In this article, I will discuss the Best Bridging Aggregator For Multi-chain with the best facilitites to transfer assets cross chains at little to no cost.

These aggregators enhance the level of interapability by offering secure and effecient solutions to users who seek to move assets around the different block chain ecosystems. Lets explore what makes thoe features of these aggregators the best in the market.

Key Point & Best Bridging Aggregator For Multi-chain List

| Protocol/Exchange | Key Points |

|---|---|

| Jumper Exchange (Li.Fi) | Multi-chain asset transfer, fast cross-chain swaps, supports various blockchain ecosystems. |

| Bungee Exchange | Decentralized bridging, low transaction fees, supports various blockchains for seamless transfers. |

| RhinoFi | Aggregates liquidity across DeFi protocols, optimized for faster token swaps, cross-chain support. |

| Across Protocol | Focus on low-cost cross-chain transfers, efficient use of liquidity pools, high scalability. |

| Stargate Finance | Unified liquidity bridge, supports cross-chain asset transfers, native cross-chain interoperability. |

| Portal Bridge (Wormhole) | Cross-chain messaging protocol, secure asset transfers, decentralized and scalable. |

| Synapse Protocol | Layer-2 bridge solution, multi-chain liquidity pooling, reduces slippage in token transfers. |

| Hop Protocol | Optimized for Ethereum Layer 2s, fast cross-chain bridging, reduces bridging fees with its token. |

| Orbit Bridge | Connects multiple chains, secure and efficient, high throughput for asset transfers. |

| Arbitrum Bridge | Ethereum Layer-2 solution, optimized for faster and cheaper transactions, enhanced security. |

1.Jumper Exchange (Li.Fi)

Jumper Exchange (Li.Fi) is the most prominent bridging aggregator for multi-chain with support for almost all existing blockchains. With sophisticated routing algorithms, Jumper Exchange minimizes costs and maximizes efficiency for users transferring assets across different chains.

Through the use of advanced liquidity pools, Jumper Exchange also optimally fills orders and reduces the overall fees. Users who value privacy without jeopardizing their funds’ security appreciate Jumper Exchange’s decentralized model. The overall blockchain support and Jumper’s decentralized nature improves user experience.

| Feature | Details |

|---|---|

| Platform Name | Jumper Exchange (Li.Fi) |

| Type | Multi-chain Bridging Aggregator |

| Supported Chains | Ethereum, Binance Smart Chain, Polygon, Avalanche, Solana, and more |

| Key Feature | Liquidity aggregation across various blockchains, low-cost transfers |

| KYC Requirement | Minimal KYC, mainly for regulatory compliance |

| Transaction Speed | Fast cross-chain transfers with optimized routes |

| Fees | Low transaction fees, optimized for minimal slippage |

| Security | Decentralized protocol with secure asset transfers |

| Unique Selling Point | Dynamic liquidity routing for efficient, cost-effective transfers |

| User Experience | Intuitive interface with simple cross-chain bridging |

2.Bungee Exchange

Bungee Exchange stands out as a premier bridging aggregator for multi-chain owing to its decentralized structure that facilitates efficient and economically advantageous cross-chain transfers. It offers support for multiple blockchains, enabling users to bridge assets without any hassle across different ecosystems.

One of the most notable characteristics of Bungee is liquidity aggregation which minimizes slippage and transaction costs by dynamically selecting the best routes for asset transfers. This makes bridging look fast and precise ensuring multi-chain interoperability.

| Feature | Details |

|---|---|

| Platform Name | Bungee Exchange |

| Type | Multi-chain Bridging Aggregator |

| Supported Chains | Ethereum, Binance Smart Chain, Polygon, Avalanche, Fantom, and more |

| Key Feature | Decentralized bridging with low transaction costs |

| KYC Requirement | Minimal KYC for regulatory compliance |

| Transaction Speed | Fast asset transfers with optimized routing |

| Fees | Low fees, dynamic selection of best routes for cross-chain swaps |

| Security | High security with decentralized validation |

| Unique Selling Point | Aggregates liquidity from multiple sources for efficient bridging |

| User Experience | User-friendly interface with simple cross-chain operations |

3.RhinoFi

RhinoFi’s exceptional multi-chain support stems from its bridging aggregator that stands out above the rest because of its seamless liquidity aggregation across DeFi protocols. By gathering liquidity from numerous gateways, it enables the most economical and efficient cross-chain transfers for all users.

