The Best Crypto Tax Automation Software, which assists traders and investors in automatically calculating cryptocurrency gains, losses, and tax obligations, will be covered in this article.

- What is Crypto Tax Automation Software?

- Why Use Crypto Tax Automation Software

- Key Point & Best Crypto Tax Automation Software

- 1. Koinly

- Koinly Features, Pros & Cons

- 2. CoinLedger

- CoinLedger Features, Pros & Cons

- 3. CoinTracker

- CoinTracker Features, Pros & Cons

- 4. ZenLedger

- ZenLedger Features, Pros & Cons

- 5. TaxBit

- TaxBit Features, Pros & Cons

- 6. CryptoTaxCalculator

- CryptoTaxCalculator Features, Pros & Cons

- 7. TokenTax

- TokenTax Features, Pros & Cons

- 8. BearTax

- BearTax Features, Pros & Cons

- 9. Blockpit

- Blockpit Features, Pros & Cons

- 10. Ledgible Crypto Tax

- Ledgible Crypto Tax Features, Pros & Cons

- Conclusion

- FAQ

Reliable tax software is crucial for correct reporting, compliance, and stress-free filing as cryptocurrency transactions get more complicated with DeFi, NFTs, and staking. Let’s investigate the best platforms on the market right now.

What is Crypto Tax Automation Software?

A digital tool called crypto tax automation software is made to automatically monitor, compute, and report taxes on cryptocurrency transactions. It arranges transactions, transfers, staking rewards, DeFi activity, and NFT sales after connecting to your cryptocurrency exchanges, wallets, and blockchains via secure APIs or CSV uploads.

The software generates ready-to-file reports like Form 8949 or other jurisdiction-specific papers by calculating capital gains, losses, and taxable income in accordance with your nation’s tax laws.

Crypto tax automation software saves time, lowers errors, and assists investors in staying in compliance with changing tax laws by doing away with manual spreadsheets and intricate computations.

Why Use Crypto Tax Automation Software

Automatic Transaction Tracking – Automatic transaction tracking imports trades, transfers, staking rewards, DeFi activity, and NFTs directly from exchanges and wallets, so you do not have to do manual data entry.

Gain and Loss Calculation – Software calculates capital gain, loss, and crypto income automatically using approved methods such as FIFO, LIFO, and HIFO.

Saves time and efffor – Offers tax reports that are ready to download and walk you through manual processes.

Ensure Tax Compliance – Country specific tax forms are available, and the ever-changing world of crypto tax is at the software’s fingertips.

Handles Complex Crypto Actions – Activities such as DeFi, yield farming, airdrops, forks, and margin trading are all properly categorized.

Audit Risk Reduction – Documentation and transparency are maximized by providing audit ready reports and transaction trails.

Multi Exchange and Wallet Support – View all of your crypto activity in one, unified dashboard.

Tax Loss Optimization – Real time tracking of tax liabilities optimizes loss taxes.

Safe API Data Integration – Sync financial data to software via API.

Perfect for Active Investors and Traders – Users with a lot of trades or multiple crypto accounts can especially benefit from this software.

Key Point & Best Crypto Tax Automation Software

| Software | Key Points |

|---|---|

| Koinly | Supports 800+ exchanges & wallets, automatic transaction syncing, DeFi/NFT support, capital gains tracking, and country-specific tax reports. |

| CoinLedger | Simple user interface, automated gain/loss calculations, IRS Form 8949 support, TurboTax integration, and portfolio tracking features. |

| CoinTracker | Real-time portfolio tracking, tax-loss harvesting tools, seamless exchange sync, NFT support, and direct TurboTax integration. |

| ZenLedger | Enterprise-grade reporting, audit support package, DeFi & staking compatibility, multi-exchange import, and tax professional collaboration tools. |

| TaxBit | IRS-compliant tax forms, enterprise accounting tools, real-time gain tracking, exchange integrations, and regulatory-focused infrastructure. |

