In this essay, I will examine the Best Crypto Wallets for Treasury Management. Wallets that are safe, dependable, and effective are necessary for managing a corporate or institutional cryptocurrency treasury.

- What is Crypto Wallets for Treasury Management?

- Why Use Crypto Wallets for Treasury Management

- Key Point & Best Crypto Wallets for Treasury Management List

- 1. Fireblocks

- Fireblocks Features, Advantages & Disadvantages

- 2. BitGo Wallet

- BitGo Wallet Features, Advantages & Disadvantages

- 3. Anchorage Digital

- Anchorage Digital Features, Advantages & Disadvantages

- 4. Ledger Enterprise

- Ledger Enterprise Features, Advantages & Disadvantages

- 5. Kraken Custody

- Kraken Custody Features, Advantages & Disadvantages

- 6. Qredo Wallet

- Qredo Wallet Features, Advantages & Disadvantages

- 7. Zengo Business Wallet

- Zengo Business Wallet Features, Advantages & Disadvantages

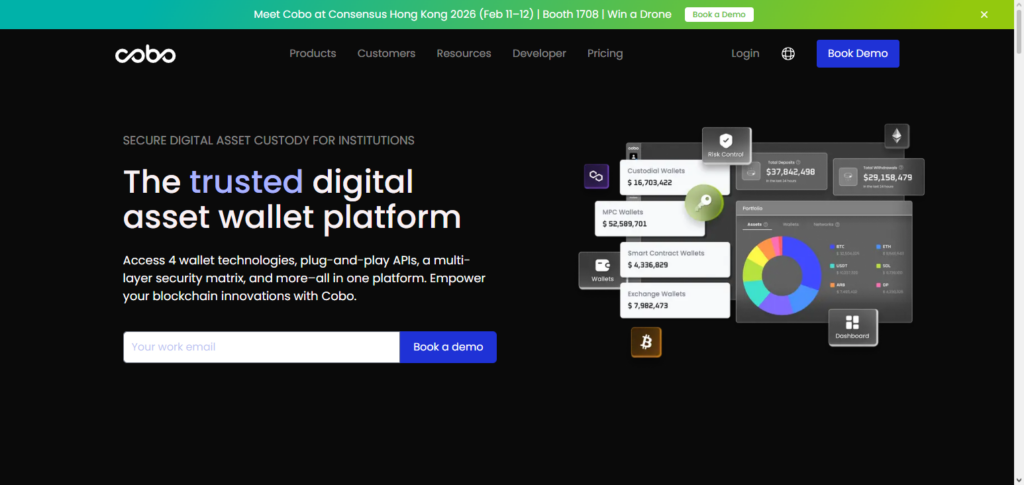

- 8. Cobo Custody

- Cobo Custody Features, Advantages & Disadvantages

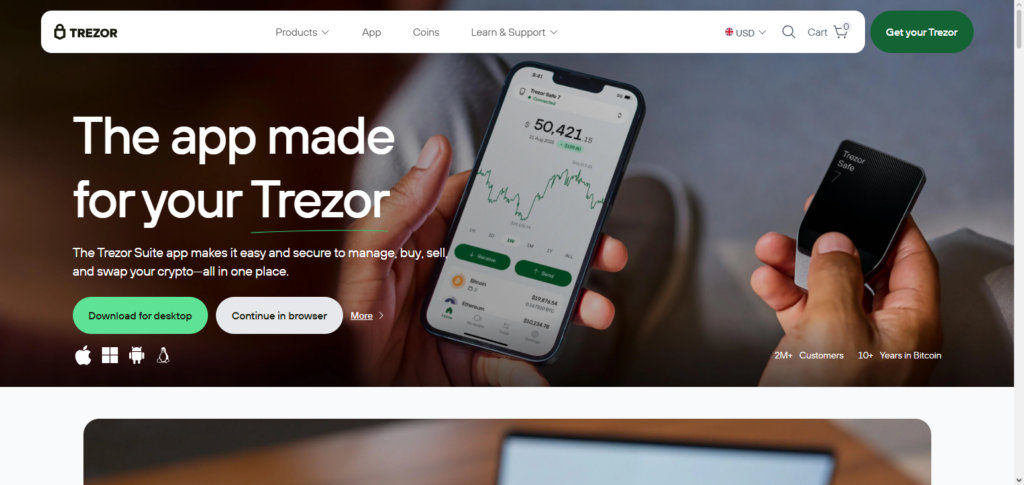

- 9. Trezor Suite (Enterprise)

