The Best AI Bots for Crypto Automation will be covered in this post, along with an examination of how AI is changing cryptocurrency trading.

- What Are AI Crypto Trading Bots?

- Benefits of Using AI Bots for Crypto Automation

- Key Point & Best AI Bots for Crypto Automation List

- 1. 3Commas

- 3Commas Features, Pros & Cons

- 2. Bitsgap

- Bitsgap Features, Pros & Cons

- 3. Coinrule

- Coinrule Features, Pros & Cons

- 4. Kryll.io

- Kryll.io Features, Pros & Cons

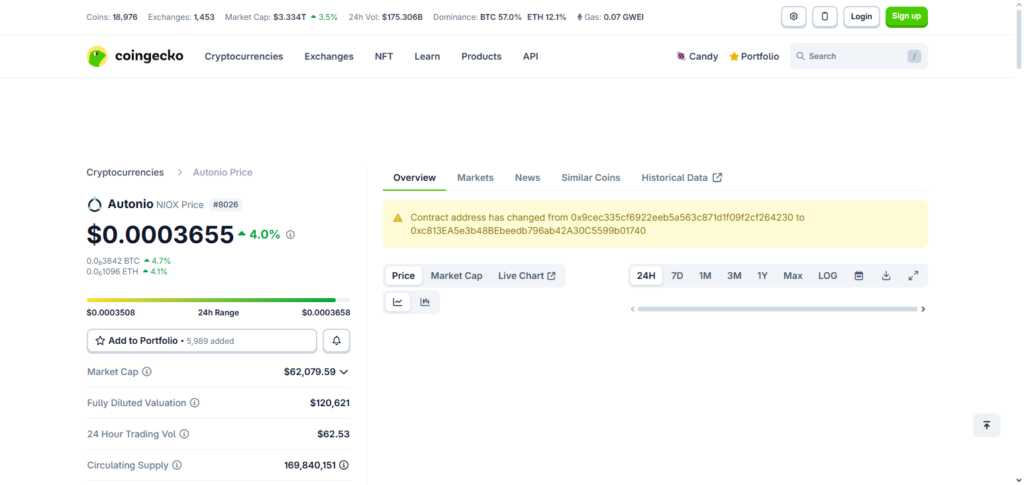

- 5. Autonio

- Autonio Features, Pros & Cons

- 6. TradeSanta

- TradeSanta Features, Pros & Cons

- 7. Pionex

- Pionex Features, Pros & Cons

- 8. Zignaly

- Zignaly Features, Pros & Cons

- 9. Gunbot

- Gunbot Features, Pros & Cons

- 10. Mudrex

- Mudrex Features, Pros & Cons

- Comparison Table of Top AI Crypto Bots

- Conclusion

- FAQ

These bots assist traders in minimizing risks, increasing profits, and saving time by automating methods and evaluating market patterns. Using AI-powered bots can improve trading’s intelligence, speed, and efficiency regardless of experience level.

What Are AI Crypto Trading Bots?

AI crypto trading bots are automated software applications that carry out cryptocurrency trades on behalf of users using artificial intelligence, machine learning, and preset algorithms.

To find trading opportunities, these bots examine market data in real time, including price fluctuations, volume, trends, and technical indicators. AI cryptocurrency trading bots can conduct trades more quickly and reliably than humans by eliminating emotional decision-making.

They are a potent tool for effective and data-driven cryptocurrency trading since they run around the clock, control risk with automated stop-loss and take-profit rules, and may modify methods in response to shifting market conditions.

Benefits of Using AI Bots for Crypto Automation

Automated Trading 24/7 – AI bots trade every hour of every day so there are no missed opportunities while you’re not watching the markets.

Emotionless Trading – Bots execute trades without fear or greed influencing decisions, creating a more disciplined trading approach.

Trade Execution Speed – AI bots are instant, and in the crypto space, time is a highly valuable resource when it comes to trading.

