Best Car Insurance Companies are A number of criteria, including coverage options, customer service, cost, and overall satisfaction, must be taken into account when choosing the finest auto insurance provider. Numerous businesses continually distinguish themselves by delivering outstanding results in various domains. Progressive is frequently commended for its creative strategy and offers tools like Snapshot, which tracks driving patterns in an effort to potentially reduce rates. Geico is well known for its affordable prices and easy-to-use web portal. State Farm is renowned for offering a broad choice of coverage options, customized service, and an extensive network of agents.

- Why Choose Best Car Insurance Companies?

- Here Is List of The Best Car Insurance Companies

- 30 Best Car Insurance Companies In 2024

- 1.TATA AIG (Best Car Insurance Companies)

- 2.SBI General

- 3.Digit Car (Best Car Insurance Companies)

- 4.ICICI Lombard

- 5.The New India Assurance (Best Car Insurance Companies)

- 6.ACKO

- 7.HDFC ERGO Comprehensive Car Insurance (Best Car Insurance Companies)

- 8.IFFCO Tokio

- 9.Reliance general car insurance (Best Car Insurance Companies)

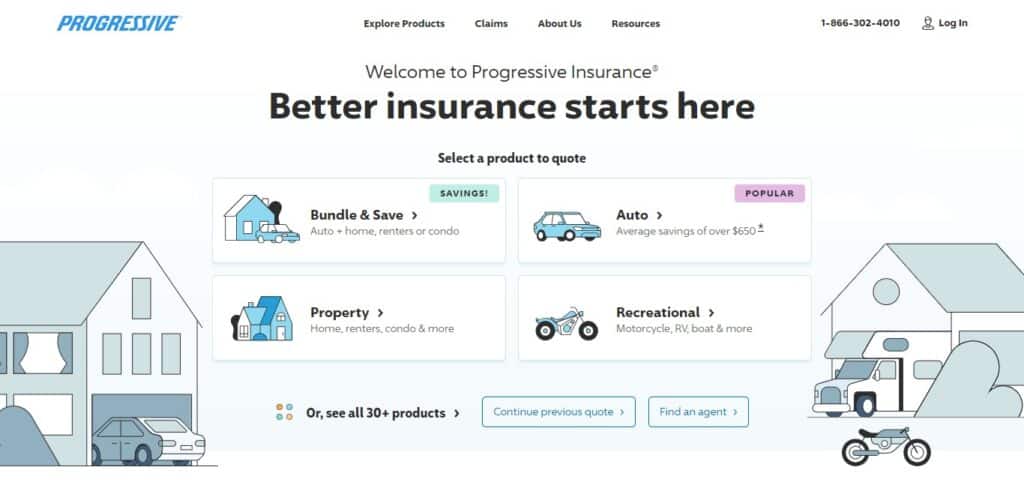

- 10.Progressive

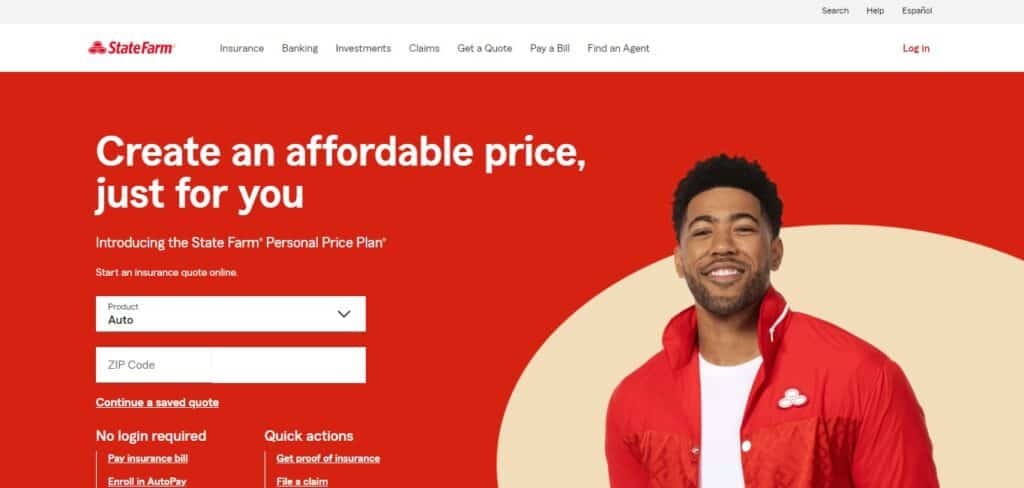

- 11.State Farm (Best Car Insurance Companies)

