The Best AI Tools for Crypto Research, which are revolutionizing the analysis and trading of digital assets by investors, will be covered in this article.

- About Crypto Research AI Tools

- How To Choose AI Tools for Crypto Research

- Understand Your Research Needs

- Confirm Data Accuracy & Reliability

- Compare Features & Functionality

- Weigh User Experience & Accessibility

- Analyze Pricing & Subscription Plans

- Appreciate Community & Support

- Assess Integration & Compatibility

- Key Point & Best AI Tools for Crypto Research List

- 1. Token Metrics

- Token Metrics Features, Pros & Cons

- 2. Nansen

- Nansen Features, Pros & Cons

- 3. Glassnode

- Glassnode Features, Pros & Cons

- 4. Arkham Intelligence

- Arkham Intelligence Features, Pros & Cons

- 5. Kaito AI

- Kaito AI Features, Pros & Cons

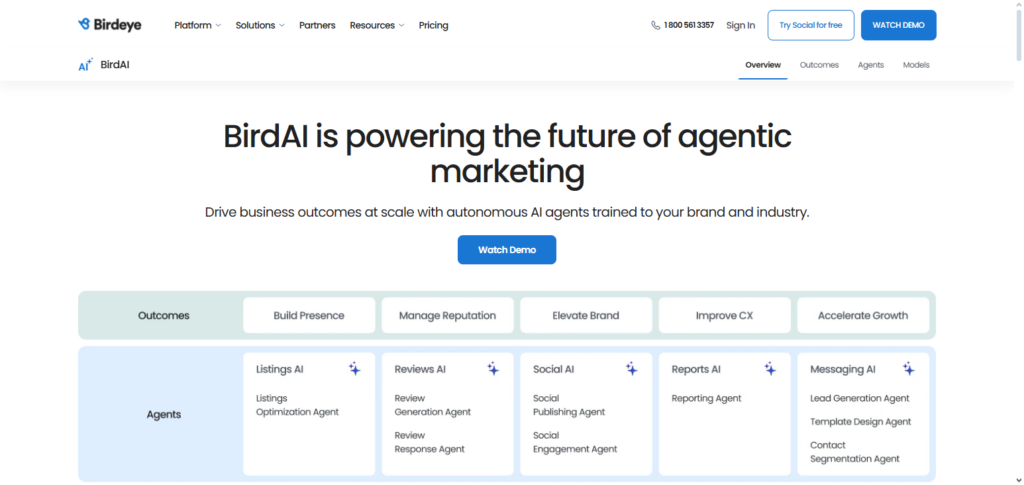

- 6. Birdeye AI

- Birdeye AI Features, Pros & Cons

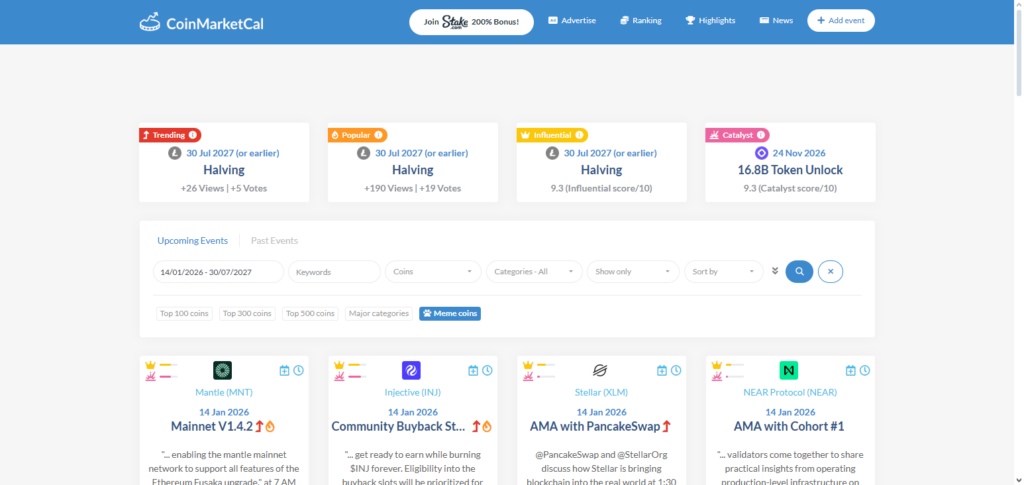

- 7. CoinMarketCal AI

- CoinMarketCal AI Features, Pros & Cons

