In this article I will focus on the Best Aggregators to Discover Bridging Deals. Bridging aggregators consolidate the complexities of cross-chain transactions by integrating diverse blockchains and liquidity providers on a single platform.

- What Are Bridging Deals?

- Why Use Aggregators for Bridging Deals?

- Key Point & Best Aggregators to Discover Bridging Deals List

- 1. Rango Exchange

- 2. Jumper Exchange

- 3. Chainspot

- 4. LI.FI Protocol

- 5. Symbiosis Finance

- 6. Across Protocol

- 7. THORChain

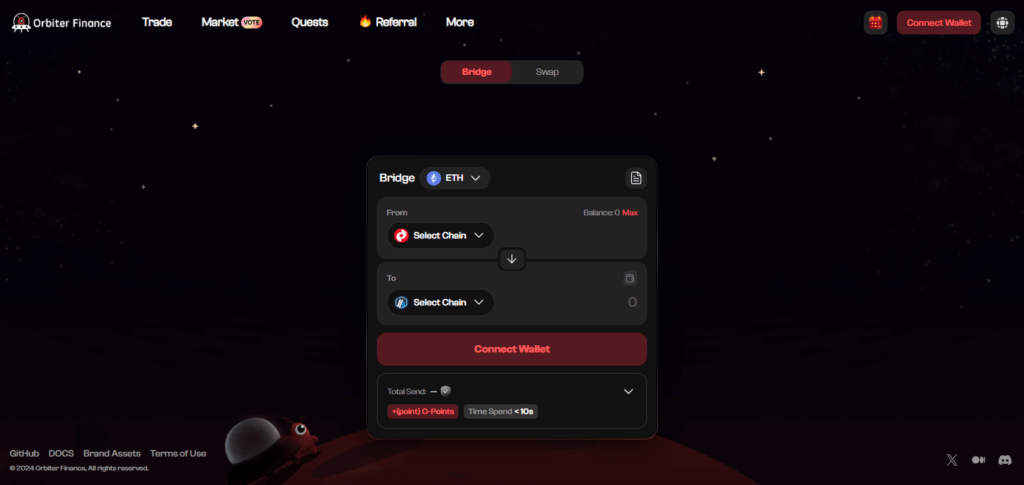

- 8. Orbiter Finance

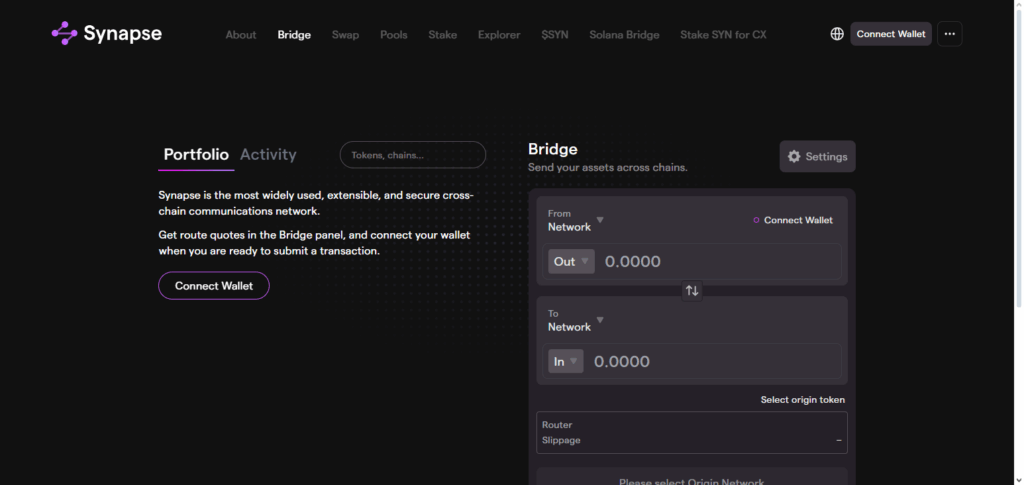

- 9. Synapse Protocol

- Pros and Cons of Using Bridging Aggregators

- Conclusion

- FAQ

They assist users in route optimization and help in calculating reduced fees and slippage. Whether a novice or a professional trader, these aggregators speed up the process of finding and executing bridging deals, improving the overall experience in terms of safety and costs.

