In this article, I will to talk about the Best Credit Cards in America catering to varying spending habits and lifestyles. These cards offer varying rewards, whether it be cash, travel, minimal to no fees, and added benefits.

- What is Credit Cards?

- How To Choose Credit Cards in America

- Key Point & Best Credit Cards in America

- 1.Citi Simplicity® Card

- 2. American Express® Gold Card

- 3. Blue Cash Preferred® from American Express

- 4. Chase Sapphire Preferred® Card

- 5. Gold Delta SkyMiles® Credit Card from American Express

- 6. Chase Sapphire Reserve®

- 7. Ink Business Preferred℠ Credit Card

- 8. The Platinum Card® from American Express

- 9. Capital One® Venture® Rewards Credit Card

- Pros & Cons

- Conclusion

- FAQ

You can build and manage your finances with these cards effectively, and take advantage of your rewards. If you’re a traveler, a daily shopper, or a business owner, this guide is for you.

What is Credit Cards?

A credit card is defined as a financial product provided by banks or other financial institutions which enables clients to make purchases or pay for services by borrowing money within a certain limit.

In contrast to a debit card which is used to make withdrawals from a bank account, a credit card allows consumers to defer making a payment, offering a short-term loan which is expected to be paid back, with interest, within a specified period.

Other benefits attached to credit cards include reward points, cash-back, travel benefits, and protection on certain purchases. Positive use strengthens credit history, while negative use results in excessive debt.

How To Choose Credit Cards in America

Understand Your Spending Patterns – Cards offer rewards on categories like grocery shopping, eating out, traveling, or getting gas.

Look at Annual Fees – Some cards offer great perks for high annual fees or have no fees but provide minimal perks.

Analyze the Interest Rates (APR) – If you plan on carrying a balance, look for a low APR. If you pay the full balance each month, APRs are less important compared to the card rewards.

Analyze the Rewards – If you spend a lot on a certain category, think of a cashback card, otherwise a card that offers points or miles on travel will be best.

Look for Initial Offers – There are cards that offer bonuses, promotional periods of 0% APR, or a credit on your statement.

Assess Other Features – Trip insurance, extended warranties, purchase protection, and concierge services are a few perks cards offer.

Look at the Requirements to Obtain the Card – Each card requires a certain credit score, make sure yours is high enough to be approved.

Review the Fine Print – Payments, late charges, fees for crossing country borders, and redemption of rewards.

Key Point & Best Credit Cards in America

| Credit Card | Key Points |

|---|---|

| Citi Simplicity® Card | No late fees, no penalty APR, 0% intro APR on purchases and balance transfers. |

| American Express® Gold Card | High rewards on dining & groceries, travel benefits, annual dining credits. |

| Blue Cash Preferred® from American Express | High cash back on groceries & streaming, intro APR on purchases, no foreign transaction fees. |

| Chase Sapphire Preferred® Card | Strong travel rewards, flexible point redemption, travel insurance & protection. |

| Gold Delta SkyMiles® Credit Card from American Express | Delta flight benefits, miles on purchases, priority boarding & free checked bag. |

| Chase Sapphire Reserve® | Premium travel perks, high points on travel/dining, airport lounge access, travel credits. |

| Ink Business Preferred℠ Credit Card | Business rewards, high points on travel & advertising, employee cards at no extra cost. |

| The Platinum Card® from American Express | Luxury travel benefits, high points on flights, airport lounge access, concierge service. |

| Capital One® Venture® Rewards Credit Card | Flat miles on all purchases, travel statement credits, no foreign transaction fees. |

