I’ll solely talk about the top AI tools for on-chain analysis in this post. These apps use cutting-edge AI to follow blockchain activity, evaluate transactions, and provide useful information for traders, investors, and cryptocurrency fans.

- What is On-Chain Analysis?

- How To Choose AI Tools for On-Chain Analysis

- Data Coverage & Blockchain Support

- AI & Analytical Capabilities

- Ease of Use & Customization

- Security & Compliance Features

- Pricing & Subscription Plans

- Community & Support

- Integration & API Access

- Key Point & Best AI Tools for On-Chain Analysis

- 1. Arkham Intelligence

- Arkham Intelligence Features, Pros & Cons

- 2. Glassnode

- Glassnode Features, Pros & Cons

- 3. Messari

- Messari Features, Pros & Cons

- 4. Token Terminal

- Token Terminal Features, Pros & Cons

- 5. Dune AI

- Dune AI Features, Pros & Cons

- 6. Chainalysis

- Chainalysis Features, Pros & Cons

- 7. Elliptic

- Elliptic Features, Pros & Cons

- 8. Covalent AI

- Covalent AI Features, Pros & Cons

- 9. CryptoQuant

- CryptoQuant Features, Pros & Cons

- 10. Santiment

- Santiment Features, Pros & Cons

- Risk & Considerations

- Reliability and Accuracy of Data

- Risks of Security and Privacy

- Subscription Fees and Costs

- Learning Curve and Complexity

- Volatility of the Market

- Restricted Multi-Chain Capability

- Dependence on AI

- Compliance and Regulatory Issues

- Conclusion

- FAQ

These services offer trustworthy, up-to-date information on anything from wallet behavior to market trends, which facilitates decision-making in the rapidly evolving cryptocurrency space.

What is On-Chain Analysis?

Examining blockchain data straight from the ledger to learn more about bitcoin transactions, network activity, and wallet behavior is known as “on-chain analysis.” Metrics including transaction volumes, token movements, active addresses, liquidity, and smart contract interactions are all tracked.

On-chain analysis is used by traders, investors, and organizations to evaluate the state of blockchain networks, comprehend market trends, and make data-driven choices.

On-chain analysis is a crucial tool for anybody navigating the cryptocurrency ecosystem since it can discover abnormalities, forecast price fluctuations, spot whale activity, and uncover new opportunities by utilizing AI and advanced analytics.

How To Choose AI Tools for On-Chain Analysis

Data Coverage & Blockchain Support

Consider the types of blockchains the tool covers. Ideally, the best AI tools extend coverage to a variety of chains, including Ethereum, Bitcoin, and Solana. Sounds good? Look for tools that provide a multi-chain or cross-chain analysis solutions!

AI & Analytical Capabilities

What type of AI features do you get? Look for predictive analytics, anomaly detection, and automated insights. If the tool can identify and analyze trends, these AI capabilities are good. The best tools help users make quick and accurate decisions, whether it’s for an investment or research!

Ease of Use & Customization

Look for an Ease-of-use features such a simple, uncluttered interface, or a customizable dashboard, with the ability to set a personal layout or preference for query modules. With more advanced tools, such as Dune AI, users get the ability to build their own dashboards, and this reduces their reliance on engineering skills to analyze the data.

Security & Compliance Features

When lots of money is on the line, gaps compliance can be a problem. With tools that include these modules, such as Chainalysis and Elliptic, you don’t need to worry about the gaps. The AI is also set to keep things more secure, so the insights will be safe!

Pricing & Subscription Plans

Evaluate both free and paid plans to choose according to your requirements. A few tools have limited free access, and subscriptions would often be needed for premium features, such as advanced analytics and APIs. Select plans that meet your budget and growth expectations.

Community & Support

Resources, such as active communities, responsive support, and documentation, help you to resolve problems quickly and learn about recent changes. Glassnode and Dune AI have user communities that are great for this purpose.

Integration & API Access

If you need to link your analytics with trading platforms, dashboards, or automated strategies, look for tools that offer API access and easy integration.

