The Best Financial API Providers that assist developers and companies in incorporating safe payments, up-to-date financial information, and robust banking services into their applications will be covered in this post.

- How To Select Financial API Providers

- Key Point & Best Financial API Providers List

- 1. Plaid

- Plaid Features, Advantages & Disadvantages

- Features

- Advantages

- Disadvantages

- 2. Stripe API

- Stripe API Features, Advantages & Disadvantages

- Features

- Advantages

- Disadvantages

- 3. PayPal Developer API

- PayPal Developer API Features, Advantages & Disadvantages

- Features

- Advantages

- Disadvantages

- 4. Square API

- Square API Features, Advantages & Disadvantages

- Features

- Advantages

- Disadvantages

- 5. Visa Developer API

- Visa Developer API Features, Advantages & Disadvantages

- Features

- Advantages

- Disadvantages

- 6. Mastercard Developers

- Mastercard Developers Features, Advantages & Disadvantages

- Features

- Advantages

- Disadvantages

- 7. Yodlee API

- Yodlee API Features, Advantages & Disadvantages

- Features

- Advantages

- Disadvantages

- 8. Alpaca API

- Alpaca API Features, Advantages & Disadvantages

- Features

- Advantages

- Disadvantages

- 9. IEX Cloud API

- IEX Cloud API Features, Advantages & Disadvantages

- Features

- Advantages

- Disadvantages

- 10. Morningstar API

- Morningstar API Features, Advantages & Disadvantages

- Features

- Advantages

- Disadvantages

- Conclusion

- FAQ

These platforms allow scalable, compliant, and user-friendly financial solutions for startups, businesses, and international digital platforms, ranging from payment processing and data aggregation to investment analytics and fraud protection.

How To Select Financial API Providers

Security & Compliance Standards: It is prudent to choose a provider that demonstrates compliance with PCI-DSS, GDPR, and SOC 2, with proven encryption techniques. These compliance standards help in the protection of sensitive data and mitigate risk in the protection of customer data.

API Reliability & Uptime: Customers look for API providers that are guaranteed to be available 99.9% of the time, followed by constant performance and real-time monitoring. With reliable APIs, customers reduce the risk of service outages that can lead to the loss of user trust.

Ease of Integration: Look for APIs that are documented, and have a structured Developer Kit, a sandbox environment, and customer service for developers. With a customer developer service, the API can be integrated at a faster rate and in turn, save time in the development process by reducing the levels of complexity.

Scalability & Performance: Customers look for an API in financial service providers that can withstand a rate of transactions that is growing, an ever-increasing number of users, and globe traffic without performance loss, and latency in response.

Pricing Transparency: Customers appreciate APIs that have no hidden pricing, in a fee structure for API calls, comparing pricing modules, a breakdown of the volume of transactions, and a discount on the volume of transactions.

Global Coverage & Currency Support: Customers appreciate a financial services provider that has enabled services to international users. Such providers are useful to users in numerous geo-locations, banks, and currencies.

Data Accuracy & Freshness: When it comes to market data and financial analytics, always select providers who give data in real-time or have data that is refreshed regularly (and is controlled for quality).

Customization & Feature Set: Identify APIs that offer flexible workflows, webhook customization, and a modular feature set that aligns with your enterprise requirements.

Customer Support & Community: Helpful and responsive technical support, an engaged developer community, and a comprehensive knowledge base can ensure that problems are resolved quickly and that it is easier to achieve a successful implementation.

Vendor Reputation & Stability: Assess the reliability of a vendor and their ability to provide continued support, regular updates, and enhanced features in the future by examining reviews, case studies, and the length of time the vendor has been in the market.

