In this article, I will explore the Community-run Bridging Aggregator for Local Altcoins. This decentralized system allows participants to move tokens over several blockchains.

- What is a Bridging Aggregator?

- Why Use a Community-run Bridging Aggregator For Local Altcoins

- Key Point & Best Community-run Bridging Aggregator For Local Altcoins List

- 1. ChainHop

- 2. LI.FI Protocol

- 3. Rango Exchange

- 4. DeBridge

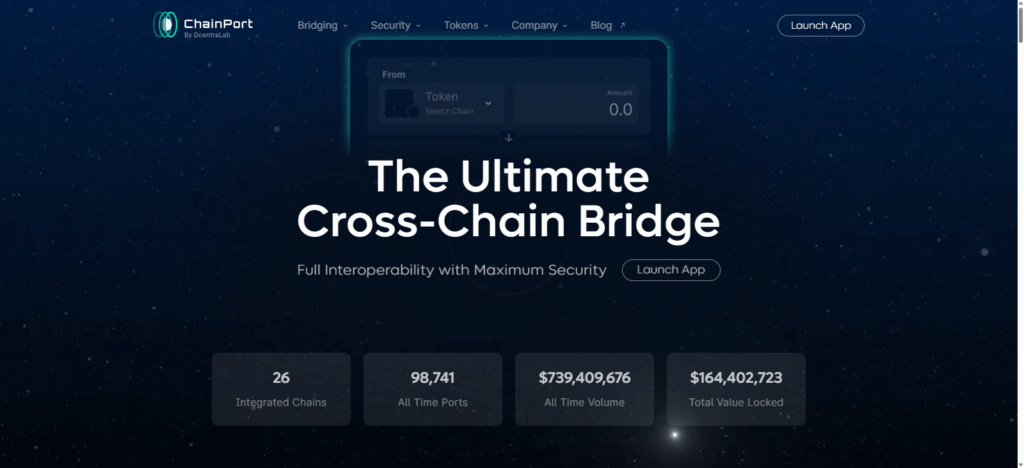

- 5. ChainPort

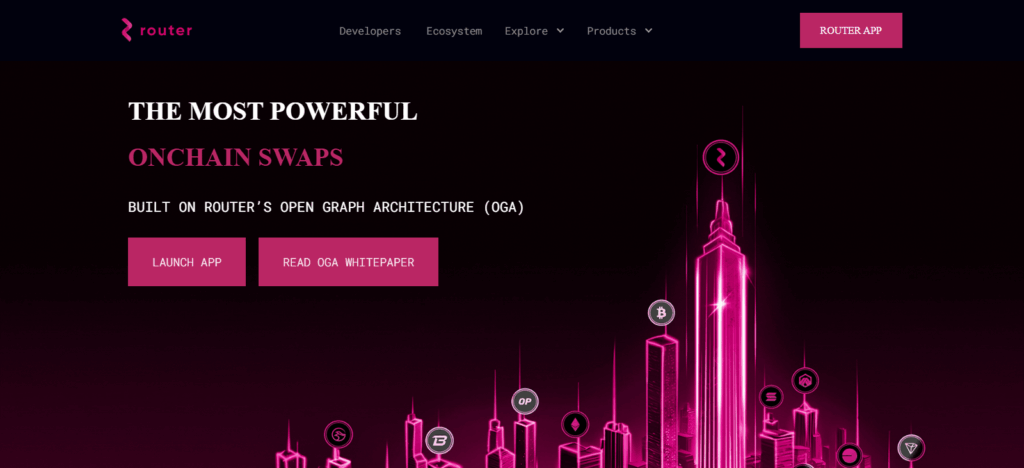

- 6. Router Protocol

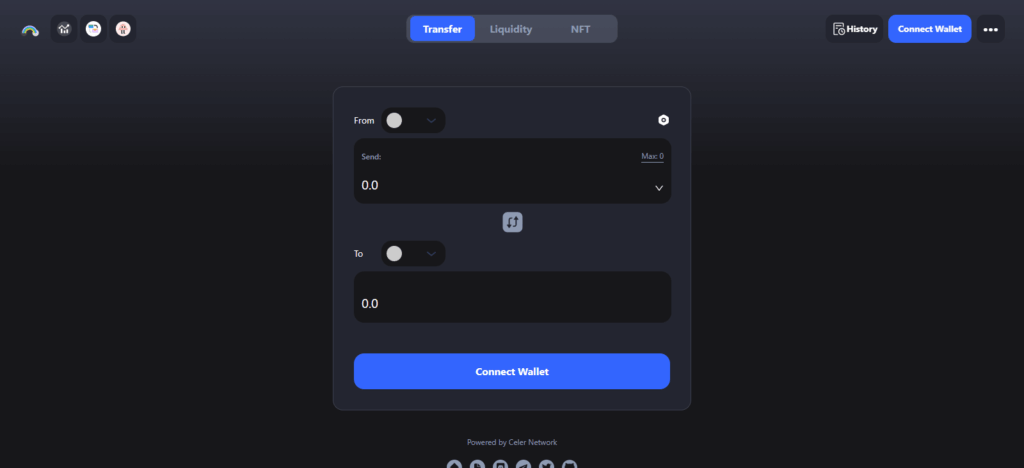

- 7. Celer cBridge

- 8. Hop Protocol

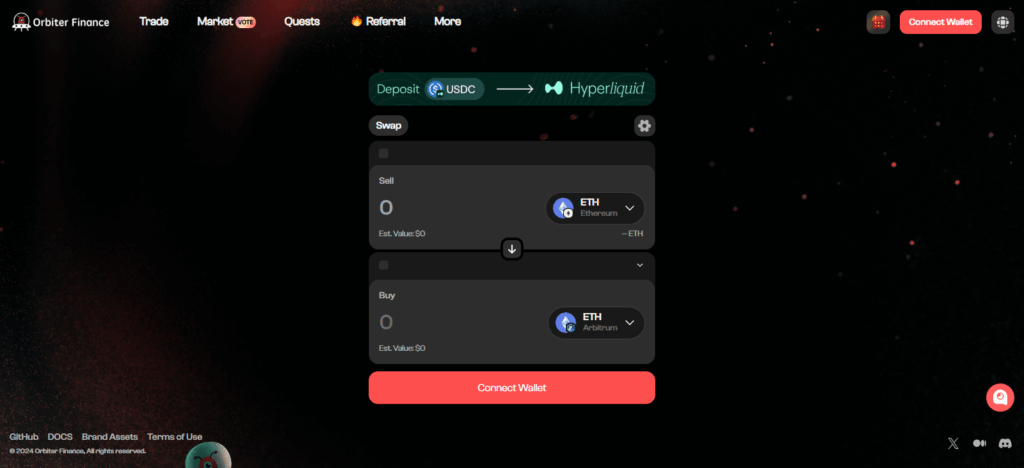

- 9. Orbiter Finance

- 10. XY Finance

- Risk & considerations

- Conclusion

- FAQ

Unlike centralized options, these aggregators emphasize community governance, offer promising but less popular altcoins with optimized liquidity, reduced costs, and safe cross-chain transactions. They enhanced local crypto ecosystems and widened adoption of underutilized tokens.

What is a Bridging Aggregator?

A Bridging Aggregator connects multiple blockchains, facilitating cross-chain transactions effortlessly. Bridging Aggregators evaluate multiple routes, bridges, and cross-chain liquidity pools, automatically determining the best and cheapest option.

Such aggregators reduce friction and the cost of transactions by maximizing reliability on token movement across blockchains. This seamless service on cross-chain transfers is beneficial for users, whether novices or veterans, in the cryptocurrency space.

Why Use a Community-run Bridging Aggregator For Local Altcoins

Decentralization and Trust: Community-run aggregators are not operated by a single entity, which minimizes the risk of censorship and failure through centralization. People get to vote, and it’s safe to assume the entity does not have interests outside the community.

Local Altcoin Liquidity: These aggregators optimize routes and liquidity pools for local and niche altcoins so the cross-chain swaps become effortless and cost effective for tokens that are ignored by mainstream bridges.

Minimal Costs and More Optimal Economy: Community-run bridges have more reward opportunities, reinvest profit made from fees, and have lower fees than centralized alternatives. This is advantageous to token holders and active ecosystem participants.

User-Focused Security: The open governance, as well as bridge and transaction protocol description, provides a security framework to users that minimizes the risks of fraud as users have proof of every step.

