The article analyzes the best performing ESG investment Funds in Europe. These funds target companies which have strong environmental and social governance and help clients grow their investment.

- What Are ESG Investment Funds?

- Why Invest in ESG Funds in Europe?

- Key Point & Best ESG Investment Funds in Europe List

- 1. Lyxor MSCI World ESG Leaders UCITS ETF

- Lyxor MSCI World ESG Leaders UCITS ETF Features

- Lyxor MSCI World ESG Leaders UCITS ETF Pros & Cons

- 2. Candriam Sustainable Equity Europe

- Candriam Sustainable Equity Europe Features

- Candriam Sustainable Equity Europe Pros & Cons

- 3. iShares MSCI Europe ESG Screened UCITS ETF

- iShares MSCI Europe ESG Screened UCITS ETF Features

- iShares MSCI Europe ESG Screened UCITS ETF Pros & Cons

- 4. Amundi MSCI Europe ESG Leaders UCITS ETF

- Amundi MSCI Europe ESG Leaders UCITS ETF Features

- Amundi MSCI Europe ESG Leaders UCITS ETF Pros & Cons

- 5. UBS MSCI Europe Socially Responsible UCITS ETF

- UBS MSCI Europe Socially Responsible UCITS ETF Features

- UBS MSCI Europe Socially Responsible UCITS ETF Pros & Cons

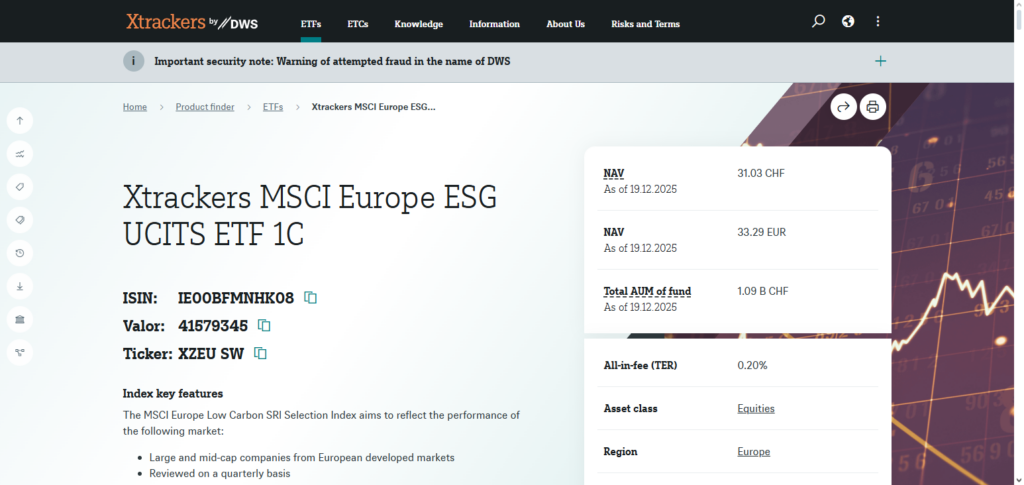

- 6. DWS Xtrackers MSCI Europe ESG UCITS ETF

- DWS Xtrackers MSCI Europe ESG UCITS ETF Features

- DWS Xtrackers MSCI Europe ESG UCITS ETF Pros & Cons

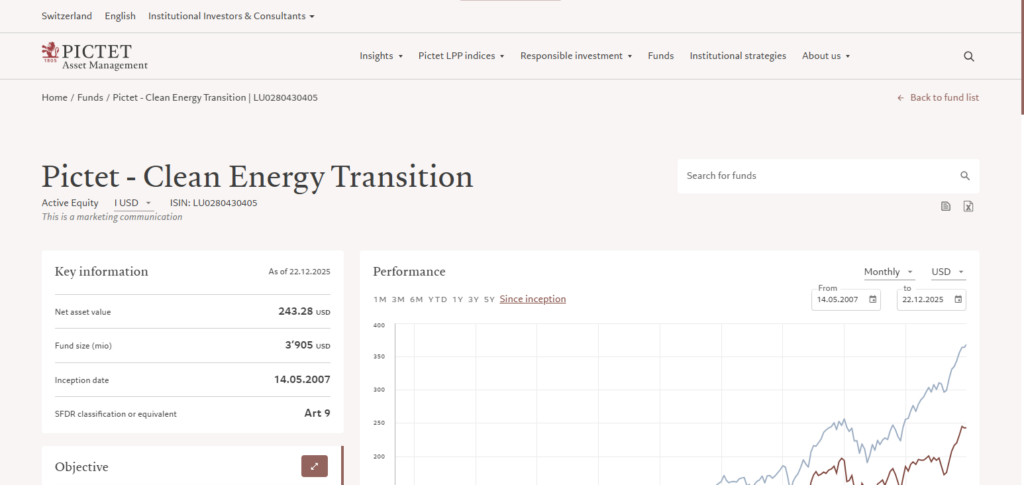

- 7. Pictet Clean Energy Transition Fund

- Pictet Clean Energy Transition Fund Features

- Pictet Clean Energy Transition Fund Pros & Cons

- 8. Nordea Global Climate and Environment Fund

- Nordea Global Climate and Environment Fund Features

- Nordea Global Climate and Environment Fund Pros & Cons

- 9. Schroder ISF Global Climate Change Equity

- Schroder ISF Global Climate Change Equity Features

- Schroder ISF Global Climate Change Equity Pros & Cons

- 10. HSBC MSCI Europe ESG Leaders UCITS ETF

- HSBC MSCI Europe ESG Leaders UCITS ETF Features

- HSBC MSCI Europe ESG Leaders UCITS ETF Pros & Cons

- Risks and Considerations

- Conclusion

- FAQ

Europe has a wide range of investment options focusing on sustainable and responsible investing on equity growth as well as diversified Smith managed sustainable equity funds.