Automated systems built into RhinoFi’s ‘smart’ routing system make sure there is a very low slippage which helps guarantee smooth transfer processes. Moreover, its focus on scalability integrated with support for a huge number of blockchains makes it an excellent option for users who need quick, safe, dependable, and multi-chain interoperability as well as ease of use.

| Feature | Details |

|---|---|

| Platform Name | RhinoFi |

| Type | Multi-chain Bridging Aggregator |

| Supported Chains | Ethereum, Binance Smart Chain, Polygon, Avalanche, and others |

| Key Feature | Aggregates liquidity from various DeFi protocols for efficient bridging |

| KYC Requirement | Minimal KYC for compliance purposes |

| Transaction Speed | Fast cross-chain transfers with optimized routing |

| Fees | Low fees and minimized slippage for cost-effective transfers |

| Security | Decentralized validation and secure asset transfers |

| Unique Selling Point | Liquidity aggregation for high efficiency and low-cost bridging |

| User Experience | Seamless cross-chain experience with an easy-to-use interface |

4.Across Protocol

As a multi-chain bridging aggregator, Across Protocol stands out for its affordable and efficient focus on cross-chain transfers. Innovations involving the use of liquidity pools ensure minimal fee requirements for moving assets across numerous blockchains.

Unlike other protocols, Across Protocol’s scalability model is capable of processing numerous transactions while maintaining speed and security. It serves multiple ecosystems and provides a simple user interface, making it the optimal solution for users requiring dependable and affordable multi-chain interoperability.

| Feature | Details |

|---|---|

| Platform Name | Across Protocol |

| Type | Multi-chain Bridging Aggregator |

| Supported Chains | Ethereum, Binance Smart Chain, Arbitrum, Polygon, and more |

| Key Feature | Low-cost, efficient cross-chain transfers with liquidity pooling |

| KYC Requirement | Minimal KYC for compliance |

| Transaction Speed | Fast transfers with optimized routing paths |

| Fees | Low fees due to efficient use of liquidity pools |

| Security | Secure decentralized transfers with trusted validators |

| Unique Selling Point | Scalability and optimized fee structure for cross-chain bridging |

| User Experience | Easy-to-use interface with smooth cross-chain integration |

5.Stargate Finance

Stargate Finance is the leading multi-chain bridging aggregator because of its unified liquidity bridge which allows for cross-chain asset transfers natively without the need for wrapping or synthetic assets. Stargate’s direct bridging of asset transfers between blockchains greatly increases the speed and security of cross-chain transactions.

The integration of Stargate within DeFi ecosystems improves liquidity and adopting focus on cross-chain usability enhances the overall experience for users. This distinct strategy helps in making Stargate an efficient, scalable, and reliable Bridging solution for multi–chain.

| Feature | Details |

|---|---|

| Platform Name | Stargate Finance |

| Type | Multi-chain Bridging Aggregator |

| Supported Chains | Ethereum, Binance Smart Chain, Polygon, Avalanche, and more |

| Key Feature | Native cross-chain asset transfers without wrapping or synthetic assets |

| KYC Requirement | Minimal KYC for compliance purposes |

| Transaction Speed | Fast and secure asset transfers between blockchains |

| Fees | Low fees with liquidity aggregation for efficient bridging |

| Security | Decentralized and secure bridging with trusted validators |

| Unique Selling Point | Unified liquidity pool for seamless and fast cross-chain transfers |