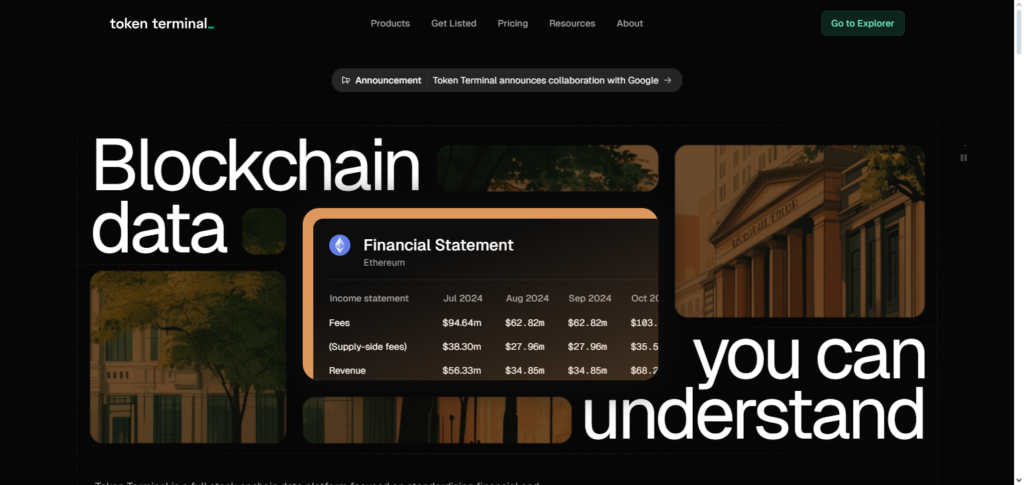

- 8. Token Terminal

- Token Terminal Features, Pros & Cons

- 9. Santiment AI

- Santiment AI Features, Pros & Cons

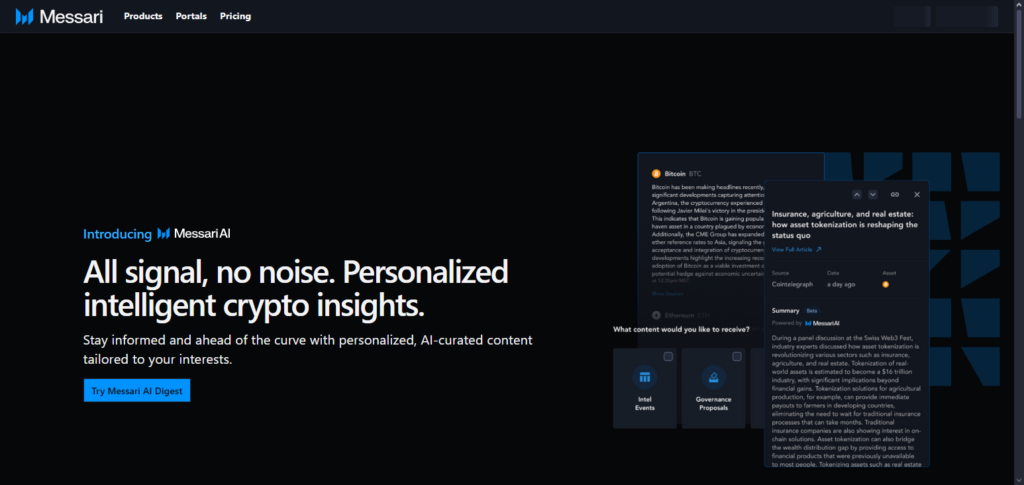

- 10. Messari AI

- Messari AI Features, Pros & Cons

- Benefits Of AI Tools for Crypto Research

- Data Driven Insights

- Predict Market Trends

- Time Efficiency

- Risk Management

- Comprehensive Market Coverage

- Personalized Alerts and Recommendations

- Enhanced Fundamental and Sentiment Analysis

- Accessible for All Skill Levels

- Conclusion

- FAQ

These tools track trends, forecast price movements, and offer market insights using artificial intelligence, machine learning, and on-chain data. These tools can assist traders of all skill levels in making more informed, data-driven decisions.

About Crypto Research AI Tools

Crypto Research AI Tools are cutting-edge systems that use blockchain analytics, machine learning, and artificial intelligence to assist traders and investors in making wise choices in the cryptocurrency market.