What Are ESG Investment Funds?

Investment funds with an ESG mandate focus their investments on firms with best in class Environmental, Social, and Governance (ESG) records.

These funds seek out and invest in firms with sustainable practices and ethical governance and positive social impact and exclude firms in controversial industries, e.g. tobacco, weapons, and fossil fuels.

ESG funds can be offered as mutual funds or as ETFs and may be actively managed or passively managed funds that track an ESG-index. These funds seek to achieve long-term returns while encouraging sustainable practices and are therefore highly sought after by responsible investors.

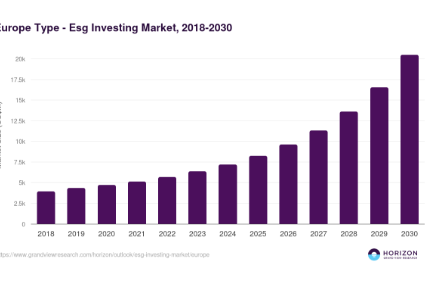

Why Invest in ESG Funds in Europe?

Ethical and Sustainable Alignment: ESG funds give investors the ability to back a company socially and to protect the environment.

Regulatory Framework: Europe has some of the strictest ESG and sustainability regulations, meaning funds have to Great due diligence.

Potential for Future Growth: Companies displaying strong ESG practices has better risk management and thus, long-term prospering financial health.

Broad Diversification: Various sectors and different countries are covered in ESG funds allowing for different diversifying investment exposure.

Lower risk exposure due to ESG: Investors will avoid controversial or unsustainable businesses, negating poor ESG risk.

Key Point & Best ESG Investment Funds in Europe List

| Fund / ETF | Key Points |

|---|---|

| Lyxor MSCI World ESG Leaders UCITS ETF | Tracks global companies with strong ESG ratings; diversified across sectors; low carbon footprint focus. |

| Candriam Sustainable Equity Europe | Actively managed European equities fund; emphasizes environmental, social, and governance criteria; integrates sustainability in stock selection. |

| iShares MSCI Europe ESG Screened UCITS ETF | Passive ETF tracking European ESG-screened companies; excludes controversial industries (e.g., tobacco, weapons). |

| Amundi MSCI Europe ESG Leaders UCITS ETF | Focuses on European companies with top ESG performance; aims for reduced ESG-related risks; ESG-compliant index methodology. |