- Trezor Suite (Enterprise) Features, Advantages & Disadvantages

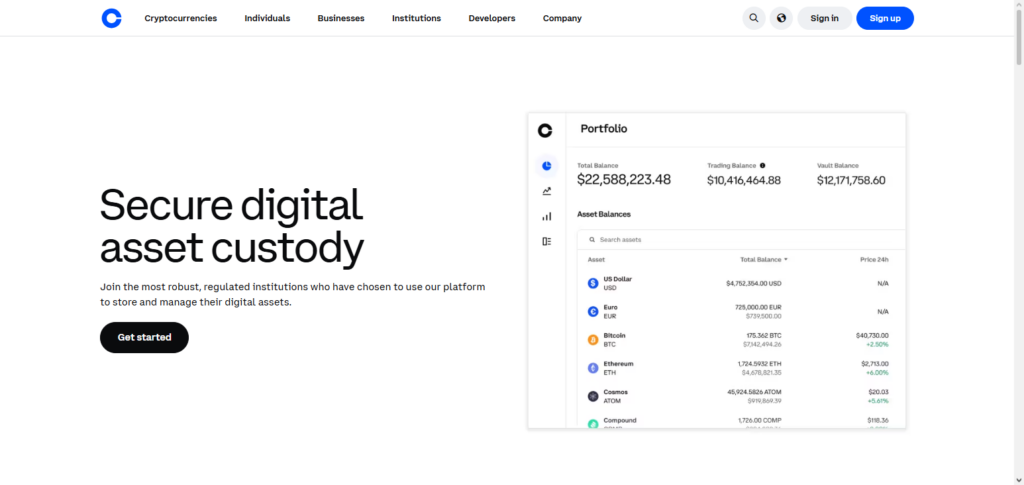

- 10. Coinbase Custody

- Coinbase Custody Features, Advantages & Disadvantages

- Conclusion

- FAQ

These wallets assist businesses in securely storing, tracking, and optimizing their digital assets. They range from hardware-based solutions to decentralized platforms and regulated custodians. For any cryptocurrency treasury, selecting the appropriate wallet guarantees security, compliance, and operational effectiveness.

What is Crypto Wallets for Treasury Management?

A Crypto Wallet for Treasury Management is a secure digital platform built exclusively for corporations and institutions to store, manage, and safeguard their bitcoin assets. Unlike personal wallets, corporate wallets offer advanced features such as multi-signature security, regulatory compliance, multi-user access, and thorough reporting.

They enable corporations to oversee massive crypto holdings, automate treasury procedures, interface with exchanges, and even earn dividends through staking or DeFi, ensuring both safety and efficiency in managing corporate digital assets.

Why Use Crypto Wallets for Treasury Management

Improved Security: Corporate crypto assets are protected using multi-signature authentication, MPC, and cold storage.

Regulatory Compliance: Meets KYC, AML, and other requirements for lawfully retaining institutional crypto.

Operational Efficiency: Large organizations get streamlined internal treasury workflows for transaction approvals

Multi-Asset Support: Manage various cryptocurrencies from one single treasury management system.

Yield & Staking Opportunities: Wallets can provide a safe means for businesses to earn rewards on crypto reserves.

Key Point & Best Crypto Wallets for Treasury Management List

| Wallet Name | Key Point / Feature |

|---|---|

| Fireblocks | Institutional-grade security, multi-layer encryption, and instant transfers. |

| BitGo Wallet | Multi-signature security with insurance coverage and enterprise solutions. |

| Anchorage Digital | Fully regulated custody with staking, lending, and advanced compliance tools. |

| Ledger Enterprise | Hardware wallet solution for businesses with robust security and offline storage. |

| Kraken Custody | Regulated crypto custody with cold storage and insured protection for assets. |

| Qredo Wallet | Decentralized custody, multi-party computation, and cross-chain interoperability. |

| Zengo Business Wallet | Keyless security with biometric authentication and institutional support. |

| Cobo Custody | Multi-chain custody with smart contract integrations and security-focused design. |

| Trezor Suite (Enterprise) | Hardware-based enterprise wallet with offline key management and backups. |

| Coinbase Custody | Regulated custody with insurance, high liquidity support, and easy enterprise access. |

1. Fireblocks

Fireblocks is one of the Best Crypto Wallets for Treasury Management since it uses financial-grade security and state of the art mechanisms in the crypto financial sector. With the use of multi-layer encryption and multi-party computation (MPC), crypto assets can be secured and transferred in an expedient and safe manner between wallets and/or exchanges.