Key Point & Best AI Tools for On-Chain Analysis

| Platform | Key Point |

|---|---|

| Arkham Intelligence | Provides on-chain intelligence and blockchain analytics for tracking wallet activity and DeFi transactions. |

| Glassnode | Offers comprehensive on-chain metrics, market insights, and investor behavior analysis for crypto assets. |

| Messari | Delivers crypto research, news, and data analytics, including detailed profiles for projects and tokens. |

| Token Terminal | Focuses on fundamental crypto metrics like revenue, valuation, and financial health of blockchain projects. |

| Dune AI | Enables custom queries and dashboards on blockchain data for analytics and insights using SQL-based analytics. |

| Chainalysis | Specializes in blockchain compliance, transaction monitoring, and crypto crime detection for businesses. |

| Elliptic | Provides blockchain risk management, compliance tools, and fraud detection solutions for crypto firms. |

| Covalent AI | Offers unified API for blockchain data, enabling analytics across multiple chains and DeFi platforms. |

| CryptoQuant | Supplies on-chain data analytics for exchanges, miners, and market sentiment to support trading strategies. |

| Santiment | Focuses on on-chain, social, and development metrics to provide actionable crypto market insights. |

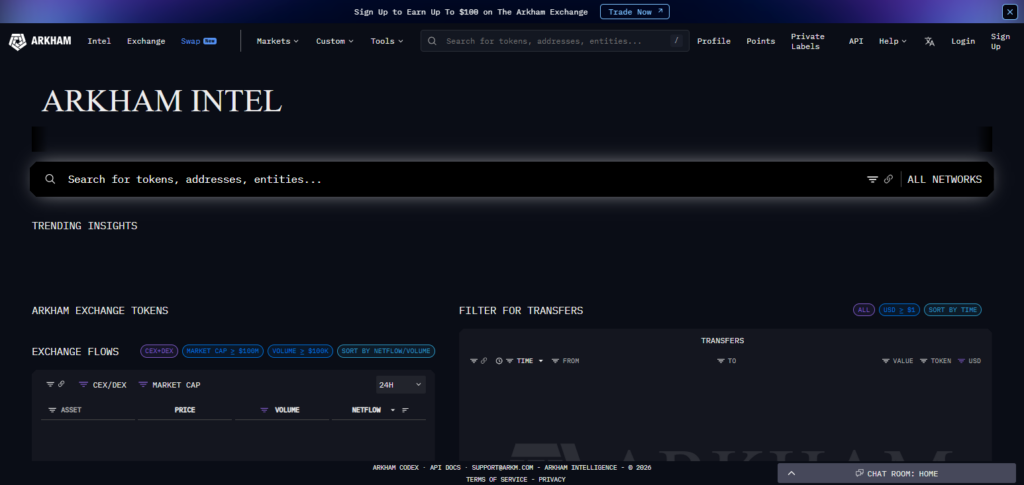

1. Arkham Intelligence

Blockchain-based analytics platform, Arkham Intelligence, provides wallet behavior analytics and on-chain analysis, as well as analytics of activities in the DeFi space. Arkham specializes in tracing the flow of transactions, studying who the active investors are, and pinpointing the wallets of crypto market movers.

Analysts use Arkham’s advanced AI tools for predictive analytics and strategic positioning analysis. Arkham Intelligence is included in the Best AI Tools for On-Chain Analysis because of the advanced ways in which it visualizes inter-wallet relationships, analyzes the risk of interactions, and provides real-time analyses for market participants, including retail and institutional investors.

Arkham Intelligence Features, Pros & Cons

Features:

- Tracking of wallets and their transactions

- Analysis of DeFi activities

- Predictive analytics using AI

- Visualization and clustering of wallets

- Dashboards and alerts in real-time

Pros:

- Excellent wallet activity tracking

- Powerful AI insight generation

- On-chain movements in real time

- Useful for both investors and institutions

- Illustrates intricate wallet networks

Cons:

- It might be hard for novice users

- Access to free version is limited

- Must comprehend blockchain systems

- Primarily concentrated on Ethereum and significant DeFi chains

- High prices for corporate solutions

2. Glassnode

Glassnode tracks blockchain metrics and other relevant market indicators in real-time, in addition to analyzing investor behavior.

They provide insight regarding active addresses, transaction counts, network health, and liquidity. Glassnode is relied upon by traders and market participants for long-term predictions and data-driven strategies.

They have been recognized for having some of the Best AI Tools for On-Chain Analysis due to their ability to visualize records of complex blockchain data, provide alerts, and assist clients in understanding macro market trends via the use of advanced AI. Their dashboards are easy to read and aid in the mitigation of risk related to crypto investments.