Large volumes of data, such as on-chain analytics, token performance, market trends, social sentiment, and project fundamentals, are analyzed by these tools. They simplify complicated market data and assist users in finding lucrative opportunities while controlling risk by offering predictive insights, warnings, and visual dashboards.

Crypto research AI technologies like Token Metrics, Nansen, Glassnode, and Messari AI have proven crucial for staying ahead in the fast-paced and unpredictable world of digital assets, for both novice and institutional investors.

How To Choose AI Tools for Crypto Research

Understand Your Research Needs

Whether your budget is for on-chain analytics or for social sentiment and for market prediction and for project fundamentals. Specialization varies among tools so you need to know your focus.

Confirm Data Accuracy & Reliability

Be certain that the provided AI blockchain data is credible and with the correct data sources and proven predictive models to avoid misguided insights.

Compare Features & Functionality

What about your portfolio tracking and alerts and dashboards and event calendars and trends prediction features? Tools should facilitate actionable insights and simplify decision making on your behalf.

Weigh User Experience & Accessibility

Adequate tools should provide plenty of features and have a fair interface and decent visualizations and be at your skill tier whether you are a beginner or a pro.

Analyze Pricing & Subscription Plans

What free features are on offer? Are there tiers on which you can access the basic features like insights while the advanced ones like analytics and predictions and data of the AI are behind a subscription paywall?

Appreciate Community & Support

Look for active community forums, walk-throughs, and customer support. This will help in maximizing the tools potential and in troubleshooting tools.

Assess Integration & Compatibility

Check whether the software integrates with your preferred wallets, exchanges, or analytics tools for a seamless workflow and improved portfolio management.

Key Point & Best AI Tools for Crypto Research List

| Platform | Key Points |

|---|---|

| Token Metrics | Provides AI-driven crypto research, market analytics, and investment insights for traders. |

| Nansen | On-chain analytics platform offering wallet tracking, NFT insights, and DeFi intelligence. |

| Glassnode | Blockchain analytics tool delivering on-chain data, metrics, and market intelligence. |

| Arkham Intelligence | Offers deep on-chain investigations, analytics, and real-time crypto intelligence. |

| Kaito AI | AI-powered crypto analytics platform that forecasts market trends and trading opportunities. |

| Birdeye AI | Uses AI to analyze crypto sentiment, market data, and social trends for investment decisions. |

| CoinMarketCal AI | AI-enhanced crypto calendar providing event-driven insights for price predictions. |

| Token Terminal | Fundamental analytics platform for crypto projects, tracking financial and on-chain metrics. |

| Santiment AI | Offers AI-driven market sentiment, social metrics, and on-chain analytics for crypto assets. |

| Messari AI | Provides AI insights, crypto research, and real-time market intelligence for investors. |

1. Token Metrics

One of the greatest AI tools for cryptocurrency research is Token Metrics, which offers comprehensive market analytics. In order to assist traders in making wise judgments, it uses artificial intelligence to evaluate project fundamentals, market trends, and historical data.

Both novice and seasoned investors can benefit from the platform’s scoring systems, price forecasts, and portfolio management features. Token Metrics offers a comprehensive perspective of the industry by covering altcoins, NFTs, and DeFi initiatives. It is a reliable option for cryptocurrency research since its AI-driven analytics enable users to find possible investment possibilities and effectively manage risk.

Token Metrics Features, Pros & Cons

Features

- Forecasts and ratings driven by AI

- Tools for tracking portfolios

- Integration of data both on-chain and off-chain

- Analyses of the fundamentals of the project

- Predictions and alerts of a custom variety

Pros

- Predictive scores driven by AI are robust.

- It is simple for novices.

- It contains fundamental analysis of good quality.

- It is a tool for risk assessment of a personalized nature.

- Models are updated frequently.

Cons

- It can be expensive to subscribe.

- There is unequal coverage of various assets.

- Predictions can be inaccurate.

- There is a high level of difficulty for the advanced features.

- Minimal social sentiment analysis is provided.

2. Nansen

One of the top AI-powered on-chain analytics platforms for cryptocurrency study is Nansen. It tracks wallet activity, token movements, and DeFi transactions in real time by combining blockchain data with a powerful analytics engine. Nansen gives traders useful data by allowing users to examine top-performing wallets, NFT activity, and liquidity flows.