| UBS MSCI Europe Socially Responsible UCITS ETF | Invests in socially responsible European companies; excludes controversial sectors; aims for long-term sustainable growth. |

| DWS Xtrackers MSCI Europe ESG UCITS ETF | Passively tracks MSCI ESG Europe Index; combines ESG rating with financial performance; broad European coverage. |

| Pictet Clean Energy Transition Fund | Actively invests in companies driving clean energy transition; high growth potential; focuses on renewable energy and sustainability trends. |

| Nordea Global Climate and Environment Fund | Global equities fund; invests in companies addressing climate change; emphasizes environmental innovation. |

| Schroder ISF Global Climate Change Equity | Focus on companies mitigating or adapting to climate change; global scope; actively managed for sustainable impact. |

| HSBC MSCI Europe ESG Leaders UCITS ETF | Tracks European companies with top ESG scores; diversified exposure; aligns with EU ESG regulations. |

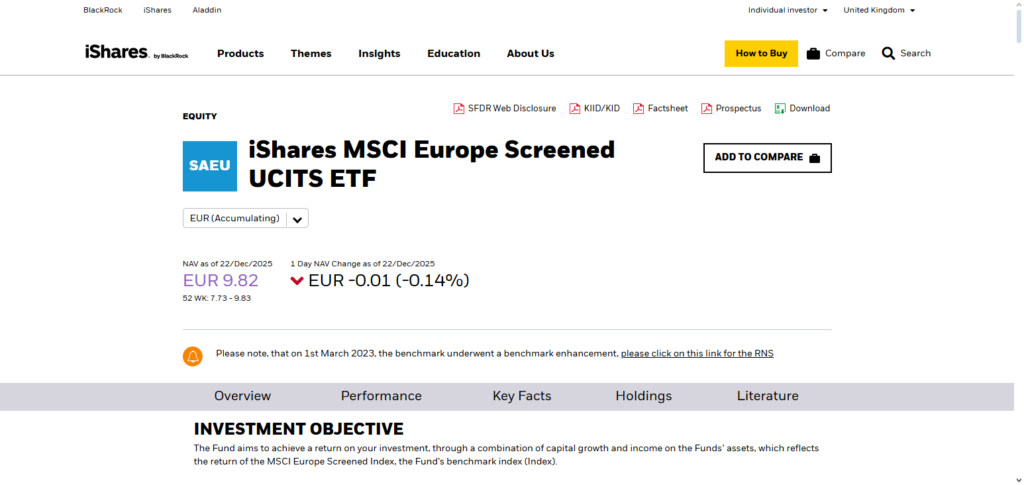

1. Lyxor MSCI World ESG Leaders UCITS ETF

Lyxor MSCI World ESG Leaders UCITS ETF is one of the Best ESG Investment Funds in Europe as it has a worldwide reach and invests in companies with superior ESG standards.

The fund tracks the MSCI World ESG Leaders Index, which includes firms with high ESG ratings, while excluding firms in controversial sectors such as tobacco, defense, and fossil fuels.

The fund provides a diversified portfolio, investing in a range of sustainable businesses in low-carbon and growing sectors. The ETF is suited for ethical, long-term investors, seeking to invest in global sustainability without losing diversified market exposure.

Lyxor MSCI World ESG Leaders UCITS ETF Features

| Feature | Explanation |

|---|---|

| Global ESG Exposure | Provides exposure to top-rated ESG companies worldwide, diversifying across sectors and regions. |

| Index Tracking | Tracks the MSCI World ESG Leaders Index, focusing on sustainability leaders while excluding controversial industries. |

| Low Carbon Footprint | Targets companies with reduced carbon emissions and environmentally responsible operations. |

| Cost Efficiency | Being an ETF, it offers low management fees compared to actively managed funds. |

| Transparency | Clear methodology and reporting on ESG criteria and holdings. |

Lyxor MSCI World ESG Leaders UCITS ETF Pros & Cons

Pros:

- Diversifies investments globally across different sectors and different countries.

- Invests in companies with better ESG ratings and strong efforts towards sustainability.

- Has a low-cost ETF structure when compared to other actively managed funds.

- Has a transparent index methodology and reporting.

