The purpose of this article on Best European ETFs for Long-Term Investors is to consider the best funds providing the most diversification, stability, and growth in Europe’s key markets.

- Why Use European ETFs for Long-Term Investors

- Key Point & Best European ETFs for Long-Term Investors

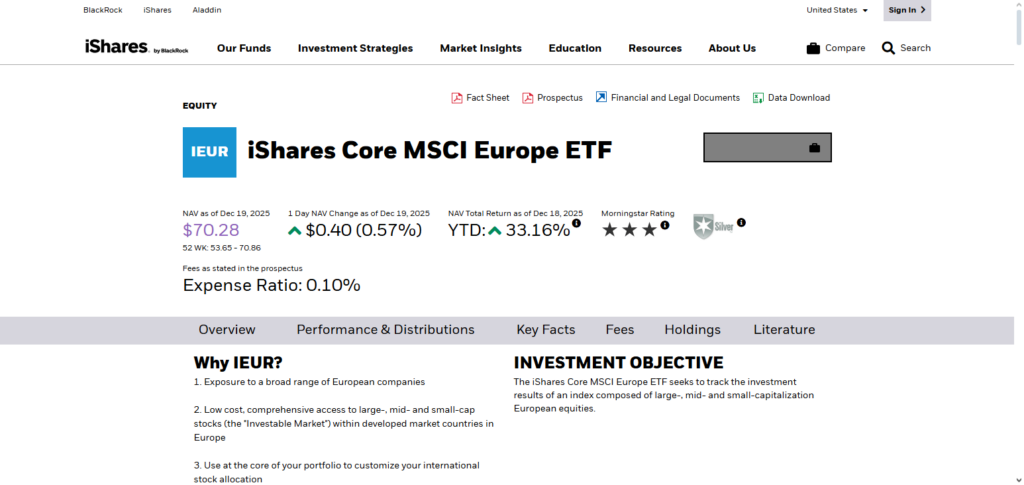

- 1. iShares Core MSCI Europe ETF

- iShares Core MSCI Europe ETF Features, Pros & Cons

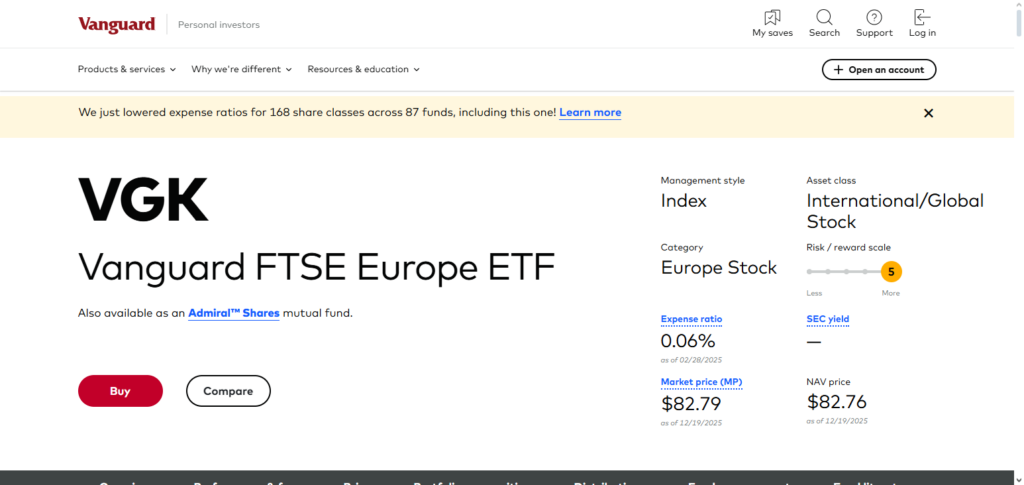

- 2. Vanguard FTSE Europe ETF

- Vanguard FTSE Europe ETF Features, Pros & Cons