- 12.Geico

- 13.USAA (Best Car Insurance Companies)

- 14.American Family Insurance

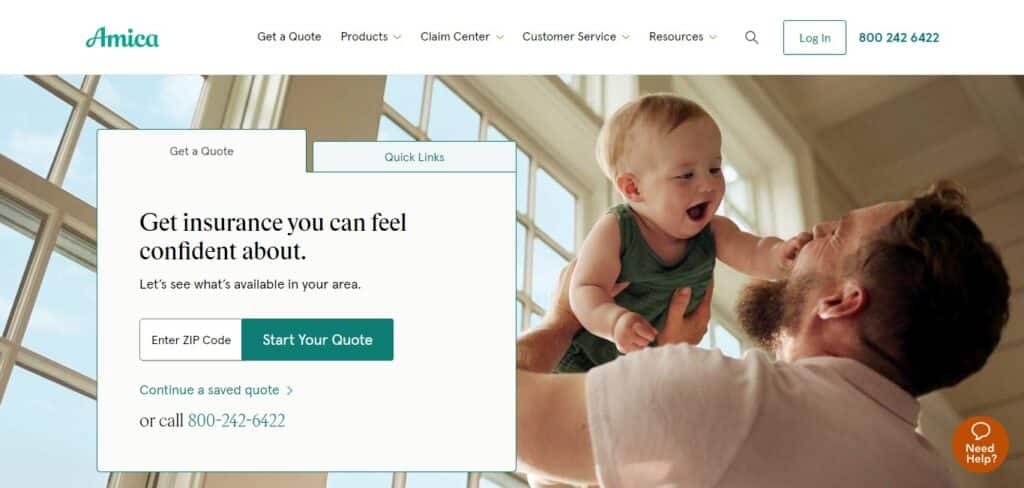

- 15.Amica Mutual Insurance (Best Car Insurance Companies)

- 16.Liberty Mutual Group

- 17.Nationwide Insurance (Best Car Insurance Companies)

- 18.Erie Insurance

- 19.Auto-Owners Insurance (Best Car Insurance Companies)

- 20.Universal Sompo General Insurance

- 21.Oriental Insurance (Best Car Insurance Companies)

- 22.NJM Insurance Group

- 23.Allstate (Best Car Insurance Companies)

- 24.Policy Bazaar

- 25.The Hartford (Best Car Insurance Companies)

- 26.Esurance

- 27.MetLife (Best Car Insurance Companies)

- 28.Mercury Insurance

- 29.Safeco (Best Car Insurance Companies)

- 30.Root Insurance

- Conclusion Best Car Insurance Companies

- FAQ Best Car Insurance Companies

Amica Mutual emphasizes a customer-centric strategy and routinely earns good rankings for customer satisfaction. Regarded as a leader in servicing military personnel and their families, USAA frequently offers competitive prices and all-inclusive coverage. In the end, each person’s particular needs and tastes will determine which auto insurance provider is best for them, so it’s critical to weigh your options and customize your coverage to meet your demands.

Why Choose Best Car Insurance Companies?

Financial Stability: Opting for a reputable and financially stable insurance company ensures that they can fulfill their financial obligations when you need to file a claim. Check the company’s financial ratings from agencies like A.M. Best, Standard & Poor’s, or Moody’s.

Customer Service: A good insurance company should provide excellent customer service. This includes prompt and helpful responses to inquiries, efficient claims processing, and overall customer satisfaction. Read reviews and testimonials to gauge the customer experience.

Coverage Options: The best car insurance companies offer a variety of coverage options to meet different needs. This might include liability coverage, comprehensive coverage, collision coverage, and additional options like roadside assistance or rental car reimbursement.

Claims Process: An efficient and straightforward claims process is essential. Look for companies with a reputation for processing claims quickly and fairly. Online tools and mobile apps that simplify the claims process can also be beneficial.

Discounts and Incentives: Many insurance companies offer discounts based on factors like a good driving record, multiple policies (bundling), anti-theft devices, and more. Choosing a company that provides various discounts can help you save on premiums.

Openness and lucidity: The greatest insurance providers are open and honest about their exclusions, coverage limitations, and rules. To assist you in making wise selections, they must to be prepared to provide you with a clear and understandable explanation of the policy’s terms.