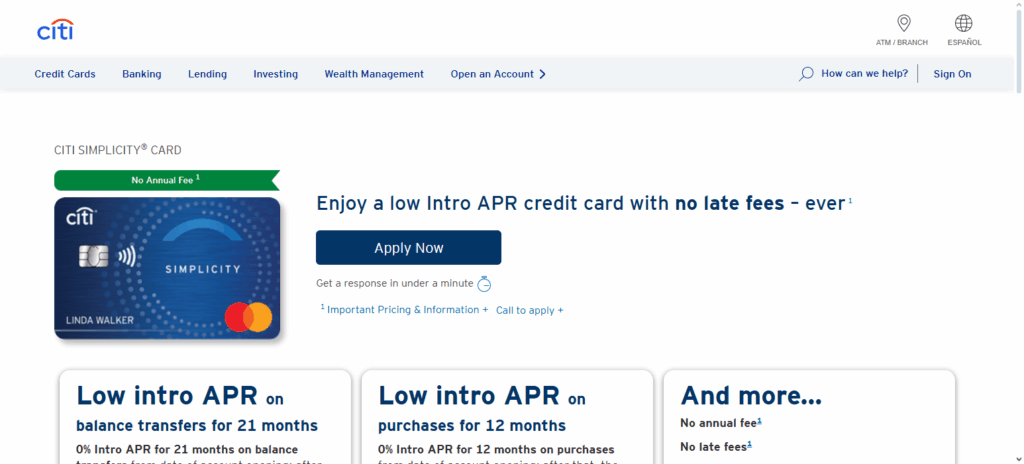

1.Citi Simplicity® Card

One of the best US credit cards for people looking to pay off debt or make big purchases with no interest is the Citi Simplicity® Card. There is no annual fee, and for the first year, you get 0% intro APR for a year for purchases and 21 months for balance transfers. This gives you almost a year to pay purchases off interest-free.

It is great for people who are trying to spend a lot or pay off debt and looking to save interest. Other than the no annual fee, the card also has no late fees, no penalty APR, and no late fees which makes the credit easy to manage for people who spend responsibly.

Unlike other cards, the Citi Simplicity® Card does not have cash back or rewards for purchases which is balanced by the long interest-free period.

| Feature | Details |

|---|---|

| Card Name | Citi Simplicity® Card |

| Type | Standard / No Annual Fee |

| Annual Fee | $0 |

| Intro APR | 0% on purchases and balance transfers for 21 months |

| Regular APR | 17.49% – 27.49% variable |

| Rewards | None (focus on low fees and long intro APR) |

| Supermarket / Dining | Not reward-based |

| Purchase Protection | Yes, limited coverage |

| Credit Check / KYC | Minimal, simple application process |

| Late Fees | No late fees |

| Foreign Transaction Fees | 3% |

| Best For | Users seeking long 0% APR and minimal KYC requirements |

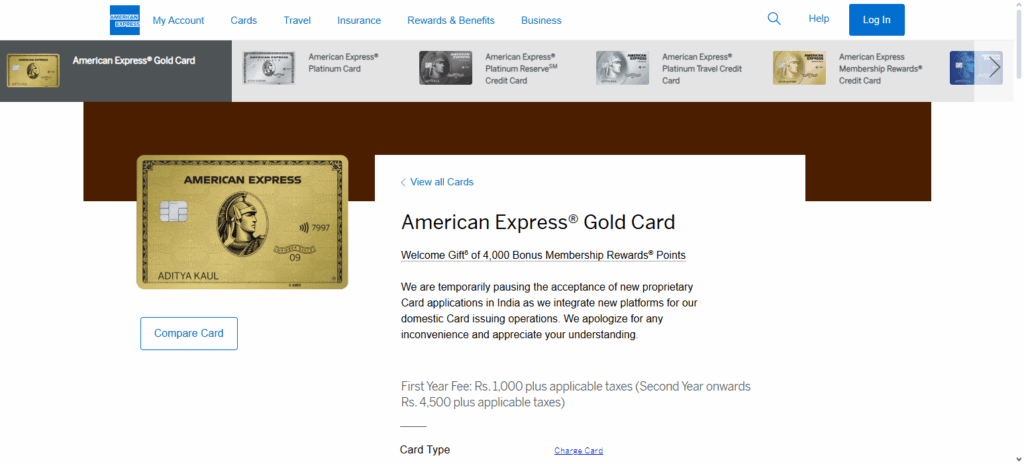

2. American Express® Gold Card

The American Express® Gold Card is one of the best Gold cards in America, especially for those who like eating out and spending money at supermarkets in the country.

