The Best The5ers Prop Firm Alternatives for Traders in 2026 will be covered in this post. These substitutes offer flexible trading conditions, competitive profit splits, and funded accounts on well-known platforms including cTrader, MT4, and MT5.

- What is The5ers Prop Firm Alternatives?

- How To Choose The5ers Prop Firm Alternatives

- Key Point & Best The5ers Prop Firm Alternatives List

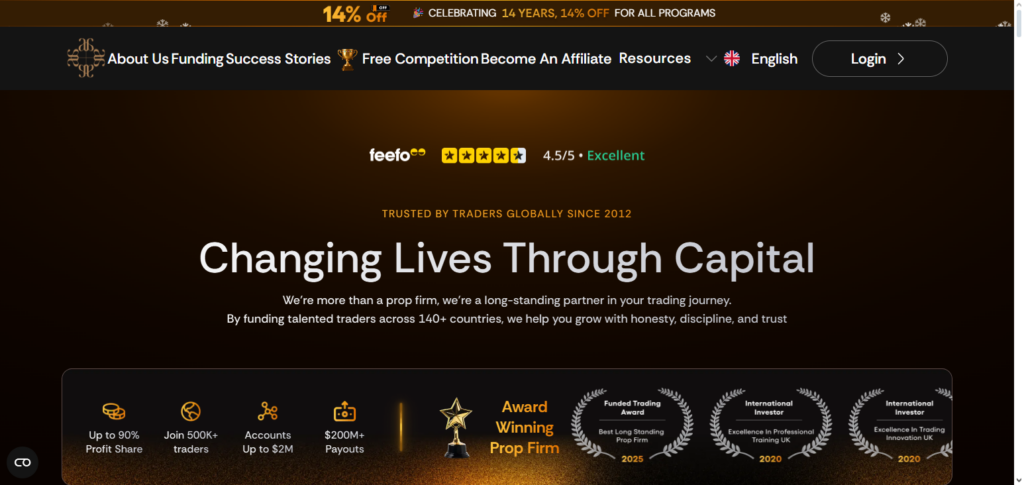

- 1. Audacity Capital

- Audacity Capital Features, pros & Cons

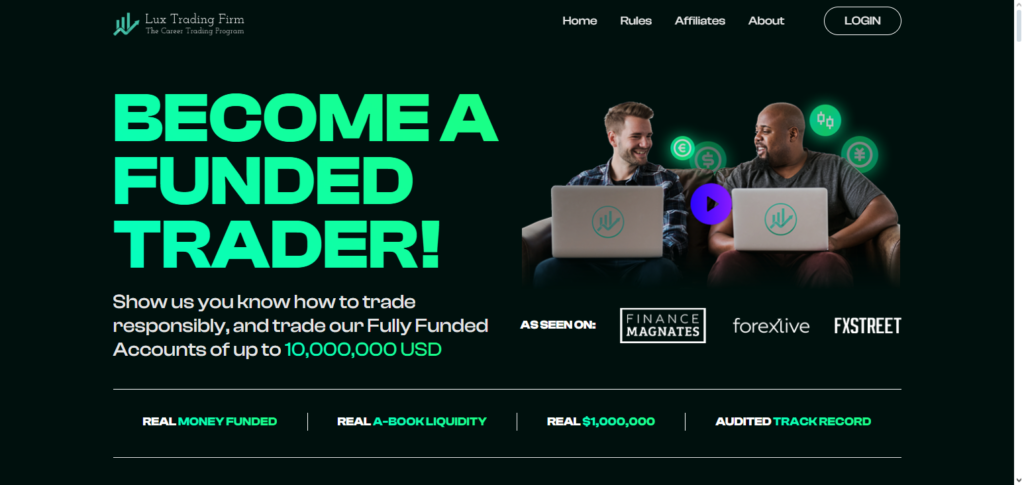

- 2. LuxTrading Firm

- LuxTrading Firm Features, pros & Cons

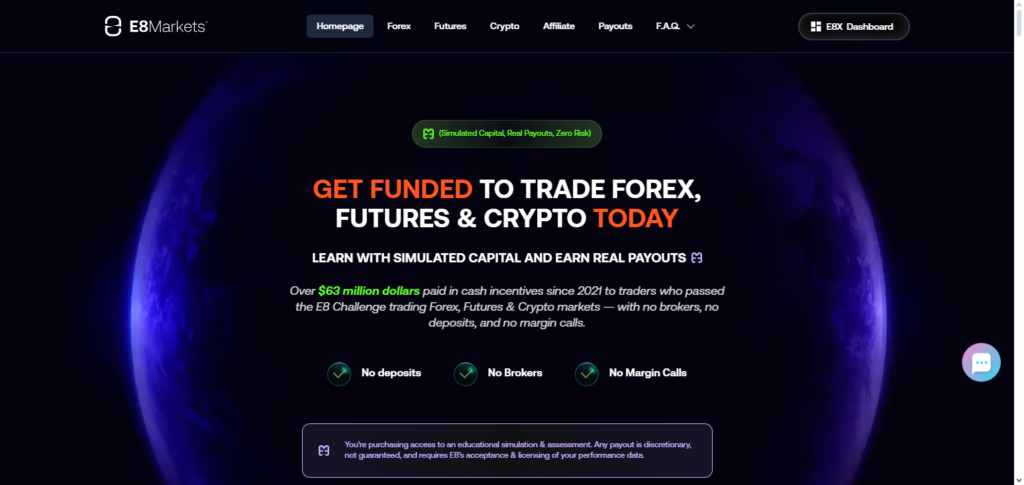

- 3. E8 Funding