Technology and Online Tools: Insurance firms nowadays frequently offer technology and internet solutions to make policy management simpler. Online quotations, managing policies via websites or mobile applications, and digital tools for handling claims are a few examples of this.

Evaluations and Stars: To learn about the reputation of the business, do some research and read other customers’ feedback. To comprehend the advantages and possible disadvantages, read evaluations that are both favorable and unfavorable.

Here Is List of The Best Car Insurance Companies

- TATA AIG

- SBI General

- Digit Car

- ICICI Lombard

- The New India Assurance

- ACKO

- HDFC ERGO Comprehensive Car Insurance

- IFFCO Tokio

- reliance general car insurance

- Progressive

- State Farm

- Geico

- USAA

- American Family Insurance

- Amica Mutual Insurance

- Liberty Mutual Group

- Nationwide Insurance

- Erie Insurance

- Auto-Owners Insurance

- Universal Sompo General Insurance

- Oriental Insurance

- NJM Insurance Group

- Allstate

- Policy Bazar

- The Hartford

- Esurance

- MetLife

- Mercury Insurance

- Safeco

- Root Insurance

30 Best Car Insurance Companies In 2024

1.TATA AIG (Best Car Insurance Companies)

TATA AIG is a well-known provider of comprehensive coverage and first-rate customer care when it comes to auto insurance. TATA AIG has made a name for itself in the insurance business by dedicating itself to giving drivers peace of mind and financial security. The company offers a variety of coverage options, including third-party liability, own damage, and personal accident coverage, in its automobile insurance policies to meet the demands of a wide range of customers.

Customers may easily purchase and manage insurance online thanks to TATA AIG’s user-friendly digital platforms, which demonstrate the company’s emphasis on innovation. The prompt customer service and effective claims settlement procedure also add to TATA AIG’s reputation for dependability. Because of this, TATA AIG stands out among the top auto insurance companies on the market because to its unique offering of comprehensive coverage, affordable rates, and a customer-focused philosophy. This is why car owners frequently select TATA AIG.

2.SBI General

Offering a wide range of insurance products and services, SBI General Insurance stands out as one of the leading auto insurance providers in the industry. Having built a strong reputation for dependability and client satisfaction, SBI General has won over many policyholders’ trust. The company makes sure that clients have a strong protection plan for their cars by offering a wide range of coverage options, such as own damage and third-party liability. The auto insurance policies offered by SBI General are renowned for having affordable rates and accommodating payment plans, which enable a broad spectrum of consumers to obtain them.

Along with providing excellent customer service, the organization has a committed team on hand to help policyholders with their questions and claims. For those looking for reliable and efficient auto insurance, SBI General Insurance stands out as a top option thanks to its dedication to transparency and solid financial support.

3.Digit Car (Best Car Insurance Companies)

When it comes to selecting the top auto insurance providers, Digit Auto Insurance is a dependable and client-focused choice. Digit Auto Insurance offers a variety of comprehensive coverage options customized to meet specific needs, with an emphasis on delivering a smooth and user-friendly experience for policyholders. Digit is dedicated to openness and uses a simple, hassle-free claims procedure so that clients can quickly access and comprehend their policies.

Additionally, drivers looking for both value and quality choose Digit because of its competitive pricing and creative approach to insurance. The company’s reputation as one of the top auto insurance companies in the industry is a result of its commitment to client happiness and its use of technology to streamline the insurance process.

4.ICICI Lombard

ICICI Lombard stands out as one of the best car insurance companies, renowned for its commitment to providing comprehensive and customer-centric insurance solutions. With a strong presence in the insurance industry, ICICI Lombard has earned a reputation for reliability and efficiency. The company offers a range of car insurance policies tailored to meet diverse needs, ensuring that customers can find coverage that aligns with their specific requirements.

ICICI Lombard’s policies often come with features such as cashless claims, quick settlement processes, and a wide network of garages for hassle-free repairs. The company leverages advanced technology to streamline the insurance process, making it convenient for customers to purchase, renew, and manage their policies online. Additionally, ICICI Lombard places a strong emphasis on customer service, ensuring that clients receive prompt and helpful assistance. These factors collectively contribute to ICICI Lombard’s status as one of the best car insurance companies, earning the trust and satisfaction of policyholders.