What Are Bridging Deals?

Bridging deals are exchanges that enable seamless movement of assets across various platforms, layers, or financial networks in the world of finance and crypto.

With cryptocurrency and decentralized finance, a bridging deal allows users to move and transfer tokens across blockchains, accessing additional liquidity, other markets, trades, and staking.

In cryptocurrency accompanying bridging deals, users are often assisted in cross-chain swaps, liquidity bridges, and in DeFi to enhance returns and hold diversified assets in different ecosystems.

Bridging deals tend to provide new earning opportunities and ease of access; however, they come with risks, like slippage, unbridled smart contracts, and transaction fees.

Why Use Aggregators for Bridging Deals?

Convenience– Bridging options is easier and faster when they are all in one interface. There is no need to go from one platform to the other.

Better Rates and Lower Fees– Making sure that the users get the ‘spending the least money for the most options’ is what they do by comparing slippage, rates, and other transaction costs.

Better Security and Reliability– Aggregators that have a good reputation and are well known reduce the risk of scams and unreliable bridges by vetting the deals they display so the users can trust the deals.

Access to More Opportunities– More opportunities that can be cross-chain and cross-platform can be available to the users because most aggregators support multiple blockchains and assets.

Convenience– Even the beginners in Bridging can find it easy because they have simple interfaces, wallet connections, and instant synthesizing.

Key Point & Best Aggregators to Discover Bridging Deals List

| Aggregator | Key Points |

|---|---|

| Rango Exchange | Multi-chain support, low fees, easy-to-use interface for bridging assets. |

| Jumper Exchange | Fast cross-chain swaps, liquidity aggregation, supports multiple blockchains. |

| Chainspot | Secure bridging options, supports major DeFi tokens, user-friendly dashboard. |

| LI.FI Protocol | Aggregates multiple bridges, optimized for best rates, developer-friendly API. |

| Symbiosis Finance | Cross-chain swaps, low slippage, supports both token swaps and liquidity bridges. |

| Across Protocol | Fast and cheap cross-chain transfers, focuses on stablecoin bridging. |

| THORChain | Decentralized cross-chain liquidity network, non-custodial, supports multiple assets. |

| Orbiter Finance | Simple UI, fast transfers, supports Ethereum and layer-2 networks. |

| Synapse Protocol | Cross-chain asset transfers, high liquidity, integrates with major wallets. |

1. Rango Exchange

Rango Exchange is one of the most appropriate aggregators for discovering bridging deals which stems from its friendly interface for all users, smooth multi-chain support, and also easy to use.

Users are able to transfer various forms of assets from one blockchain to another with speed with low fees, low slippage, and low-cost transfers.

The platform uses the best and most reputable rates from various aggregators to optimize the users’ satisfaction without the hassle of rate comparisons.

It uses a user friendly interface and wallet functionalities to allow users to perform cross-chain exchange. It aims to provide the users with quick and smooth access to optimized deals and transactions which sets a standard for all bridging aggregators.

| Feature | Details |

|---|---|

| Platform Name | Rango Exchange |

| Category | Best Aggregators to Discover Bridging Deals with Minimal KYC |

| Key Function | Multi-chain asset bridging and cross-chain swaps |

| Supported Networks | Ethereum, BNB Chain, Polygon, Avalanche, Cosmos, and other major chains |

| Unique Advantage | Aggregates multiple bridges and DEXs to deliver the most efficient routes |

| User Requirement | Minimal KYC – accessible to most global users |

| Fees & Slippage | Competitive rates with low slippage optimization |

| User Experience | Simple interface, wallet integration, real-time tracking |

| Best For | Traders and investors seeking seamless cross-chain transfers with minimal friction |

2. Jumper Exchange

Jumper Exchange is a leader in aggregating bridging deals because of its speed, efficiency, and multi-blockchain support on a single platform.

Its sophisticated algorithm pulls from a spectrum of liquidity sources to provide optimal cross-chain swaps, minimizing user fees and slippage. It provides support for many tokens to facilitate secure and transparent transfers on various widely used blockchains.