Glassnode Features, Pros & Cons

Features:

- Cross-chain on-chain analysis

- Tracking of active users and transactions

- Analytics on network health

- Market sentiment tracking

- Dashboards that can be customized

Pros:

- Coverage is reliable, rich in data

- Useful for in real-time for analytics and trading

- Dashboards that are easy to comprehend and visualize

- Coverage of Bitcoin, Ethereum, and leading altcoins

- Great reputation in the analytics and crypto world

Cons:

- High price plans for advanced features

- Steep learning curve for new users

- Oversaturation of data

- Predictive analysis is not strong

- Coverage is limited to large, established coins

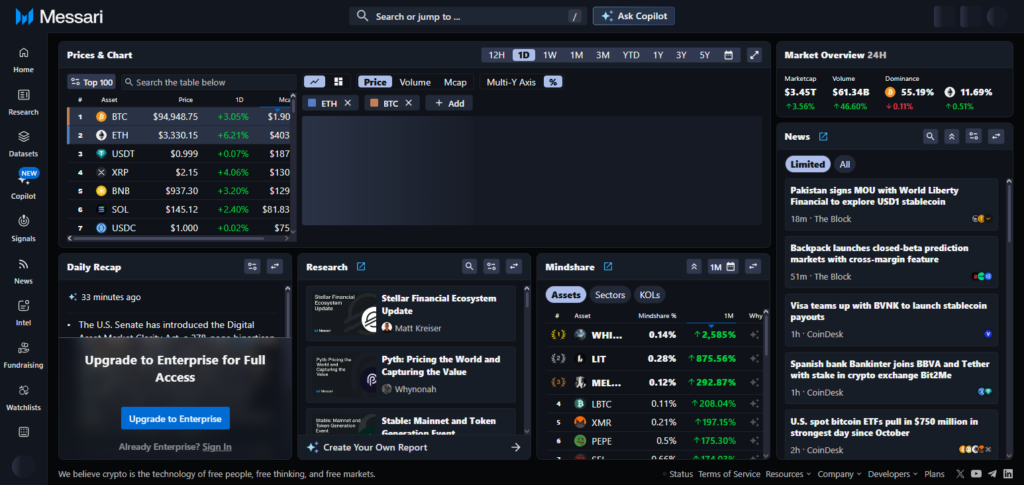

3. Messari

Messari is an all-in-one cryptocurrency research platform that fuses market intelligence, crypto news, and rich blockchain project analytics. They provide project profiles, token metrics, regulatory updates, and insight on the trend.

Messari is used by investors in order to better understand the fundamentals of a cryptocurrency and conduct due diligence on a new offering.

Messari is recognized for having some of the Best AI Tools for On-Chain Analysis due to their ability to apply AI analytics on reliable on-chain data, which helps users evaluate token economics, liquidity, and the performance of projects. Messari is excellent for complex crypto decision-making due to their metrics and research reports.

Messari Features, Pros & Cons

Features:

- News about and research on crypto projects

- Market data and token metrics

- Analysis on the fundamentals of blockchain projects

- Alerts and updates about regulations

- Personalized dashboards and reports

Pros:

- Research platform of great breadth

- Insights about tokens/projects in great detail

- Great for investors who are conducting due diligence

- Merges analytics with news

- For specialists, robust analytics tools

Cons:

