I’ll go over the top cryptocurrency payment gateway providers in this post, which assist companies in safely and effectively accepting stablecoins, Ethereum, Bitcoin, and other digital assets.

- What is Crypto Payment Gateway Providers?

- How To Choose Crypto Payment Gateway Providers

- Cryptocurrencies Accepted

- Payment Gateway Transaction Fees

- Payment Gateway Automatic Fiat Conversion

- Payment Gateway Security & Compliance

- Payments Gateway Extensions & Plugins & APIs

- Payments Gateway Settlement Times

- Payment Gateway Global Provider

- Key Point & Best Crypto Payment Gateway Providers

- 1. CoinPayments

- CoinPayments Features, Pros & Cons

- 2. BitPay

- BitPay Features, Pros & Cons

- 3. Coinbase Commerce

- Coinbase Commerce Features, Pros & Cons

- 4. NOWPayments

- NOWPayments Features, Pros & Cons

- 5. Crypto.com Pay

- Crypto.com Pay Features, Pros & Cons

- 6. Binance Pay

- Binance Pay Features, Pros & Cons

- 7. OpenNode

- OpenNode Features, Pros & Cons

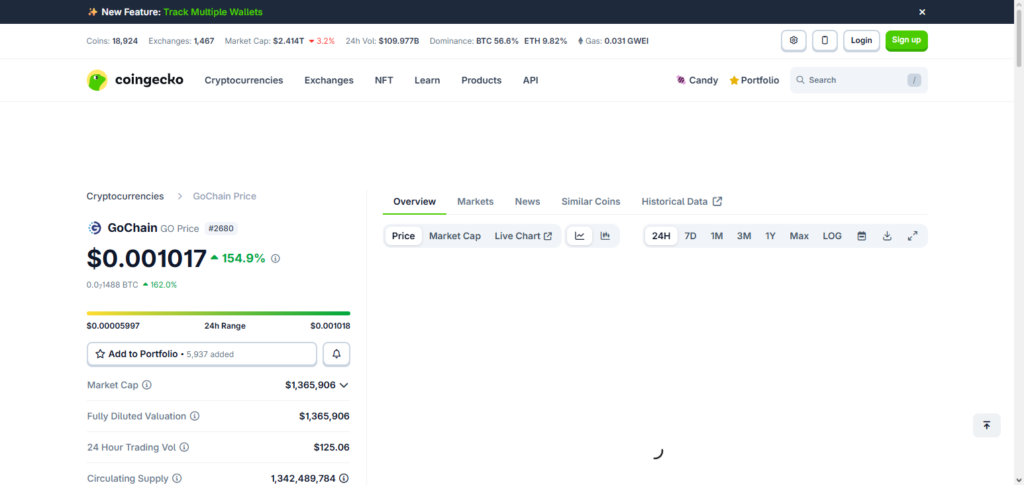

- 8. GoCoin

- GoCoin Features, Pros & Cons

- 9. Alchemipay

- Alchemipay Features, Pros & Cons

- 10. Paybito

- Paybito Features, Pros & Cons

- Conclusion

- FAQ

Selecting the appropriate payment gateway is crucial for lowering prices, preventing chargebacks, and guaranteeing seamless transactions as the use of cryptocurrencies continues to spread throughout the world. Let’s examine the leading platforms, their attributes, advantages, and comparative analysis.

What is Crypto Payment Gateway Providers?

Companies that give businesses the ability to securely and effectively accept cryptocurrency payments from clients are known as crypto payment gateway providers. These platforms conduct transactions in digital assets like Bitcoin, Ethereum, and stablecoins, serving as a bridge between retailers and blockchain networks.

They make it easy to integrate with both online and physical stores by offering solutions including point-of-sale systems, invoicing, checkout plugins, and APIs. Numerous cryptocurrency payment gateways also provide automatic conversion to fiat money, which lowers the risk of price volatility while enabling companies to grow internationally by providing quick, inexpensive, and borderless payment options.

How To Choose Crypto Payment Gateway Providers

Cryptocurrencies Accepted

For a greater reach to varying customers globally, select a payment gateway provider that supports multiple coins.