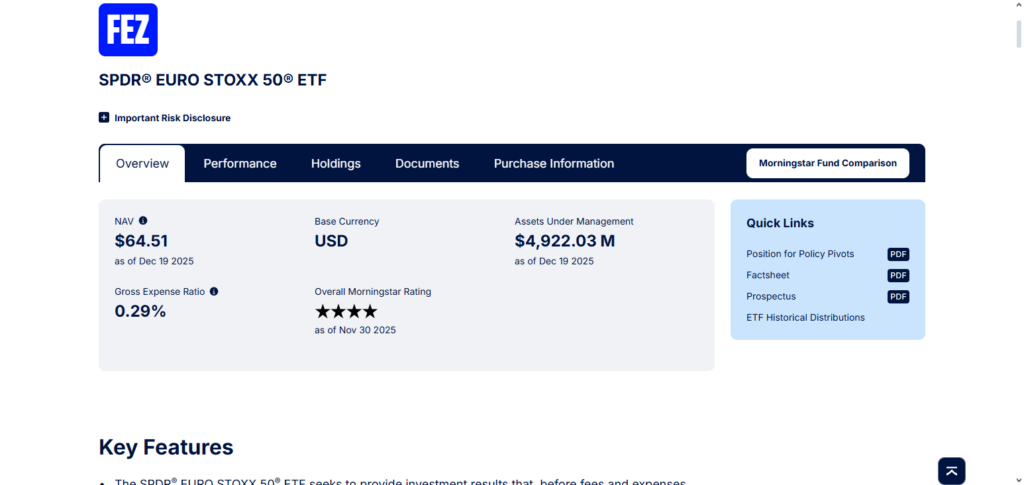

- 3. SPDR EURO STOXX 50 ETF

- SPDR EURO STOXX 50 ETF Features, Pros & Cons

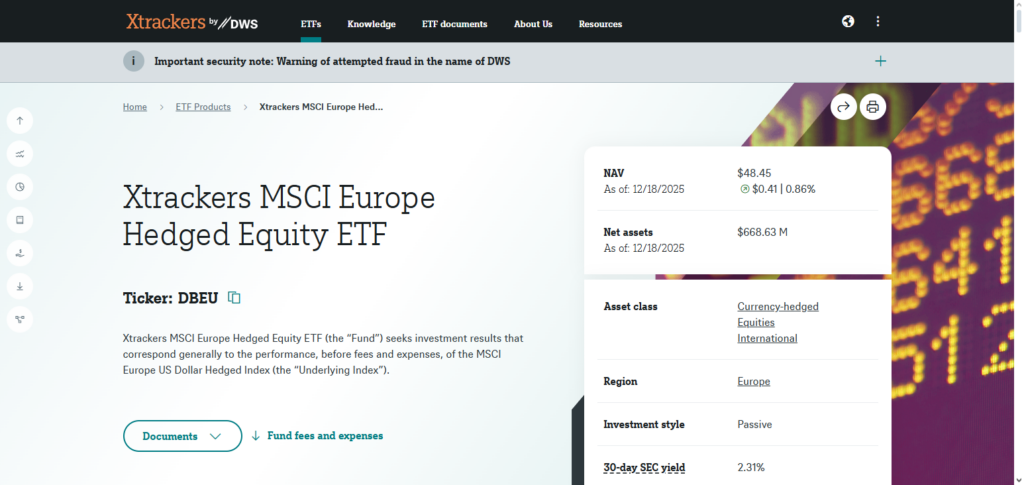

- 4. Xtrackers MSCI Europe Hedged Equity ETF

- Xtrackers MSCI Europe Hedged Equity ETF Features, Pros & Cons

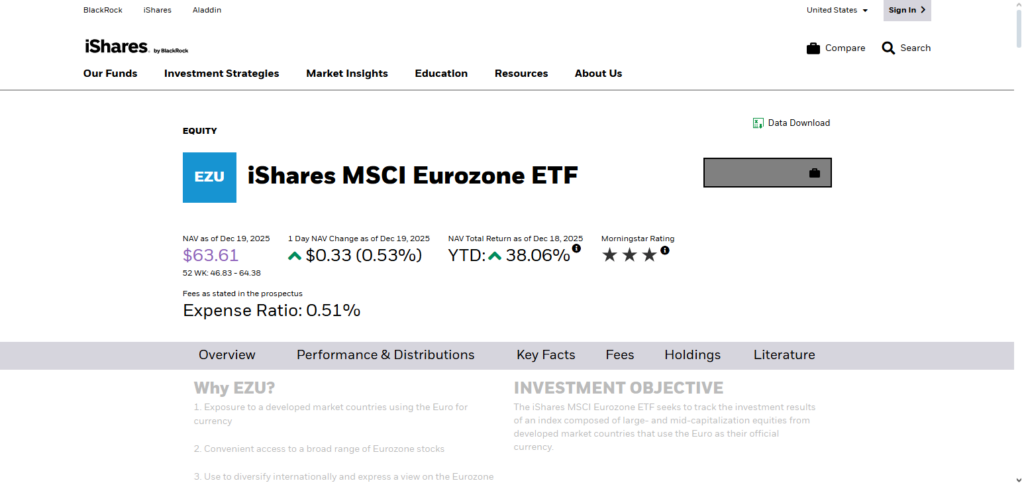

- 5. iShares MSCI Eurozone ETF

- iShares MSCI Eurozone ETF Features, Pros & Cons

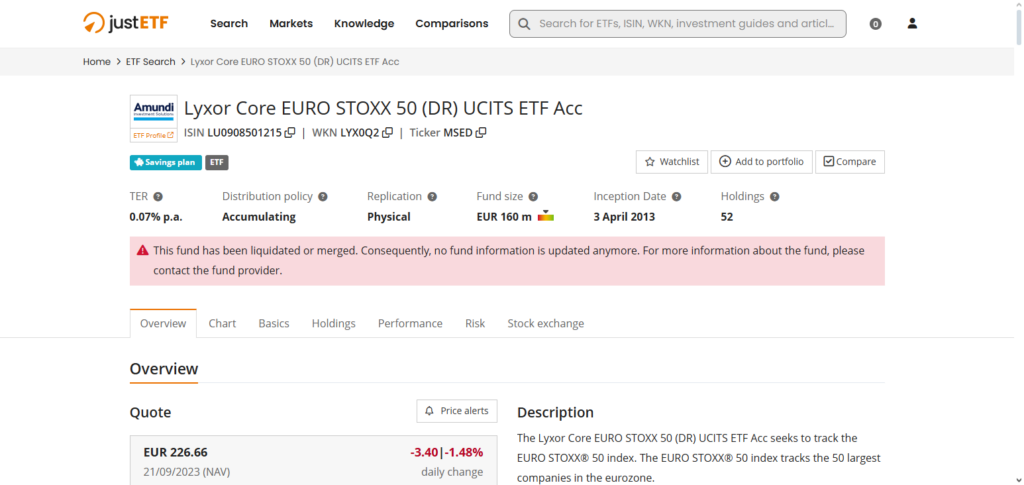

- 6. Lyxor EURO STOXX 50 ETF

- Lyxor EURO STOXX 50 ETF Features, Pros & Cons