| CryptoTaxCalculator | Advanced DeFi & NFT tax handling, global tax compliance, bulk transaction imports, capital gains summaries, and customizable reporting. |

| TokenTax | CPA-backed tax filing services, margin & derivatives support, DeFi compatibility, tax-loss harvesting, and personalized tax assistance. |

| BearTax | Easy CSV uploads, automated gain calculations, audit-ready reports, exchange API support, and affordable pricing tiers. |

| Blockpit | European tax compliance focus, automated transaction categorization, audit trail documentation, DeFi support, and portfolio insights. |

| Ledgible Crypto Tax | Institutional-grade crypto accounting, GAAP reporting tools, enterprise integrations, audit support, and digital asset reconciliation features. |

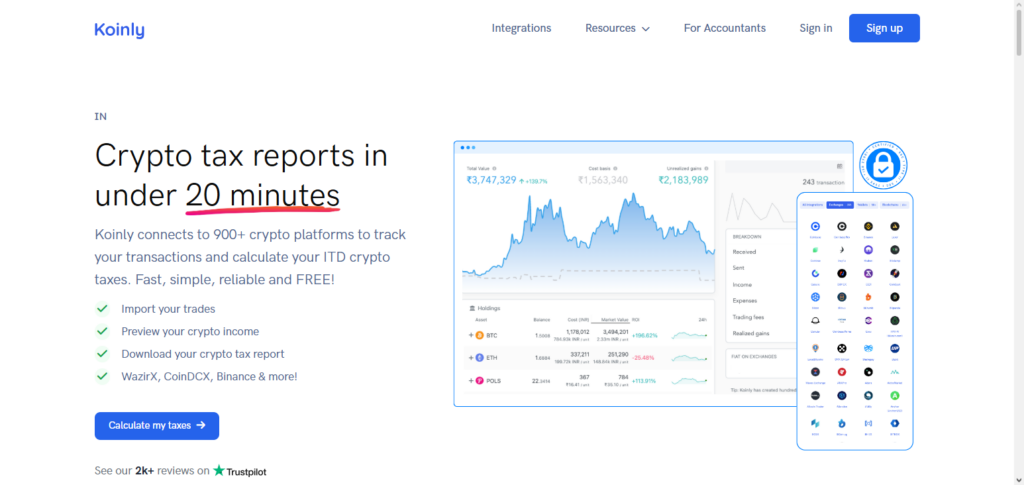

1. Koinly

With support for more than 800 exchanges, wallets, and blockchains worldwide and tax reports for more than 20 countries, Koinly is one of the most popular and top crypto tax automation software products available. It classifies trades, computes gains, losses, and revenue from staking, NFTs, and DeFi activities, and automatically syncs transactions via APIs or CSV uploads.

Koinly simplifies filing by producing official tax forms such as IRS Form 8949, Schedule D, HMRC, and other country-specific reports that can be exported to widely used tax software. Crypto tax reporting is made simpler and more effective for both traders and investors by its user-friendly dashboard, which provides real-time tax position knowledge throughout the year.