Market Analysis Ability – Bots assess more market data in a shorter time frame compared to manual trading which greatly enhances market assessments.

Risk Management – Bots do the work of stop-loss, take-profit, and position sizing automations to prevent losses.

Strategy Optimization and Backtesting – With strategies, users can backtest them using previous market data before going live.

Efficiency and Time Saving – Automation decreases the workload of manual trading and monitoring.

Support for Multiple Exchanges – Several bots allow users to control trades on different exchanges using a single interface.

Consistent Execution of Strategies – Bots execute strategies exactly as programmed without human error.

Beginner Automation – With the option of no-code strategies, new users can take a more hands-on role.

Key Point & Best AI Bots for Crypto Automation List

| Trading Bot/Platform | Key Point |

|---|---|

| 3Commas | Popular platform for automated trading with smart trading terminals, portfolio tracking, and DCA bots supporting multiple exchanges. |

| Bitsgap | Offers automated trading, arbitrage, and demo trading with AI-powered signals and cross-exchange management. |

| Coinrule | No-code trading platform allowing users to create automated trading strategies with templates and AI tools. |

| Kryll.io | Drag-and-drop strategy builder for automated trading, backtesting features, and marketplace for strategy sharing. |

| Autonio | AI-powered trading platform with customizable bots, strategy marketplace, and community-driven features. |

| TradeSanta | Cloud-based crypto trading bot platform for automated trading using DCA and grid strategies across multiple exchanges. |

| Pionex | Exchange with built-in trading bots, low fees, and a variety of automated strategies for beginners and pros. |

| Zignaly | Cloud-based platform offering automated trading, signal copy trading, and integration with multiple exchanges. |

| Gunbot | Highly customizable trading bot supporting multiple strategies, indicators, and exchanges for active traders. |

| Mudrex | Marketplace and platform for algorithmic trading with pre-built bots, backtesting, and AI-driven strategy creation. |

1. 3Commas

3Commas is a well-known cryptocurrency trading platform that caters to both novice and expert traders. It provides portfolio management tools, automatic DCA (Dollar-Cost Averaging) bots, and intelligent trading terminals that are linked across several exchanges, including Coinbase, KuCoin, and Binance.

To lower trading risks, users can concurrently set up take-profit and stop-loss methods. With market knowledge, its AI-powered signals assist traders in making well-informed selections.

Additionally, the platform offers a social trading community where users can exchange strategies. Because of its extensive feature set and intuitive UI, 3Commas is regarded as one of the top AI bots for crypto automation.

3Commas Features, Pros & Cons

Features

- Smart Trading Terminal – Integrated system for manual and automated trades across multiple exchanges.

- DCA & Grid Bots – Advanced bot types are employed to average out positions and capture possible market ranges.

- Take Profit & Stop Loss – Assign multiple risk management orders.

- AI Signals & Alerts – Provide market updates to inform bot strategy decisions.

- Portfolio Tracking – Overview of real-time performance and distribution of assets.

Pros

- Smart trading terminal that has grid and DCA bots.

- Supports multiple exchanges (Coinbase, KuCoin, Binance, etc)

- Advanced risk management (take profit + stop loss)

- Market analytics + AI signals.

- Community/social sharing of strategies

Cons

- Subscription pricing full features is quite expensive.

- Dashboards can be overwhelming for novices.

- Bots cannot be standalone.

- Some bots need volatility fine tuning.

- Extreme market moves will lag the bots.

2. Bitsgap

Users may trade and manage several cryptocurrency exchanges from a single interface with Bitsgap, a powerful automated trading platform. It is appropriate for both novice and experienced traders because it focuses on arbitrage opportunities, portfolio tracking, and demo trading.

Its AI-driven trading signals examine market patterns and offer suggestions for improving bot tactics. By creating grid and DCA bots with unique characteristics, users may reduce risks and increase revenue.