Key Point & Best Financial API Providers List

| API / Platform | Key Points (Core Features & Use Cases) |

|---|---|

| Plaid | Securely connects user bank accounts, enables real-time transaction data, balance checks, and identity verification. Ideal for fintech apps, budgeting tools, and payment verification. |

| Stripe API | Powerful payment processing, subscription management, invoicing, fraud prevention, and global currency support. Widely used for eCommerce, SaaS billing, and online marketplaces. |

| PayPal Developer API | Supports online payments, digital wallets, recurring billing, payouts, and international transactions. Best for quick integrations and global payment acceptance. |

| Square API | Offers POS integrations, inventory tracking, customer profiles, and in-person + online payment solutions. Great for retail, restaurants, and small businesses. |

| Visa Developer API | Provides payment authorization, fraud detection, tokenization, and cross-border transaction services. Used by banks and enterprises for secure card-based solutions. |

| Mastercard Developers | Enables identity services, fraud prevention, payment authentication, and open banking solutions. Designed for financial institutions and secure transaction platforms. |

| Yodlee API | Aggregates financial data, tracks spending, categorizes transactions, and provides insights across multiple accounts. Ideal for personal finance and wealth management apps. |

| Alpaca API | Commission-free trading, real-time market data, portfolio management, and brokerage automation. Perfect for building stock trading and investment platforms. |

| IEX Cloud API | Delivers real-time and historical stock market data, company fundamentals, and financial metrics. Used for financial analysis, dashboards, and trading tools. |

| Morningstar API | Provides in-depth investment research, fund data, portfolio analytics, and ratings. Best for wealth management platforms and financial advisory services. |

1. Plaid

Plaid is one of the most trusted providers offering financial data services that allow user-facing applications to connect securely with the user’s bank account, gaining access to the user’s transactions, balances, the user’s identity, and income insights.

Most Fintech startups, budgeting apps, and payment services use Plaid to facilitate onboarding and enhance the user experience. With robust encryption and compliance standards, data security and regulatory alignment are ensured.

For seamless installations, good customer support, and documentation, and to over 5,000 financial institutions, Plaid is definitely one of the Best Financial API Providers.

Plaid Features, Advantages & Disadvantages

Features

- Authentication and linking of bank accounts is done securely

- Data on transactions and balances is real-time

- Tools for identity and income verification

- Coverage of Financial Institutions is extensive

- SDKs and documentation is available for developers

Advantages

- Onboarding users is fast and seamless

- Data security and compliance is robust

- Good reliability and uptime

- Good performance scalability for startups and large enterprises

- A plethora of fintech applications utilize this software

Disadvantages

- For small startups, the pricing model can be prohibitive.

- Bank Coverage is limited on an international scale relative to the coverage in the U.S.*

- Occasional connection issues with smaller banks.

- More difficult options for customization.

- Reliance on third-party financial institutions.

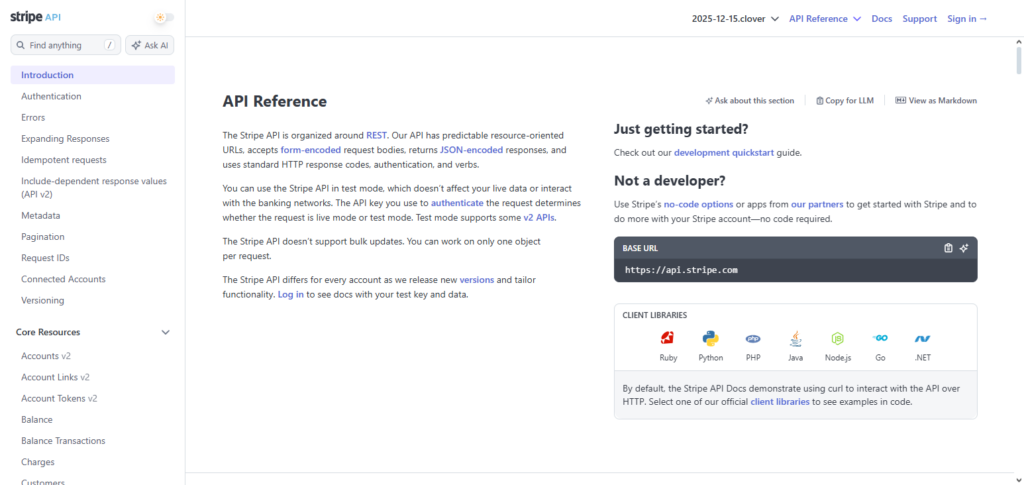

2. Stripe API

The Stripe API stands out as one of the most advanced payment and financial infrastructure solutions on the market today. Stripe helps companies of all sizes build revenue streams by accepting payments, managing subscriptions, invoicing, and fighting fraud.

