I’ll go over how to trade cryptocurrency options and futures in this post, along with a beginner-friendly introduction to risk management, hedging, and leverage.

- What are Crypto Futures?

- What is Crypto Options?

- How to Trade Crypto Options & Futures

- Example Situation:

- Step 1: Pick a Trading Platform

- Step 2: Futures vs. Options

- Step 3: Example of Futures Trading

- Step 4: Sample Options Trade

- Step 5: Keep Track and Consider the Risks

- Step 6: Trade Completion

- Key Trading Strategies for Beginners

- Hedging

- Speculation

- Covered Calls

- Stop-Loss and Take-Profit

- Leverage Management

- Diversification

- Time-Based Strategy (Options Only)

- How Futures Trading Works

- Contract Choosing

- Position Selection

- Treating Costs as Leverage

- Margin Cost

- Profit/Loss and Funding Fees (Mark to Market)

- Risk Management with Stop Loss and Take Profit Orders structures

- Closing Position

- Choosing the Right Platform Crypto Futures

- Regulation and Security

- Liquidity

- Leverage Options

- Fees and Funding Rates

- Interface and User Tools

- Customer Care

- Reputation and Reviews

- Typical Errors Made by Novices

- Excessive Leverage

- No Risk Management

- No or Little Research Done

- Loss Chasing

- No Plan

- Ignoring Fees and Funding

- Volatility

- Tools and Resources

- Trading Platforms and Exchanges

- Tools for Technical Analysis and Charting

- Portfolio Trackers

- Market Research Platforms

- Learning Resources

- Demo Accounts and Simulators

- Expert and Community Insights

- Tools for Risk Management

- Conclusion

- FAQ

The fundamentals of futures and options, important trading techniques, and platform selection will all be covered. By following these guidelines, newbies can comfortably start trading while limiting potential losses in the unpredictable crypto market.

What are Crypto Futures?

Crypto futures are likely to be financial contracts that allow traders to sell or buy a cryptocurrency at a striking price at a specific future date. Spot trading means you own the asset, but with futures, you don’t need to own the coin to speculate price movements.

Hedging positions or using futures to enlarge a bet increasing the upside potential is a common use. There are two main types. Perpetual futures that are open-ended, and fixed-term futures with a date to settle. Given the margin and leverage, the volatility impacts the profit and loss. For advanced trading strategies, futures are essential.

What is Crypto Options?

Crypto options trading involves contracts which allow the buyer the right, but not the obligation, to purchase (call option) or sell (put option) a cryptocurrency at a certain price (strike) before or on a given expiration date.

Options are primarily used for hedging (protection against adverse price movement) and speculation (risking to gain profit) purposes. A trader pays a premium for this right which is lost if the Option expires.

Important considerations are: time decay, implied volatility, options and strike selection. Options are such that they are versatile yet complex at the same time; one wrong estimate on the timing or volatility can result in a loss.

How to Trade Crypto Options & Futures

Example Situation:

You think that the price of Bitcoin (BTC) will go up in a month.