Payment Gateway Transaction Fees

Payment processors have different fees, and some have a greater payment gap (the difference between the payment made by the customer and the payment received by the business, at the bank) than others, meaning that some payment processors are more profitable than others.

Payment Gateway Automatic Fiat Conversion

If payment gateways and payment processing supply quotes seem to fluctuate, use a payment gateway that will convert your payments to fiat and send your bank settlements (adding to your bank account) to the country’s currency (the country’s currency \ ( \ country currency ) , e. g., Chinese RMB (Renminbi) .

Payment Gateway Security & Compliance

Ensure your payment gateway has robust security measures, like payment data encryption, 2-Factor Authentication, and non-custodial secret payment gateway options.

Payments Gateway Extensions & Plugins & APIs

Check your payment gateway to make sure there are APIs, Extensions, and Plugins to connect to your Shopify, WooCommerce, and/or Magento and custom websites.

Payments Gateway Settlement Times

Different payment gateways have different timings in terms of payment settlements and transactions. Some payment gateways have instant payments, and others’ payments are dependent on payments based on blockchain confirmations.

Payment Gateway Global Provider

For Payment Gateways & Payment Processor’s global reach, make sure they support your home country. Also, if your country has Payment Gates & Payment Processor drawn multiple currency exchange, make sure your country has the ability to payment gateways & payment processors to support multiple countries.

Key Point & Best Crypto Payment Gateway Providers

| Platform | Key Point |

|---|---|

| CoinPayments | Supports 2,000+ cryptocurrencies, making it one of the most diverse multi-coin payment processors for global merchants. |

| BitPay | Offers automatic crypto-to-fiat settlement, reducing volatility risk for businesses accepting digital assets. |

| Coinbase Commerce | Non-custodial payment solution allowing merchants full control over private keys and funds. |

| NOWPayments | Provides flexible instant payouts with automatic coin conversion across 300+ cryptocurrencies. |

| Crypto.com Pay | Enables cashback rewards for customers, encouraging higher engagement and repeat purchases. |

| Binance Pay | Zero transaction fees within the Binance ecosystem, ideal for cost-efficient crypto transfers. |

| OpenNode | Specializes in Bitcoin payments with Lightning Network support for near-instant, low-fee transactions. |

| GoCoin | Focuses on high-risk industries, providing crypto payment acceptance for sectors often restricted by traditional processors. |

| Alchemipay | Bridges crypto and traditional finance by supporting both fiat and digital currency transactions globally. |

| PayBito | Combines exchange and payment gateway services, allowing seamless crypto liquidity integration for merchants. |

1. CoinPayments

CoinPayments is a front runner in the best crypto payment gateway providers category as it is able to feature over 2,000 different cryptocurrencies. This is a pioneering multi-coin feature in crypto payment processing today.

Merchants can accept a variety of digital assets including the major coins like Bitcoin and Ethereum without the need to have multiple separate wallets for the different coins. With built in auto coin conversion processing, CoinPayments will also reduce merchant’s exposure to processing volatility as the system will convert payment processing to stable coins or even fiat automatically.

Aside from the global coverage and major e-commerce platforms’ plugins, CoinPayments works with businesses that need flexible and scalable means to accept crypto. It even has a robust API for wallets and developer integrations.

CoinPayments Features, Pros & Cons

Key Features

- 2,000+ cryptocurrencies supported.

- Coin conversion is automatic.

- Plugins for E-commerce. (Shopify, WooCommerce)

- Multi-wallets.

- Merchant dashboard and API.

Pros

- Very wide support for coins.

- Payout options are flexible.

- Integration with stores is easy.

- Merchants have built-in wallets.

- APIs are developer-friendly.

Cons

- Interface is complex for beginners.

- Network fees are higher for some currencies.

- No support for chargebacks.

- Support is slow.

- There may be conversion limits, depending on your account.

2. BitPay

BitPay is widely known as one of the best providers of crypto payment gateways, particularly for firms that need dependable crypto-to-fiat settlement options. BitPay eliminates price volatility concerns for merchants and provides predictable revenue in USD, EUR, GBP, etc. by instantly converting customer crypto payments to local currencies.

Its features include hosted invoices, payment buttons, and settlements through direct deposits to bank accounts and debit cards.