Koinly Features, Pros & Cons

Features

- Automated transaction sync via API & CSV

- 800+ Exchange, wallet & blockchain support

- Gain/income & cost basis calculations

- DeFi, NFTs, and staking activity support

- Reports for specific countries

Pros

- User-friendly for all

- Robust data source support

- Real-time tax estimate dashboard

- Various cost-basis calculatons available

- Major jurisdiction tax PDFs

Cons

- Manual review required for DeFi/NFT reporting

- Limited reports for lower plan levels

- No CPA filing service in app

- Reports of sync errors in reviews

- Premium levels are expensive

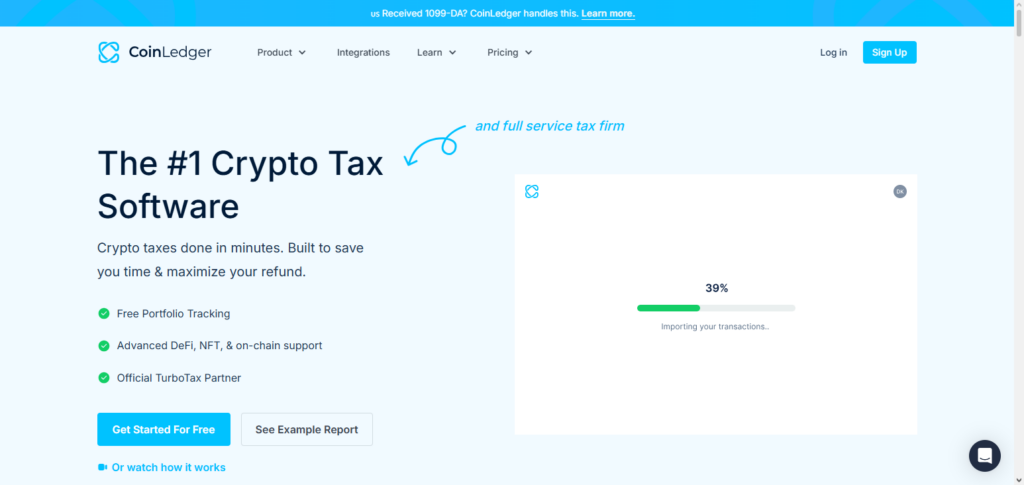

2. CoinLedger

The finest crypto tax automation software for beginners is CoinLedger, which is perfect for customers filing in the US and Canada. CryptoTrader was its previous name.Connect exchanges and wallets, import trades, and instantly generate correct tax returns and supporting papers like IRS Form 8949 and Schedule D—it streamlines the entire tax process.

The platform automates cost-basis computations and gain/loss tracking, and it interacts with popular exchanges, DeFi protocols, and NFT transactions. Even first-time filers may easily navigate cryptocurrency tax season with CoinLedger’s user-friendly interface and guided procedure. Additionally, it provides tools like CPA share links and tax-loss harvesting analysis to facilitate communication with tax experts.

CoinLedger Features, Pros & Cons

Features

- Easy exports into popular tax tools

- Summary of tax-loss harvesting

- H&R Block & TurboTax exports

- Form 8949 & Schedule D generation

- Tax gain & loss automation

Pros

- Fast report generation

- Compliance in tax support in the USA

- DeFi involves a few advanced automation tools

- The workflow is user friendly

- Good documentation & stimulation guides

Cons

- Forms for taxes outside the USA are few

- Reporting for advanced automation DeFi tools are limited3. No access to direct accountant portal.

- Each tax year, the costs can be significant.

- Not the best option for large enterprises.

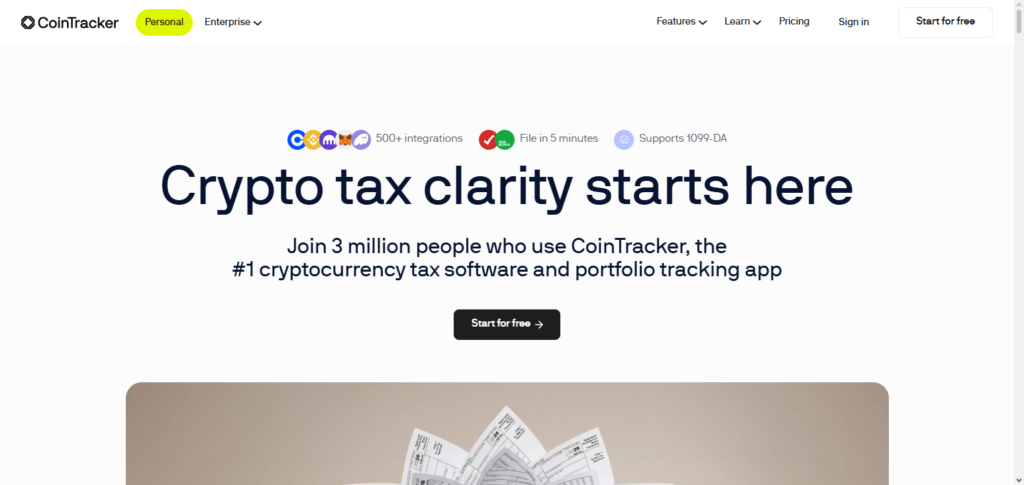

3. CoinTracker

One of the top crypto tax automation software systems, CoinTracker offers robust portfolio management and tax filing assistance for more than 500 exchanges and wallets. Its real-time dashboard instantly updates as markets change, tracking both your tax liability and cryptocurrency net worth at the same time.