Local Ecosystem Growth: Community-run aggregators are building and supporting local blockchain projects for lesser-known altcoins.

Key Point & Best Community-run Bridging Aggregator For Local Altcoins List

| Bridging Aggregator | Key Points |

|---|---|

| ChainHop | Focuses on fast, low-cost cross-chain transfers with multiple liquidity sources. |

| LI.FI Protocol | Aggregates multiple bridges and DEXs to provide optimal cross-chain swap routes. |

| Rango Exchange | Supports multi-chain swaps with community-driven features and token incentives. |

| DeBridge | Decentralized bridging protocol emphasizing secure, cross-chain asset transfers. |

| ChainPort | Offers simple token transfers across chains with strong integration for emerging tokens. |

| Router Protocol | Provides cross-chain liquidity routing and multi-chain interoperability solutions. |

| Celer cBridge | High-speed, low-cost cross-chain bridge with scalable layer-2 support. |

| Hop Protocol | Optimized for Ethereum Layer-2 transfers with fast liquidity routing. |

| Orbiter Finance | Focuses on efficient asset movement between Ethereum L1 and L2 networks. |

| XY Finance | Multi-chain bridge aggregator that prioritizes smaller altcoins and DeFi tokens. |

1. ChainHop

ChainHop is designed as a community-run bridging aggregator to serve local altcoins as well as allow for seamless transfers across multiple chains. It also bridges the gap for community members to engage and support the platform.

Unlike traditional centralized bridges, ChainHop users make the ecosystem bridge the gap to cross-chain transfers, void of centralized profit motives. It combines various liquidity sources and routing options for the most optimal, cost-efficient, and low slippage token swaps on the market for niche crosses that larger platforms would likely disregard.

By servicing local altcoin cross-chain swaps, liquidity is enhanced, slippage is minimized, and support is given to smaller projects. ChainHop is transparent, community-governed, and focused on the growth of emerging decentralized tokens and is thus a trusted and reliable option for cross-chain bridging.

| Feature | Details |

|---|---|

| Platform Name | ChainHop |

| Type | Community-run Bridging Aggregator |

| Focus | Local and emerging altcoins |

| KYC Requirement | Minimal KYC, user-friendly onboarding |

| Supported Chains | Multiple blockchains (Ethereum, BSC, Polygon, etc.) |

| Governance | Community-driven decisions on token listings and fees |

| Transaction Speed | Optimized for fast cross-chain transfers |

| Fees | Low and transparent, determined by community governance |

| Security | Decentralized smart contracts with focus on transparency |

| Liquidity | Aggregates multiple bridges and pools for better token support |

2. LI.FI Protocol

LI.FI Protocol is a community-driven cross-chain transfers aggregator that facilitates the movement of local altcoins. It merges numerous bridges and DeFi exchanges, consolidating cross-chain transfers within a single service.

Routing and feature developments performed LI.FI bridges allagators based on community needs (token holders) instead of relying on centralized entities. LI.FI’s altcoin aggregator specifically empowers local projects by solving routing for local altcoins that have little liquidity and even less cross-chain transfer options.

It prioritizes community governance, trust, and protection of on-ramps, off-ramps, and bridge liquidity, thus decreasing cross-chain swapping friction for local projects. It increases the adoption and usability of altcoins which are less known.

| Feature | Details |

|---|---|

| Platform Name | LI.FI Protocol |

| Type | Community-run Bridging Aggregator |

| Focus | Local and emerging altcoins |

| KYC Requirement | Minimal KYC for easy access |

| Supported Chains | Multiple blockchains including Ethereum, Binance Smart Chain, Polygon, and others |

| Governance | Community-driven, users participate in token support and fee decisions |

| Transaction Speed | Optimized routes for fast cross-chain transfers |

| Fees | Low and transparent, determined by community consensus |

| Security | Decentralized smart contracts with audits for safe transfers |

| Liquidity | Aggregates multiple bridges and DEXs for better token availability |

3. Rango Exchange

Rango Exchange is a community-owned bridging aggregator optimized for local altcoins, offering secure self-governed cross-chain swaps.

Rango Exchange is not like a normally centralized bridge. Rango bridges and decentralized exchanges natively prioritize local and emerging tokens, and community members collaboratively influence the routings for swaps, token listings, and swaps.