Jumper Exchange’s user-friendly graphical user interface (GUI) which incorporates wallets and optimally simplifies user bridging experience is complemented by its sophisticated structure. An emphasis on speed, reliability, and optimized deals makes it a preferred choice among bridging aggregators.

| Feature | Details |

|---|---|

| Platform Name | Jumper Exchange |

| Category | Best Aggregators to Discover Bridging Deals with Minimal KYC |

| Key Function | Cross-chain swaps and asset transfers |

| Supported Networks | Ethereum, Arbitrum, Optimism, Polygon, BNB Chain, Avalanche, and more |

| Unique Advantage | Advanced routing engine that scans liquidity sources for best rates |

| User Requirement | Minimal KYC – quick and accessible entry |

| Fees & Slippage | Optimized for low fees and reduced slippage |

| User Experience | Clean interface, fast execution, wallet integration |

| Best For | Users who want quick, cost-effective cross-chain swaps with minimal hassle |

3. Chainspot

Chainspot is one of the leading aggregators for finding bridging deals as a result of their attention to security, dependability, and comprehensive blockchain coverage.

They enable users to shift assets across several networks, at a very little risk, with opaque pricing and little slippage. Chainspot has a platform that aggregates several bridges and helps users select the best bridge available in terms of both price and efficiency without having to sift through several bridges themselves.

Users enjoy a delightful experience due to the seamless integration of their responsive software with real-time transaction monitoring and wallet services.

Users looking for a unique answer to their cross-chain transfer challenges will appreciate Chainspot’s focus on safety stockpiles, deal closure speed, and streamlined transactions across networks.

| Feature | Details |

|---|---|

| Platform Name | Chainspot |

| Category | Best Aggregators to Discover Bridging Deals with Minimal KYC |

| Key Function | Aggregates bridges and DEXs for secure cross-chain transfers |

| Supported Networks | Ethereum, Polygon, Arbitrum, Optimism, BNB Chain, Avalanche, and others |

| Unique Advantage | Emphasis on security and transparency while providing efficient routes |

| User Requirement | Minimal KYC – accessible for global users |

| Fees & Slippage | Competitive fees with optimized slippage management |

| User Experience | User-friendly dashboard, wallet connection, real-time transfer tracking |

| Best For | Users who value safe, reliable, and cost-effective bridging deals |

4. LI.FI Protocol

LI.FI Protocol is one of the best aggregators for finding bridging opportunities because it consolidates numerous bridges and sources of liquidity into one unified platform. Its automated routing system selects the best route for cross-chain transfers to reduce fees and slippage.

The platform is block and token agnostic, accommodating both small and large transfers. Secure and transparent bridging is facilitated LI.FI’s developer APIs, instant settlement systems, streamlined dashboards, seamless integrations, and active bridging. It is the best choice bridging aggregator for focus on optimizing deals for speed, flexibility, and efficiency.

| Feature | Details |

|---|---|

| Platform Name | LI.FI Protocol |

| Category | Best Aggregators to Discover Bridging Deals with Minimal KYC |

| Key Function | Aggregates multiple bridges and DEXs for optimized cross-chain transfers |

| Supported Networks | Ethereum, Polygon, Arbitrum, Optimism, Avalanche, BNB Chain, and more |

| Unique Advantage | Smart routing system that finds the most efficient and cost-effective path |

| User Requirement | Minimal KYC – quick and borderless access |

| Fees & Slippage | Designed to minimize fees and reduce slippage during swaps |

| User Experience | Developer-friendly API, wallet integration, intuitive interface |

| Best For | Users and developers needing flexible, fast, and efficient bridging deals |

5. Symbiosis Finance

Symbiosis Finance offers great aggregating features of bridging deals. The reason for this is the platform’s cross chain swapping and liquidity optimization.

Symbiosis Finance lets users transfer assets across different blockchains in record time and with little slippage and great fees. Symbiosis Finance gets liquidity from different Zero pools and makes sure users get the cheapest and the effective bridging deals.