Bitsgap guarantees strategic decision-making with sophisticated analytics and backtesting capabilities. Its multi-exchange capabilities make it stand out as one of the top AI bots for cryptocurrency automation.

Bitsgap Features, Pros & Cons

Features

- Multi-Exchange Connectivity – Supervise assets on diverse exchanges from a single dashboard.

- Grid & DCA Bots – Set automated trade execution within your specified parameters.

- Arbitrage Tool – Discover and take advantage of different prices for the same asset across various exchanges.

- Demo Mode – Refine strategies with simulated funds.

- AI-Driven Signals – Alerts for market trends and optimizing strategies.

Pros

- Dashboards for multiple exchanges in one place.

- AI signals and in-bot arbitrage.

- Risk-free practice mode.

- Bots (DCA and grid) with backtesting.

- Integrated portfolio management across multiple exchanges.

Cons

- Advanced pricing automation comes with a monthly fee.

- Sometimes, the arbitrage has slower profit growth.

- It can be difficult to understand for new users.

- The bots require a certain amount of trading for them to function effectively.

- Bots cannot be standalone. (API is required for integration with other exchanges)

3. Coinrule

Coinrule is an automated, no-code cryptocurrency trading platform that lets users create trading strategies without knowing how to program. It has real-time market monitoring, rule-based automation, and pre-built templates.

Both new and experienced traders can use AI-driven methods including trend-following, scalping, and stop-loss modifications. Prior to live execution, strategies can be tested using historical data thanks to its user-friendly interface.

Coinrule offers smooth automation and risk management through interfaces with several significant exchanges. One of the greatest AI bots for cryptocurrency automation is Coinrule, which combines accessibility and sophisticated strategic adaptability.

Coinrule Features, Pros & Cons

Features

- No-Code Rule Builder – Assemble a bot with straightforward rule templates.

- Pre-Built Strategies – Automation configurations already constructed waiting for your trade instructions.

- Backtesting Engine – Employ historical data to kick the tires on your bots.

- Multi-Exchange Support – Via the API, link prominent exchanges.

- Real-Time Alerts – Notifications when trading actions are executed and for performance parameters.

- Paper trading and backtesting.

- Automation is easy for starters.

- Connection to multiple exchanges.

Cons

- Limited rules for the free tier.

- Advance some strategies are locked to the pro tier.

- For some pros, the strategy customization may be too basic.

- Depends on how stable the exchange API is.

- Alerts can be slow.

4. Kryll.io

Without the need for technical knowledge, Kryll.io provides a drag-and-drop interface for developing automated cryptocurrency trading methods. It offers a marketplace for exchanging and buying pre-built strategies, backtesting capabilities, and real-time market statistics. AI algorithms are used by the platform to minimize possible losses, identify trends, and optimize trading patterns.

Grid, DCA, and arbitrage bots can be used by traders based on their personal risk tolerance. Its cloud-based design guarantees uninterrupted strategy operation around-the-clock. Because of its community-driven marketplace, AI-driven insights, and customizable approach, Kryll.io is one of the top AI bots for crypto automation.

Kryll.io Features, Pros & Cons

Features

- Drag-and-Drop Strategy Builder – Visual design strategies for automation without the need for code.

- Cloud Execution – Bots operate non-stop, 24/7.

- Strategy Marketplace – Buy/sell bots created by other users.

- Backtesting Analytics – Assessment of trading performance before going live.

- Multiple Bot Types – More than just grid, DCA, and arbitrage bots.

Pros

- No code drag and drop to build strategies.

- You can buy and sell strategies in the marketplace.

- Cloud execution at 24/7.

- Backtesting analytics.

- Supports a variety of bot types (grid bots, DCA, etc.)

Cons

- Costs for the strategy marketplace can add up.

- Overwhelming is a possibility for newcomers.

- Bots can be resource-intensive.

- The interface is cluttered.

- The cost may vary depending on how much you use the platform.