- 7. Amundi MSCI Europe ESG Leaders ETF

- Amundi MSCI Europe ESG Leaders ETF Features, Pros & Cons

- 8. SPDR MSCI Europe Consumer Staples ETF

- SPDR MSCI Europe Consumer Staples ETF Features, Pros & Cons

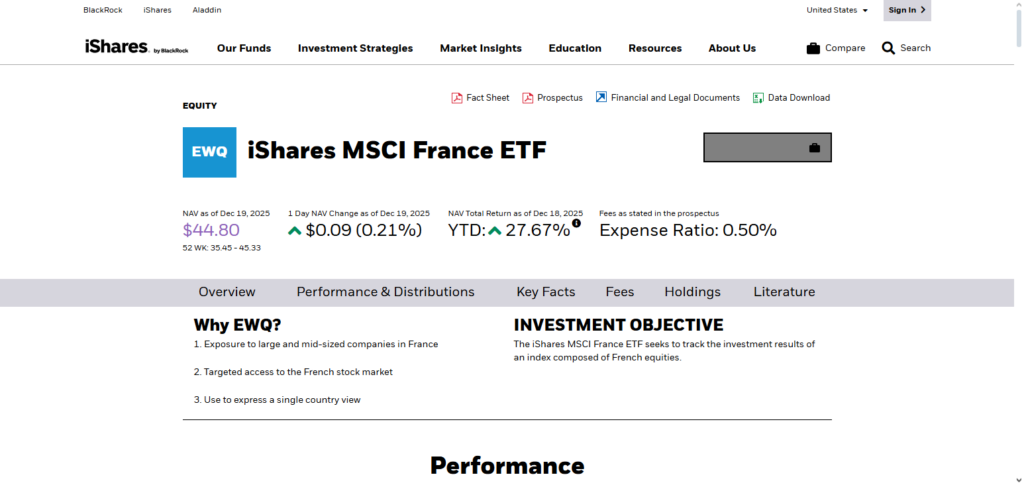

- 9. iShares MSCI France ETF

- iShares MSCI France ETF Features, Pros & Cons

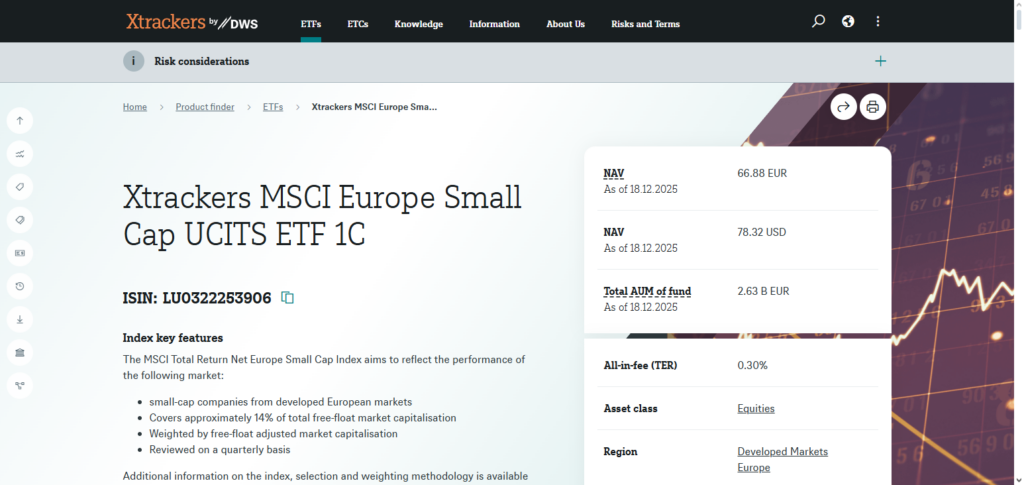

- 10. Xtrackers MSCI Europe Small Cap ETF

- Xtrackers MSCI Europe Small Cap ETF Features, Pros & Cons

- Conclusion

- FAQ

Investors will be able to access blue-chip companies, additional small caps, and developing sectors, thereby enabling the construction of a complete portfolio for the long term.

Why Use European ETFs for Long-Term Investors

Broad Market Diversification: European ETFs span across various countries, industries, and companies which protects investors from being exposed to any one market.

Low-Cost Investing: The majority of European ETFs have low expense ratios which allows investors to keep more of their returns over longer horizons.