- E8 Funding Features, pros & Cons

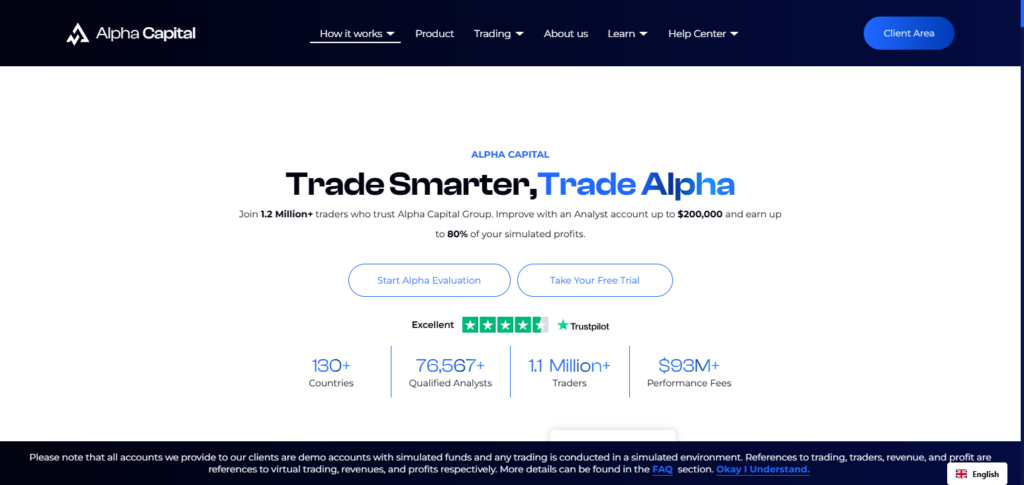

- 4. Alpha Capital Group

- Alpha Capital Group Features, pros & Cons

- 5. RebelsFunding

- RebelsFunding Features, pros & Cons

- 6. TradeDay

- TradeDay Features, pros & Cons

- 7. Finotive Funding

- Finotive Funding Features, pros & Cons

- 8. FundedNext

- FundedNext Features, pros & Cons

- 9. Ment Funding

- Ment Funding Features, pros & Cons

- 10. ThinkCapital

- ThinkCapital Features, pros & Cons

- Conclusion

- FAQ

Examining these possibilities can help you increase your capital and trade with less personal risk, regardless of your level of experience.