| User Experience | User-friendly interface with simple cross-chain operations |

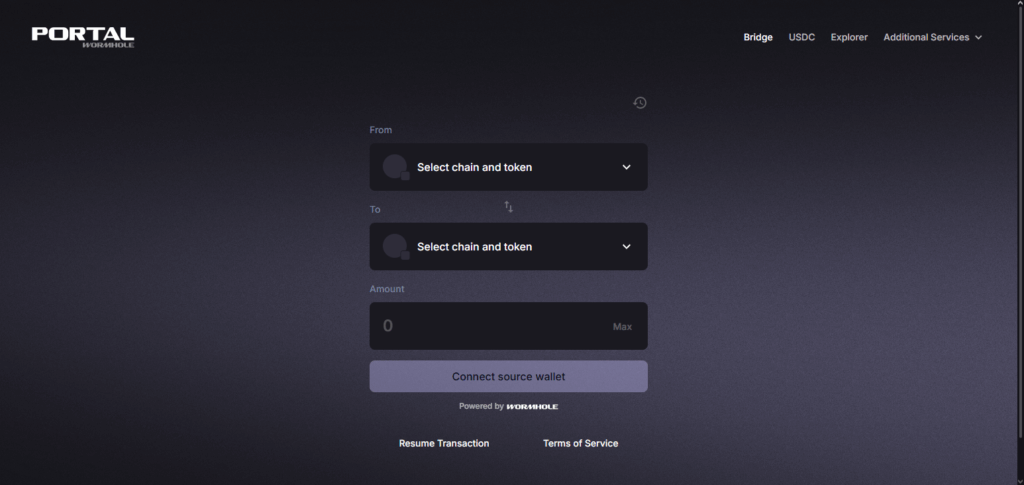

6.Portal Bridge (Wormhole)

Portal Bridge (Wormhole) is among the leading bridging aggregators for multi-chain, owing to its reliable cross-chain messaging system that guarantees safe, decentralized transfers of assets. It enables the transfer of tokens and information between different blockchains without the risk of losing security.

Its sophisticated architecture implements a system of trusted validators which allows achieving precision in transactions while preventing any manipulation. Offering a comprehensive range of chains coupled with high scalability, Portal Bridge provides fast and reliable multi-chain interoperability.

| Feature | Details |

|---|---|

| Platform Name | Portal Bridge (Wormhole) |

| Type | Multi-chain Bridging Aggregator |

| Supported Chains | Ethereum, Solana, Binance Smart Chain, Polygon, and more |

| Key Feature | Secure and seamless cross-chain messaging for asset transfers |

| KYC Requirement | Minimal KYC for regulatory compliance |

| Transaction Speed | Fast and reliable cross-chain transfers |

| Fees | Low transaction fees for efficient asset transfers |

| Security | Decentralized network of validators for secure, tamper-proof transfers |

| Unique Selling Point | Cross-chain messaging with native asset transfer functionality |

| User Experience | Intuitive interface for simple, seamless bridging operations |

7.Synapse Protocol

Synapse Protocol stands out as a premier bridging aggregator for multi-chain due to its unique Layer-2 approach and emphasis on high liquidity with low slippage. Synapse makes cross-chain transactions easy and inexpensive by integrating different blockchains and decentralized exchanges.

Through its novel liquidity pooling system, Synapse enables scalable asset transfers which avoid the traditional bottlenecks encountered in bridges. Synapse Protocol’s cross-chain seamless user experience makes it ideal for anyone looking for reliable low-cost bridging.

| Feature | Details |

|---|---|

| Platform Name | Synapse Protocol |

| Type | Multi-chain Bridging Aggregator |

| Supported Chains | Ethereum, Binance Smart Chain, Avalanche, Polygon, and more |

| Key Feature | Layer-2 bridging solution with liquidity pools for efficient asset transfers |

| KYC Requirement | Minimal KYC for compliance |

| Transaction Speed | Fast and cost-efficient cross-chain transfers |

| Fees | Low fees, optimized for reduced slippage |

| Security | Decentralized and secure bridging with multiple validators |

| Unique Selling Point | High liquidity pooling and Layer-2 bridging for scalability |

| User Experience | Seamless integration for smooth multi-chain interoperability |

8.Hop Protocol

Hop Protocol is the most efficient bridging aggregator for multichain because it is optimized for Ethereum Layer-2 systems, allowing quick and affordable cross-chain transfers. Its novel token bridging system permits the movement of assets across various Layer-2 frameworks without burdening users with gas fees.