Access to Global Leaders: Investors gain access to large European companies in many industries including finance, healthcare, and consumer staples.

Stable Dividend Income: Many European companies offer dividends which provides money to investors over time in addition to compounding.

Economic Balance: Europe allows for diversification beyond the U.S. and emerging markets, further reducing the risk in a portfolio.

Long-Term Growth Potential: Developed countries with innovative industries provides steady growth while being exposed to a developed economy.

Flexible Investment Options; European ETFs can customize to broad market, ESG, sector, country, or small cap focused.

Key Point & Best European ETFs for Long-Term Investors

| ETF Name | Key Focus / Sector |

|---|---|

| iShares Core MSCI Europe ETF | Broad exposure to large and mid-cap European companies |

| Vanguard FTSE Europe ETF | Tracks FTSE Developed Europe Index, diversified across countries |

| SPDR EURO STOXX 50 ETF | Tracks 50 largest Eurozone companies, blue-chip focus |

| Xtrackers MSCI Europe Hedged Equity ETF | Currency-hedged exposure to European equities |

| iShares MSCI Eurozone ETF | Large- and mid-cap companies in Eurozone countries |

| Lyxor EURO STOXX 50 ETF | Tracks EURO STOXX 50, focus on major Eurozone companies |

| Amundi MSCI Europe ESG Leaders ETF | ESG-focused European leaders, sustainable investing |

| SPDR MSCI Europe Consumer Staples ETF | Consumer staples sector within European markets |

| iShares MSCI France ETF | French large- and mid-cap companies |

| Xtrackers MSCI Europe Small Cap ETF | Focused on small-cap European companies |

1. iShares Core MSCI Europe ETF

For long-term European stock market exposure, the iShares Core MSCI Europe ETF (IEUR) is an essential building block. This fund covers almost 1,000 large-, mid-, and small-cap companies across developed Europe.

It tracks the MSCI Europe Investable Market Index. Launched in 2014, the fund’s diversified exposure encompasses the tech, healthcare, finance, and consumer sectors. The fund’s expenses are 0.10% per year, making it a very low-cost diversified option.

The top 10 holdings are SAP, ASML, Nestlé, and Novartis. The fund works for investors who want broad geographical coverage at low expenses with excellent liquidity.

iShares Core MSCI Europe ETF Features, Pros & Cons

Features

- Consistently Tracks MSCI Europe Index

- Large, mid, and small-cap exposure

- Includes developed European markets

- Low annual expenses

- High liquidity and diversification

Pros

- Widely offers multiple international markets

- Cost-effective for long-term investments

- Low cost

- Suitable as a core

- Trustworthy iShares brand

Cons

- Includes economies that are slowing

- Less developed Europe exposure

- Currency for non-EUR’s

- Below average dividend yields

- Volatility

2. Vanguard FTSE Europe ETF

The Vanguard FTSE Europe ETF (VGK) tracks the FTSE Developed Europe All Cap Index, which comprises U.K, French, German, Swiss, and 1,200+ other companies across Europe. The ETF captures a wide array of European developed stock markets.

VGK is a great choice for frugal investors since it is one of the cheapest funds around with an annual expense ratio of roughly 0.06%. VGK was launched in 2005 and has almost 100% equity in the most major companies in different sectors of Europe, allowing for a broad and well-diversified exposure to developed Europe equity. VGK is considered a great long-term investment.

Vanguard FTSE Europe ETF Features, Pros & Cons

Features

- Annual FTSE Developed Europe Index

- Over 1,000 European companies

- Strikingly Low Expense Ratio

- Low cost passive index-fund

- Strong country diversification

Pros

- Considered as one of the most inexpensive European ETFs

- Long-term performance potential

- High transparency

- Expands over the sectors

- Vanguard’s Reputation

Cons

- Heavy focused especially on UK stocks

- Excluding emerging markets

- Currency variation

- Less adaptability

- No targeted sectors

3. SPDR EURO STOXX 50 ETF

The SPDR EURO STOXX® 50 ETF (FEZ) aims to replicate the performance of the EURO STOXX 50 Index, which includes 50 of the largest blue-chip companies across major sectors (financials, consumer goods, energy and industrials) of the Eurozone.