- For complete features, paid subscription is needed

- Not a lot of focus on real-time trading alerts

- For a casual user, it can be a lot

- Predictive capabilities of AI is limited

- Research focused, less visualization

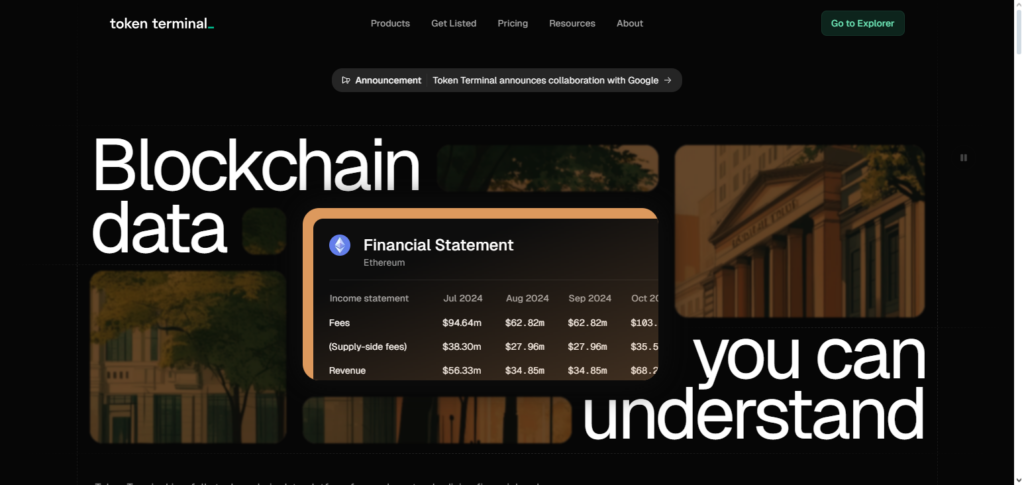

4. Token Terminal

Token Terminal is specialized in providing analytics on the financial fundamentals of blockchain analytics so that investors can assess revenue models, valuation of the project, and the tokenomics.

It provides data on users, cash flow, and market performance so that project comparisons and evaluation of investment decisions can be made.

Token Terminal was awarded as one of the Best AI Tools for On-Chain Analysis due to the integration of AI in providing forecast analytics, growth trend analytics, and identifying hidden profits. It provides numerous dashboards that depict data that is complex in nature on blockchain and DeFi ecosystems in an easy to understand format.

These dashboards help both retail and institutional investors in the effective and strategic allocation of their capital in the highly uncertain crypto investment environment.

Token Terminal Features, Pros & Cons

Features:

- Analytics of revenue and valuations of crypto projects

- Analysis of tokenomics

- Metrics for users and transactions

- Comparison of DeFi and blockchain projects

- Dashboards with data-driven insights

Pros:

- Centered on core fundamental financial metrics

- Assists to assess project value and health

- Ideal for institutional investors

- Comparison among projects is clear and straightforward

- For DeFi tokens, reliable revenue tracking

Cons:

- Small or niche projects are not adequately supported

- To access full features, a subscription is required

- Social or market sentiment is less focused on

- For short-term trading analysis, it’s not ideal

- Some financial literacy is needed

5. Dune AI

Dune AI has the best offerings for blockchain querying, visualization, and dashboard construction. It empowers users with the ability to perform their unique SQL queries on blockchain datasets, providing analytics down to the level of individual DeFi protocols, NFTs, and even transaction granular flows.

Dune AI currently is among the Best AI Tools for On-Chain Analysis, and is very flexible and provides analysts with the ability to customize dashboards for real-time insights and monitoring of emerging patterns.

The available templates, API integration, and the ability to customize for a no-code solution provide great value for researchers, traders, and developers who need on-chain data and are not highly specialized in the technical layers of blockchain.

Dune AI Features, Pros & Cons

Features:

- API for integration

- Multi-chain capability

- Templates from the community

- Custom dashboards and visualizations

- SQL-based blockchain query system

Pros:

- Customizable analytics

- Flexible pricing (both free and premium plans)

- Great for developers and analysts

- Templates from the community

- Analysis of data (both real-time and historical)

Cons:

- Advanced SQL queries require knowledge of SQL

- Users may find the system daunting

- No native predictive AI models

- Fewer curated insights; more focus on user dashboards

- Fewer compliance features

6. Chainalysis

Chainalysis is a leading platform for blockchain compliance and investigations. It is used for regulatory compliance, fraud detection, risk assessments, and monitoring transactions.

It helps businesses and regulatory entities identify and detect suspicious activities, track the movement of funds, and comply with regulations related to cryptocurrencies.

Chainalysis is listed as one of the Best AI Tools for On-Chain Analysis due to its integration of AI to predict the flow of transactions, detect the presence of malefactors, and supply actionable intelligence to help other financial institutions and law enforcement agencies.

It helps support risk mitigation, transparency, and trust in the crypto ecosystem which is critical for secure, compliant, corporate trading.

Chainalysis Features, Pros & Cons

Features:

- Monitoring for blockchain compliance.

- Detection of fraud and risk.

- Analysis and tracking of transactions.

- Tools for regulatory reporting.

- Dashboards for enterprises.

Pros:

- Great for compliance and security.

- Used by institutions and regulators.

- Detection of fraudulent wallets and actions.

- Audit reporting and documentation.

- Support for a variety of blockchains.

Cons:

- Costly for single users.

- Trading insights occur less frequently.