The Amex Gold comes with a $325 annual fee and first-class rewards like 4X Membership Rewards® points for all non-restaurant and restaurant purchases (including takeout and delivery and up to $25,000 a year, then 1X) at U.S. Supermarkets and all worldwide dining establishments, 4X points at U.S. supermarkets on up to $25,000 per year in purchases, and 3X point on flights with direct booking.

On top of that, Gold Card members earn $120 yearly or $10 per month to pay for eats and $120 in Uber cash, so it is geared to add savings to your everyday spending and all of this is available monthly. The cash “back” is really in points, which can be redeemed in travel, gift cards, or statement credits. The membership points really cover for spending in the everyday world.

| Feature | Details |

|---|---|

| Card Name | American Express® Gold Card |

| Type | Rewards / Premium Credit Card |

| Annual Fee | $250 |

| Rewards | 4X points at restaurants, 4X points at U.S. supermarkets (on up to $25,000/year), 3X points on flights booked directly with airlines or Amex Travel |

| Intro Offers | 60,000 Membership Rewards® points after spending $4,000 in first 6 months |

| Purchase Protection | Yes, up to 90 days |

| Credit Check / KYC | Minimal, straightforward application |

| Foreign Transaction Fees | None |

| Best For | Frequent diners, supermarket shoppers, and travelers seeking high rewards points |

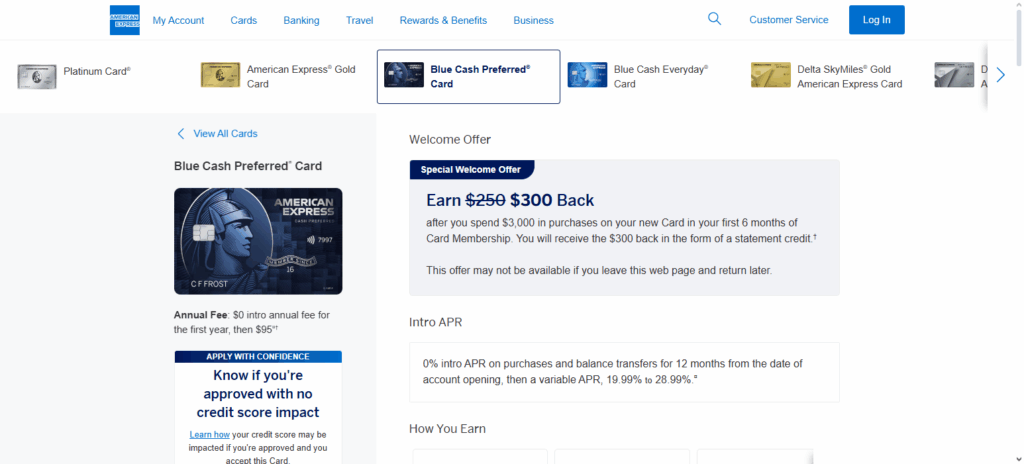

3. Blue Cash Preferred® from American Express

The Blue Cash Preferred® Card from American Express is among the top credit cards in the USA. It is especially valuable for those who shop at U.S. supermarkets, use streaming services, and spend on transit.

With a waived first-year annual fee, and $95 for subsequent years, this card is generous with cash back offers: 6% on U.S. supermarkets (on $6,000 purchases per year, then 1% 6%) and select U.S. streaming subscriptions, and 3% on U.S. gas stations and transit (taxi, rideshare, parking, tolls, train, bus) .