Its ideal for long-term investors that want to have focused exposure on the major players in Europe and don’t want to invest in the broader market.

Their expense ratio is about the same as other Eurozone blue-chip trackers. By investing in the most liquid companies, it is able to offer the investor stable returns that are core to the Eurozone. The index is about 60% of the euro-area free-float market cap.

SPDR EURO STOXX 50 ETF Features, Pros & Cons

Features

- Tracks EURO STOXX 50 Index

- Focus on the Top 50 companies of the Eurozone

- Heavy Blue-chip portfolio

- High market liquidity

- Dividend yielding companies

Pros

- Strong branded leaders

- Stable returns over the Long Term

- Suitable for conservative level risk

- Maximum dividend possible

- Exposure to most of the Eurozone

Cons

- Limited options

- No small caps or mid caps

- High concentration risk

- Lower focus on growth

- Eurozone specific

4. Xtrackers MSCI Europe Hedged Equity ETF

In order to shield long-term investors from changes in foreign exchange rates, the Xtrackers MSCI Europe Hedged Equity ETF seeks to offer exposure to a wide variety of developed European equities while hedging currency risk back to a base currency (often USD or EUR).

When currency volatility could otherwise gradually reduce investment gains, hedged exchange-traded funds (ETFs) can be advantageous. This structure appeals to investors that prioritize return stability, even if hedging may marginally increase costs in comparison to non-hedged alternatives.

Hedged versions usually cost more than unhedged broad market ETFs because of the additional currency management, however particular expense ratios vary by share class.

Xtrackers MSCI Europe Hedged Equity ETF Features, Pros & Cons

Features

- Follows MSCI Europe Index

- With the Hedged Currency Structure

- Exposure to Developed European Equity

- Reduces Foreign Exchange Volatility

- FX Volatility Actively Managed

Pros

- Currency Risk Protection

- USD investors secure stable returns

- Broad coverage of Europe

- Permitted when FX is unstable

- Risk is managed at a professional level

Cons

- High expense ratio

- Gains are outweighed by the hedging

- Structure is complex

- Less efficient to tax

- Opportunities are limited in some markets

5. iShares MSCI Eurozone ETF

The iShares MSCI Eurozone ETF offers investors large- and mid-cap exposure across major economies like France, Germany, and Spain by concentrating on businesses in the Eurozone, or nations that utilize the euro.

Long-term investors who prefer concentrated exposure to the euro-area economic bloc rather than all of Europe, which includes non-Euro nations like the UK and Switzerland, may benefit from this more focused regional approach.

The fund is an attractive choice for individuals who are optimistic about the integrated Eurozone economy because its expense ratio is generally low, in line with broad Eurozone equities strategies, and it comprises businesses from a variety of industries.

iShares MSCI Eurozone ETF Features, Pros & Cons

Features

- Follows MSCI Eurozone Index

- Euro-using countries focus

- Large and mid caps

- Exposed to diverse sectors

- Index tracking is transparent

Pros

- Exposure to Eurozone only

- Industrial and banking strength

- Good for regional diversification

- High holding stability

- Index method is reliable

Cons

- UK and Switzerland are excluded

- Currency risk is present

- Small caps limited

- Economic dependence to Eurozone

- Growth is expected at a moderate level

6. Lyxor EURO STOXX 50 ETF

The Lyxor EURO STOXX 50 ETF also tracks the same core EURO STOXX 50 Index as the SPDR fund and also provides focused exposure to the 50 largest and most liquid firms in the Eurozone.