Cons:

- Has a low level of active management flexibility.

- Risks exposure to global market and currency volatility.

- Has a chance of underperforming in sectors that are not prioritized by the ESG criteria.

- Underrepresenting small-cap ESG opportunities.

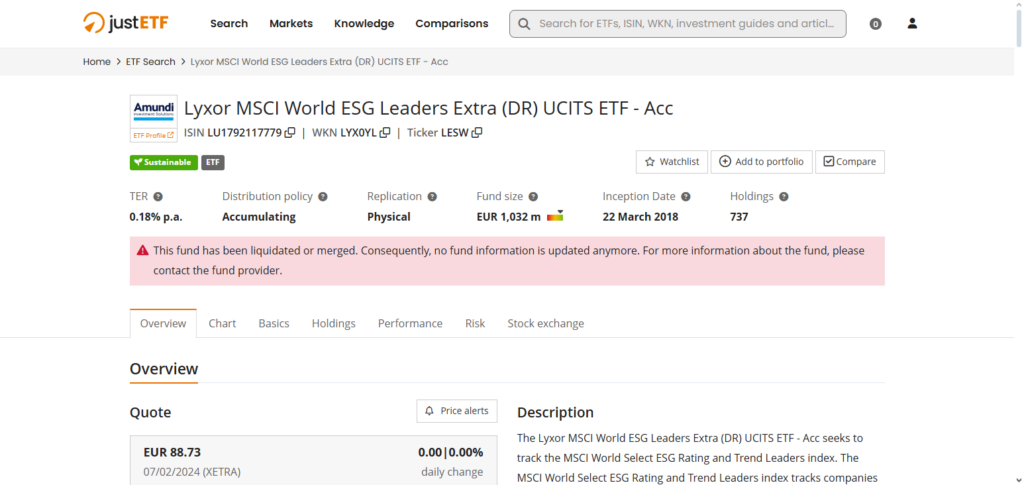

2. Candriam Sustainable Equity Europe

Candriam Sustainable Equity Europe is one of the leading ESG investment in Europe and is an actively managed European equities fund.

The fund incorporates ESG considerations in the stock selection process and targets firms with strong governance and social relations, positive impact on the environment, and with sustainability risks, as well as growth opportunities.

The fund seeks to deliver long-term returns while improving the world. Avoiding controversial sectors and improving responsible companies makes fund invest in the ethical European market. Active management lets the fund respond flexibly to ESG market opportunities.

Candriam Sustainable Equity Europe Features

| Feature | Explanation |

|---|---|

| Actively Managed | Fund managers select European companies with high ESG ratings for long-term growth. |

| Strong ESG Integration | Incorporates environmental, social, and governance criteria into stock selection. |

| Avoids Controversial Sectors | Excludes industries like tobacco, weapons, and fossil fuels. |

| Flexible Investment | Allows adjusting holdings according to market and sustainability trends. |

| Ethical European Exposure | Focuses on responsible European companies contributing positively to society and the environment. |

Candriam Sustainable Equity Europe Pros & Cons

Pros:

- Is an actively managed European equities fund with strong ESG integration.

- Has a focus that centers around long-term sustainable growth and ethical investing.

- Has an (ESG) integration that includes an avoidance of sectors like tobacco and other more controversial sectors that include weapons and fossil fuels.

- More flexible portfolio management in order to pivot to ESG trends.

Cons:

- Has higher management fees compared to the more passive ETF options available.

- Fund performance relies a lot on the performance of the manager.

- Less global diversification (concentrated in Europe).

- A chance of underperforming breadth of the European market indices.