The combination of decentralized governance and liquidity provision across numerous chains guarantees efficient yet stable transactions. This scalability and preference for Ethereum based systems make Hop Protocol the leading solution for multi-chain interoperability.

| Feature | Details |

|---|---|

| Platform Name | Hop Protocol |

| Type | Multi-chain Bridging Aggregator |

| Supported Chains | Ethereum, Optimism, Arbitrum, Polygon, and more |

| Key Feature | Optimized for Ethereum Layer-2, providing fast and low-cost transfers |

| KYC Requirement | Minimal KYC for compliance |

| Transaction Speed | High-speed, low-cost cross-chain transfers |

| Fees | Low fees with token-specific bridging options |

| Security | Secure decentralized bridging with robust validator system |

| Unique Selling Point | Focus on Ethereum Layer-2 scalability and fast cross-chain bridging |

| User Experience | Simple and intuitive interface for Layer-2 asset transfers |

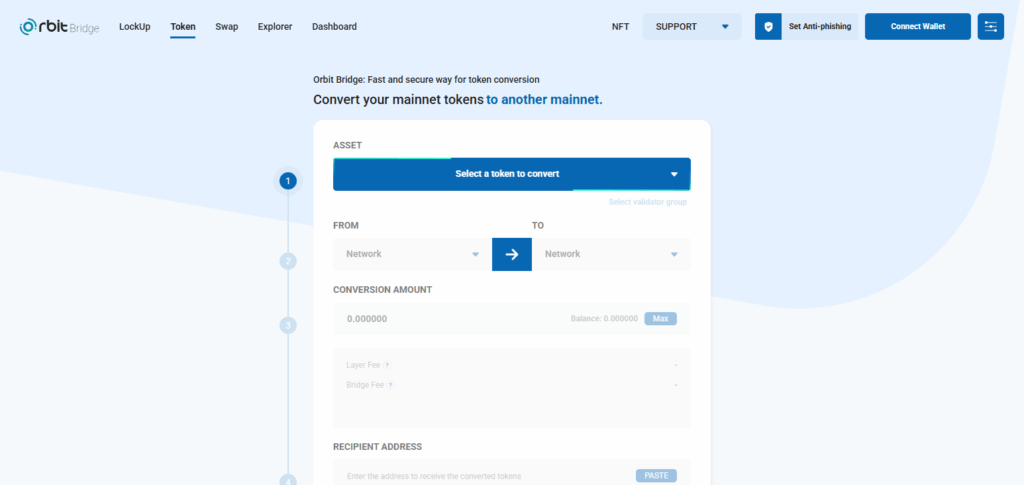

9.Orbit Bridge

Orbit Bridge stands out as the leading bridging aggregator for multi-chain blockchain integration due to its extensive coverage, high throughput, and low latency. Its distinct advantage is in enabling rapid and secure transfer of assets across different ecosystems without using any centralized organizations.

The user-friendly design of Orbit’s interface together with cross-chain compatibility enhances user experience while still maintaining safety and trust due to its decentralized setup making it less vulnerable to malicious attacks. This is why Orbit Bridge offers the most balance between performance and convenience on multi-chain bridging.

| Feature | Details |

|---|---|

| Platform Name | Orbit Bridge |

| Type | Multi-chain Bridging Aggregator |

| Supported Chains | Ethereum, Binance Smart Chain, Avalanche, Terra, and more |

| Key Feature | High-throughput cross-chain bridging with decentralized validation |

| KYC Requirement | Minimal KYC for compliance |

| Transaction Speed | Fast, efficient asset transfers across supported chains |

| Fees | Low transaction fees, optimized for minimal slippage |

| Security | Decentralized bridging with secure cross-chain data validation |

| Unique Selling Point | High scalability with multi-chain support for efficient transfers |

| User Experience | Easy-to-use interface for seamless cross-chain asset movement |