In order to calculate correct capital gains and income tax reports, CoinTracker classifies trades, DeFi activity, and NFT events and makes it simple to import transactions.

It is appropriate for multi-jurisdiction portfolios since it supports both international tax jurisdictions for customers in many nations as well as U.S. forms like IRS 8949 and Schedule D. CoinTracker effortlessly integrates tax compliance and portfolio management with mobile apps and connection with TurboTax/H&R Block.

CoinTracker Features, Pros & Cons

Features

- Portfolio tracking dashboard.

- Syncs over 500 wallets and exchanges.

- Calculates tax liabilities and capital gains.

- Supports NFTs and DeFi.

- Exports tax reports to (TAX/TurboTax).

Pros

- Great for insights on portfolios.

- Data is updated with auto-sync.

- Reporting for multiple jurisdictions.

- Reporting for multiple jurisdictions.

- Supports mobile apps.

Cons

- Premium subscription required for full functionality.

- Portfolio size negatively impacts reporting speed.

- Reporting for tax optimization is limited.

- Accounting functionality is rudimentary.

- Tax report fees are high.

4. ZenLedger

The best cryptocurrency tax automation software, ZenLedger, combines robust support features for active traders and complex portfolios with tax reporting. It supports DeFi, staking, and NFT activity, automatically imports transaction history, and connects to hundreds of wallets and exchanges.

In addition to producing comprehensive tax reports, such as IRS Form 8949 and Schedule D, ZenLedger provides audit-ready documentation, which is very helpful in the event that tax authorities have concerns about your files.

Its 24/7 customer service across a variety of plans, which guarantees assistance is always available when needed, is one of its distinguishing characteristics. It may cost more than some of its rivals, but for heavy users, its comprehensive documentation and interface with well-known tax filing programs like TurboTax make it a good option.

ZenLedger Features, Pros & Cons

Features

- Syncs with dozens of wallets and exchanges.

- Tax reports are audit ready.

- Includes mobile, DeFi, staking and NFTs.

- Can export to TurboTax.

- Tax summaries and income categorization.

Pros

- Ideal for complicated portfolios.

- Excellent compliance features.

- Good customer service.

- Detailed adjustments are well broken out in reporting.

- Great for tax pros

Cons

- Pricier tiers are available.

- Reporting is less updated.

- There is a learning curve.

- Manual adjustments are required to a degree.

- Don’t expect successor· follows with CPA draining.

5. TaxBit

For individuals, companies, and institutions alike, TaxBit is the top enterprise-grade crypto tax automation software that automates tax computations and reporting at scale. TaxBit, which was developed by tax lawyers and certified public accountants, centralizes the intake of data from wallets and exchanges, computes cost basis, profits, and losses automatically, and produces tax forms that are in compliance.

It is appropriate for sophisticated use cases beyond personal tax filings since it facilitates worldwide tax compliance across more than 150 countries and thousands of assets while interacting with key banking systems. TaxBit’s strong automation and audit-ready reporting reduce human labor and guarantee accuracy, assisting customers in adhering to ever-more-complex requirements in the realm of digital assets.

TaxBit Features, Pros & Cons

Features

- Engine that calculates taxes automatically.