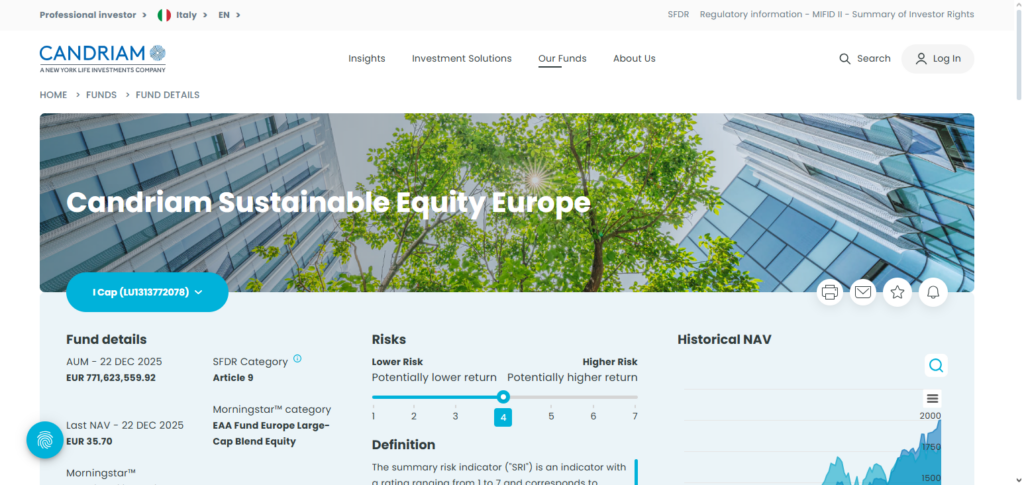

3. iShares MSCI Europe ESG Screened UCITS ETF

If you are a passive investor, you should consider this ETF as one of the best ESG investment funds in Europe. It tracks the MSCI Europe ESG Screened Index, which removes companies considered harmful in their industries, such as tobacco, controversial weapons, and thermal coal.

This ETF easily diversifies across European equities with strong ESG ratings, adding the benefits of low cost, transparency, and simplicity to investors wanting to align their investments with sustainable values.

As the ETF is focused on long-term value creation, it provides investors with the opportunity for easy, consistent ESG exposure without the hassles of active fund management.

iShares MSCI Europe ESG Screened UCITS ETF Features

| Feature | Explanation |

|---|---|

| Passive ESG Investing | Tracks the MSCI Europe ESG Screened Index, offering hands-off ESG exposure. |

| Excludes Controversial Sectors | Avoids companies involved in weapons, tobacco, and fossil fuels. |

| Broad European Coverage | Diversified across multiple industries in Europe. |

| Low-Cost ETF | Provides cost-efficient exposure to ESG equities. |

| Transparent Methodology | ESG scoring and index composition are publicly available. |

iShares MSCI Europe ESG Screened UCITS ETF Pros & Cons

Pros:

- Passive and very low cost out of all the available ESG investments.

- Broad range of ESG screened companies in Europe.

- Excluding controversial industries for responsible investing.

- Transparent index methodology.

Cons:

- Passively investing could mean missing out on the top-performing ESG companies.

- Less flexibility is limited to responding to market changes.

- Only European exposure.

- Small-cap companies may be slightly underrepresented.

4. Amundi MSCI Europe ESG Leaders UCITS ETF

Amundi MSCI Europe ESG Leaders UCITS ETF is considered among the best ESG investment funds in Europe, as it focuses on European companies with the best ESG performance.

This fund tracks the MSCI Europe ESG Leaders Index, which focuses on companies with more sustainable business practices, lower carbon emissions, and better governance. It avoids controversial sectors, maintaining diversified exposure to many sectors.

Investors receive a cost-efficient and fully transparent approach to sustainable European equity investing. This fund is financially performant and balances with ESG impacts, perfect for the ethical investor with a need for growth.

Amundi MSCI Europe ESG Leaders UCITS ETF Features

| Feature | Explanation |

|---|---|

| European ESG Leaders | Invests in top-rated ESG companies in Europe for sustainable growth. |

| Index Tracking | Passively follows MSCI Europe ESG Leaders Index. |

| Low Fees | Being an ETF, it offers a cost-effective way to access ESG investments. |

| Diversified Portfolio | Exposure across sectors reduces concentration risk. |

| Regulatory Compliance | Adheres to EU ESG regulations for responsible investing. |

Amundi MSCI Europe ESG Leaders UCITS ETF Pros & Cons

Pros:

- Has investments in ESG regarded as the best in Europe.

- ETF structure has low costs with a fully transparent passive.

- Designed for broad sector diversification which reduces overall concentration.