Rango is popular for its low fees and high transparency. Rango is especially focused on smaller projects for fast crossing of tokens in bulk. This helps improve cross-chain availability and strengthens local altcoins on decentralized bridges to acquire mainstream adoption and use.

| Feature | Details |

|---|---|

| Platform Name | Rango Exchange |

| Type | Community-run Bridging Aggregator |

| Focus | Local and emerging altcoins |

| KYC Requirement | Minimal KYC for quick access |

| Supported Chains | Ethereum, Binance Smart Chain, Polygon, Avalanche, and others |

| Governance | Community-driven decisions on token listings, fees, and routing strategies |

| Transaction Speed | Efficient cross-chain swaps with optimized routes |

| Fees | Low and transparent, influenced by community governance |

| Security | Decentralized smart contracts, regularly audited for safety |

| Liquidity | Aggregates multiple bridges and liquidity pools to ensure token availability |

4. DeBridge

DeBridge is a community-run bridging aggregator specializing in safe and efficient cross-chain transfers of local altcoins. DeBridge is governed by its user base and, as such, DeBridge Routing, DeBridge Development, and DeBridge Supported Token all cater to user needs as opposed to a centralized operator.

DeBridge’s decentralized structure accommodates each aggregator’s preferred connection to several liquidity sources and cross-chain bridges, enabling the provision of optimised, cost-effective transfers for emerging or lesser-known tokens that mainstream aggregators typically bypass.

By focusing on efficient and affordable cross-chain transfer, DeBridge promotes the use, to, and sustainability of local altcoins and to ecosystems in a decentralized manner, and the primary focus remains active engagements in the community.

| Feature | Details |

|---|---|

| Platform Name | DeBridge |

| Type | Community-run Bridging Aggregator |

| Focus | Local and emerging altcoins |

| KYC Requirement | Minimal KYC for easy onboarding |

| Supported Chains | Ethereum, Binance Smart Chain, Polygon, Avalanche, and other major chains |

| Governance | Community-driven, users participate in token support and fee decisions |

| Transaction Speed | Optimized for fast and efficient cross-chain transfers |

| Fees | Low and transparent, set with community input |

| Security | Decentralized smart contracts with focus on transparency and audits |

| Liquidity | Aggregates multiple bridges and liquidity pools for reliable transfers |

5. ChainPort

ChainPort serves as a community-run bridging aggregator that aims to ease cross-chain transfers for altcoins local to a given community. It assumes community governance as a core characteristic of its business model.

Running as a non-centralized bridge, ChainPort delegates platform governance and decision-making on token inclusion and associated fees to its users while addressing the needs of small, emerging altcoins.

Its aggregator model interfaces with a number of bridges and liquidity for efficient, cost-friendly transfer routes while addressing slippage and delays.

The trust of users is fostered by the blend of transparency, security, and community-led enhancement and development of local token ecosystems. This positions ChainPort as a critical solution for the adoption of unknown cryptocurrencies while providing cross-chain interoperability.

| Feature | Details |

|---|---|

| Platform Name | ChainPort |

| Type | Community-run Bridging Aggregator |

| Focus | Local and emerging altcoins |

| KYC Requirement | Minimal KYC for fast access |

| Supported Chains | Ethereum, Binance Smart Chain, Polygon, Avalanche, and others |

| Governance | Community-driven decisions on token listings, fee structures, and platform upgrades |

| Transaction Speed | Optimized for efficient cross-chain transfers |

| Fees | Low and transparent, determined by community consensus |

| Security | Decentralized smart contracts with audits for secure transfers |

| Liquidity | Aggregates multiple bridges and liquidity pools for better token support |

6. Router Protocol

Router Protocol provides secure and community-oriented bridging aggregation solutions with a special focus on decentralized governance for local altcoins. Having Router Protocol as a community bridging aggregator opens the possibility of community governance around peripheral altcoins.

Advanced aggregation systems reduce slippage and transaction costs by more efficiently allocating liquidity for the transaction. In cross-chain transactions, local altcoins are often overlooked, making Router Protocol a strong candidate for becoming a decentralized solution.