- Company and personal financial records

- Tax projections in the moment

- Compliance for more than150 countries

- Trail documenting for audits

Pros

- Built with CPA/taxexpert foundation

- Compliant with regulations

- Business use is scalable

- Tracking complete and precise

- Integration for enterprise use

Cons

- More expensive than the most elementary tools

- Onboarding is complicated

- Newcomers do not find the interface easy to use

- Less visualization of portfolio

- Wizard for filing not embedded

6. CryptoTaxCalculator

For traders and investors who require comprehensive support for computations and reporting across exchanges, wallets, DeFi, and NFT activity, CryptoTaxCalculator is the most flexible crypto tax automation software platform. It creates ready-to-file tax reports that accountants can examine, automatically aggregates transaction data, and arranges and classifies deals.

CryptoTaxCalculator assists in optimizing tax liabilities while guaranteeing compliance with many tax jurisdictions, supporting FIFO, LIFO, and other cost-basis methodologies. For both occasional and regular traders looking for simplified tax reporting, it strikes a mix between accuracy, usability, and adaptability, even though it might not have all the sophisticated portfolio tracking tools available in larger platforms.

CryptoTaxCalculator Features, Pros & Cons

Features

- Supports multiple tax and cost-basis methodologies

- History of exchanges and wallets imports

- Supports decentralized finance and staking

- Tax reports that are detailed are generated

- Exports for accountants

Pros

- Tax methodologies flexible

- Support for multiple jurisdictions

- Tracking of deductions and losses

- Built for traders and investors

- Categorization of transactions in detail

Cons

- Lack of polish is presistent for the interface

- Delays with large datasets

- Inconsistent assistance

- Tool for direct filing not available

- ‘Best not to use for institutions

7. TokenTax

One of the greatest cryptocurrency tax automation software choices for intricate and high-end tax filing situations is TokenTax. TokenTax is perfect for high-net-worth people and professionals managing sizable or complex portfolios because it provides CPA-assisted filing services in addition to automated transaction synchronization from exchanges and wallets.

It facilitates a range of cryptocurrency operations, like as cross-border transfers, margin and derivatives trading, and DeFi. In order to simplify end-to-end tax compliance, TokenTax also interfaces with TurboTax and other filing systems.

Although it costs more than many of its rivals, users looking for individualized support during tax season find that the combination of professional tax advice and sophisticated analytical tools makes the price point worthwhile.

TokenTax Features, Pros & Cons

Features

- Trades and wallets synchronised

- Filing with a CPA is an option (assisted)

- Margin and derivatives trades are supported

- Reporting of equities and NFTs

- TurboTax is integrated

Pros

- Excellent support for Complex Tax Scenarios

- Assistance from CPA is an option

- Great support for derivatives

- In addition to the previous claims, there are available extensive analytical tools

- Excellent global assistance

Cons

- Among the highest priced tools

- Too sophisticated for beginners

- CPA assistance requires payment

- Can be seen as a messy UI

- Some even the most basic users overpay for functionalities

8. BearTax

With key capabilities for integrating transactions by API or CSV and automatically calculating gains, losses, and taxable income, BearTax offers the most straightforward crypto tax automation software experience. Beginners may easily use it because to its straightforward user interface, which also supports standard reporting choices and downloadable reports that are audit-ready.

Those who want a simple platform to handle cryptocurrency tax requirements without unnecessary bells and whistles may find BearTax’s affordability and emphasis on core tax functions appealing. BearTax offers dependable computations and compliance capabilities that enable customers to effectively automate tax filing throughout tax season, while having a feature set that may not be as comprehensive as those of its larger rivals.

BearTax Features, Pros & Cons

Features

- Imports via APIs & CSV

- Automated Gain/Loss calculations

- Crypto tax reports

- Support for NFTs taxes

- Summaries ready for audits

Pros

- User-friendly and neat platform

- Low-end pricing

- Rapid report generation and easy imports

- Best suited for low volume portfolios

- Suitable for beginners

Cons

- Basic features are advanced

- Basic DeFi management

- International tax form features are basic

- Agent portal not available

- Portfolio analysis limited

9. Blockpit

Blockpit is a top crypto tax automation software platform with a European focus that makes it easier to track, analyze, and report crypto taxes across wallets and exchanges. It automatically synchronizes transactions, classifies them, and generates tax reports that adhere to the laws of different nations.