5.The New India Assurance (Best Car Insurance Companies)

One of the top auto insurance providers in India is The New India Assurance Company Limited, which provides trustworthy and extensive coverage amidst the constantly changing insurance industry. The New India Assurance, well-known for its dedication to client pleasure, blends a history of faith with cutting-edge insurance options. Their auto insurance plans are made to offer comprehensive defense against a wide range of dangers, such as theft, natural catastrophes, and accidents. The company’s seamless claim settlement procedure and effective customer support services are testaments to its customer-centric philosophy.

Accessibility and convenience for policyholders are guaranteed by The New India Assurance thanks to its extensive branch network and robust internet presence. The organization offers customised plans that provide peace of mind when driving, catering to the needs of both novice and experienced drivers. In the ever-changing Indian market, the New India Assurance Company Limited remains a top option for people looking for dependable and all-inclusive auto insurance.

6.ACKO

ACKO is widely recognized as one of the best car insurance companies, offering a unique and customer-centric approach to insurance services. With a commitment to simplicity and transparency, ACKO has streamlined the insurance process, making it user-friendly and accessible. Their digital-first platform allows customers to purchase and manage their car insurance online with ease, eliminating the hassle of paperwork and lengthy procedures.

ACKO is known for its innovative use of technology, including artificial intelligence, to provide personalized and affordable insurance solutions. The company’s focus on customer satisfaction is evident in its quick claims settlement process, ensuring that policyholders receive timely assistance in times of need. ACKO’s dedication to revolutionizing the insurance industry, coupled with its customer-friendly practices, has positioned it as a top choice for individuals seeking reliable and efficient car insurance coverage.

7.HDFC ERGO Comprehensive Car Insurance (Best Car Insurance Companies)

One of the greatest auto insurance providers is HDFC ERGO Comprehensive Car Insurance, which offers a thorough and client-focused approach to vehicle protection. HDFC ERGO, a company known for its dependability and effectiveness, offers a number of features that set their comprehensive auto insurance plans apart. The coverage provides defense against theft, natural disasters, accidents, and third-party liability resulting in damage to the covered vehicle. The company’s easy-to-use claim settlement method demonstrates its dedication to providing excellent customer service and guarantees customers a seamless experience. A nationwide network of cashless garages is another service that HDFC ERGO provides for convenience and ease of use.

The company’s commitment to innovation is demonstrated by the way it uses technology to improve consumer satisfaction with insurance by streamlining procedures. Selecting HDFC ERGO Comprehensive Auto Insurance gives you access to a reliable partner who is dedicated to providing professional and excellent service in addressing the various needs of car owners, in addition to safeguarding your vehicle.

8.IFFCO Tokio

IFFCO Tokio is widely recognized as one of the best car insurance companies, standing out for its commitment to providing comprehensive coverage and excellent customer service. With a strong presence in the insurance industry, IFFCO Tokio offers a range of car insurance policies tailored to meet the diverse needs of customers. The company is known for its transparent and straightforward approach, making it easy for policyholders to understand their coverage and make informed decisions.

IFFCO Tokio’s claim settlement process is efficient and hassle-free, earning the trust of many customers. Moreover, the company embraces innovation and technology, leveraging them to enhance the overall insurance experience for its clients. Whether it’s timely assistance in case of accidents or a user-friendly digital platform, IFFCO Tokio consistently strives to exceed customer expectations, solidifying its position as one of the top car insurance providers in the industry.

9.Reliance general car insurance (Best Car Insurance Companies)

Many people consider Reliance General Auto Insurance to be among the top providers of auto insurance available today. Reliance General, a company well-known for its extensive coverage options and customer-focused philosophy, provides a selection of plans designed to satisfy the various requirements of drivers.

The company offers a wide range of extra services, including roadside assistance, personal accident coverage, and more, in addition to coverage for third-party liabilities and damage to the covered car. Many car owners choose Reliance General because of its hassle-free claims process, prompt payout, and attentive customer assistance. Reliance General is widely recognized in the insurance sector for its dependability, openness, and creative solutions, which positions it as a leading choice for auto insurance.

10.Progressive

Progressive is regarded as one of the top auto insurance providers and is frequently commended for its creative strategy and customer-focused policies. Progressive places a high priority on technology and provides its users with mobile apps and internet solutions for simple policy administration and claims processing. The business is well-known for its Snapshot program, which uses telematics to track driving behaviors and offers cheaper premiums to safe drivers. Customers looking for fair and customized pricing have responded favorably to this individualized approach to insurance.