It offers payment solutions in most currencies, all major payment methods, and features complex revenue optimization tools. Developers enjoy ample and accurate documentation, SDKs, and other tools for custom integrations.

Automated tax reporting, payment out, and secure tokenization services make Stripe a candidate for “Best Financial API Providers.” Because of its reliability and scalability, Stripe is often the selected financial partner for eCommerce, SaaS, and marketplace companies.

Stripe API Features, Advantages & Disadvantages

Features

- Payment processing and subscriptions on a global scale.

- Integrated fraud protection with Radar.

- Supports multiple currencies and payment types.

- Invoicing and billing automation.

- Analytics and reporting.

Advantages

- Great tools for developers and valuable documentation.

- Infrastructure that can scale seamlessly.

- Operating in many countries worldwide.

- Apart from high-demand scalability, it also has firm standards for security and compliance.

- Flexible API with lots of options for customization.

Disadvantages

- Costs of transactions can pile up quickly.

- Limited customer support over the phone.

- Non-standard features that most users require can be very technical.

- Newer accounts may experience a lag when it comes to payouts.

- Pricing for the services can be complicated.

3. PayPal Developer API

Businesses may include digital wallets, mass payouts, recurring billing, and worldwide payment processing into their apps with the help of the PayPal Developer API. It is perfect for cross-border trade since it allows international transactions, currency conversions, and buyer protection features.

Sandbox environments and RESTful APIs facilitate rapid testing and deployment. PayPal is a mid-platform strength among the Best Financial API Providers because of its large global user base, reliable brand recognition, and support for both consumer and merchant solutions. For startups and businesses hoping for quick, global payment adoption, this makes it very beneficial.

PayPal Developer API Features, Advantages & Disadvantages

Features

- Integration of a digital wallet and payment by card.

- Billing and subscriptions that recur.

- Currency conversion on a global scale.

- Support for payouts and bulk payments.

- Buyer and seller protection.

Advantages

- Integration and setup are very straightforward.

- Supports transactions on an international scale.

- Buyers and consumers globally trust the services.

- Different options for checkout.

Disadvantages

- Fees for transactions and currency are on the higher side.

- Your account can become limited, and holdings can also occur.

- There is little customization when compared to other companies in the market.

- Payment for support can be slow.5. Complex dispute resolution process

4. Square API

Square API allows users to manage online and face-to-face payments, payment capture and processing, inventory, and customer and employee data. It is widely used by small retailers, eateries, and businesses who require a single solution for all of their commerce activities.

App developers can customize integration for point-of-sale devices, customer loyalty management, and analytical reporting dashboards.

One of the Best Finacial API Provider, Square has seamless integration of physical and digital payments, providing businesses with a single unified platform to meet their payment needs and gaining real-time insights on sales, customers, and operations with data from all panets of the digital-financial ecosystem.

Square API Features, Advantages & Disadvantages

Features

- Integration with POS systems

- Orders and inventory management

- Tools for customer profiles and loyalty

- Payment processing: in-person and online

- Dashboards for analytics and reporting

Advantages

- Excellent for local and small-scale firms

- Consolidated sales data for online and offline

- Straightforward pricing

- Seamless integration with hardware

- Dashboards are easy to use

Disadvantages

- International availability is restricted

- Fees for payment transactions via card

- Lack of advanced options for API customizations

- Unsuitable for large businesses

- Limited support for multiple currencies

5. Visa Developer API

Visa Developer API features a suite of premium services for payment authorization, fraud prevention, cross border transaction processing, and tokenization for fraud protection. It is tailored for banking, and larger organization, and fintech services that require processing of high volumes of payment cards in a secured environment.