With the Router Protocol, users receive the transparency and security of a decentralized solution for cross-chain interoperability, reinforced by the community focus for development. This encourages the circulation of local tokens and fosters proximity and cross-chain interoperability.

| Feature | Details |

|---|---|

| Platform Name | Router Protocol |

| Type | Community-run Bridging Aggregator |

| Focus | Local and emerging altcoins |

| KYC Requirement | Minimal KYC for user-friendly access |

| Supported Chains | Ethereum, Binance Smart Chain, Polygon, Avalanche, and other major chains |

| Governance | Community-driven decisions on token listings, fees, and platform upgrades |

| Transaction Speed | Optimized for fast and efficient cross-chain transfers |

| Fees | Low and transparent, set by community consensus |

| Security | Decentralized smart contracts with focus on transparency and safety |

| Liquidity | Aggregates multiple bridges and liquidity pools for reliable token support |

7. Celer cBridge

Celer cBridge is a community-run bridging aggregator that focuses on fast and inexpensive cross-chain transfers, particularly on regional altcoins.

Because of the community governance model, cBridge focuses on the community’s needs on token support, fees, and upgrades rather than on centralized decision-making.

Its extensive aggregation design combines many liquidity sources and bridge routes, thus optimizing for the lowest slippage and transfer time.

With the empowerment of smaller projects, support for developing altcoins, and building a decentralized environment for regional tokens to operate freely, Celer cBridge combines safety, user governance, and transparency to operate on many blockchain systems.

| Feature | Details |

|---|---|

| Platform Name | Celer cBridge |

| Type | Community-run Bridging Aggregator |

| Focus | Local and emerging altcoins |

| KYC Requirement | Minimal KYC for easy access |

| Supported Chains | Ethereum, Binance Smart Chain, Polygon, Avalanche, Fantom, and other major chains |

| Governance | Community-driven, users participate in token support and fee decisions |

| Transaction Speed | Fast and optimized cross-chain transfers |

| Fees | Low and transparent, influenced by community governance |

| Security | Decentralized smart contracts with audits for safety |

| Liquidity | Aggregates multiple bridges and liquidity pools to ensure token availability |

8. Hop Protocol

Hop Protocol is a community-driven cross-chain transfer services aggregator, primarily for local altcoins on Ethereum Layer-2.

Unlike centralized bridges, Hop Protocol is fully community-driven, allowing users to vote on altcoin support, routing priorities, and user-initiated fee structures for bridges, especially tailored to smaller and emerging altcoins.

Its smart routing technology accesses several liquidity pools and bridges to find the most efficient and least costly ways to transfer funds, thereby reducing transfer times and slippage.

By focusing on the most cross-chain-bridged local tokens, Hop Protocol enhances the Cross-chain-bridged ecosytem and improves the usability of local tokens.

| Feature | Details |

|---|---|

| Platform Name | Hop Protocol |

| Type | Community-run Bridging Aggregator |

| Focus | Local and emerging altcoins, especially Ethereum Layer-2 tokens |

| KYC Requirement | Minimal KYC for quick and easy access |

| Supported Chains | Ethereum L1, Polygon, Arbitrum, Optimism, and other Layer-2 networks |

| Governance | Community-driven decisions on token listings, fee structures, and platform upgrades |

| Transaction Speed | Fast, optimized routes for Layer-2 to Layer-2 transfers |

| Fees | Low and transparent, determined with community input |

| Security | Decentralized smart contracts with audits for safe transfers |

| Liquidity | Aggregates multiple bridges and liquidity pools to ensure token availability |

9. Orbiter Finance

Orbiter Finance prioritizes community governance in its approach to cross-chain transfers and local altcoin bridging.

Orbiter Finance ensures community members directly participate in governance decisions about which tokens to support and how to allocate liquidity and fees, especially for smaller and more nascent tokens.

Orbiter Finance uses advanced aggregation technology to connect bridges and liquidity sources, which helps slippage and delays in transactions, providing optimal transfer routes.