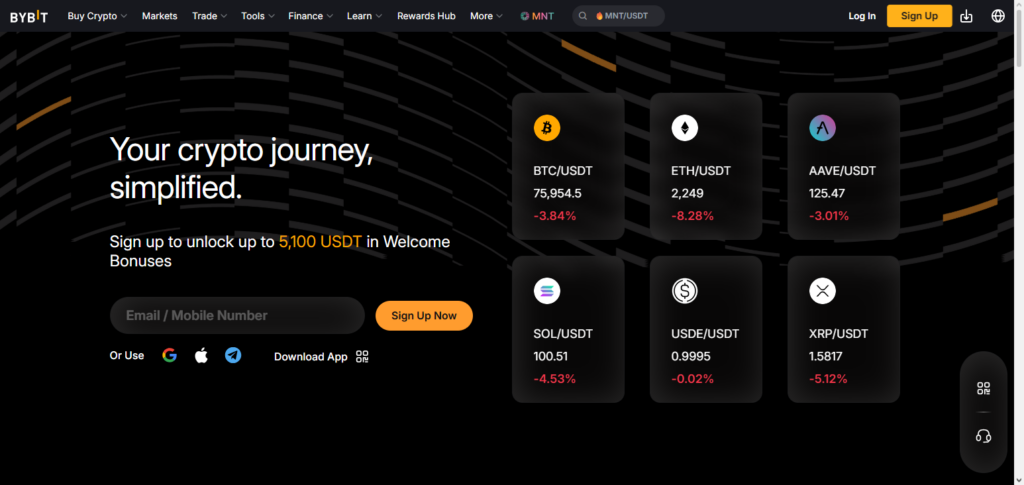

Step 1: Pick a Trading Platform

- Pick a crypto derivatives exchange (i.e. ByBit, Binance, FTX)

- Do KYC verification and fund account

Step 2: Futures vs. Options

- Futures: bet (long) or bet against (short) BTC to go down

- Options: call option allows you to buy BTC at a specific strike price

Step 3: Example of Futures Trading

- Pick BTC perpetual futures

- choose your leverage, e.g. (5x)

- open a long position of 0.1 at BTC $30,000

- to control risk, set your stop-loss at $29,000

Step 4: Sample Options Trade

- Pick a BTC call option with a $32,000 strike price and a one-month expiry

- Settle the premium (let’s say $500)

- Watch the BTC price – if BTC climbs past $32,000 before expiration, you can exercise this option for a profit, or you can just sell the option to make a profit

Step 5: Keep Track and Consider the Risks

- Check on your positions every day

- If the market goes against you, close your positions or move your stop-loss.

- To avoid liquidation, don’t use more leverage than you can afford

Step 6: Trade Completion

- For futures: to realize a profit or loss, close out your positions.

- For options: exercise or sell the option before expiry

Key Trading Strategies for Beginners

Hedging

- Utilize frameworks to shield your futures or options from the constant changes in crypto prices.

- Example: If you possess BTC, take a brief short sell in the futures in order to limit the risk to the downside.

Speculation

- Embrace the amount of profit you expect to gain from the pricing changes in the short-run.

- Keep positions small, and use some leverage, to avoid risk getting out of hand.

Covered Calls

- Collect premium income by writing call options on your coin positions.

- Assists in producing additional returns in stagnant markets.

Stop-Loss and Take-Profit

- Establish prices at which you want to withdraw so that your losses remain in check.

- Important for maintaining the volatility in derivatives of crypto.

Leverage Management

- When you begin, practice and use a little or moderate leverage.

- Do not use higher leverage and until you fully comprehend the risk that lies ahead of you in the market.

Diversification

- Distribute trades among several coins or different instruments.

- This lowers the risk of incurring loss of significant size from one position.

Time-Based Strategy (Options Only)

- The options you sell will lose (or gain) value due to time.

- Timing is critical with short duration options, while with long duration options you won’t get hit by time decay.

How Futures Trading Works

Contract Choosing

- Types of futures contracts can be the perpetual (no expiration) or fixed-term (expires on a specific date)

Position Selection

- Long position: You expect the price of an asset (i.e. Bitcoin) to increase.

- Short position: You expect the asset price will decrease.

Treating Costs as Leverage

- You purchase futures contracts with borrowed money in order to make a higher profits.

- Example: If $1,000 is being used to purchase Bitcoin, a 5x leverage will allow the purchase of a Bitcoin worth $5,000.

Margin Cost

- Pay the opening margin which is used as a collateral.

- Maintenance margin is a margin that ensures that a position is bought.

Profit/Loss and Funding Fees (Mark to Market)

- Profit and losses are settled daily.

- There can be deducting of of funds which occur periodically amongst long traders and short traders.

Risk Management with Stop Loss and Take Profit Orders structures

- Automatically close a position when the price reaches below or above the desired profits.

Closing Position

- Buy (if short) or sell (if long) the asset to make the profit. If you don’t sell before expiration, you lose.

Choosing the Right Platform Crypto Futures

Regulation and Security

- Look for exchange with strong regulatory measures and a commitment to user protection (cold storage, 2FA, insurance funds).