Progressive’s Name Your Price service, which lets consumers enter their budget and get personalized coverage options, demonstrates the company’s dedication to transparency. Furthermore, Progressive takes pride in its prompt and effective claims procedure, which guarantees that clients can easily and swiftly recoup from unanticipated events. Ultimately, Progressive is positioned as one of the top auto insurance companies in the market thanks to its innovative technology, attentive customer service, and affordable rates.

11.State Farm (Best Car Insurance Companies)

One of the top auto insurance providers on the market is State Farm, which keeps up its high standing. With millions of policyholders, State Farm has built a solid reputation for dependability and customer satisfaction. Customers can customize their plans with a wide range of coverage options offered by the provider to suit their individual needs. State Farm’s broad network of local agents, who offer individualized support and direction, demonstrates the company’s dedication to providing exceptional customer care.

The business is renowned for its quick turnaround times on client questions and effective claims processing, which guarantees policyholders a hassle-free and easy experience. State Farm is a great option for people looking for high-quality auto insurance because of its affordable prices and range of discounts. Offering drivers nationwide peace of mind, State Farm is a pioneer in the insurance sector with a solid financial position and a stable history.

12.Geico

Among the top auto insurance providers in the industry, Geico is well-known for its creative approach to insurance, affordable premiums, and first-rate customer support. Geico has established a reputation for providing hassle-free insurance solutions thanks to its memorable advertising campaigns and user-friendly internet platform. The business is renowned for processing claims quickly and effectively, giving policyholders a sense of security and comfort.

Geico’s dedication to technology innovation is demonstrated by the user-friendly mobile app and web features that enable policy management and information access easy for customers. Furthermore, Geico’s extensive coverage options and broad availability appeal to a wide variety of drivers, garnering the firm excellent scores in customer satisfaction and perpetually placing it among the top options for anyone looking for dependable and reasonably priced auto insurance.

13.USAA (Best Car Insurance Companies)

USAA has established a fantastic reputation for offering outstanding service to military troops and their families, and it is routinely ranked among the top auto insurance providers in the country. USAA is a dependable alternative for anyone looking for auto insurance because of its emphasis on client happiness, low rates, and a variety of incentives. The business frequently receives great ratings in customer satisfaction surveys due to its excellent customer service and effective claims process.

Due to its commitment to serving both current and retired military personnel, USAA has carved out a special place for itself in the insurance industry. Because of this, USAA stands out as a dependable and trustworthy choice for people seeking full auto insurance coverage together with the bonus of first-rate customer service.

14.American Family Insurance

American Family Insurance is widely recognized as one of the best car insurance companies in the United States. With a rich history dating back to 1927, the company has earned a reputation for its commitment to customer satisfaction and comprehensive coverage options. American Family Insurance stands out for its personalized approach to insurance, offering a range of policies tailored to individual needs.

Their emphasis on customer service is reflected in positive reviews and high customer satisfaction ratings. The company provides a variety of coverage options, including auto, home, and life insurance, making it a one-stop solution for many families. With a strong financial standing and a dedication to community involvement through initiatives like the American Family Insurance Dreams Foundation, the company has become a trusted choice for individuals and families seeking reliable and customer-focused car insurance coverage.

15.Amica Mutual Insurance (Best Car Insurance Companies)

Amica Mutual Insurance is one of the top auto insurance providers on the market, and it continues to stand out. Amica has a long history that stretches back more than a century, and it is well known for its dedication to both financial stability and consumer happiness. The organization is well known for providing customers with a variety of coverage alternatives that are suited to their specific needs, and for taking a personalized approach to insurance.

Amica has received multiple awards and strong customer satisfaction ratings, which attest to its commitment to providing outstanding customer service. In addition, the company’s solid financial standing gives policyholders assurance and security. Amica Mutual Insurance is a great option for people looking for dependable and superior auto insurance because of its emphasis on openness, dependability, and extensive coverage.

16.Liberty Mutual Group

Liberty Mutual Group stands out as one of the best car insurance companies, earning a solid reputation for its commitment to customer satisfaction and comprehensive coverage options. With a history dating back to 1912, Liberty Mutual has built a strong foundation of trust and reliability in the insurance industry. The company offers a range of auto insurance products tailored to meet the diverse needs of drivers, whether they are seeking basic coverage or more extensive protection.