New users can get a $250 statement credit for $3,000 eligible purchases in the first 6 months . Due to the excellent cash back offer and rewards, this card is ideal for everyday spending, especially given the fee waivers for first time users.

| Feature | Details |

|---|---|

| Annual Fee | $0 introductory annual fee for the first year; $95 thereafter |

| Rewards | 6% cash back at U.S. supermarkets (on up to $6,000 per year in purchases, then 1%); 6% on select U.S. streaming subscriptions; 3% at U.S. gas stations and on transit; 1% on other purchases |

| Intro APR | 0% on purchases and balance transfers for the first 12 months; variable APR of 20.24%–29.24% thereafter |

| Credit Score Needed | Good to excellent (typically 670 or higher) |

| Foreign Transaction Fee | 2.7% of each transaction after conversion to U.S. dollars |

| Application Process | Requires basic KYC documents: proof of identity (e.g., passport, driver’s license) and proof of address (e.g., utility bill, bank statement) |

| Best For | Individuals seeking high cash back rewards on everyday spending, particularly in supermarkets and on streaming services |

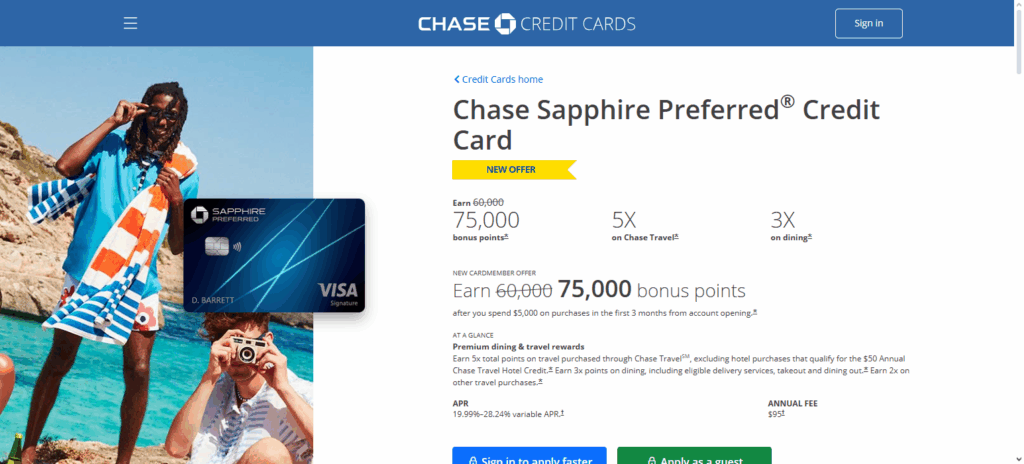

4. Chase Sapphire Preferred® Card

The Chase Sapphire Preferred® Card is one of the best credit cards in the US, especially for value-seeking and flexible traveling customers.

With an annual fee of $95, cardholders earn 5 points per dollar for travel purchases through Chase Ultimate Rewards, 3 points on dining, online grocery purchases (excluding Target, Walmart, and wholesale clubs), and select streaming services, and 2 points on other travel purchases .

As an added benefit, customers get a $50 annual hotel credit for hotel stays booked through Chase Travel ([Chase][2]). And, of course, there is a bonus of 10% anniversary points which means customers will get bonus points equal to 10% of their total purchases every account anniversary year.

| Feature | Details |

|---|---|

| Card Name | Chase Sapphire Preferred® Card |

| Best For | Travel rewards and dining |

| Annual Fee | $95 |

| Signup Bonus | 60,000 points after spending $4,000 in first 3 months |

| Rewards Rate | 2X points on travel and dining, 1X on all other purchases |

| Foreign Transaction Fees | None |

| Minimal KYC | Requires standard identity verification, minimal documentation for U.S. residents |

| Redemption Options | Travel, gift cards, statement credits, transfer to travel partners |

| Security Features | Zero liability protection, fraud monitoring, chip technology |

| Customer Support | 24/7 phone and online support |

| Extra Benefits | Trip cancellation/interruption insurance, purchase protection, extended warranty |