Companies can utilize features such as automated workflows, real-time monitoring, and compliance based control features. Fireblocks is also good for enterprises that want to keep looking to keep things safe and also want to earn DeFi, lending, and staking, as it good in those areas as well.

Fireblocks Features, Advantages & Disadvantages

Features

- MPC-based private key security

- Institutional transfer network

- Policy driven access control

- Real time monitoring and alerts

- Integration with staking and defi

Advantages

- Rapid internal transfers between partners

- Strong compliance and automated workflows

- Extremely high security and reduced key risk

- Support multiple assets and integrations

- Veers towards large enterprise treasuries

Disadvantages

- Complex workflows may yield a learning curve

- Over-reliance on the online platform

- Not ideal for retail users

- Advanced features may be overkill for small treasury

- Learning curve for complex workflows

2. BitGo Wallet

BitGo Wallet is an example of the Best Crypto Wallets for Treasury Management thanks to its insurance coverage and multi-signature security system. BitGo offers businesses the ability to design their own unique access controls and security policies.

With support of over 100 cryptocurrencies, businesses can diversify their portfolios. Instant transfers, hot and cold storage, and regulatory compliance are some of the other features available among BitGo’s enterprise solutions.

Additionally, the platform offers access to liquidity and trading platform integrations. BitGo Wallet balances safety and operational efficiency to allow companies to confidently and securely manage their crypto treasury.

BitGo Wallet Features, Advantages & Disadvantages

Features

- Multi signature security (MSIG)

- Options for insurance coverage

- Integration with APIs and exchanges

- Management of hot and cold storage

- Support for more than 100 assets

Advantages

- Proven institutional security

- Options for custody flexibility

- Simple integration with trading systems

- Insurance coverage offers greater protection for assets

- Support for developers is robust

Disadvantages

- Increasing complex custody for novice users

- Varying support response times

- Advanced services may require contracts

- Users pay for the custody and the costs can increase for those who are active

- Centralization

- Lack of decentralization (custodial)

- Not a custodial service

3. Anchorage Digital

Anchorage Digital is regulated and offers custody, staking, and lending, making it one of the Best Crypto Wallets for Treasury Management. With software and hardware security isolation, multisignature and multi-party computation, Anchorage puts security first.

With institutional clients in mind, Anchorage Digital provides KYC/AML compliance processes, a variety of digital assets, and custodian staking. Anchorage offers businesses the ability to manage treasury operations by directly utilizing custody staking and yield services.

Anchorage Digital is optimal for large portfolio assets and crypto funds, as it provides integration with all the major crypto exchanges, treasury management simplification, and a full safety control layer with dedicated account managers.

Anchorage Digital Features, Advantages & Disadvantages

Features

- Custody is fully regulated

- Stake and earn services

- MPC + hardware isolation

- Compliance tools (KYC/AML)

- Support for dedicated accounts

Advantages

- Other services regulated by financial authorities

- All-in-one custody + staking

- Greater trust for institutions

- Strong guidance and support

- Coverage for multiple assets

Disadvantages

- Onboarding tends to be slow

- Enterprises have higher minimums

- Less control to DIY

- Not great for small holders

- Contracts may be involved

4. Ledger Enterprise

Among the Best Crypto Wallets for Treasury Management, Ledger Enterprise offers a competitive hardware-based Treasury Management solution. It offers cold storage with secure elements and strong encryption, minimizing the risks that come with online storage. Ledger’s multi-account functionality as well as department and subsidiary integration make its enterprise services suitable for large businesses.

Ledger Enterprise also allows companies to set customizable transaction approval steps for increased control over their business expenditure. From mainstream to DeFi tokens, Ledger Enterprise supports a variety of digital assets. For businesses that value the safe and efficient management of their crypto treasury, Ledger Enterprise offers enterprise-grade management tools and hardware crypto treasury services.