- Verify the regulations to avoid legal or operational issues.

Liquidity

- The higher the liquidity, the better. You want to be able to enter and exit trades freely.

- Look for exchanges with high trading volumes for the crypto pairs you wish to trade.

Leverage Options

- Ensure the amount of leverage is within your level of risk aversion.

- New traders are encouraged to trade with lower amounts of leverage.

Fees and Funding Rates

- Compare costs associated with trading (fees, funding rates, withdrawals, etc.)

- A platform with lower trading costs will be better for active traders.

Interface and User Tools

- A responsive trading platform with level 2 quotes, advanced orders, and good charting tools will be a better platform.

- A good platform will offer a demo trading option for beginner traders to improve their skills.

Customer Care

- A platform with a good care team will provide you with help when the trade is very volatile.

Reputation and Reviews

- An exchange that has been around will have a good identifiable track record; historically bad exchanges are bad.

Typical Errors Made by Novices

Excessive Leverage

- High leverage is used witout risk knowledge causing liquidation to happen quickly.

No Risk Management

- Stop-loss and take-profit orders are not set causing large losses to be a part of the equation.

No or Little Research Done

- Losing trades made based on rumors and not on market data and analysis.

Loss Chasing

- Adding to a losing position is common and in most cases, losses rot a driven posiiton.

No Plan

- An empty position is entered and a lack of goals leads to a bad strat.

Ignoring Fees and Funding

- Trading fees, funding rates, and slippage are underestimated causing negative effects.

Volatility

- Sudden changes in the price of a derivative cause liquidation.

Tools and Resources

Trading Platforms and Exchanges

- Binance, Bybit, FTX, and OKX for derivatives trading.

- Typical features include leverage, options, futures, and sometimes demo accounts.

Tools for Technical Analysis and Charting

- TradingView, CryptoCompare, and Coinigy for more advanced charting.

- Best for analyzing the trends and indicators of prices.

Portfolio Trackers

- Blockfolio, Delta, and CoinStats to track and monitor positions.

- Shows real-time P&L and insights joining to diversification.

Market Research Platforms

- CoinDesk, The Block, and Messari for the latest news and updates.

- These platforms help to analyze the current trends and prices.

Learning Resources

- YouTube, Binance Academy, Udemy.

- Learning to beginners to help them to gain the knowledge of strategy, risk management, and the concept of derivatives.

Demo Accounts and Simulators

- Test option and futures trading virtually before using real money.

- Beginners create to understand the mechanics of leverage.

Expert and Community Insights

- Reddit (r/CryptoCurrency), Twitter, and Telegram groups.

- Copying and learning the tricks of the trade from better players is a winning strategy.

Tools for Risk Management

- Set your stop-loss, take-profit, and trailing orders.

- These are built into the trading platforms, and are designed to protect your capital during trades in volatile markets.

Conclusion

Although trading cryptocurrency options and futures presents substantial risks, it also presents strong prospects for leverage, hedging, and portfolio growth. Learning the fundamentals, selecting a safe and dependable platform, and practicing with tiny positions or demo accounts should be the first steps for beginners.

Risk management, stop-losses, diversification, and prudent use of leverage are important tactics. Traders may manage the volatility of cryptocurrency derivatives while limiting losses and optimizing possible gains by combining education, methodical preparation, and regular monitoring. Success in cryptocurrency futures and options occurs gradually, not all at once; patience and practice are crucial.

FAQ

Can beginners trade crypto derivatives safely?

Yes, by starting with small positions, low leverage, demo accounts, and proper risk management.

How much leverage should I use as a beginner?

Start with 1x–5x leverage. High leverage increases both potential gains and the risk of liquidation.

What strategies are best for beginners?

Hedging, speculation with small positions, and covered calls. Always combine with stop-loss orders.

Which platforms are recommended for trading options and futures?

Reputable exchanges like Binance, Bybit, OKX, and FTX offer security, liquidity, and educational tools.

How do I manage risk in crypto derivatives?

Use stop-loss and take-profit orders, limit leverage, diversify positions, and avoid trading emotionally.