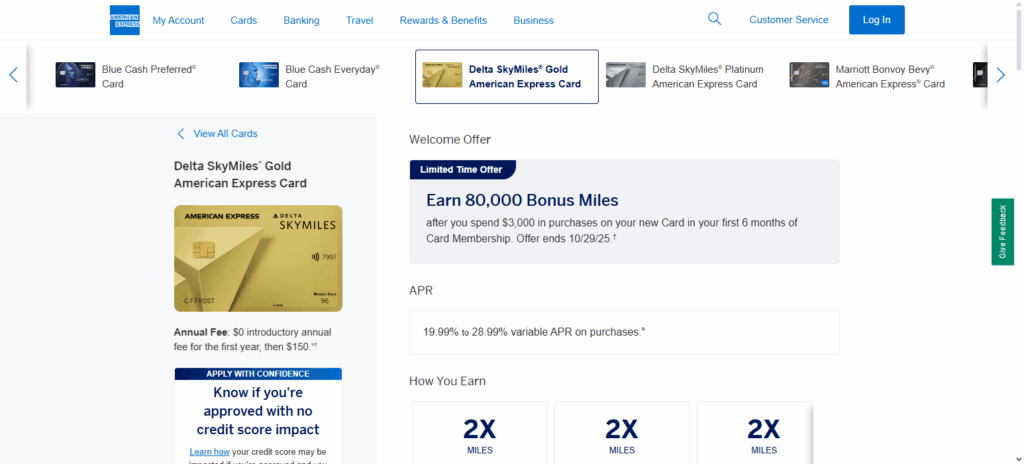

5. Gold Delta SkyMiles® Credit Card from American Express

The Gold Delta SkyMiles® Credit Card from American Express is a great pick for Delta Airlines loyalists who appreciate different benefits for their purchases. The card comes with a $0 annual fee for the first year and then $150 for subsequent years.

Cardholders receive 2 miles per dollar spent on Delta SkyMiles purchases, 2 miles everywhere else on food and 2 miles on groceries.

The Gold Delta SkyMiles Card comes with great additional perks like a free first checked bag on Delta flights, priority boarding on Delta flights, a 15% discount on award flights booked and the card is able to receive a $200 Delta Flight Credit for annual purchases of $10,000, which is great as flights can get rather pricey.

This card is perfectly suited for people who are frequent Delta Airlines passengers and rewards them for their purchases.

| Feature | Details |

|---|---|

| Card Name | Gold Delta SkyMiles® Credit Card from American Express |

| Type | Travel Rewards Credit Card |

| Eligibility / KYC | Minimal KYC required for approval |

| Annual Fee | $0 introductory first year, then $99 (varies by region) |

| Rewards Program | Earn Delta SkyMiles on purchases: 2X on Delta purchases, 1X on others |

| Welcome Bonus | Sign-up bonus: Up to 40,000 SkyMiles (terms apply) |

| APR | Standard purchase APR: 17.24% – 25.24% variable (region dependent) |

| Foreign Transaction Fees | None |

| Additional Benefits | Priority boarding on Delta flights, first checked bag free, travel insurance, no preset spending limit (subject to approval) |

| Deposit/Payment Methods | Bank transfer, credit card payments |

| Customer Support | 24/7 phone and online support |

| Best For | Frequent Delta flyers seeking rewards with minimal KYC |

| Other Notes | Can be paired with Delta Sky Club membership for extra benefits |