- Beginners may find it difficult.

- Compliance – centric.

- Users may find the visuals limiting.

7. Elliptic

Elliptic is a risk management and blockchain analytics platform for compliance, fraud, and AML (anti-money laundering) detection solutions. It provides enterprise-level analytics and reporting as well as the detection of fraud in suspicious wallets and transactions.

Recognized as one of the Best AI Tools for On Chain Analysis for its ability to detect and analyze the presence and flow of transactions and provide insight in the future for financial institutions and crypto companies, Elliptic uses AI to predict and analyze possible irregularities.

His level of cross-chain tracking of cryptocurrencies strengthens the security of the organizations he serves from the risk of fraud, providing the confidence required to operate within the regulations.

Elliptic Features, Pros & Cons

Features:

- Tools for compliance with anti-money laundering (AML)

- Detection of fraud and risk scoring.

- Monitoring of transactions and wallets.

- Analytics for fraud investigation on blockchains.

- Reporting on compliance.

Pros:

- Outstanding security for enterprises and compliance.

- AI for anomaly detection.

- Industry Certifications

- Fraud and Risk Mitigation

Cons:

- Premium Cost

- Less Comprehensive for Market Analytics or Trading

- Investment Guidance is Secondary, Compliance is Primary

- Casual User Dashboards are Sparse

- AML Knowledge is Required

8. Covalent AI

With a single API for blockchain data, Covalent AI offers thorough on-chain analytics across several chains. It helps businesses, investors, and developers monitor DeFi activities, token flows, and smart contract interactions.

Covalent AI is one of the best AI tools for on-chain analysis because of its real-time insights and ease of integration, which let users create dashboards, conduct market research, and automate analytics.

It enables organizations and developers to make data-driven decisions, simplify blockchain analytics, and obtain a comprehensive understanding of the decentralized ecosystem by combining data from hundreds of blockchain networks.

Covalent AI Features, Pros & Cons

Features:

- All-in-One API for blockchain information

- Multi-chain Accessibility

- Insights for Tokens and DeFi

- Historical and Real-Time Data

- Dashboards and Applications Integration

Pros:

- Seamless API Functionality

- Hundreds of Blockchains Covered

- Excellent for Analysts and Developers

- Access to Data in Real-Time

- No Cost for Limited Access

Cons:

- Creating Dashboards Requires Technical Skills

- More Intermediate Level Dashboards

- Automated Thought Processes are Minimal

- More Data than Insights

- Costs for Enterprise Capabilities can be Significant

9. CryptoQuant

CryptoQuant is one of the more powerful platforms used for analytics regarding the on-chain financial market, as well as data on the analytic flow of exchange, miner activity, on-chain liquidity, and liquidity concentration.

CryptoQuant provides customer analytic metrics such as inflows, outflows, exchange liquidity, out of chain liquidity, and exchange reserve, as well as market sentiment. CryptoQuant employs these algorithms for predictive analytics.

CryptoQuant is one of the Best AI Tools For On-Chain Analysis. For data intensive on-chain analysis and crypto trading, CryptoQuant is a preferred provider based upon the comprehensive dashboards that enable users to assess and optimize all aspects of portfolio crypto trading, as well as data driven analytics and all aspects of the crypto portfolio.

CryptoQuant Features, Pros & Cons

Features:

- Market Analysis and Prediction

- On-Chain Data Dashboards

- Alerts for Data Anomalies

- Analysis of Miners and Liquidity

- Flow of Exchanges

Pros:

- Top Tier for Traders Tracking Market Movements

- Alerts for Whale Movement in Real-Time

- Data for Exchanges is Entirely Comprehensive

- Analysis of Major Coins and BTC, ETH are Included

- Both Analyses – Short and Long – are Supported

Cons:

- Analytics for Multiple Chains is Lacking

- Free version has limitations

- Less emphasis on primary project evaluation

- Dashboards may be complicated for newbies

- Sparse features for compliance

10. Santiment

Santiment offers analytics for the crypto market from the perspective of on-chain analytics, social analytics, and development analytics, focusing on the activities of the tokens, expansion of the network, and market sentiment.

It holds the data related to the active addresses, social interaction related to the project, and the changes brought about the development of the project to provide the overall project health.

Among the Best AI Tools for On-Chain Analysis, Santiment combines social data and blockchain data to provide predictive analytics and actionable insights for traders/investors using social signals and blockchain data analytics.