Zero’s platform is very easy to use and offers wallet integration and real time cross chain transaction tracking. This makes cross chain transactions secure and compliant. Symbiosis Finance guarantees speed and dependable pathways and offers a unique hassle-free bridging deals which is a great solution for users.

| Feature | Details |

|---|---|

| Platform Name | Symbiosis Finance |

| Category | Best Aggregators to Discover Bridging Deals with Minimal KYC |

| Key Function | Cross-chain swaps and liquidity aggregation |

| Supported Networks | Ethereum, BNB Chain, Polygon, Avalanche, Arbitrum, Optimism, and more |

| Unique Advantage | Unified liquidity pool enabling seamless token swaps across blockchains |

| User Requirement | Minimal KYC – fast and open to global participants |

| Fees & Slippage | Competitive fees with optimized slippage handling |

| User Experience | Easy-to-use interface, wallet integration, real-time transaction updates |

| Best For | Users seeking simple, reliable, and low-cost cross-chain bridging deals |

6. Across Protocol

Across Protocol stands tall as one of the first and best aggregators ever created for bridging deals. It prides itself on fast, secure and low-cost cross-chain transfers and focuses on stablecoin and token bridging for low fee and low slippage transactions.

It aggregates multiple stablecoin and token bridging deals and distributes them for just slippage, while offering various coping mechanisms to calculate various zdr deals.

It boasts an advanced UI which, combined with wallet support, allows advanced and beginner users to execute complex transfers with ease. Commitment to dependability, Across Protocol guarantees the unmatched transparency, Along with optimized efficiency, Across never fails to amaze users with the easy and safe means of discovering bridging deals.

| Feature | Details |

|---|---|

| Platform Name | Across Protocol |

| Category | Best Aggregators to Discover Bridging Deals with Minimal KYC |

| Key Function | Cross-chain transfers with focus on speed and low cost |

| Supported Networks | Ethereum, Arbitrum, Optimism, Polygon, and other L2 solutions |

| Unique Advantage | Specialized in stablecoin and token bridging with high efficiency |

| User Requirement | Minimal KYC – accessible for most global users |

| Fees & Slippage | Very low fees and minimal slippage compared to traditional bridges |

| User Experience | Simple interface, wallet integration, near-instant transaction settlement |

| Best For | Users prioritizing fast, cheap, and stable cross-chain bridging deals |

7. THORChain

THORChain allows users to discover bridging deals because it is fully decentralized and non-custodial when it comes to cross-chain asset transfers. Most other aggregators rely on centralized third parties to process cross-chain transactions.

This gives users an added layer of security because they can remain confident there is no centralized entity capable of blocking transactions. THORChain pulls liquidity from multiple chains to provide users with the best rates and lowest slippage on every transaction.

Users do not have to worry about transaction time because the network is highly optimized and enhanced with wallet integrations with no loss of on-chain visibility. It allows users to reap the benefits of bridging deals without sacrificing decentralization and security that other providers miss.

| Feature | Details |

|---|---|

| Platform Name | THORChain |

| Category | Best Aggregators to Discover Bridging Deals with Minimal KYC |

| Key Function | Decentralized cross-chain swaps without intermediaries |

| Supported Networks | Bitcoin, Ethereum, Binance Chain, Litecoin, Cosmos, and other major chains |

| Unique Advantage | Non-custodial liquidity network enabling direct asset-to-asset swaps |

| User Requirement | Minimal KYC – fully decentralized access |

| Fees & Slippage | Market-driven fees with competitive slippage management |

| User Experience | Wallet integration, transparent swaps, real-time tracking |

| Best For | Users seeking secure, decentralized, and direct cross-chain bridging deals |

8. Orbiter Finance

Orbiter Finance is an aggregator that stands out on the market for bridging deals because of its fast, inexpensive, and easy cross-chain transfers. Users can bridge multiple blockchains and tokens with very low fees and slippage.

Orbiter Finance routes every transaction through the optimal liquidity source to ensure minimal slippage, Orbiter Finance aggregates liquidity to find the most optimal routes to each transaction.

Its simple bridging process, comprehensive wallet support, and real-time transaction tracking adds to the quality of service for customer care. Orbiter Finance is unparalleled in its ability to speedily and effortlessly execute bridging deals on varied networks, while reliably offering ease of use.

| Feature | Details |

|---|---|

| Platform Name | Orbiter Finance |

| Category | Best Aggregators to Discover Bridging Deals with Minimal KYC |

| Key Function | Layer-2 to Layer-2 and Layer-2 to Ethereum cross-chain transfers |

| Supported Networks | Ethereum, Arbitrum, Optimism, zkSync, StarkNet, Polygon, and others |

| Unique Advantage | Specializes in fast, low-cost transfers between Ethereum Layer-2 networks |

| User Requirement | Minimal KYC – open and borderless access |

| Fees & Slippage | Very low fees with optimized transaction costs |

| User Experience | Simple interface, quick execution, wallet compatibility |

| Best For | Users moving assets efficiently across Ethereum and Layer-2 ecosystems |

9. Synapse Protocol

Synapse Protocol is an aggregator for bridging deals between blockchains that offers users a fascinating mix of features – cross-chain liquidity, flexible bridging options, and prudent security all within a single interface.