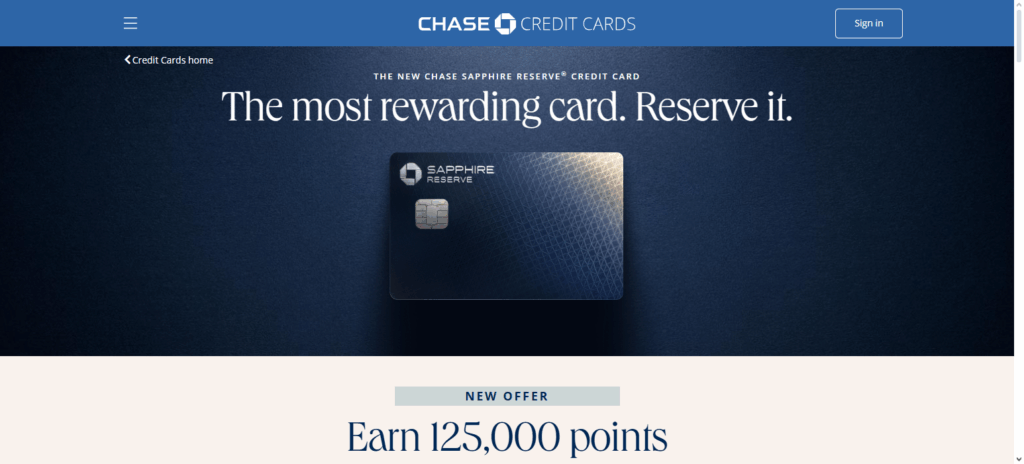

6. Chase Sapphire Reserve®

One of the best credit cards in America and best suited for travelers and their benefits is the Chase Sapphire Reserve. For an annual fee of $795, the benefits justify the fee if the traveler is a heavy user of the card. Cardholders do receive an annual fee of $300 which applies to a long list of travel-related expenses, so most members should be able to get the fee back.

Cardholders receive $500 in credits for stays with The Edit which includes luxury hotels, perks like room upgrades, and breakfast for two. For dining, members receive $300 in annual dining credits with the Sapphire Reserve Exclusive Tables program and $300 in entertainment credits for purchases with StubHub and viagogo.

The Card includes access to 1,300+ airport lounges through Priority Pass Select and the Sapphire Lounge network. Sapphire Reserve members receive $120 in credits for Peloton, $300 in DoorDash promos, $120 in Apple subscriptions and a $300 DoorDash card. Sapphire Reserve is most suited for travelers for the best services.

| Feature | Details |

|---|---|

| Card Name | Chase Sapphire Reserve® |

| Issuer | JPMorgan Chase |

| Annual Fee | $795; $195 for each authorized user |

| Welcome Bonus | 125,000 points after spending $6,000 in the first 3 months |

| Rewards Program | 8x points on travel through Chase Ultimate Rewards, 4x on travel and dining, 1x on all other purchases |

| APR | 20.24% variable |

| Foreign Transaction Fees | None |

| Credit Score Requirement | Typically 740 or higher; lower scores may still be approved but not instantly |

| Income Requirement | Sufficient income to support credit line; minimum credit line often starts at $10,000 |

| KYC Requirements | Standard KYC procedures; minimal KYC may apply depending on applicant’s profile |

| Approval Odds | Higher for applicants with excellent credit and low recent credit activity |

| Best For | Frequent travelers seeking premium rewards and benefits |

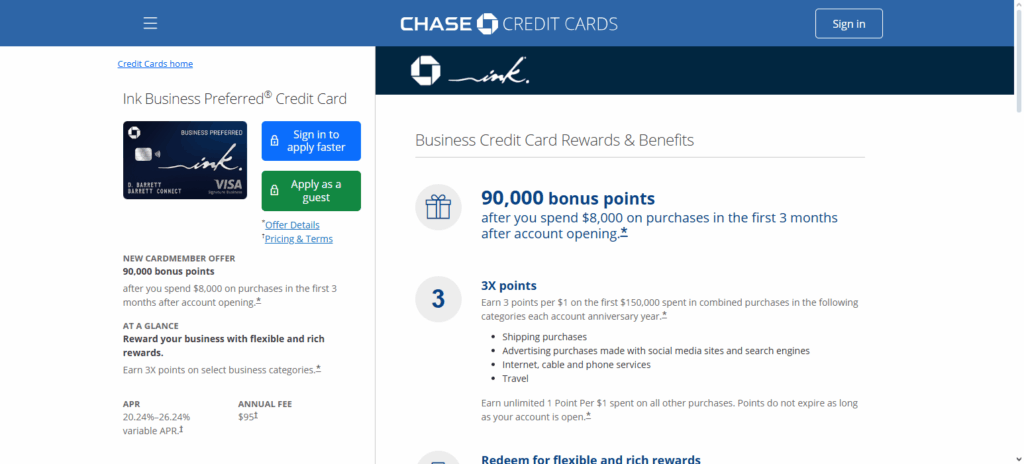

7. Ink Business Preferred℠ Credit Card

The Chase Ink Business Preferred® Credit Card is consistently rated among the finest business credit cards in the United States. For only $95 per year, this card provides small business owners with rewards on everyday purchases.