5. Autonio

Autonio is a cryptocurrency trading platform driven by AI that prioritizes community-driven, decentralized automation. For more intelligent decision-making, it enables traders to create unique strategies, utilize pre-made templates, and incorporate AI indicators.

To increase trading efficiency, the software facilitates risk assessment, backtesting, and optimization. Features like automatic execution, strategy marketplace access, and signal notifications are advantageous to users.

In order to improve AI recommendations, Autonio also concentrates on learning from market trends. It is one of the top AI bots for cryptocurrency automation, fusing strong AI-based tools for profitable trading with community expertise.

Autonio Features, Pros & Cons

Features

- AI Strategy Optimization – Smart adaptation to market patterns.

- Pre-Built Templates – Fast deployment for various strategies.

- Community Marketplace – Use and share community bots.

- Custom Risk Parameters – Personalize your risk settings and trade triggers.

- Real-Time Market Analytics – Insights to optimize bot performance.

Pros

- Automation and overall strategy optimization with AI.

- Fast bot setup with pre-made templates.

- Marketplace for the community.

- Focus of decentralization with transparency.

- Customized risk settings.

Cons

- Compared to larger bots, a smaller user base.

- Fewer integrated exchanges.

- Newer users may have learning time.

- Paywalls for advanced features.

- Manual adjustments may be necessary for some bots.

6. TradeSanta

TradeSanta is a cloud-based cryptocurrency trading bot platform that offers sophisticated options for experts while streamlining automation for novices.

It provides grid and DCA bots to maximize trading methods and supports a number of exchanges, such as Binance, Huobi, and OKX. Through analytics dashboards, users may define take-profit and stop-loss levels, automate buy and sell orders, and monitor performance.

Pre-configured templates and AI signals lower human mistake while increasing revenue. For users looking for dependable and simple automated trading solutions, TradeSanta is regarded as one of the top AI bots for cryptocurrency automation.

TradeSanta Features, Pros & Cons

Features

- Cloud-Based Automation – Bots run without installing software.

- Grid & DCA Bots – Includes DCA and grid bots.

- User-Friendly Interface – Simple for novice users.

- Multi-Exchange Integration – Compatible with various exchanges.

- Pre-Configured Templates – Select strategies rapidly.

Pros

- Based on the cloud and user friendly.

- Competitive and affordable pricing.

- Bots for DCA & grid.

- Supported exchanges (Binance, Huobi, OKX, etc.)

- Ready made strategies.

Cons

- AI signals are very basic.

- Basic analytics option.

- Fewer advanced features for pros.

- Limited customization.

- Support may be slower.

7. Pionex

Pionex is a cryptocurrency exchange that does not require third-party software because it has built-in automated trading bots. It provides a range of bots, such as grid, DCA, and arbitrage bots, along with inexpensive trading fees. In order to maximize profit potential while lowering risks, its AI-based algorithms constantly modify trading parameters in response to market patterns.

Through an easy-to-use interface, users can easily track performance and adjust tactics. Pionex is perfect for both novices and experts due to its integrated automation and exchange access. Because of its affordability, ease of use, and effectiveness, Pionex is among the top AI bots for cryptocurrency automation.

Pionex Features, Pros & Cons

Features

- Built-In Bots on Exchange – No need for API connections.

- Low Trading Fees – Save on cost for automated trading.

- Grid & DCA Bots – Basic automation features provided.

- Rebalancing Bots – Adjust your portfolio to stay within target allocations.

- Auto Parameter Adjustment – Bots manage settings based on market conditions.

Pros

- Bots are built-in on native exchange (no API).

- Extremely low trading costs.

- A variety of bots (grid, DCA, rebalancing).

- Simple for beginner setups.

- Auto adjustments based on market data.

Cons

- Just the Pionex exchange.

- Fewer complex customization options.

- AI features are not as advanced as some competitors.

- Monitoring grid strategies is a requirement.

- No integration with external exchanges.