Supported by Bitcoin, Bitcoin Cash, and Ethereum, as well as various stablecoins, BitPay combines enterprise-grade security, a robust suite of compliance capabilities, and support for merchants worldwide to facilitate the integration of traditional finance with digital currencies and appeals to both enterprises and online merchants.

BitPay Features, Pros & Cons

Key Features

- Settlements are automatic crypto-to-fiat.

- There are hosted invoices.

- Buttons for billing and payment.

- Some stablecoins are supported.

- Settlements via bank deposits and cards are direct.

Pros

- Risk of price volatility is reduced.

- Long-standing platform that is trusted.

- Onboarding merchants is easy.

- Compliance and reporting is strong.

- Payouts globally are available.

Cons

- Less support for altcoins compared to the rest.

- Some rivals have lower fees.

- Certain features are custodial.

- Some features are restricted by region.

- Micro-transactions are not good for this.

3. Coinbase Commerce

Coinbase Commerce is one of the best crypto payment gateways owing to its non-custodial model where merchants own their private keys and funds. This type of model is different from custodial gateways, where funds are not held by the merchants, thus giving merchants more autonomy and security.

They receive funding from the largest cryptocurrency payment processors, including Bitcoin, Litecoin, Ethereum, and USD Coin, making them a favorite for e-commerce, creators, and nonprofits.

They are easy to adopt due to the ability to integrate with Coinbase wallets, and the plugins for Shopify and WooCommerce. Their fee structures and dashboards are very simple compared to many of their competitors, and they offer a balance between ownership of your crypto and professional-grade offerings, especially for businesses.

Coinbase Commerce Features, Pros & Cons

Key Features

- Ability to accept non-custodial crypto

- Custom dashboard and reporting tools

- Integrated wallets

- Plugins for major e-commerce platforms

- Multi coin support

Pros

- Merchants own their private keys

- Added security of being in Coinbase ecosystem

- Easy for new users to set up

- Predictable cost due to straightforward pricing

- Advanced reporting tools for merchants

Cons

- No integrated fiat conversion

- Limited altcoins compared to other payment gateways

- Network will determine when you can settle

- No loyalty features

- Support for certain countries can be restricted

4. NOWPayments

NOWPayments is among the best crypto payment gateway providers. They allow instant payouts and automated coin conversions for over 300 crypto. As an added bonus, Merchants can decide to receive payment crypto of their selection or automatically convert. They can convert to stablecoins or fiat via supported partners.

NOWPayments has customizable payment buttons and offers plugins to your desired e-commerce site (WooCommerce, Shopify, MageMoment, etc.) They also have an invoicing feature. Developers can achieve integrations fairly seamlessly via the provided API and documentation. With lower payment alternative and and support for both on chain and off chain transactions, they are the best provider for developers looking for for control and adaptable payment acceptance globally.

NOWPayments Features, Pros & Cons

Key Features

- Over 300 crypto options for payment

- Automatic coin conversion

- Payment button and plugin

- Immediate payouts

- Developer API

Pros

- Variety of coin payment options along with trusted conversion

- Low prices

- Great support for integration

- Payouts on demand

- Payment options on-chain and off-chain

Cons

- Lesser known brand

- Developer intervention may be required for advanced features

- Fees for auto conversion

- Dependency on partner networks for liquidity

- Unsuitable for merchants who only accept fiat

5. Crypto.com Pay

Crypto.com Pay is listed as one of the best crypto payment gateway providers due to the cashback rewards program. With the rewards program, customers are incentivized to pay using crypto. Merchants using Crypto.com Pay have the ability to give 10% cashback to customers in CRO tokens.

This in turn increases repeat purchases and raises overall buy/sell activity on the site. The platform has the ability to support multiple crypto currencies and can be integrated seamlessly into online checkouts or in person via QR code payments.

With the support of the entire Crypto.com ecosystem, (exchange, wallet, and app services), they provide merchant tools and high liquidity especially for consumer-oriented retailers that want to target crypto shoppers.