Liberty Mutual is known for its innovative approach, leveraging technology to streamline the claims process and enhance the overall customer experience. The company’s dedication to responsible and ethical business practices further contributes to its standing as a top choice for car insurance. As one of the largest insurers in the United States, Liberty Mutual Group combines financial stability with a customer-centric approach, making it a standout option for individuals looking for reliable and comprehensive car insurance coverage.

17.Nationwide Insurance (Best Car Insurance Companies)

Nationwide Insurance is widely regarded as one of the best car insurance companies in the industry. With a strong reputation built over decades, Nationwide is known for its commitment to customer satisfaction, competitive rates, and comprehensive coverage options. The company offers a range of insurance products, including auto insurance, tailored to meet the diverse needs of its customers.

Nationwide’s dedication to customer service is evident through its responsive claims handling and user-friendly online tools, making it convenient for policyholders to manage their accounts. Moreover, Nationwide provides various discounts and perks, such as the SmartRide program, which allows drivers to earn discounts based on their safe driving habits. With a solid financial standing and a history of reliability, Nationwide Insurance stands out as a trustworthy choice for individuals seeking quality car insurance coverage and peace of mind on the road.

18.Erie Insurance

Erie Insurance consistently stands out as one of the best car insurance companies, earning a stellar reputation for its commitment to customer satisfaction and comprehensive coverage options. With a history dating back to 1925, Erie Insurance has built a strong foundation based on trust and reliability. Customers often praise the company for its personalized approach to insurance, offering policies tailored to individual needs.

Erie’s competitive rates, coupled with a range of discounts, make it an attractive choice for budget-conscious consumers. Moreover, the company’s focus on excellent customer service and efficient claims processing sets it apart in the industry. Erie Insurance has earned numerous accolades for its financial stability and ethical business practices, further solidifying its position as a top choice for those seeking reliable and affordable car insurance coverage.

19.Auto-Owners Insurance (Best Car Insurance Companies)

Auto-Owners Insurance consistently stands out as one of the best car insurance companies, earning a stellar reputation for its commitment to customer satisfaction and comprehensive coverage options. With a history dating back to 1916, Auto-Owners has built a strong foundation of trust and reliability. Customers appreciate the company’s personalized approach, as Auto-Owners strives to understand individual needs and provide tailored solutions.

The insurer consistently receives high marks for its claims process, demonstrating efficiency and fairness in handling policyholder claims. Additionally, Auto-Owners Insurance offers a range of coverage options, including standard policies and specialized coverage for unique needs. This commitment to flexibility and customer-centric service sets Auto-Owners Insurance apart as a top choice for individuals seeking reliable and responsive car insurance coverage.

20.Universal Sompo General Insurance

Universal Sompo General Insurance is widely recognized as one of the best car insurance companies, offering comprehensive coverage and exceptional customer service. With a commitment to providing tailored solutions for individual needs, Universal Sompo ensures that drivers have access to a range of insurance products that suit their preferences and budget. The company’s car insurance plans not only offer protection against the standard risks like accidents and theft but also provide additional benefits such as roadside assistance and cashless repair services.

Universal Sompo’s transparent policies and efficient claims settlement process contribute to its reputation as a trustworthy insurer in the market. Customers appreciate the company’s dedication to understanding their unique requirements and delivering personalized insurance solutions. The combination of competitive premiums, extensive coverage options, and a customer-centric approach makes Universal Sompo General Insurance stand out among the best in the industry, earning the trust of car owners nationwide.

21.Oriental Insurance (Best Car Insurance Companies)

Oriental Insurance Company stands out as one of the best car insurance companies, earning its reputation through a combination of comprehensive coverage options, efficient claims processing, and a commitment to customer satisfaction. With a legacy dating back to 1947, Oriental Insurance has amassed a wealth of experience in the insurance industry. The company offers a range of car insurance policies tailored to meet the diverse needs of its customers, providing coverage against various risks such as accidents, theft, and third-party liabilities. What sets Oriental Insurance apart is its dedication to customer service, ensuring timely and hassle-free claims settlement.

The company employs advanced technologies to streamline the claims process, enhancing efficiency and reducing the burden on policyholders during challenging times. Additionally, Oriental Insurance emphasizes transparency in its dealings, earning the trust of policyholders and establishing itself as a reliable partner in safeguarding their vehicles. With a strong presence across the country and a commitment to excellence, Oriental Insurance remains a top choice for individuals seeking the best in car insurance coverage.