What is The5ers Prop Firm Alternatives?

Other proprietary trading companies that provide traders with comparable funding opportunities, trading difficulties, and growth plans are The5ers Prop Firm Alternatives. While adhering to the firm’s regulations, these options enable traders to access funds, trade with less personal risk, and possibly grow their accounts.

By selecting an alternative, traders can choose the prop firm that best suits their trading style and objectives by having greater choice in terms of account sizes, profit splits, risk management guidelines, and evaluation procedures.

How To Choose The5ers Prop Firm Alternatives

Funding Options: Look at the different account sizes and capital the firm offers. Make sure it aligns with your trading style and risk appetite.

Profit Split & Payouts: Analyze the profit share and how often you can withdraw to maximize your profits.

Evaluation Rules: Consider the firm’s challenge or evaluation requirements. Do they have specific trading goals? What are the drawdown limits and timeframe conditions?

Trading Flexibility: Check what markets and instruments you can trade. What trading styles are allowed (scalping, swing, or day trading)? What leverage do they offer?

Reputation & Support: Look into trader reviews to gauge the firm’s reliability and the responsiveness of their support to ensure you are making the right choice.

Key Point & Best The5ers Prop Firm Alternatives List

| Prop Firm | Key Points / Features |

|---|---|

| Audacity Capital | Flexible account sizes, high profit splits, fast scaling programs, global access, supportive community. |

| LuxTrading Firm | Low evaluation fees, multiple account options, transparent rules, consistent payouts, trader-friendly platform. |

| E8 Funding | Instant funding for skilled traders, reasonable risk rules, flexible trading styles, competitive profit share, simple onboarding. |

| Alpha Capital Group | Offers mini to large accounts, clear trading rules, fast withdrawals, multiple trading instruments, global trader support. |

| RebelsFunding | Quick funding, flexible profit split, low challenge requirements, trader education support, easy scaling. |

| TradeDay | Simple evaluation, fair rules, rapid payout system, scalable accounts, trader-focused risk management. |

| Finotive Funding | Multiple account types, low evaluation fees, diverse market access, transparent conditions, supportive trading community. |

| FundedNext | Fast evaluation, competitive profit splits, flexible risk parameters, easy account scaling, instant funding. |

| Ment Funding | Clear evaluation paths, multiple account sizes, trader-friendly platforms, moderate risk rules, prompt payouts. |

| ThinkCapital | Flexible funding programs, various account tiers, global access, transparent trading conditions, strong trader support. |

1. Audacity Capital

Audacity Capital is recognized for its trader-centric offerings, with varying account sizes and an up to 80% profit split. Traders have the opportunity to quickly scale their accounts, provided they achieve the requisite performance metrics.

The company is compatible with various trading platforms, including MT4, MT5, and cTrader, and offers trading options for Forex, indices, and commodities. The rules regarding risk are straightforward, with defined daily and total drawdown limits. For those seeking a comparable growth potential to The5ers and wanting to keep personal risk at a reasonable level, Audacity Capital is a solid option.

Audacity Capital Features, pros & Cons

Features:

- Account options of varying sizes

- Up to 80% profit share

- MT4, MT5, and cTrader support

- Scaling of accounts is done quickly

- Rules are clear and transparent

Pros:

- Multiple funding paths for traders

- Comprehensive support in trader education

- Payouts are done quickly and consistently

- Risk management is done at clear levels

- Accessible globally

Cons:

- Evaluation fees can be high for newbies

- Trading in cryptocurrency is highly limited

- Account scaling done is contingent on compliance to several rules

- Advanced accounts come with more features

- The time taken to respond to customer support varies

2. LuxTrading Firm

LuxTrading Firm has low-cost evaluation challenges and uses scale-able challenges with trader’s payout split of 75-80%. They do weekly as well as frequent payouts. They allow traders to use MT4, MT5, and cTrader platforms, which offer Forex, commodities, indices, and crypto. They have transparent set of rules, with daily and maximum draw-downs.