New cardmembers will receive a 90,000-point bonus which is worth $1,845 in travel after meeting the $8,000 minimum spending in 3 months requirement. Business owners receive 3 points for every dollar spent within the first $150,000 per year on a grouped range of purchases including: travel, shipping, internet, telephone, advertising, and most importantly, social media .

Every other purchase has a earning rate of 1 point per dollar spent. These points are redeemable through the Chase Ultimate Rewards® portal, as well as flexible and transferable travel rewards with their travel and hospitality partners.

The card offers a complete range of business expense management features at zero cost, and earns significant rewards on other expenses including other perks like primary auto rental collision damage waiver, trip cancellation/interruption insurance, and cell phone protection.

| Feature | Details |

|---|---|

| Card Name | Ink Business Preferred℠ Credit Card |

| Issuer | Chase Bank |

| Type | Business Credit Card |

| Annual Fee | $95 |

| Welcome Bonus | 100,000 points after spending $15,000 in first 3 months |

| Rewards | 3× points on travel, shipping, internet, cable & phone services, advertising purchases; 1× points on all other purchases |

| Points Redemption | Travel, cash back, gift cards via Chase Ultimate Rewards® |

| Foreign Transaction Fee | None |

| KYC Requirements | Minimal, standard business verification |

| Additional Benefits | Employee cards at no extra cost, cell phone protection, purchase protection, travel insurance |

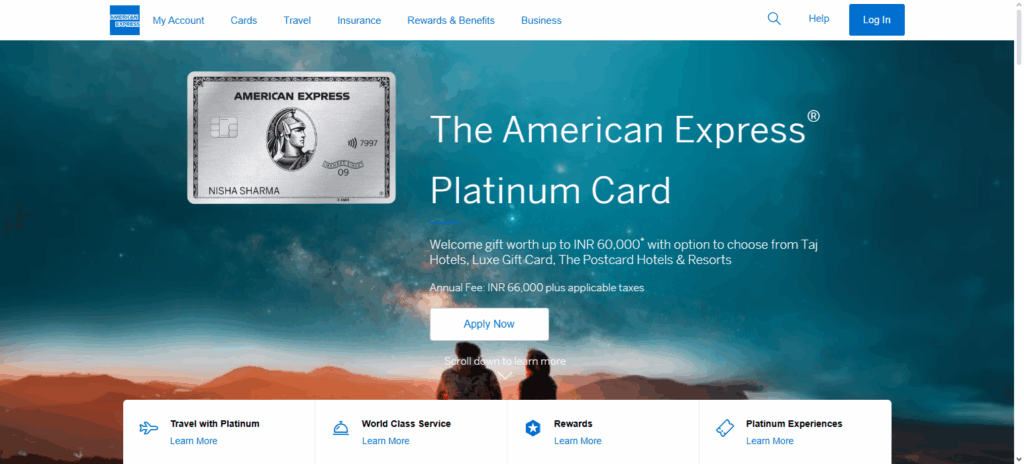

8. The Platinum Card® from American Express

The Platinum Card® from American Express is rated among the best credit cards in America. It is best suited for travelers and people who love the best things in life. It is the best premium credit card for travelers. The benefits from the card are easy to get and justify the $895 annual fee.

This is primarily because the card earns 5 Membership Rewards® points for every dollar spent on flights booked directly with airlines and American Express Travel, and every dollar spent on prepaid hotel bookings. Moreover, the card earns access to the Global Lounge Collection which comprises over 1,300 airport lounges globally and $600 hotel credits for eligible bookings through American Express Travel.