Investors with a long time horizon looking for exposure to the most important multinationals with a presence in most industries in Europe will find this to be an excellent long term investment. Most of the time Lyxor’s variations are lower in costs which may attract investors looking for an alternative to SPDR.

Given the composition of the underlying index which are highly ranked within their industries, this ETF will most likely provide investors with income in the form of dividends and other forms of positive income growth, thus making it a good ETF to buy and hold.

Lyxor EURO STOXX 50 ETF Features, Pros & Cons

Features

- Stakes claim in EURO STOXX 50 Index

- 50 largest companies in Eurozone

- UCITS-compliant ETF

- Reasonable expense ratio

- High trading volumes

Pros

- Exposure to European heavyweights

- Strong dividend-payers

- High liquidity

- Strong focus Eurozone

- Highly rated European ETF provider

Cons

- Limited investment scope

- Sector concentration

- Absence of small-cap growth

- Eurozone-only focus

- Market-cap weighted bias

7. Amundi MSCI Europe ESG Leaders ETF

The Amundi MSCI Europe ESG Leaders ETF appeals to investors seeking some degree of sustainability along with financial return as it aims at companies with better environmental, social, and governance performance in Europe by tracking an MSCI ESG Leaders index.

ESG funds are also meant to align ethical investing with some degree of responsibility by assessing the corporate responsibility. MSCI ESG ETFs tend to have slightly higher expense ratios than conventional broad market ETFs. For long term buy and hold investors looking for growth along with the ESG principles, this ETF has plenty of diversification along with good values.

Amundi MSCI Europe ESG Leaders ETF Features, Pros & Cons

Features

- MSCI index with ESG focus

- Corporate sustainability screening

- Exposure to developed Europe

- Responsible investment

- Diversified leaders in ESG

Pros

- Aligns with positive ethical investing

- Reduces ESG risk

- Focus on long-term sustainability

- High quality company selection

- Meets growing demand of investors

Cons

- Higher expense ratio

- Exclusion of some large companies

- ESG criteria may be subjective

- Limited flexibility in sectors

- Performance may vary from broad index

8. SPDR MSCI Europe Consumer Staples ETF

The SPDR MSCI Europe Consumer Staples ETF is concerned with the consumer staples portion of Europe, acquiring companies/functioning within the production of staple goods like foods, drinks, and household products that are in constant high demand regardless of the economic condition.

Broad equity investors can keep defensive sector ETFs like these on for the long haul. Consumer staples ETFs, for example, are useful for long-term investors concerned with recessionary periods since they are defensive and tend to pay steady dividends.

Though these ETFs tend to have higher expense ratios than broad market ETFs due to their specialization, they lower the overall risk on a diversified long-term portfolio.

SPDR MSCI Europe Consumer Staples ETF Features, Pros & Cons

Features

- Sector-specific ETF

- Focus on essential goods companies

- Defensive investment thesis

- Dividend-paying stocks

- MSCI Europe Consumer Staples Index tracker

Pros

- Low volatility

- Stable cash flow

- High dividend yield

- Sector with recession resistance

- Balances portfolio risk

Cons

- Limited growth potential

- Specific focus

- Impacted by copy consumer behavior

- Charges more than generic ETFs

- Less variety

9. iShares MSCI France ETF

Investors get specific exposure to French equities through the iShares MSCI France ETF. It offers access to France’s major firms in the consumer goods, luxury, and banking and industrials sectors by following the MSCI France Index.

This single-country exposure could be ideal for long-term investors or others looking for targeted diversification in addition to broader continental ETFs. Although these ETFs are likely to be more volatile than their regional counterparts, they facilitate targeted participation in the gains of that sole nation. Most MSCI country ETFs also record reasonable expense ratios given their focus.

iShares MSCI France ETF Features, Pros & Cons

Features

- Focused on one country

- Follows MSCI France Index

- Investments in large and medium-sized French companies

- Focused on luxury and industrial

- Index is clearly defined

Pros

- Exposure specifically to France

- French companies with substantial influence

- Fits for France to the portfolio

- Well spread investments with France

- Simple France allocation

Cons

- Increased country risk

- Economic reliance on France

- Less variety

- Currency risk

- Political risk

10. Xtrackers MSCI Europe Small Cap ETF

Potentially high-growth stocks in developed Europe that are often overlooked by larger cap funds are the focus of the Xtrackers MSCI Europe Small Cap ETF. This fund emphasizes small cap stocks.