By tracking whale movements and social cues, its AI features reveal new patterns and possible investment opportunities. Nansen reduces uncertainty in the unpredictable cryptocurrency markets by enabling investors to make data-driven decisions through comprehensive dashboards and visualizations.

Nansen Features, Pros & Cons

Features

- Tracking and labeling of wallets

- Analytics for NFTs and DeFi

- Dashboards for on-chain data

- Smart alerts

- Analytics for trendspotting

Pros

- Outstanding visualization of on-chain data.

- Excellent analysis of the flow of smart money.

- Good support for DeFi and NFTs.

- Analytics is done in real time.

- It is beneficial for advanced traders.

Cons

- It the algorithm is quite simple and basic.

- Expensive plans for premium users.

- Difficult to use for beginners.

- There is a high level of difficulty.

- The interface can be cumbersome.

3. Glassnode

One of the top AI tools for cryptocurrency research is Glassnode, a blockchain analytics platform that leads the market. To assist investors in comprehending market activity, it offers on-chain measurements, market insights, and historical data. The platform uses artificial intelligence (AI) to identify abnormalities and patterns in data such as exchange flows, hodler activity, and network health.

The dashboards offered by Glassnode are easy to use and serve traders, analysts, and institutions. Potential price changes and market cycles are identified with the use of its predictive analytics. Glassnode helps investors make well-informed decisions, improve trading methods, and reduce risks in the cryptocurrency ecosystem by fusing AI-driven insights with trustworthy on-chain data.

Glassnode Features, Pros & Cons

Features

- Metrics related to on-chain data

- Indicators of the health of the market.

- Monitoring crypto flows in real time

- Recording transactions

- Flow tracking

- Analyzing network activity

- Data visualization tools

Pros

- Credible data

- Identifying trends in data

- Data analytics

- Longitudinal studies

- Data flow tracking

Cons

- Little use of predictive analytics

- More restrictions on basic packages

- Steep learning curve

- Insufficient notifications

- Data primarily on Bitcoin and Ethereum

4. Arkham Intelligence

One of the greatest AI tools for cryptocurrency research is Arkham Intelligence, which focuses on real-time analytics and in-depth on-chain investigations. It provides thorough insights into transaction patterns, wallet activity, and new market trends. Arkham’s AI algorithms are capable of identifying questionable activities, spotting fresh opportunities, and giving institutions and investors useful information.

It is particularly helpful for tracking the movement of large holders and comprehending intricate DeFi interactions. Arkham Intelligence is an essential tool for serious crypto research since it enables traders to make smart decisions while staying ahead of market trends by providing very granular data and predictive insights.

Arkham Intelligence Features, Pros & Cons

Features

- Analysis of wallets and users

- Recognition of transactional patterns

- Detection of fraud and discrepancies

- Insight into transactions as they happen

- Analytics

Pros

- User-analytical research

- Monitoring HNWI

- Recognition of patterns

- Forensic analytics

- Analytics in real-time

Cons

- Descriptions of the document might be complex

- Most features come at an extra cost

- Charts are non-standard

- Unique use for some

- Forecasting is poor

5. Kaito AI

Kaito AI is an analytics tool for research in crypto powered by AI. It is one of the best tools out there for crypto research. Kaito utilizes ML in order to provide users with insights to help with actionable trades along with forecasting trends in the market as well as assessing token performance.

Kaito AI gives users the ability to better understand market shifts by using on-chain analytics, recorded prices in the past, and social signals to give users market predictions. Kaito AI has risk and opportunity alerts, tools to optimize portfolios, and is designed for retail and institutional investors. Kaito AI is great for users who want analytics simplified to help investments in more complicated market conditions. Kaito AI is for investors who want to take crypto investing seriously.

Kaito AI Features, Pros & Cons

Features

- On-chain + social integration

- AI market forecasting

- Trend predictions

- Pattern detection

- Signal alerts

Pros

- Strong alert system

- Good forecast accuracy

- Easy to interpret insights

- Great for trend discovery

- Combines multiple data sources

Cons

- Fewer assets than larger platforms

- Still maturing platform

- Paid tiers necessary for best alerts.

- Occasional false signals.

- Limited depth in fundamental research.

6. Birdeye AI

One of the greatest AI tools for cryptocurrency research is Birdeye AI, a top AI-driven platform with expertise in sentiment analysis, social metrics, and market information. To determine market sentiment and any price repercussions, it analyzes news, social media, and community discussions.