The hotel credits are $600 each year. Other benefits include $200 in Uber Cash, $400 in Lululemon credits, and $300 in dining credits through Resy. This is why people value the Platinum Card® more than the rest. The exclusive benefits, Lululemon and Uber Cash credits, justify the fee in the card.

| Feature | Details |

|---|---|

| Card Name | The Platinum Card® from American Express |

| Issuer | American Express |

| Type | Personal / Premium Rewards Credit Card |

| Annual Fee | $695 |

| Welcome Bonus | 100,000 Membership Rewards® points after spending $6,000 in first 6 months |

| Rewards | 5× points on flights booked directly or via Amex Travel, 5× points on prepaid hotels booked on Amex Travel, 1× points on other purchases |

| Points Redemption | Travel, gift cards, statement credits, transfer to airline/hotel partners |

| Foreign Transaction Fee | None |

| KYC Requirements | Minimal, standard identity verification |

| Additional Benefits | Airport lounge access (Centurion & Priority Pass), Uber credits, TSA PreCheck/Global Entry fee credit, purchase protection, concierge services |

9. Capital One® Venture® Rewards Credit Card

The Capital One® Venture® Rewards Credit Card remains a classic American credit card choice, particularly for those who want uncomplicated rewards. It has a $95 annual fee and earns cardholders 2 miles for every dollar spent, every day, making it a terrific choice for ordinary purchases.

Furthermore, for every dollar spent on hotel, vacation rentals, and rental cars booked through Capital One Travel, cardholders earn 5 miles. One of the best features is the 75,000-mile bonus for spending $4,000 in the first 3 months, which is worth $750 in travel.

For travel, miles can be redeemed for nearly any travel expense or transferred to 15+ travel partners. Cardholders also receive up to $120 in statement credits to cover the fees of Global Entry or TSA PreCheck and Capital One Travel offers lower rates on flights, hotels, and rental cars. For travelers who want simplicity and competitive benefits, the Venture Rewards Credit Card has the necessary features.

| Feature | Details |

|---|---|

| Card Name | Capital One® Venture® Rewards Credit Card |

| Issuer | Capital One |

| Type | Personal / Travel Rewards Credit Card |

| Annual Fee | $95 |

| Welcome Bonus | 75,000 miles after spending $4,000 in first 3 months |

| Rewards | 2× miles on every purchase; 5× miles on hotels and rental cars booked through Capital One Travel |

| Points Redemption | Travel statement credits, transfer to travel partners, gift cards, cash back |

| Foreign Transaction Fee | None |

| KYC Requirements | Minimal, standard identity verification |

| Additional Benefits | Travel insurance, no blackout dates on travel redemption, extended warranty, rental car insurance |

Pros & Cons

Pros

- Credit Building. With responsible use, credit cards can help build your credit score, making it easier to get loans in the future .

- Rewards & Perks. Many credit cards offer cash back, travel points, purchase protections, and other benefits like fraud liability. .

- Convenience. Credit cards can be useful for online shopping, travel reservations, and cash emergencies.

- Consumer Protections. Credit cards provide consumer protection for unauthorized use, purchase disputes, etc .

Cons

- High Interest Rates. Credit cards can have exorbitant interest rates, especially when balances are carried month over month .

- Debt Risk. Easy credit is a psychological trap. It increases the odds of acquiring debt .

- Fees. Credit cards can have a host of fees, including annual fees, late payment fees, and foreign transaction fees.

- Credit Score. Failure to make a payment or keep a balance high can result in having a lower credit score .

Conclusion

To sum up, the most suitable American credit card for you will depend on your earning pattern, monetary objectives, and way of living.

Whatever your preference for cards might be, there will be one that matches your requirements, be it cashback, travel rewards, minimal costs, or additional benefits. Rewards and benefits are maximized and a solid reimbursement history is attained through responsible card use.

A thorough assessment of the features, costs, and rewards schemes will result in a card that increases ease of monetary transactions, gives essential safety, and promotes economic progress over a period, turning the credit card from a liability into a value addition.

FAQ

What are the best credit cards in America?

The best credit cards vary by need: cashback cards like Blue Cash Preferred®, travel rewards cards like Chase Sapphire Reserve®, and business cards like Ink Business Preferred® offer top benefits in their categories.

How do I choose the right credit card?

Consider your spending habits, annual fees, rewards programs, interest rates, and additional perks to match a card to your lifestyle.

Do these cards offer rewards on everyday spending?

Many do: grocery, dining, gas, and streaming purchases often earn cashback or points, depending on the card.

Is it safe to use credit cards in America?

Yes, most cards offer fraud protection, zero-liability policies, and purchase protection for secure transactions.