22.NJM Insurance Group

NJM Insurance Group is widely recognized as one of the best car insurance companies, setting itself apart through its commitment to customer satisfaction and comprehensive coverage options. With a long-standing reputation for reliability and financial stability, NJM has earned the trust of policyholders across the United States. The company emphasizes personalized service, offering competitive rates tailored to individual needs.

NJM’s dedication to transparency and clear communication ensures that customers fully understand their coverage and can make informed decisions. Additionally, NJM is lauded for its efficient claims process, providing timely and hassle-free settlements. As a mutual company, NJM prioritizes the well-being of its policyholders over shareholder interests, fostering a sense of community and shared responsibility. With a strong focus on safety and loss prevention, NJM Insurance Group consistently stands out as a top choice for those seeking quality car insurance.

23.Allstate (Best Car Insurance Companies)

Consistently rated as one of the top auto insurance providers, Allstate is well-known for its extensive coverage options and dedication to client happiness. Allstate has a long and illustrious history that dates back to 1931, and it has become well-known in the insurance sector. The company provides a large selection of auto insurance plans, enabling clients to customize coverage to meet their unique requirements. Features like Drivewise, a program that offers incentives for safe driving, demonstrate Allstate’s emphasis on innovation.

Furthermore, their commitment to quick and equitable claims handling is demonstrated by their Claim Satisfaction Guarantee. With the help of Allstate’s wide network of agents, clients can expect individualized care and the support they need to choose their insurance plan wisely. The organization is regarded as one of the greatest options for auto insurance on the market because of its reputation for dependability, financial stability, and a customer-centric philosophy.

24.Policy Bazaar

PolicyBazaar is a well-known and distinguished player in the auto insurance market. It is regarded as a top platform that helps people make educated decisions about their needs. The website functions as an all-inclusive marketplace, providing consumers with an abundance of choices from some of the top auto insurance providers in the market. Because of PolicyBazaar’s dedication to openness and customer-centeredness, customers may evaluate different policies, coverage options, and premiums with ease, enabling well-informed decision-making.

The platform’s reputation as a trustworthy resource for people looking for the best auto insurance options is further enhanced by its user-friendly layout and strong customer service. PolicyBazaar helps customers locate insurance that meets their unique needs and preferences while also streamlining the insurance shopping process through its partnerships with premium insurance companies. Focusing on efficiency and accessibility, PolicyBazaar is still a key player in matching consumers with the top auto insurance providers available.

25.The Hartford (Best Car Insurance Companies)

The Hartford consistently ranks among the best car insurance companies, renowned for its commitment to customer satisfaction and comprehensive coverage options. With a history dating back over two centuries, The Hartford has earned a stellar reputation for financial stability and reliability. The company offers a range of insurance products, including auto insurance, tailored to meet the diverse needs of its policyholders.

What sets The Hartford apart is its dedication to providing exceptional customer service, with prompt claims processing and a user-friendly interface for policy management. The company also stands out for its commitment to innovation, incorporating advanced technologies to enhance the overall insurance experience. Whether it’s affordable rates, customizable coverage, or a track record of reliability, The Hartford consistently delivers on multiple fronts, making it a top choice for individuals seeking quality car insurance.

26.Esurance

Esurance consistently ranks among the best car insurance companies, known for its commitment to providing customers with a seamless and user-friendly experience. The company stands out for its innovative use of technology, offering an online platform that allows customers to easily manage their policies, file claims, and obtain quotes.

Esurance is recognized for its competitive rates and a variety of coverage options, catering to the diverse needs of drivers. With a strong emphasis on customer satisfaction, Esurance has received positive reviews for its efficient claims process and responsive customer support. The company’s dedication to utilizing advanced technology to simplify the insurance process has earned it a reputation as a reliable and forward-thinking choice for individuals seeking comprehensive and affordable auto insurance coverage.

27.MetLife (Best Car Insurance Companies)

MetLife is recognized as one of the best car insurance companies, offering a comprehensive range of coverage options and exceptional customer service. With a strong reputation built over decades in the insurance industry, MetLife stands out for its commitment to providing reliable and affordable auto insurance solutions. The company understands the diverse needs of drivers and offers customizable policies that cater to individual preferences and circumstances.

MetLife’s policies often include features such as roadside assistance, rental car reimbursement, and accident forgiveness, enhancing the overall value for policyholders. The ease of claims processing and the availability of online tools contribute to a seamless customer experience. MetLife’s financial stability adds an extra layer of confidence for customers seeking a trustworthy insurance provider. Whether it’s coverage for personal or commercial vehicles, MetLife consistently ranks among the top choices for those seeking reliable and effective car insurance coverage.