- Has ESG compliance as set by the EU.

Cons:

- Company investments are limited to just Europe.

- Passive management reduces flexibility.

- Sectors without growth will have ESG lag and even non ESG traditional indices.

- For investors not in the Eurozone, there is a currency risk.

5. UBS MSCI Europe Socially Responsible UCITS ETF

UBS MSCI Europe Socially Responsible UCITS ETF has been recognized as one of the most reputable ESG investment funds in Europe as it targets socially responsible companies in Europe. The ETF invests in companies with positive ESG and excludes any firms in the tobacco, weapons, and fossil fuel industries.

The aim of the ETF is to achieve long-term sustainable growth by investing in socially and environmentally aligned growth opportunities. Investors obtain diversified exposure across regions and industries in Europe while advancing responsible corporate accountability.

This fund is suitable for investors looking for ethical investment opportunities, as it strikes an appropriate balance between financial performance and social responsibility. The fund fees are low and it provides a transparent, diversified, and sustainable equity portfolio in Europe.

UBS MSCI Europe Socially Responsible UCITS ETF Features

| Feature | Explanation |

|---|---|

| Socially Responsible Focus | Targets companies with strong social and governance practices. |

| Excludes Controversial Sectors | Avoids industries like tobacco and weapons. |

| Diversified European Exposure | Broad allocation across sectors and countries. |

| Transparent ESG Criteria | Provides clear information on ESG screening and selection. |

| Long-Term Sustainability | Aims for ethical growth and responsible investing. |

UBS MSCI Europe Socially Responsible UCITS ETF Pros & Cons

Pros:

- Investing socially and with responsible ethics.

- For sustainable investing, controversial industries are excluded.

- Broad sector diversification across Europe.

- Methodology is transparent for selection of ESG.

Cons

- Passive structure implies a lack of activity in adjustments.

- Exposure is just to Europe.

- Smaller cap firms in ESG may be even more poorly represented.

- Performance could be better than in the overall indices of equities.

6. DWS Xtrackers MSCI Europe ESG UCITS ETF

DWS Xtrackers MSCI Europe ESG UCITS ETF is one of the leading ESG investment fund focusing on the European market. The fund tracks the MSCI Europe ESG Leaders Index and excludes companies in detrimental industries and those that do poorly on ESG.

The ETF is both cost and sustainably efficient and provides exposure to multiple industries in Europe. The fund is designed to provide a European Equities investment, where exposure is gained in an easy and transparent way to implement and ESG compliance is guaranteed. It is a good fit for investors who want to invest ethically, without the hassles of an actively managed fund.

DWS Xtrackers MSCI Europe ESG UCITS ETF Features

| Feature | Explanation |

|---|---|

| European ESG Leaders | Tracks companies with high ESG scores in Europe. |

| Passive Investment | Low-cost, hands-off approach to ESG investing. |

| Diversified Sectors | Exposure across multiple industries for balanced risk. |

| EU ESG Compliance | Meets sustainability regulations and reporting standards. |

| Transparent Methodology | Publicly available index methodology ensures clarity for investors. |

DWS Xtrackers MSCI Europe ESG UCITS ETF Pros & Cons

Pros:

- Large ESG coverage for European companies.

- Passive fund management means less flexibility.

- Transparent ESG methodology.

- Meets EU obligations on sustainability.

Cons:

- Less flexibility in active management.

- Regional constraints, leading to missed worldwide opportunities.

- Lesser representative among smaller organizations.

- Underperformance in non-ESG high-growth industries.

7. Pictet Clean Energy Transition Fund

This fund is known as one of the best ESG investment funds in Europe, investing in companies that are primary drivers in the further development of renewables and sustainable technologies. The fund is actively managed and invests in companies that focus on energy efficiency, renewable energy, and innovation in various industries.

It targets long-term growth opportunities as a result of the fund’s focus on the global transition to clean energy, while maintaining strong ESG characteristics.

The fund’s active management is a benefit to the fund’s responsiveness to changes in the market and to changes in sustainability regulations. Therefore, the fund is a strong fit for investors wanting exposure to the rapidly growing clean energy sector and who want to have a strong positive impact on the environment.