The platform also offers services in identification, risk management, and compliance with payment processing regulations.

One of the Best Financial API Providers with respect to cross border payment processing, Visa has built robust infrastructure for seamless payments in all territories. His is their cross border and sustained moderate innovation of the solution.

Visa Developer API Features, Advantages & Disadvantages

Features

- Processing and authorizing payments

- Management of risks and fraud detection

- Tokenization

- Solutions for payments across borders

- Tools for Identity verification

Advantages

- Coverage of payment network across the globe.

- Enterprise-level standards of security.

- Dependable with higher and optimal up time.

- Major banks have confidence in the services.

- Large volumes of the services offered.

Disadvantages

- It takes a lot of time to integrate.

- Services are not available for small developers.

- More stringent rules available.

- Less flexible pricing options are available.

- Financial Institution partnership is a requirement.

6. Mastercard Developers

Mastercard Developers has multiple APIs for identity verification and fraud and payment method authentication. It aids digital payments, data analytics, and financial inclusion for businesses and financial institutions.

Developers can utilize tools for improved security, customer onboarding, and transaction transparency. Mastercard has been recognized among Best Financial API Providers and has a distinctive mid-platform advantage for both cybersecurity and compliance and connectivity to global financial networks.

This allows organizations to design and develop safe, scalable, and adaptable financial products.

Mastercard Developers Features, Advantages & Disadvantages

Features

- APIs for open banking

- Tools for fraud detection

- Services for identity and authentication

- Solutions for payment processing

- Insights and analytics on data

Advantages

- Global monetary network

- Security and Compliance

- Fraud detection

- Enterprise and Bank Trust

- API integration

Disadvantages

- Complexity

- Startups

- Compliance

- Price Transparency

- Regulatory Setup

7. Yodlee API

Yodlee API offers financial data aggregation by enabling applications to collect and analyze customer information for banking, credit, and investment data. It helps users analyze their spending, net worth, and cash flow and is suited for personal finance management and wealth management services.

Yodlee has been recognized among Best Financial API Providers and mid-platform compliance, and data security is a strength of Yodlee, which extends to the secure handling of sensitive data. Noteworthy is Yodlee’s mid-platform strength, which covers the majority of financial institutions and offers superior analytics to financial advisors and consumers.

Yodlee API Features, Advantages & Disadvantages

Features

- Aggregate Data

- Data Segmentation

- Cash flow and net worth

- Insights

- Investment data

Advantages

- Financial institution

- Data accuracy

- Wealth management applications

- Secure data

- Financial insights

Disadvantages

- Pricing

- Data refresh

- Setup

- Real-time

- Development

8. Alpaca API

Developers can create unique investing and stock trading applications using the commission-free Alpaca API trading and brokerage platform. Using contemporary REST and WebSocket APIs, it provides automated trading tools, portfolio management, and real-time market data.

Alpaca is used by financial platforms and fintech businesses to develop user-friendly trading experiences. Alpaca’s mid-platform appeal stems from its smooth integration of brokerage services with developer tools, which enables the quick implementation of safe, scalable, and creative investment solutions for both professional and retail traders. Alpaca is regarded as one of the Best Financial API Providers.

Alpaca API Features, Advantages & Disadvantages

Features

- Free stock trading.

- Market data available in real time.

- Automated trading.

- Managing accounts and portfolios.

- Market simulation (Paper Trading).

Advantages

- Focused on developers.

- Integration is simplified and streamlined.

- Trading at a low cost.

- Flexible infrastructure

- Excellent for fintech startups.

Disadvantages

- Support for international markets is not available.

- Limited products.

- Subject to U.S. markets regulations.

- Limited trading tools.

- Suboptimal for traditional brokerages

9. IEX Cloud API

The IEX Cloud API offers financial statements, corporate fundamentals, real-time and historical stock market data, and sophisticated analytics. Developers creating trading tools, research portals, and financial dashboards frequently use it.

