. earns points that can be redeemed for stays at other hotels and airlines through the Chase Ultimate Rewards programme. offers travel insurance along with other beneficial benefits.

Gold Card from American Express: Accumulates points from Membership Rewards, which can be exchanged for flights with different airlines. gives extra points for grocery and restaurants. offers protects against shopping and travel insurance, among other benefits.

Credit Card Capital One Venture Rewards: earns miles at a fixed rate on all purchases. enables you to exchange miles for a set amount towards any travel-related transaction. No costs for international transactions.

Citi Premier® Credit Card: Accumulates ThankYou Points that can be exchanged for airline partners. gives extra points for dining, entertainment, and travel. offers perks for travel protection.

Pros And Cons Best Credit Cards To Earn Travel Points

Here are some general pros and cons to consider:

Pros:

- The primary advantage is the ability to earn points or miles that can be redeemed for travel-related expenses such as flights, hotel stays, rental cars, and more.

- Many travel credit cards offer lucrative sign-up bonuses, providing a significant number of points or miles after meeting a minimum spending requirement.

- Some travel credit cards offer benefits such as travel insurance, rental car insurance, airport lounge access, and other travel-related perks.

- Cards with flexible redemption options allow you to use points or miles for various travel-related expenses, giving you more freedom in how you use your rewards.

Cons:

- Some cards may limit redemption options, or the value of points/miles may vary depending on the type of travel or specific partners.

- Some cards may have high spending requirements to unlock the bonus, and it’s essential to avoid overspending just to reach the threshold.

- These benefits may come with specific conditions and limitations, so it’s crucial to understand the coverage and exclusions.

- Flexibility may vary among cards, and some may have restrictions on redemption options or partner programs.

Conclusion Best Credit Cards To Earn Travel Points

In conclusion, carefully weighing a variety of aspects is necessary when selecting the best credit card to accrue travel points. Travel credit cards are full of alluring incentives and bonuses, but before you apply, be sure the card will fit your spending style, way of life, and travel preferences by weighing the advantages and disadvantages.

The capacity to earn travel rewards can greatly improve your travel experiences, particularly through continued spending and sign-up bonuses. A travel credit card can gain significant value by offering beneficial benefits like lounge access and flexible redemption choices.

But one shouldn’t ignore certain disadvantages including yearly costs, exorbitant interest rates, and restricted acceptance in some areas. Making the most of a credit card’s benefits requires an understanding of its terms and conditions as well as the nuances of its rewards programme.

The greatest credit card to use to accrue travel points ultimately comes down to your personal preferences and how well the card fits into your overall budget. Examine your travel habits, purchasing trends, and ability to handle the intricacies of specific rewards programmes. By doing this, you can select a credit card for travel that not only earns points quickly but also improves your trip experience in general. Remain aware of any modifications to the terms and conditions at all times, and use the card sensibly to optimise.

FAQ Best Credit Cards To Earn Travel Points

What is a travel rewards credit card?

A travel rewards credit card is a type of credit card that allows cardholders to earn points, miles, or other rewards specifically geared towards travel-related expenses such as flights, hotels, and rental cars.

What are the key features to look for in a travel credit card?

Key features to consider include the rewards rate for spending, sign-up bonuses, annual fees, redemption options, travel-related perks (such as travel insurance, lounge access, and no foreign transaction fees), and the flexibility of the rewards program.

How can I redeem travel points?

Redemption options vary but often include booking flights, hotels, rental cars, or other travel-related expenses directly through the credit card’s rewards portal. Some cards also allow for cashback or statement credits, and others may offer transferable points to airline or hotel partners.

What is an annual fee, and are travel credit cards worth it despite having one?

An annual fee is a yearly charge for using the credit card. While many travel credit cards have annual fees, the benefits, rewards, and perks offered can often outweigh the cost for frequent travelers. It’s important to assess your spending habits and travel needs to determine if the card’s features justify the annual fee.

Do travel credit cards affect my credit score?

Opening a new credit card can have a temporary impact on your credit score, typically due to a hard inquiry. However, responsible use of the credit card, including timely payments and maintaining a low credit utilization ratio, can positively influence your credit score over time.