Crypto.com Pay Features, Pros & Cons

Key Features

- Cash back on crypto payments

- CRO rewards

- Payment via app and QR

- Tools for merchant checkout

- Supports various coins and stablecoins

Pros

- Encouraging customers to use crypto

- Compatibility with the Crypto.com ecosystem

- Convenient mobile payments

- Solid liquidity

- Ideal for consumer retail

Cons

- CRO-based rewards could be off-putting

- Ecosystem fees

- Crypto.com accounts are a must

- Fewer plugins compared to others

- Support can be slow

6. Binance Pay

Binance Pay is also one of the best crypto payment gateway providers for users within the Binance ecosystem as they offer zero transaction fees on many user-to-user transfers. As one of the largest crypto exchanges in the world, they support the payment acceptance of multiple cryptocurrencies and stablecoins.

Merchants can manage their funds within Binance, and can also convert their funds to fiat or any other asset when needed. Coupled with invoicing tools and global reach, they provide QR code payment solutions.

Binance Pay is the provider for businesses seeking seamless integration for the acceptance of crypto, as their liquidity and security standards are among the best in the industry.

Binance Pay Features, Pros & Cons

Key Features

- No/little fees on transactions

- Many major coins are supported

- Integration with Binance ecosystem

- Payment via QR & wallet

- Payouts can be done in various ways

Pros

- Transactions are economical

- Global support is strong

- Binance exchange provides strong liquidity

- Mobile wallet is easy to use

- Settlement is quick

Cons

- Need to have a Binance account

- There are fewer tools for enterprises

- Not great for use outside the Binance ecosystem

- Few options for auto fiat conversion

- Customer service can be slow

7. OpenNode

OpenNode firmly believes in Bitcoin payments, with expertise in Lightning Network payments, meaning they can close transactions with minimal fees.

This provides quick settlements to merchants, especially for micropayments, or high-volume transactions. Since flexible on-chain Bitcoin settlements for Lightning payments have also been added, merchant needs can also be addressed.

OpenNode has simplified integration for online shops, point-of-sale, and billing systems through use of APIs, Plugins, and Reporting. OpenNode also provides a bonus for added security and optional automatic conversion to fiat. This is especially beneficial for businesses with a focus on efficient payment systems and the adoption of Bitcoin.

OpenNode Features, Pros & Cons

Key Features

- Bitcoin payments & Lightning Network

- Support for on-chain and off-chain

- Integrations and API

- Settlement of BTC is automatic

- Dashboard for Merchant

Pros

- Bitcoin payments that have very low fees and are quick

- Micropayments are great

- Good tools for developers

- Bitcoin ecosystem focused optional

- Conversion is automatic

Cons

- Just Bitcoin support

- Understanding Lightning is a requirement

- Not for multiple coins

- Fewer plugins compared to others

- Not for audiences interested in altcoins

8. GoCoin

Among the best crypto payment gateways for high-risk industries is GoCoin, which allows processing of payments for Bitcoin, Litecoin, and Ethereum. GoCoin provides alternative payment solutions for high-risk clients.

GoCoin fully developed and custom-made solutions, and other features that allow the handling of fraud for complex e-commerce situations, including APIs, and hosted checkout pages, and is then redirected to fraud monitoring.

GoCoin’s compliance, security, and integration flexibility in multiple areas allow merchants to accept digital currency, gaming, and digital goods without the restrictions of traditional banking. GoCoin provides a strong mixture of payment acceptance and risk-managed infrastructure, especially for clients who need reliable gateways in areas where traditional services are provided.

GoCoin Features, Pros & Cons

Key Features

- Accepts crypto payments

- Fraud monitoring

- Checkout pages (hosted)

- API integrations

- Risk management

Pros

- Ideal for high-risk businesses

- Multiple coin support

- Fraud tools included

- Simple checkout

- Affordable fees

Cons

- Less coins supported

- Outdated interface

- Insufficient reporting

- Limited reach compared to large gateways

- Onboarding requires review time

9. Alchemipay

Alchemipay is one of the best crypto payment gateway providers because of its hybrid structure of supporting crypto and traditional fiat transactions, merging the two worlds of decentralized and central finance.

Alchemipay provides merchants with the ability to accept a wide array of digital assets with settlement options in fiat, thus catering to customers across all payment preferences. With strong APIs and developer assistance, Alchemipay is designed to help e-commerce websites and POS systems.