These insights are combined with on-chain data by Birdeye AI to find discounted assets and new trends. Traders can gain a competitive edge by using the platform to identify early signs prior to market changes. Birdeye AI assists investors in managing risk, making well-informed decisions, and effectively exploring profitable opportunities across digital assets by fusing AI with crypto analytics.

Birdeye AI Features, Pros & Cons

Features

- Analysis of social sentiment

- Scoring of news impact

- Signals on and off chain

- Heatmap trends

- Alert signals

Pros

- Focus on social sentiment.

- Good detection of relevant events.

- Dashboards are good

- Signals are sent quickly

- Provides short-term trading utility

Cons

- Sentiment can be exaggerated

- Alerts need to be adjusted

- Fewer on-chain metrics in depth

- Limited tools for fundamentals

- Full features are reserved for paid plans

7. CoinMarketCal AI

One of the greatest AI tools for cryptocurrency research is CoinMarketCal AI, which emphasizes predictive analytics and event-driven insights. In order to predict possible market reactions, it keeps track of forthcoming cryptocurrency events, announcements, and project milestones.

Its AI systems help traders predict market moves by analyzing past event data to estimate probability of price implications. Additionally, CoinMarketCal AI compiles data from the community and verifies the accuracy of events.

Investors can reduce uncertainty by planning trades around significant developments by integrating calendar data with AI predictions. For traders looking for a tactical edge in the rapidly evolving cryptocurrency ecosystem, this makes it an invaluable tool.

CoinMarketCal AI Features, Pros & Cons

Features

- Research based on events

- Forecasting price impacts

- Community validated events

- Calendar reminders

- Scoring based on probability

Pros

- Excellent to use for trading based on events

- Forecasting price reactions is automated

- Events are diverse

- The interface is easy to use

- Alerts are useful

Cons

- The accuracy of event data is based on the community.

- There are few conventional analytics.

- Not useful for research that is comprehensive and long-term

- The AI forecasts are at times ambiguous

- There is less emphasis on fundamentals.

8. Token Terminal

One of the greatest AI tools for cryptocurrency study is Token Terminal, a basic analytics platform. Financial and on-chain statistics, including as revenue indicators, user growth, and token performance, are used to assess cryptocurrency initiatives.

Similar to conventional stock analysis, Token Terminal enables investors to compare projects impartially. While monitoring financial health, its AI-powered insights assist in identifying undervalued assets and growth possibilities.

Long-term investors and organizations looking for in-depth project analytics will find the platform appropriate. Token Terminal is a recognized resource for comprehending cryptocurrency foundations and project longevity since it helps strategic investment decisions by fusing AI predictions with trustworthy facts.

Token Terminal Features, Pros & Cons

Features

- Key financial metrics

- Analysis of revenue and valuation

- Data on-chain economically

- Project analysis

- Industry benchmarking

Pros

- Good emphasis on the fundamentals

- Financial KPIs are good

- Valuable for long-term analysis

- Simpler project comparisons

- Appeal to institutions

Cons

- Less predictive AI tools

- Limited social data

- UI can feel bland

- Not for short-term traders

- Some measurements are complicated to understand

9. Santiment AI

Santiment AI serves as a well-rounded market intelligence tool and facilitates AI-enabled crypto research. The platform offers predictive analytics based on social information, on-chain activity, and market analysis. Through tracking whale activity, social info, and network activity, Santiment AI helps users identify opportunities for profit.

Additionally, the platform provides market anomaly alerts and visualizations to assist users in responding to trends.

The platform integrates AI and blockchain data to offer comprehensive market insights, which, in conjunction with its user-friendly design and advanced features, make it a great choice for novices and experts alike. With Santiment AI, users are able to anticipate trends, adjust risk levels in their portfolios, and make informed decisions based on data.

Santiment AI Features, Pros & Cons

Features

- Social sentiment signals

- Analytics on-chain

- Alerts

- Track market behavior

- Dashboards

Pros

- Sentiment plus on-chain

- Alerts for anomalies are useful

- Community metrics are strong

- Great for identifying trends

- Indicators are flexible

Cons

- Data can be noisy

- UI is a bit outdated

- Approximately $30 a month

- Sometimes off predictions

- It takes time to learn predictions

10. Messari AI

One of the greatest AI tools for crypto research is Messari AI, a well-known platform that integrates real-time market data with AI analytics. It offers information on market trends, token metrics, and project fundamentals.