Although small caps are riskier than their large-cap counterparts, they may yield more significant gains over extended periods.

As a result, this ETF is a suitable option for those looking for further long-term gains. Small-cap ETFs have higher expense ratios than large-cap ETFs due to elevated trading costs and a higher demand for research. A small-cap element may improve a fund’s balance and enhance its growth for decades.

Xtrackers MSCI Europe Small Cap ETF Features, Pros & Cons

Features

- Targeting small-cap stocks in Europe

- Follows MSCI Europe Small Cap Index

- Considerable growth potential

- Wide country range

- Aiming for capital growth in the long run

Pros

- More growth potential

- Less exposure to large-cap stocks

- Better allocation to innovative companies

- Good for long-term growth

- Adds more to the portfolio

Cons

- Increased fluctuations

- Less tradeable

- More cost

- More sensitive to economic conditions

- More chance for short-term trade fluctuations

Conclusion

For long-term investors in Europe, ETFs offers the chance to get in ust a one-single investment a diversified portfolio covering a number fundraising of the most lucrative economies in the world. One of the most cost-effective options is to start with a broad market fund, the iShares Core MSCI Europe ETF or the Vanguard FTSE Europe ETF.

These two funds are ideal for a core portfolio. Other options, focusing on bigger, stable companies with good dividends, are the SPDR EURO STOXX 50 ETF or the Lyxor EURO STOXX 50 ETF. Sector or thematic ETFs such as the SPDR MSCI Europe Consumer Staples ETF or the Amundi MSCI Europe ESG Leaders ETF allow a more focused investment on growing defensive or sustainably growing segments of the market.

There is additional diversification to be gained with country-specific funds, such as the iShares MSCI France ETF or the Xtrackers MSCI Europe Small Cap ETF, as well as additional Small Cap funds.

These, together with others, developed according to one’s risk tolerance, investment horizon, or thematic preferences, can help long-term investors building a portfolio for Europe potential growth to target one’s focus for smoother cash flow from the bigger and mid and Small Cap equities.

FAQ

Why invest in European ETFs for the long term?

European ETFs allow investors to access a broad range of developed European economies, spreading risk across countries, sectors, and companies. Over the long term, these funds benefit from compounding, economic growth in Europe, and dividend reinvestment, helping build a resilient investment portfolio.

What are the best broad-market European ETFs?

For broad exposure, iShares Core MSCI Europe ETF (IEUR) and Vanguard FTSE Europe ETF (VGK) are top choices. They track large and mid-cap companies across multiple European countries, offer low expense ratios (0.06–0.10%), and provide diversification across sectors.

Which ETFs focus on Eurozone blue-chip companies?

ETFs like SPDR EURO STOXX 50 ETF and Lyxor EURO STOXX 50 ETF target the 50 largest and most liquid Eurozone companies. They are ideal for long-term investors seeking stability, dividends, and exposure to major European industry leaders.

Are there ESG-focused European ETFs?

Yes, the Amundi MSCI Europe ESG Leaders ETF focuses on companies with strong environmental, social, and governance practices. ESG ETFs appeal to investors who want sustainable, responsible long-term growth.

Can I invest in sector-specific or country-specific ETFs?

Absolutely. Sector ETFs, like the SPDR MSCI Europe Consumer Staples ETF, provide exposure to defensive industries. Country-specific ETFs, such as the iShares MSCI France ETF, allow investors to focus on a single country’s economic growth and potential.