For both startups and large corporations, the API provides scalable data access and various price models.

The mid-platform strength of IEX Cloud, one of the Best Financial API Providers, is its extensive coverage of U.S. and international markets, low latency feeds, and high-quality data accuracy, which enable users to make well-informed, data-driven investment decisions.

IEX Cloud API Features, Advantages & Disadvantages

Features

- Stock market data in real-time

- Financial data from previous years

- Fundamentals of companies

- Financial ratios and other metrics

- Data streams via WebSocket

Advantages

- Flexible data

- Quality and accuracy of data

- Easy endpoint API

- Performance and reliability

- Perfect for data analytics platforms

Disadvantages

- Poor coverage of global markets

- Paid plans necessary for advanced data

- Not a data trading platform

- Lower tiers are subject to rate limits

- Compared to other companies, the data breadth is less

10. Morningstar API

Morningstar API consists of investment research, ratings on funds, portfolio analysis, and data on market performance. Wealth managers, financial advisors, and investment platforms trust the API and its comprehensive research.

It covers mutual funds, ETFs, stocks, and asset allocation. Morningstar is recognized as one of the Best Financial API Providers. Its mid-platform value is attributed to its research-driven approach, careful industry reputation, and integration of advanced industry financial intelligence into contemporary digital frameworks to enhance investment strategies and portfolio management.

Morningstar API Features, Advantages & Disadvantages

Features

- Data on investment research

- Fund performance metrics and ratings

- Portfolio analytics

- Insights on asset allocation

- Reports on performance in the market

Advantages

- Data source is highly trusted

- Financial insights of professional quality

- Perfect for advisors and platforms for wealth management

- Data coverage with strong history

- Research methodology is very dependable

Disadvantages

- Access is very costly for full data

- Developer’s self-service options are limited

- Learning is more difficult

- There is less data in real-time

- Onboarding is more geared towards enterprises

Conclusion

In conclusion, developing safe, scalable, and user-friendly financial applications requires selecting from the Best Financial API Providers. Platforms like Plaid, Stripe, PayPal, Visa, and Morningstar show how strong APIs can increase data access, streamline payments, reduce fraud, and provide useful financial information.

The correct API partner guarantees regulatory compliance, smooth integration, and long-term dependability whether you are creating an enterprise-grade payment system, a fintech startup, or an investing platform.

You can speed innovation, increase customer confidence, and develop digital financial experiences that are ready for the future by coordinating your business objectives with a reliable financial API supplier.

FAQ

What are Financial API Providers?

Financial API providers offer application programming interfaces that allow developers to connect apps with banking systems, payment networks, market data platforms, and financial services. These APIs enable features like payments, account linking, investment data access, fraud detection, and financial analytics within web and mobile applications.

Which are considered the Best Financial API Providers?

Some of the best financial API providers include Plaid, Stripe, PayPal Developer API, Square API, Visa Developer API, Mastercard Developers, Yodlee, Alpaca, IEX Cloud, and Morningstar. These platforms are known for reliability, strong security standards, developer-friendly tools, and broad financial service coverage.

How do Financial APIs improve application security?

Financial APIs use encryption, tokenization, multi-factor authentication, and compliance standards like PCI-DSS, GDPR, and SOC 2. These measures protect sensitive data, reduce fraud risk, and ensure secure transactions between users, applications, and financial institutions.

Are Financial APIs suitable for startups and small businesses?

Yes, many providers offer flexible pricing models, sandbox environments, and detailed documentation that make it easy for startups and small businesses to integrate financial features without heavy upfront costs. Platforms like Stripe, Square, and Plaid are especially popular for early-stage products.

What should I look for when choosing a Financial API Provider?

Key factors include security compliance, documentation quality, scalability, supported regions and currencies, uptime reliability, pricing transparency, and customer support. Choosing a provider that aligns with your business model and technical stack is essential for long-term success.