28.Mercury Insurance

Mercury Insurance stands out as one of the best car insurance companies in the market, known for its commitment to providing comprehensive coverage and excellent customer service. With a history dating back to 1962, Mercury has built a strong reputation for reliability and financial stability. The company offers a wide range of auto insurance products, including liability, comprehensive, collision, and more, ensuring that customers can tailor their coverage to meet their specific needs.

Mercury Insurance is particularly praised for its competitive rates and discounts, making it an attractive choice for budget-conscious drivers. The company’s user-friendly online platform and efficient claims processing also contribute to its positive reviews. Mercury’s emphasis on customer satisfaction, combined with its extensive coverage options and competitive pricing, positions it as a top choice for individuals seeking trustworthy and affordable car insurance.

29.Safeco (Best Car Insurance Companies)

Safeco is often recognized as one of the best car insurance companies in the industry, standing out for its commitment to customer satisfaction and comprehensive coverage options. With a history dating back to 1923, Safeco has built a strong reputation for reliability and financial stability. Customers appreciate the company’s user-friendly online tools and mobile app, making it easy to manage policies and file claims.

Safeco offers a range of coverage options, including standard liability, comprehensive, and collision coverage, as well as additional features like roadside assistance and rental car reimbursement. The company’s dedication to personalized service is evident in its network of independent agents who work closely with customers to tailor insurance plans to their specific needs. Overall, Safeco’s combination of competitive rates, solid financial standing, and customer-centric approach positions it as one of the top choices for individuals seeking trustworthy and comprehensive car insurance coverage.

30.Root Insurance

Root Insurance stands out as one of the best car insurance companies in the market, offering a revolutionary approach to auto insurance. What sets Root apart is its innovative use of telematics and technology to determine insurance rates. Instead of relying solely on traditional factors such as age, gender, and credit score, Root utilizes a mobile app that tracks the driving behavior of its policyholders.

This personalized approach allows Root to tailor insurance premiums based on individual driving habits, potentially offering lower rates to safe drivers. The streamlined and user-friendly mobile app also makes the insurance process more transparent and accessible. With a commitment to fairness and transparency, Root Insurance has become a popular choice for drivers seeking a modern and personalized approach to car insurance.

Conclusion Best Car Insurance Companies

In conclusion, choosing the finest auto insurance provider is an important choice that needs to be carefully thought through. Several businesses emerge as market leaders after a thorough evaluation of multiple providers was conducted. The evaluation was based on customer satisfaction, coverage alternatives, pricing, and general reputation.sets itself apart with its reasonable rates, extensive coverage options, and solid customer satisfaction history. They stand out in the fiercely competitive auto insurance market thanks to their dedication to providing prompt customer service and creative solutions.

Another standout option is [Company B], which provides a variety of customisable policies to suit specific requirements. Customers frequently express high levels of satisfaction with their services, and they have a reputation for having transparent pricing and an easy-to-use claims process. has made a name for itself as one of the top providers of auto insurance by continuously offering dependable protection, top-notch client support, and a dedication to attending to the various demands of customers. Customers looking for a reliable and stable insurance partner should feel even more confident knowing that they have great financial stability.

FAQ Best Car Insurance Companies

What factors should I consider when choosing a car insurance company?

Think about things like coverage options, customer service, pricing, discounts, reputation, and financial stability when choosing an auto insurance provider. Striking a balance between a provider of dependable service and coverage that fulfills your demands is crucial.

What types of coverage are offered by car insurance companies?

Liability coverage, which protects against both property damage and personal injury, is usually included with auto insurance. Companies also provide comprehensive, uninsured/underinsured motorist, collision, and other add-ons like roadside assistance and rental car coverage.

How do I save money on car insurance?

Bundling policies, keeping up a clean driving record, raising deductibles, taking advantage of discounts (such safe driver or multi-car discounts), and checking quotes from several providers to find the best deals are some ways to save money on auto insurance.

Are online car insurance quotes reliable?

Online quotes can be trusted, but it’s important to give precise details. Please be truthful when providing details about your driving history, type of vehicle, and coverage requirements as these factors will determine how accurate the quotation will be.

What factors impact car insurance premium?

Your driving history, age, place of residence, kind of car, coverage limitations, and deductible are some of the variables that affect your rate. Additionally, certain insurance firms may take into account variables like marital status and credit score.