Alchemipay’s compliance features, risk management, and support for various global currencies are great for international businesses. Alchemipay simplifies the conversion and settlement process, allowing merchants to embrace crypto payments while still having access to traditional banking and fiat systems.

Alchemipay Features, Pros & Cons

Key Features

- Support for crypto and fiat

- API and plugins

- Global currencies

- Flexible settlement

- Reporting and analytics

Pros

- Great crypto to fiat transition

- Operates in worldwide markets

- Flexible payout options

- Great for developers

- Strong compliance

Cons

- Less established than old school competitors

- Conversion/settlement fees

- Less plugins than the best

- Support responsiveness is inconsistent

- Fiat routes require setup

10. Paybito

Paybito came out as one of the best crypto payment gateway providers for the reason that they have an exchange and payment gateway integrated into one. This gives an option to merchants crypto liquidity as they can accept crypto payments.

This also allows businesses to ease the crypto received and convert to other assets or to fiat, improving flexibility in terms of treasury and decreasing exposure to volatility. Paybito works with wallets, POS, and online checkout systems. It has features to support a wide variety of crypto and compliance mechanisms, also having payment processing features and trading features.

Paybito also has multi-signature wallets. This results in merchants having the trading and payment processing features that they are looking for. Their unified platform helps businesses that are deep into working with digital assets simplify their functions.

Paybito Features, Pros & Cons

Key Features

- Gateway + exchange

- Multi coin support

- Tools for wallets

- Merchant integrations

- Liquidity support

Pros

- Combined crypto liquidity and processing

- Excellent security measures

- Good for flexible conversions

- Wallet access

- Great for treasury management

Cons

- Complexity of combined platforms

- Less global user adoption

- Charges for certain features

- Limited plugin ecosystem

- Account creation is necessary

Conclusion

Selecting the most suitable option from the top rated cryptocurrency payment gateways depends primarily on your preferences for your business model, target audience, and how you prefer to manage your settlements.

For instance, those aligned with the business model of prioritizing payment security and compliance, and use of credit card and bank account payment options, are likely to prefer Coinbase Commerce and Bitpay. On the other hand, nowpayment and coinpayment are likely to suit internationally targeting merchants focusing on alternative coins due to their extensive supportive cryptocurrencies.

Merchants who would like to benefit from the ecosystem of payment cryptocurrencies with strong liquidity as well as customer reward/ incentive programs would likely prefer Crypto.com Pay and Binance Pay. OpenNode would likely suit bitcoin merchants due to its efficiency in the Lightning Network. For some flexibility in treasury management, some hybrid options like Alchemipay and integrated exchange solutions like PayBito would add some flexibility.

In the end, the most appropriate provider meets your needs with respect to the transactional costs, cryptocurrencies, ease of integration, security, and the flexibility concerning the number of crypto wallets and conversion to cash etc. which in turn will provide you with the seamless acceptance of cryptocurrencies and much lower operational risks.

FAQ

What is a crypto payment gateway?

A crypto payment gateway is a service that enables businesses to accept cryptocurrency payments from customers. It works like a traditional payment processor (e.g., for credit cards) but handles digital assets like Bitcoin, Ethereum, stablecoins, and altcoins. These gateways can provide tools such as invoices, checkout buttons, APIs, and settlement options in crypto or fiat.

Why should businesses use a crypto payment gateway?

Accepting crypto payments helps businesses expand their reach to global customers, reduce cross-border transaction fees, avoid chargebacks, and offer faster payment settlement. Many gateways also offer optional automatic conversion to fiat, protecting merchants from cryptocurrency price volatility.

How do crypto payment gateways differ from traditional payment processors?

Crypto gateways handle digital asset transactions rather than fiat through banks. They can avoid chargebacks (irreversible crypto payments), support global digital wallets, and offer lower fees and faster settlement. Some also allow optional automatic conversion to fiat, bridging crypto and traditional currency.

Can crypto payment gateways convert crypto to cash?

Yes. Many gateways like BitPay and Coinbase Commerce offer automatic or manual fiat settlement, converting crypto payments into USD, EUR, or local currency to protect merchants from price volatility.