Through security and transparency, Orbiter Finance empowers local altcoin ecosystems to facilitate cross-chain adoption and governance to sustain network effects across cross-chains.

| Feature | Details |

|---|---|

| Platform Name | Orbiter Finance |

| Type | Community-run Bridging Aggregator |

| Focus | Local and emerging altcoins across multiple chains |

| KYC Requirement | Minimal KYC for easy onboarding |

| Supported Chains | Ethereum, Binance Smart Chain, Polygon, Arbitrum, Optimism, and others |

| Governance | Community-driven decisions on token listings, fees, and platform features |

| Transaction Speed | Efficient, optimized cross-chain transfers |

| Fees | Low and transparent, determined by community consensus |

| Security | Decentralized smart contracts with audits to ensure safety |

| Liquidity | Aggregates multiple bridges and liquidity sources for reliable token swaps |

10. XY Finance

XY Finance is a community bridge aggregator and cross-chain transfer solution for local altcoins. Unlike centralized bridges, XY Finance is governed by its users. XY Finance users vote for token listings, bridge fees, and routing.

XY Finance prioritizes support for emerging and niche tokens. First, users cross-bridge aggregators and multiple liquidity sources.

Then, XY Finance closes and secures transfer routes and optimizes cross-chain transfers by reducing slippage and latency.

XY Finance creates a positive impact on local token ecosystems, endorses local adoption of niche and emerging cryptocurrencies, and sustains community-centered ecosystems on the blockchain. XY Finances strives for cross-chain functionality and decentralized governance.

| Feature | Details |

|---|---|

| Platform Name | XY Finance |

| Type | Community-run Bridging Aggregator |

| Focus | Local and emerging altcoins |

| KYC Requirement | Minimal KYC for quick and easy access |

| Supported Chains | Ethereum, Binance Smart Chain, Polygon, Avalanche, Fantom, and other major chains |

| Governance | Community-driven decisions on token listings, fee structures, and platform updates |

| Transaction Speed | Optimized for fast and efficient cross-chain transfers |

| Fees | Low and transparent, influenced by community governance |

| Security | Decentralized smart contracts with audits for safe transfers |

| Liquidity | Aggregates multiple bridges and liquidity pools to ensure reliable token availability |

Risk & considerations

Smart Contracts: Even decentralized bridges rely on self-executing contracts. Such contracts contain code and open source issues, which may result in the loss of funds. Consider trusting that contracts are audited and secure.

Liquidity: Local or niche altcoins tend to have limited liquidity. As such, there may be an increased risk of slippage, failed transactions, or delays when trying to cross-link the altcoin.

Governance: Community-run and decentralized systems are largely dependent on self-organizing bodies. As such, the absence of coordinated self-governance leads to delays and poor optimizations in the support of certain tokens.

Exploiting the Bridge: Cross-chain bridges are fraudsters’ targets. Aggregators and underlying technology can be hacked and internally bridged in an attack or exploited to compromise funds.

Gray Areas: Local coins and certain cross-chain transactions may be legally questionable, leaving potential legal risks for the users.

Fees and Network Congestion: Transfers will be impacted by network congestion which will affect the speed and cost of transactions.

Token Swaps: Not all altcoins are cross-chain compatible, so users must analyze potential points of failure.

Conclusion

To summarize, the community-managed bridging aggregators for local altcoins provide decentralized, transparent, and user-centric approaches for cross-chain transfers.

Enabling the community to manage governance for token listings, routing mechanisms, and the fees with the support of decentralized bridges look after cross-path bridges for valuable yet ignored altcoins.

Providing versatile liquidity routes with unsophisticated slippage and a focus on safety and security, they considerably improve the overall cross-chain transaction experience. Despite the potential challenges of weak liquidity,

Unsophisticated slippage and smart contract issues, the community management approach improves the confidence of community members, sustains the growth of local ecosystems, and maintains the use and viability of smaller altcoins.

FAQ

How does community governance work?

Token holders or platform members can vote on token listings, fee structures, routing strategies, and platform upgrades, ensuring decisions reflect community interests.

Why are they important for local altcoins?

They prioritize smaller or emerging tokens that are often overlooked by mainstream bridges, providing better liquidity, lower fees, and optimized transfer routes.

What is a community-run bridging aggregator?

A community-run bridging aggregator is a decentralized platform that allows users to transfer tokens across different blockchains, with governance and decisions controlled by the community rather than a centralized entity.

What are the advantages over centralized bridges?

Community-run aggregators offer decentralized governance, tailored support for local altcoins, better transparency, and often reduced fees, fostering growth for smaller ecosystems.

Can I transfer any token using these aggregators?

Not all tokens are supported; users need to check compatibility across the chains they want to interact with.