It helps users transfer a variety of tokens with minimal fees and slippage across different blockchains. Protocol aggregates several bridges and identifies the optimal transaction routing for maximum speed and minimum cost.

Its user-friendly app, wallet connectivity, and transaction monitoring in real-time streamlined the bridging mechanism and made it user-friendly for even novices in crypto. Protocol Synapse is unmatched in speed, clarity and optimal routing of transactions, and effectively streamlines the transfer of assets across blockchains.

| Feature | Details |

|---|---|

| Platform Name | Synapse Protocol |

| Category | Best Aggregators to Discover Bridging Deals with Minimal KYC |

| Key Function | Cross-chain asset transfers and liquidity aggregation |

| Supported Networks | Ethereum, BNB Chain, Avalanche, Polygon, Arbitrum, Optimism, Fantom, and more |

| Unique Advantage | Deep liquidity pools enabling efficient and secure bridging across chains |

| User Requirement | Minimal KYC – accessible globally |

| Fees & Slippage | Competitive fees with low slippage optimization |

| User Experience | User-friendly interface, wallet integration, real-time swap tracking |

| Best For | Users seeking high-liquidity, fast, and secure cross-chain bridging deals |

Pros and Cons of Using Bridging Aggregators

Pros

- Convenience: Aggregators save time and effort as they provide multiple bridges and swaps in one spot.

- Better Rates: They assess different sources of liquidity to provide users the best and most affordable route.

- Infrastructure: They facilitate the transfer of multiple blockchains and assets automatically.

- Lower Slippage & Fees: They reduce the price impact and costs of a transaction through optimized routing.

- User Friendly: They have dashboards and wallets that provide ease in bridging and tracking in real time.

- Aggregrated Risks: Integrating bridges that have undergone vetting reduces the risk of loss.

Cons

- Smart Contract Risks: Security problems due to leakage of privacy come from the use of third party contracts.

- Reliability Issues: Transactions can be delayed and even failed through downtimes and routing errors.

- Extra Costs: Some Aggregators may request payment for their services in addition to the bridging payments.

- Isolating Yourself: Too much reliance on a single aggregator can result in a loss of freedom.

- Manipulation: Sophisticated options and those from multiple chains may be difficult.

Conclusion

Bridging aggregators have become invaluable to people who want to transfer assets across several blockchains in a safe and easy way.

Rango Exchange, Jumper Exchange, Chainspot, LI.FI Protocol, Symbiosis Finance, Across Protocol, THORChain, Orbiter Finance, and Synapse Protocol break down complicated cross-chain transactions to their simplest forms, all while providing optimal value, low fees, and little slippage.

Alongside low barriers to entry, these tools all have user-friendly designs, wallet integrations, and little KYC. Using these aggregators, people can cut their expenses and time, while also gaining more diverse bridge options. This all results in more efficient and dependable cross-chain transactions.

FAQ

Are bridging aggregators safe to use?

Most reputable aggregators implement security checks and smart contract audits. However, users should always be aware of potential smart contract risks and use trusted platforms.

Do I need to complete KYC to use bridging aggregators?

Many bridging aggregators, like Rango Exchange and Jumper Exchange, require minimal or no KYC, allowing global users to access cross-chain transfers quickly.

How do aggregators reduce fees and slippage?

Aggregators scan multiple liquidity sources and routes to find the most cost-efficient path for transactions, helping users save on fees and minimize slippage.

Which aggregator is best for beginners?

Platforms like Rango Exchange, Jumper Exchange, and Orbiter Finance are beginner-friendly due to their intuitive interfaces, wallet integration, and simple cross-chain transfer process.

Can I use multiple aggregators at the same time?

Yes, using multiple aggregators can help users compare rates and ensure they get the most efficient bridging deals.