Pictet Clean Energy Transition Fund Features

| Feature | Explanation |

|---|---|

| Clean Energy Focus | Invests in companies driving the renewable energy transition. |

| Active Management | Fund managers select high-potential sustainable growth stocks. |

| Global Exposure | Invests in clean energy companies worldwide. |

| High Growth Potential | Targets innovative companies benefiting from sustainability trends. |

| ESG Integration | Strong environmental and social responsibility criteria applied in selection. |

Pictet Clean Energy Transition Fund Pros & Cons

Pros:

- Invests in sustainability and renewable energy providers.

- Active management, flexible investment selection.

- Transition to clean energy is highly profitable.

- ESG integration during investment selection is strong.

Cons:

- Volatility may increase due to sector focus.

- Management fees are higher than passive vehicles such as ETFs.

- Policy and regulation sensitivity.

- Other energy investments are outside clean energy.

8. Nordea Global Climate and Environment Fund

One of Nordea’s best funds across the globe is the Global Climate and Environment Fund as it focuses on assets in businesses that are trying to mitigate Climate Change and solve Environmental problems. Renewable energy, water management, and green technologies are some of the diversified sectors that the the fund invests in.

The fund is perfect for those who want to have Global ESG exposure with a focus on Climate as it combines ethical investment goals with the potential of thriving in newly available market as fund shifts focus on Climate to solve Environmental problems.

Nordea Global Climate and Environment Fund Features

| Feature | Explanation |

|---|---|

| Climate-Focused Investment | Targets companies addressing climate change challenges. |

| Global Diversification | Exposure to innovative firms across multiple countries. |

| Actively Managed | Managers select investments based on ESG and growth potential. |

| Environmental Innovation | Focus on renewable energy, water, and green technology companies. |

| Long-Term ESG Goals | Aligns investments with sustainable development objectives. |

Nordea Global Climate and Environment Fund Pros & Cons

Pros:

- Invests in firms combating climate change.

- ESG global diversification across targeted sectors.

- Managed fund to steer towards sustainable growth.

- Environmental innovation is prioritized.

Cons:

- Management fees are higher than other funds.

- Climate-related sector concentration is high.

- Industries have high volatility and are niche.

- Managers primarily control returns.

9. Schroder ISF Global Climate Change Equity

Schroder ISF Global Climate Change Equity is an exemplary fund that deals with investments in multiple companies which change or reduce the effects of climate change.

The fund is one of the most prestigious in Europe, as it aims at mitigating the damage climate change has on the environment, as well as adapting to it. In this fund, climate change is viewed as an opportunity, as the fund aims at innovating the use of renewable energy, efficiency, as well as environmental energy alternatives.

The fund is aimed at investors who want ethical and climate-focused investments and want long-term growth. The fund has strong headrise in ESG and thus it is one of the most sought funds across the globe.

Schroder ISF Global Climate Change Equity Features

| Feature | Explanation |

|---|---|

| Global Climate Focus | Invests in companies mitigating or adapting to climate change. |

| Actively Managed | Managers identify top-performing ESG stocks globally. |

| Innovation-Driven | Focuses on firms providing renewable energy and environmental solutions. |

| Diversified Portfolio | Reduces sector risk while targeting high ESG impact. |

| Sustainability Integration | ESG principles guide investment selection and risk management. |

Schroder ISF Global Climate Change Equity Pros & Cons

Pros:

- Funds the global leaders who are adapting to or mitigating climate change.

- Strategic position and flexibility through active management.

- The risk of over-concentration is reduced through global diversification.

- Strong sustainability factors added during the selection of stocks.

Cons:

- Fees are more than ETFs.

- The sector is focused and may be more volatile.

- Performance is reliant on the skill of the fund manager.

- Limited exposure to mainstream industries which are outside of the ESG Focus.

10. HSBC MSCI Europe ESG Leaders UCITS ETF

One of the top ESG investment funds in Europe, the HSBC MSCI Europe ESG Leaders UCITS ETF tracks Europe’s top ESG scoring companies.