8. Zignaly

Zignaly is a cloud-based cryptocurrency trading bot platform that lets users construct own automated tactics, include AI signals, and mimic the strategies of experienced traders. It provides features including take-profit management, trailing stop-loss, and portfolio tracking, and it supports a number of exchanges.

By examining market patterns, identifying opportunities, and lowering risks, AI-powered analytics support decision-making. With access to tried-and-true tactics from leading traders, Zignaly’s marketplace appeals to both novice and expert users. Because it combines copy trading with AI-driven insights, it is considered one of the best AI bots for cryptocurrency automation.

Zignaly Features, Pros & Cons

Features

- Copy Trading – Replicate the strategies of the professional traders.

- Signal Integration – Utilize AI or external market signal providers.

- Multi-Exchange Support – Integrate leading exchanges through API.

- Trailing Stop & Take Profit – Sophisticated risk control.

- Portfolio Dashboard – Track aggregate performance.

Pros

- Professional signals for copy trading.

- Support for multiple exchanges.

- Features for take profit and trailing stop.

- integration of AI and third-party signals.

- A dashboard for tracking portfolios.

Cons

- Subscription is needed for the best features.

- Risk of copy trading is tied to the signal providers.

- At the highest tier, it can be quite expensive.

- In a fast-moving market, alerts can be delayed.

- Bots need a lot of careful risk assessment.

9. Gunbot

Bollinger Bands, gain, step gain, and ping pong are just a few of the methods that Gunbot, a highly customizable cryptocurrency trading bot, supports. It enables traders to customize bots to certain market situations and is compatible with numerous exchanges.

The platform offers automated order execution, AI-assisted optimization, and backtesting. Risk levels, trade frequency, and strategy triggers are among the trading factors that users can manage.

It is perfect for busy traders looking for fine-grained management because of its adaptability. Offering extensive customisation and AI-enhanced techniques for optimal trading efficiency, Gunbot is among the top AI bots for cryptocurrency automation.

Gunbot Features, Pros & Cons

Features

- Highly Customizable Strategy Engine – Extensive control over bot parameters.

- Indicator-Based Triggers – Incorporate RSI, Bollinger Bands, MACD, etc.

- Support for Many Exchanges – Extensive market reach.

- One-Time License – Base version comes without reoccurring fees.

- Automated Order Execution – Carry out exact instructions without manual intervention.

Pros

- Extremely flexible customizable strategies.

- There are advanced indicators and triggers.

- Many exchanges are supported.

- A one-time license with no monthly payment for the base.

- It is suitable for power users.

Cons

- There are no friendly beginner features.

- The design of the interface is dated.

- A strategy setup is required hands-on.4. Limited support compared to other platforms.

- No native paper trading.

10. Mudrex

Mudrex is an algorithmic cryptocurrency trading platform and marketplace that lets users design, test, and implement automated methods without knowing any code. It includes pre-built bots, data for performance optimization, and AI-driven plan building.

Traders can access expert-developed techniques, diversify their portfolios, and keep an eye on live trading. Additionally, Mudrex offers risk management tools including DCA, stop-loss, and trailing strategies.

Its AI-driven suggestions enable users to maximize profits and adjust to changes in the market. Because of its professional methods, clever AI-driven trading tools, and accessibility, Mudrex is one of the top AI bots for crypto automation.

Mudrex Features, Pros & Cons

Features

- Automated Strategy Marketplace – Utilize bots built by experts.

- AI-Powered Strategy Design – Bots respond to changing market conditions.

- Backtesting Tools – Analyze prior results before implementing.

- Diversified Bot Portfolios – Mitigate risk through a variety of strategies.

- User-Friendly UI – Intuitive interfaces for tracking and easy setup.

Pros

- Marketplace for automated strategy solutions.

- AI strategy automation.

- Performance analytics and backtesting.

- Diversified portfolio bots.

- Clean and User-friendly UI.