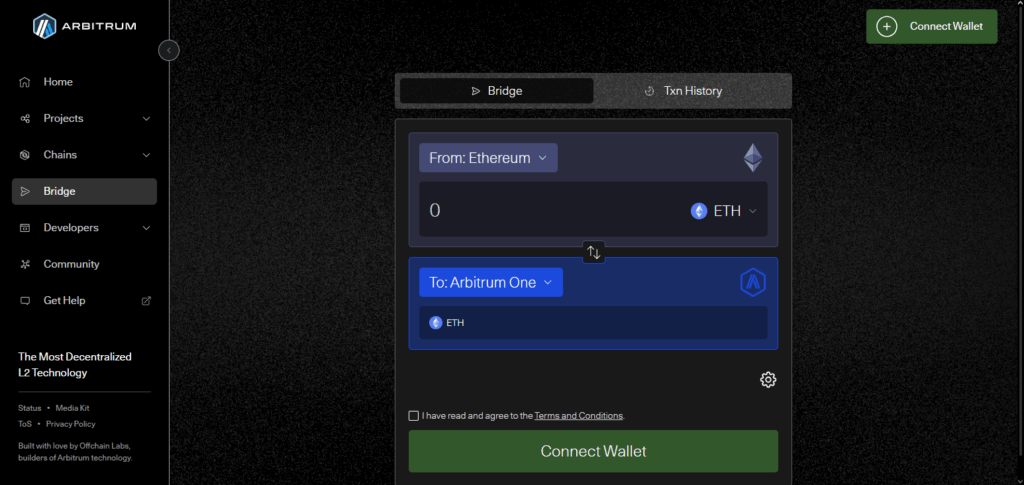

10.Arbitrum Bridge

Arbitrum Bridge remains the most prominent bridging aggregator for cross-chain “multi-chain” transfers because it enables easy movement from Ethereum to its Layer-2 network, Arbitrum. Its rollup approach uniquely combined with Ethereum’s security provides faster, cheaper and more secure transactions, ensuring reduced gas fees.

Arbitrum has optimized its system for swift user transactions and asset movement across Ethereum ecosystems. Offering a robust infrastructure and exceptional user experience, Arbitrum Bridge stands out as the go-to answer for reliable multi-chain interoperability.

| Feature | Details |

|---|---|

| Platform Name | Arbitrum Bridge |

| Type | Multi-chain Bridging Aggregator |

| Supported Chains | Ethereum, Arbitrum, and other Ethereum Layer-2 solutions |

| Key Feature | Fast, low-cost transfers between Ethereum mainnet and Arbitrum |

| KYC Requirement | Minimal KYC for compliance |

| Transaction Speed | High-speed, low-latency asset transfers |

| Fees | Low gas fees, optimized for Ethereum Layer-2 scalability |

| Security | Secure bridging with Ethereum mainnet’s security features |

| Unique Selling Point | Optimized for Ethereum Layer-2, focusing on scalability and reduced gas costs |

| User Experience | Intuitive user interface for seamless Ethereum-to-Arbitrum bridging |

Conclusion

As we have seen in the earlier parts of the report, an optimal multi-chain bridging aggregator differs for every user as they have unique preferences, but we can emphasize Jumper Exchange, Bungee Exchange and Synapse Protocol because they offer integration with other chains without restrictions, support low-cost transactions, and have a scalable infrastructure.

All aggregators have their strengths, for example, some have enhanced liquidity aggregation and support Layer-2 or native asset transfers, thus proving themselves as dependable for swift, secure, and inexpensive multi-chain transactions. With the right bridge choice, users will enjoy greater convenience and efficiency in a multi-chain setup.