It provides insightful dashboards for users so that they can discover patterns, anticipate chances for profitable trading, and enhance their trading methods using on-chain data and community analytics.

Santiment Features, Pros & Cons

Features:

- Development, social, and on-chain metrics

- Tracking of token activity and network growth

- Analysis of market sentiments

- Insights through Predictive AI

- Alerts and dash boards are customizable

Pros:

- Effective synthesis of social data and on-chain

- Predictive analytics on the market

- Effective in identifying new trends

- Dashboards are customizable for traders

- Supports a wide range of block-chains

Cons:

- Limited features on the free plan

- AI predictions could be wrong

- More data analytics, less compliance

- Can be complex for a new user

- Some metrics could be harder to understand

Risk & Considerations

Reliability and Accuracy of Data

The data on the blockchain is transparent. However, the AI tools are only as good as the interpretations. Missing pieces of a data set, or a misconfigured query, can lead to incorrect insights. These can negatively impact a trade or an investment. Always verify data cross-referencing multiple data sources.

Risks of Security and Privacy

Some tools require wallet connections or an API key. If these are not properly secured, sensitive information can be leaked. Always use reliable tools with good security practices.

Subscription Fees and Costs

Most advanced AI tools have paid subscriptions for full access. For smaller investors, the cost of enterprise-level subscriptions can be debilitating. Analyze if the cost is worth the features.

Learning Curve and Complexity

Some tools like Dune AI or Covalent AI require at least some technical or coding knowledge. If the tool is too advanced, newbies may have a hard time with the setup, dashboards, or with writing the queries. Select tools that align with your skills.

Volatility of the Market

While on-chain analysis can be helpful, it does not guarantee future outcomes of the market. The cryptocurrency market is highly unstable and the AI tools can not be relied on to predict some of the more sudden changes in the market.

Restricted Multi-Chain Capability

Certain services are specialized to certain blockchain networks (like Ethereum or Bitcoin). If you deal with multiple chains, check if the service has the blockchain networks you require.

Dependence on AI

AI can improve your analysis, but should not be the substitute for your own research or any risk management. Let AI insights lead you, but do not take them as gospel.

Compliance and Regulatory Issues

For institutional or corporate trading using AI tools, ensure that your use adheres to applicable local regulatory and reporting obligations with respect to financial trading.

Conclusion

To sum up, the way traders, investors, and institutions manage the intricate cryptocurrency ecosystem has been completely transformed by the Best AI Tools for On-Chain Analysis.

While Dune AI, Covalent AI, and CryptoQuant enable custom analytics and real-time data tracking, platforms such as Arkham Intelligence, Glassnode, Messari, and Token Terminal offer practical insights into market behavior, tokenomics, and project foundations.

Santiment integrates social and on-chain analytics for predictive market insights, while security-focused solutions like Chainalysis and Elliptic guarantee compliance and fraud detection. In an increasingly data-driven cryptocurrency environment, utilizing these AI-powered platforms enables users to make well-informed decisions, reduce risks, and maximize opportunities.

FAQ

What are on-chain analysis tools?

On-chain analysis tools are platforms that track, analyze, and visualize blockchain data directly from the ledger. They provide insights into transaction flows, wallet behavior, token activity, and network metrics, helping traders, investors, and institutions make informed decisions.

Which are the best AI tools for on-chain analysis?

Some of the top tools include Arkham Intelligence, Glassnode, Messari, Token Terminal, Dune AI, Chainalysis, Elliptic, Covalent AI, CryptoQuant, and Santiment. Each offers unique features, from market insights and custom dashboards to compliance monitoring and predictive analytics.

Why use AI-powered on-chain analysis tools?

AI-powered tools enhance traditional on-chain analysis by processing vast amounts of blockchain data in real-time. They identify trends, detect anomalies, predict market movements, and generate actionable insights, reducing risk and improving investment strategies.

Can on-chain AI tools detect fraudulent activity?

Yes. Platforms like Chainalysis and Elliptic specialize in identifying suspicious transactions, wallet clusters, and potential fraud, helping businesses and regulators ensure compliance and reduce financial risk.

Are these tools suitable for both beginners and professionals?

Yes. Tools like Dune AI and Santiment offer user-friendly dashboards for beginners, while advanced features in Glassnode, Covalent AI, and Token Terminal cater to professional analysts and institutional investors.