Cons

- Strategy costs reduce your profits.

- Some bots are “black box.”

- Takes practice to select strategies.

- Additional costs for advanced features.

- Limited exchange support compared to competitors.

Comparison Table of Top AI Crypto Bots

| Bot/Platform | Key Features | Exchange Support | Best For | Pricing |

|---|---|---|---|---|

| 3Commas | Smart trading, DCA & grid bots, AI signals, portfolio tracking | Binance, Coinbase, KuCoin, Kraken, more | All-round automation | Subscription tiers |

| Bitsgap | Multi-exchange dashboard, arbitrage, demo mode, AI signals | Major exchanges via API | Multi-exchange traders | Paid plans |

| Coinrule | No-code rule builder, templates, real-time alerts | Binance, Kraken, KuCoin, more | Beginners & intermediate | Tiered subscription |

| Kryll.io | Drag-drop strategy builder, cloud bot execution | Multiple API exchanges | Visual strategy creators | Usage-based pricing |

| Autonio | AI optimization, strategy marketplace, risk parameters | Selected exchanges via API | AI-centric strategy users | Free + paid |

| TradeSanta | Cloud automation, grid & DCA bots, templates | Binance, OKX, Huobi, etc. | Beginner-friendly automation | Affordable plans |

| Pionex | Built-in bots (no API), low fees, rebalancing | Native exchange only | Easy built-in automation | Low trading fees |

| Zignaly | Copy trading, trailing stop, signals | Binance, KuCoin, Bitmex, more | Signal followers | Subscription + profit share |

| Gunbot | Custom strategies, indicator triggers | Binance, KuCoin, Kraken, etc. | Experienced traders | One-time license |

| Mudrex | Strategy marketplace, AI bots, backtesting | Multiple exchanges | Diversified portfolios | Subscription |

Conclusion

In conclusion, AI-powered automation has transformed the world of cryptocurrency trading, making it simpler for novice and expert traders to optimize returns while lowering risks. A variety of intelligent features, such as DCA and grid bots, AI-driven signals, strategy marketplaces, and multi-exchange support, are provided by platforms like as 3Commas, Bitsgap, Coinrule, Kryll.io, Autonio, TradeSanta, Pionex, Zignaly, Gunbot, and Mudrex.

With the help of these tools, traders can effectively manage their portfolios, execute precise plans, and stay ahead of market trends. Using the top AI bots for cryptocurrency automation guarantees quicker decision-making, reliable performance, and the capacity to trade continuously without human intervention, making them essential in the ever-changing cryptocurrency market of today.

FAQ

What are AI crypto trading bots?

AI crypto trading bots are automated software programs that use artificial intelligence and algorithms to execute trades on behalf of traders. They analyze market trends, optimize strategies, and execute buy or sell orders without human intervention, ensuring faster, precise, and round-the-clock trading.

Why should I use AI bots for crypto trading?

AI bots help reduce emotional trading, improve decision-making, and save time. They allow for 24/7 monitoring, execute complex strategies instantly, and can analyze vast amounts of data to identify profitable opportunities. This makes trading more efficient and potentially more profitable.

Which are the best AI bots for crypto automation?

Some of the top AI crypto bots include 3Commas, Bitsgap, Coinrule, Kryll.io, Autonio, TradeSanta, Pionex, Zignaly, Gunbot, and Mudrex. Each offers unique features such as strategy marketplaces, AI-powered signals, grid and DCA bots, and multi-exchange support.

Are AI crypto bots safe to use?

Yes, AI crypto bots are generally safe when used on reputable platforms. However, trading always carries risks, and it’s important to start with small investments, enable risk management features, and use trusted exchanges.

Do I need coding skills to use these bots?

No, most modern AI trading platforms like Coinrule, Kryll.io, and Mudrex are designed for non-coders with drag-and-drop strategy builders, pre-built templates, and intuitive dashboards. Advanced users can still customize strategies if desired.