They have a variety of profiles for scalpers, swing traders, and long-term traders. LuxTrading Firm puts trader satisfaction first, and has made it easy for them to access scale-able accounts, with a responsive educator team and a strong customer services, making them one of the best firms to offer traders a The5ers’s-style funded trading experience.

LuxTrading Firm Features, pros & Cons

Features:

- Evaluation challenges that are low cost

- Different types of accounts

- Up to 80% profit share

- Trading on MT4, MT5, and cTrader

- Rules on drawdown are transparent

Pros:

- New traders can enter at a low price

- The conditions for trading are clear

- Account scalability for traders who are profitable

- Satisfactory trading on forex, indices, and commodities.

- Support is very responsive

Cons:

- Leverage on some accounts is limited

- Resources for education on trading are practically nonexistent

- Trading in cryptocurrency is highly limited

- Some traders may find the evaluation period to be inadequate

- In the processing of withdrawals, there may be a delay

3. E8 Funding

E8 Funding offers instant funded trader accounts with $0 risk. They offer trader a profit split of 80% and flexible withdrawals. They offer trading for Forex, commodities, and indices on MT4, MT5, and TradingView integration.

They have straightforward evaluations which focus trader to use a single strategy, as the draw down limit is high. E8 Funding is best for traders who want low-risk capital growth and have strong transparent service with a focus on scalability. They have strong competitors to The5ers with plenty of accounts, flexible pricing, and added educational content.

E8 Funding Features, pros & Cons

Features:

- Funding is available right away for skilled traders.

- All trading styles are permitted.

- Up to 80% profit split.

- Compatible with MT4, MT5, and TradingView.

- Relaxed drawdown limitations.

Pros:

- Immediate ability to access funds.

- Various trading styles supported (i.e. scalping, swing, etc.).

- Clear evaluation and rules.

- Quick to get funds.

- Evaluation costs are low.

Cons:

- Beginners get restricted account size options.

- Some markets are unavailable.

- Limited educational resources.

- Customer support can take time.

- Doesn’t suit casual traders.

4. Alpha Capital Group

Alpha Capital Group has a variety of account sizes that offer profit splits up to 80% with regular withdrawals (usually weekly or bi-weekly). They are compatible with MT4 and MT5 platforms and service the Forex, commodities, and indices markets. Evaluation rules are straightforward, consisting of daily and overall account drawdown limits to protect the trader.

They prioritize fast account scaling and offer a global trading community with educational resources. They offer flexible funding options, transparent rules, and quick customer service, making them reliable as a The5ers alternative for traders seeking capital growth while trading multiple instruments.

Alpha Capital Group Features, pros & Cons

Features:

- Account sizes vary from mini to large.

- Compatible with MT4 and MT5.

- Up to 80% profit share.

- Withdrawal speed is great.

- Defined daily and overall drawdown limits.

Pros:

- Account size flexibility for all tiers.

- Consistent payouts (weekly or bi-weekly).

- Supports traders from all over the world.

- Available trading markets (Forex, indices, commodities).

- Trustworthy and reliable.

Cons:

- Evaluation period can be tough.

- Limited options for crypto.

- To scale, strict goals have to be met.

- For large accounts, evaluations are more costly.

- Some rules may be constrictive to more risky traders.

5. RebelsFunding

RebelsFunding is optimal for traders who want quick funding, achievable profit splits of 75%-80% with multiple withdrawal options. They offer trading on MT4, MT5, and cTrader platforms for Forex, indices, and commodities. Their evaluation is flexible and provides reasonable pricing, along with clear drawdown rules with no hidden costs.

They offer account scaling for high-performing traders along with education and a focus on risk management with transparent conditions. With a strong community and responsive customer support, RebelsFunding is a reliable alternative to The5ers for traders who want funding while trading their strategies without too many restrictions.