Messari AI provides investors with a comprehensive understanding of the cryptocurrency market by monitoring news, regulatory changes, and on-chain activity. Potential hazards, possibilities, and new ventures are highlighted by its AI algorithms.

For improved decision-making, the platform also provides dashboards, warnings, and research reports. Investors may optimize their portfolios, make data-driven decisions, and maintain an advantage in the ever changing cryptocurrency market by utilizing Messari AI.

Messari AI Features, Pros & Cons

Features

- Research for market & blockchain

- Analytics of news

- Token screen

- Project profiles

- Alerts in real-time

Pros

- Hub for research is extensive

- Highly trusted data for the industry

- Applicable to both advanced & entry level

- Alerts & news are timely

- Sturdy fundamentals

Cons

- Paid plans offer the best insights

- AI tools are still developing

- UI can be overwhelming

- More attention on deep wallet tracking is needed

- Some features overlap with other tools

Benefits Of AI Tools for Crypto Research

Data Driven Insights

Investors can utilize the accurate and insightful analysis on on-chain data, market data, and social data from AI tools to help make decisions.

Predict Market Trends

Investors will continue to have a competitive edge with AI tools predicting movements in price, performance in tokens, and new emerging market tendencies through machine learning.

Time Efficiency

Investors save a great deal of manual research time when driven AI tools are used, and they offer a great deal of actionable data presented in an easy to understand way.

Risk Management

Using predictive models, alerts, and trend analysis, AI tools help investors in a way that manage their loss in a better way, and help in optimizing their portfolio in the best way for varying market conditions.

Comprehensive Market Coverage

Altcoins, DeFi tokens, NFTs, and mega cap coins like Bitcoin and Ethereum are covered through AI tools providing the entire crypto ecosystem.

Personalized Alerts and Recommendations

Clients can actively adjust their approach in an efficient way through improvements in the time and market of the AI tools along with personalized alerts and recommendations for changing conditions, events, and activities associated with wallets.

Enhanced Fundamental and Sentiment Analysis

Investors will have a better all around view of on-chain data, social sentiment, news around the project, and the fundamentals of the crypto. AI takes all of these factors and unifies them for an investor.

Accessible for All Skill Levels

AI tools help all users, from neophytes to institutional investors, break down advanced analytics, making the crypto research process easy and actionable.

Conclusion

To sum up, using AI techniques for cryptocurrency research has become crucial for both institutional traders and private investors.

Combining on-chain data, market analytics, social sentiment, and predictive intelligence, platforms such as Token Metrics, Nansen, Glassnode, Arkham Intelligence, Kaito AI, Birdeye AI, CoinMarketCal AI, Token Terminal, Santiment AI, and Messari AI offer thorough insights.

In the rapidly evolving crypto industry, these tools assist users in seeing possibilities, controlling risks, and making data-driven decisions. Investors may keep ahead of market trends and maximize the potential of their cryptocurrency investments by incorporating AI into their research.

FAQ

What are AI tools for crypto research?

AI tools for crypto research are software platforms that use artificial intelligence, machine learning, and data analytics to analyze blockchain data, market trends, social sentiment, and project fundamentals. They help investors make informed decisions, predict market movements, and manage risks efficiently.

Why should I use AI tools for crypto research?

Crypto markets are highly volatile and data-heavy. AI tools process vast amounts of information quickly, provide predictive insights, and identify hidden trends that manual analysis might miss. They give investors a competitive edge in trading and long-term investing.

Which are the best AI tools for crypto research?

Some of the top platforms include Token Metrics, Nansen, Glassnode, Arkham Intelligence, Kaito AI, Birdeye AI, CoinMarketCal AI, Token Terminal, Santiment AI, and Messari AI. Each tool specializes in different areas like on-chain analytics, social sentiment, market forecasting, or fundamental analysis.

Are these tools suitable for beginners?

Yes. While some platforms cater to institutional investors, many offer beginner-friendly dashboards, tutorials, and automated insights. Tools like Token Metrics, Messari AI, and CoinMarketCal AI are particularly approachable for new traders.

Can AI tools guarantee profit in crypto trading?

No tool can guarantee profit. AI tools provide data-driven insights, trend analysis, and predictions, but market conditions are unpredictable. They are meant to reduce risk and inform better decisions rather than ensure guaranteed gains.