In addition to offering ready-to-file tax summaries for investors to use for their own or an accountant’s assistance, Blockpit supports a wide variety of assets and protocols. Users can avoid mistakes and expedite the tax-filing procedure with the aid of its transparent, compliant reports.

Blockpit is a reliable option for consumers who require trustworthy crypto tax computation and reporting solutions because of its emphasis on user-friendliness and demographic tax compliance.

Blockpit Features, Pros & Cons

Features

- Automatic transaction synchronization and categorization

- Multi-country reporting for taxes

- Support for NFTs and DeFi

- Downloadable reports that meet legal requirements

- Tracking and coverage of blockchain

Pros

- Excellent focus on tax reporting for Europe

- Compliance overview is easy

- Plenty of supported assets

- Reporting is easy

- Good overview of taxes

Cons

- Limited US tax forms

- Cost of advanced subscriptions is high

- Manual adjustment are necessary at times

- Reporting is slow for account that are large

- Lower sophisticated tax strategy

10. Ledgible Crypto Tax

For accountants, organizations, and tax experts who manage the digital assets of numerous clients, Ledgible Crypto Tax is the top crypto tax automation tool available. It creates comprehensive cost-basis, tax, and reporting outputs and collects, normalizes, and reconciles crypto data for smooth integration with accounting systems.

The platform from Ledgible delivers sophisticated reporting features, such as 1099 and 8949 data for compliance and audit preparation, and supports SOC-audited security requirements.

It combines digital asset tax compliance with more general financial reporting requirements, making it perfect for businesses managing complex portfolios, multi-entity accounting, and institutional-level tax operations due to its scalability and enterprise emphasis.

Ledgible Crypto Tax Features, Pros & Cons

Features

- Support for tax and accounting of enterprise level

- Data normalization and reconciliation

- Multi-client handling

- Workbooks ready for audit in detail

- Connects to accounting books

Pros

- Optimal for accountants/institutions

- Profound, extensive tax analytics

- Grows with large portfolios

- Merges with financial accounting

- Reporting with high compliance

Cons

- Overly complex for personal use

- Enterprise pricing is high

- Time to configure is necessary

- Unfriendly to beginners

- Consumer offerings are limited

Conclusion

Your needs and tax jurisdiction determine which is the best crypto tax automation software in your case. Other variables include the complexity of your transactions and the volume at which you trade.

If you trade at high frequencies or use automated trading, you will not want to use CoinTracker or Koinly, while ZenLedger and TokenTax may be a better fit. For enterprise-level trading, compliance and accounting integrations of a crypto tax software like TaxBit or Ledgible may better suit your needs.

Optimally, the software will be able to automatically pull your transactions, calculate your gains and losses correctly, support your DeFi and NFT activities, and allow you to generate tax reports that meet the compliance requirements of your jurisdiction.

The right crypto tax software will let you rest easy that you will not face the penalties and audit risks that come with filing your taxes manually. Savings in time will be necessary to maintain the accuracy of the software.

FAQ

What is crypto tax automation software?

Crypto tax automation software automatically imports cryptocurrency transactions from exchanges, wallets, and blockchains, categorizes them, and calculates your taxable gains, losses, and income. It prepares ready-to-file tax reports based on your country’s regulations, saving time and reducing errors compared to manual calculations.

Why do I need crypto tax automation software?

Because every crypto trade, swap, NFT sale, or DeFi activity can have tax implications, tracking all transactions manually is error-prone and time-consuming. Tax automation software simplifies this process and helps ensure compliance with tax laws.

Which is the best crypto tax automation software for beginners?

For beginners, tools like Koinly and CoinLedger are popular due to their intuitive interfaces, wide exchange support, step-by-step workflows, and built-in tax reporting features.

Can crypto tax software handle DeFi and NFT transactions?

Yes — most top platforms, such as ZenLedger, TaxBit, and Blockpit, support DeFi protocols, staking, yield farming and NFT transactions, automatically calculating tax liabilities for complex activity.