By excluding ESG detractors like tobacco, weapons, and fossil fuels, the ETF offers a well-diversified exposure to multiple industries. The ETF aims to reconcile sustainable investing with passive management at a fee, while providing a simple and effective way to invest in line with ESG principles.

The strategy works for investors wanting ethically responsible European equities with good governance and environmental care. It is one of the most sought-after funds for investors because of its alignment with EU ESG regulations.

HSBC MSCI Europe ESG Leaders UCITS ETF Features

| Feature | Explanation |

|---|---|

| European ESG Exposure | Tracks top ESG-rated European companies. |

| Passive ETF | Offers low-cost, transparent ESG investment. |

| Diversified Portfolio | Broad sector allocation reduces risk concentration. |

| EU ESG Compliance | Fully aligned with European sustainability regulations. |

| Transparent Methodology | Provides clear ESG scoring and index tracking. |

HSBC MSCI Europe ESG Leaders UCITS ETF Pros & Cons

Pros:

- Well diversified across European ESG leaders.

- Inexpensive cost as this is a passively managed fund.

- Methodology and holdings are transparent.

- Meets EU-defined ESG compliance.

Cons:

- Focus is on European companies only.

- Being passively managed lacks the ability to be flexible to market conditions.

- Underrepresentation of smaller companies may exist.

- Non-euro investors face currency risk.

Risks and Considerations

Market Volatility: These are funds that are still subject to the full volatility of the stock market and will decline in the face of a recession.

Sector Concentration Risk: There are funds available that only target certain sectors e.g. renewable energy. These funds may have a greater than normal volatility.

Management Fees: These funds will generally be more expensive than other passively managed ETFs which will lower the returns.

Performance Variability: Based on the restrictions in the ESG metrics there are a lot fewer stocks to investments to pick from and this will most often lead to lower overall returns than the index.

Limited Exposure: Exclusions of entire industries or small cap companies reduces the diversification of the fund.

Conclusion

To sum up, the top ESG investment funds in Europe are a chance for investors to harmonize their investments with sustainability and socially respectable, environmentally safe practices while still aiming for financially responsible long-term returns.

Investors in Europe can target quality ESG compliant stocks through fully diversified ETFs like Lyxor MSCI World ESG Leaders UCITS ETF and HSBC MSCI Europe ESG Leaders UCITS ETF, or through actively managed funds like Pictet Clean Energy Transition Fund and Nordea Global Climate and Environment Fund.

Investing in these funds not only supports investors in the practice of ethical investing, but also helps them reduce the exposure of their investment to the adverse consequences of financially irresponsible investing, and as a result, these funds need to be included in the asset allocation of every responsible investor.

FAQ

What are ESG investment funds?

ESG investment funds are mutual funds or ETFs that focus on companies with strong Environmental, Social, and Governance practices. They aim to generate financial returns while supporting sustainability, ethical practices, and responsible corporate behavior.

Why should I invest in ESG funds in Europe?

Europe has some of the most stringent ESG regulations and a growing number of companies adopting sustainable practices. Investing in ESG funds allows you to support environmentally friendly and socially responsible businesses while potentially reducing long-term risks.

What are the best ESG investment funds in Europe?

Some of the top ESG investment funds in Europe include Lyxor MSCI World ESG Leaders UCITS ETF, Candriam Sustainable Equity Europe, iShares MSCI Europe ESG Screened UCITS ETF, Amundi MSCI Europe ESG Leaders UCITS ETF, UBS MSCI Europe Socially Responsible UCITS ETF, DWS Xtrackers MSCI Europe ESG UCITS ETF, Pictet Clean Energy Transition Fund, Nordea Global Climate and Environment Fund, Schroder ISF Global Climate Change Equity, and HSBC MSCI Europe ESG Leaders UCITS ETF.

Are ESG funds more expensive than traditional funds?

Actively managed ESG funds may have slightly higher fees due to research and sustainability analysis. However, many ESG ETFs are passively managed and offer low-cost options, making them competitive with traditional investment funds.

Can ESG funds deliver good returns?

Yes. While ESG funds focus on sustainability, they also invest in financially strong companies. Historical performance shows that many ESG funds can match or outperform conventional funds over the long term, especially as sustainability becomes a global priority.