RebelsFunding Features, pros & Cons

Features:

- Quick funding for already proven traders

- 75-80% profit sharing

- Supports MT4, MT5, and cTrader

- Challenges with low-cost evaluations

- Sets of risk management rules

Pros:

- Speedy access to funded accounts

- Diverse trading strategies accepted

- Evaluation and rules are clear

- Scalability for successful traders

Cons:

- Beginners have little accounts to choose from

- Withdrawals can be delayed

- No trading in crypto

- Evaluation rules are rigid

- Support response times can vary

6. TradeDay

TradeDay is aimed at providing the simplest possible user experience. They are quick to evaluate and offer profit splits of up to 80%. Traders can use MT4, MT5, and TradingView, and can trade Forex, indices, and commodities. TradeDay has set daily and maximum withdrawal limits, and has a variety of accounts for novices and pros.

They offer regular and quick withdrawals and support weekly or bi-weekly withdrawals. They offer account scaling and encourage traders to grow their accounts. They also offer educational support, which is very responsive. They are a good alternative to The5ers, especially for traders who want straightforward policies, fast funding, and the ability to trade flexibly with simple requirements.

TradeDay Features, pros & Cons

Features:

- No-nonsense evaluations

- Compatible with MT4, MT5, TradingView

- 80% profit sharing

- Withdrawals processed quickly

- Account sizes that scale

Pros:

- Rules that can be understood easily

- Simple evaluations

- Variety of account sizes

- Available for trading Forex, indices, and commodities

- Risk management is clear

Cons:

- Restrictions on account instruments

- Evaluation fees can be steep

- Scaling is only for top performers

- Crypto trading is limited

- Support response times can vary

7. Finotive Funding

Finotive Funding has several account types that offer profit splits of 80% and withdrawals every 1, 2, or 4 weeks. Traders can use MT4, MT5, and CTrader and trade forex, indices, commodities, and cryptocurrencies. Their evaluations are inexpensive, and they have straightforward trading rules that include daily and total drawdown limits.

Finotive Funding focuses on account scaling, teaches risk management, and has fast customer service, making it a great choice for new and veteran traders. Finotive Funding, unlike The5ers, provides traders who want unrestricted capital access with flexible funding options and a strong community.

Finotive Funding Features, pros & Cons

Features:

- Several different account types

- 80% profit sharing

- Compatible with MT4, MT5, cTrader

- Weekly payouts

- Clear rules on drawdown

Pros:

- Evaluations that are low-cost

- Rules that are fair and clear

- Good support for traders with different levels of experience

- Accounts that can be scaled

- Trading strategies that are flexible

Cons:

- Beginners can only open small accounts

- There are limitations on crypto trading

- Withdrawals are sometimes slow

- The quality of educational content is low

- Some accounts have more restrictive leverage

8. FundedNext

FundedNext provides quick evaluations and instant funding with profit splits of 80% and frequent withdrawals. Traders can use MT4, MT5, and TradingView to trade forex, indices, commodities, and crypto. They have drawdown rules that are easy to adjust, letting traders use any strategy they want whether it’s scalping, swinging, or news trading.

FundedNext has a transparent process with low fees for evaluation and account scaling for those who are profitable. It has fast customer service and useful educational materials, making it a great alternative to The5ers when traders want to access capital fast and when they want to have account growth opportunities.

FundedNext Features, pros & Cons

Features:

- Quick evaluation period

- Options for immediate funding

- Compatible with MT4, MT5, and TradingView

- You keep 80% of the profits

- More liberal risk parameters

Pros:

- Rapid trading capital availability

- Can implement various trading methods

- Straightforward evaluation process

- Account scaling for higher success tiers

- Frequent access to profits

Cons:

- Beginners may find accounts overly restrictive

- Some markets are off-limits

- Support is potentially unresponsive

- Resources for education are scarce

- You might find some of the rules around trading overly controlling

9. Ment Funding

With Ment Funding, traders can choose from a variety of account types that have profit shares of 80% with withdrawals that can be made either weekly or bi-weekly. Using MT4, MT5, and TradingView, traders can access a variety of assets, including Forex, commodities, indices, crypto, and more.