Ledger Enterprise Features, Advantages & Disadvantages

Features

- Keys stored offline in hardware

- Management of multiple accounts

- Custom policies for approvals

- Enterprise tool integrations

- Support for broad assets

Advantages

- Storage offline is highly secure

- Good model for compliance

- Easy model for physical security

- Manage hardware devices is simple

- Approval audits are clear and pathways

Disadvantages

- Devices of hardware manage requires

- Features on-chain interaction are limited

- Supporting staking/yield is not built in

- For trading real-time is less responsive

- Teams may be slowed by manual workflows

5. Kraken Custody

Among the Best Crypto Wallets for Treasury Management, Kraken Custody is one of the most prominent, as it provides fully regulated and insured services for institutions. By securing clients’ assets in cold storage and providing operational flexibility with hot wallets, Kraken Custody can fully insurer and support businesses’ crypto assets.

Kraken provides businesses with real-time transaction visibility, account support, and regulatory guidance. As one of the most regulated and highest insured crypto firms, Kraken is most suitable for enterprises and funds to rely on and manage their crypto and other digital assets.

Kraken Custody Features, Advantages & Disadvantages

Features

- Custodian is regulated

- Focus on cold storage

- Options for insurance

- Tools for compliance and reporting

- Support for multiple currencies

Advantages

- There is compliance and security

- Assets are protected by insurance

- Auditors have reporting that’s easy

- Krakens ecosystem is accessible

- Cold hot segregation is simple.

Disadvantages

- Control is custodial, no self-custody

- Service level determines fee variance

- Less sophisticated treasury automations

- Less DeFi focus

- Onboarding could involve checks

6. Qredo Wallet

Among the Best Crypto Wallets for Treasury Management, Qredo Wallet stands out for its focus on decentralized custody and multi-party computation (MPC). This design helps enterprises maintain security and ease of access at the same time. Also, Qredo offers cross-chain interoperability.

Further, Qredo automates treasury operations and provides multi-user approval and compliance tools for institutions. Qredo is the best choice for businesses that want to eliminate the risk of a counterparty, while controlling the private keys.

Qredo has permissioned integrations for trading, DeFi, and NFT activities. Its modern treasury management solutions provides security and operational efficiency, thanks to its decentralized design.

Qredo Wallet Features, Advantages & Disadvantages

Features

- Custody with MPC that is decentralized.

- Ability to interoperate across chains.

- Approvals with multiple users.

- Access to DeFi that is on-chain.

- Workflows for treasury that are automated.

Advantages

- There is no custody, and it is decentralized.

- Flexibility across chains.

- Good for active operations for treasuries.

- Tools for enterprises that are strong.

- Settlement internally that is fast.

Disadvantages

- It is newer in comparison to incumbents.

- There is complexity for teams that are non-technical.

- The liquidity is determined by the networks.

- The UI can be dense.

- It is not thebest fit for keeping pure storage in cold.

7. Zengo Business Wallet

Zengo Business Wallet is one of the Best Crypto Wallets for Treasury Management as it offers a biometric authenticated, keyless security system. This means enterprises do not need to operate private keys, which diminishes the possibility of theft or the loss of the key.

Zengo Business Wallet has a multiple-user functionality and offers transaction approvals and asset tracking. In addition, it has strategic integrations with various staking and lending protocols, which allows treasury teams to optimize the yield on surplus funds.

Zengo Business Wallet has convenience, security, and compliance reinforced with the best practices to help organizations manage the treasury by simplifying the processes while keeping risk low.

Zengo Business Wallet Features, Advantages & Disadvantages

Features

- Security that is keyless and uses biometrics.

- Access by multiple users.

- Workflows for approvals of transactions.

- Dashboards for tracking assets.

- Integration with platforms for yield.

Advantages

- It is highly secure and easy.

- Management of private keys is not necessary.

- It is excellent for teams.

- Support for desktop and mobile.

- Options for staking and yield embedded.

Disadvantages

- There is less of a formation in enterprises.

- Some features that are advanced are still in development.

- Biometrics of the device can be relied on.

- The storage is not fully cold, and offline.

- There is a little reporting for institutions at a granular level.

8. Cobo Custody

Cobo Custody is among the Best crypto wallets for treasury management due to its multi-chain support and enterprise-grade features. It combines the best of both worlds, including hardware-backed storage, MPC tech, and policy-based storage controls.

In addition to solid treasury management, Cobo has smart contract functionality, staking, and yield optimizations. Cobo Custody offers businesses treasury management, with comprehensive reporting, operational streamlining, transaction management, and compliance monitoring.

Trezor enables organizations to manage and streamline diverse digital asset packages with multi-blockchain support. Cobo Custody is versatile enough to support the most complex treasury automation, workflows, and growth strategies.