They have affordable and easy to understand evaluations and daily and overall drawdown limits. Ment Funding assists traders by providing account scaling to top performers, educational resources, and a community-based, clear, and supportive atmosphere.

Because of its positive reviews and its flexible trading options, Ment Funding is an excellent alternative to The5ers for traders looking to increase their capital while employing their chosen trading methods.

Ment Funding Features, pros & Cons

Features:

- Different account sizes are offered

- Available on MT4, MT5, and TradingView

- 80% profit share

- Withdrawals can be weekly or bi-weekly

- There are specific drawdown rules

Pros:

- Funding programs are more flexible

- Supports various trading methods

- Profitable traders can increase their account size

- The evaluation criteria are clear

- Support is dependable

Cons:

- You may only trade a small amount of crypto

- There is a fee for evaluation

- Account scaling is locked behind a consistency requirement

- The resources for beginners are scarce

- There are trade limitations for more aggressive traders

10. ThinkCapital

ThinkCapital provides flexible funding options with recurring withdrawals and profit sharing of up to 80%. Forex, indices, commodities, and cryptocurrency can all be traded on the MT4, MT5, and cTrader platforms. Evaluation problems are simple, with clear daily and maximum drawdown guidelines.

In addition to supporting account scaling for profitable traders, the company places a strong emphasis on risk management, education, and prompt client service. For traders looking for a The5ers substitute that strikes a balance between funding flexibility, transparent trading regulations, and a variety of trading instruments, ThinkCapital is perfect. This allows traders to execute strategies effectively while increasing their capital with little personal risk.

ThinkCapital Features, pros & Cons

Features:

- Flexible funding options for accounts

- Split profits to 80%

- Withdrawals are made regularly

- Risk management policies are clear and covered

Pros:

- Account sizes are flexible

- Forex, commodities, indices, and crypto are available

- High achievers get scalable accounts

- Evaluation rules are simple

- Support is quick to respond

Cons:

- With some accounts, you must pay evaluation fees

- Smaller accounts have crypto trading restrictions

- Scaling up is very rule dependent

- Not much educational content is available

- Some accounts have more restrictive leverage policies

Conclusion

For traders who wish to increase their capital while successfully controlling risk, selecting the appropriate prop firm is essential. Audacity Capital, LuxTrading Firm, E8 Funding, Alpha Capital Group, RebelsFunding, TradeDay, Finotive Funding, FundedNext, Ment Funding, and ThinkCapital are some of the alternatives to The5ers that provide flexible account sizes, competitive profit splits, clear trading rules, and access to well-known platforms like MT4, MT5, and cTrader.

Each company offers distinct advantages, such as scalable accounts and quick funding, which makes it simpler for traders to locate a program that suits their trading style. Traders may confidently choose the finest alternative to optimize profits and trading success by comparing these organizations.

FAQ

What are The5ers Prop Firm Alternatives?

The5ers Prop Firm Alternatives are other proprietary trading firms that provide funding, trading challenges, and growth programs similar to The5ers. They allow traders to access capital, trade with lower personal risk, and potentially scale their accounts based on performance.

How do these alternative prop firms work?

Most alternatives require traders to complete an evaluation or challenge to qualify for funded accounts. Once funded, traders can trade Forex, commodities, indices, or crypto on platforms like MT4, MT5, or cTrader, following the firm’s risk management rules.

What profit splits can I expect?

Profit splits typically range from 70% to 80%, depending on the firm and account type. Many firms offer frequent withdrawals, often weekly or bi-weekly, allowing traders to access profits quickly.

Which trading platforms do these firms support?

Most top alternatives support MT4, MT5, cTrader, and sometimes TradingView, enabling traders to execute scalping, swing, and long-term strategies across multiple markets.

How do I choose the right alternative?

Compare factors like account size, profit split, evaluation rules, trading platforms, risk limits, and customer support. Choose a firm that aligns with your trading style, experience, and growth goals.