Cobo Custody Features, Advantages & Disadvantages

Features

- Multi-chain capabilities

- MPC + Hardware Protection

- Smart contract integration

- Yield & staking

- Compliance & reporting

Advantages

- Flexible treasury across multiple chains

- Robust security tech stack

- Active growth of assets

- Enterprise level compliance

- Operational dashboards

Disadvantages

- Multi-chain complexity

- Extended onboarding

- Not solely hardware cold-storage

- Feature training required

- Discrepant support levels

9. Trezor Suite (Enterprise)

Trezor Suite (Enterprise) is among the Best crypto wallets for treasury management, offering hardware-based offline storage and enhanced enterprise features. It allows organizations to store private keys offline and manage multiple users and accounts.

Trezor Suite (Enterprise) offers peace of mind with backups and recovery for major cryptocurrencies and supports offline private key storage.

For operational oversight and compliance, Trezor Suite (Enterprise) offers tailored approval workflows and reporting. Hardware security along with enterprise tools foster a blend of control, safety, and transparency to protect businesses from cyber threats while optimally managing the crypto treasury.

Trezor Suite (Enterprise) Features, Advantages & Disadvantages

Features

- Hardware based private key protection

- Multi account management

- Recovery & backup

- Policy management

- Suite clear dashboard

Advantages

- Risk minimization due to offline security

- Enterprise controls are simple

- Excellent for long term holding

- Audit trails visibility

- Trezor brand support

Disadvantages

- DeFi integrations are scarce

- Key management is manual

- Less feature rich than custodial alternatives

- Absence of built-in staking

- Dependent on hardware

10. Coinbase Custody

Coinbase Custody is one of the Best Crypto Wallets for Treasury Management. It is a regulated, insured, and secure crypto wallet for institutional investors. It offers cold storage and hot wallet options, operational efficiency, and secure operational efficiency.

Coinbase Custody integrates easily with trading, staking, and lending services, and supports multiple cryptocurrencies. Enterprises receive detailed reports, audit-ready statements, and help with regulatory compliance.

Its reliable reputation and large liquidity pool make it a good option for large enterprises with significant digital assets. Coinbase Custody is safe, convenient, and scalable, which is why institutional investors trust it for treasury management.

Coinbase Custody Features, Advantages & Disadvantages

Features

- Custody regulated service

- Insurance included

- Cold/hot storage

- Audit + reporting

- Exchange reporting integration

Advantages

- Reputable + liquidity

- Trade + yield integration is simple

- Insurance is an additional benefit

- Excellent reporting for compliance

Disadvantages

- Custodial model means third‑party control

- Fees for storage & operations

- Less private key ownership control

- Can be slower for some workflows

- May not suit pure self‑custody purists

Conclusion

Choosing the correct wallet is vital for secure and effective crypto treasury management. Advanced security, regulatory compliance, multi-asset support, and operational flexibility are all provided by the Best Crypto Wallets for Treasury Management, which include Fireblocks, BitGo, Anchorage Digital, Ledger Enterprise, Kraken Custody, Qredo, Zengo Business Wallet, Cobo Custody, Trezor Suite, and Coinbase Custody.

Whether you prioritize offline hardware security, decentralized control, or integrated staking and yield options, these wallets provide enterprises with the tools needed to safeguard assets, streamline treasury operations, and maximize returns while minimizing risks in today’s dynamic crypto landscape.

FAQ

What is a crypto treasury wallet?

A crypto treasury wallet is a secure digital wallet designed for businesses or institutions to store, manage, and protect large amounts of cryptocurrency. These wallets often offer multi-signature security, compliance features, and support for multiple assets.

Which wallets are best for enterprise crypto management?

Top wallets include Fireblocks, BitGo, Anchorage Digital, Ledger Enterprise, Kraken Custody, Qredo, Zengo Business Wallet, Cobo Custody, Trezor Suite, and Coinbase Custody. They combine security, compliance, and operational efficiency.

Are these wallets safe for storing large crypto assets?

Yes, most of these wallets use multi-party computation (MPC), hardware security, cold storage, and insurance coverage to protect funds from hacks and unauthorized access.

Can these wallets handle multiple cryptocurrencies?

Absolutely. Most enterprise wallets support a wide range of crypto assets, including Bitcoin, Ethereum, stablecoins, and DeFi tokens, allowing diversified treasury management.